Accounting Only in Tally Prime

Excise Sum: 1

The following would be recorded in journal using double entry system. Do the posting process from journal and prepare the Trial balance and trading account and profit &loss account and balance sheet in the books of M/S Siva Park for the following financial year of 1.4.2010 to 31.3.2011.

| Particulars | RS | Particulars | RS |

|---|---|---|---|

| Cash | 50000 | Capital | 300000 |

| Furniture | 30000 | Reserves | 20000 |

| Building | 60000 | Bills payable | 10000 |

| Free hold property | 50000 | Bank O/d | 5000 |

| SBI bank | 80000 | Prepaid expenses | 12000 |

| Machinery | 50000 | Typewriter | 7000 |

| Sundry Debtors Nandhu & Co was Rs.1000 Bill no. RM45 | |||

| Sundry Creditors SMR & Co was Rs.5000 Bill no.GH34 | |||

Transaction During the Period:

- Apr 01 Bought goods from M/S VINE & CO was Rs.50000 Bill No.TN54

- Apr 15 Paid Telephone charges Rs.500

- Apr 17 Issue debit note against to M/S SMR & CO was Rs.5000

- Apr 19 Credit note received from M/S Nandhu&CO was Rs.1000

- Apr 21 Goods sold to M/S Maran& CO was Rs.110000

- Apr 23 Cash withdraw from bank Rs.50000

- Apr 28 Amount withdraw from personal use Rs.1000

- May 02 Received interest Rs. 20000

- May 05 Bank loan received Rs.1000

- June 01 Bank O/D settled Rs.300

- June 08 Stolen of typewriter Rs.1000

- Aug 28 Discount received Rs.10000

- Sep 01 Paid stationery 500

- Sep 05 Cash deposit in to bank Rs.2000

- Sep 08 Salary due Rs1000

- Sep 20 Withdraw from bank Rs 500

- Sep 25 Paid wages by cheque Rs.500

- Oct 01 Divided received Rs.1000

- Oct 05 Paid water charges Rs.100

- Oct 20 Paid electrical charges RS.200

Answer

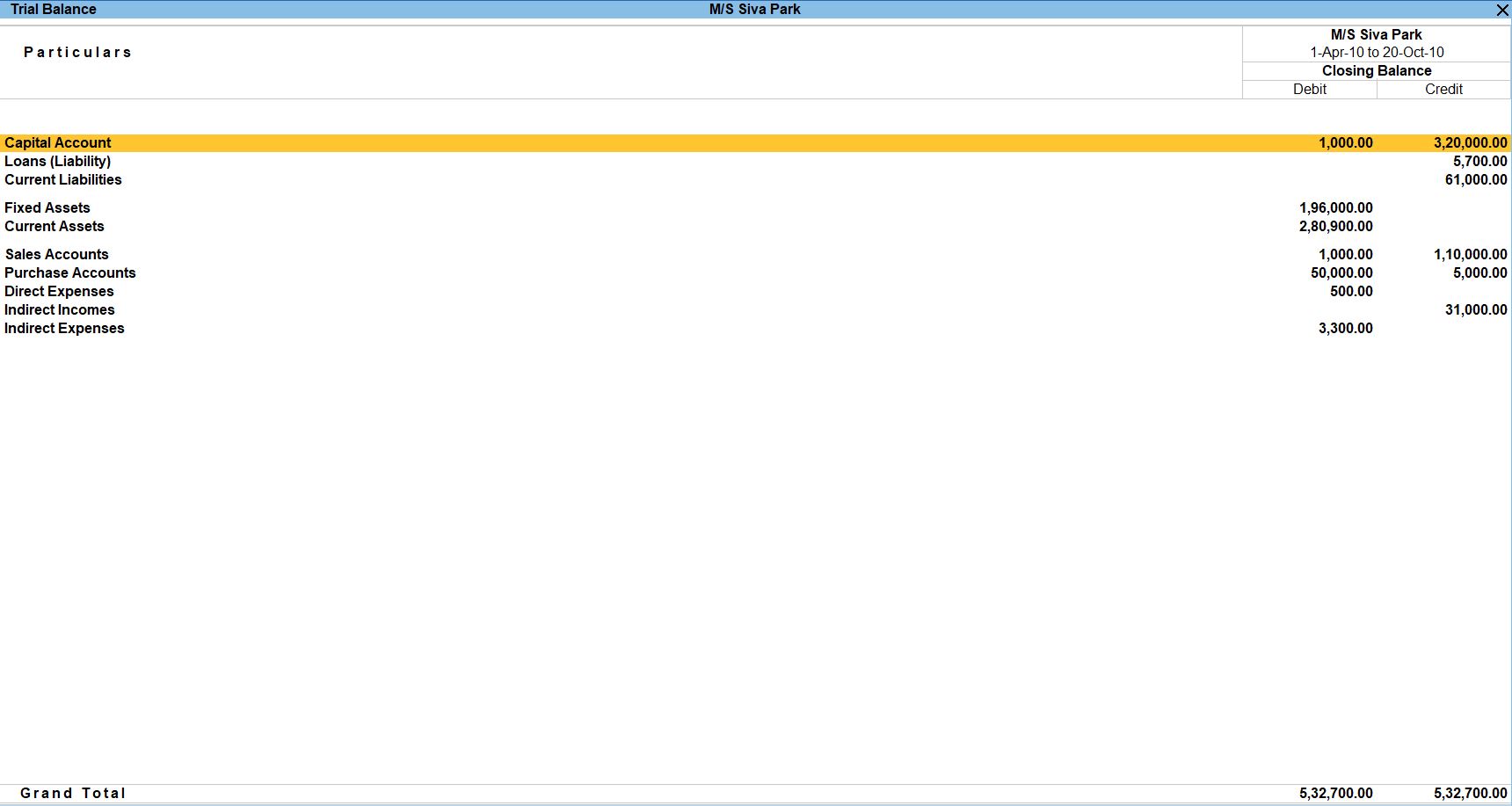

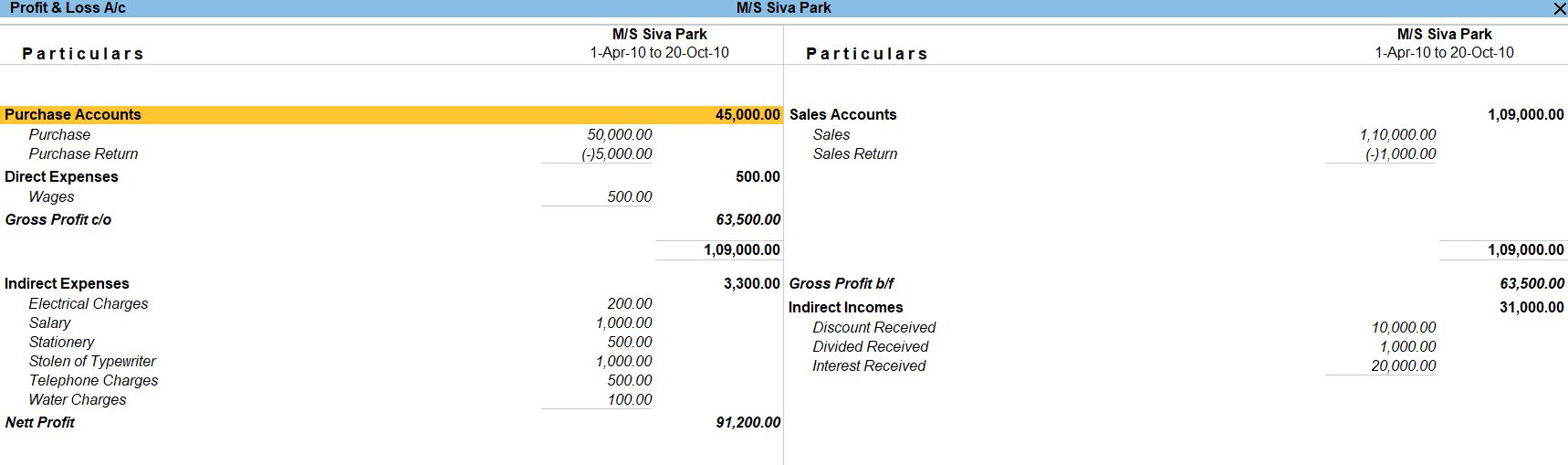

| Opening Balance | 340000 |

| Gross Profit | 63500 |

| NetProfit | 91200 |

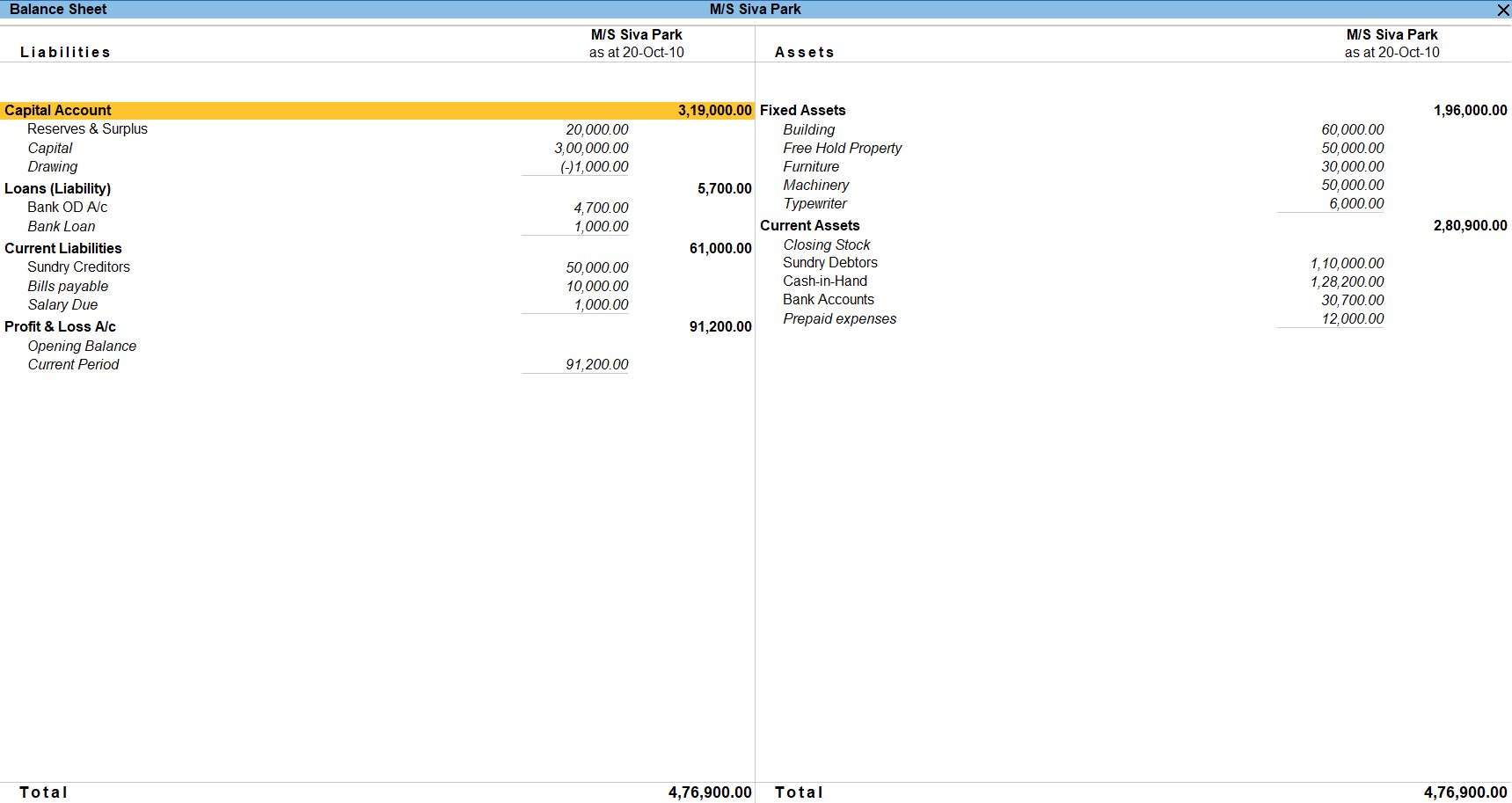

| Balance Sheet | 476900 |

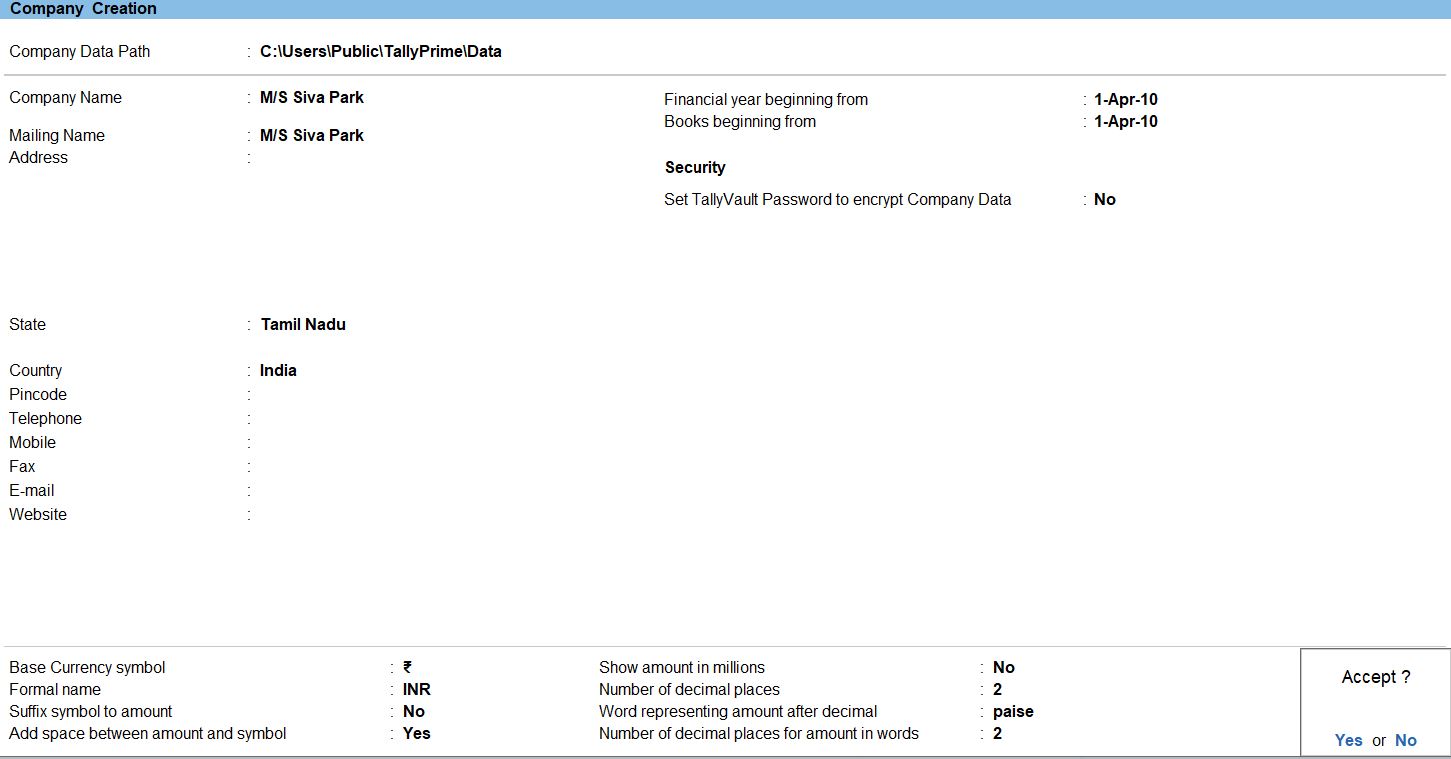

Create a New Company

- Go to the Gateway of Tally.

- Select "Create Company" or "Company Info" (exact wording may vary based on your version).

Enter Company Details:

Fill in the details for M/S Siva Park.

- Company Name: M/S Siva Park

- Address: [Enter the company's address]

- Financial Year: April 1, 2010, to March 31, 2011

- Books Beginning from: April 1, 2022

- Country: [Select the country]

Go to Gateway of Tally:

- Navigate to the Gateway of Tally by pressing G or clicking on the Gateway of Tally icon.

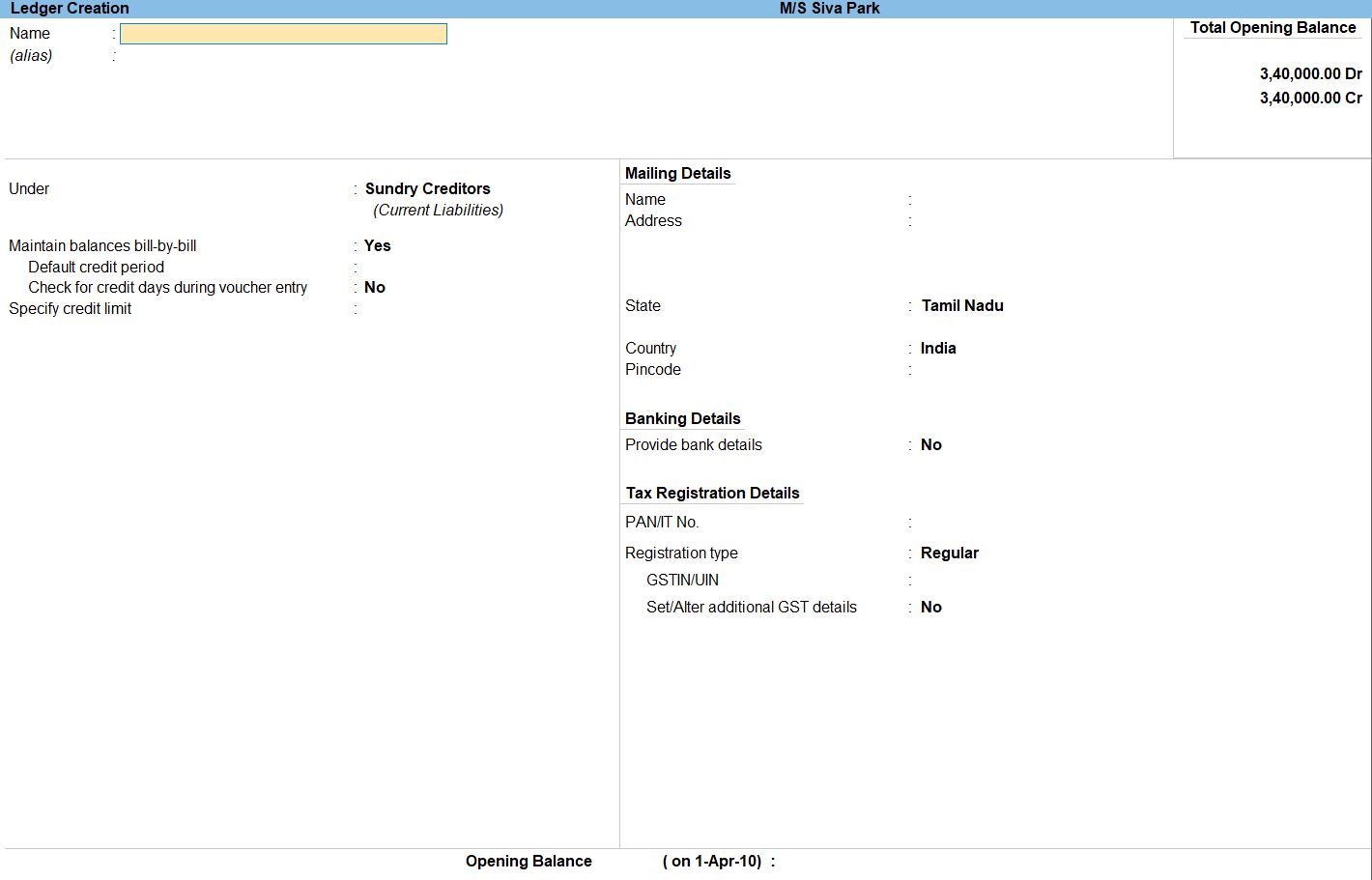

Create Ledgers:

- From the Gateway of Tally, go to "Create".

- Select "Ledgers" under "Accounts Info."

Create Cash Ledger:

- Create a ledger for Cash with the opening balance of Rs. 50,000.

Create Capital Ledger:

- Create a ledger for Capital with the opening balance of Rs. 300,000.

Create Furniture Ledger:

- Create a ledger for Furniture with the opening balance of Rs. 30,000.

Create Reserves Ledger:

- Create a ledger for Reserves with the opening balance of Rs. 20,000.

Create Building Ledger:

- Create a ledger for Building with the opening balance of Rs. 60,000.

Create Bills Payable Ledger:

- Create a ledger for Bills Payable with the opening balance of Rs. 10,000.

Create Freehold Property Ledger:

- Create a ledger for Freehold Property with the opening balance of Rs. 50,000.

Create Bank O/D Ledger:

- Create a ledger for Bank O/D with the opening balance of Rs. 5,000.

Create SBI Bank Ledger:

- Create a ledger for SBI Bank with the opening balance of Rs. 80,000.

Create Prepaid Expenses Ledger:

- Create a ledger for Prepaid Expenses with the opening balance of Rs. 12,000.

Create Machinery Ledger:

- Create a ledger for Machinery with the opening balance of Rs. 50,000.

Create Typewriter Ledger:

- Create a ledger for Typewriter with the opening balance of Rs. 7,000.

Create Sundry Debtors Ledger (Nandhu & Co):

- Create a ledger for Sundry Debtors - Nandhu & Co with the opening balance of Rs. 1,000.

Create Sundry Creditors Ledger (SMR & Co):

- Create a ledger for Sundry Creditors - SMR & Co with the opening balance of Rs. 5,000.

Save and Exit:

- Save the ledger entries.

- To use the default ledger, press page up button.

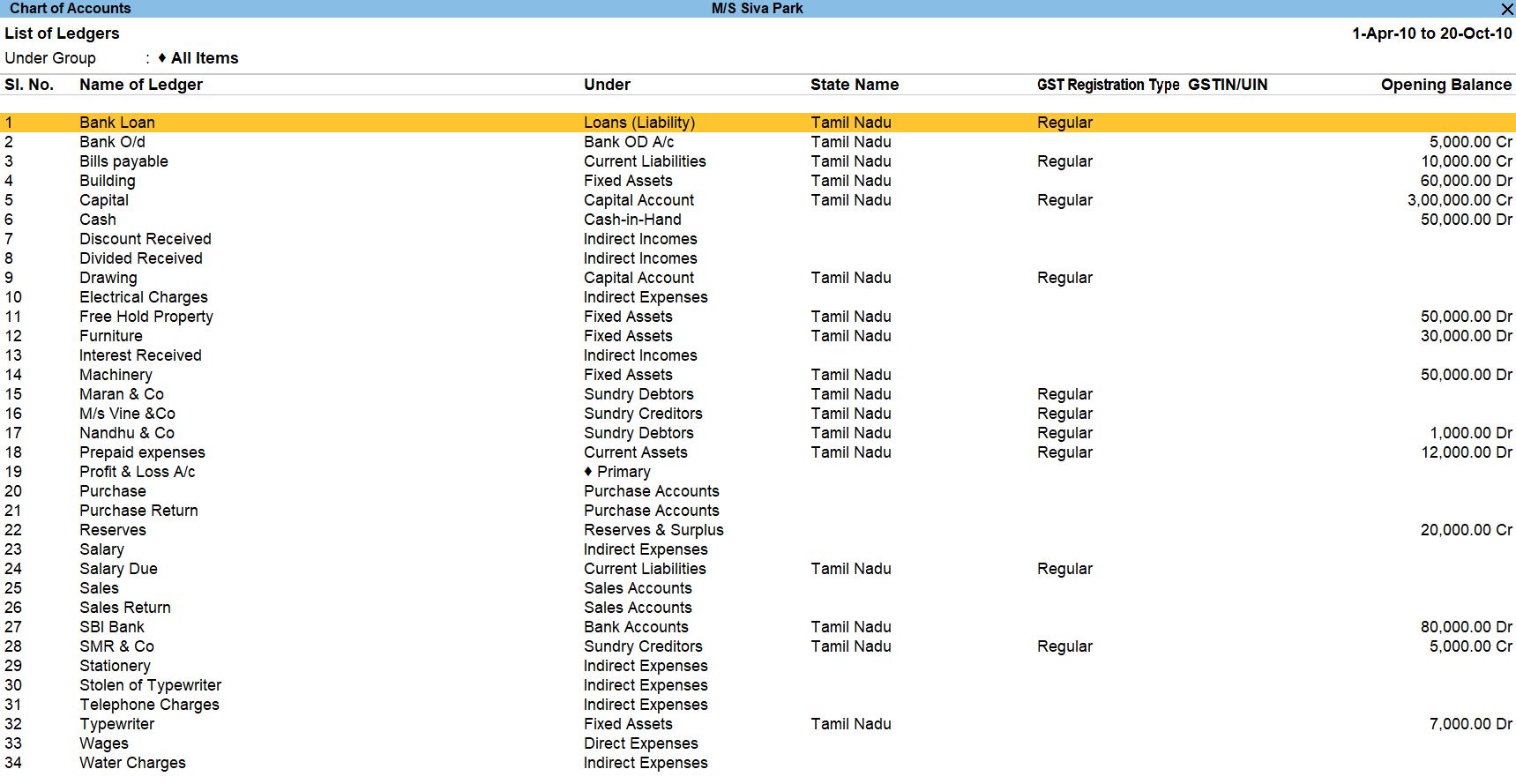

Select Chart of Accounts:

- Under the "Display" menu, choose "Account Books" and then select "Ledgers" or "Group Summaries."

Select Trial Balance:

- Under the "Display" menu, choose "Trial Balance." You can do this by pressing T or by navigating to "Display" -> "Trial Balance."

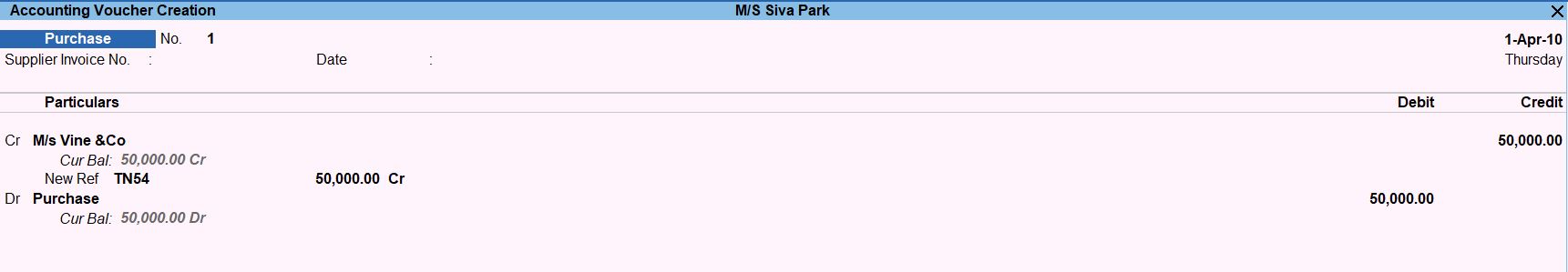

Apr 01 Bought goods from M/S VINE & CO was Rs.50000 Bill No.TN54.

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounts Information:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Voucher Type:

- Choose the appropriate voucher type. Since you want an accounting-only entry, select "F9: Purchase" as the As Voucher type.

Enter Purchase Entry Details:

- In the Purchase Voucher screen:

- Date: Set the date to April 01.

- Party A/c Name: Select or create the ledger for M/S VINE & CO.

- Under: Choose the appropriate group for the party (like Sundry Creditors).

- Amount: Enter Rs. 50,000.

- Bill No.: Enter TN54 in the Bill No. field.

- Narration: Enter a brief description, such as "Goods purchased from M/S VINE & CO, Bill No. TN54."

Debit and Credit Accounts:

- Debit the account representing the goods purchased (e.g., "Purchase Account" under "Goods Purchases") with Rs. 50,000.

- Credit the account representing the party (e.g., "M/S VINE & CO" under "/b>Sundry Creditors") with Rs. 50,000.

Save the Voucher:

- Press Ctrl + A to save the Purchase Voucher.

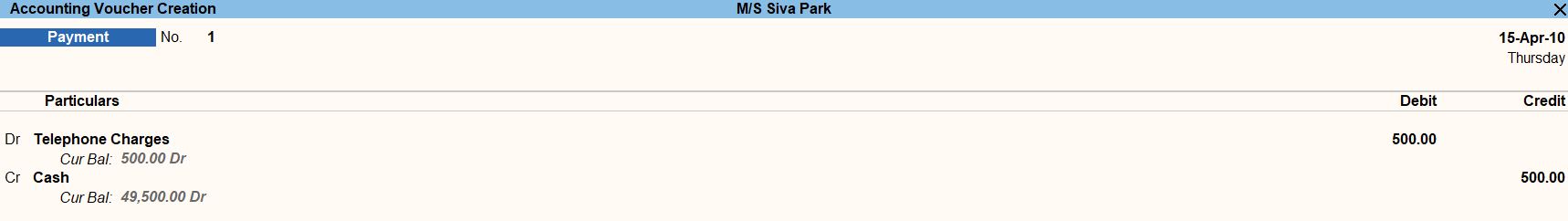

Apr 15 Paid Telephone charges Rs.500

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounts Information:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Payment Type:

- Choose "F5: Payment" to create a Payment Voucher.

Enter Voucher Details:

- In the Payment Voucher screen:

- Date: Set the date to April 15.

- Party A/c Name: Select or create the ledger for Telephone Charges.

- Under: Choose the appropriate group for the party (e.g., "Indirect Expenses").

- Amount: Enter Rs. 500.

- Payment Mode: Select "Cash" if you are paying in cash.

Debit and Credit Accounts:

- Debit the account representing the expense (e.g., "Telephone Charges") with Rs. 500..

- Credit the account representing the payment (e.g., "Cash" or your cash ledger) with Rs. 500.

Save the Voucher:

- Press Ctrl + A to save the Payment Voucher.

- follow the above steps for the transaction below.

- Apr 28 Amountwithdraw from personal use Rs.1000

- Sep 01 Paid stationery Rs.500

- Sep 25 Paid Wages by Cheque Rs.500

- Oct 05 Paid Water Charges Rs. 100

- Oct 20 Paid Electrical charges Rs. 200

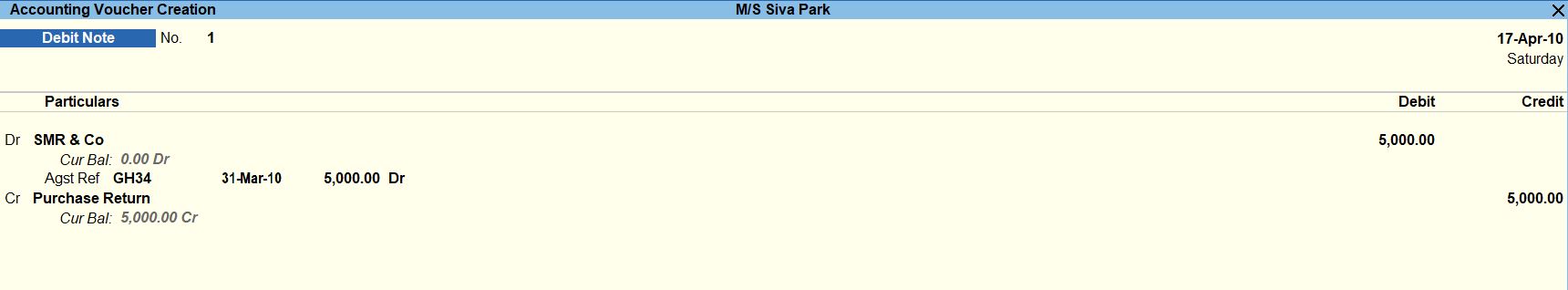

Apr 17 Issue debit note against to M/S SMR & CO was Rs.5000

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounts Information:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Debit Note Voucher:

- Choose "Alt + F5: Debit Note" to create a Debit Note Voucher

Enter Voucher Details:

- In the Debit Note Voucher screen:

- Date: Set the date to April 17.

- Party A/c Name: Select or create the ledger for "M/s SMR & Co.".

- Under: Choose the appropriate group for the party (like "Sundry Creditors").

- Amount: Enter Rs. 5000.

- Narration: Enter a brief description, such as "Debit Note against M/s SMR & Co."

Debit and Credit Accounts:

- Debit the account representing the party (e.g., "M/s SMR & Co.") with Rs. 5000.

- Credit the account representing the return (e.g., "Purchase Return") with Rs. 5000.

Save the Voucher:

- Press Ctrl + A to save the Debit Note Voucher.

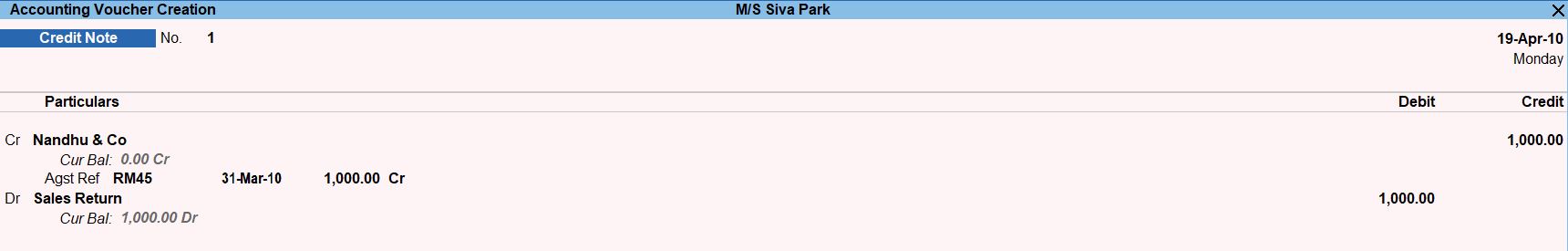

Apr 19 Credit note received from M/S Nandhu&CO was Rs.1000

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounts Information:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Debit Note Voucher:

- Choose "Alt + F6: Credit Note" to create a Credit Note Voucher.

Enter Voucher Details:

- In the Debit Note Voucher screen:

- Date: Set the date to April 19.

- Party A/c Name: Select or create the ledger for "M/s Nandhu & Co."

- Under: Choose the appropriate group for the party (like "Sundry Debtors").

- Amount: Enter Rs. 1000.

- Narration: Enter a brief description, such as "Credit Note received from M/s Nandhu & Co."

Debit and Credit Accounts:

- Debit the account representing the party (e.g., "M/s Nandhu & Co.") with Rs. 5000.

- Credit the account representing the return (e.g., "Sales Return") with Rs. 5000.

Save the Voucher:

- Press Ctrl + A to save the Debit Note Voucher.

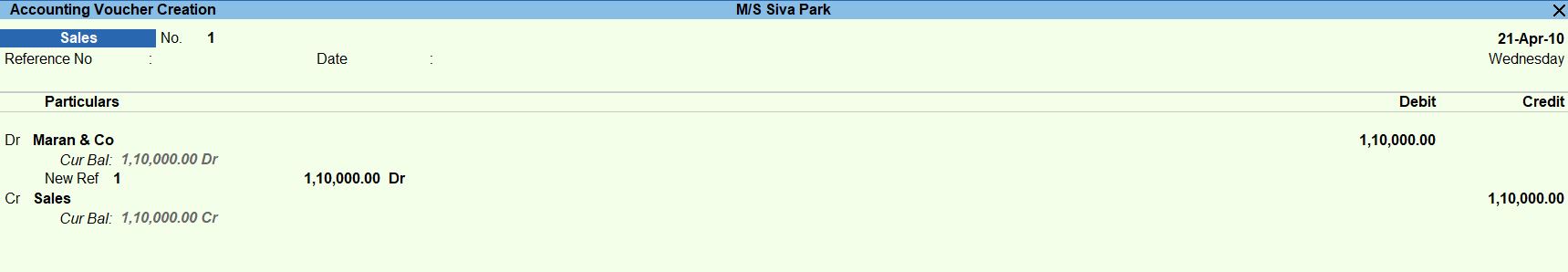

Apr 21 Goods sold to M/S Maran& CO was Rs.110000

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounts Information:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Debit Note Voucher:

- Choose "F8: Sales" to create a Sales Voucher

Enter Voucher Details:

- In the Debit Note Voucher screen:

- Date: Set the date to April 21.

- Party A/c Name: Select or create the ledger for "M/S Maran & Co."

- Under: Choose the appropriate group for the party (like "Sundry Debtors").

- Amount: Enter Rs. 110,000.

- Narration: Enter a brief description, such as "Goods sold to M/S Maran & Co."

Debit and Credit Accounts:

- Debit the account representing the party (e.g., "M/S Maran & Co.") with Rs. 5000.

- Credit the account representing the return (e.g., "Sales") with Rs. 5000.

Save the Voucher:

- Press Ctrl + A to save the Debit Note Voucher.

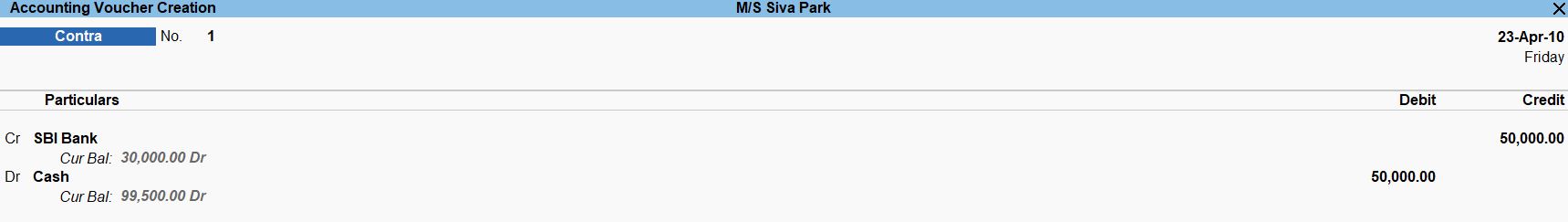

Apr 23 Cash withdraw from bank Rs.50000

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounts Information:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Debit Note Voucher:

- Choose "F4: Contra" to create a Contra Voucher.

Enter Voucher Details:

- In the Debit Note Voucher screen:

- Date: Set the date to April 23.

- Debit Account: Select the account to be debited (e.g., "Cash").

- Amount: Enter Rs. 50,000.

- Credit Account: Select the account to be credited (e.g., "SBI Bank").

- Narration: Enter a brief description, such as "Cash withdrawal from SBI Bank."

Save the Voucher:

- Press Ctrl + A to save the Debit Note Voucher.

- follow the above steps for the transaction below.

- June 01 Bank O/D settled Rs.300

- Sep 05 Cash deposit in to bank Rs.2000

- Sep 20 Withdraw from bank Rs.500

May 02 Received interest Rs. 20000

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounts Information:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Debit Note Voucher:

- Choose "F6: Receipt" to create a Receipt Voucher.

Enter Voucher Details:

- In the Debit Note Voucher screen:

- Date: Set the date to May 02.

- Received From: Enter the name of the party from whom you received the interest.

- Under: Choose the appropriate group for the party (e.g., "Sundry Creditors").

- Amount: Enter Rs. 20,000.

- Credit Account: Select the ledger for "Received Interest."

- Narration: Enter a brief description, such as "Received interest for May."

Save the Voucher:

- Press Ctrl + A to save the Debit Note Voucher.

- follow the above steps for the transaction below.

- May 05 Bank Loan Received Rs.1000

- Aug 28 Discount Received Rs.10000

- Oct 01 Divided received Rs.1000

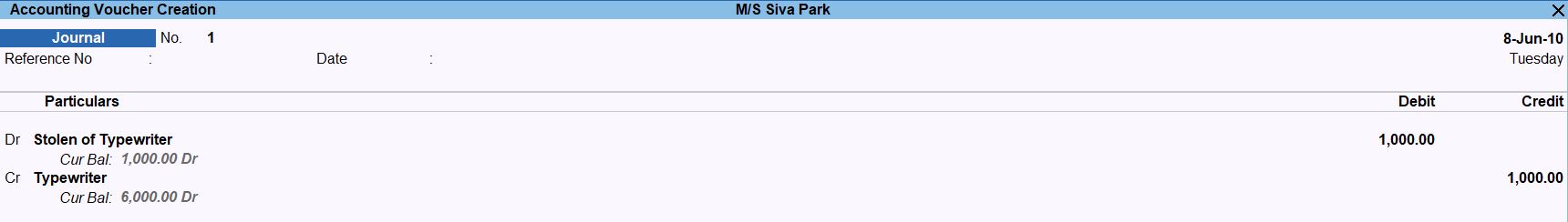

June 08 Stolen of typewriter Rs.1000

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounts Information:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Debit Note Voucher:

- Choose "F7: Journal" to create a Journal Voucher.

Enter Voucher Details:

- In the Debit Note Voucher screen:

- Date: Set the date to June 08.

- Debit Account: Select the account representing the loss or expense (e.g., "Stolen Expense" or "Loss on Theft").

- Amount: Enter Rs. 1000.

- Credit Account: Select the account representing the typewriter (e.g., "Typewriter").

- Narration: Enter a brief description, such as "Stolen of typewriter worth Rs. 1000."

Save the Voucher:

- Press Ctrl + A to save the Debit Note Voucher.

Profit and Loss

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Reports:

- From the Gateway of Tally, go to "Reports" by selecting it from the main menu.

Financial Reports:

- Under "Reports," navigate to "Profit & Loss" in the "Financial Reports" section.

Balance Sheets

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Reports:

- From the Gateway of Tally, go to "Reports" by selecting it from the main menu.

Financial Reports:

- Under "Reports," navigate to "Balance Sheet" in the "Financial Reports" section.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions