Seamless GST Tax Payment in Tally Prime: A Step-by-Step Tutorial

GST – TAX PAYMENT

Timeline for Payment

- Regular Dealers: 20th of the subsequent month

- Composition Dealers: 18th of the subsequent month

Mode of Payments

- Online Mode:

- Internet banking through authorized banks

- Credit card or debit card after registering the same in the common portal through authorized bank

- National Electronic Fund Transfer (NEFT) from any bank

- Real Time Gross Settlement (RTGS) from any bank

- Offline Mode:

- Cash

- Cheque

- Demand draft by depositing Over the Counter Payment (OTC) from authorized banks

Tax Payments

20-08-23 Sri Lakshmi Electronics made the payment of the following taxes to the government:

| Type of Tax | Tax Amount |

|---|---|

| Central Tax | 15,790 |

| State Tax | 790 |

| Integrated Tax | 34,200 |

| Bank Account Details | ||||

|---|---|---|---|---|

| A/c No | IFS code | Bank Name | Branch | Opening Balance |

| 6523532771 | IDIB000N062 | Indian Bank | Salem | 572000 |

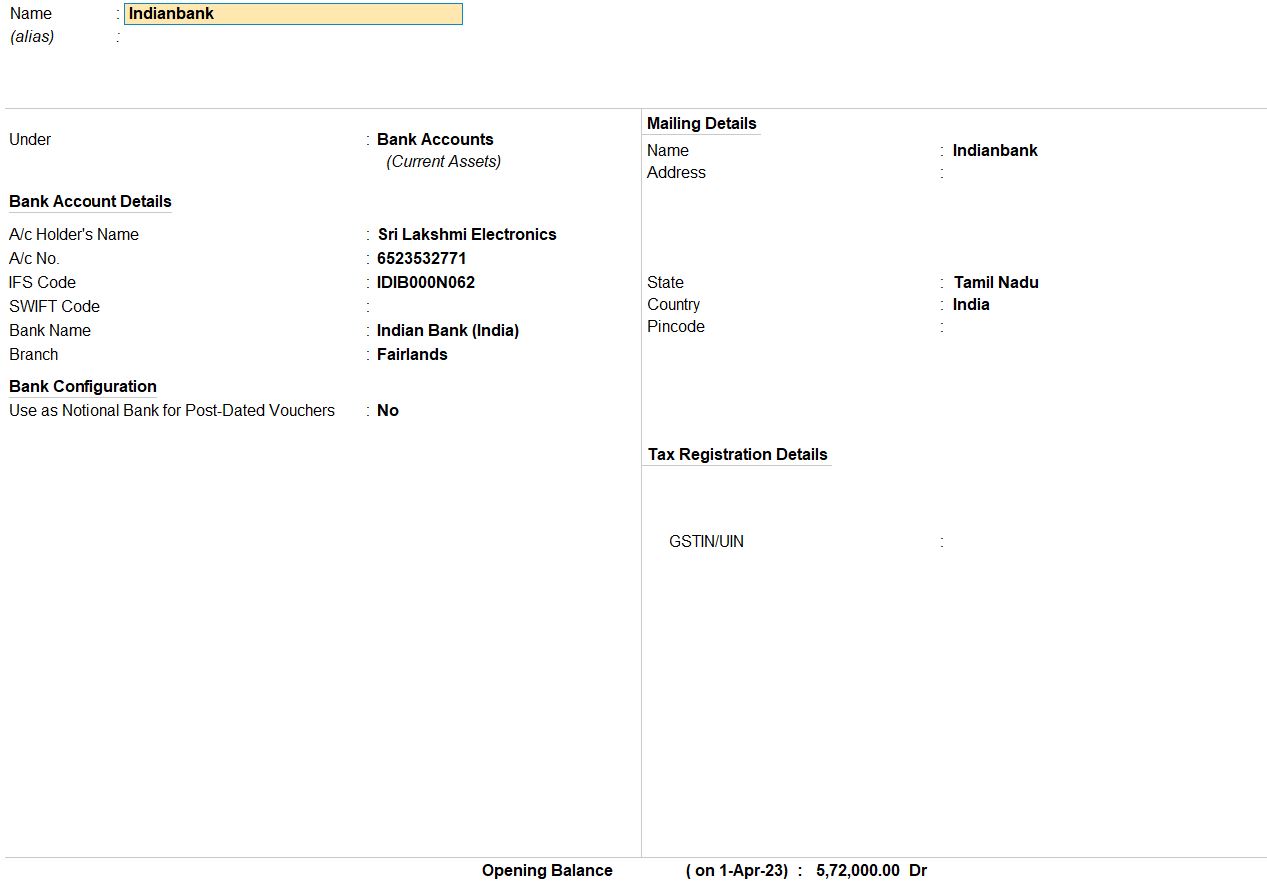

Ledger Creation

- Access Ledger Creation:

- Go to Gateway of Tally.

- Navigate to Create or press C.

- Select Ledgers or press C.

- Create Ledger:

- Choose "Create" under Single Ledger.

- Enter Ledger Name:

- Enter "Indian Bank" as the ledger name.

- Select Group:

- Choose "Bank Accounts" as the group.

- Bank Account Details:

- In the Bank Account Details section:

- Enter Account Number: 6523532771.

- Input the IFSC Code: IDIB000N062.

- Specify the Bank Name: Indian Bank.

- Mention the Branch: Salem.

- Opening Balance:

- Set the Opening Balance as Rs. 572,000.

- Save:

- Verify the details entered.

- Press Ctrl + A to save the ledger.

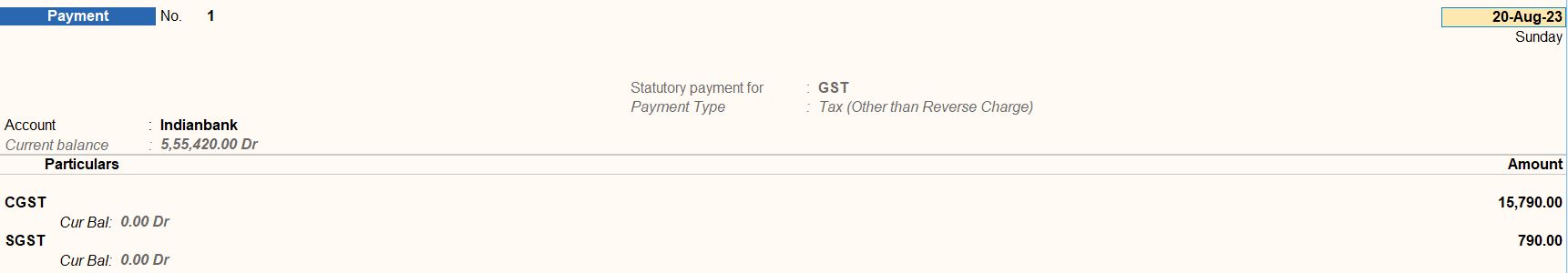

20-08-23 Sri Lakshmi Electronics made the payment of the following taxes to the government:

| Type of Tax | Tax Amount |

|---|---|

| Central Tax | 15,790 |

| State Tax | 790 |

| Integrated Tax | 34,200 |

- Access Payment Voucher:

- Go to Gateway of Tally.

- Navigate to Accounting Vouchers or press V.

- Choose Single Entry Mode:

- Press Alt + J to switch to Single Entry Mode.

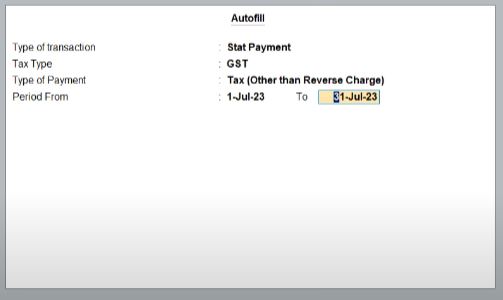

- Select Type of Transaction:

- Press Alt + J to access the Stat Payment details.

- Choose "Stat Payment" as the type of transaction.

- Specify Tax Type:

- Select "GST" as the Tax Type.

- Select Type of Payment:

- Choose "Tax (Other than Reverse Charge)" as the type of payment.

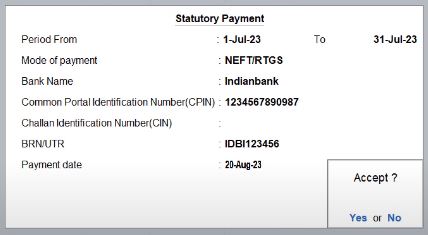

- Period From:

- Set the Period From date as 1-Jul-23 and Period To date as 31-Jul-23.

- Enter Particulars:

- Enter the following details under Particulars:

- CGST: Rs. 15,790

- SGST: Rs. 7,900

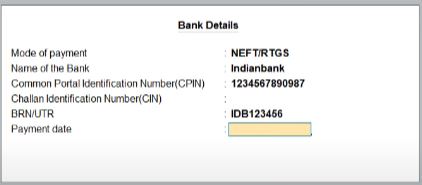

- Bank Details:

- Enter the Bank Details:

- Mode of Payment: NEFT/RTGS.

- Name of the Bank: Indian Bank.

- CPIN: 123456780987.

- BRN/UTR: IDB123456.

- Payment Date: 20-8-23.

- Review and Save:

- Review all the details entered.

- Press Ctrl + A to save the payment voucher.

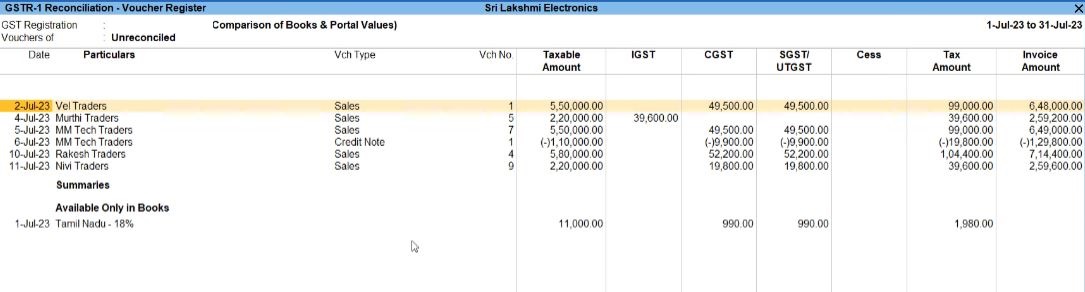

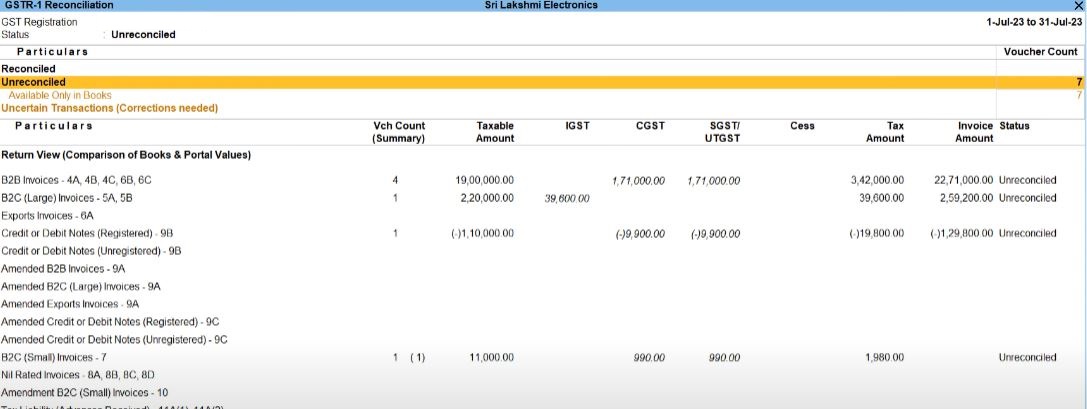

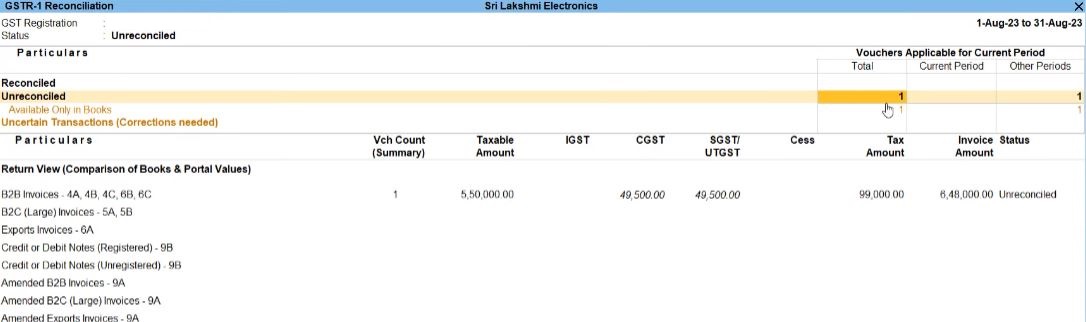

View Challan Reconciliation Report

- Access Gateway of Tally:

- Open Tally Prime software and log in with your credentials.

- From the main screen, go to the Gateway of Tally.

- Navigate to Display More Reports:

- In the Gateway of Tally, navigate to the "Display More Reports" option.

- Select GST Reports:

- Under the Display More Reports menu, choose the "GST Reports" option.

- Choose Challan Reconciliation:

- From the GST Reports menu, select the "Challan Reconciliation" option.

- Update Details:

- Once inside the Challan Reconciliation report, press Alt + S to update the details.

- Enter the following information:

- Period From: 1-Jul-23 to 31-Jul-23

- Mode of Payment: NEFT/RTGS

- Name of the Bank: Indian Bank

- CPIN (Common Portal Identification Number): 123456780987

- BRN/UTR: IDB123456

- Payment Date: 20-8-23

- Review and Save:

- Review the details entered to ensure accuracy.

- Save the changes by pressing Ctrl + A.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions