Handling Normal Rated Transactions with Ease

1st May 2023, Mukil Enterprises Pvt. Ltd. purchased Mahindra Truck from Mahindra Industries Pvt. Ltd. vide Supplier Invoice No. MT01/177. The company also charged TCS at 1% in the Invoice. The amount ₹ 10,80,000 was paid through bank vide cheque 510133.

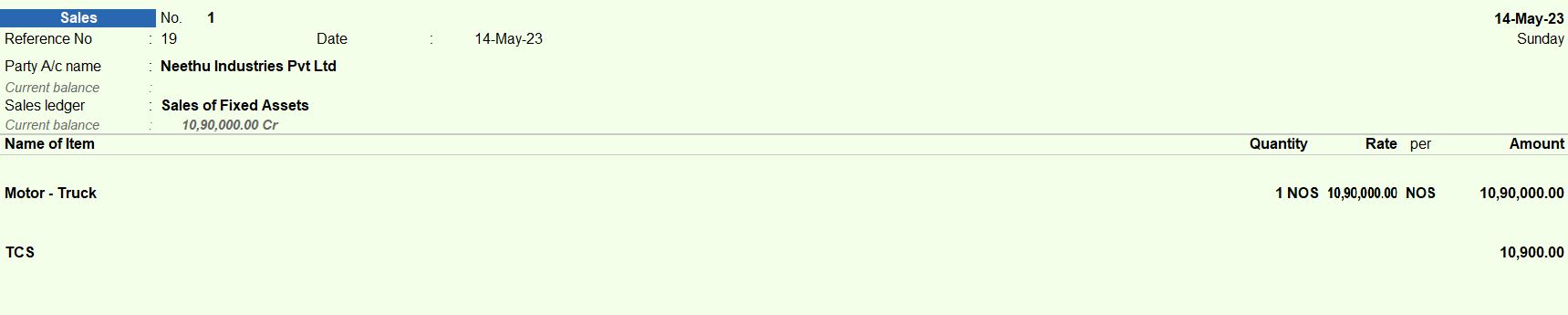

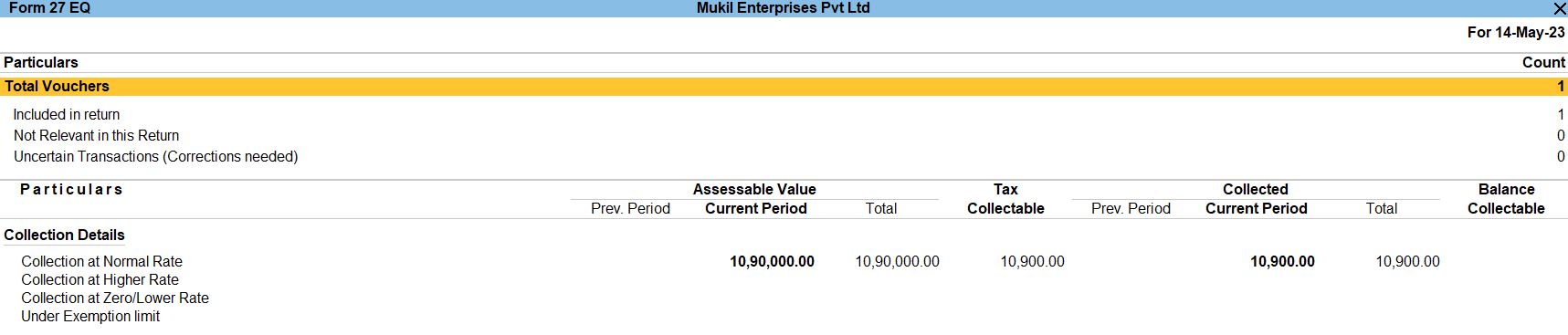

14th May 2023, Mukil Enterprises Pvt. Ltd. sold the Motor Vehicle to Neethu Industries Pvt. Ltd. on credit with Sale Bill No. 19.

Additionally, TCS at 1% is charged on the invoice towards sale of any motor vehicles (both new & old).

| Item | Qty | Rate |

|---|---|---|

| Motor Vehicle-Mahindra Truck | 1 | ₹ 10,90,000 |

16th May 2023 Mukil Enterprises Pvt. Ltd received the full amount from Neethu Industries Pvt. Ltd. against the Sales made on 14th May 2023. The payment was received vide Bank A/c cheque 911891.

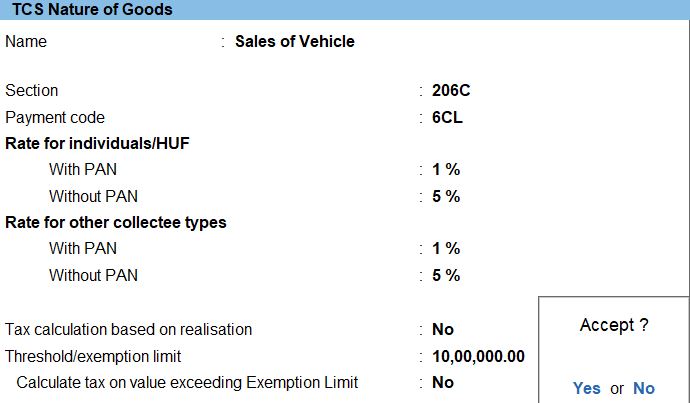

- Navigate to TCS Nature of Goods:

- Open Tally Prime software.

- Go to the "Masters" section.

- Create New TCS Nature of Goods:

- From the menu, select "Goods & Services Tax (GST)" or "Statutory and Taxation" depending on Tally Prime version.

- Choose "Nature of Goods/Services" or "TCS Nature of Goods" option.

- Enter Details:

- Name: Enter "Sales of Vehicle" as the name of the TCS Nature of Goods entry.

- Section: Specify "206C" as the section for this TCS entry.

- Payment Code: Input "6CL" as the payment code for this entry.

- Tax Rates:

- Rate for Individuals/HUF:

- With PAN: Enter the rate as "1%".

- Without PAN: Enter the rate as "5%".

- Rate for other collectee types:

- With PAN: Enter the rate as "1%".

- Without PAN: Enter the rate as "5%".

- Threshold/Exemption Limit:

- Enter the threshold/exemption limit as "10,00,000".

- Save Changes:

- After entering all the necessary details, save the TCS Nature of Goods entry.

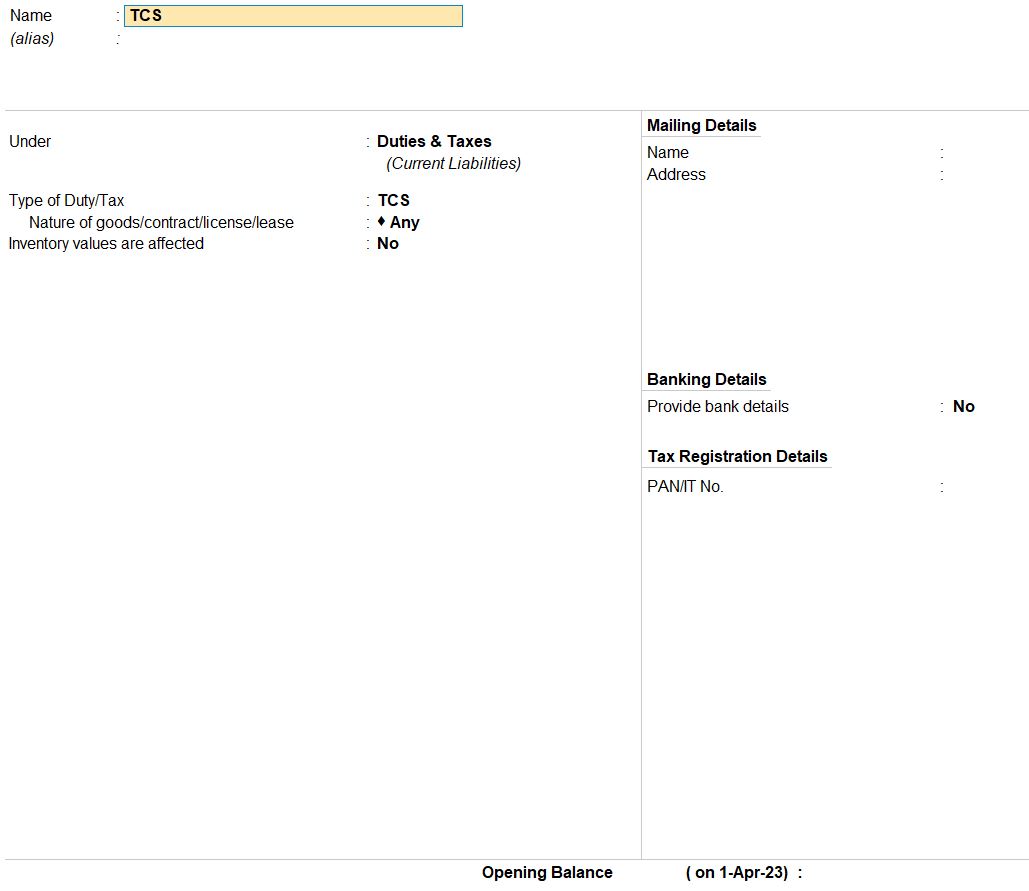

TCS Ledger Creation

- Navigate to Ledger Creation:

- Open Tally Prime software.

- Go to the "Create " section.

- Create New Ledger:

- From the menu, select "Ledgers."

- Choose "Create" to add a new ledger.

- Enter Ledger Details:

- Name: Enter "TCS" as the name of the ledger.

- Under: Select "Duties & Taxes" to categorize it correctly.

- Type of Duty/Tax:

- Select "TCS" from the list of duty/tax types available in the ledger creation form.

- Nature of Goods/Contract/License/Lease:

- Since the nature of goods/contract/license/lease is specified as "Any," you don't need to make any specific selections here. Leave it as default or blank.

- Save Changes:

- After entering all the necessary details, save the ledger.

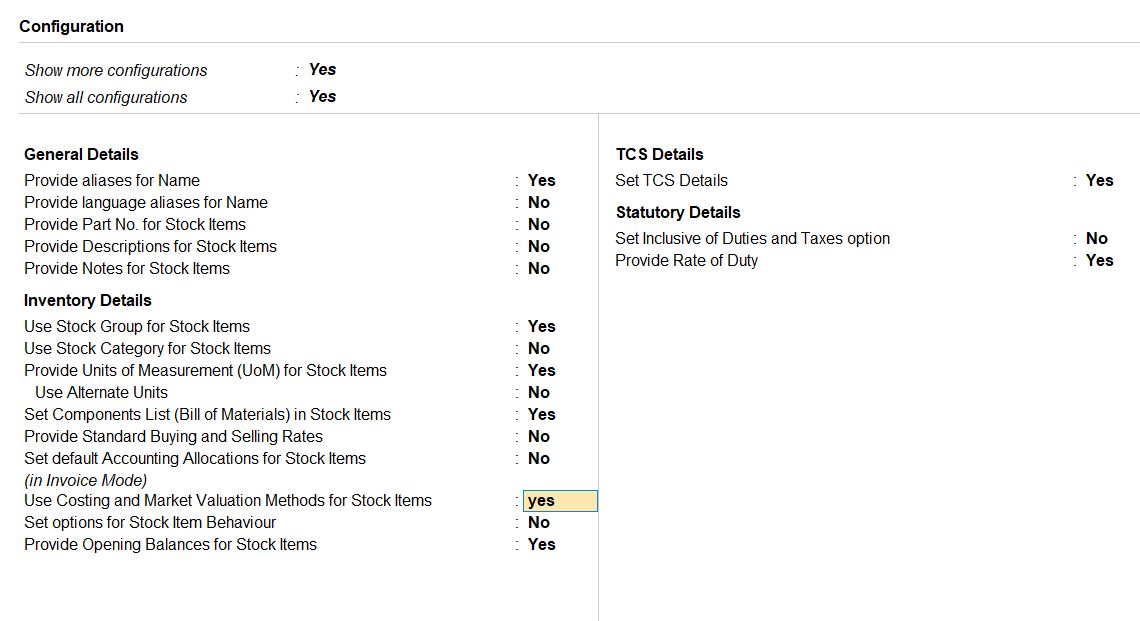

- Navigate to Stock Item Creation:

- Open Tally Prime software.

- Go to the "Inventory" section.

- Create New Stock Item:

- From the menu, select "Stock Items."

- Choose "Create" to add a new stock item.

- Enter Stock Item Details:

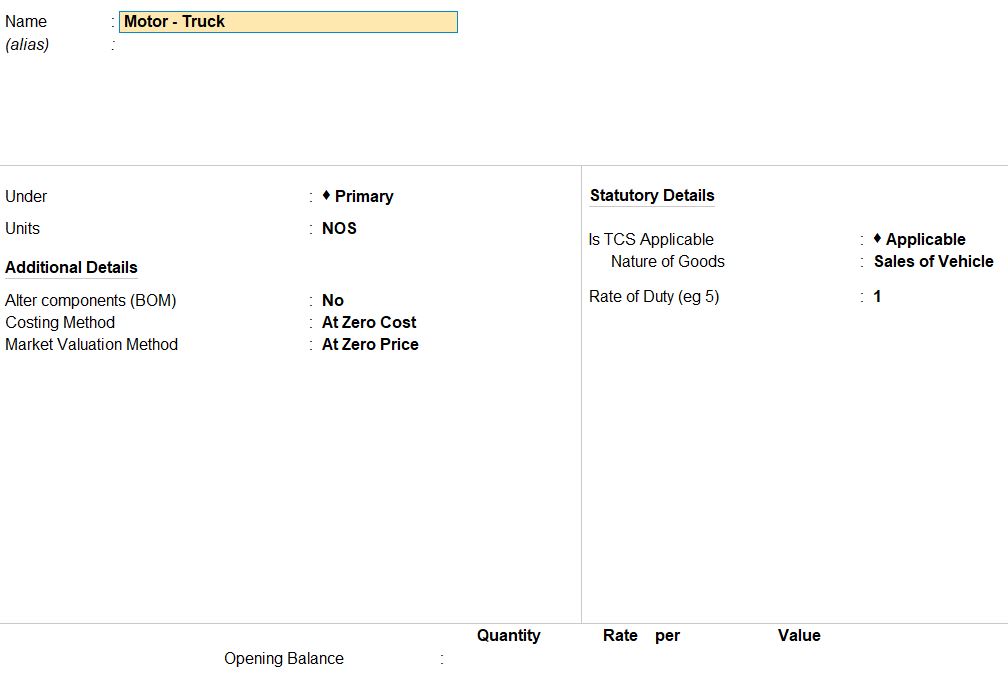

- Name: Enter "Motor-Truck" as the name of the stock item.

- Under: Select "Primary" to categorize it correctly.

- Units: Specify "Nos" as the unit of measurement for the stock item.

- Additional Details:

- Costing Method: Choose "At Zero Cost" for the costing method. This indicates that the cost of the stock item will be considered zero.

- Market Valuation Method: Select "At Zero Price" for the market valuation method. This means that the price of the stock item will be considered zero.

- Is TCS Applicable: Set this option to "Applicable" to enable TCS for this stock item.

- Nature of Goods: Enter "Sales of Vehicle" as the nature of goods for TCS purposes.

- Rate of Duty: Input "1" as the rate of duty for TCS.

- Save Changes:

- After entering all the necessary details, save the stock item.

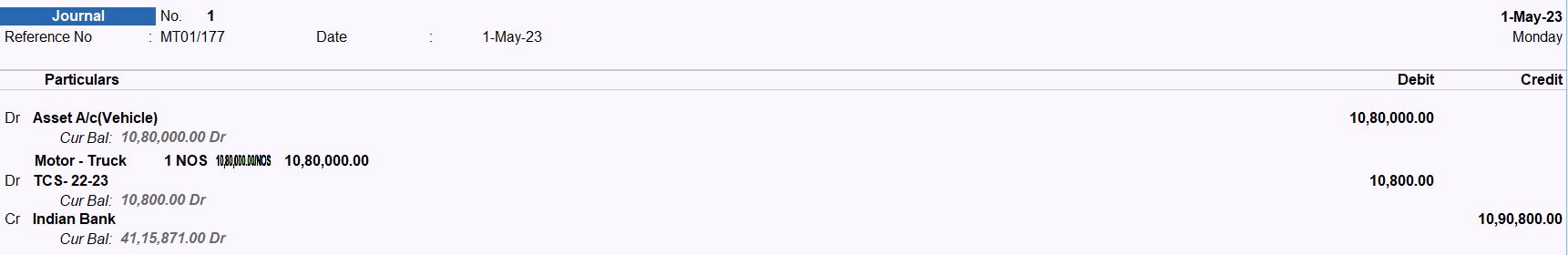

1st May 2023, Mukil Enterprises Pvt. Ltd. purchased Mahindra Truck from Mahindra Industries Pvt. Ltd. vide Supplier Invoice No. MT01/177. The company also charged TCS at 1% in the Invoice. The amount ₹ 10,80,000 was paid through bank vide cheque 510133.

- Navigate to Journal Voucher Entry:

- Open Tally Prime software.

- Go to the "Accounting Vouchers" section.

- Enter Date and Voucher Details:

- Set the voucher date as 1st May 2023.

- Choose "Journal" as the voucher type.

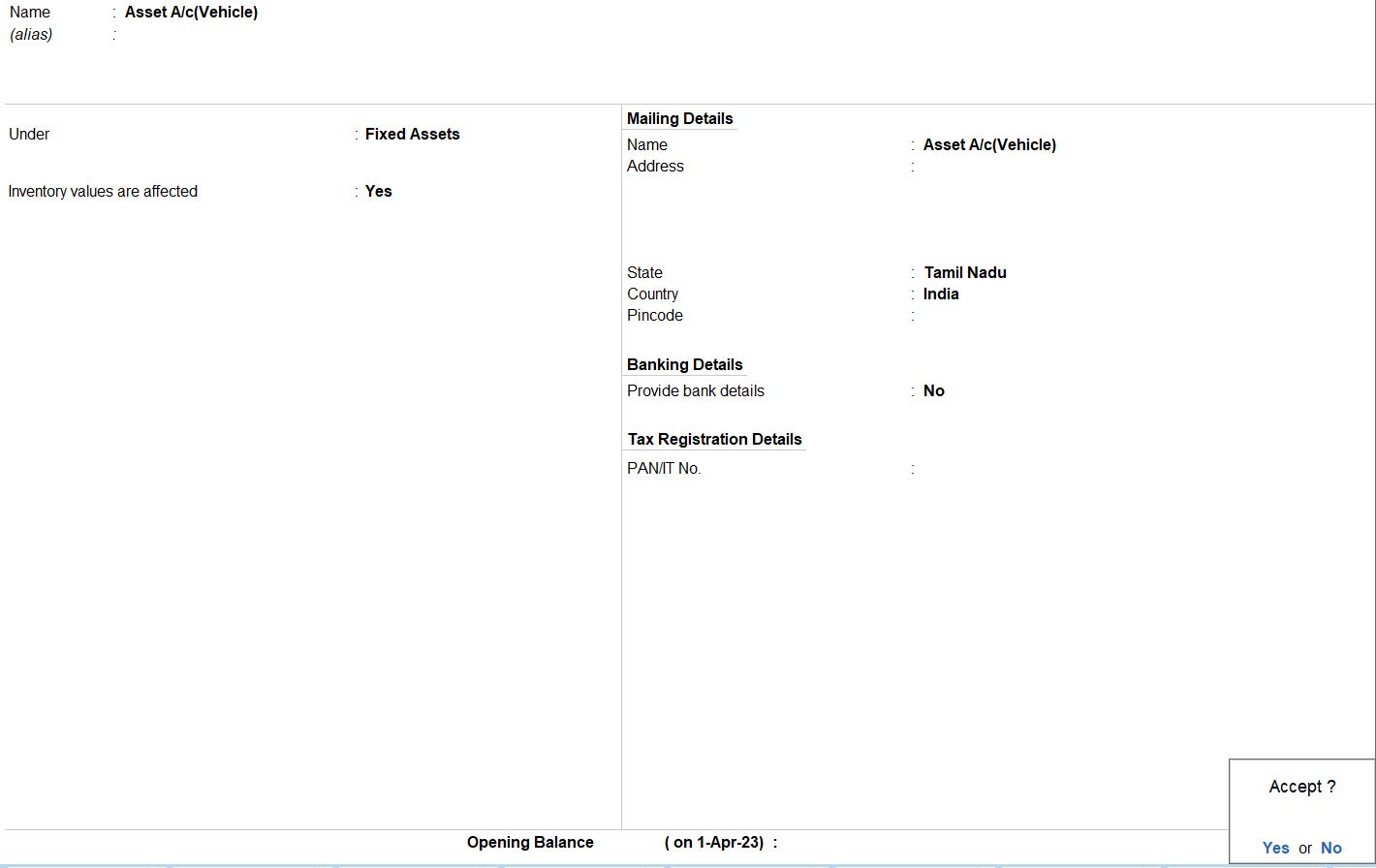

- Enter Debit Entries:

- Debit: Asset A/c(Vehicle) under Fixed Assets.

- Inventory values are affected: Yes.

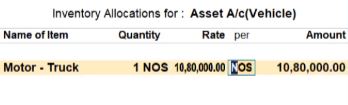

- Enter the following details for inventory allocation:

- Name of item: Motor-Truck

- Quantity: 1 Nos

- Rate: ₹1,080,000

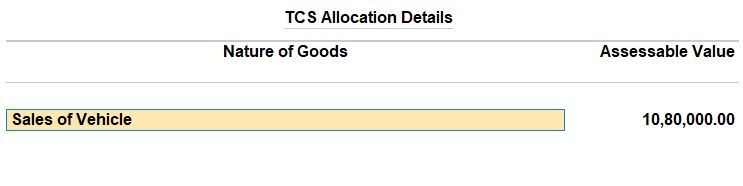

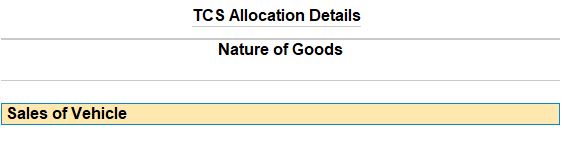

- TCS Allocation Details:

- Nature of Goods: Sales of Vehicle

- Assessable Value: ₹1,080,000

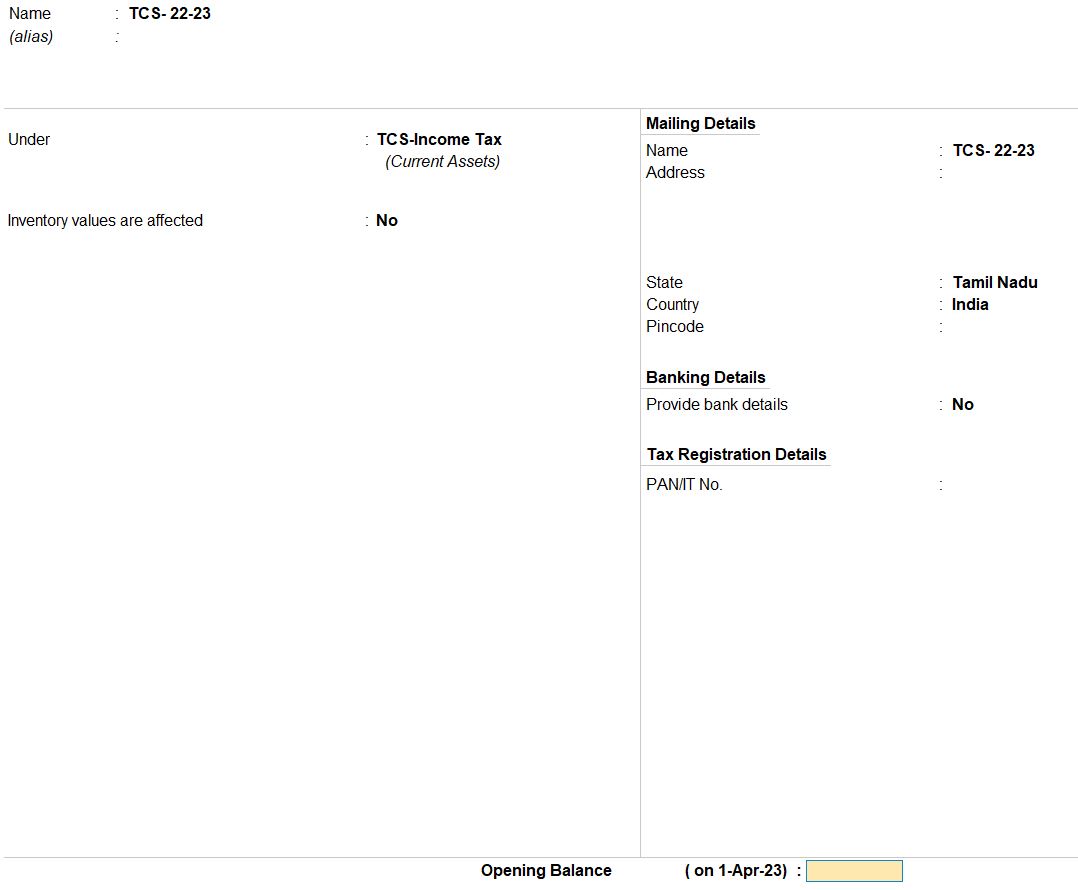

- Enter Credit Entry:

- Credit: TCS 22-23 under TCS - Income Tax.

- Inventory values are affected: No.

- Amount: ₹10,800 (1% of the assessable value)

- Enter Payment Details:

- Debit: Indian Bank.

- Credit: Bank Cheque No. 510133.

- Amount: ₹1,080,000.

- Save and Verify:

- Save the journal voucher after verifying all the entries.

- Double-check all the details entered to ensure accuracy.

14th May 2023, Mukil Enterprises Pvt. Ltd. sold the Motor Vehicle to Neethu Industries Pvt. Ltd. on credit with Sale Bill No. 19.

Additionally, TCS at 1% is charged on the invoice towards sale of any motor vehicles (both new & old).

| Item | Qty | Rate |

|---|---|---|

| Motor Vehicle-Mahindra Truck | 1 | ₹ 10,90,000 |

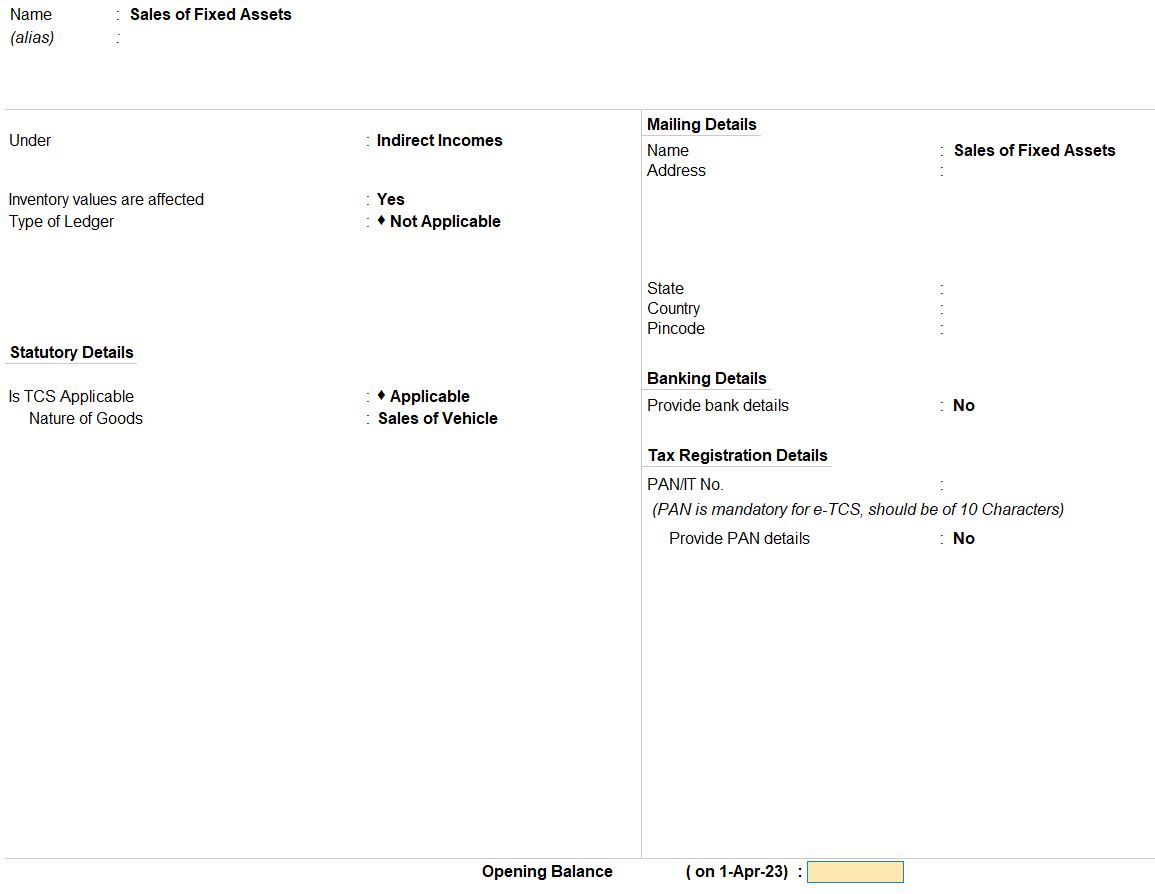

- Navigate to Sales Voucher Entry:

- Open Tally Prime software.

- Go to the " Vouchers" section.

- Enter Date and Voucher Details:

- Set the voucher date as 14th May 2023.

- Choose "Sales" as the voucher type.

- Enter Party Details:

- Ledger Creation: Sales of Fixed Assets under Indirect Income.

- Inventory values are affected: Yes.

- Party A/c Name: Neethu Industries Pvt Ltd under Sundry Debtors.

- Choose "Sales of Fixed Assets" as the sales ledger.

- Enter Item Details:

- Name of Item: Motor-Truck.

- Quantity: 1.

- Rate: ₹1,090,000.

- Total: ₹1,090,000.

- Enter TCS Details:

- Debit: TCS.

- Credit: Sales of Fixed Assets.

- Amount: ₹10,900 (1% of the sales amount).

- Save and Verify:

- Save the sales voucher after verifying all the entries.

- Double-check all the details entered to ensure accuracy.

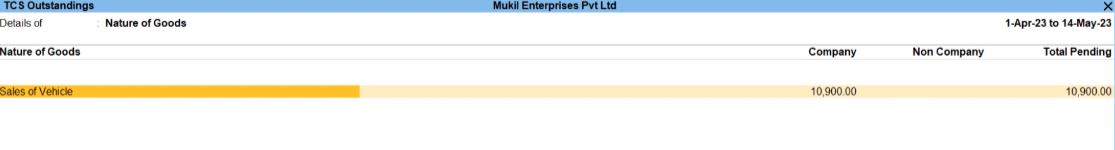

16th May 2023 Mukil Enterprises Pvt. Ltd received the full amount from Neethu Industries Pvt. Ltd. against the Sales made on 14th May 2023. The payment was received vide Bank A/c cheque 911891.

- Navigate to Receipt Voucher Entry:

- Open Tally Prime software.

- Go to the "Accounting Vouchers" section.

- Enter Date and Voucher Details:

- Set the voucher date as 16th May 2023.

- Choose "Receipt" as the voucher type.

- Ensure that the voucher mode is set to "Single Entry Mode."

- Enter Transaction Details:

- Account: Indian Bank.

- Particulars: Neethu Industries Pvt Ltd.

- Enter the amount received from Neethu Industries Pvt Ltd, which is ₹1,100,900.

- Enter TCS Allocation Details:

- Under the same entry, add the TCS allocation details:

- Sales of Vehicle under Nature of Goods.

- Neethu Industries Pvt Ltd.

- Enter the assessable value for TCS allocation, which is ₹1,100,900.

- Save and Verify:

- Save the receipt voucher after verifying all the entries.

- Double-check all the details entered to ensure accuracy.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions