Navigating GST for Exports Goods in Tally Prime

Exports

05-07-23 Deepika Pvt Ltd exported the following goods to Ratha Traders Singapore under LUT:

| Item | Qty | Rate |

|---|---|---|

| MS Printer | 4 Nos | 6500 |

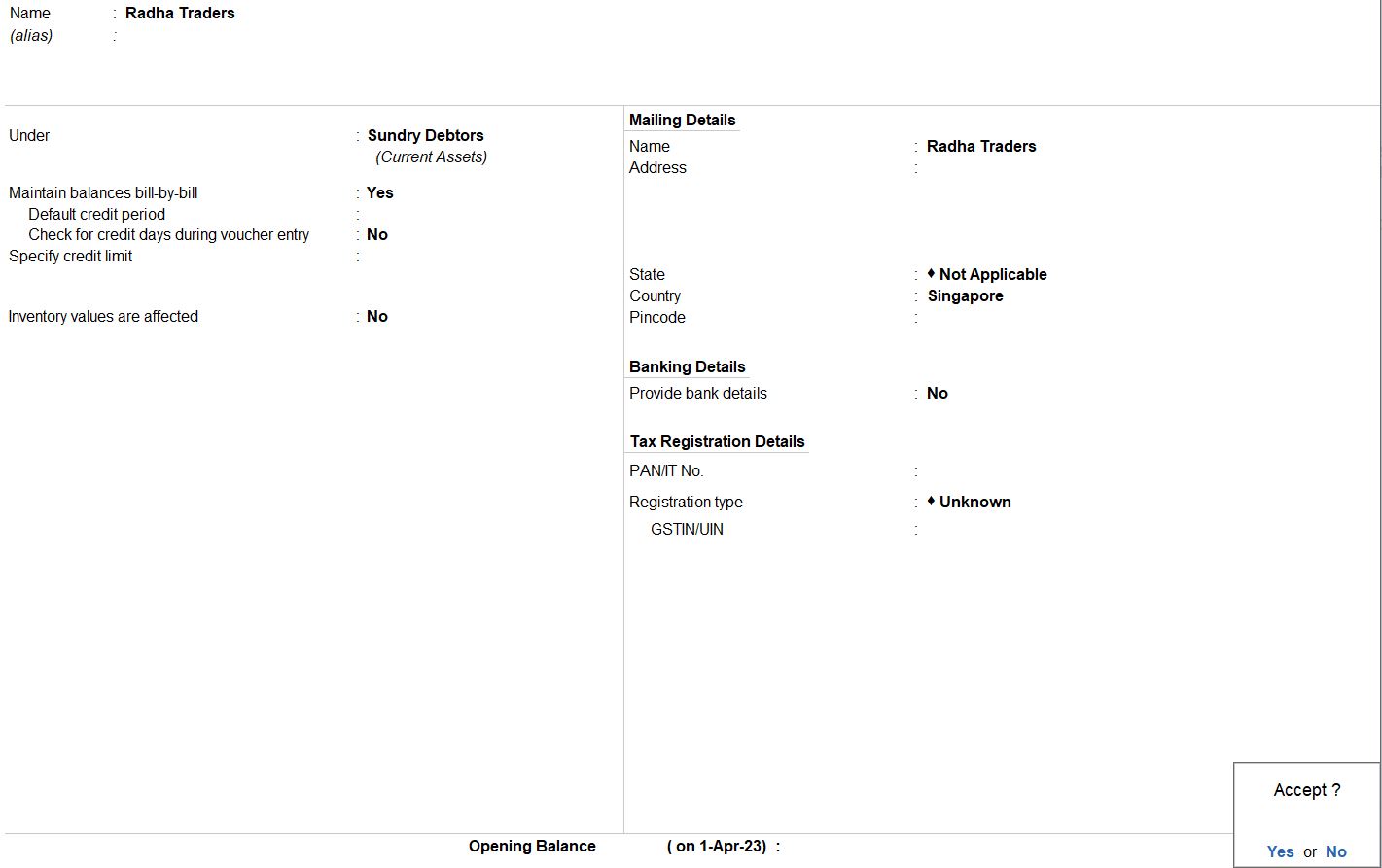

| Party Name | Ratha Traders |

|---|---|

| Country | Singapore |

| SALES LEDGER | |

| Name | Sales Export |

| Under | Sales Account |

| HSN/SAC | 12345678 |

| Nature of transaction | Export LUT/Bond |

| Taxability | Exempt |

| Type of Supply | Goods |

Exports Taxable

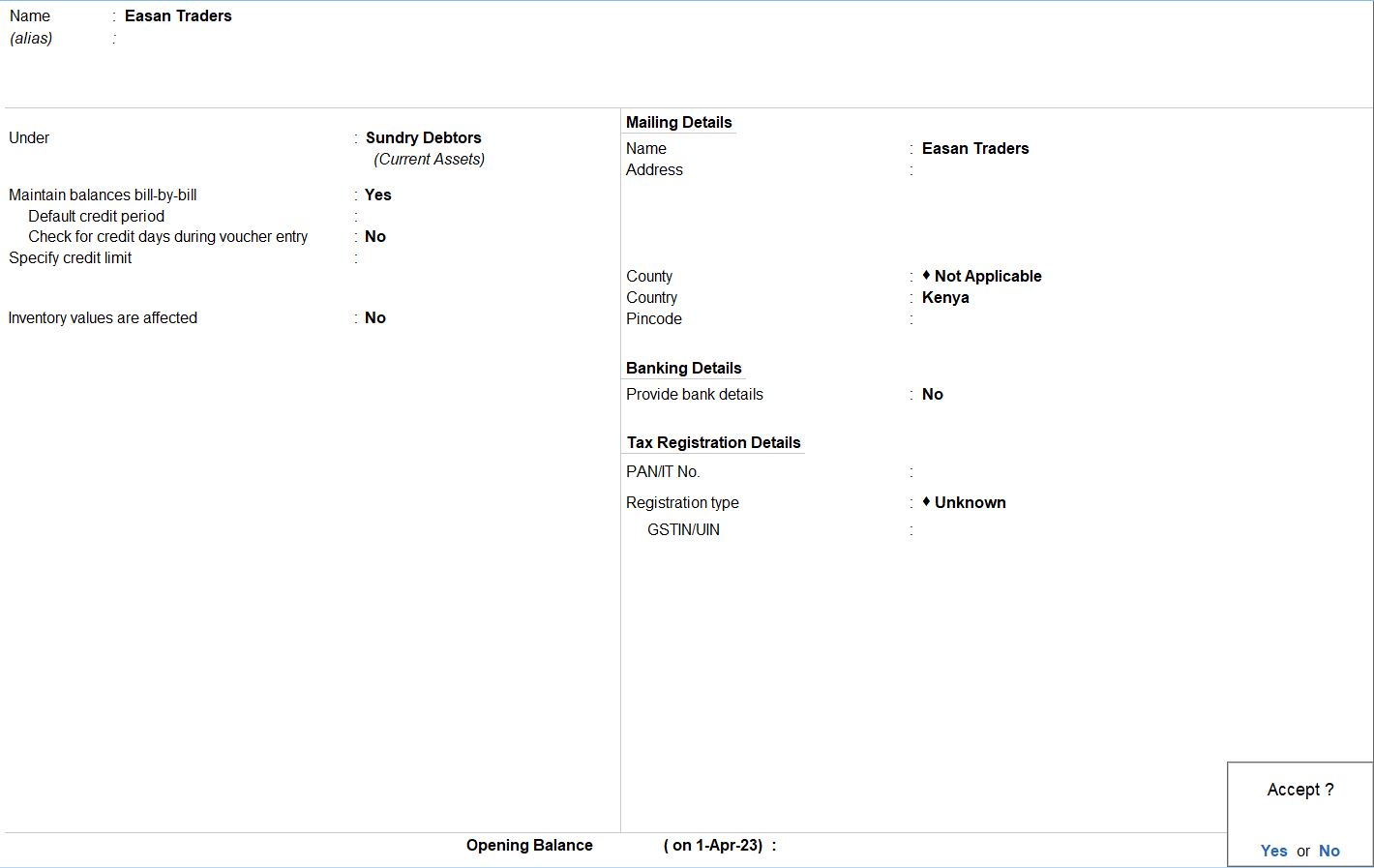

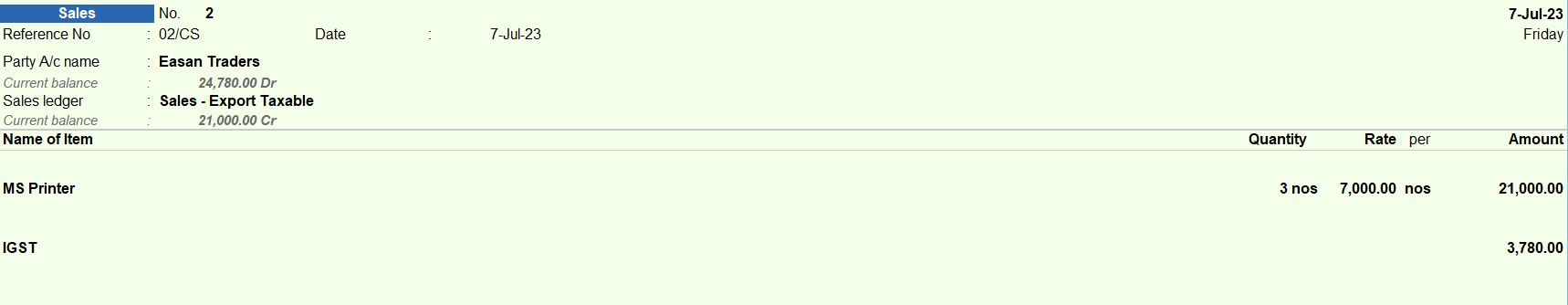

07-07-23 Deepika Pvt Ltd exported the following taxable goods to Easan Traders, Kenya, and charged integrated tax:

| Item | Qty | Rate |

|---|---|---|

| MS Printer | 3 Nos | 7000 |

| Party Name | Easan Traders |

|---|---|

| Under | Sundry Debtors |

| Country | Kenya |

| TAX LEDGER | |

| Name | Integrated Tax |

| Under | Duties & Taxes |

| Type of Duty/Tax | As Integrated Tax |

| Percentage of calculation as | 0% |

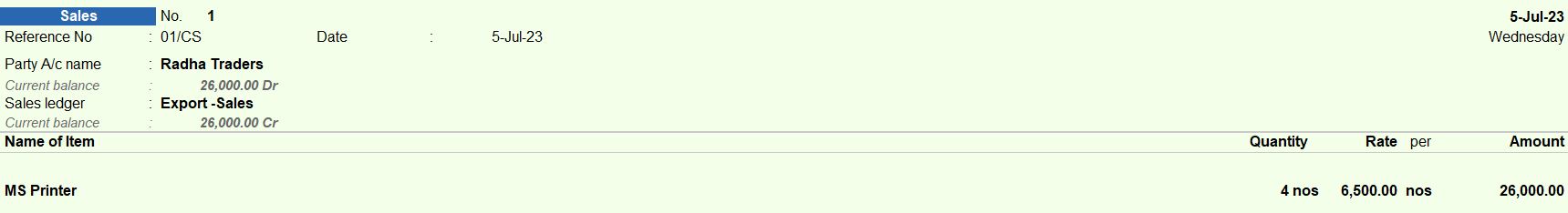

05-07-23 Deepika Pvt Ltd exported the following goods to Ratha Traders, Singapore, under Letter of Undertaking (LUT):

| Item | Qty | Rate |

|---|---|---|

| MS Printer | 4 Nos | 6500 |

Sales Voucher Details:

- Access Sales Voucher:

- From the Gateway of Tally, navigate to "Accounting Vouchers" and select "F8: Sales" voucher.

- Enter Details:

- Set the voucher date to 05-07-23.

- Optionally, provide a narration to describe the transaction.

- Party Details:

- Enter the party name as "Ratha Traders" located in Singapore.

- Ensure the party ledger is set up properly with the correct country details.

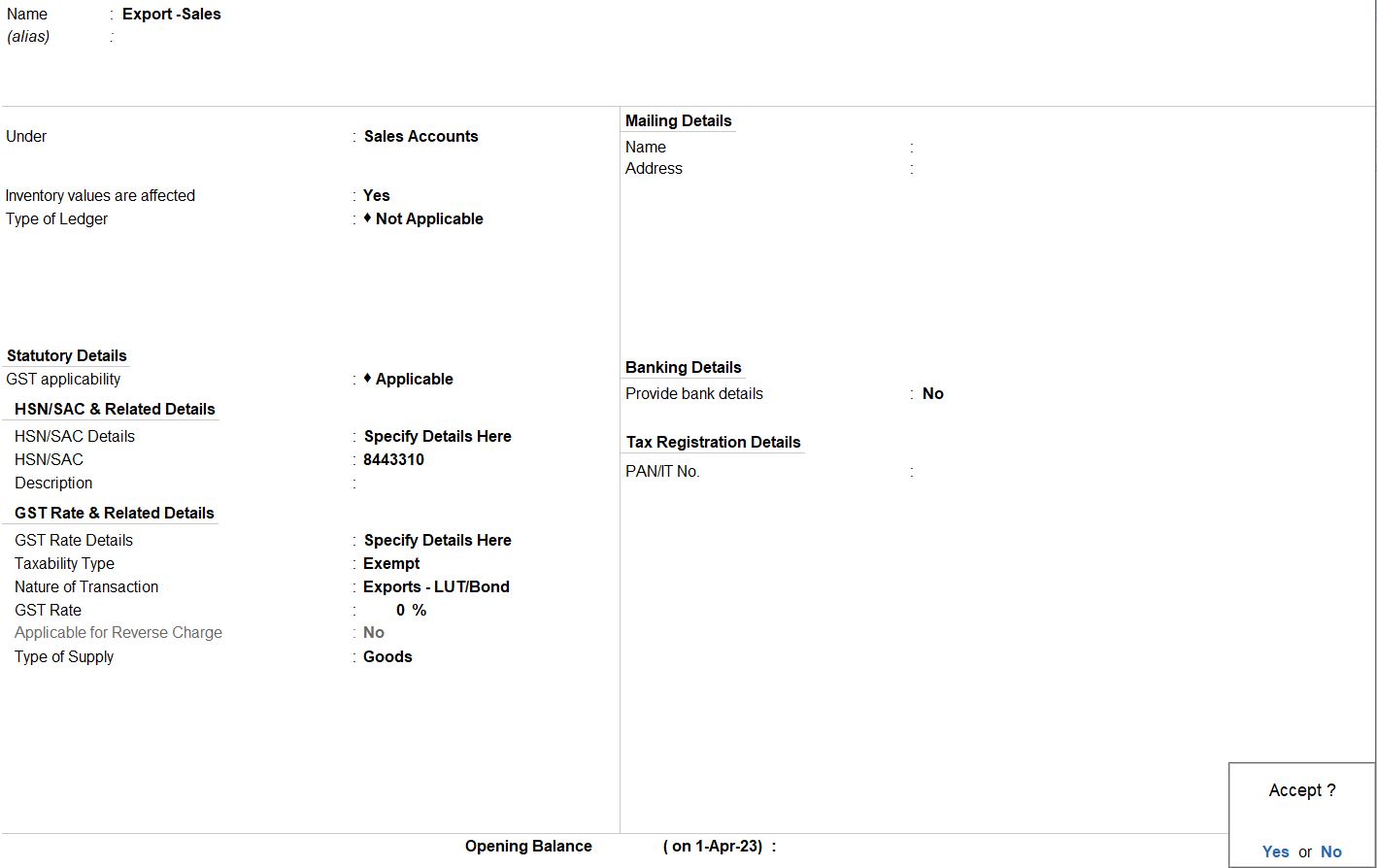

- Sales Ledger:

- Select the appropriate sales ledger, such as "Export - Sales," under the Sales Account group.

- Specify HSN/SAC details as 12345678.

- Set the taxability type as exempt.

- Choose "Exports - LUT/Bond" as the nature of the transaction.

- Set the GST rate to 0% since exports are exempt from GST.

- Item Details:

- Enter the item details, such as "MS Printer."

- Specify the quantity as 4 and the rate as 6500.

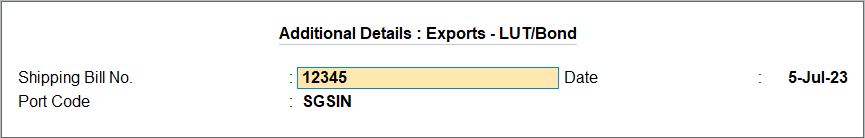

- Additional Details:

- Enter shipping bill details, such as the bill number and date, in the Additional Details section.

- Review and Save:

- Review the sales voucher to ensure accuracy.

- Press Ctrl + A to save the sales voucher.

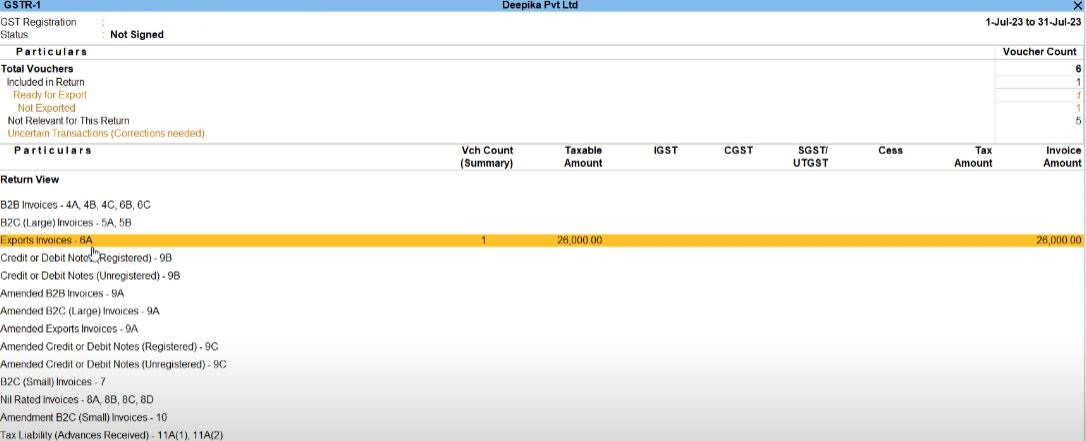

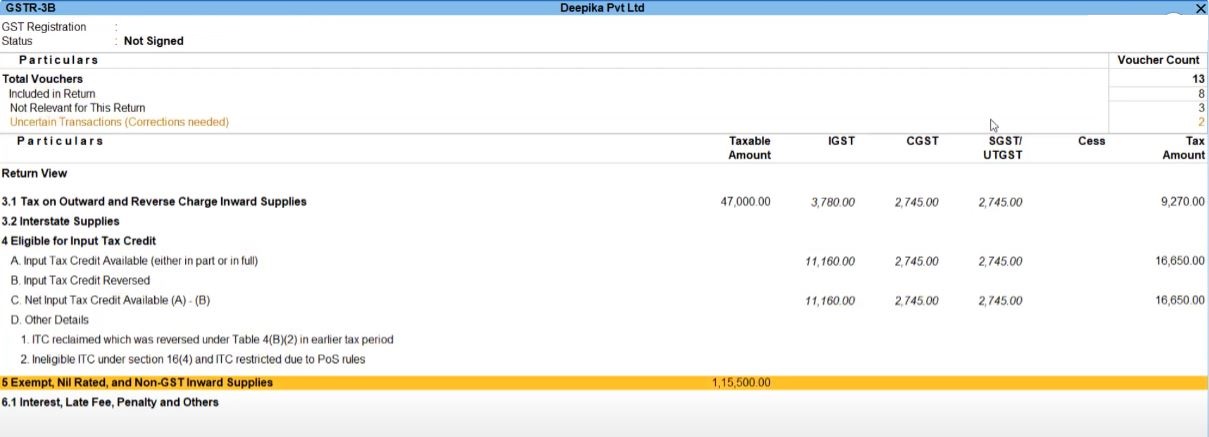

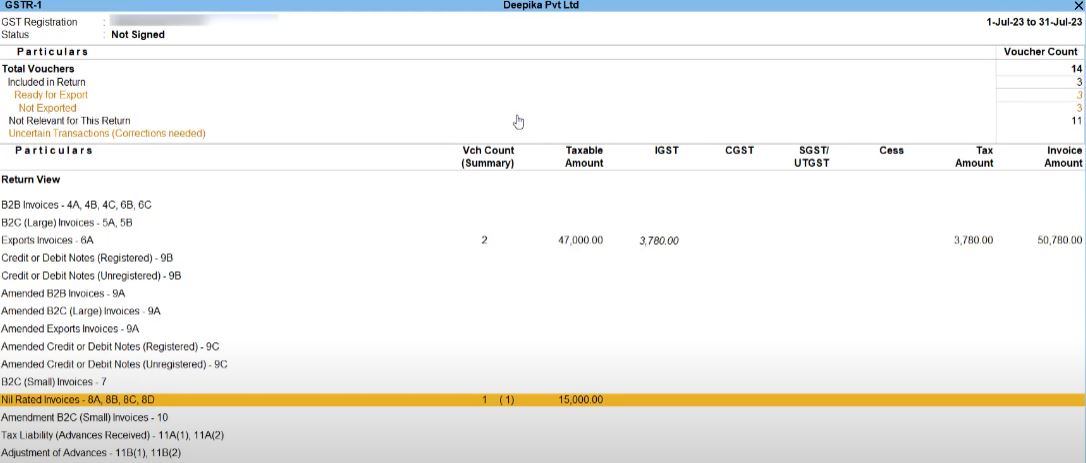

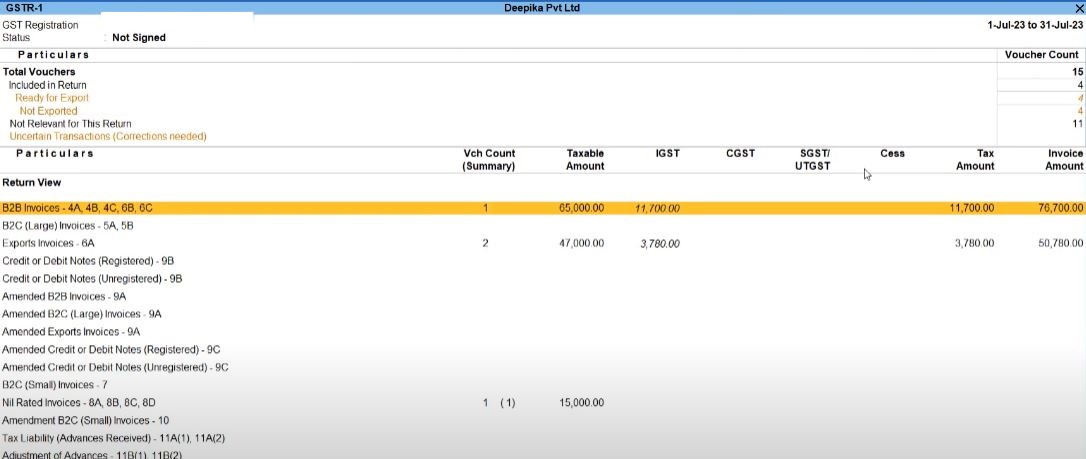

Reports

- Gateway of Taly -> Display More Reports -> GST Reports

Exports Taxable

07-07-23 Deepika Pvt Ltd exported the following taxable goods to Easan Traders, Kenya, and charged integrated tax:

| Item | Qty | Rate |

|---|---|---|

| MS Printer | 3 Nos | 7000 |

Sales Voucher Details:

- Access Sales Voucher:

- From the Gateway of Tally, navigate to "Accounting Vouchers" and select "F8: Sales" voucher.

- Enter Details:

- Set the voucher date to 07-07-23.

- Optionally, provide a narration to describe the transaction.

- Party Details:

- Enter the party name as "Easan Traders" located in Kenya.

- Ensure the party ledger is set up properly with the correct country details.

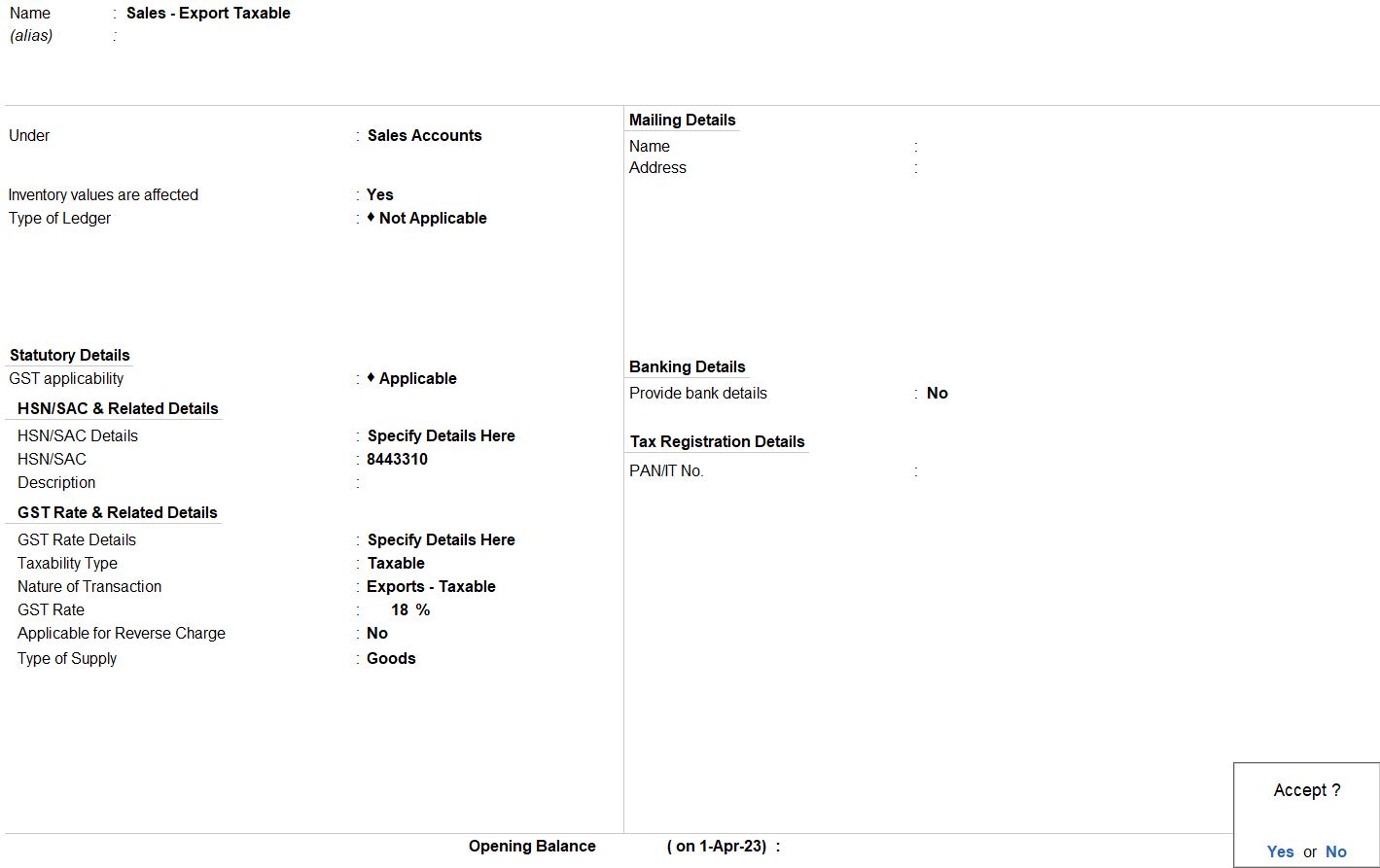

- Sales Ledger:

- Select the appropriate sales ledger, such as "Export - Sales Taxable," under the Sales Account group.

- Specify GST applicability and taxability type as taxable.

- Choose "Exports Taxable" as the nature of the transaction.

- Set the GST rate to 18% since the goods are taxable.

- Item Details:

- Enter the item details, such as "MS Printer."

- Specify the quantity as 3 and the rate as 7000.

- Integrated Tax (IGST):

- Enter the IGST amount charged on the sale. In this case, it is 3780.

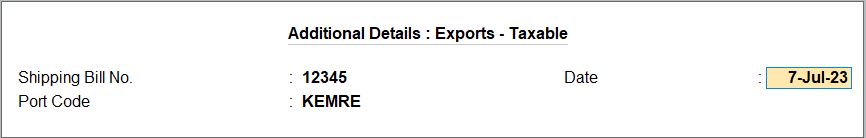

- Additional Details:

- Enter shipping bill details, such as the bill number and date, in the Additional Details section.

- Optionally, provide the port code.

- Review and Save:

- Review the sales voucher to ensure accuracy.

- Press Ctrl + A to save the sales voucher.

Reports

- Gateway of Taly -> Display More Reports -> GST Reports

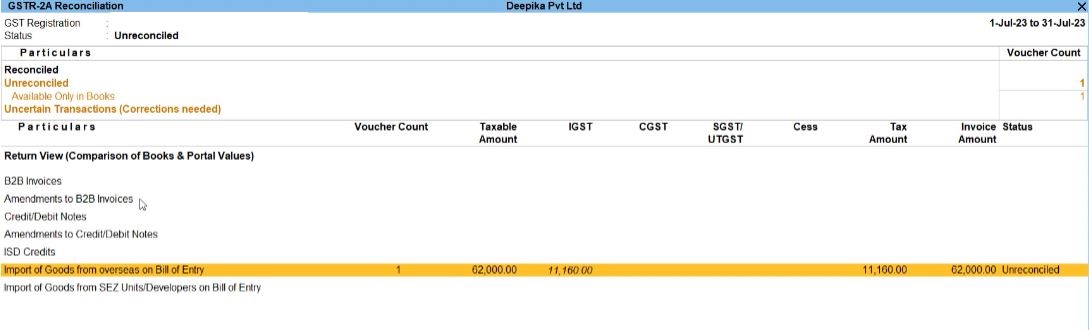

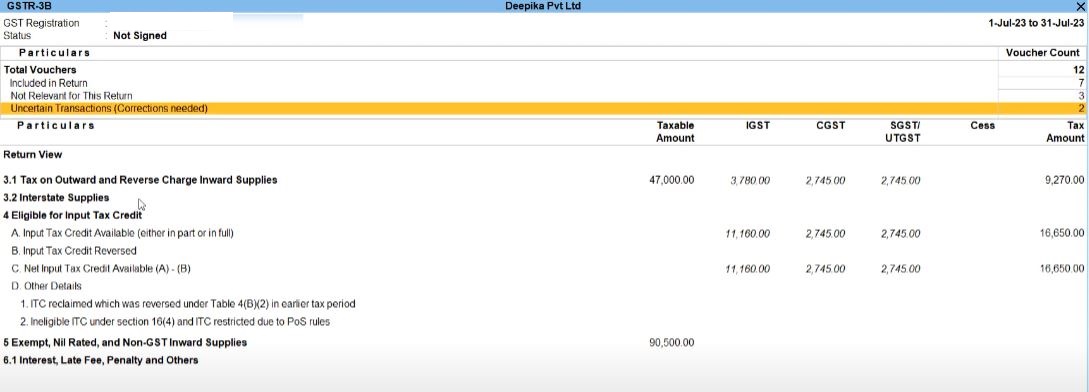

Imports Goods

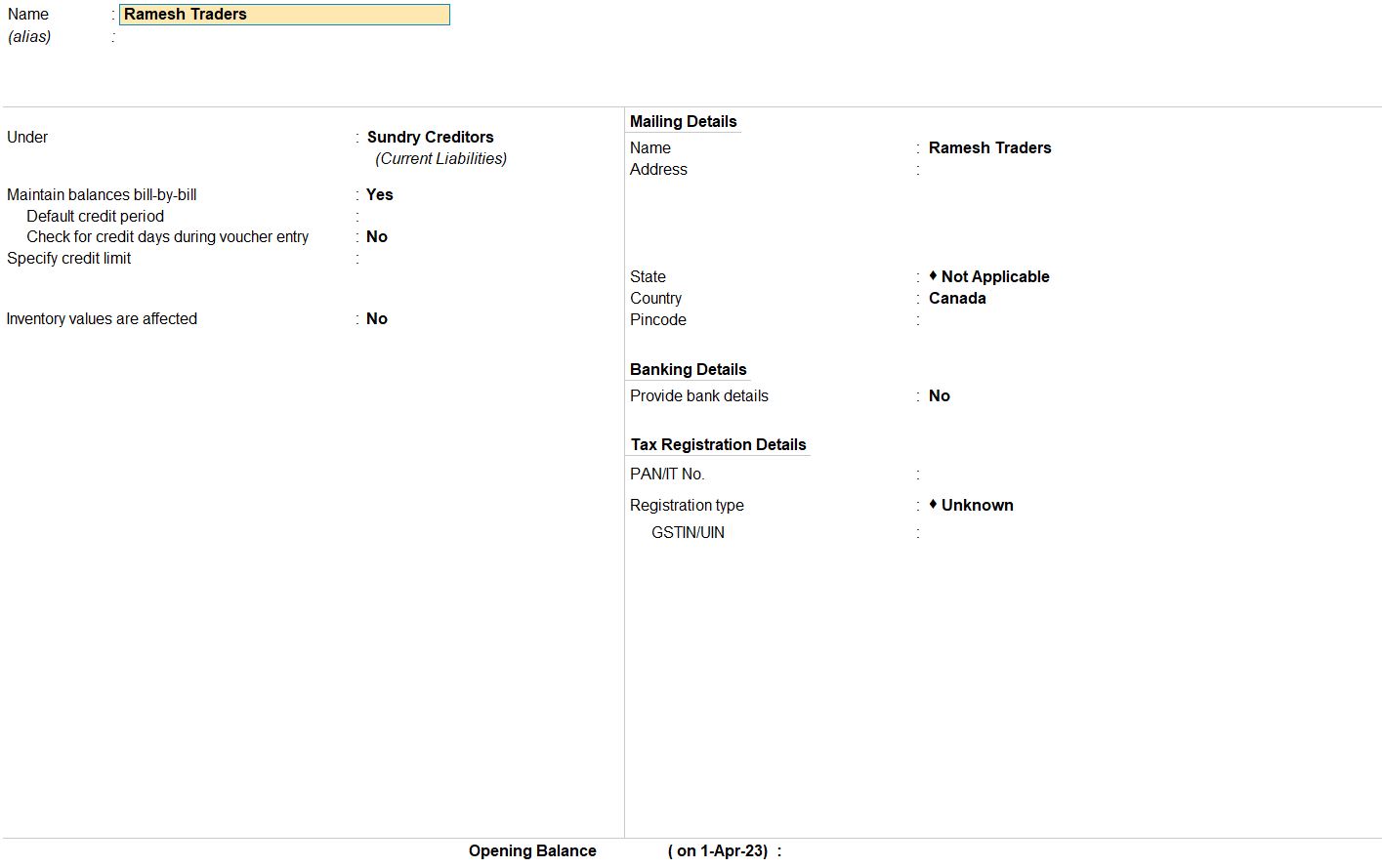

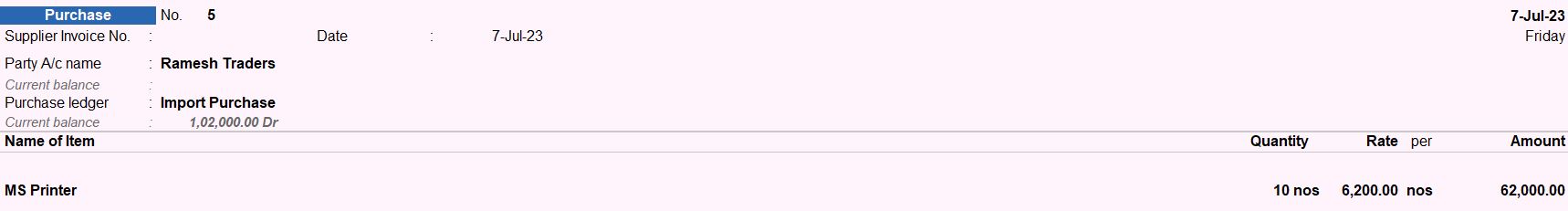

07-07-23 Deepika Pvt Ltd imported the following taxable goods from Ramesh Traders, Canada:

| Item | Qty | Rate |

|---|---|---|

| MS Printer | 10 Nos | 6200 |

| Party Name | Ramesh Traders |

|---|---|

| Country | Canada |

| PURCHASE LEDGER | |

| Name | Purchase Imports |

| Under | Purchase Account |

| Nature of transaction | Imports Taxable |

| Taxability | Taxable |

| Tax Type | Integrated Tax 18% |

| Type of Supply | Goods |

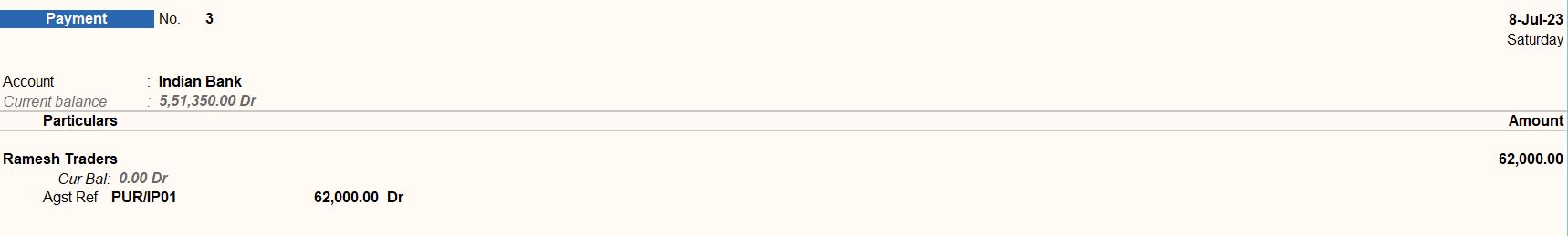

08-07-23 Made a payment of Rs. 62,000 to Ramesh Traders against the purchase invoice 03 through Indian bank.

08-07-23 Made a payment of Integrated Tax of Rs. 11,160 to the government through Indian bank.

After making a payment of integrated tax, we can raise an input tax credit by recording the journal voucher.

07-07-23 Deepika Pvt Ltd imported the following taxable goods from Ramesh Traders, Canada:

| Item | Qty | Rate |

|---|---|---|

| MS Printer | 10 Nos | 6200 |

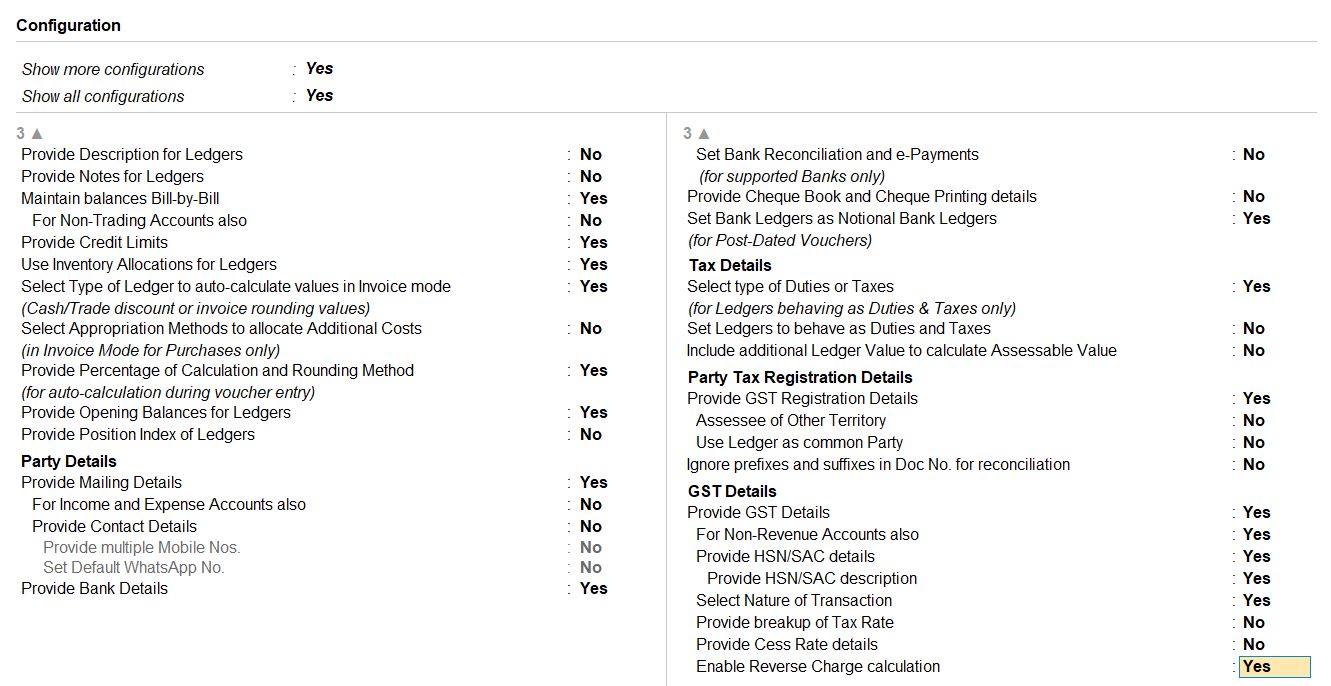

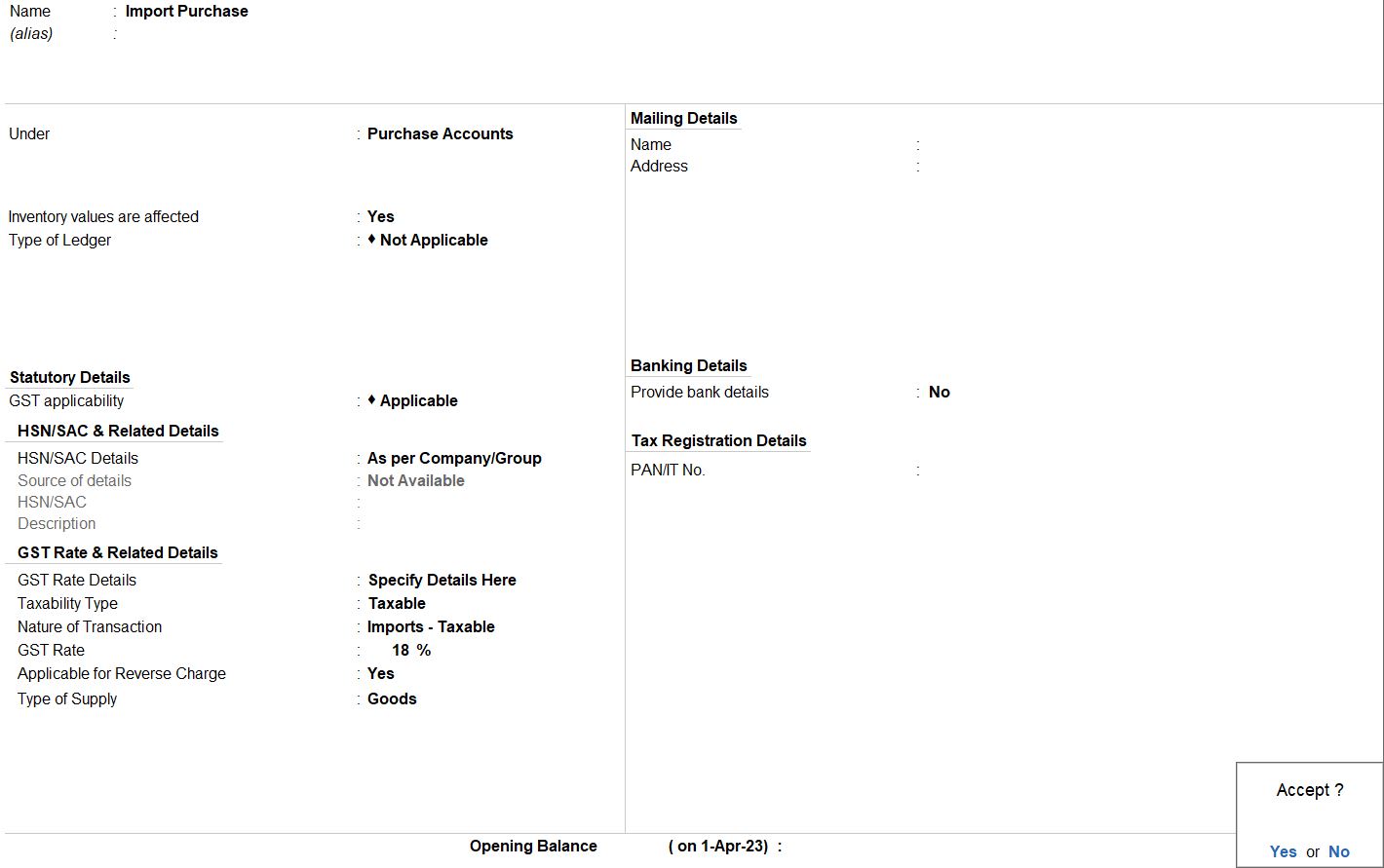

Purchase Voucher Details:

- Access Purchase Voucher:

- From the Gateway of Tally, navigate to "Accounting Vouchers" and select "F9: Purchase" voucher.

- Enter Details:

- Set the voucher date to 07-07-23.

- Optionally, provide a narration to describe the transaction.

- Party Details:

- Enter the party name as "Ramesh Traders" located in Canada.

- Ensure the party ledger is set up properly with the correct country details.

- Purchase Ledger:

- Select the appropriate purchase ledger, such as "Import Purchase," under the Purchase Account group.

- Set the nature of the transaction as "Imports Taxable."

- Specify taxability as "Taxable."

- Choose the tax type as "Integrated Tax" at 18%.

- Enable Reverse Charge Calculation by selecting "Yes."

- Item Details:

- Enter the item details, such as "MS Printer."

- Specify the quantity as 10 and the rate as 6200.

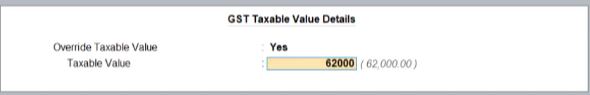

- GST Taxable Value Details:

- Override Taxable Value by selecting "Yes."

- Enter the taxable value as 62000.

- Review and Save:

- Review the purchase voucher to ensure accuracy.

- Press Ctrl + A to save the purchase voucher.

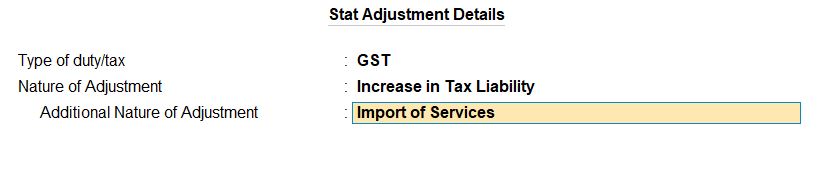

Increase In Tax Liability:

- Access Journal Voucher:

- Press Alt + J to access the journal voucher.

- Enter Details:

- Set the voucher date as per the transaction date.

- Optionally, provide a narration to describe the adjustment.

- Select Type of Duty/Tax:

- Choose GST as the type of duty/tax for the adjustment.

- Nature of Adjustment:

- Specify the nature of the adjustment as "Increase In Tax Liability."

- Additional Nature of Adjustment:

- Select "Import of Services" as the additional nature of adjustment.

- Debit Entry:

- Debit the ledger account representing the expense incurred for the import of services. In this case, the ledger account could be "Import Purchase Exp" or any other relevant account.

- Enter the amount of 11160 in the debit side.

- Credit Entry:

- Credit the Integrated Goods and Services Tax (IGST) ledger account.

- Enter the same amount of 11160 in the credit side.

- Review and Save:

- Review the journal voucher to ensure accuracy.

- Press Ctrl + A to save the journal voucher.

08-07-23 Made a payment of Rs. 62,000 to Ramesh Traders against the purchase invoice 03 through Indian bank.

Access Payment Voucher:

- Go to the Gateway of Tally:

- Navigate to Accounting Vouchers > Payment Voucher.

- Enter Voucher Details:

- Set the voucher date as 08-07-23.

- Optionally, provide a voucher reference number or any necessary narration.

- Select Party Ledger:

- In the "Account" field, select "Ramesh Traders" as the party ledger.

- Debit Entry:

- Debit the ledger account representing the payment made to Ramesh Traders. This could be the Purchase Ledger or any relevant ledger account.

- Enter the amount of Rs. 62000 in the debit side.

- Credit Entry:

- Credit the Indian Bank ledger account.

- Enter the same amount of Rs. 62000 in the credit side.

- Enter Purchase Invoice Reference:

- Optionally, in the payment voucher, you can mention the purchase invoice number "03" in the Narration or Remarks field to link the payment to the specific invoice.

- Review and Save:

- Review the payment voucher to ensure accuracy.

- Press Ctrl + A to save the payment voucher.

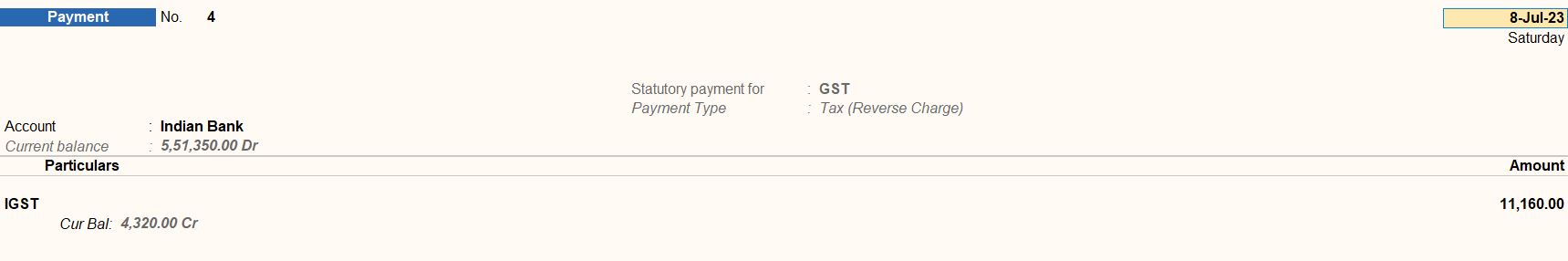

08-07-23 Made a payment of Integrated Tax of Rs. 11,160 to the government through Indian bank.

Access Payment Voucher:

- Go to the Gateway of Tally:

- Navigate to Accounting Vouchers > Payment Voucher.

- Enter Voucher Details:

- Set the voucher date as 08-Jul-23.

- Optionally, provide a voucher reference number or any necessary narration.

- Select Party Ledger:

- Since this is a statutory payment, select "Indian Bank" as the party ledger.

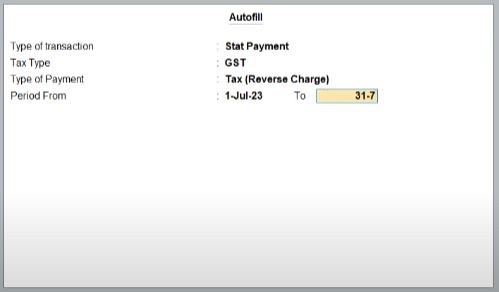

- Enter Tax Type and Period:

- In the Type of Transaction field, select "Stat Payment."

- Choose "GST" as the Tax Type.

- Select "Tax (Reverse Charge)" as the Type of Payment.

- Set the period from 1-Jul-23 to 31-Jul-23.

- Enter Particulars:

- Enter "IGST" in the Particulars column.

- Enter the amount of IGST in the respective amount column.

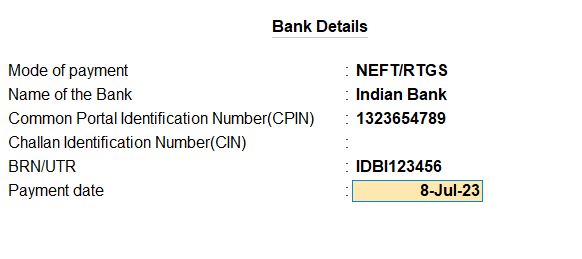

- Enter Bank Details:

- Choose "NEFT/RTGS" as the Mode of Payment.

- Select "Indian Bank" as the Name of the Bank.

- Enter the Common Portal Identification Number (CPIN) as "1323654789".

- Input the BRN/UTR as "IDBI123456".

- Set the Payment date as 8-Jul-23.

- Review and Save:

- Review the payment voucher to ensure accuracy.

- Press Ctrl + A to save the payment voucher.

After making a payment of integrated tax, we can raise an input tax credit by recording the journal voucher.

Access Journal Voucher:

- Go to the Gateway of Tally:

- Navigate to Accounting Vouchers > Journal Voucher.

- Enter Voucher Details:

- Set the voucher date as the relevant date.

- Optionally, provide a voucher reference number or any necessary narration.

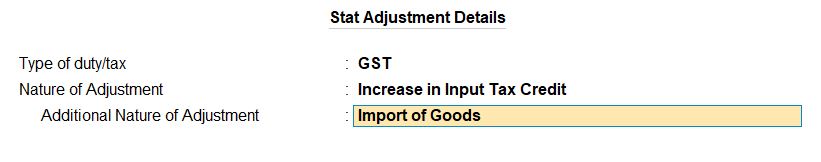

- Select Tax Type and Nature of Adjustment:

- Press Alt + J to access the Stat Adjustment.

- In the Type of Duty/Tax field, select "GST."

- Choose "Increase in Input Tax Credit" as the Nature of Adjustment.

- Additionally, select "Import of Goods" as the Additional Nature of Adjustment.

- Enter Debit and Credit Entries:

- Debit IGST ledger account with the amount of IGST (11160).

- Credit the Import Purchase Expense ledger account with the same amount (11160).

- Review and Save:

- Review the journal voucher to ensure accuracy.

- Press Ctrl + A to save the journal voucher.

Reports

- Gateway of Taly -> Display More Reports -> GST Reports

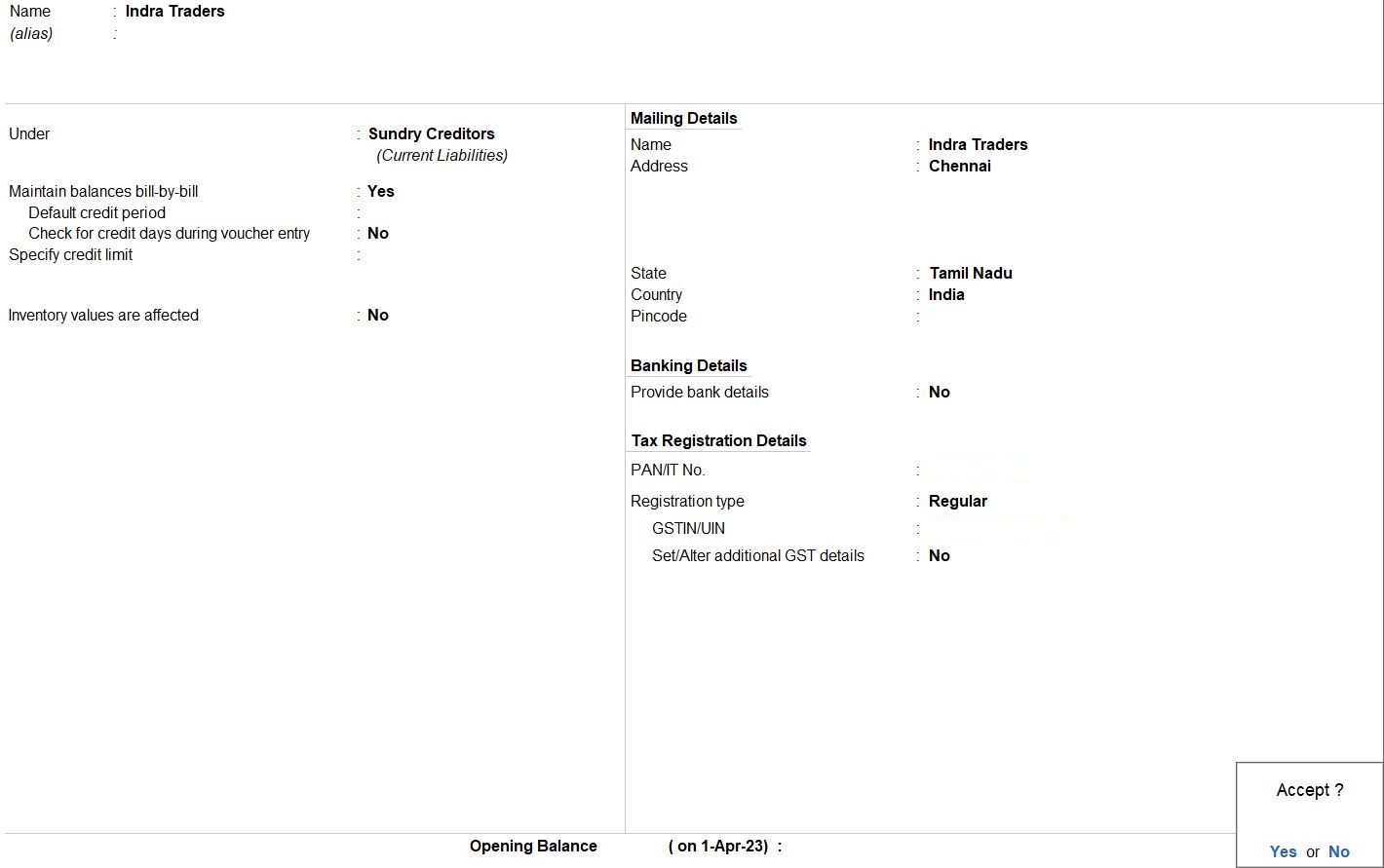

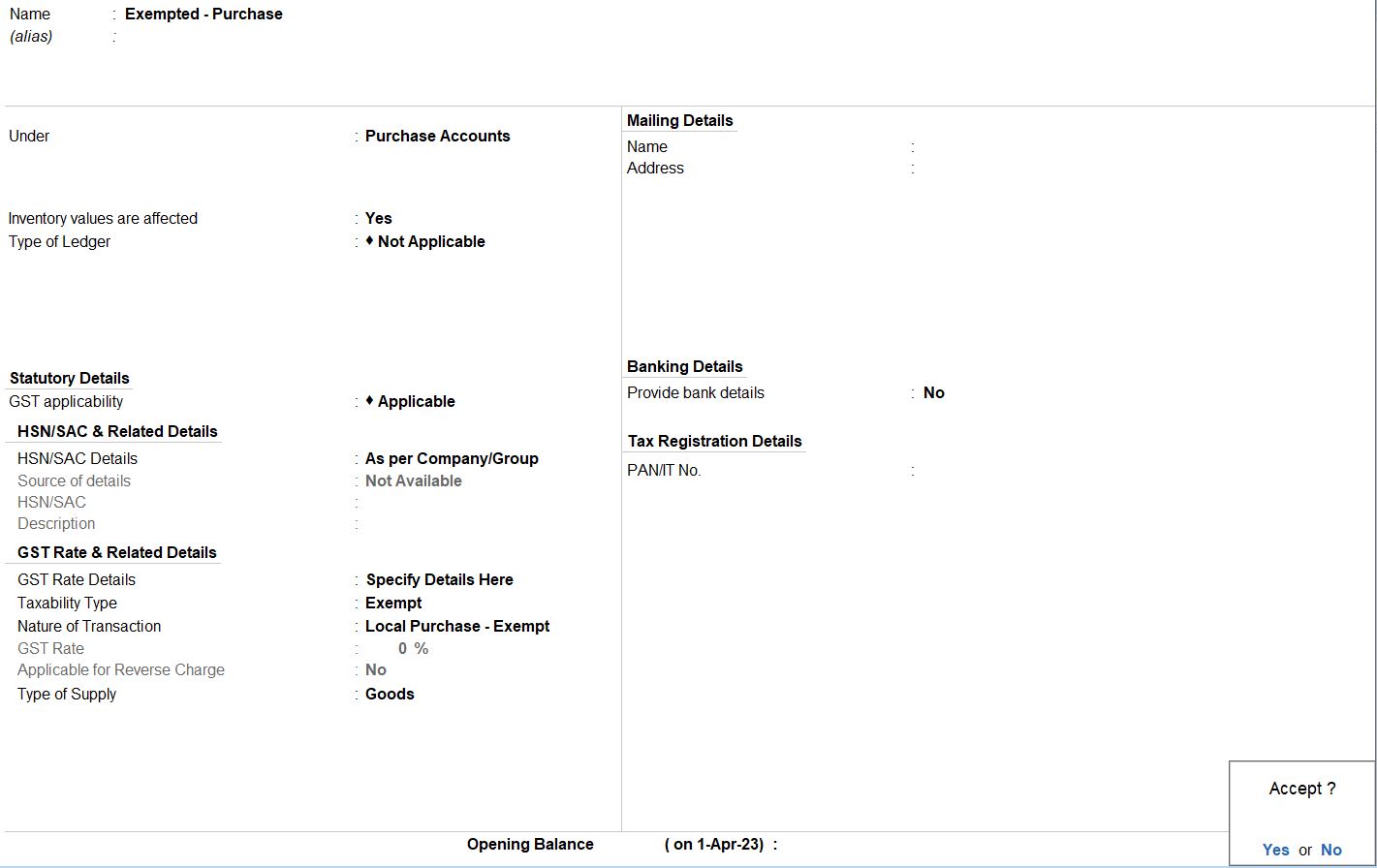

Exempted Goods

08-07-23 Deepika Pvt Ltd purchased the following exempted goods from Indra Traders, Tamil Nadu, with supplier invoice number 004:

| Item | Qty | Rate |

|---|---|---|

| Stamp | 100 | 250 |

| PARTY NAME | |

|---|---|

| Name | Indra Traders |

| Set / alter details | Yes |

| Registration type | Regular |

| PAN | AABFP2450N |

| GSTIN/UIN | 33AABFP2450N1ZA |

| PURCHASE LEDGER | |

| Name | Purchase Exempt |

| GST Applicable | Applicable |

| Nature of Transaction | Purchase Exempt |

| Type of Supply | Goods |

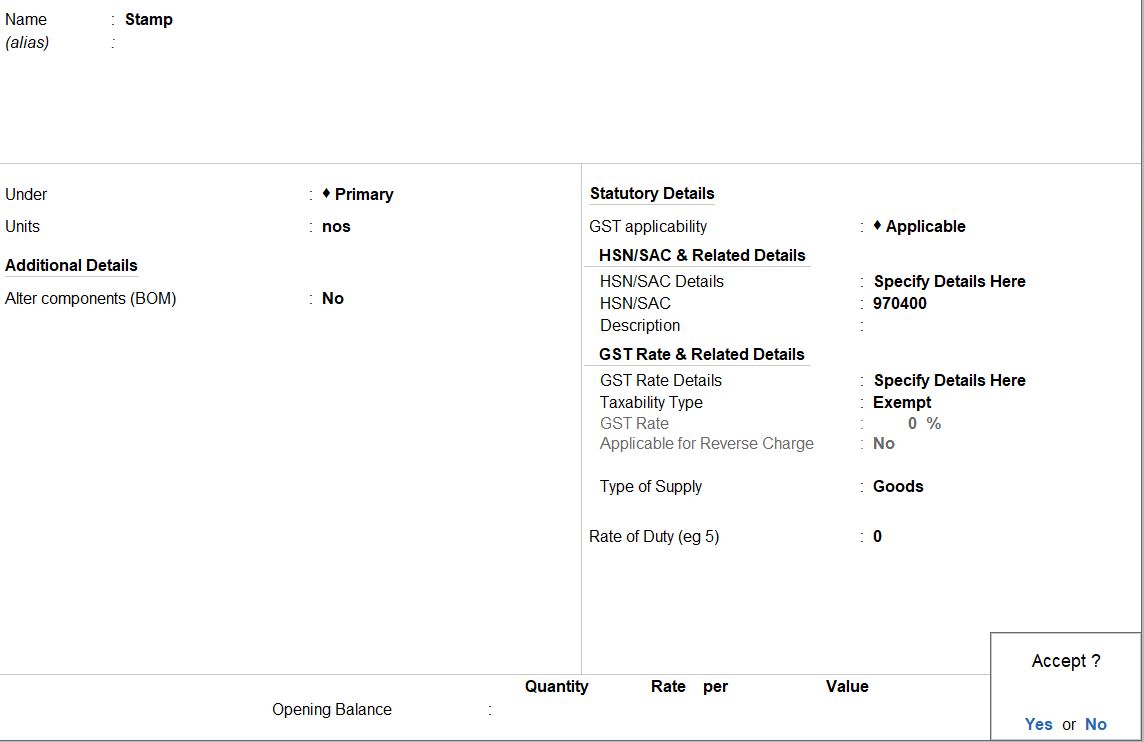

Stock Item

| STAMPS | |

|---|---|

| Name | Stamps |

| STATUTORY INFORMATION | |

| GST Applicable | Applicable |

| Set/alter GST details | Yes |

| TAX RATE DETAILS | |

| Description | Stamps |

| HSN/SAC | 9702000 |

| Calculation Type | On Value |

| Taxability | Exempt |

| Type of Supply | Goods |

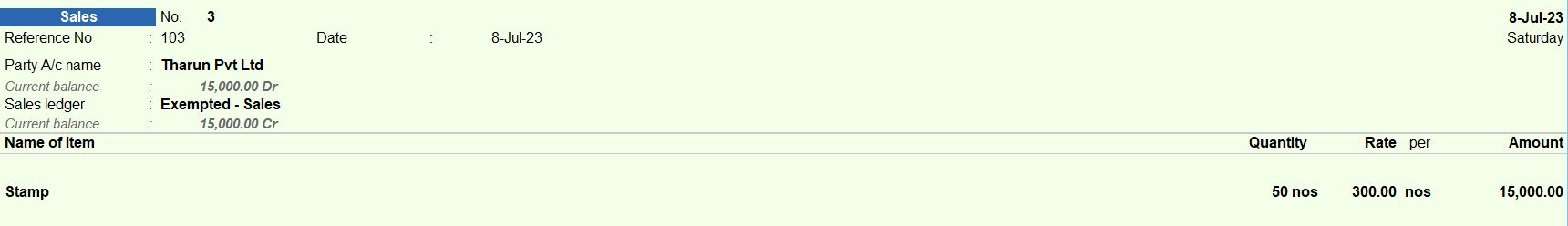

08-07-23 Deepika Pvt Ltd sold the following exempted goods to Tharun Pvt Ltd, a registered dealer in Tamil Nadu:

| Item | Qty | Rate |

|---|---|---|

| Stamp | 50 | 300 |

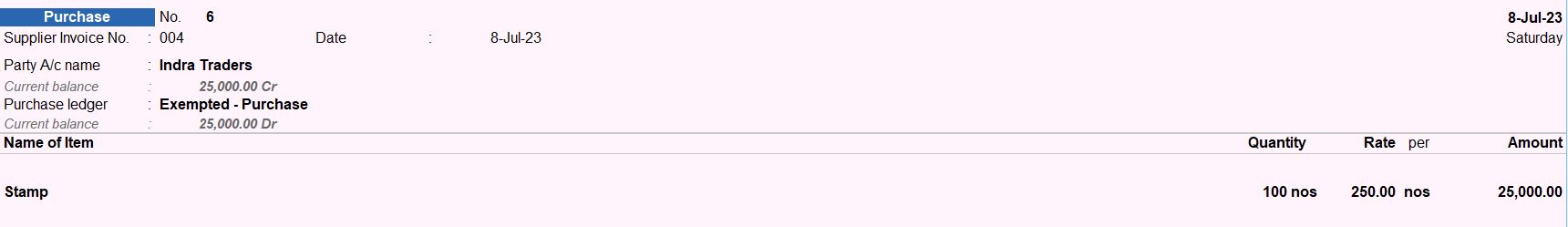

08-07-23 Deepika Pvt Ltd purchased the following exempted goods from Indra Traders, Tamil Nadu, with supplier invoice number 004:

| Item | Qty | Rate |

|---|---|---|

| Stamp | 100 | 250 |

Access Purchase Voucher:

- Go to the Gateway of Tally:

- Navigate to Accounting Vouchers > F9 (Purchase).

- Enter Voucher Details:

- Set the voucher date as 08-07-23.

- Enter the supplier invoice number as "004."

- Optionally, provide additional details such as narration.

- Select Supplier Details:

- Select the supplier "Indra Traders" from the list.

- Ensure that the registration type is set to "Regular" and the PAN and GSTIN/UIN are provided.

- Choose Purchase Ledger:

- Select the purchase ledger named "Purchase Exempt."

- Ensure that the ledger has "GST Applicable" set to "Applicable" and the "Nature of Transaction" set to "Purchase Exempt."

- Enter Item Details:

- Enter the item details:

- Item: Stamp

- Quantity: 100

- Rate: 250

- Ensure that the stock item "Stamps" is selected.

- Confirm that the GST details are correctly set as follows:

- HSN/SAC: 9702000

- Taxability: Exempt

- Calculation Type: On Value

- Type of Supply: Goods

- Review and Save:

- Review the voucher to ensure accuracy.

- Press Ctrl + A to save the purchase voucher.

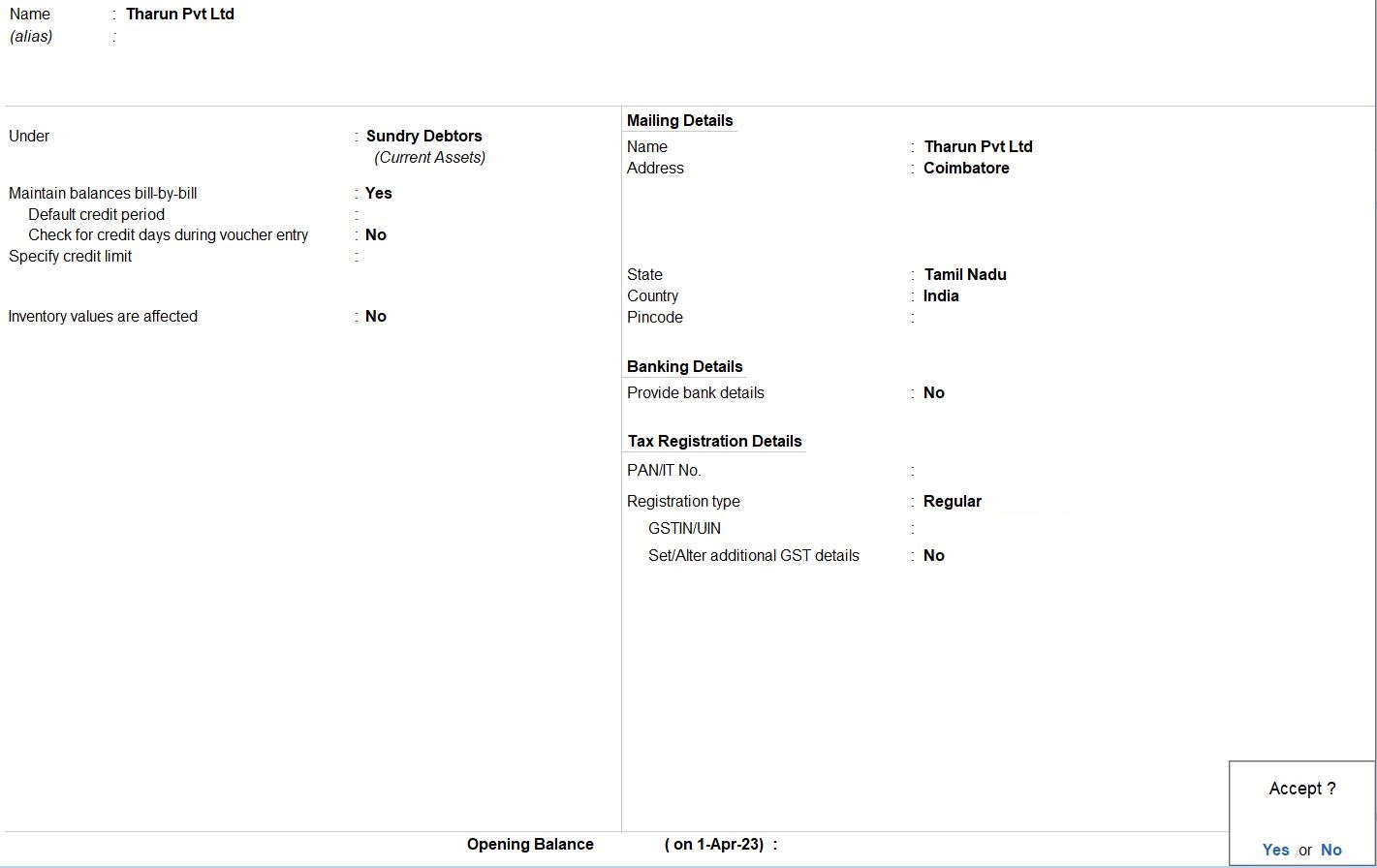

08-07-23 Deepika Pvt Ltd sold the following exempted goods to Tharun Pvt Ltd, a registered dealer in Tamil Nadu:

| Item | Qty | Rate |

|---|---|---|

| Stamp | 50 | 300 |

Access Sales Voucher:

- Go to the Gateway of Tally:

- Navigate to Accounting Vouchers > F8 (Sales).

- Enter Voucher Details:

- Set the voucher date as 08-07-23.

- Optionally, enter any additional details such as the party reference number or narration.

- Select Party Details:

- Choose the party "Tharun Pvt Ltd" from the list of ledgers.

- Ensure that Tharun Pvt Ltd is set as a registered dealer in Tamil Nadu.

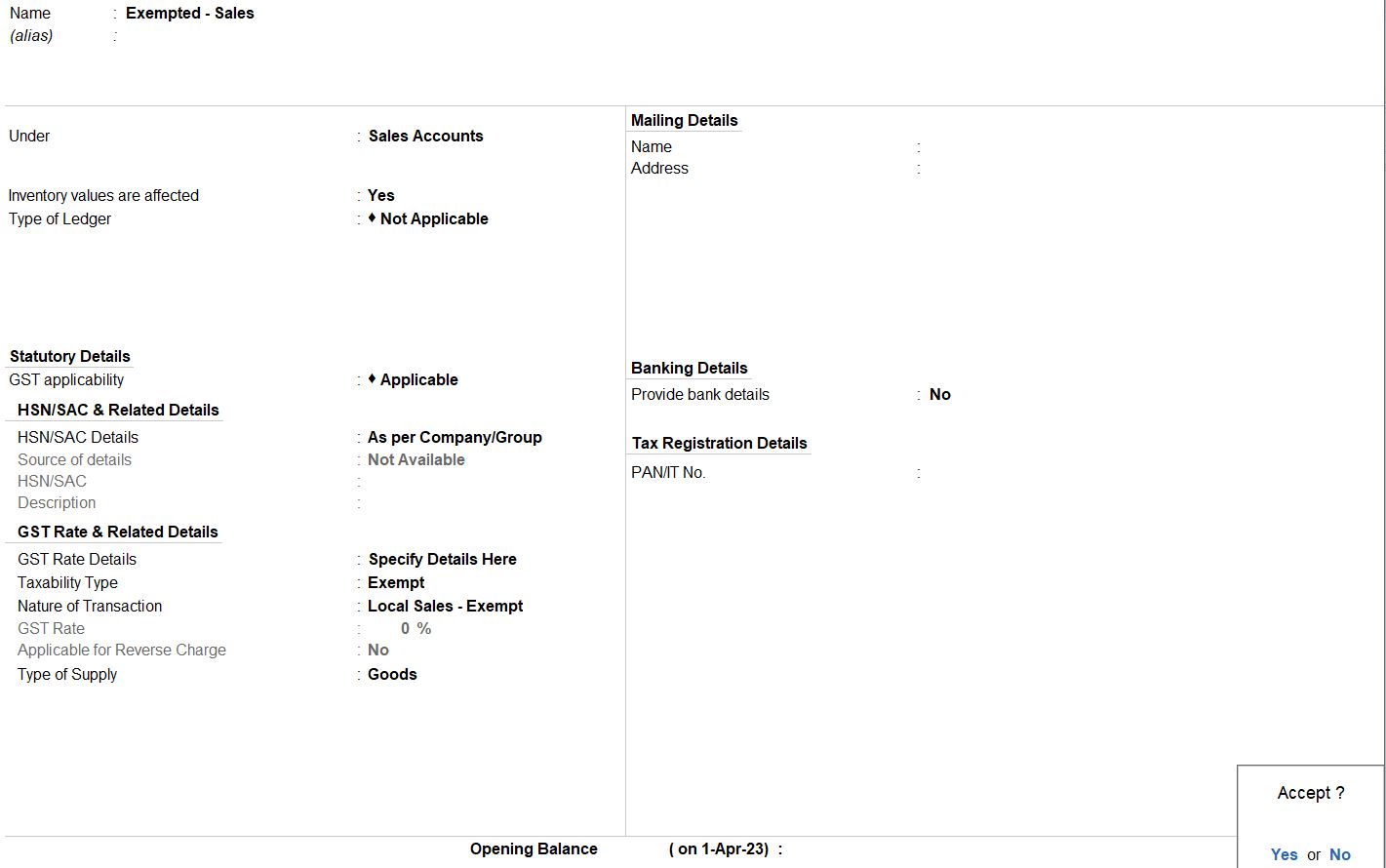

- Choose Sales Ledger:

- Select the sales ledger named "Exempted - Sales."

- This ledger should be configured for exempted sales and have the appropriate GST settings.

- Enter Item Details:

- Enter the item details:

- Item: Stamp

- Quantity: 50

- Rate: 300

- Ensure that the stock item "Stamp" is selected.

- Review and Save:

- Review the voucher to ensure accuracy.

- Press Ctrl + A to save the sales voucher.

Reports

- Gateway of Taly -> Display More Reports -> GST Reports

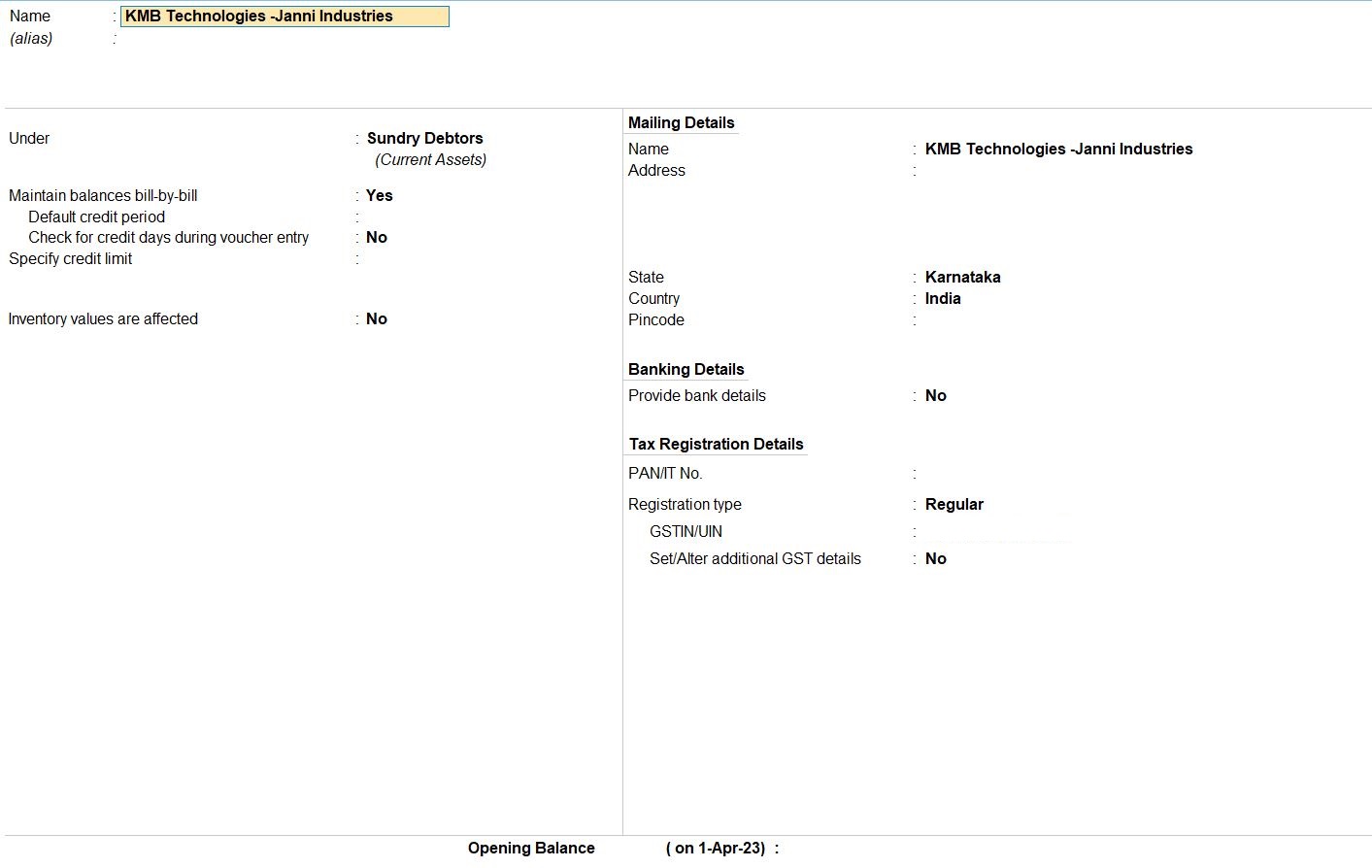

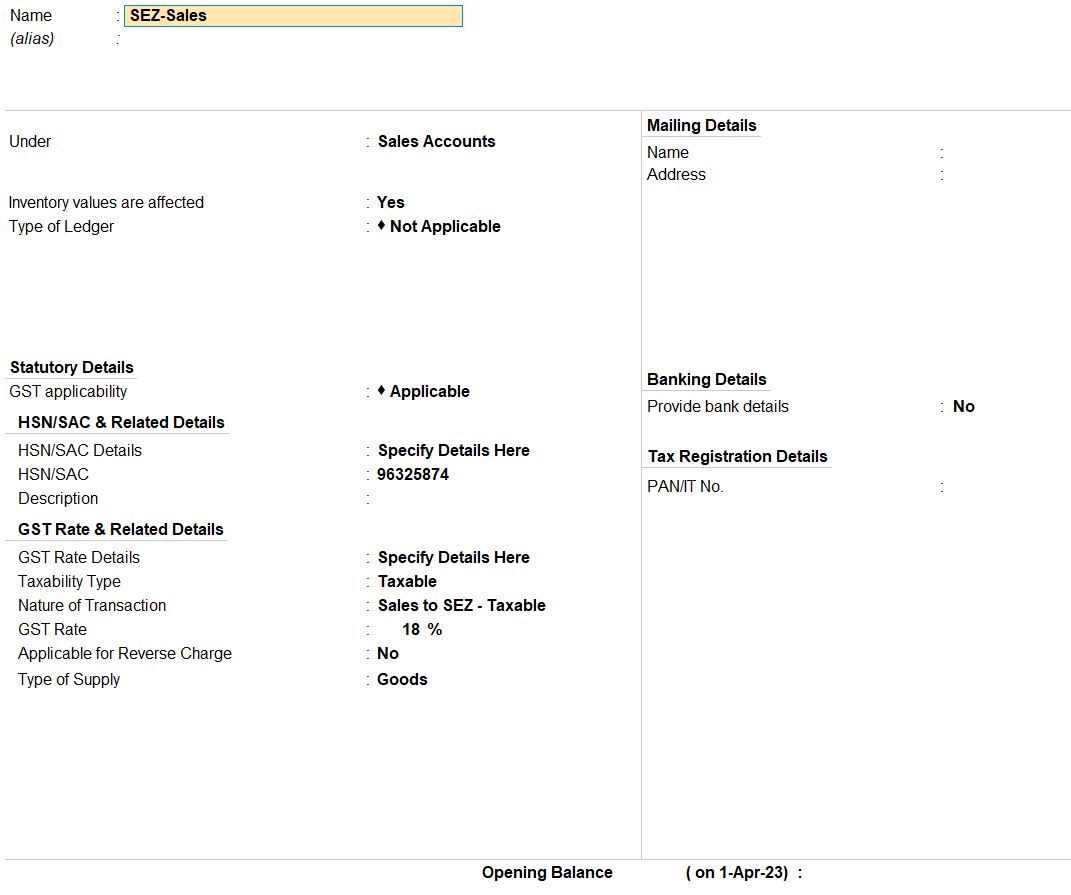

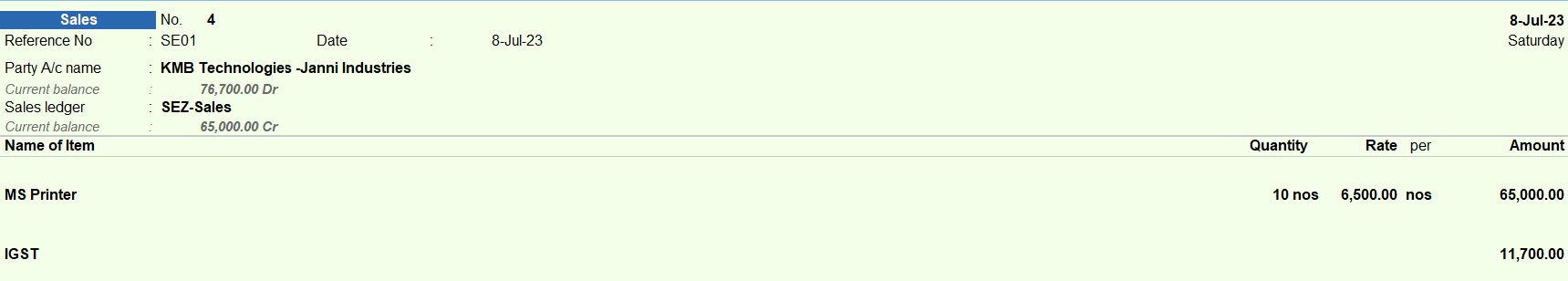

SEZ Sales

08-07-23 Deepika Pvt Ltd sold the following to KMB Technologies – Janni Industries area (SEZ), Karnataka:

| Item | Qty | Rate |

|---|---|---|

| MS Printer | 10 | 65000 |

| PARTY NAME | |

|---|---|

| Party Name | KMB Technologies - Janni Industries |

| Under | Sundry Debtors |

| State | Karnataka |

| Set/alter details | Yes |

| Registration type | Regular |

| SALES LEDGER | |

| Name | SEZ Sales |

| Under | Sales Accounts |

| GST Applicable | Applicable |

| Nature of Transaction | Sales to SEZ - Taxable |

| Type of Supply | Goods |

Access Sales Voucher:

- Go to the Gateway of Tally:

- Navigate to Accounting Vouchers > F8 (Sales).

- Enter Voucher Details:

- Set the voucher date as 08-07-23.

- Optionally, enter any additional details such as the party reference number or narration.

- Select Party Details:

- Choose the party "KMB Technologies - Janni Industries" from the list of ledgers.

- Ensure that KMB Technologies is set as a registered dealer in Karnataka.

- Choose Sales Ledger:

- Select the sales ledger named "SEZ Sales."

- This ledger should be configured for SEZ Sales and have the appropriate GST settings.

- Enter Item Details:

- Enter the item details:

- Item: MS Printer

- Quantity: 10

- Rate: 65000

- Ensure that the stock item "MS Printer" is selected.

- Review and Save:

- Review the voucher to ensure accuracy.

- Press Ctrl + A to save the sales voucher.

Reports

- Gateway of Taly -> Display More Reports -> GST Reports

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions