Mastering Advance Receipt Entries in GST with Tally Prime

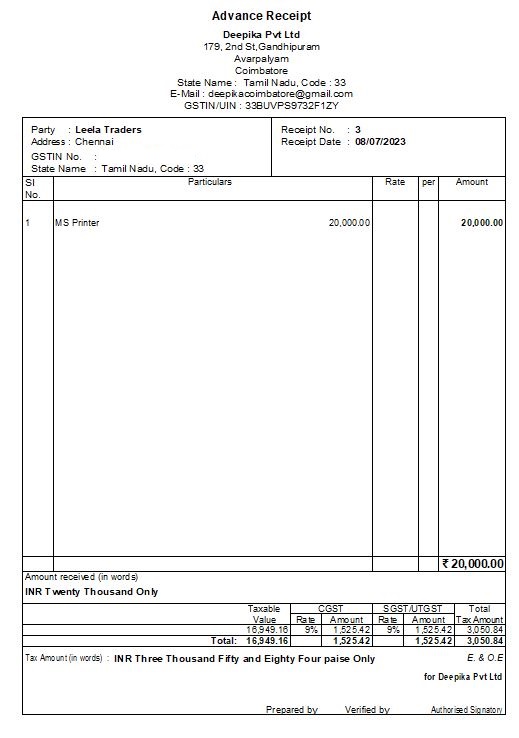

08-07-23 Deepika Pvt Ltd received an advance amount of Rs. 20,000 from Leela Traders towards a sale agreement for MS Printer.

09-07-23 Deepika Pvt Ltd sold the following to Leela Traders, using the advance received on 08-07-23:

| Item | Qty | Rate |

|---|---|---|

| MS Printer | 8 | 6500 |

| Party Name | Leela Traders |

|---|---|

| Under | Sundry Debtors |

| Set/alter details | Yes |

| Registration type | Regular |

10-07-23 Deepika Pvt Ltd purchased the following goods from ND Traders, who is a registered dealer from Tamil Nadu, and charged Central and State Tax:

| Item | Qty | Rate |

|---|---|---|

| MS Printer | 100 | 6000 |

20-07-23 Deepika Pvt Ltd received an advance amount of Rs. 100,000 from Leela Traders towards the sale agreement of MS Printer through Bank with reference Adv02.

22-07-23 Deepika Pvt Ltd received an advance amount of Rs. 50,000 from Leela Traders towards the sale agreement of MS Printer through Bank with reference Adv03.

01-08-23 Sold the following goods to Leela Traders against the advance received on 20-07-23:

| Item | Qty | Rate |

|---|---|---|

| MS Printer | 40 | 6500 |

01-08-23 Leela Traders cancelled the advance receipt which was received on 22-07-23 (ADV03).

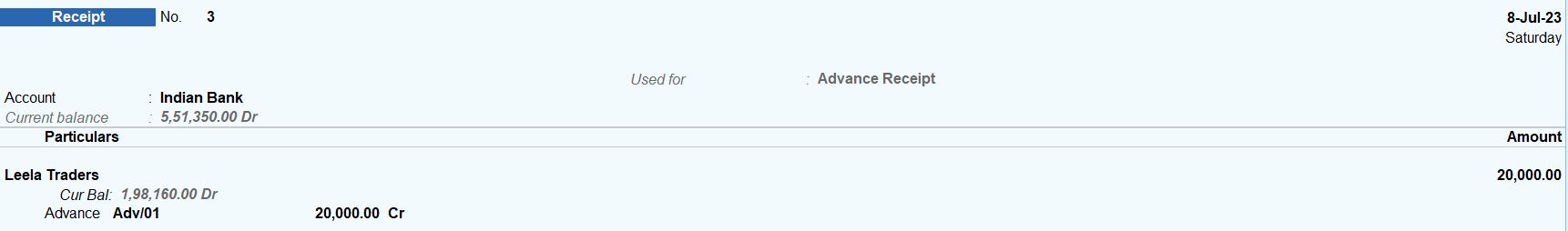

08-07-23 Deepika Pvt Ltd received an advance amount of Rs. 20,000 from Leela Traders towards a sale agreement for MS Printer.

| Party Name | Leela Traders |

|---|---|

| Under | Sundry Debtors |

| Set/alter details | Yes |

| Registration type | Regular |

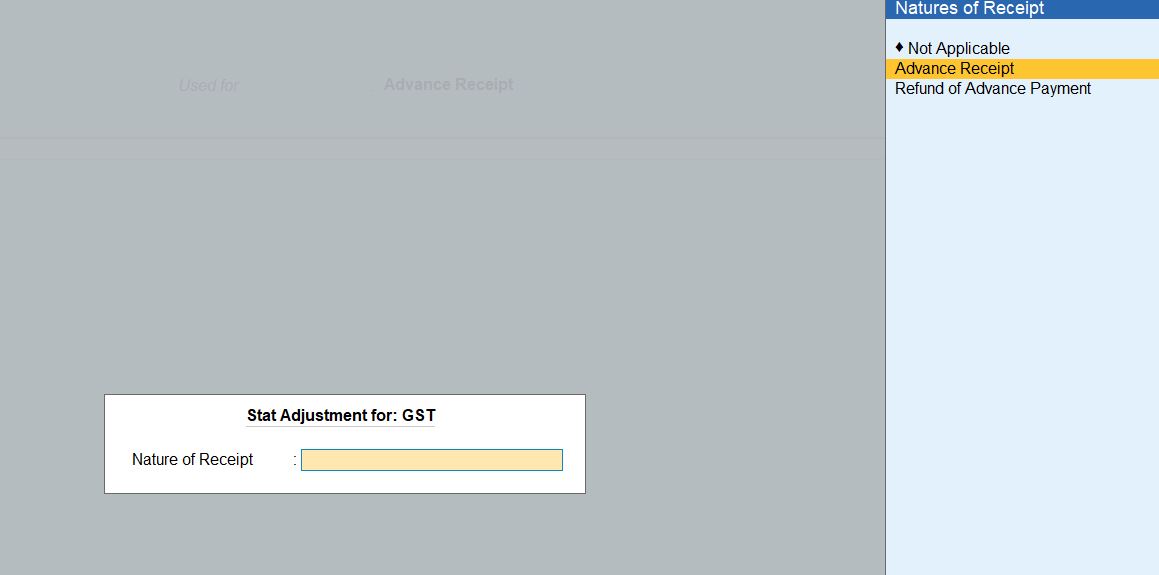

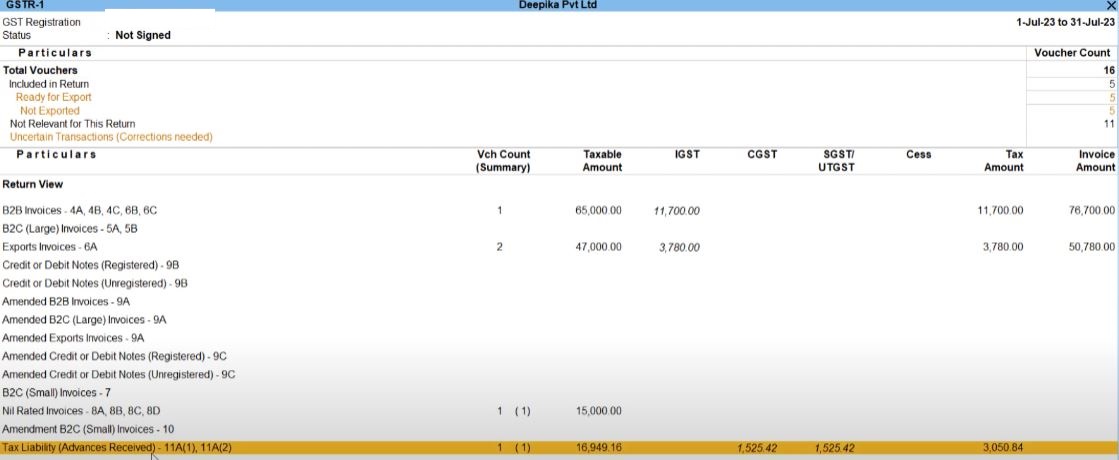

Access Receipt Voucher:

- Go to the Gateway of Tally:

- Navigate to Accounting Vouchers.

- Press Ctrl+ H to enable single entry mode.

- Enter Voucher Details:

- Set the voucher date as 08-07-23.

- Choose the voucher type as Receipt.

- Select Party Details:

- Choose the party "Leela Traders" from the list of ledgers.

- Ensure that Leela Traders is set as a regular dealer.

- Choose Receipt Ledger:

- Select the receipt ledger for the advance amount received.

- This ledger should be configured for the nature of receipt and have the appropriate GST settings.

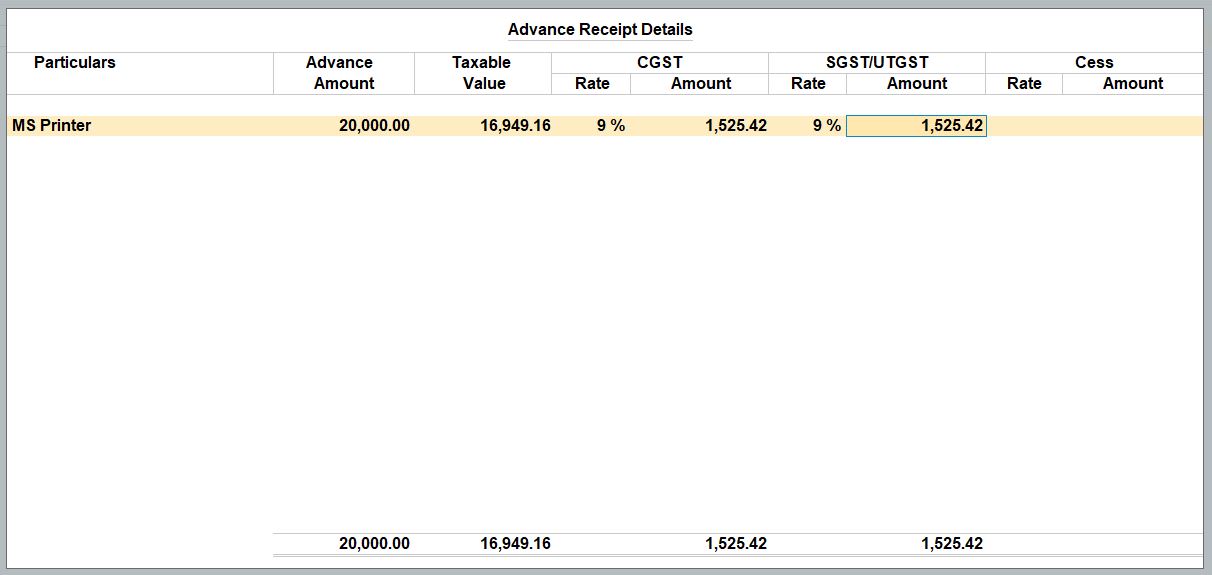

- Enter Item Details:

- Enter the item details:

- Item: MS Printer

- Advance Amount: Rs. 20000

- Taxable Value: Rs. 16949.16

- CGST: Rs. 1525.42

- SGST/UTGST: Rs. 1525.42

- Ensure that the stock item "MS Printer" is selected.

- Review and Save:

- Review the voucher to ensure accuracy.

- Press Ctrl + A to save the receipt voucher.

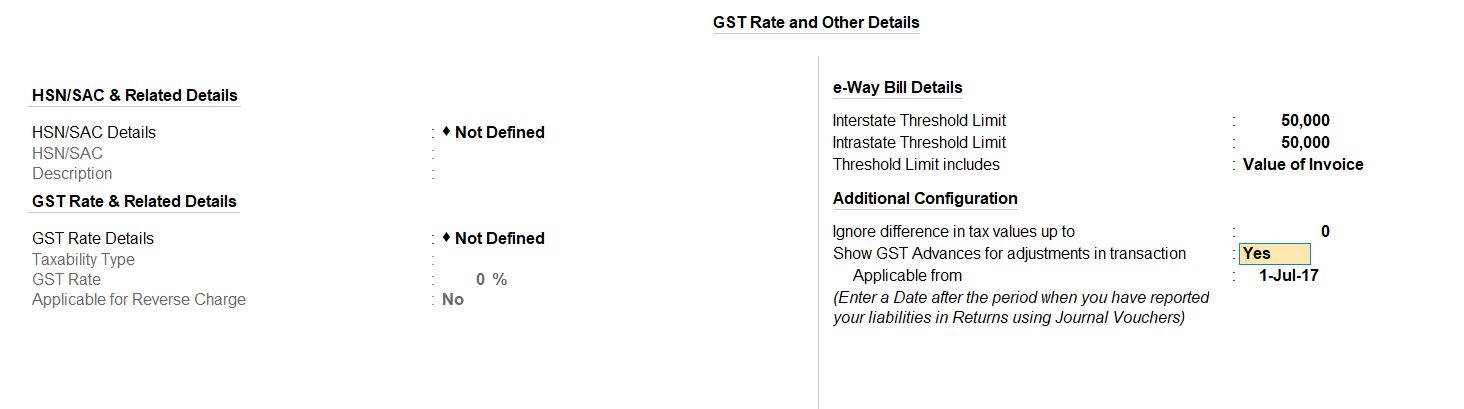

Set/Alter Company GST Rate and Other Details - Yes:

- This option allows you to set or modify the GST (Goods and Services Tax) rates and other related details for your company.

- By enabling this option, you can enter or update the GST rates applicable to various goods and services, as well as configure other GST-related settings.

Show GST Advances for Adjustments in Transaction - Yes:

- When enabled, this setting displays GST advances for adjustments directly within transactions.

- It allows you to adjust GST advances against liabilities or other transactions conveniently during voucher entry.

- This feature enhances the visibility of GST advances and facilitates easier reconciliation of GST-related transactions.

Applicable From - 1-Apr-23:

- This field specifies the date from which the configured settings are applicable.

- In this case, it indicates that the settings, including GST rates and other related details, are applicable from April 1, 2023.

- Any changes made to the settings will take effect from this specified date onwards.

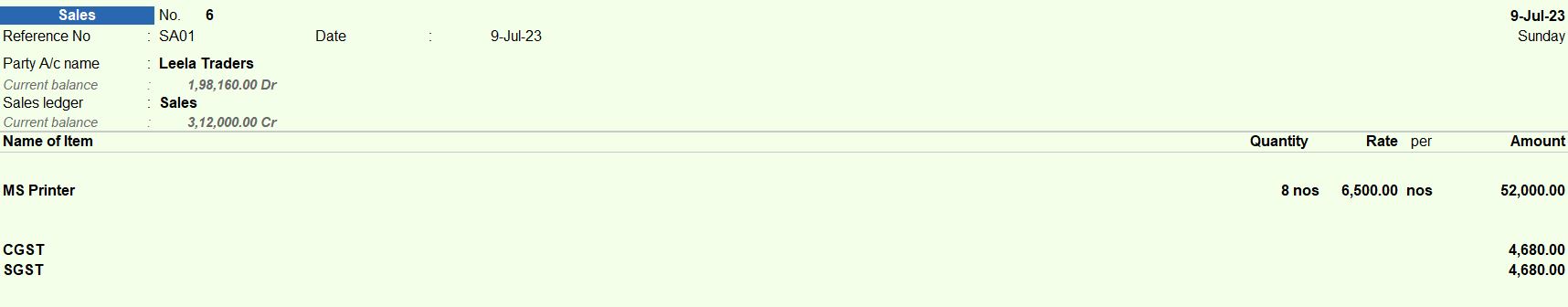

09-07-23 Deepika Pvt Ltd sold the following to Leela Traders, using the advance received on 08-07-23:

| Item | Qty | Rate |

|---|---|---|

| MS Printer | 8 | 6500 |

Sales Voucher Details for Leela Traders:

- Party A/c Name: Leela Traders

- Sales Ledger: Sales

- Item Details:

- Item: MS Printer

- Quantity: 8 units

- Rate: Rs. 6500 per unit

- CGST (Central Goods and Services Tax): Rs. 4680

- SGST (State Goods and Services Tax): Rs. 4680

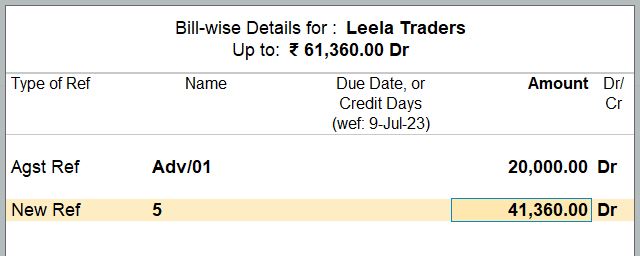

- Bill-wise Details:

- Against Reference: AD01

- Due Date: Not specified

- Amount: Rs. 20000 (Advance amount received on 08-07-23)

- New Reference:

- Name: 5

- Due Date: Not specified

- Amount: Rs. 41360 (Total invoice amount after adjusting the advance)

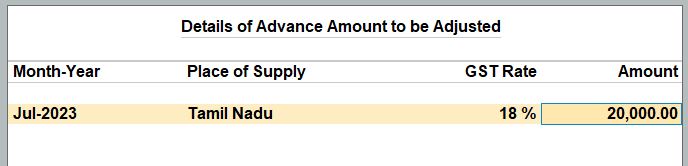

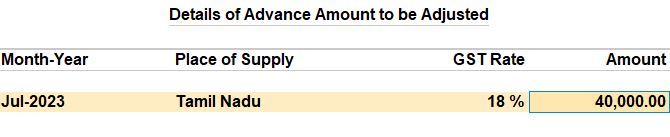

- Details of Advance Amount to be Adjusted:

- Month-Year: Jul-2023

- Place of Supply: Tamil Nadu

- GST Rate: 18%

- Amount: Rs. 20000

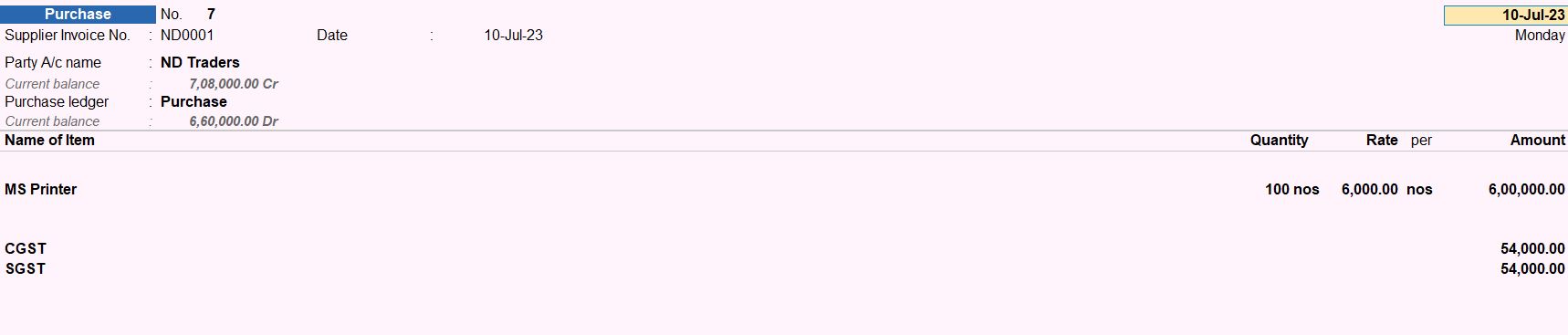

10-07-23 Deepika Pvt Ltd purchased the following goods from ND Traders, who is a registered dealer from Tamil Nadu, and charged Central and State Tax:

| Item | Qty | Rate |

|---|---|---|

| MS Printer | 100 | 6000 |

Purchase Details for ND Traders:

- Party Name: ND Traders

- Registration Type: Registered dealer

- Location: Tamil Nadu

- Purchase Ledger: Purchase

- Item Details:

- Item: MS Printer

- Quantity: 100 units

- Rate: Rs. 6000 per unit

- Tax Details:

- Central Tax (CGST): Charged by the seller, applicable at the central level.

- State Tax (SGST): Charged by the seller, applicable at the state level.

- Calculation:

- Total taxable amount = Quantity * Rate per unit = 100 * 6000 = Rs. 600,000

- Tax Components:

- CGST: Charged at a certain percentage of the taxable amount.

- SGST: Also charged at a certain percentage of the taxable amount.

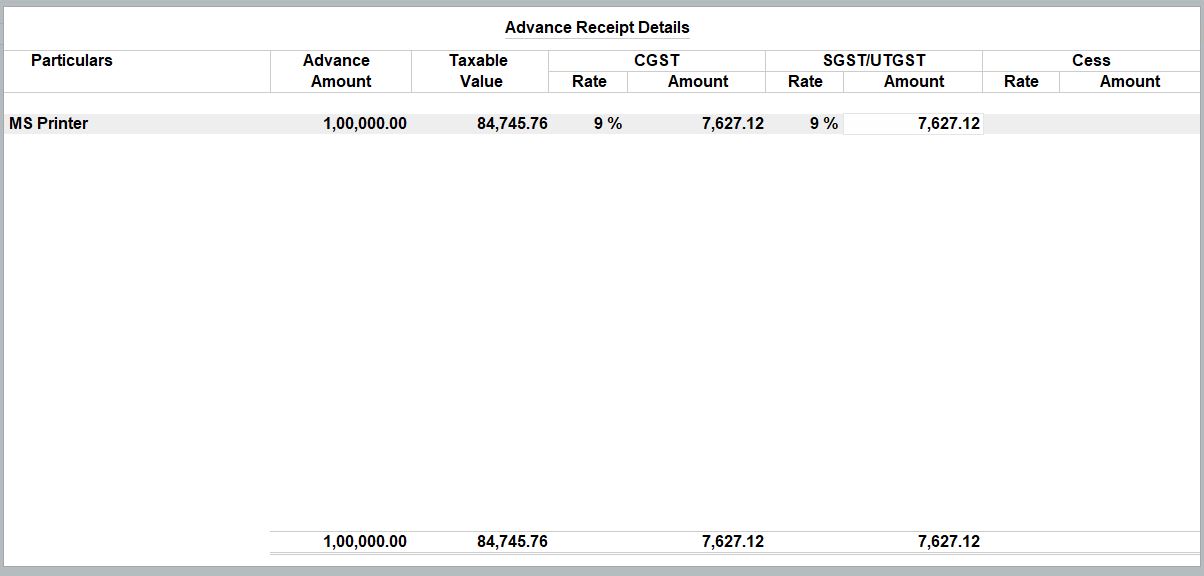

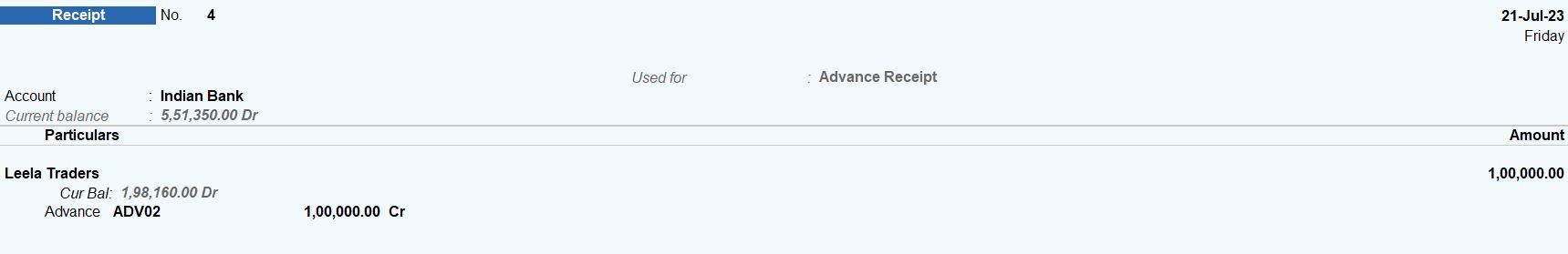

20-07-23 Deepika Pvt Ltd received an advance amount of Rs. 100,000 from Leela Traders towards the sale agreement of MS Printer through Bank with reference Adv02.

Advance Receipt Details for Leela Traders:

- Account Details: Indian Bank (Bank Account where the advance amount is deposited)

- Party Details:

- Party Name: Leela Traders

- Nature of Receipt: Advance Receipt

- Advance Receipt Details:

- Particulars: MS Printer (the item for which the advance is received)

- Advance Amount: Rs. 100,000

- Taxable Value: Rs. 84,745.75

- CGST: Rs. 7,627.12 (9% of the taxable value)

- SGST/UTGST: Rs. 7,627.12 (9% of the taxable value)

- Bill-wise Details:

- Type of Reference: Advance

- Name: ADV02 (Reference code for the advance payment)

- Due Date: Not specified

- Amount: Rs. 100,000

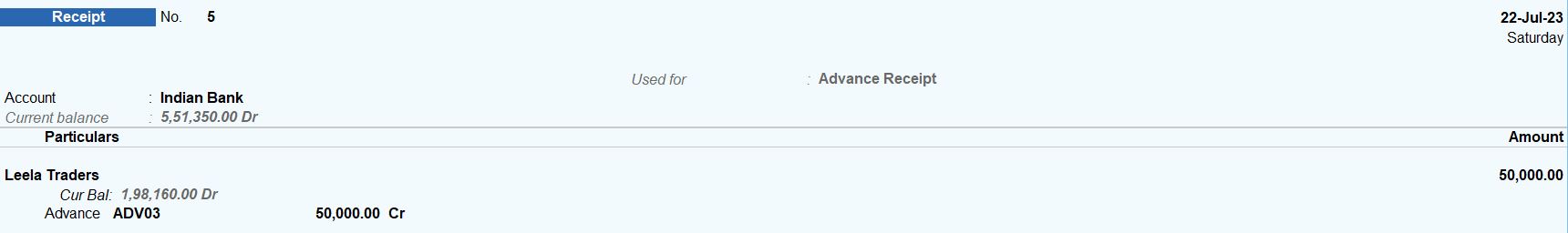

22-07-23 Deepika Pvt Ltd received an advance amount of Rs. 50,000 from Leela Traders towards the sale agreement of MS Printer through Bank with reference Adv03.

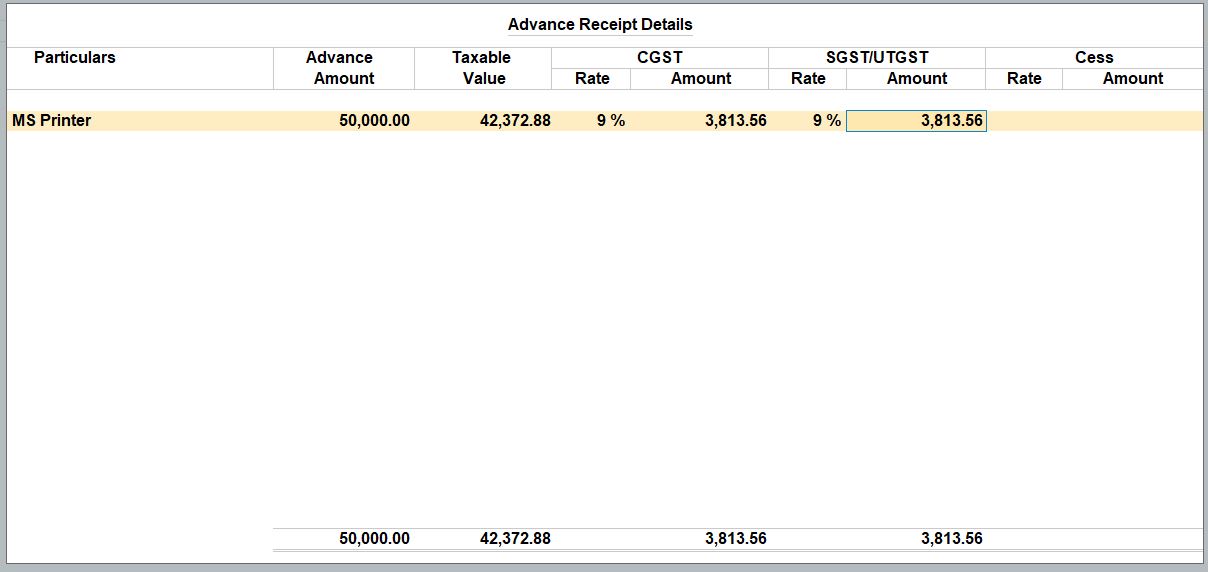

Advance Receipt Details for Leela Traders:

- Account Details: Indian Bank (Bank Account where the advance amount is deposited)

- Party Details:

- Party Name: Leela Traders

- Nature of Receipt: Advance Receipt

- Advance Receipt Details:

- Particulars: MS Printer (the item for which the advance is received)

- Advance Amount: Rs. 50,000

- Taxable Value: Rs. 42,372.88

- CGST: Rs. 3,813.56 (9% of the taxable value)

- SGST/UTGST: Rs. 3,813.56 (9% of the taxable value)

- Bill-wise Details:

- Type of Reference: Advance

- Name: ADV03 (Reference code for the advance payment)

- Due Date: Not specified

- Amount: Rs. 50,000

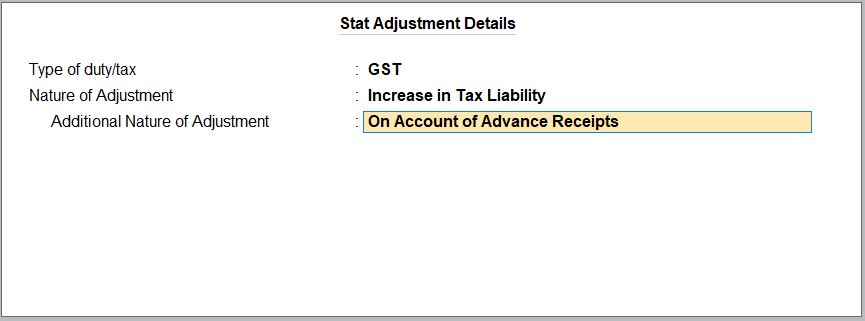

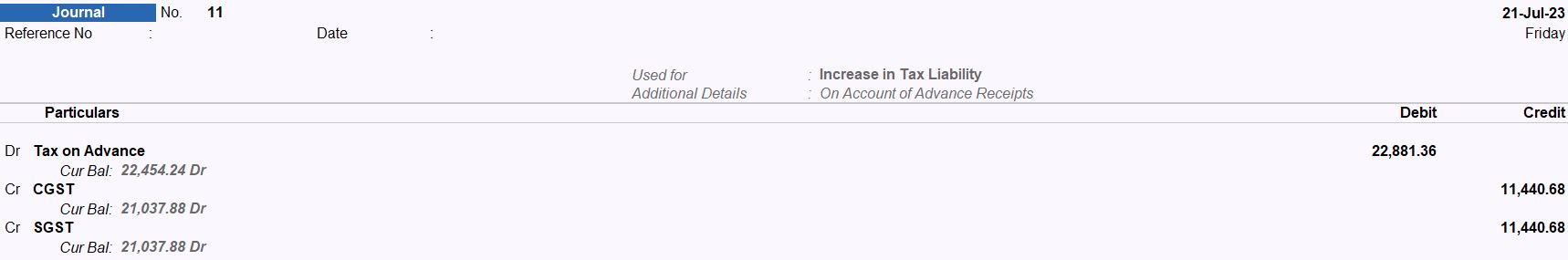

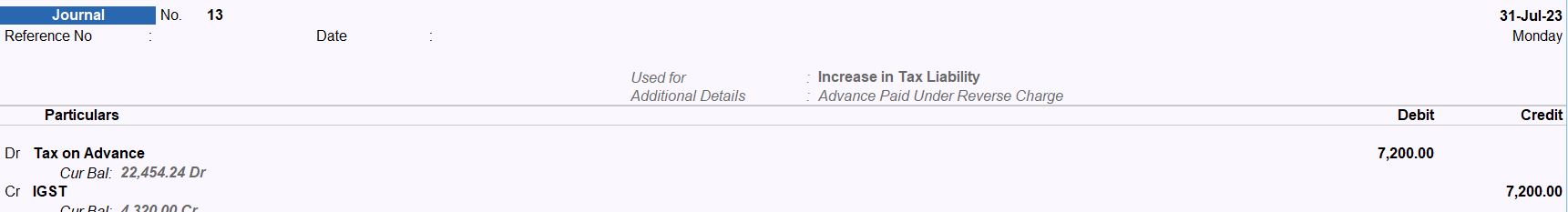

Increase in Tax Liability - Journal Voucher:

- Access Journal Voucher:

- Go to the Gateway of Tally.

- Navigate to Accounting Vouchers.

- Press Alt+ J.

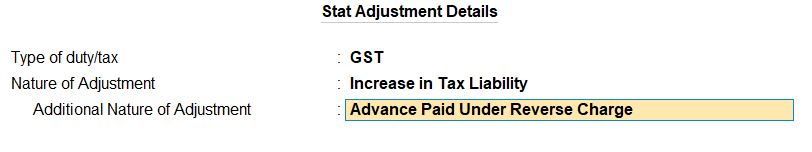

- Stat Adjustment Details:

- Type of Duty/Tax: GST

- Nature of Adjustment: Increase in Tax Liability

- Additional Nature of Adjustment: On Account of Advance Receipt

- Debit (DR) Entry:

- Account: Tax on Advance

- Amount: Rs. 22,881.36

- Credit (CR) Entries:

- Account: CGST

- Amount: Rs. 11,440.68

- Account: SGST

- Amount: Rs. 11,440.68

01-08-23 Sold the following goods to Leela Traders against the advance received on 20-07-23:

| Item | Qty | Rate |

|---|---|---|

| MS Printer | 40 | 6500 |

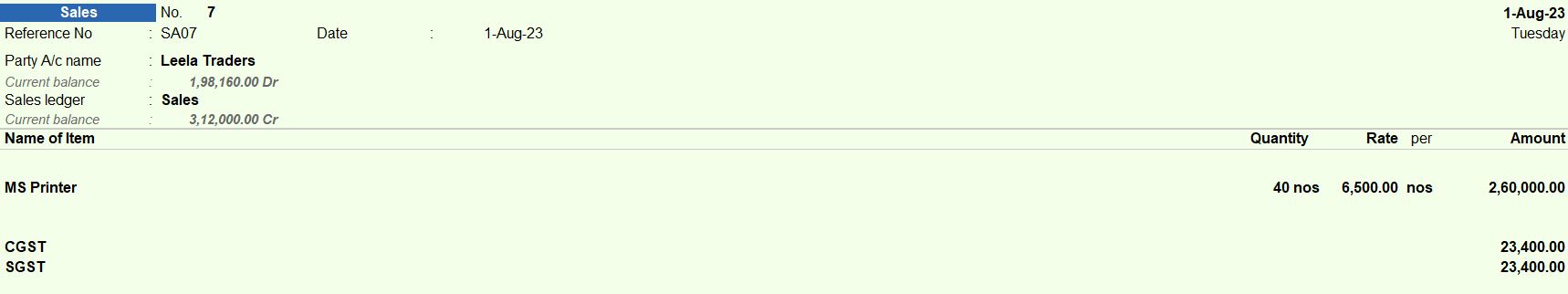

Sales Transaction for Leela Traders - Sales Voucher:

- Date: 01-08-23

- Party A/c Name: Leela Traders

- Sales Ledger: Sales

- Details of Items Sold:

- Item: MS Printer

- Quantity: 40

- Rate: Rs. 6500 per unit

- Tax Calculation:

- CGST: Rs. 23,400

- SGST: Rs. 23,400

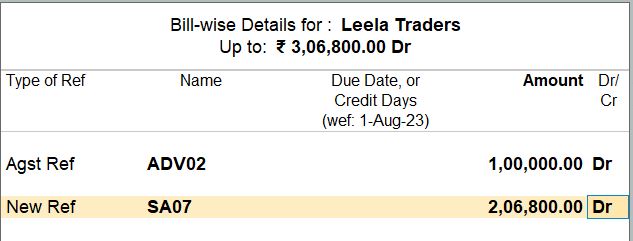

- Bill-wise Details:

- The sale is adjusted against the advance received from Leela Traders (ADV03), and a new reference (Invoice No. 7) is generated for the remaining amount of Rs. 1,00,000.

- The total amount of the new invoice is Rs. 2,06,800.

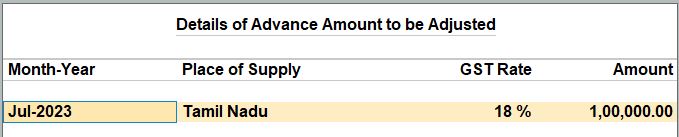

- Details of Advance Amount to be Adjusted:

- Month-year: Jul-2023

- Place of Supply: Tamil Nadu

- GST Rate: 18%

- Amount: Rs. 1,00,000

Decrease in Tax Liability - Journal Voucher:

- Type of Duty/Tax: GST

- Nature of Adjustment: Decrease in tax liability

- Additional Nature of Adjustment: Cancellation of Advance Receipt

- Credit Entry:

- Account: Tax on Advance

- Amount: Rs. 7627.12

- Debit Entries:

- Account: CGST

- Amount: Rs. 3813.56

- Account: SGST

- Amount: Rs. 3813.56

Payment Entries

30-07-23 Made a payment of Rs. 40,000 to Sakthi Traders, located in Singapore, towards the purchase of cartage. Increased tax liability also.

01-08-23 Deepika Pvt Ltd raised a purchase invoice against the advance paid on 30-07-23 to Sakthi Traders, Singapore:

| Item | Qty | Rate |

|---|---|---|

| Ink Cartage | 40 | 1000 |

| Name | Sakthi Traders |

|---|---|

| Under | Sundry Creditors |

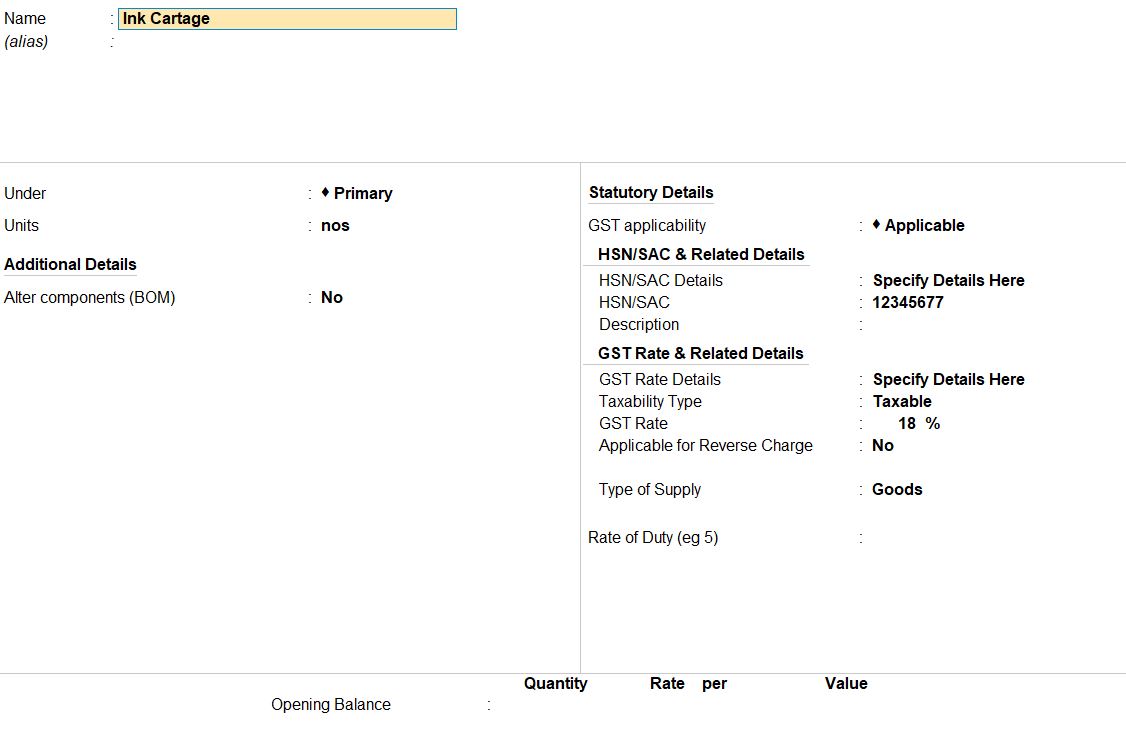

| INK CARTAGE | |

|---|---|

| Name | Ink Cartridge |

| Under | Primary |

| Units | Nos |

| STATUTORY INFORMATION | |

| GST Applicable | Applicable |

| Set/alter GST details | Yes |

| TAX RATE DETAILS | |

| HSN/SAC | 12345677 |

| Calculation Type | On value |

| Taxability | Taxable |

| Is Reverse Charge Applicable | Yes |

| Integrated Tax | 18% |

| Type of Supply | Goods |

30-07-23 Made a payment of Rs. 40,000 to Sakthi Traders, located in Singapore, towards the purchase of cartage. Increased tax liability also.

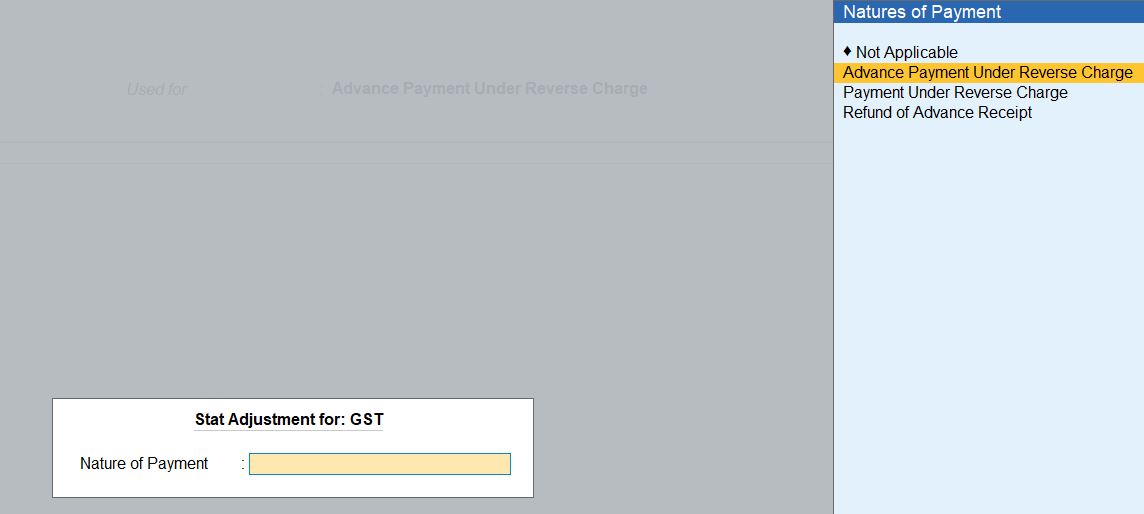

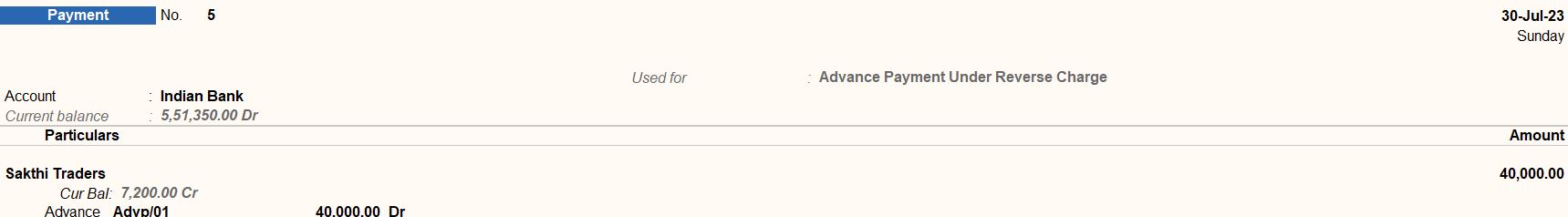

- Payment Details:

- Date: 30-07-23

- Amount: Rs. 40,000

- Party Name: Sakthi Traders

- Nature of Payment: Advance Payment Under Reverse Charge

- Stat Adjustment for GST:

- Nature of Payment: Advance Payment Under Reverse Charge

- Account: Indian Bank

- Ledger Creation:

- Sakthi Traders:

- Under: Sundry Creditors

- Ink Cartage Ledger Details:

- Under: Primary

- Units: Nos

- GST Applicable: Yes

- Reverse Charge Applicable: Yes

- Integrated Tax Rate: 18%

- HSN/SAC: 12345677

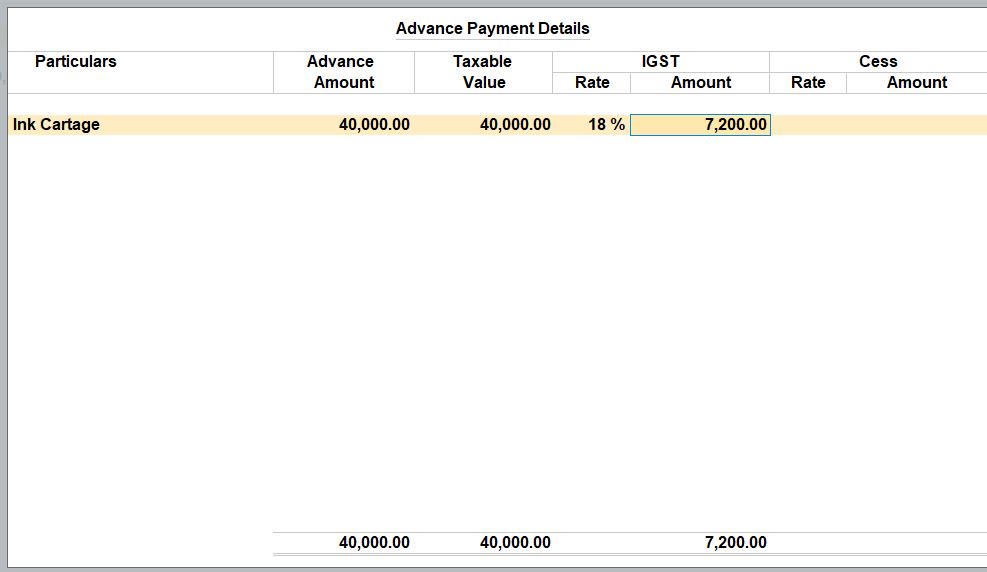

- Advance Payment Details:

- Particulars: Ink Cartage

- Advance Amount: Rs. 40,000

- Taxable Value: Rs. 40,000

- GST Rate: 18%

- IGST Amount: Rs. 7,200

- Bill-wise Details:

- Type of Ref: Advance

- Name: Advp/01

- Amount: Rs. 40,000

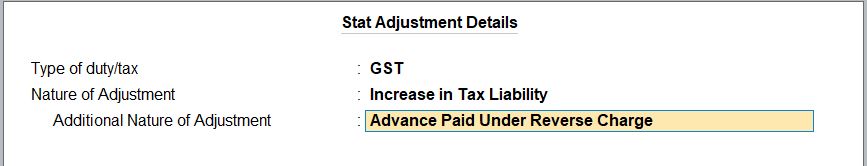

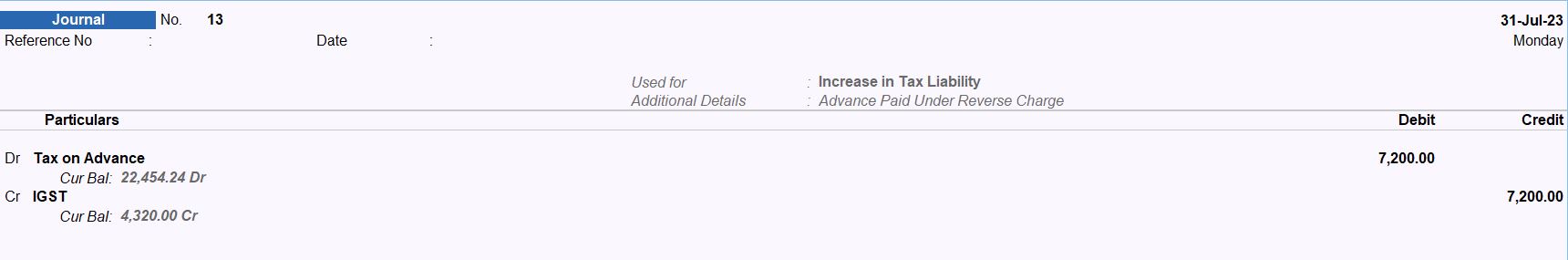

- Journal Voucher Details:

- Type of Adjustment: State Adjustment

- Type of Duty/Tax: GST

- Nature of Adjustment: Increase In Tax Liability

- Additional Nature of Adjustment: Advance Paid Under Reverse Charge

- Entries:

- Debit (DR): Tax on Advance - Rs. 7,200

- This represents the tax amount paid on the advance under the reverse charge mechanism, which has increased the tax liability.

- Credit (CR): IGST (Integrated Goods and Services Tax) - Rs. 7,200

- This entry credits the IGST account with the amount of Rs. 7,200, reflecting the increase in the tax liability due to the advance payment.

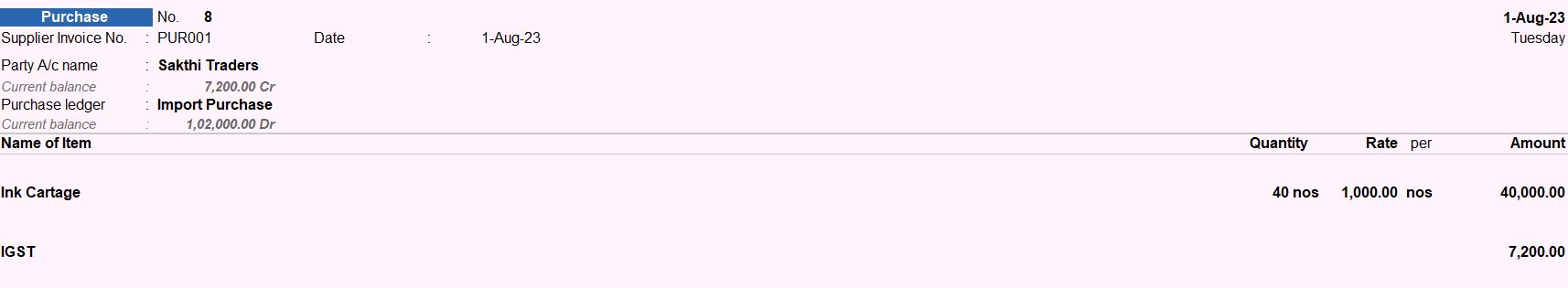

01-08-23 Deepika Pvt Ltd raised a purchase invoice against the advance paid on 30-07-23 to Sakthi Traders, Singapore:

| Item | Qty | Rate |

|---|---|---|

| Ink Cartage | 40 | 1000 |

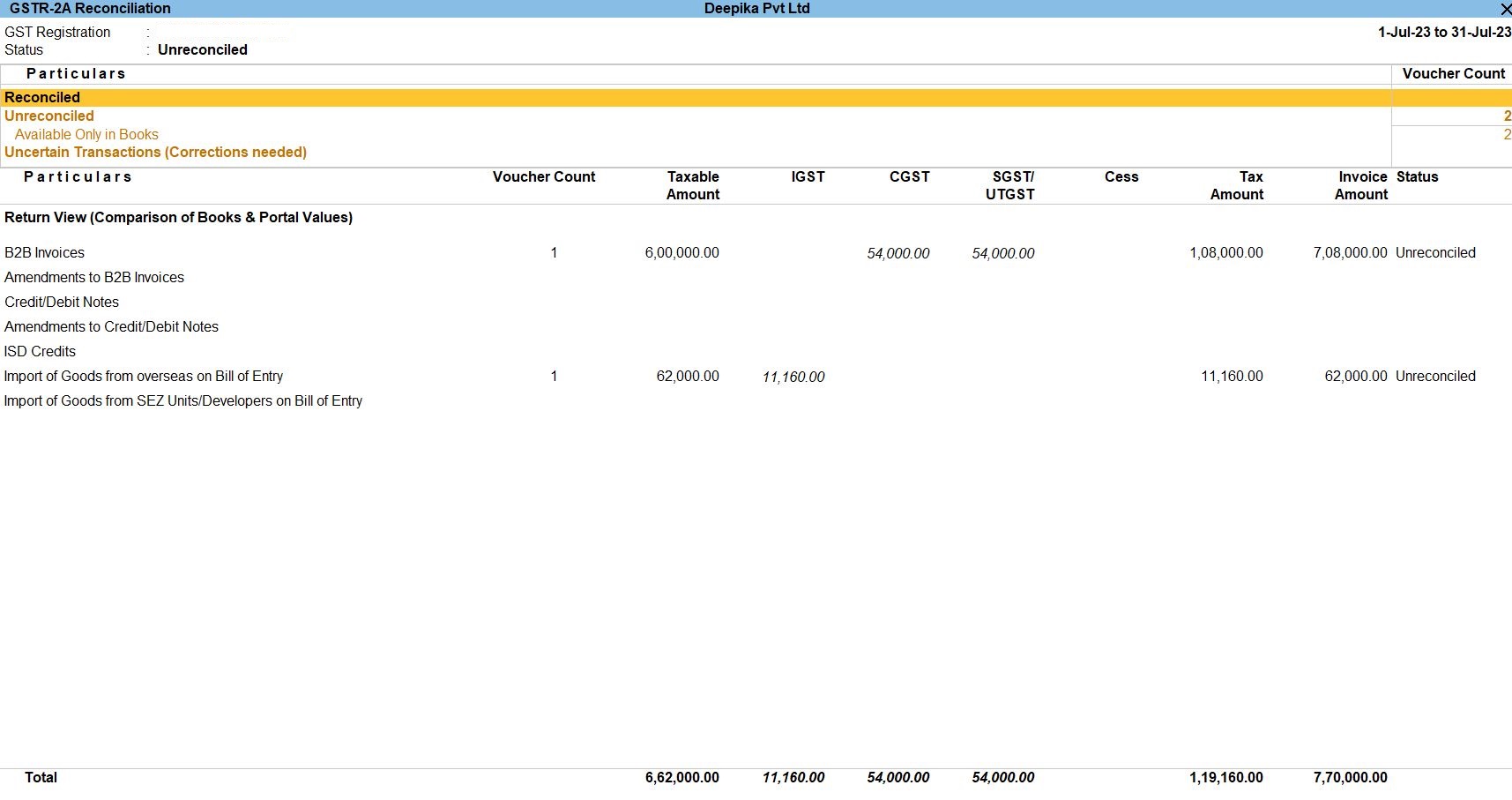

Purchase Voucher Details:

- Party A/c Name: Sakthi Traders

- Purchase Ledger: Import Purchase

Items Purchased:

- Item: Ink Cartage

- Quantity: 40

- Rate: Rs. 1000 per unit

- Amount: Rs. 40,000 (40 * 1000)

Taxes:

- IGST (Integrated Goods and Services Tax): Rs. 7200

- This represents the IGST charged on the taxable purchase.

Additional Details:

- Nature of Transaction: Imports - Taxable

- Bill of Entry No: 12345676

- Date: 1-Aug-23

- Port Code: SIG01

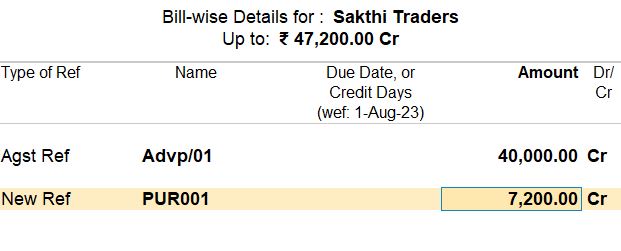

Bill-wise Details:

- Type of Ref: Against Reference (Agst Ref)

- Name: Advp/01

- Due Date or Credit Days: Not specified

- Amount: Rs. 40,000

- This indicates that the purchase is adjusted against an advance payment made previously.

- Type of Ref: New Reference (New Ref)

- Name: PUR001

- Due Date or Credit Days: Not specified

- Amount: Rs. 7200

- This is a new reference for the IGST amount.

Details of Advance Amount to be Adjusted:

- Month-year: Jul-2023

- Place of Supply: Tamil Nadu

- GST Rate: 18%

- Amount: Rs. 40,000

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions