Mastering Statutory Dashboard Overview Reports in Tally Prime

The Statutory Dashboard in Tally Prime offers a comprehensive view of compliance-related tasks such as GST returns, pending actions, and reconciliations. It is a customizable tool that helps businesses monitor their statutory obligations efficiently. Here is an overview of how to customize the Statutory Dashboard in Tally Prime to track GST-related reports and actions.

Step-by-Step Guide to Customizing the Statutory Dashboard

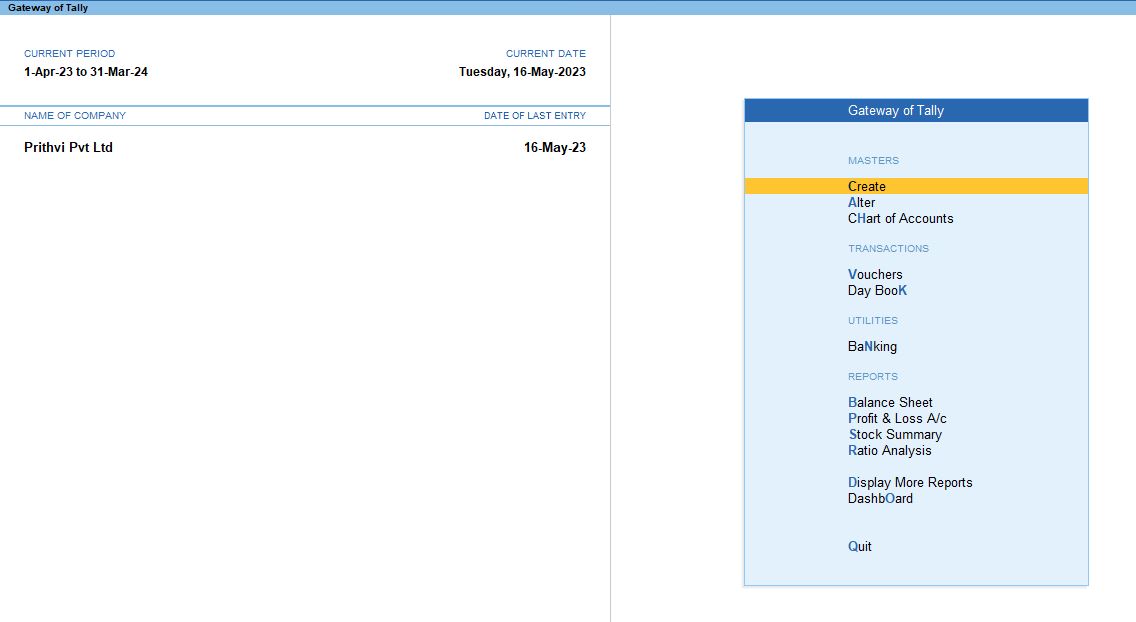

1. Select the Company

Start by opening Tally Prime and selecting the relevant company that you wish to configure statutory reports for.

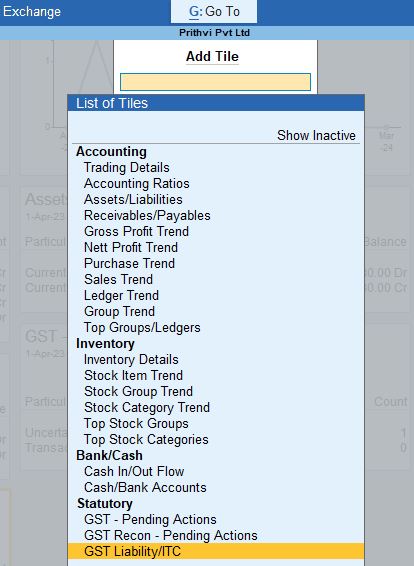

2. Add Tile for GST Pending Actions - GSTR-1

Start by opening Tally Prime and selecting the relevant company that you wish to configure statutory reports for.

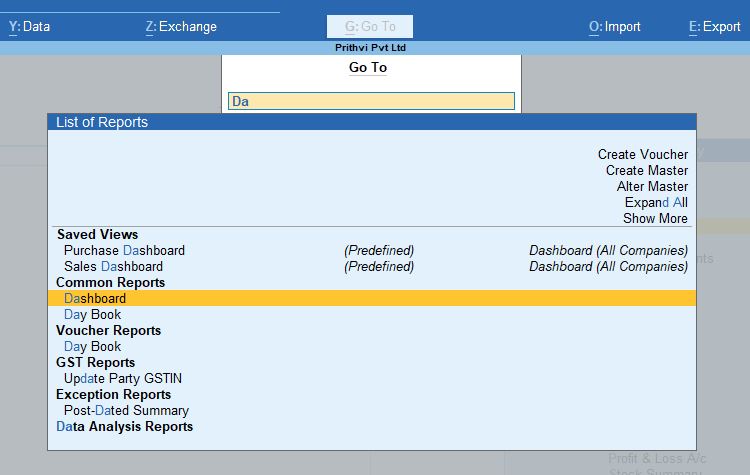

- Press Alt + G to open the Go To menu.

- Navigate to the Dashboard

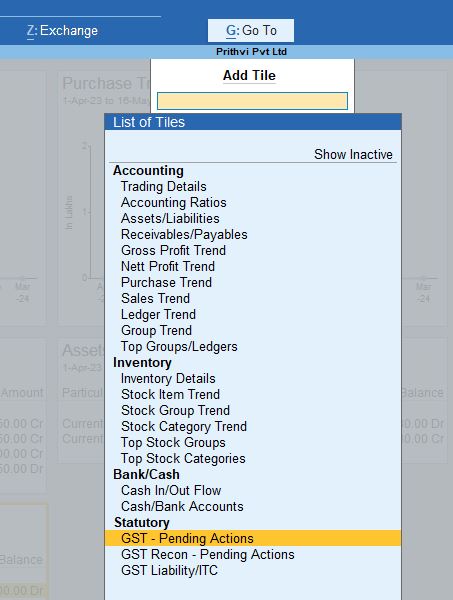

- Press Alt + A to Add Tile.

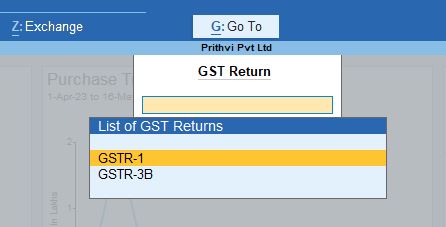

- Select GST – Pending Actions and then choose GSTR-1 to display pending GST actions related to GSTR-1.

- You might see alerts like Uncertain Transaction - 1, which indicate pending or mismatched transactions.

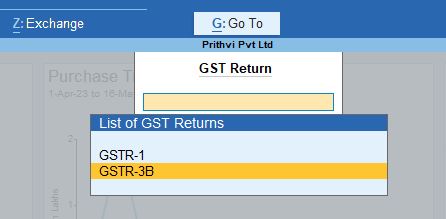

3. Add Tile for GST Pending Actions - GSTR-3B

- Again, press Alt + G to access the Go To menu.

- Navigate to Dashboard, and press Alt + A to add another tile.

- Select GST – Pending Actions and choose GSTR-3B for pending actions related to GSTR-3B.

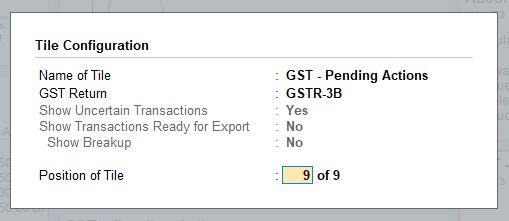

Configure the GSTR-3B Tile

- Alt + C to configure the tile.

- Set the parameters as follows:

- Name of Tile: GST – Pending Actions

- GST Return: GSTR-3B

- Position of Tile: 12 of 12 (this determines the position of the tile on the dashboard).

This tile helps track any pending or incomplete GSTR-3B filing actions.

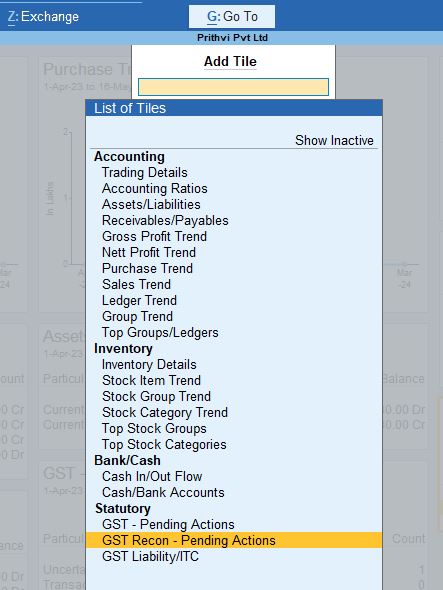

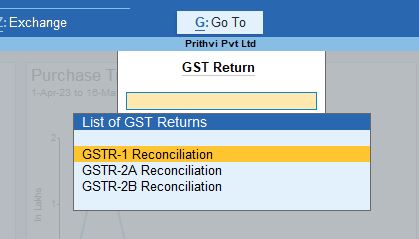

4. Add Tile for GST Reconciliation - GSTR-1

- Press Alt + G to open the Go To menu and select Dashboard.

- Press Alt + A to Add Tile.

- Choose GST – Recon - Pending Actions, and then select GSTR-1 Reconciliation.

This tile provides a quick view of any reconciliation pending for GSTR-1, allowing you to review mismatches or incomplete data.

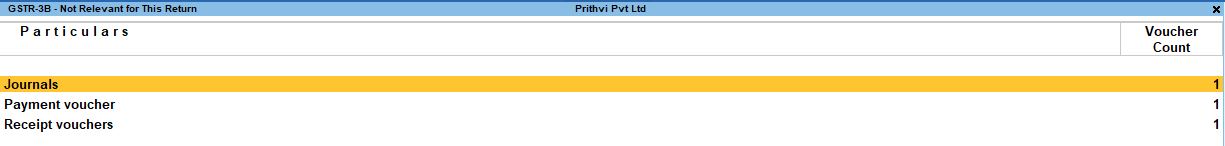

5. Add Tile for GST Liabilities ITC - GSTR-3B

- Access the Go To menu using Alt + G and open the Dashboard.

- Add another tile by pressing Alt + A.

- Choose GST Liabilities ITC and then select GSTR-3B to track Input Tax Credit (ITC) liabilities.

- You can further configure the tile to focus on specific transactions such as Non-GST Transactions, Journals, Payment Vouchers, or Receipt Vouchers.

This tile provides a summary of GST liabilities, showing how much is payable and the ITC available

6. Configure the Tiles

You can customize the dashboard tiles to suit your specific requirements by pressing Alt + C, to configure each tile. Here are common configuration options:

Tile Configuration Options:

- Name of Tile: Set the title of the tile based on the report you wish to track (e.g., GST – Pending Actions, GSTR-1 Reconciliation).

- GST Return: Choose the applicable GST form, such as GSTR-1 or GSTR-3B.

- Position of Tile: Determine the placement of the tile on your dashboard (e.g., 12 of 12).

These settings ensure that the dashboard provides you with relevant and concise information at a glance.

Conclusion

The Statutory Dashboard in Tally Prime is an essential tool for managing GST compliance. By adding and customizing tiles, you can stay on top of pending GST actions, reconciliations, and liabilities. This feature simplifies tracking your statutory obligations, helping ensure timely filing and reconciliation of GST returns, all from a single, customizable interface.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions