Goods And Service Tax in Tally Prime

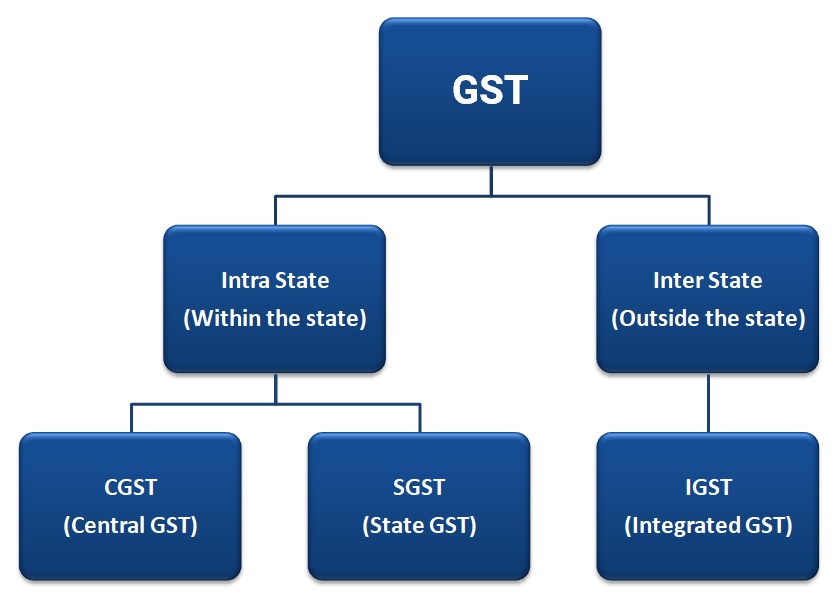

What is GST Tax?

GST is known as the Goods and Services Tax. It is an indirect tax which has replaced many indirect taxes in India such as the excise duty, VAT, services tax, etc. The Goods and Service Tax Act was passed in the Parliament on 29th March 2017 and came into effect on 1st July 2017.

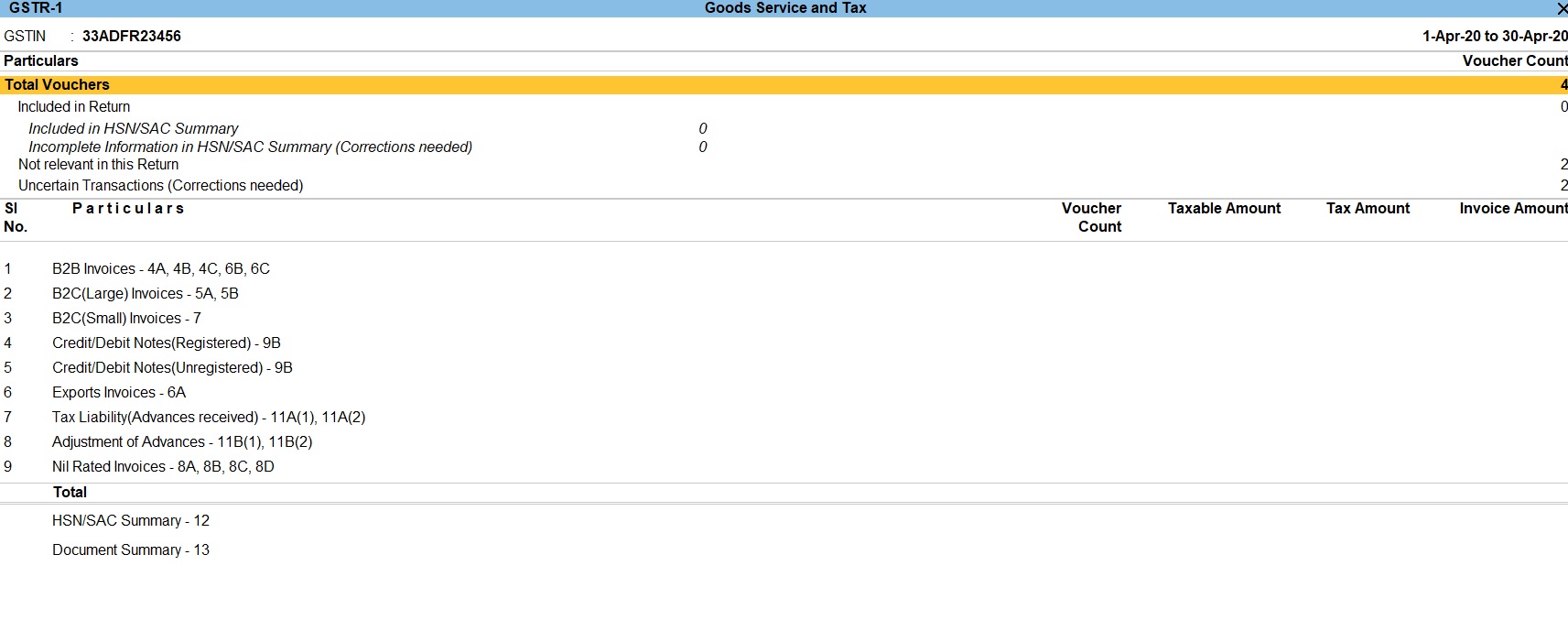

- GSTR 1 is a monthly return of outward supplies. Essentially, it is a return showing all the sales transactions of a business.

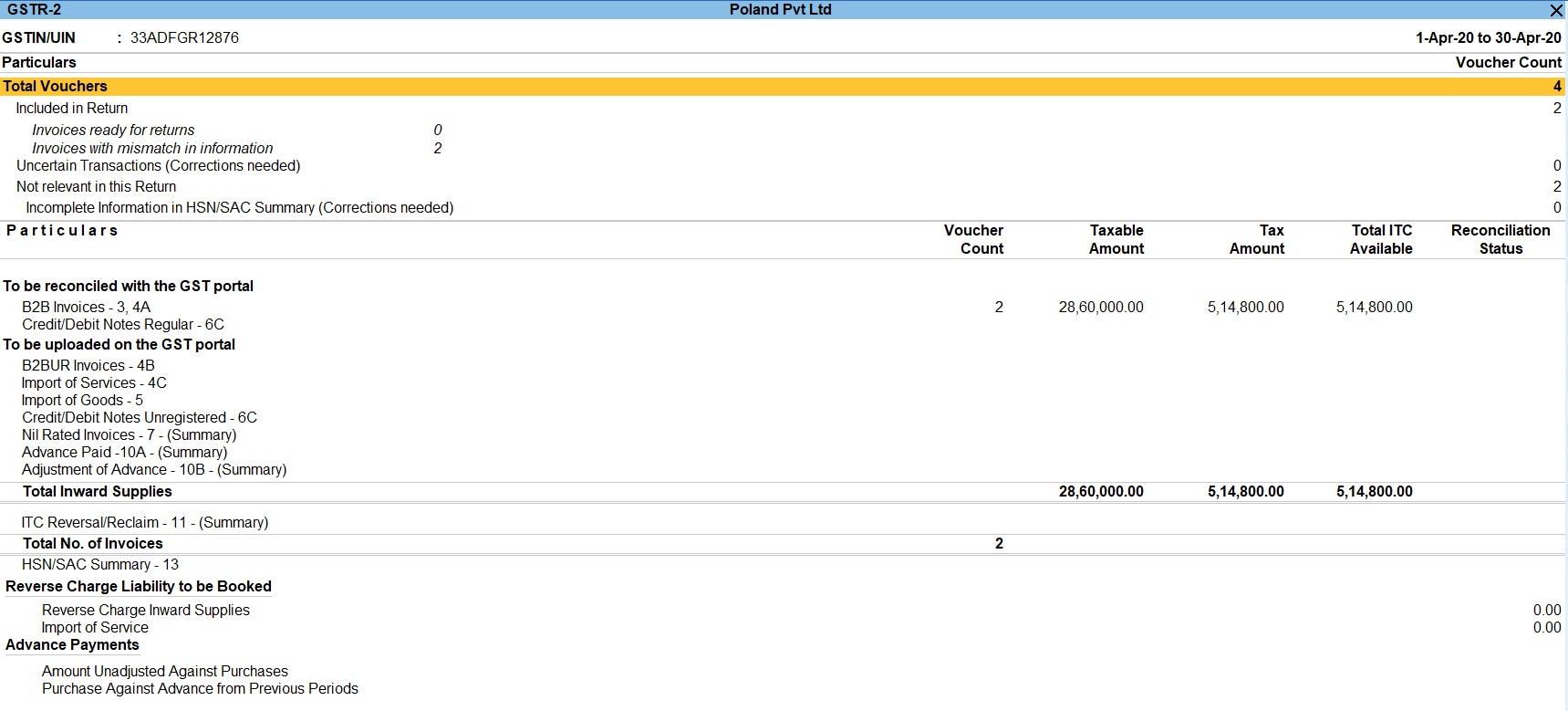

- GSTR-2 contains details of all the purchases transactions of a registered dealer for a month. It will also include purchases on which reverse charge applies.

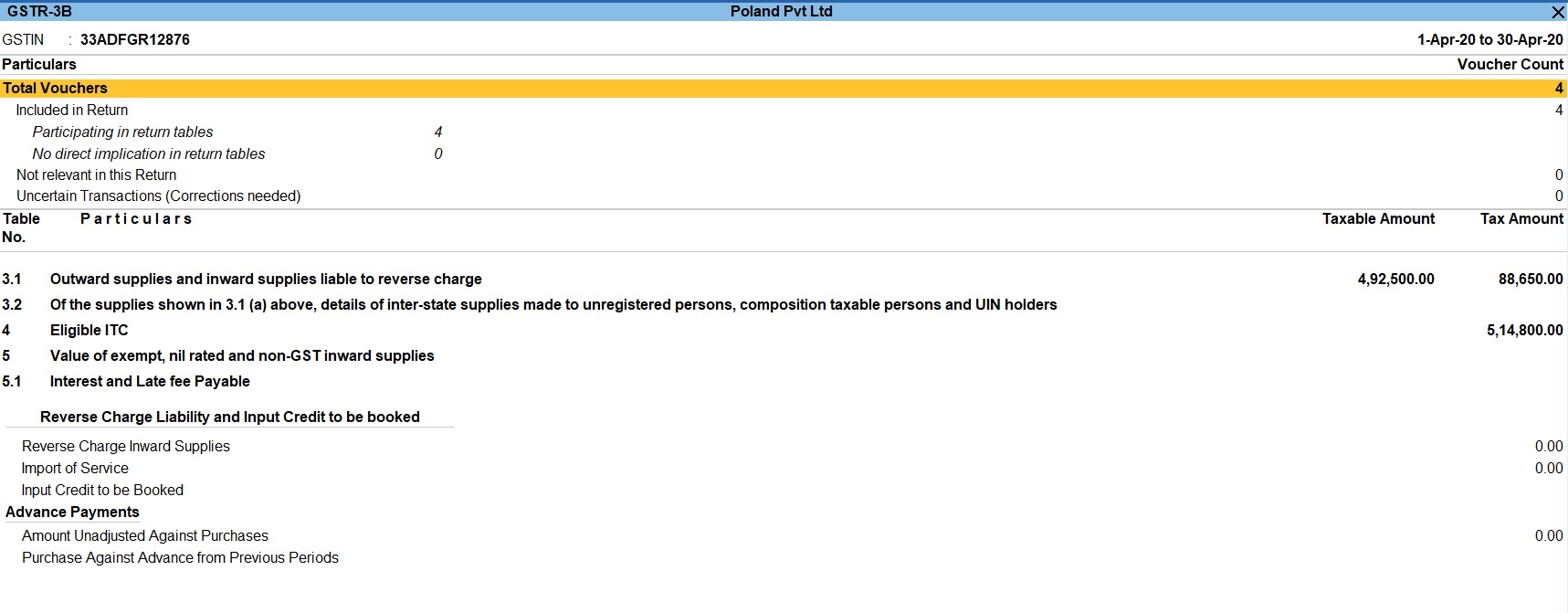

- GST-3b is a monthly self-declaration to be filed by a registered GST dealer along with GSTR1 and GSTR2 return. it is a simplified return to declare summary liabilities for a tax period.

Intrastate transaction

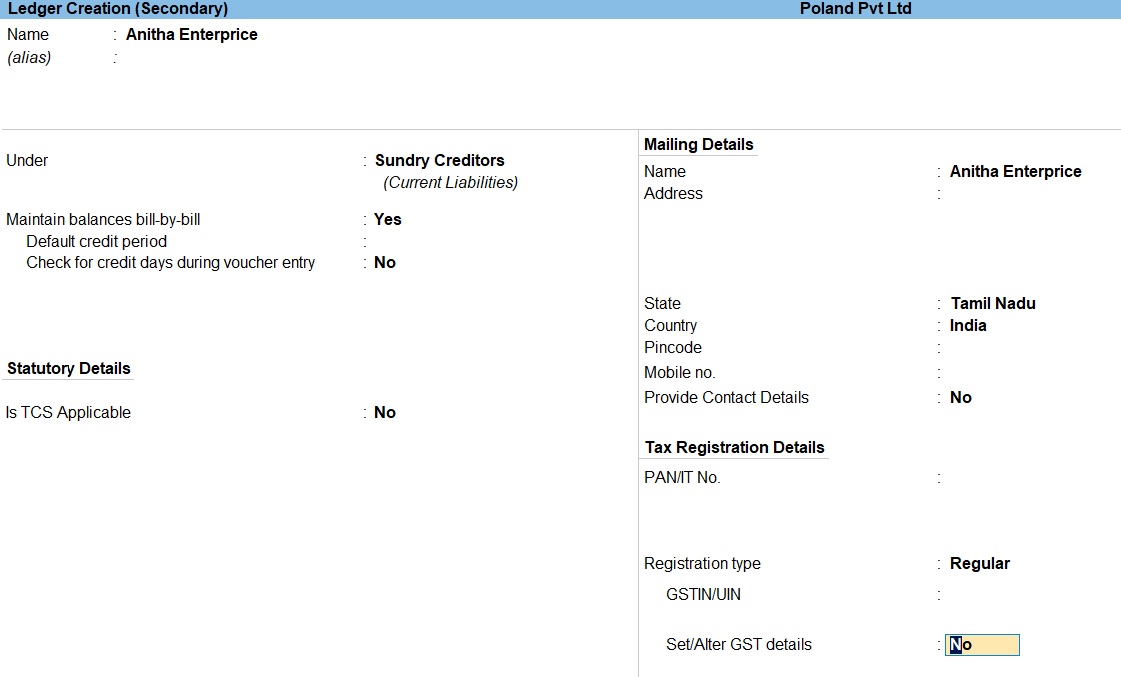

1. Go to Gateway of Tally prime > masters > Ledgers > Create .

2. Enter the party’s Name .

3. Select sundry creditors as the group name in the field Under .

4. Select goods Tax as the Type of duty/tax

5. The Ledger Creation screen appears as shown below:

6. press Enter to save.

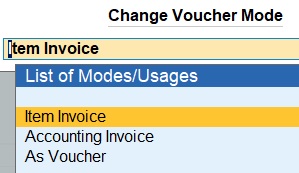

1. Select Change mode >Item Invoice > Enter

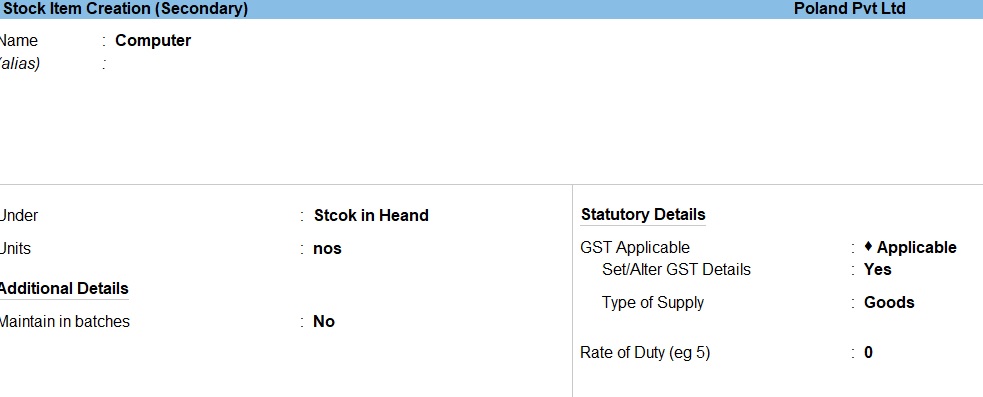

2. Go to Gateway of Tally prime > voucher> Purchase> Alt+ C > Create.

3. Enter the Stock Name .

4. Select Stock in Hand as the group name in the field Under.

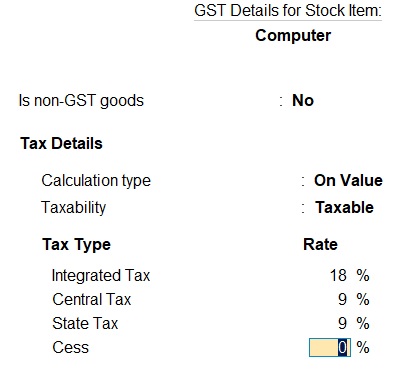

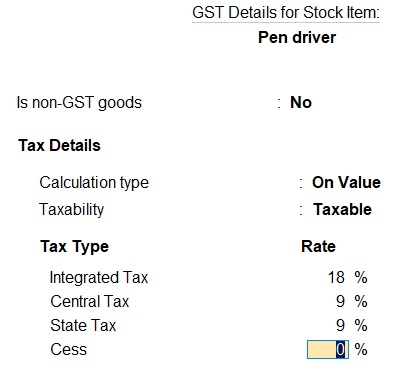

5. Select Set/alter GST details Enter YES.

6. Select goods Tax as the Type of duty/tax

7. press Enter to save.

Common tax ledger creation

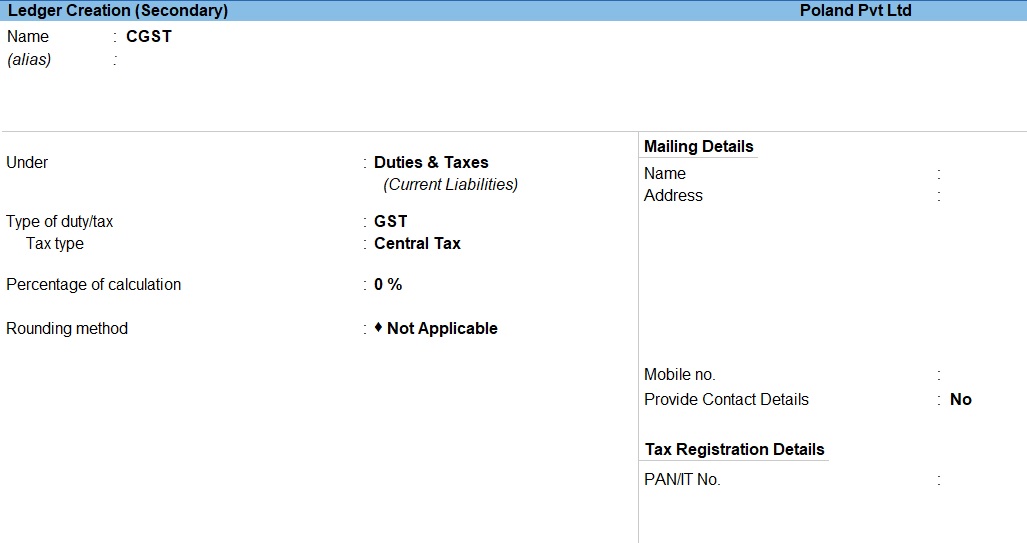

1. Go to Gateway of Tally > voucher > purchase >Alt+ C > Create .

2. Enter the tax ledger Name .

3. Select Duties & Taxes as the group name in the field Under .

4. Select central tax as the Type of duty/tax .

5. The Ledger Creation screen appears as shown below:

6. Press Enter to save.

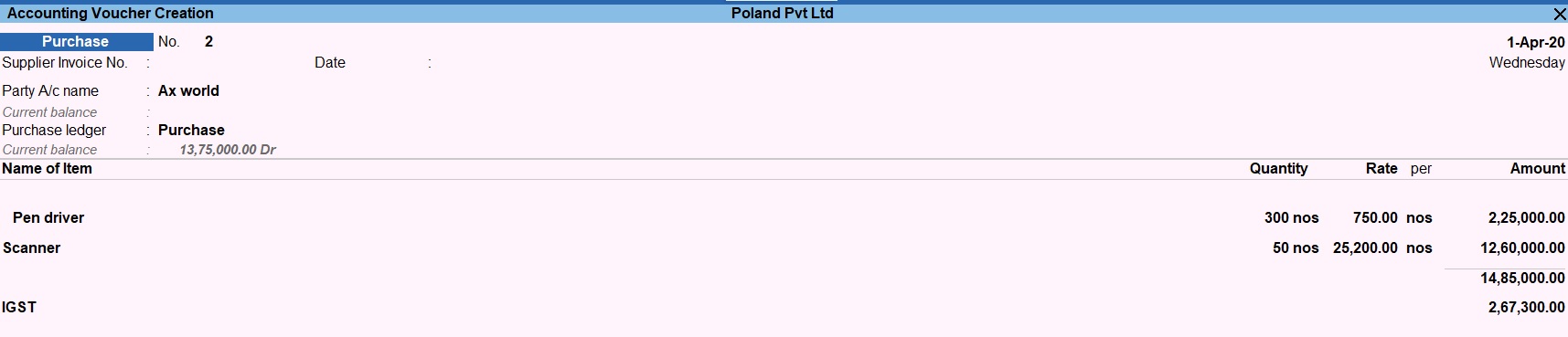

Interstate transaction

1. Go to Gateway of Tally prime > voucher > purchase >Alt+ C > Create .

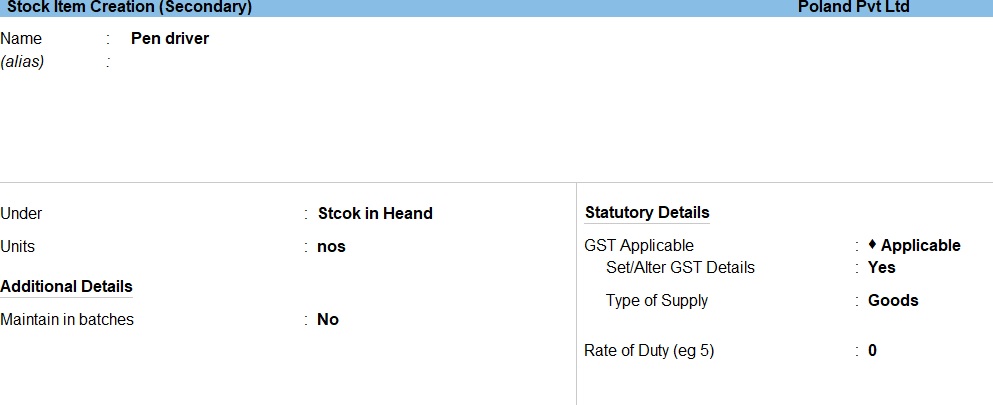

2. Enter the Stock Name .

3. Select Stock in Hand as the group name in the field Under .

4. Select Set/alter GST details Enter YES.

6. Select goods Tax as the Type of duty/tax

7. The Ledger Creation screen appears as shown below:

8. press Enter to save.

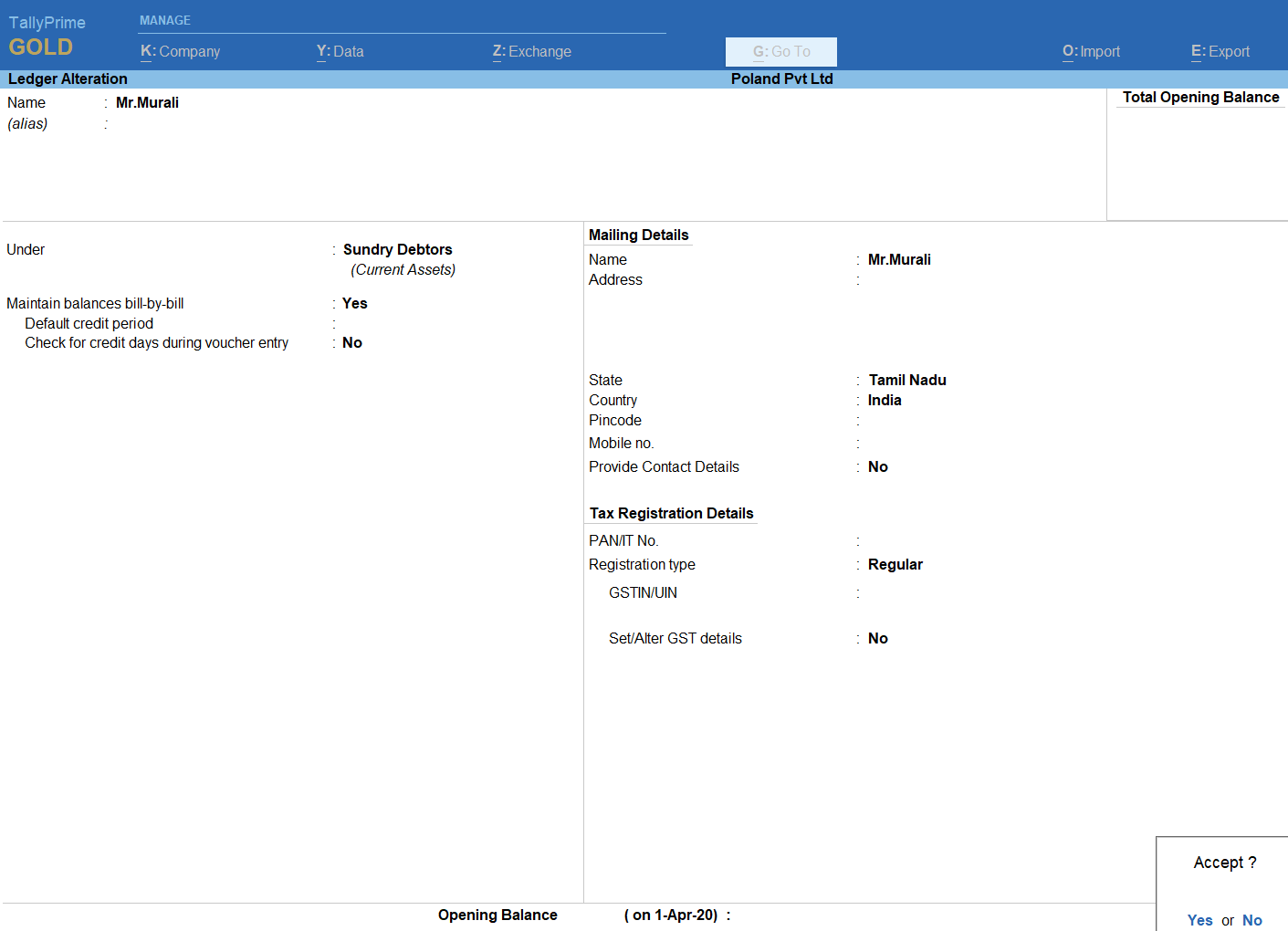

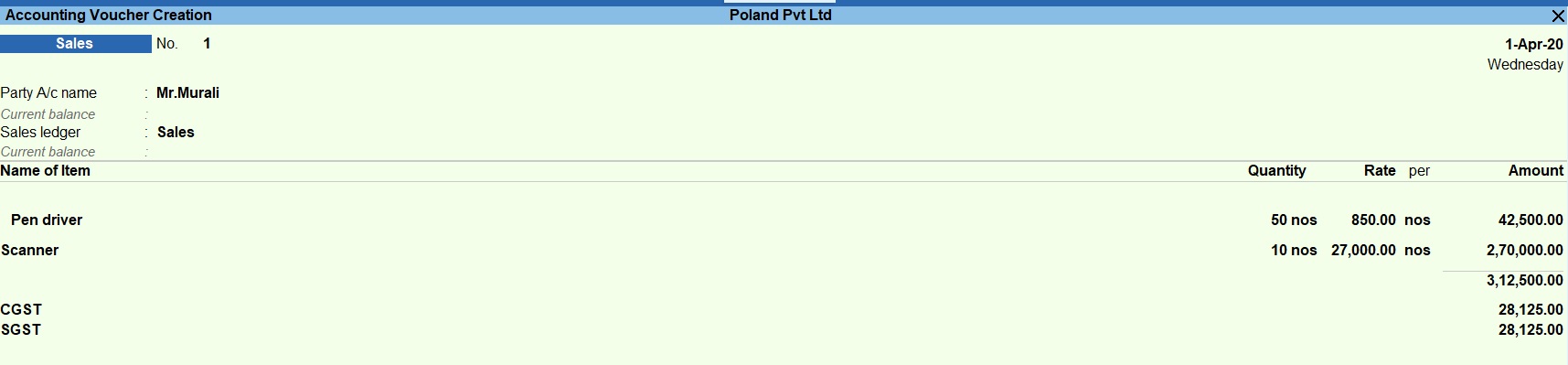

Intrastate Sales Transaction

1. Go to Gateway of Tally prime > masters > Ledgers > Create.

2. Enter the party’s Name.

3. Select sundry Debtors as the group name in the field Under.

4. Select goods Tax as the Type of duty/tax

5. The Ledger Creation screen appears as shown below:

6.press Enter to save.

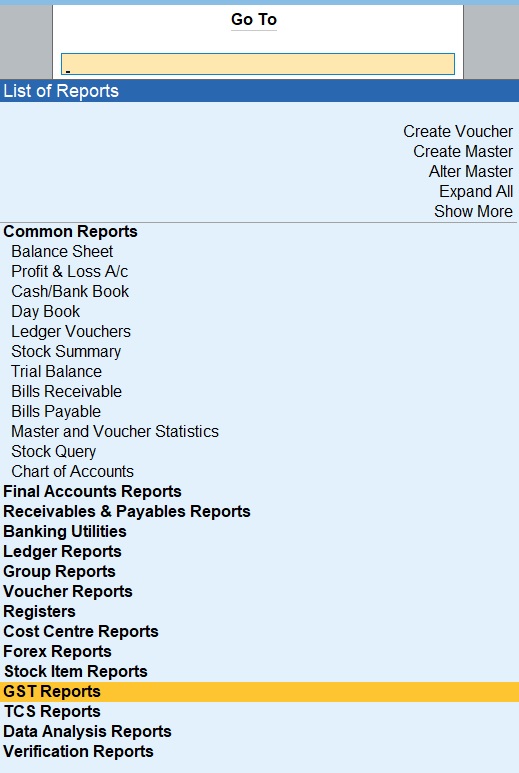

Reports

1. Go to Gateway of Tally prime > GO To > GST Reports>Enter.

2.Go to Gateway of Tally prime > GO To > GST Reports > GSTR-1> Enter.

3.Go to Gateway of Tally prime >Display more Reports> Statutory Reports> GST Reports> GSTR-2> Enter.

4.Go to Gateway of Tally prime > Display more Reports > Statutory Reports > GST Reports > GSTR -3B > Enter.

GOODS AND SERVICE TAX SUM

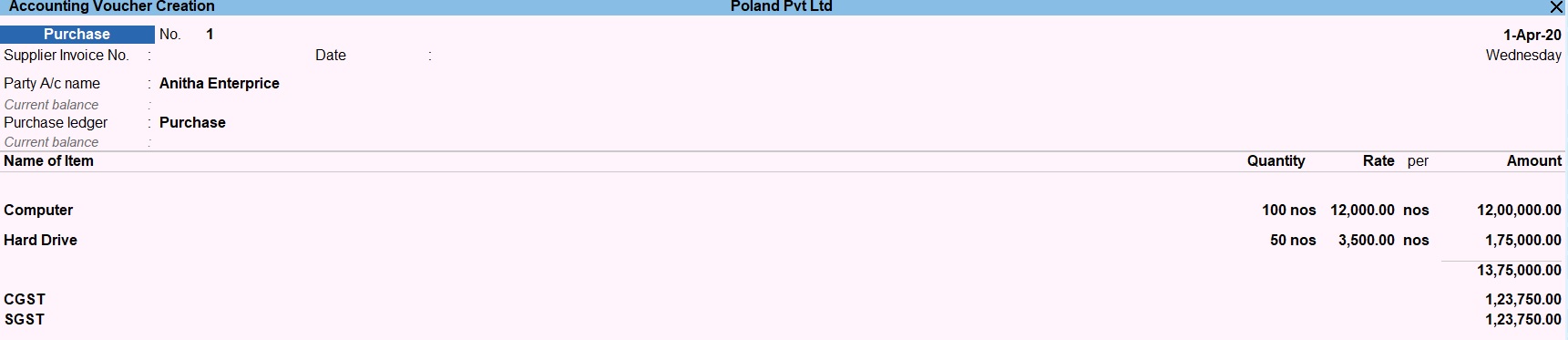

1. Purchasing the following goods from Anita enterprises, Tamilnadu with supplier invoice 101

- Computer 100nos Rs.12000

- External Hard Drive 50nos Rs.3500

- Pen driver 300nos Rs.750

- Scanner 50nos Rs.25200

- Pen driver 50nos Rs.850

- Scanner 10nos Rs.27000

- Computer 10nos Rs.14000

- External Hard Drive 10nos Rs.4000

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions