Budget in Tally Prime

What is Budget?

- The budget is a financial plan that helps you estimate and allocate funds for various income and expense categories within your organization.

- Budgets are essential for managing your finances effectively, monitoring performance, and ensuring that you stay within your financial limits.

Important of Budgeting in Tally

- Financial Planning: It helps you plan how you'll manage your money, set goals, and decide where to spend and save.

- Expense Control: Budgets prevent you from overspending by setting limits on different spending categories.

- Performance Monitoring: You can compare your actual income and expenses with what you planned (the budget). This helps you see if you're meeting your financial goals or need to adjust.

- Decision-Making: Budgets provide data to make smart financial decisions, such as when to invest, hire, or cut costs.

Purpose of Budget

- Revenue Forecasting

- Cash Flow Management

- Compliance and Reporting

Example Sum

The Following Would Be Recording in Journal Using Double Entry System. Do The Posting Process from Journal Entries and Prepare The Trial Balance, Trading A/C, Profit & Loss A/C And Balance Sheet In The Books Of M/S. GREEN PARK LTD For The Following Year 2022 To 2023.

| Particulars | Dr | Cr |

|---|---|---|

| Central Bank of India | 7,00,000 | |

| Profit & Loss | 5,00,000 | |

| Capital | 20,00,000 | |

| Cash | 13,00,000 | |

| Bank Loan | 7,00,000 | |

| Land & Building | 7,00,000 | |

| Plant & Machinery | 2,50,000 | |

| Furniture | 2,50,000 | |

| Accounts Receivable | 3,00,000 | |

| Accounts Payable | 3,00,000 | |

| Bank O/D | 2,00,000 | |

| Good Will | 2,00,000 | |

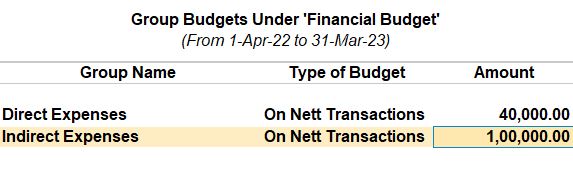

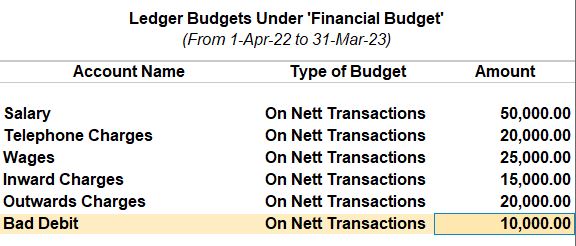

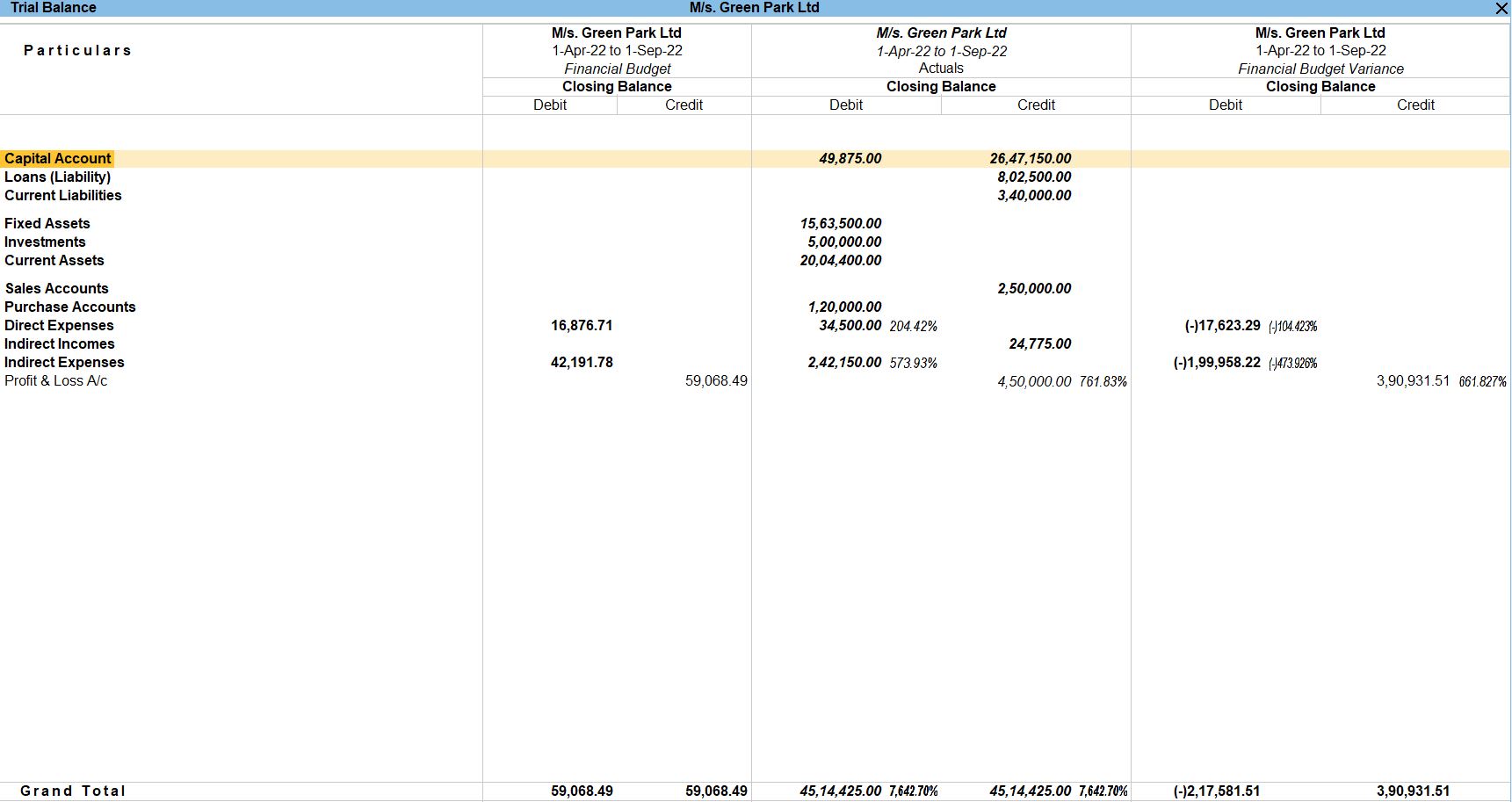

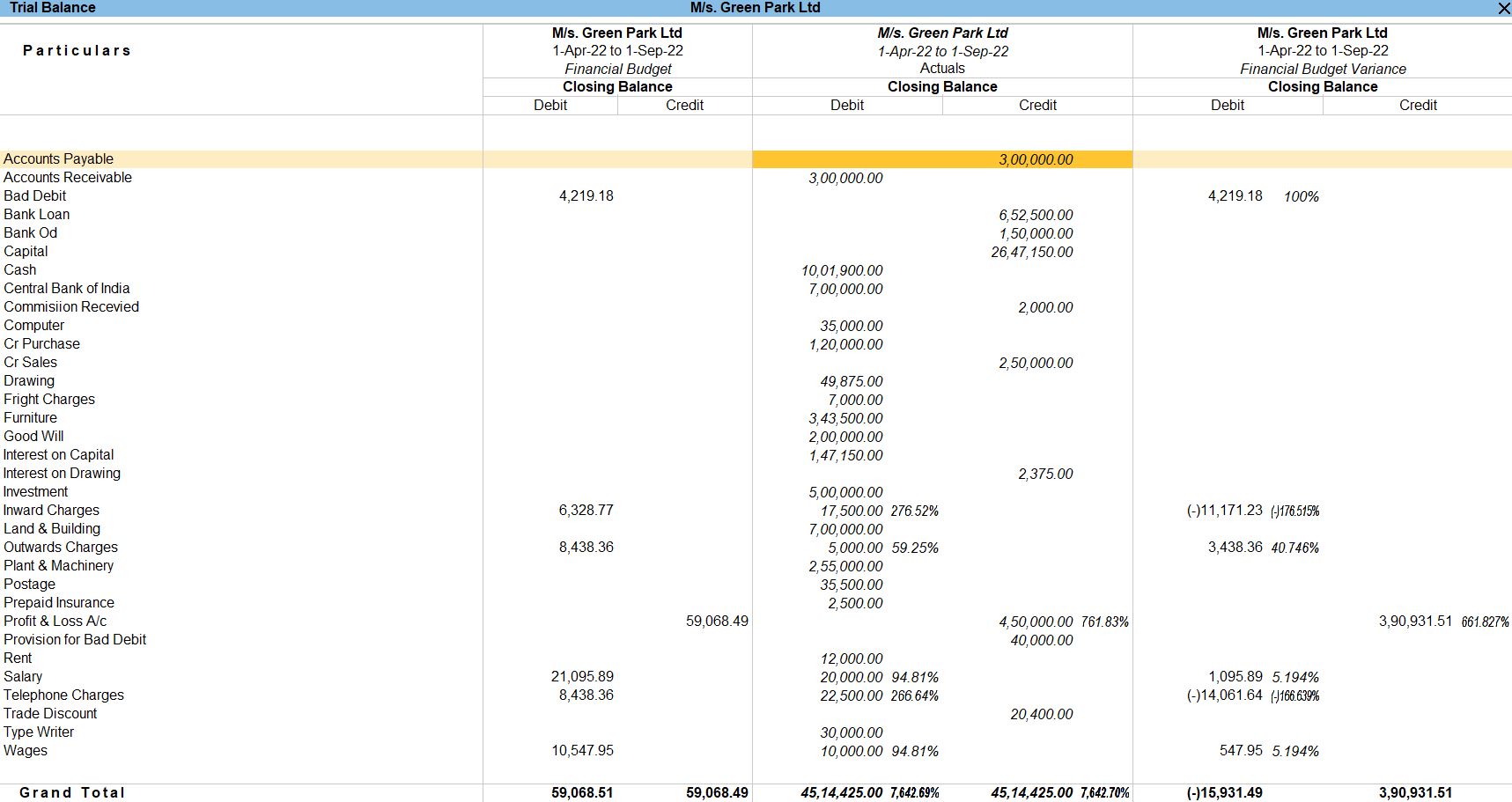

Budget

Title of the Budget : Financial Budget

Period of Budget : 1.4.2022 to 31.3.2023

| Ledger Name | Estimated Amount (Rs) |

|---|---|

| Salary | 50000 |

| Telephone Charges | 20000 |

| Wages | 25000 |

| Inward Charges | 15000 |

| Outward Charges | 20000 |

| Bad Debit | 10000 |

Title of the Budget : Infrastructure Budget

Period of Budget : 1.4.2022 to 31.3.2023

TRANSACTION DURING THE PERIOD

- Apr 01 Additional Capital Investing the Amount of Rs.500000.

- Apr 03 Paid Insurance 2500.

- Apr 10 Provision for Bad Debit Rs.50000 Allocate to P&L A/C.

- Apr 16 Cash Deposit in Bank Rs.70000.

- Apr 18 Bought on Credit From M/S. Selva Traders Rs.120000 Bill No:25 35days.

- Apr 21 Withdraw from Personal Use Rs.47500.

- Apr 28 Allow Interest on Capital in The Current Balance @ 6%.

- May 01 Paid For: Salary: 20000, Wages: 10000.

- May 11 Amount Settled To M/S. Selva Traders and Less Trade Discount @ 17%.

- May 21 Purchased Furniture Rs.45000 And Computer Rs.35000.

- May 28 Goods Sold To M/S. Reliance Ltd Rs.250000 Bill No:35 45days.

- Jun 01 Prepaid Insurance Rs.2500.

- Jun 15 Commission Received Rs.2000.

- Jun 18 Interest on Drawings @ 5%.

- Jun 21 Paid for Telephone Charges Rs.7500, Inward Charges Rs.10000.

- Jun 29 Purchased Typewriter Rs.17500.

| Ledger Name | Estimated Amount (Rs) |

|---|---|

| Furniture | 75000 |

| Typewriter | 30000 |

| Computer | 90000 |

- July 01 Paid for Rent Rs.12000, Postage Rs.8000.

- July 11 Bad Debit Written Off M/S. Reliance Ltd Rs.10000.

- July 21 Amount Received From M/S. Reliance Ltd Rs.240000.

- July 29 The Bad Debit Amount Adjusted to Provision A/C.

- Aug 01 Withdraw from Bank Rs.20000.

- Aug 05 Bank Loan Settled Rs.47500.

- Aug 08 Bank O/D Settled Rs.50000.

- Aug 19 Purchased Furniture Rs.48500 And Typewriter Rs.12500.

- Aug 21 Paid for Telephone Charges Rs.15000, Inward Charges Rs.7500, Outward Charges Rs.5000, Postage Rs.27500, Fright Charges Rs.7000.

- Sep 01 Purchase Plant & Machinery Rs.5000.

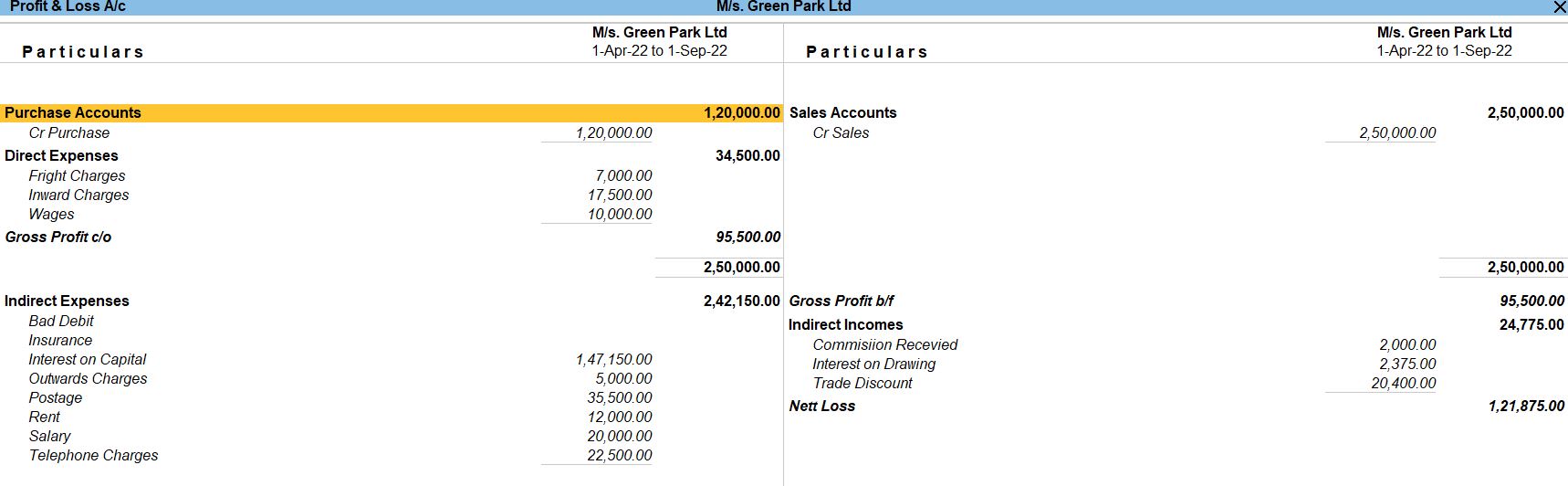

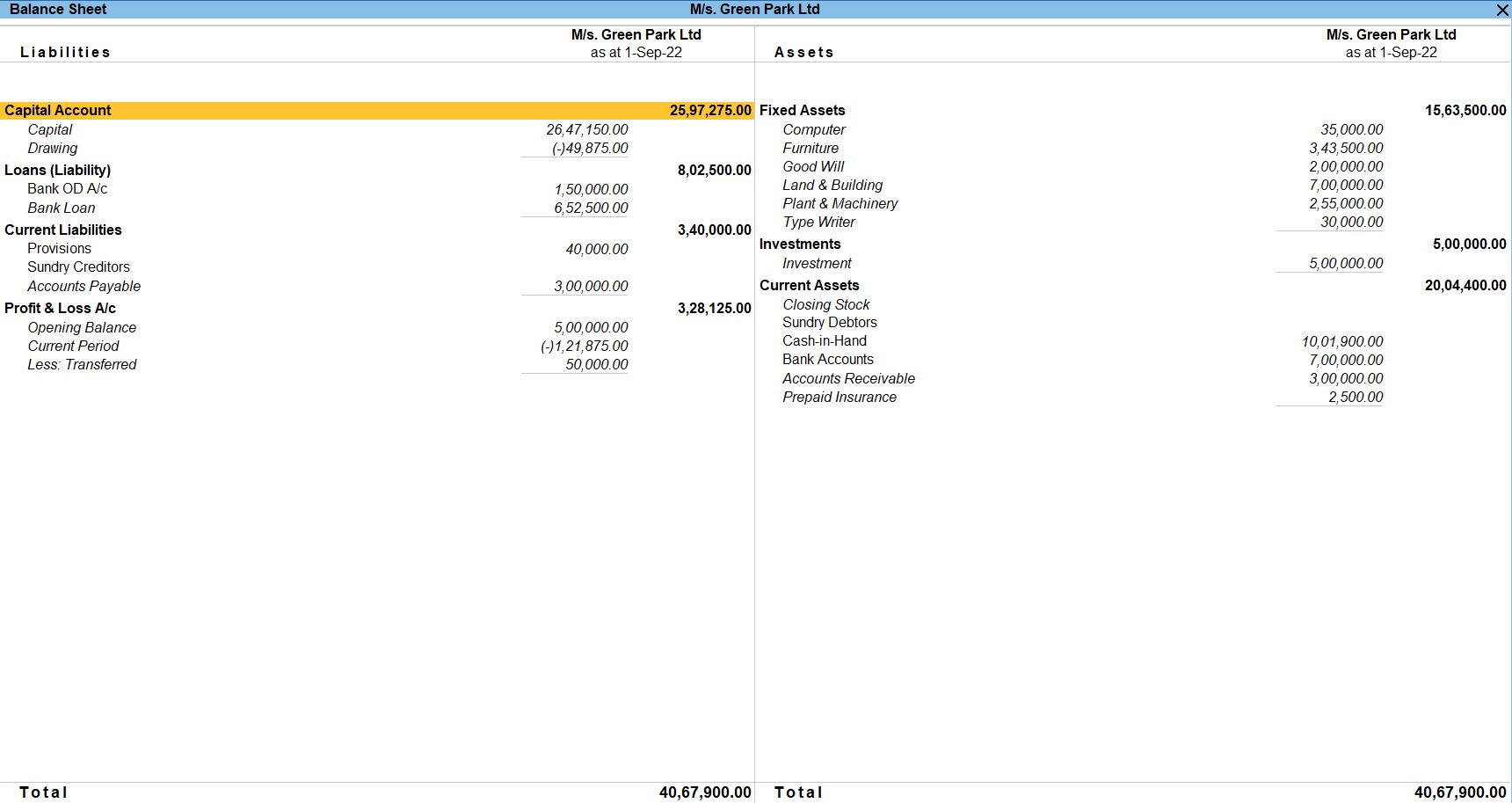

| Opening Balance | 3700000 |

|---|---|

| Gross Profit | 95500 |

| Net Loss | 121875 |

| Balance sheet | 4067900 |

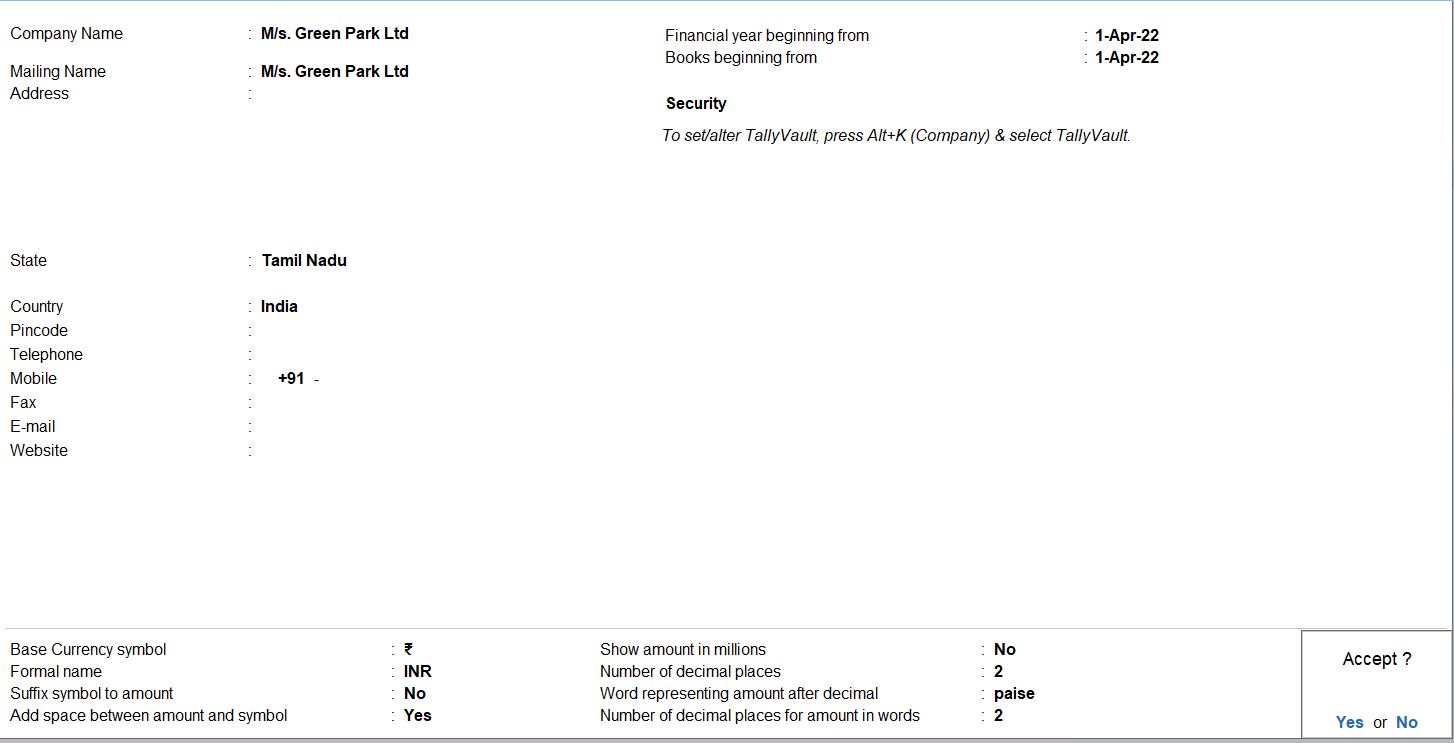

Create a New Company

- Go to the Gateway of Tally.

- Select "Create Company" or "Alt+ K" (exact wording may vary based on your version).

Enter Company Information

Fill in the necessary information about the company:

- Company Name: Enter "M/S. GREEN PARK LTD."

- Mailing Name: You can use the same name or a shorter version for mailing purposes.

- Address: Enter the company's address.

- Country: Select the country where the company is located.

- State: Choose the state.

- Pincode: Enter the company's pin code.

- Phone: Enter the company's contact number.

- Email: Provide the company's email address.

Provide Financial Year Details:

Set the financial year details:

- Books Beginning From: Select the start date of the financial year (e.g., April 1, 2022).

Save and Exit:

- Save your work as needed, and when you're finished, exit Tally Prime.

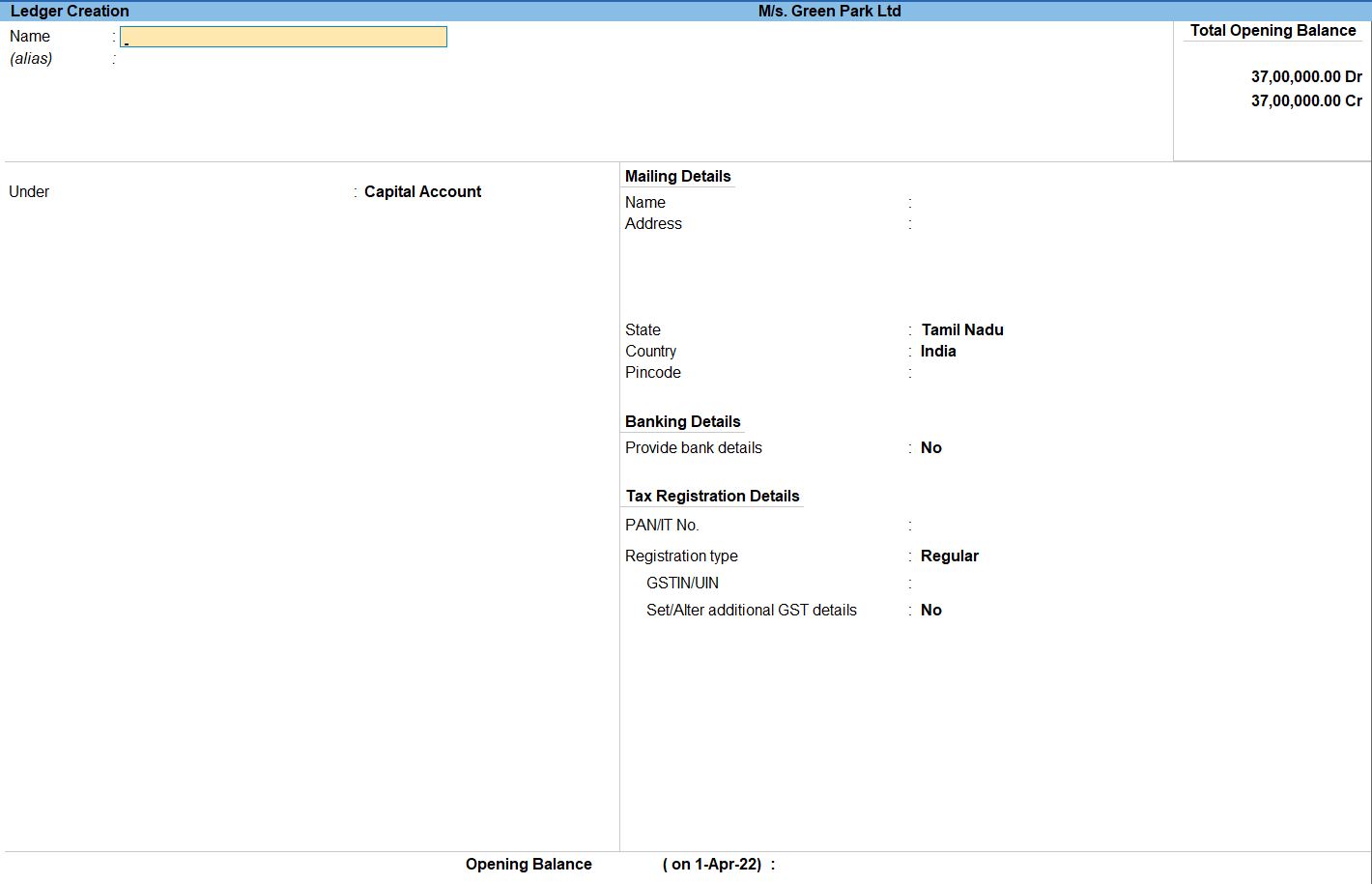

Create Ledgers :

Go to Gateway of Tally:

- Go back to the Gateway of Tally.

Access Accounts Info:

- Select "Accounts Masters" again.

Create Ledgers:

- Choose "Ledgers" and then select "Create" to create new ledgers.

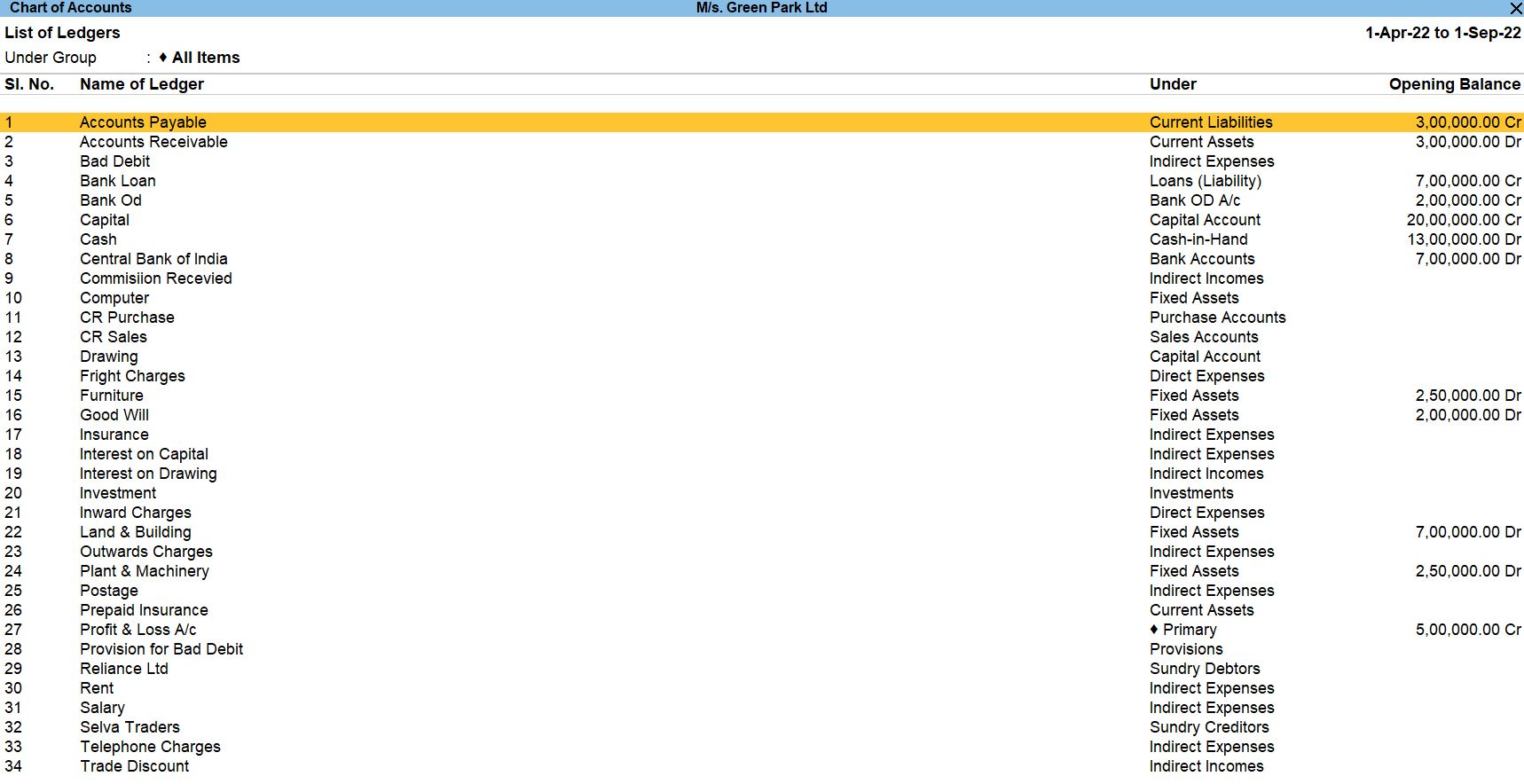

Central Bank of India:

- Create the ledger with the name "Central Bank of India" and group it under "Bank Accounts."

- Enter the opening balance as 7,00,000 in the "Opening Balance" field.

Profit & Loss:

- Create the ledger with the name "Profit & Loss" and group it under "Indirect Income."

- Enter the opening balance as 5,00,000 in the "Opening Balance" field.

Capital:

- Create the ledger with the name "Capital" and group it under "Capital Accounts."

- Enter the opening balance as 20,00,000 in the "Opening Balance" field.

Cash:

- Create the ledger with the name "Cash" and group it under "Cash-in-Hand."

- Enter the opening balance as 13,00,000 in the "Opening Balance" field.

Bank Loan:

- Create the ledger with the name "Bank Loan" and group it under "Secured Loans."

- Enter the opening balance as 7,00,000 in the "Opening Balance" field.

Land & Building:

- Create the ledger with the name "Land & Building" and group it under "Fixed Assets."

- Enter the opening balance as 7,00,000 in the "Opening Balance" field.

Plant & Machinery:

- Create the ledger with the name "Plant & Machinery" and group it under "Fixed Assets."

- Enter the opening balance as 2,50,000 in the "Opening Balance" field.

Furniture:

- Create the ledger with the name "Furniture" and group it under "Fixed Assets."

- Enter the opening balance as 2,50,000 in the "Opening Balance" field.

Accounts Receivable:

- Create the ledger with the name "Accounts Receivable" and group it under "Sundry Debtors."

- Enter the opening balance as 3,00,000 in the "Opening Balance" field.

Accounts Payable:

- Create the ledger with the name "Accounts Payable" and group it under "Sundry Creditors."

- Enter the opening balance as 3,00,000 in the "Opening Balance" field.

Bank O/D:

- Create the ledger with the name "Bank O/D" and group it under "Bank OD A/c."

- Enter the opening balance as 2,00,000 in the "Opening Balance" field.

Goodwill:

- Create the ledger with the name "Goodwill" and group it under "Intangible Assets."

- Enter the opening balance as 2,00,000 in the "Opening Balance" field.

Save and Exit:

- Save your work, and when you're finished, exit Tally Prime.

Select Chart of Accounts:

- Under the "Display" menu, choose "Account Books" and then select "Ledgers" or "Group Summaries."

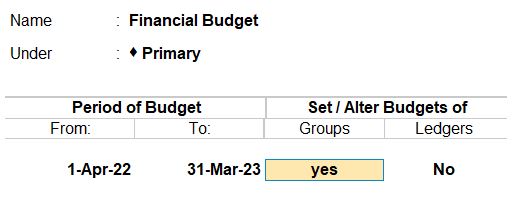

Budget Creation

Go to Gateway of Tally:

- Navigate to "Gateway of Tally."

Create an Employee Group:

- Go to"Create">"AccountingMasters" > "Budget" > "Create."

Enter Budget Details:

- In the "Create Budget" screen:

- Name of Budget: Enter "Financial Budget."

- Period of Budget: Set the period from 1.4.2022 to 31.3.2023.

Specify Ledger and Group Budgets:

- Enter the estimated amounts for each ledger account and group:

- Salary (Under Direct Expenses): Rs. 50,000

- Telephone Charges (Under Indirect Expenses): Rs. 20,000

- Wages (Under Direct Expenses): Rs. 25,000

- Inward Charges (Under Indirect Expenses): Rs. 15,000

- Outward Charges (Under Indirect Expenses): Rs. 20,000

- Bad Debit (Under Indirect Expenses): Rs. 10,000

Save the Budget:

- Press Ctrl + A to save the budget.

Verify the Budget Entry:

- Check the budget entry to ensure that the estimated amounts have been applied correctly.

Save and Exit:

- Save your work, and when you're finished, exit Tally Prime.

follow the above steps for the budget below.

Title of the Budget : Infrastructure Budget

Period of Budget : 1.4.2022 to 31.3.2023

| Ledger Name | Estimated Amount (Rs) |

|---|---|

| Furniture | 75000 |

| Typewriter | 30000 |

| Computer | 90000 |

TRANSACTION DURING THE PERIOD

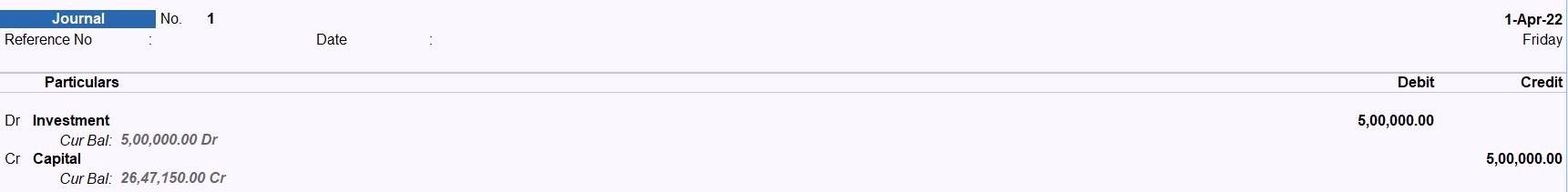

Apr 01 Additional Capital Investing the Amount of Rs.500000.

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounting Vouchers:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Journal Voucher:

- Choose "F7: Journal" to create a Journal Voucher.

Enter Voucher Details:

- In the Journal Voucher screen:

- Date: Set the date to April 01.

- Particulars:

- In the Debit column:

- Account: Select or create the ledger for "Investment.

- Amount: Enter Rs. 500,000.

- In the Credit column:

- Account: Select or create the ledger for "Capital."

- Amount: Enter Rs. 500,000.

- Narration: Enter a brief description, such as "Additional capital investment."

Debit and Credit Accounts:

- Debit the account representing the investment (e.g., "Investment") with Rs. 500,000.

- Credit the account representing the capital (e.g., "Capital") with Rs. 500,000.

Save the Voucher:

- Press Ctrl + A to save the Payment Voucher.

follow the above steps for the budget below.

- Apr 10 Provision for Bad Debit Rs.50000 Allocate to P&L A/C.

- Apr 28 Allow Interest on Capital In The Current Balance @ 6%.

- Jun 01 Prepaid Insurance Rs.2500.

- Jun 18 Interest on Drawings @ 5%.

- July 11 Bad Debit Written Off M/S. Reliance Ltd Rs.10000.

- July 29 The Bad Debit Amount Adjusted to Provision A/C.

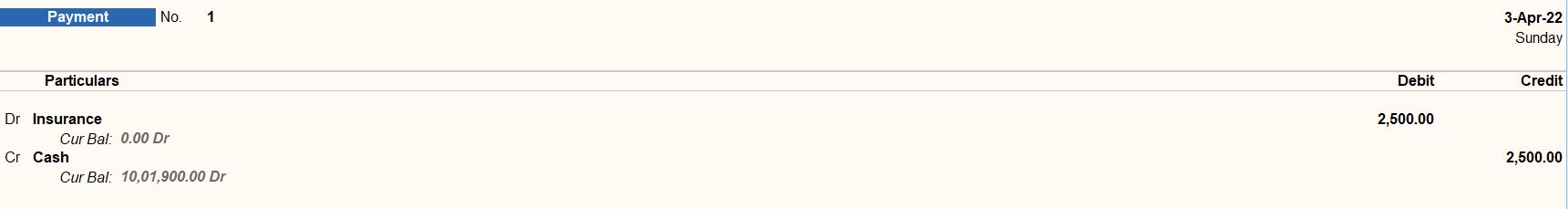

Apr 03 Paid Insurance 2500.

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounting Vouchers:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Payment Voucher:

- Choose "F5: Payment" to create a Payment Voucher.

Enter Voucher Details:

- In the Payment Voucher screen:

- Date: Set the date to April 03.

- Party's A/c Name: Select or create the ledger for "Insurance."

- Under: Choose the appropriate group for the insurance payment (e.g., "Indirect Expenses").

- Amount: Enter Rs. 2500.

- Credit Account: Select or create the ledger for "Cash."

- Narration: Enter a brief description, such as "Paid insurance."

Debit and Credit Accounts:

- Debit the account representing the expense (e.g., "Insurance") with Rs. 2500.

- Credit the account representing the payment method (e.g., "Cash") with Rs. 2500.

Save the Voucher:

- Press Ctrl + A to save the Payment Voucher.

follow the above steps for the budget below.

- Apr 21 Withdraw from Personal Use Rs.47500.

- May 01 Paid For: Salary: 20000, Wages: 10000.

- May 11 Amount Settled To M/S. Selva Traders and Less Trade Discount @ 17%.

- May 21 Purchased Furniture Rs.45000 And Computer Rs.35000.

- Jun 21 Paid for Telephone Charges Rs.7500, Inward Charges Rs.10000.

- Jun 29 Purchased Typewriter Rs.17500.

- July 01 Paid for Rent Rs.12000, Postage Rs.8000.

- Aug 05 Bank Loan Settled Rs.47500.

- Aug 19 Purchased Furniture Rs.48500 And Typewriter Rs.12500.

- Aug 21 Paid for Telephone Charges Rs.15000, Inward Charges Rs.7500, Outward Charges Rs.5000, Postage Rs.27500, Fright Charges Rs.7000.

- Sep 01 Purchase Plant & Machinery Rs.5000.

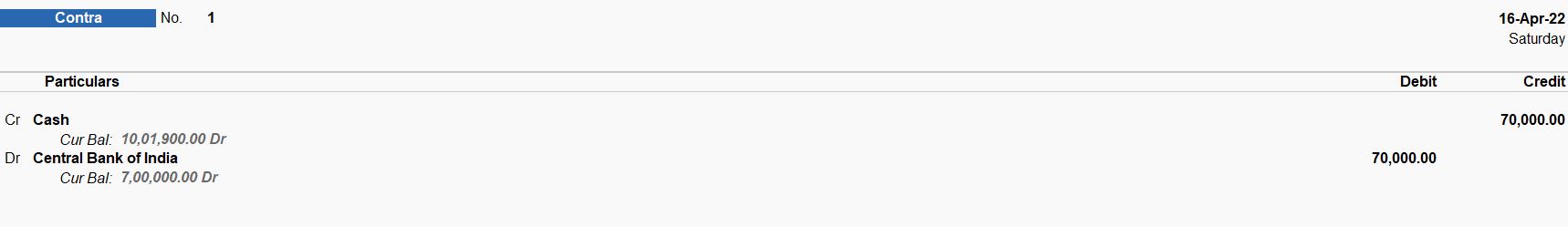

Apr 16 Cash Deposit in Bank Rs.70000.

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounting Vouchers:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Contra Voucher:

- Choose "F4: Contra" to create a Contra Voucher.

Enter Voucher Details:

- In the Contra Voucher screen:

- Date: Set the date to April 16.

- Credit: Select or create the ledger for "Central Bank of India"

- Debit: Select or create the ledger for "Cash."

- Amount: Enter Rs. 70,000.

- Narration: Enter a brief description, such as "Cash deposit in the bank."

Debit and Credit Accounts:

- Debit the account representing the cash (e.g., "Cash") with Rs. 70,000.

- Credit the account representing the bank (e.g., "Central Bank of India") with Rs. 70,000.

Save the Voucher:

- Press Ctrl + A to save the Payment Voucher.

follow the above steps for the budget below.

- Aug 01 Withdraw from Bank Rs.20000.

- Aug 08 Bank O/D Settled Rs.50000.

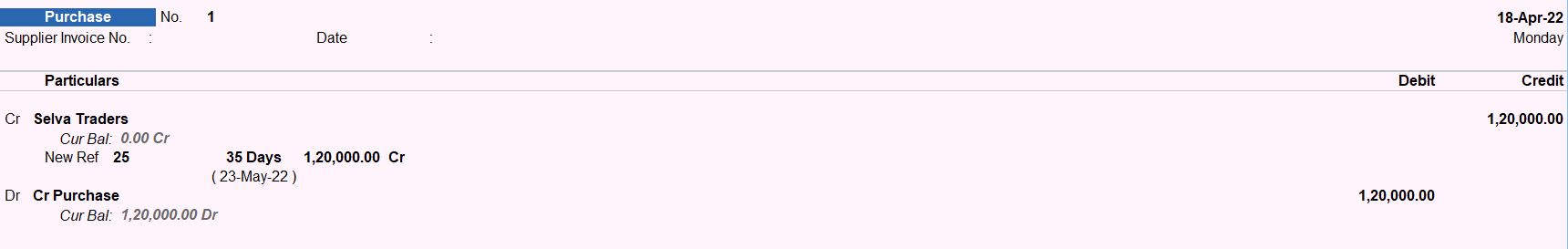

Apr 18 Bought on Credit From M/S. Selva Traders Rs.120000 Bill No:25 35days.

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounting Vouchers:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Purchase Voucher:

- Choose "F9: Purchase" to create a Purchase Voucher.

Enter Voucher Details:

- In the Purchase Voucher screen:

- Date: Set the date to April 18.

- Supplier Invoice No: Enter "25" as the bill number.

- Credit Period: Enter "35" days.

- Particulars:

- In the Debit column:

- Account: Select or create the ledger for "Purchase.

- Amount: Enter Rs. 120,000.

- In the Credit column:

- Account: Select or create the ledger for "M/S. Selva Traders."

- Narration: Enter a brief description, such as "Purchase on credit from M/S. Selva Traders."

Debit and Credit Accounts:

- Debit the account representing the purchase (e.g., "Purchase") with Rs. 120,000.

- Credit the account representing the supplier (e.g., "M/S. Selva Traders").

Save the Voucher:

- Press Ctrl + A to save the Payment Voucher.

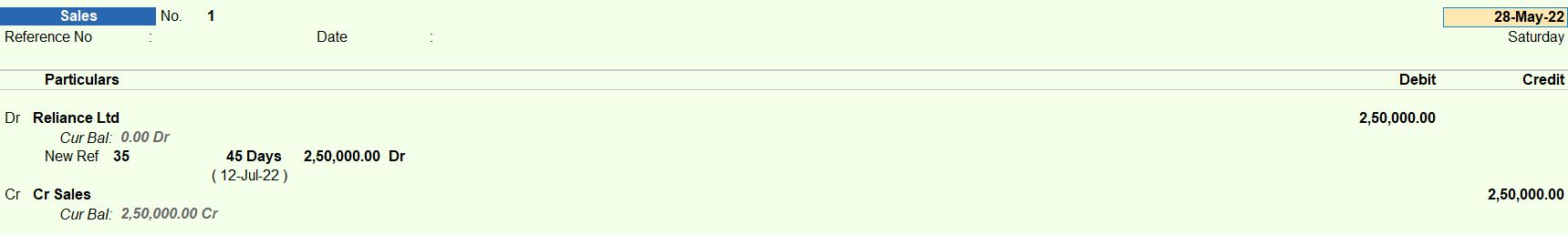

May 28 Goods Sold To M/S. Reliance Ltd Rs.250000 Bill No:35 45days.

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounting Vouchers:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Sales Voucher:

- Choose "F8: Sales" to create a Sales Voucher.

Enter Voucher Details:

- In the Sales Voucher screen:

- Date: Set the date to May 28.

- Buyer's Order No: Enter "35" as the bill number.

- Credit Period: Enter "45" days.

- Particulars:

- In the Debit column:

- Account: Select or create the ledger for "M/S. Reliance Ltd."

- Amount: Enter Rs. 250,000.

- In the Credit column:

- Account: Select or create the ledger for "Sales."

Debit and Credit Accounts:

- Debit the account representing the buyer (e.g., "M/S. Reliance Ltd") with Rs. 250,000.

- Credit the account representing the sales (e.g., "Sales").

Save the Voucher:

- Press Ctrl + A to save the Payment Voucher.

Jun 15 Commission Received Rs.2000.

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Accounting Vouchers:

- From the Gateway of Tally, go to "Transaction" or press V to directly access Vouchers.

Select Receipt Voucher:

- Choose "F6: Receipt" to create a Receipt Voucher.

Enter Voucher Details:

- In the Receipt Voucher screen:

- Date: Set the date to June 15.

- Mode of Payment: Choose the appropriate mode of payment (e.g., "Cash").

- Particulars:

- In the Debit column:

- Account: Select or create the ledger for "Cash"

- Amount: Enter Rs. 2000.

- In the Credit column:

- Account: Select or create the ledger for "Commission Received."

Debit and Credit Accounts:

- Debit the account representing the mode of payment (e.g., "Cash") with Rs. 2000.

- Credit the account representing the commission received (e.g., "Commission Received").

Save the Voucher:

- Press Ctrl + A to save the Payment Voucher.

Profit and Loss

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Reports:

- From the Gateway of Tally, go to "Reports" by selecting it from the main menu.

Financial Reports:

- Under "Reports," navigate to "Profit & Loss" in the "Financial Reports" section.

Balance Sheets

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Reports:

- From the Gateway of Tally, go to "Reports" by selecting it from the main menu.

Financial Reports:

- Under "Reports," navigate to "Balance Sheet" in the "Financial Reports" section.

View Budget Reports:

- After creating and entering the budget data, you can view budget reports.

- Go to Gateway of Tally >Display More Reports >Trial Balance > Budgets Leger -wise.

Select Budget Name:

- Choose the budget name for which you want to view the report.

View Budget Reports:

- Tally Prime provides various budget reports, such as Budget Variance, Budget Comparison, etc.

- You can explore these reports to analyse how your actual expenses compare to the budgeted amounts.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions