Various Interest Calculation Methods in Tally Prime Demystified

What is interest calculation?

TallyPrime automatically calculates the pending interest amount till the date of your entry and auto-fills the amount column with the pending interest of the ledger selected.

Calculate Interest formula:

- The formula for Simple Interest (SI) is “principal x rate of interest x time period divided by 100” or (P x R x T/100).

- Example: 10,000 x 8 x 5 = INR 4,00,000 / 100 = 4000.

Purchase Interest:

- Purchase Interest typically refers to the interest incurred on purchases made on credit.

- This interest may be charged by your suppliers or creditors when you delay making payments for goods or services you have received.

- It's an additional cost associated with your purchases.

Sales Interest:

- Sales Interest typically refers to the interest income earned on sales made on credit.

- This interest income may be charged by your customers or debtors when they delay making payments for the goods or services they have purchased from your company.

- It's additional revenue earned because of extending credit terms to your customers.

Bank A/c Interest:

- Bank A/C Interest typically refers to the interest income or expense associated with your bank accounts.

- This can include interest earned on your bank deposits or interest paid on loans or overdrafts provided by the bank.

The following would be recording in journal using double entry system. Do the posting process from journal entries and prepare the trial balance, trading A/c, profit & loss A/c and balance sheet in the books of Jeeva Royal Electronics for the following year 2023 to 2024.

| Jeeva Royal Electronics | |

|---|---|

| Address | 10, Junction Main Road, Veerapandiar Nagar, Swarnapuri, Salem-636004 |

| Phone | 0427 589 4563 |

| Mobile No | 95940 50186 |

| Fax No | - |

| jeevaroyalelectronic@gmail.com | |

| Website | jeevaroyalelectronic.in |

| Particular | Amount | Particular | Amount |

|---|---|---|---|

| SBI Bank | 200000 | Capital | 300000 |

| Cash | 100000 | Sundry income | 80000 |

| Raw materials | 50000 | Bank loan | 100000 |

| Bill receivable | 80000 | Provision Bad debit | 75000 |

| Factory Rent | 20000 | Reserve fund | 33000 |

| Royalty on production | 50000 | Bill Payable | 350000 |

| Free hold property | 80000 | Bad debit recovered | 62000 |

| Discount allowed | 20000 | Rent received | 30000 |

| Investing on shares | 100000 | Building | 180000 |

| Stock in hand | 150000 |

Answer : 10,30,000

Apr 01 Goods purchased from Meera Electronics for the following. Bill No: MS101 (30 days)

- Sony Tv 500Nos@ Rs. 5600

- Sony I- Pad 50Nos@ Rs. 4500

- Lenovo laptop 7Nos@ Rs. 10000

- Micro max Phone 8Nos@ Rs.3000

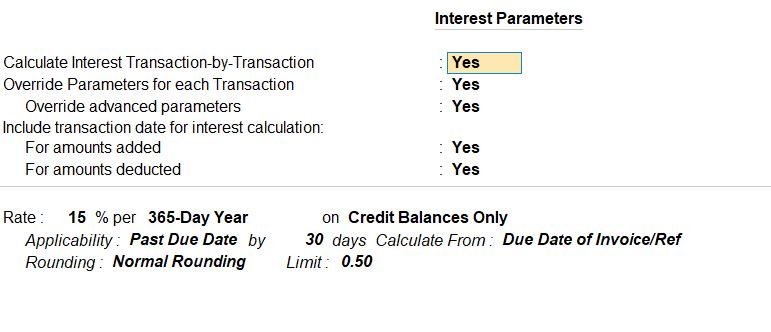

| Rate of Interest | 15% |

| Interest Style | 365 days |

| Interest Balance | Credit Balance Only |

| Applicability | Past Due Date by 30 Days |

| Form | Due Date of Invoice Ref |

Apr 02 Goods Sold Thanvika Electronics for the following. Bill No: JRE102 (20 days)

- Sony Tv 300Nos@ Rs. 6600

- Sony I- Pad 20Nos@ Rs. 5600

- Lenovo laptop 3Nos@ Rs. 15000

- Micro max Phone 3Nos@ Rs.7000

| Rate of Interest | 12% |

| Interest Style | 365 days |

| Interest Balance | Debit Balances Only |

| Applicability | Always |

| Form | Eff. Date of Transaction |

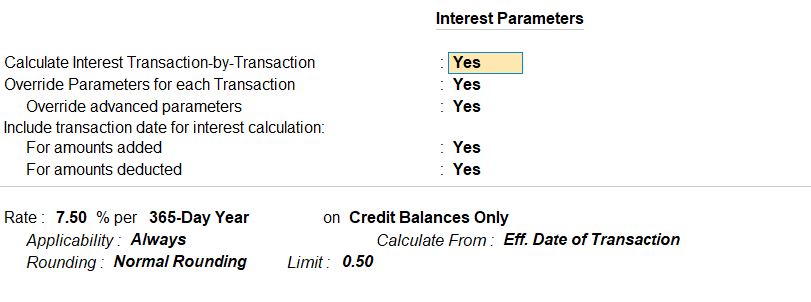

Apr 10 Credit Amount received from Sree Electronics Rs. 100000. Bill No: SE103(10 days)

| Rate of Interest | 7.50% |

| Interest Style | 365 days |

| Interest Balance | Credit Balances Only |

| Applicability | Always |

| Form | Eff. Date of Transaction |

Apr 12 Jeeva Royal Electronics fully settled to Sree Electronics with interest.

Apr 12 Amount paid form Ramay was Rs. 25000

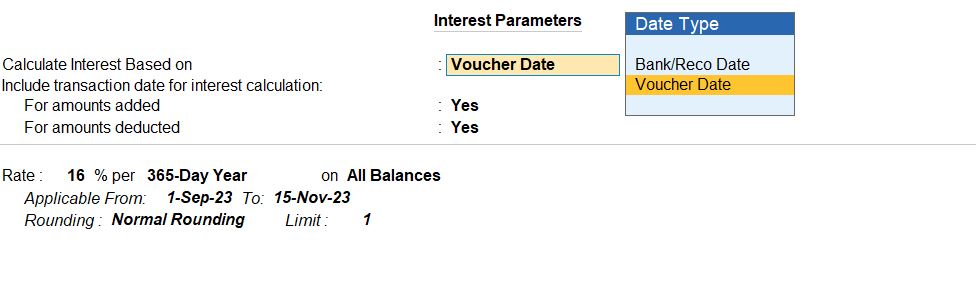

Bank Interest

| Rate of Interest | 16% |

| Interest Style | 365 days |

| Interest Balance | All balance |

| Applicable from | 1-sep-2022 to 15-Nov-2022 |

| Rounding | Normal rounding |

| Limit | 1 |

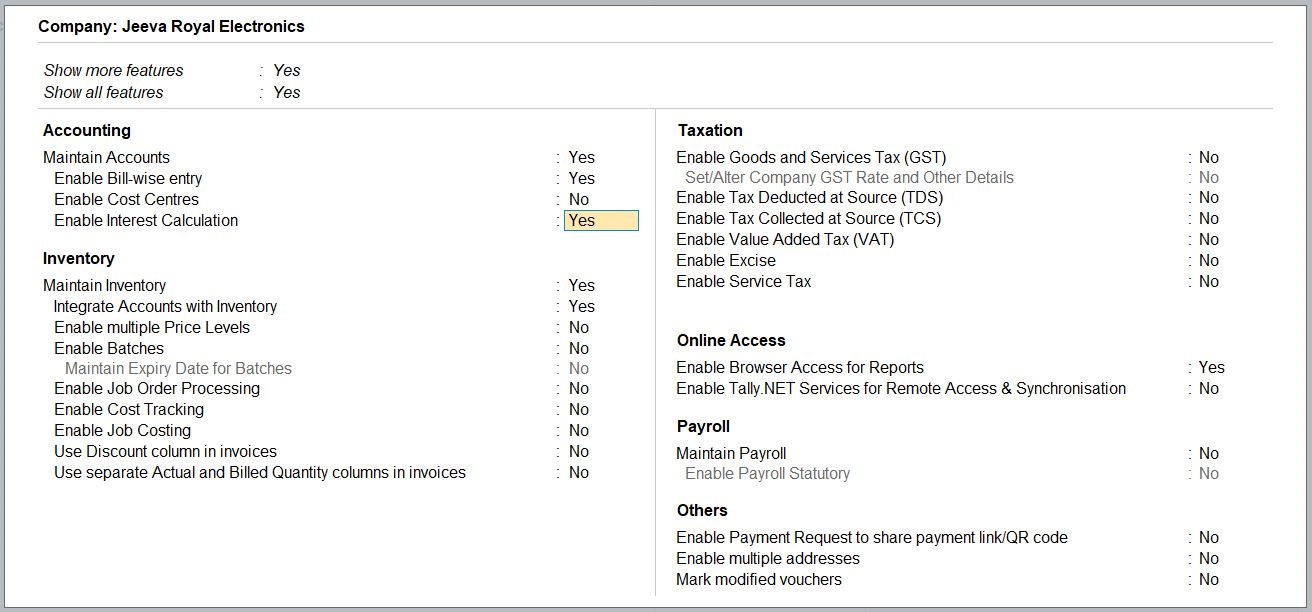

Create a New Company

Create a New Company

- Go to the Gateway of Tally.

- Select "Create Company" or "Alt+K" (exact wording may vary based on your version).

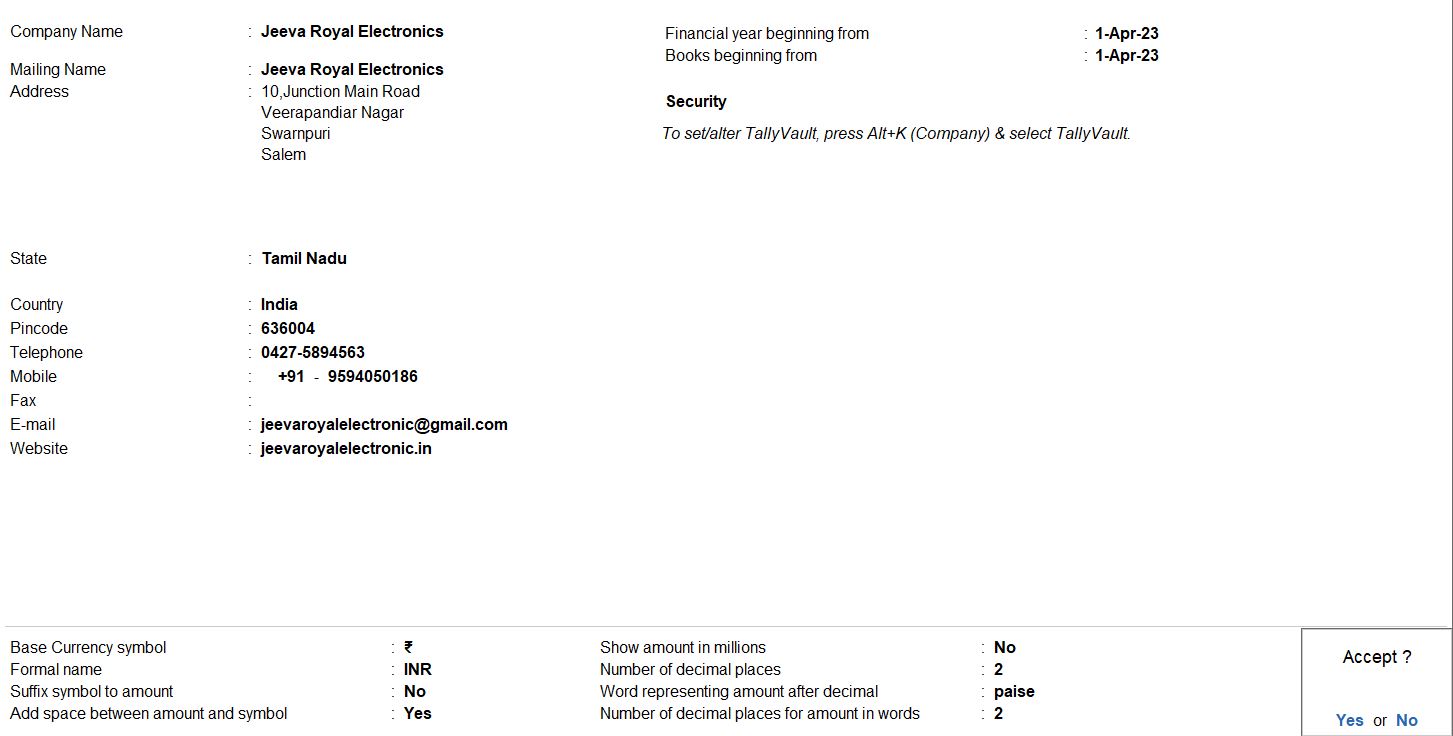

Fill Company Information:

- Company Name: Jeeva Royal Electronics

- Address: 10, Junction Main Road, Veerapandiar Nagar, Swarnapuri, Salem- 636004

- Phone: 0427 589 4563

- Mobile No: 95940 50186

- Fax No: (leave it blank)

- Email: jeevaroyalelectronic@gmail.com

- Website: jeevaroyalelectronic.in

Financial Year Settings:

- Set the Financial Year starting from April 1, 2022, to March 31, 2023.

- Similarly, set the next financial year from April 1, 2023, to March 31, 2024.

Enable Interest Calculation:

- While filling in company details, you will find the option "Enable Interest Calculation." Set it to "Yes."

Select the Appropriate Security Controls, TDS/TCS, and GST Details:

- Configure security controls, TDS/TCS details, and GST details based on the requirements of M/s. Jeeva Pvt Ltd.

Save the Company:

- Press Ctrl + A to save the company details.

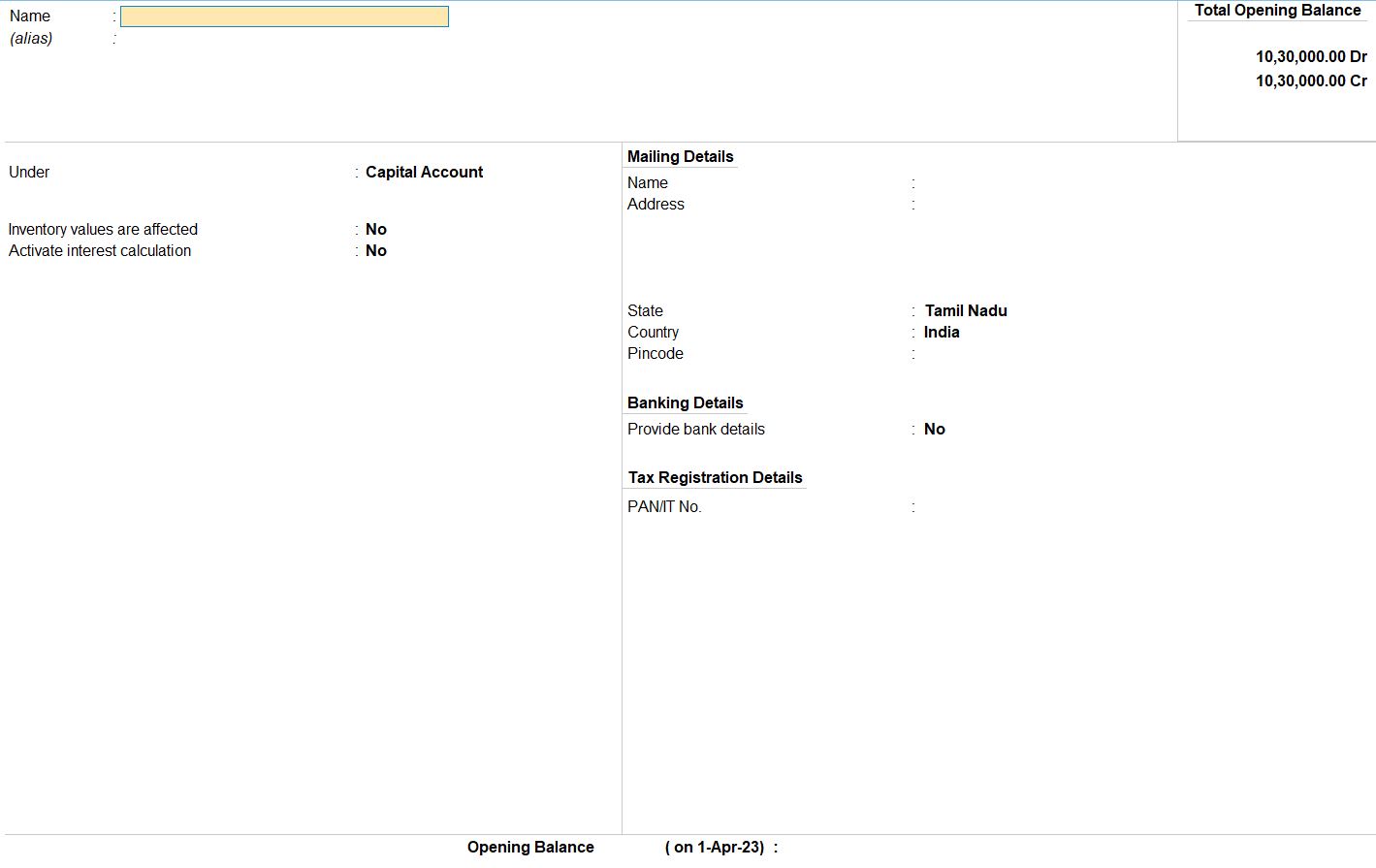

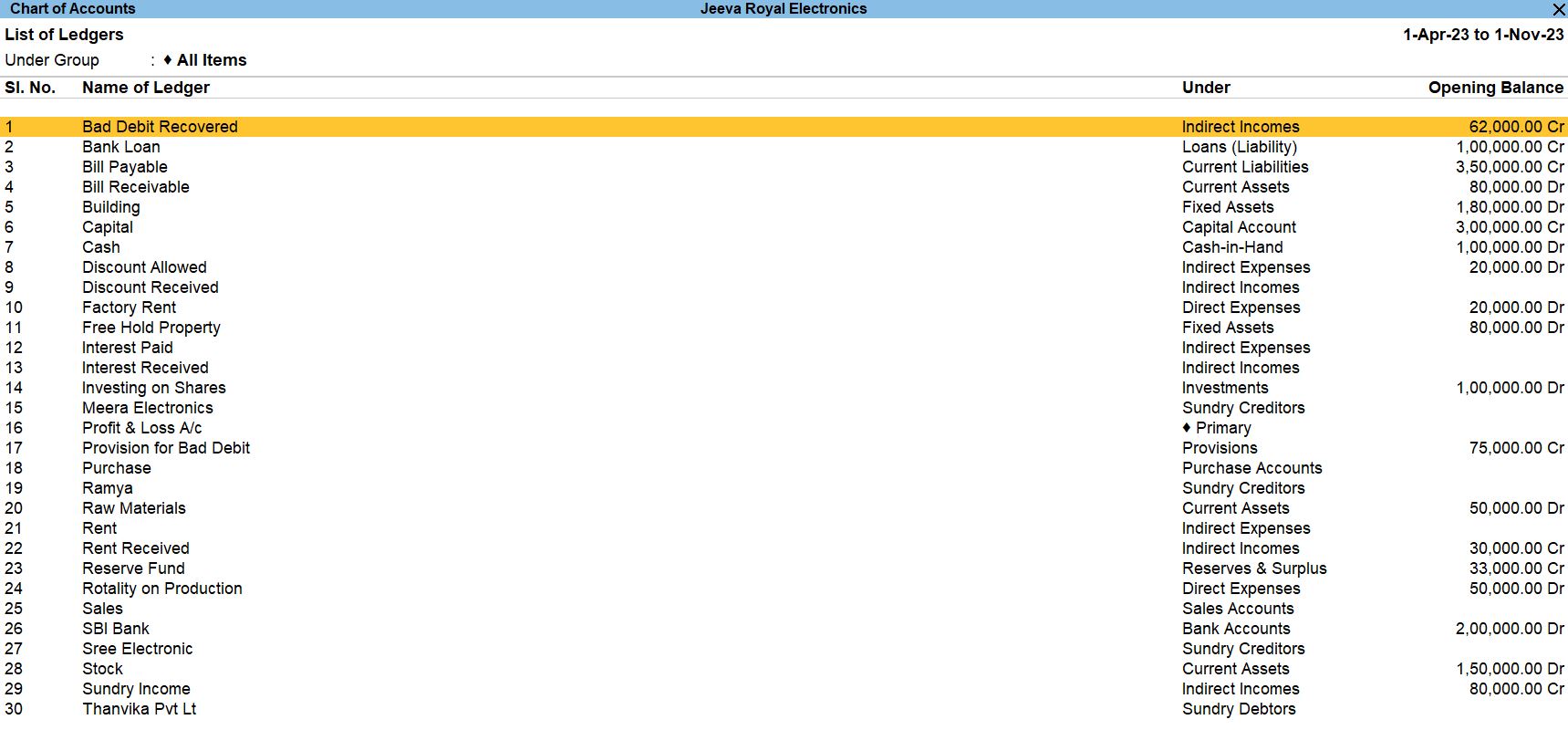

Create Opening Balance

Go to Gateway of Tally:

- Navigate to the "Gateway of Tally."

Access Ledger Creation:

- Select "Accounts Masters" from the main menu.

Create Ledgers:

- Choose "Ledgers" and then "Create" to create new ledgers.

Enter Ledger Details:

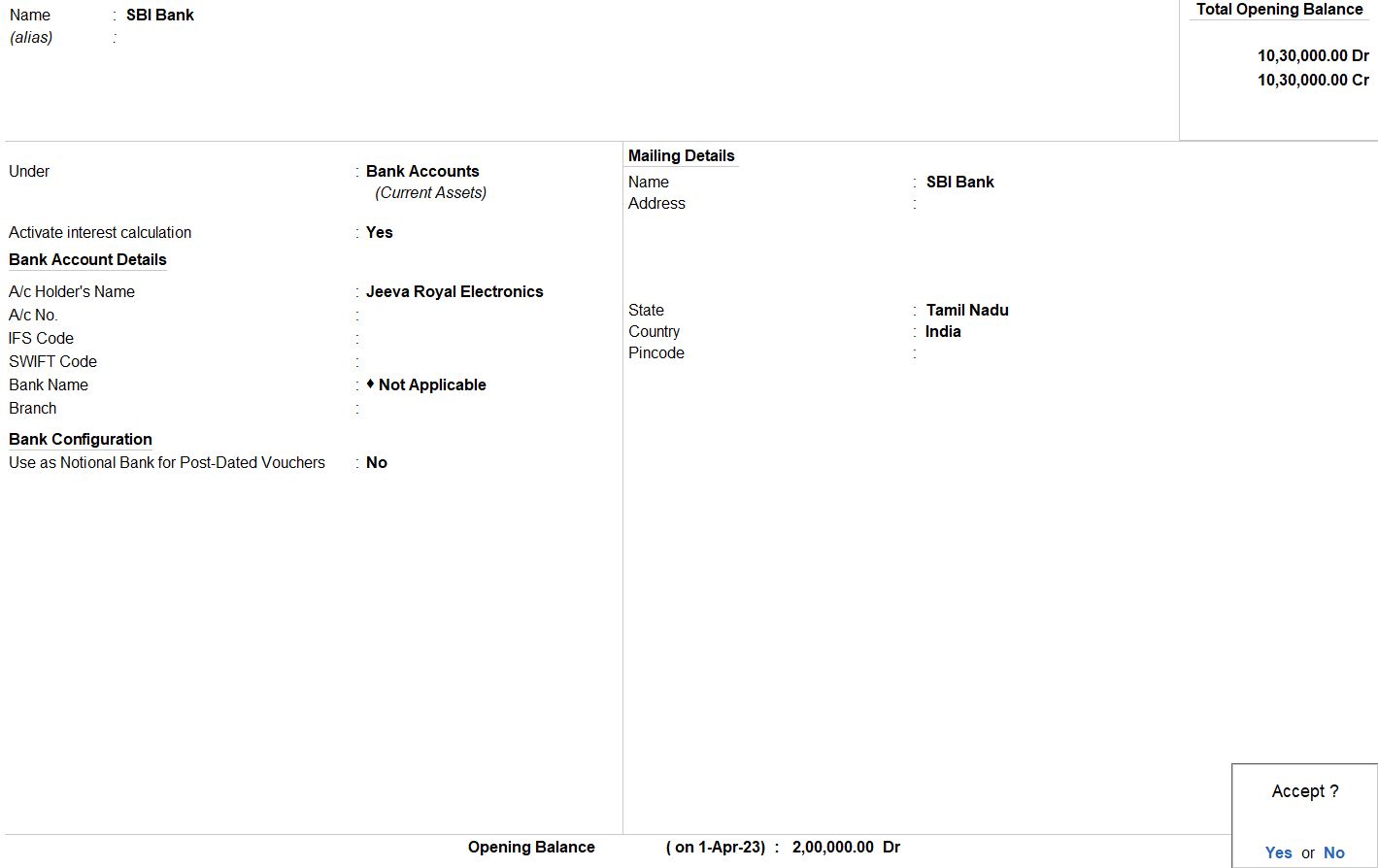

- SBI Bank:

- Name: SBI Bank

- Under: Bank Accounts

- Opening balance: Rs. 200,000

- Cash:

- Name: Cash

- Under: Cash-in-Hand

- Opening balance: Rs. 100,000

- Raw materials:

- Name: Raw materials

- Under: Direct Expenses

- Opening balance: Rs. 50,000

- Bill receivable:

- Name: Bill receivable

- Under: Current Liabilities

- Opening balance: Rs. 80,000

- Factory Rent:

- Name: Factory Rent

- Under: Indirect Expenses

- Opening balance: Rs. 20,000

- Royalty on production:

- Name: Royalty on production

- Under: Indirect Income

- Opening balance: Rs. 50,000

- Freehold property:

- Name: Freehold property

- Under: Fixed Assets

- Opening balance: Rs. 80,000

- Discount allowed:

- Name: Discount allowed

- Under: Indirect Expenses

- Opening balance: Rs. 20,000

- Investing on shares:

- Name: Investing on shares

- Under: Investments

- Opening balance: Rs. 100,000

- Stock in hand:

- Name: Stock in hand

- Under: Current Assets

- Opening balance: Rs. 150,000

Save the Ledgers:

- Press Ctrl + A to save each ledger entry.

Select Chart of Accounts:

- Under the "Gateway of Tally" menu, choose "Chart of Accounts" and then select "Groups" or "Ledgers."

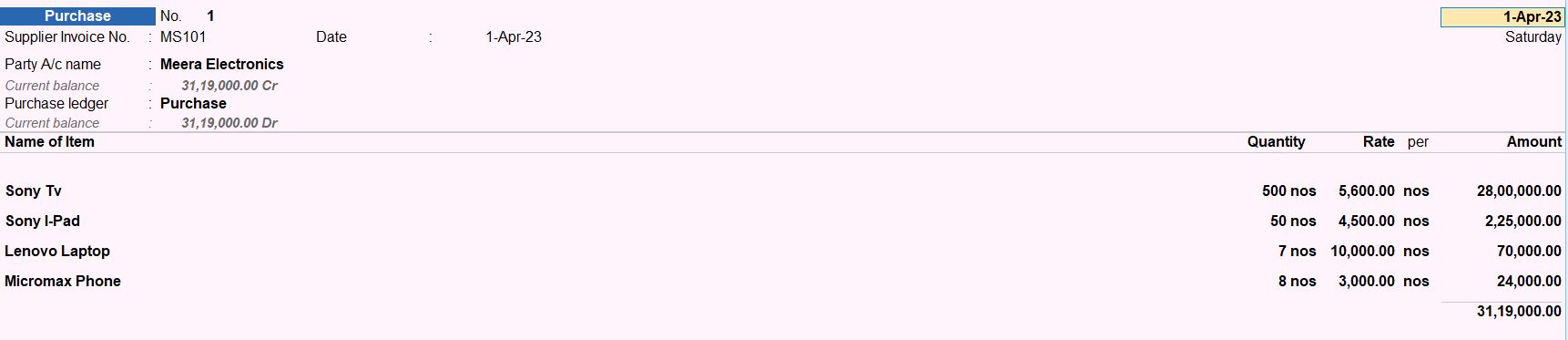

Apr 01 Goods purchased from Meera Electronics for the following. Bill No: MS101 (30 days)

- Sony Tv 500Nos@ Rs. 5600

- Sony I- Pad 50Nos@ Rs. 4500

- Lenovo laptop 7Nos@ Rs. 10000

- Micro max Phone 8Nos@ Rs.3000

| Rate of Interest | 15% |

| Interest Style | 365 days |

| Interest Balance | Credit Balance Only |

| Applicability | Past Due Date by 30 Days |

| Form | Due Date of Invoice Ref |

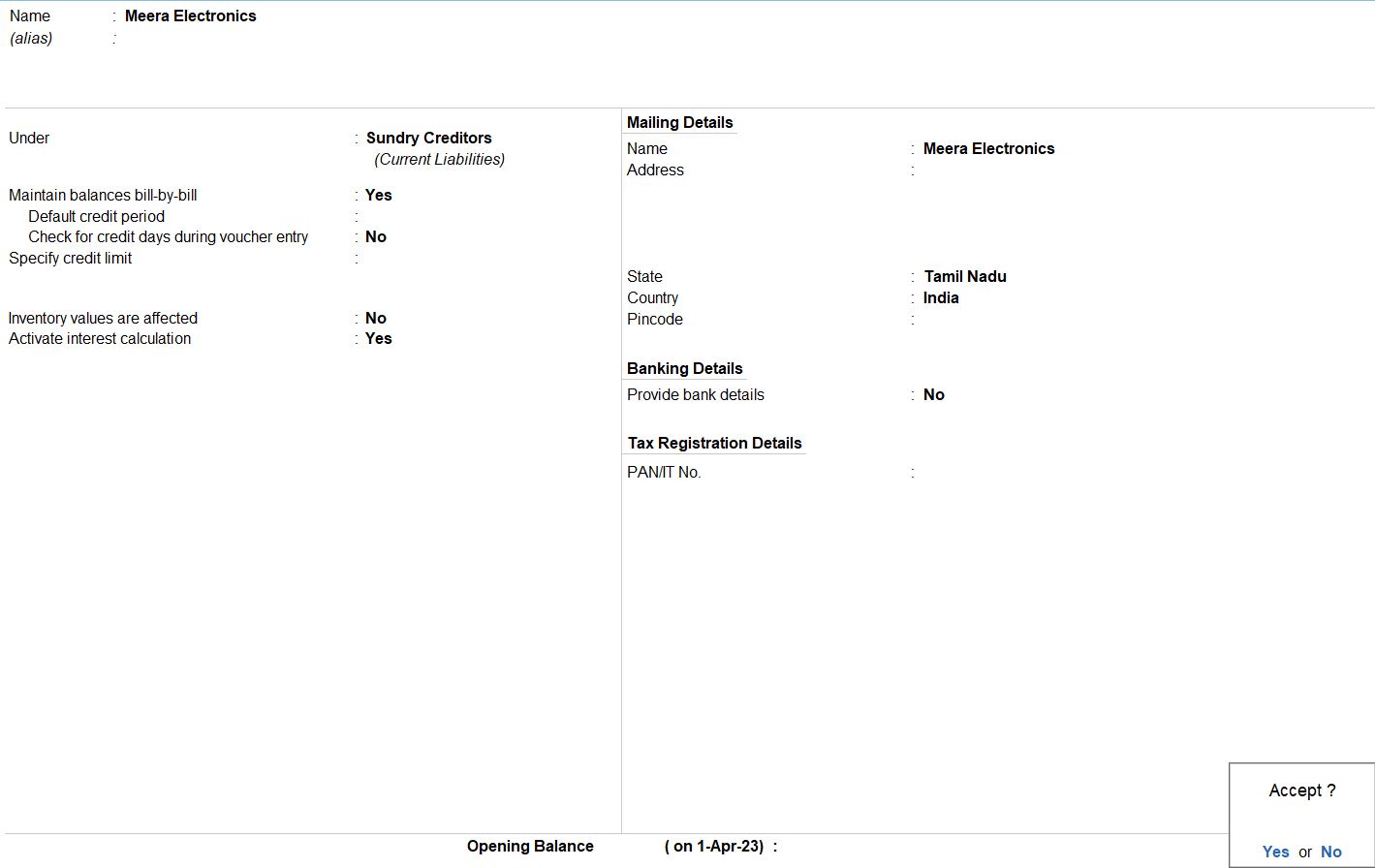

Step 1 : Create Party Ledger

- Go to "Gateway of Tally."

- Select "Accounts Masters" from the main menu.

- Choose "Ledgers" and then "Create."

- Enter the following details for the party ledger:

- Name: M/s. Meera Pvt Ltd

- Under: Sundry Creditors (or a suitable group)

- Address: [Enter the address]

- Contact Details: [Enter phone, email, etc.]

- Calculate Interest Transaction-by-transaction: Yes

- Override parameters for each Transaction: Yes

- Override advanced parameters: Yes

- Include transaction date for interest calculation: Yes

- For amounts added: Yes

- For amounts deducted: Yes

- Rate of Interest: 15%

- Interest Style: 365 Days

- Interest Calculation: Credit Balance Only

- Applicability: Set "Yes" for Past Due Date

- By: 30 Days

- Form: Due Date of Invoice Ref

- Press Ctrl + A to save.

Step 2 : Record Purchase Voucher

- Go to "Gateway of Tally."

- Select "Accounting Vouchers" from the main menu.

- Choose "F9: Purchase" to create a new purchase voucher.

- Enter the following details in the purchase voucher:

- Supplier Invoice No: MS101

- Supplier Invoice Date: [Enter the invoice date]

- Party's A/c Name: M/s. Meera Pvt Ltd

For each item:

- Particulars: Sony TV

- Qty: 500

- Rate: 5600

- Particulars: Sony I-Pad

- Qty: 50

- Rate: 4500

- Particulars: Lenovo Laptop

- Qty: 7

- Rate: 10000

- Particulars: Micro Max Phone

- Qty: 8

- Rate: 3000

Press Ctrl + A to save the purchase voucher.

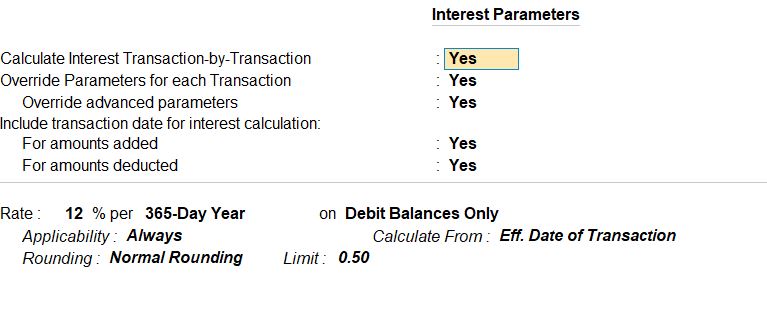

Apr 02 Goods Sold Thanvika Electronics for the following. Bill No: JRE102 (20 days)

- Sony Tv 300Nos@ Rs. 6600

- Sony I- Pad 20Nos@ Rs. 5600

- Lenovo laptop 3Nos@ Rs. 15000

- Micro max Phone 3Nos@ Rs.7000

| Rate of Interest | 12% |

| Interest Style | 365 days |

| Interest Balance | Debit Balances Only |

| Applicability | Always |

| Form | Eff. Date of Transaction |

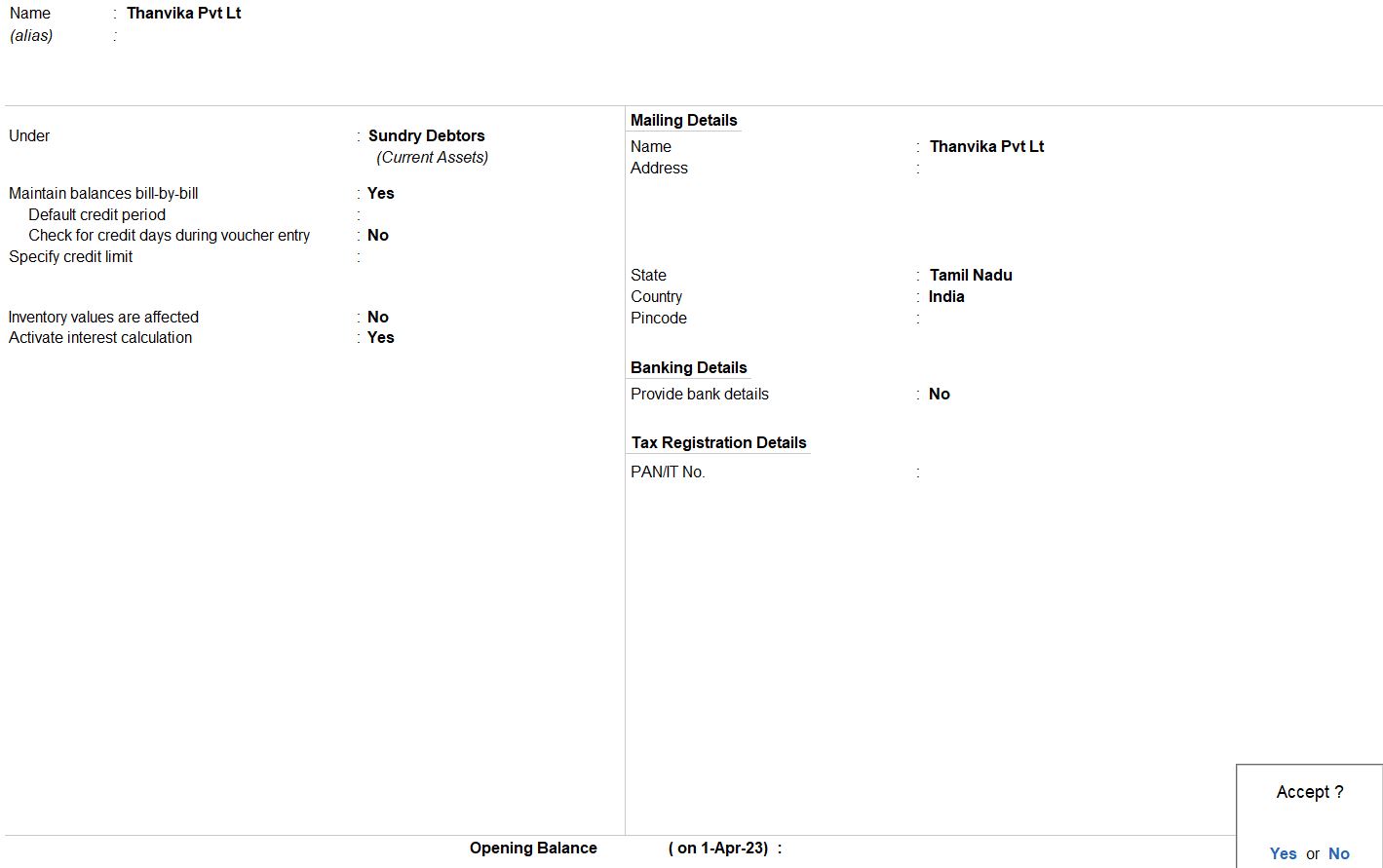

Step 1 : Create Party Ledger

- Go to "Gateway of Tally."

- Select "Accounts Info" from the main menu.

- Choose "Ledgers" and then "Create."

- Enter the following details for the party ledger:

- Name: M/s. Thanvika Pvt Ltd

- Under: Sundry Debtors (or a suitable group)

- Address: [Enter the address]

- Contact Details: [Enter phone, email, etc.]

- Rate of Interest: 12%

- Interest Style: 365 Days

- Interest Calculation: Debit Balances Only

- Applicability: Always

- Form: Eff. Date of Transaction

- Press Ctrl + A to save.

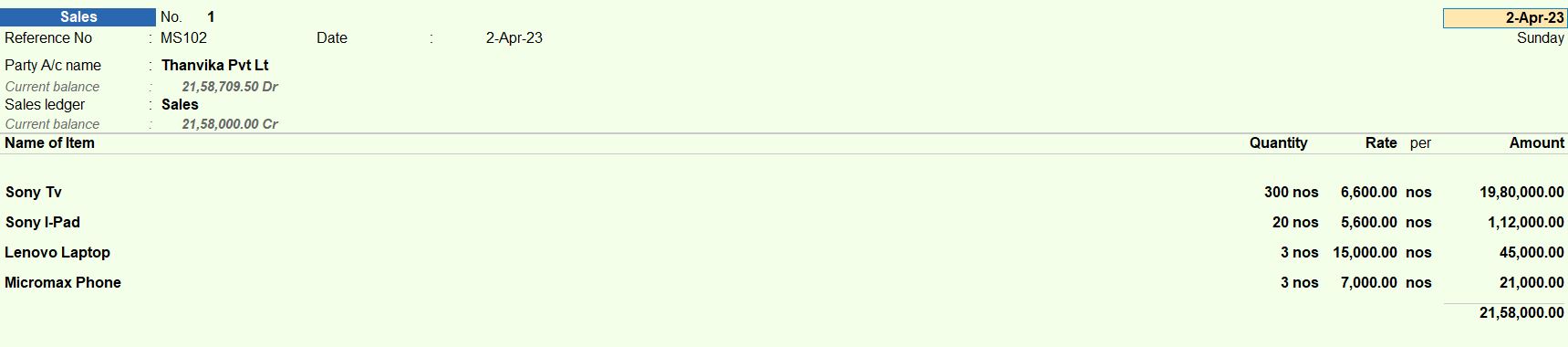

Step 2 : Record Sales Voucher

- Go to "Gateway of Tally."

- Select "Accounting Vouchers" from the main menu.

- Choose "F8: Sales" to create a new sales voucher.

- Enter the following details in the sales voucher:

- Customer Invoice No: MS102

- Customer Invoice Date: [Enter the invoice date]

- Party's A/c Name: M/s. Thanvika Pvt Ltd

For each item:

- Particulars: Sony TV

- Qty: 300

- Rate: 6600

- Particulars: Sony I-Pad

- Qty: 20

- Rate: 5600

- Particulars: Lenovo Laptop

- Qty: 3

- Rate: 15000

- Particulars: Micro Max Phone

- Qty: 3

- Rate: 7000

Press Ctrl + A to save the sales voucher.

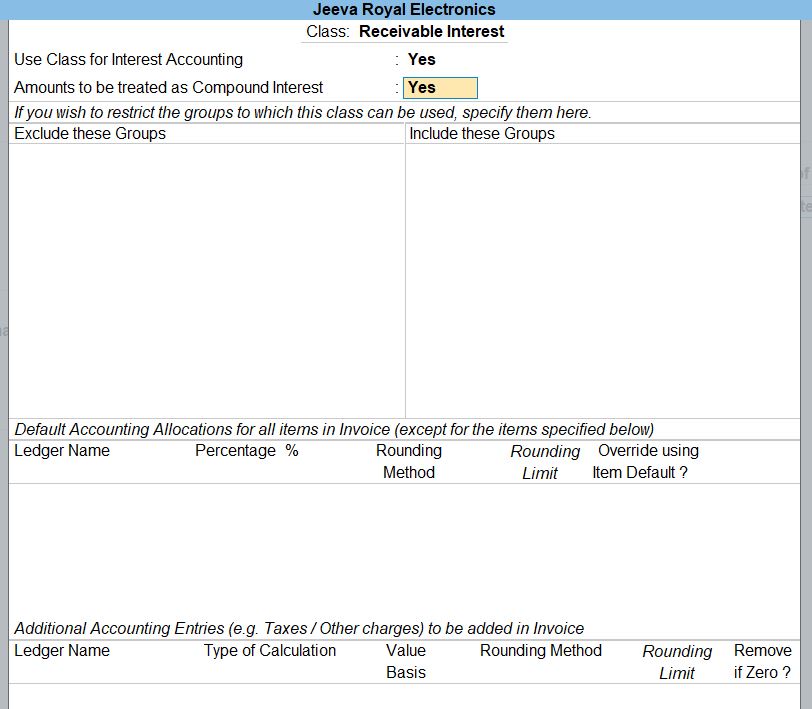

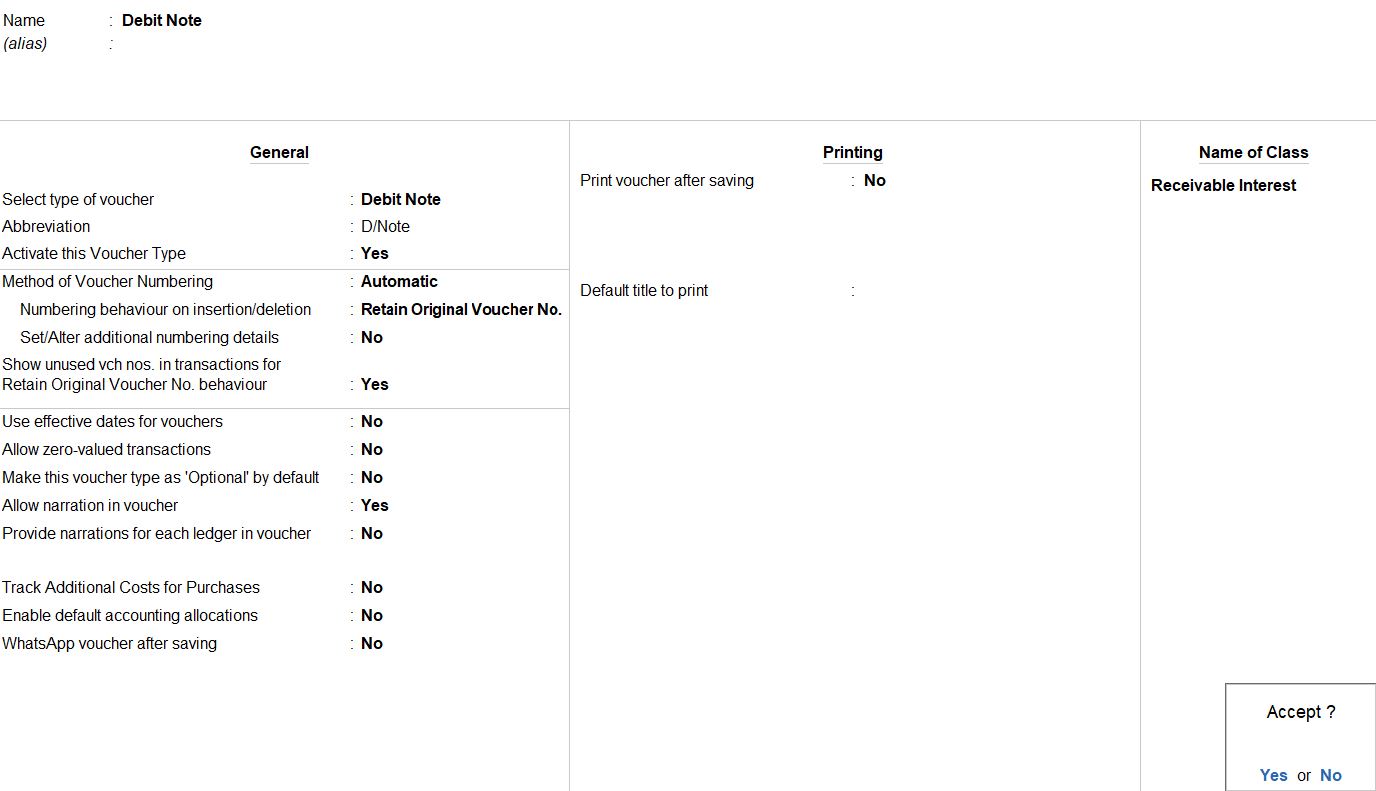

VOUCHER TYPE

Debit Note Voucher

Step 1 : Access Voucher Type Alteration

- Go to "Gateway of Tally."

- Select "Accounts Info" from the main menu.

- Choose "Voucher Types" and then "Alter."

Step 2 : Create a New Voucher Type

- Select "Debit Note" from the list of voucher types.

- Press Enter to open the voucher type alteration screen.

Step 3 : Update Voucher Type Details

- Make the following modifications:

- Name of Class: Receivable Interest

- Use class for interest accounting: Yes

- Amounts to be treated as compound interest: Yes

Step 4 : Save Changes

- Press Ctrl + A to save the changes.

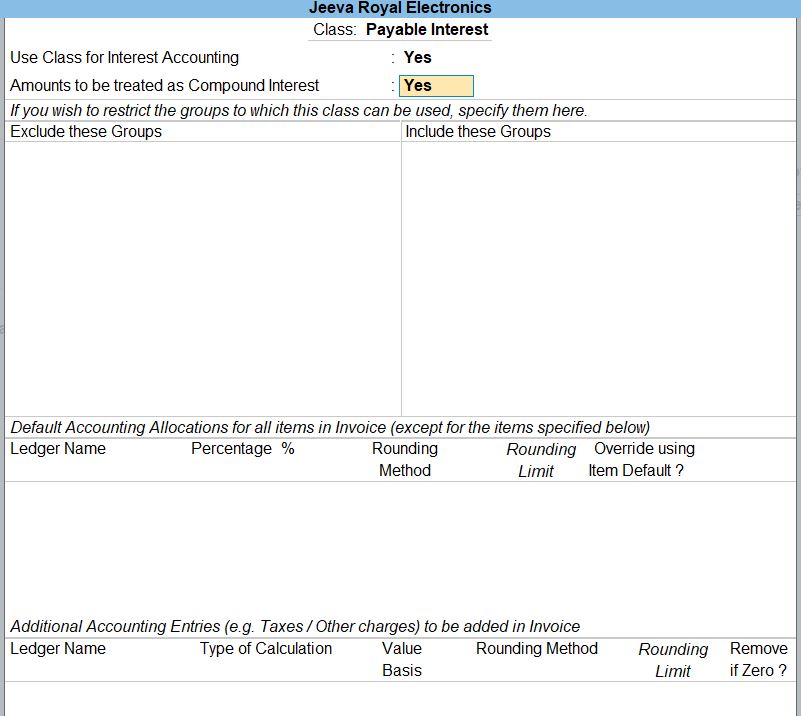

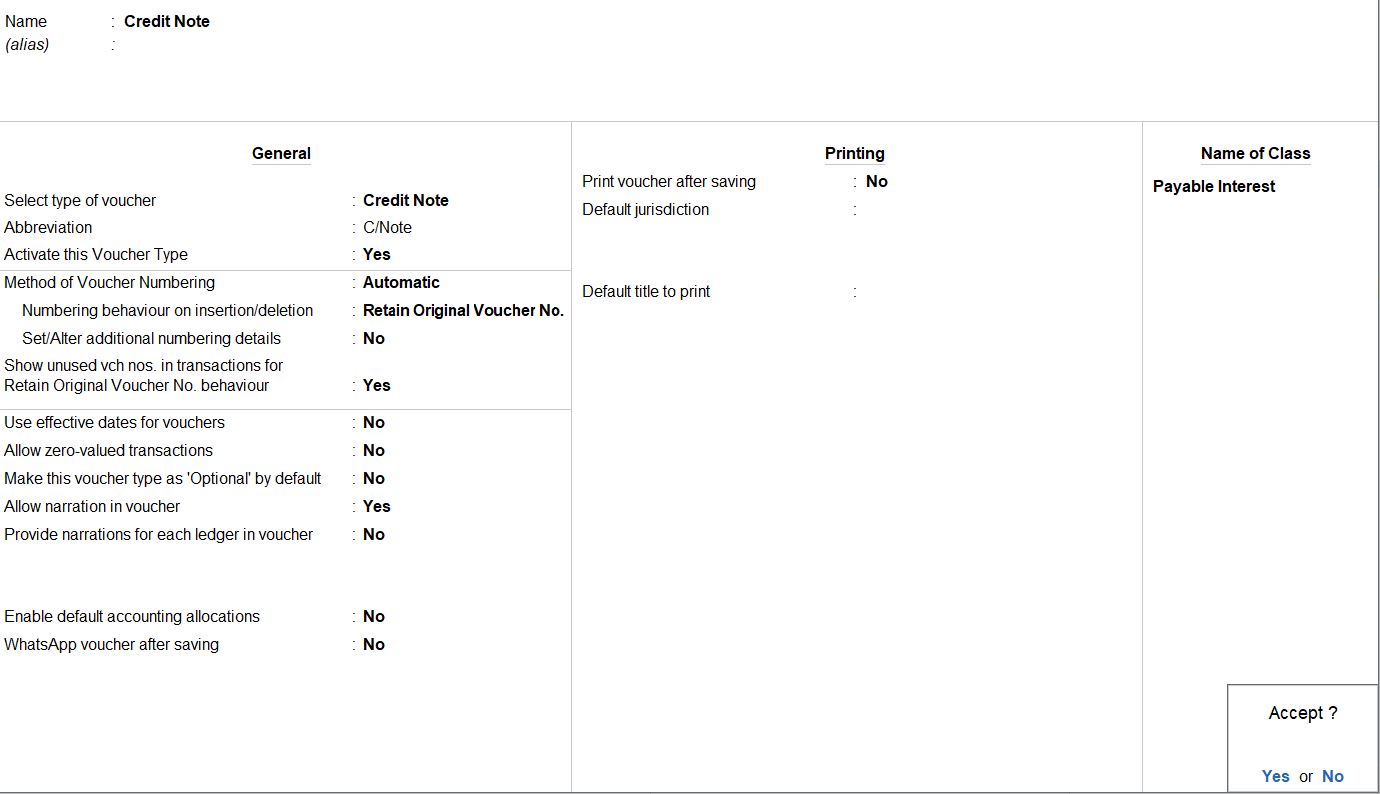

Credit Note Voucher

Step 1 : Access Voucher Type Alteration

- Go to "Gateway of Tally."

- Select "Accounts Info" from the main menu.

- Choose "Voucher Types" and then "Alter."

Step 2 : Create a New Voucher Type

- Select "Credit Note" from the list of voucher types.

- Press Enter to open the voucher type alteration screen.

Step 3 : Update Voucher Type Details

- Make the following modifications:

- Name of Class: Payable Interest

- Use class for interest accounting: Yes

- Amounts to be treated as compound interest: Yes

Step 4 : Save Changes

- Press Ctrl + A to save the changes.

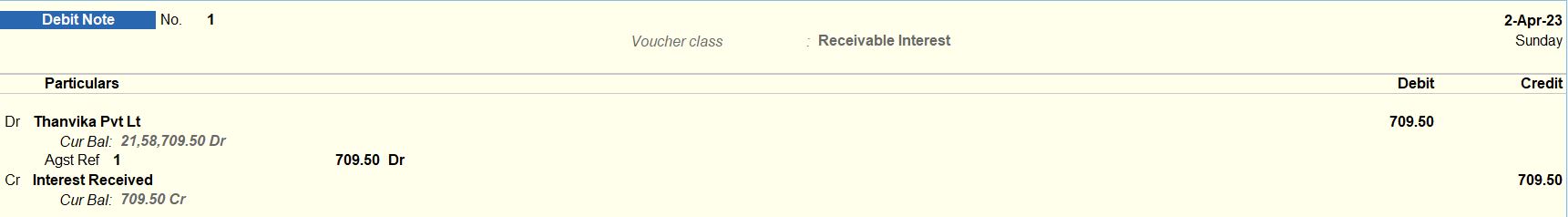

Interest Received Voucher

Step 1 : Create a Voucher Class

- Go to "Gateway of Tally."

- Select "Accounts Masters" from the main menu.

- Choose "Voucher Types" and then "Create."

- Enter the Voucher Class details:

- Name of Class: Receivable Interest

- Type of Class: Debit Note

- Applicability: All Entries

- Classes to Include: Leave it blank for all classes.

- Save the Voucher Class.

Step 2 : Create a Debit Note Voucher

- Go to "Gateway of Tally."

- Select "Accounting Vouchers" from the main menu.

- Choose "Alt +F5: Debit Note" to create a new Debit Note voucher.

Step 3 : Use Voucher Class

- While entering the Debit Note Voucher:

- Debit Thanvika Pvt Ltd Account: Rs. 709.50

- Credit Interest Received Account: Rs. 709.50

- Select "Receivable Interest" as the Voucher Class for the Debit Note.

Step 4 : Save the Voucher

- Press Ctrl + A to save the Debit Note Voucher.

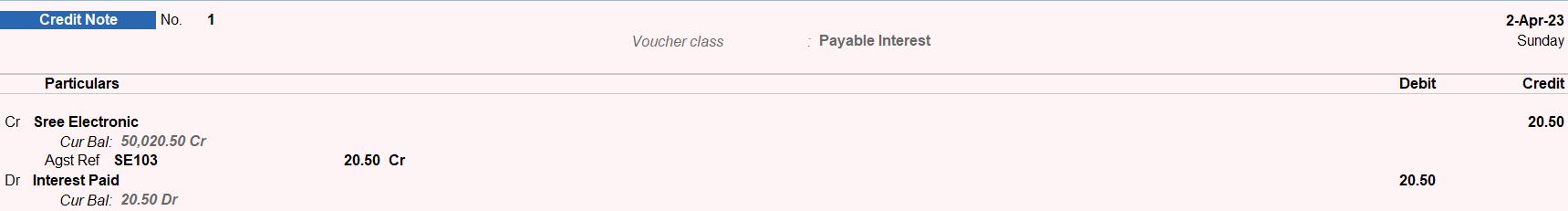

Interest Payable Voucher

Step 1 : Create a Voucher Class

- Go to "Gateway of Tally."

- Select "Accounts Masters" from the main menu.

- Choose "Voucher Types" and then "Create."

- Enter the Voucher Class details:

- Name of Class: payable Interest

- Type of Class: Credit Note

- Applicability: All Entries

- Classes to Include: Leave it blank for all classes.

- Save the Voucher Class.

Step 2 : Create a Debit Note Voucher

- Go to "Gateway of Tally."

- Select "Accounting Vouchers" from the main menu.

- Choose "Alt +F6: Credit Note" to create a new Credit Note voucher.

Step 3 : Use Voucher Class

- While entering the Credit Note Voucher:

- Debit Interest Received Account: Rs. 20.50

- Credit Sree Electronic Account: Rs. 20.50

- Select "Payable Interest" as the Voucher Class for the Credit Note.

Step 4 : Save the Voucher

- Press Ctrl + A to save the Credit Note Voucher.

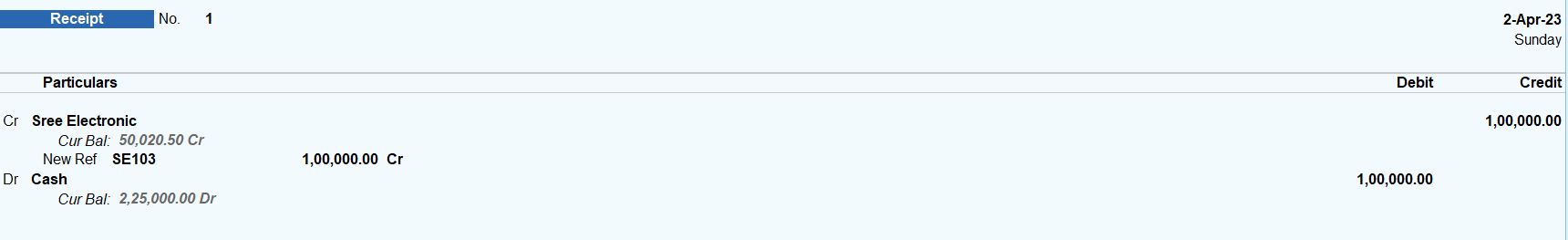

Apr 10 Credit Amount received from Sree Electronics Rs. 100000. Bill No: SE103(10 days)

| Rate of Interest | 7.50% |

| Interest Style | 365 days |

| Interest Balance | Credit Balances Only |

| Applicability | Always |

| Form | Eff. Date of Transaction |

Step 1 : Create Party Ledger

- Go to "Gateway of Tally."

- Select "Master" from the main menu.

- Choose "Create" under "Accounting Masters" and then "Ledgers."

- Create a party ledger named "Sree Electronic."

Step 2 : Configure Ledger for Interest Calculation

- Go to "Gateway of Tally."

- Select "Accounts Info" from the main menu.

- Choose "Ledgers" and then "Alter."

- Select "Sree Electronic."

- Set the following details for the ledger:

- Rate of Interest: 7.50%

- Interest Style: 365 days

- Interest Calculation: Simple Interest

- Applicability: Always

- Form: Effective Date of Transaction

Step 3 : Create Receipt Voucher

- Go to "Gateway of Tally."

- Select "Accounting Vouchers" from the main menu.

- Choose "F6: Receipt" to create a new receipt voucher.

Step 4 : Enter Details

- While entering the receipt voucher:

- Debit Cash Account: Rs. 100,000

- Credit Sree Electronic Account: Rs. 100,000

Step 5 : Save the Voucher

- Press Ctrl + A to save the receipt voucher.

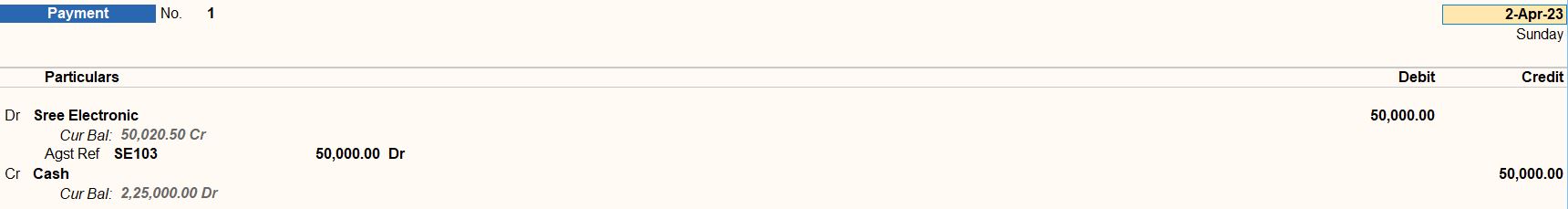

Apr 12 Jeeva Royal Electronics fully settled to Sree Electronics with interest.

Step 1: Settle the Account with Interest

- Go to "Gateway of Tally."

- Select "Accounting Vouchers" from the main menu.

- Choose "F5: Payment" to create a new payment voucher.

Step 2: Enter Details

- While entering the payment voucher:

- Debit Sree Electronics Account: Enter the total amount to be settled.

- Credit Cash Account: Enter the amount paid in cash.

Step 3: Save the Voucher

- Press Ctrl + A to save the payment voucher.

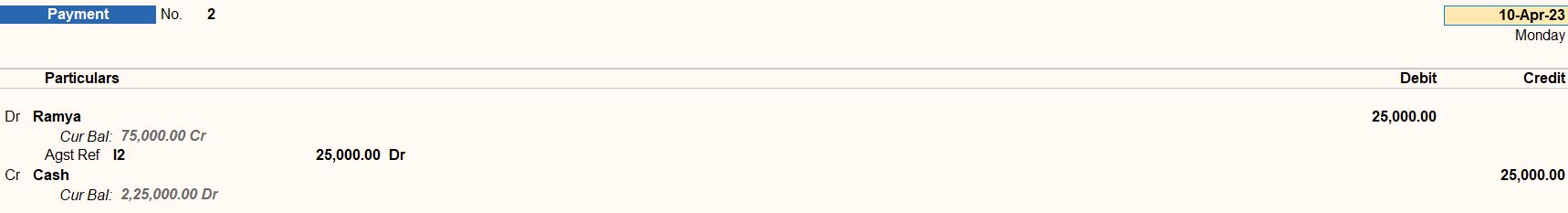

Apr 12 Amount paid form Ramay was Rs. 25000

Step 1: Create Party Ledger for Ramya

- Go to "Gateway of Tally."

- Select "Master" from the main menu.

- Choose "Create" under "Accounting Info" and then "Ledgers."

- Create a party ledger named "Ramya."

Step 2: Create Payment Voucher

- Go to "Gateway of Tally."

- Select "Accounting Vouchers" from the main menu.

- Choose "F5: Payment" to create a new payment voucher.

Step 3: Enter Details

- While entering the payment voucher:

- Debit Ramya Account: Enter Rs. 25,000.

- Credit Cash Account: Enter Rs. 25,000.

Step 4: Save the Voucher

- Press Ctrl + A to save the payment voucher.

Bank Interest

| Rate of Interest | 16% |

| Interest Style | 365 days |

| Interest Balance | All balance |

| Applicable from | 1-sep-2022 to 15-Nov-2022 |

| Rounding | Normal rounding |

| Limit | 1 |

- Go to "Gateway of Tally."

- Select "Master" from the main menu.

- Choose "Ledger" under "Accounts Info."

- Select "Alter" to modify an existing ledger.

- Search and choose the "SBI Bank" ledger.

- In the Ledger Alteration screen:

- Set "Activate Interest Calculation" to Yes.

- Choose "Calculate Interest Based On" and select Voucher Date.

- Set "Include Transaction Date for Interest Calculation" to Yes.

- Set "For Amounts Added" to Yes.

- Set "For Amounts Deducted" to Yes.

- Set "Bank Interest" to Yes.

- Enter the rate of interest as 16%.

- Choose "Interest Style" and select 365 Days.

- Set "Interest Balance" to All Balances.

- Set "Applicable From" to 1-Sep-2022.

- Set "Applicable To" to 15-Nov-2022.

- Choose "Rounding Method" and select Normal Rounding.

- Set "Limit" to 1.

- Press Enter to save the alterations.

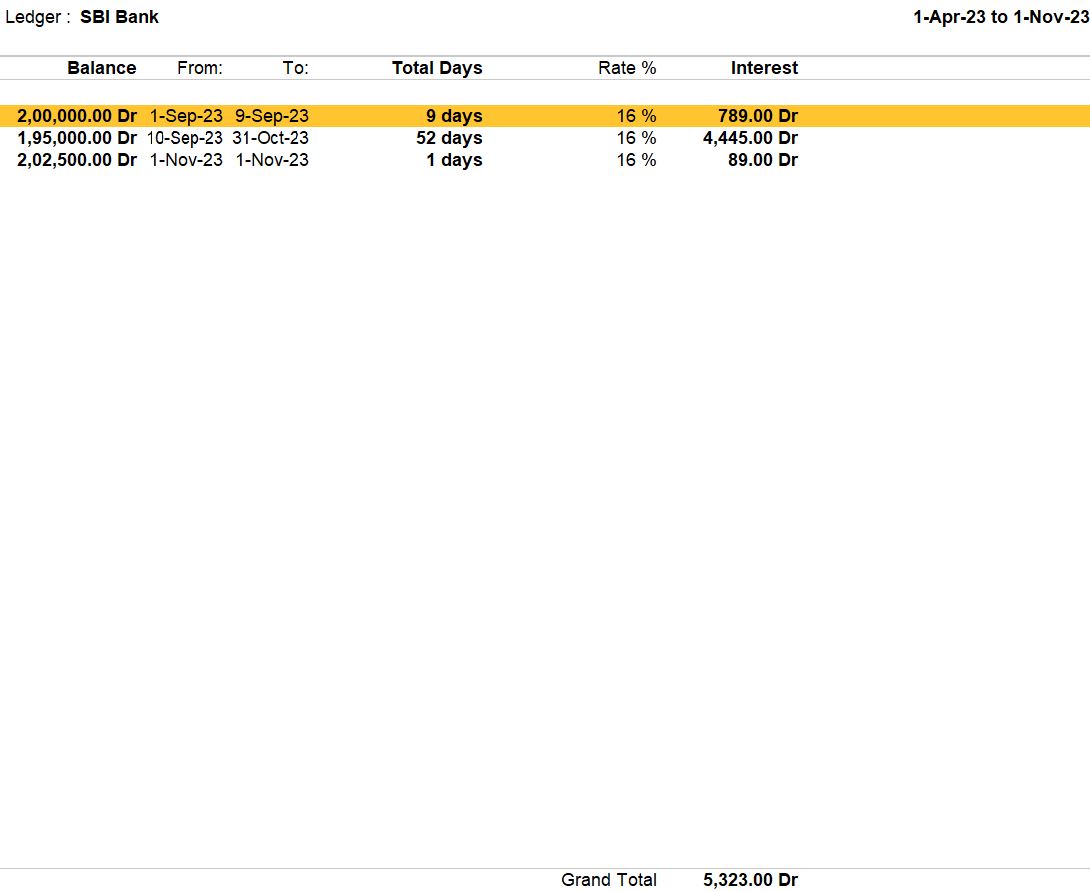

Reports

Go to Gateway of Tally:

- Navigate to the "Gateway of Tally."

Access Stock Summary:

- Select "Reports" from the main menu.

- Display More Reports > Statements of Accounts > Group > Bank Accounts > SBI Bank Ledger.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions