GST Purchase Cancellation of Services in Tally Prime

Cancellation of Services

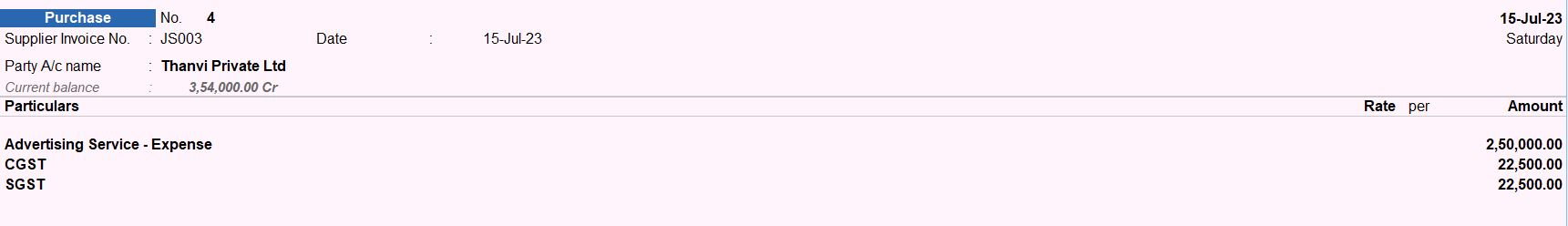

15-07-23 JS Enterprises received Advertising Services worth Rs. 250,000 from Thanvi Pvt Ltd. Additionally, GST @18% with Central Tax components is charged on the invoice with reference number JS003.

18-07-23 JS Enterprises cancelled Advertising Services with Thanvi Pvt Ltd, as they failed to provide the services as per the terms & conditions of the contract. The invoice amounting to Rs. 250,000 received on 15-07-23 against the bill number JS003 with GST @18% with Central Tax and State Tax components was cancelled.

20-07-23 JS Enterprises received window cleaning services worth Rs. 150,000 from Sandy Glass Industries. Additionally, GST @18% with Integrated Tax component is charged on the invoice with reference number JS004.

21-07-23 JS Enterprises cancelled the window cleaning services from Sandy Glass Industries, as they failed to provide the services as per the terms & conditions of the contract. The invoice amounting to Rs. 100,000 received on 20-07-23 against the bill number JS004 with GST @18% with integrated tax component was cancelled.

15-07-23 JS Enterprises received Advertising Services worth Rs. 250,000 from Thanvi Pvt Ltd. Additionally, GST @18% with Central Tax components is charged on the invoice with reference number JS003.

- Date : 15-07-23

- Party Ledger:

- Name: Thanvi Pvt Ltd

- Particulars:

- Advertising Service – Expense: Rs. 250,000 (This represents the total amount paid for the advertising services)

- CGST: Rs. 22,500 (This represents the Central GST component charged on the invoice)

- SGST: Rs. 22,500 (This represents the State GST component charged on the invoice)

- Additional Details:

- Invoice Reference Number : JS003

- Press Enter to save the voucher

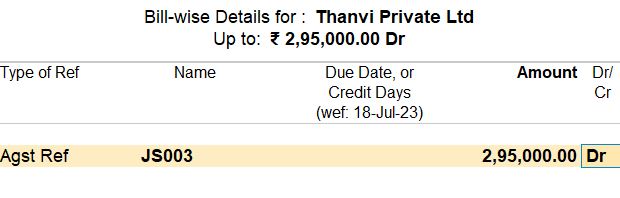

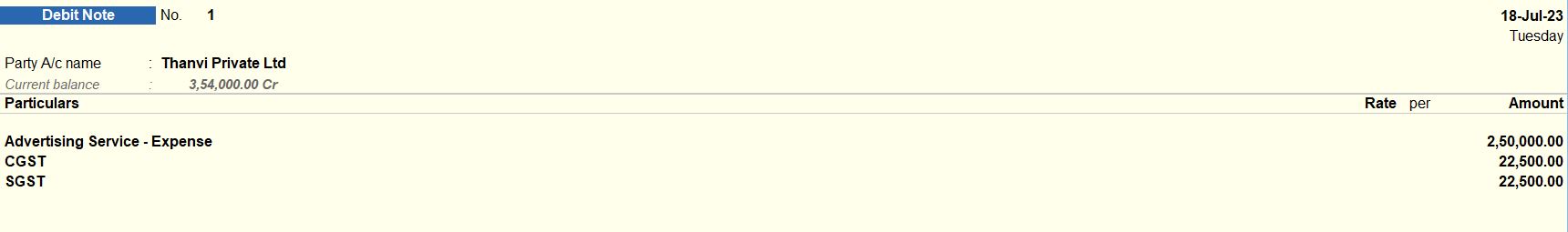

18-07-23 JS Enterprises cancelled Advertising Services with Thanvi Pvt Ltd, as they failed to provide the services as per the terms & conditions of the contract. The invoice amounting to Rs. 250,000 received on 15-07-23 against the bill number JS003 with GST @18% with Central Tax and State Tax components was cancelled.

- Go to Vouchers by pressing FV or navigating through Gateway of Tally > Vouchers.

- Select F9: Debit Note from the right side of the screen or press F9.

- Fill in the following details:

- Voucher Date: 18-Jul-23

- Supplier Invoice No: D01

- Supplier Invoice Date: 18-Jul-24

- Party A/c Name: Thanvi Pvt Ltd

- Enter the following particulars:

- Account Name: Advertising Service - Expense Amount: Rs. 250,000

- Account Name: CGST Amount: Rs. 22,500

- Account Name: SGST Amount: Rs. 22,500

- Enter additional details:

- Local Purchase - Taxable

- Reason for Issuing Note: 07-others

- Now, enter the Bill-wise details:

- Type of Ref: Agst Ref

- Name: JS003

- Due Date: Leave it blank if not applicable

- Amount: Rs. 295,000

- Press Enter to save the voucher.

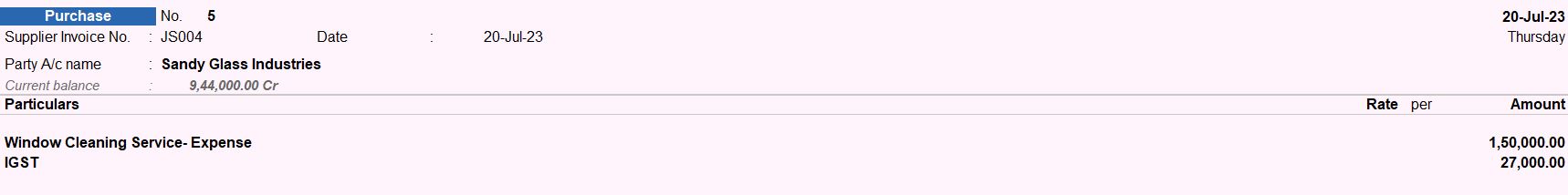

20-07-23 JS Enterprises received window cleaning services worth Rs. 150,000 from Sandy Glass Industries. Additionally, GST @18% with Integrated Tax component is charged on the invoice with reference number JS004.

- Go to Vouchers by pressing FV or navigating through Gateway of Tally > Vouchers.

- Select F9: Purchase from the right side of the screen or press F9.

- Fill in the following details:

- Voucher Date: 20-Jul-23

- Supplier Invoice No: JS004

- Party A/c Name: Sandy Glass Industries

- Enter the following particulars:

- Account Name: Window Cleaning Service - Expense

- Amount: Rs. 150,000

- Account Name: IGST

- Amount: Rs. 27,000

- Press Enter to save the voucher.

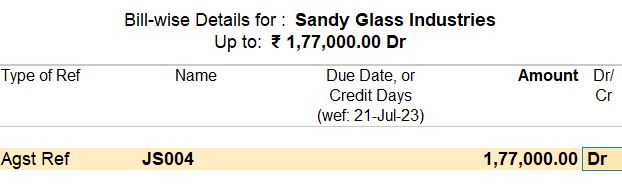

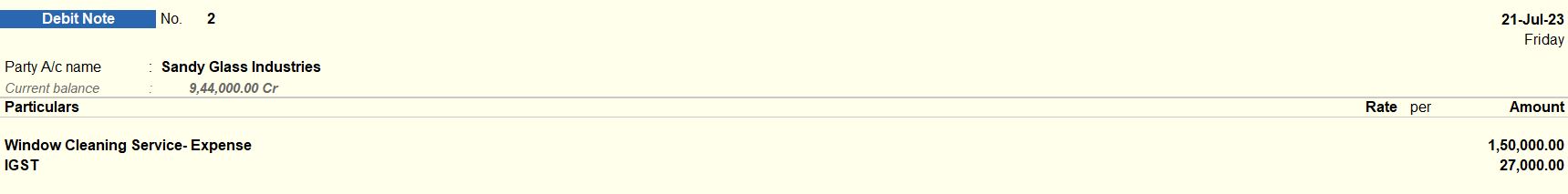

21-07-23 JS Enterprises cancelled the window cleaning services from Sandy Glass Industries, as they failed to provide the services as per the terms & conditions of the contract. The invoice amounting to Rs. 100,000 received on 20-07-23 against the bill number JS004 with GST @18% with integrated tax component was cancelled.

- Go to Vouchers by pressing FV or navigating through Gateway of Tally > Vouchers.

- Select F9: Debit Note from the right side of the screen or press F9.

- Fill in the following details:

- Voucher Date: 21-Jul-23

- Supplier's Debit/Credit Note No: D02

- Supplier's Debit/Credit Note Date: 21-Jul-24

- Party A/c Name: Sandy Glass Industries

- Enter the following particulars:

- Account Name: Window Cleaning Service - Expense Amount: Rs. 100,000

- Account Name: IGST Amount: Rs. 18,000

- Enter additional details:

- Interstate Purchase: Taxable

- Reason for Issuing Note: 07-others

- Now, enter the Bill-wise details:

- Type of Ref: Agst Ref

- Name: JS004

- Due Date: Leave it blank if not applicable

- Amount: Rs. 177,000

- Press Enter to save the voucher.

Saving the Voucher:

- After entering all the necessary details, press Enter to save the voucher.

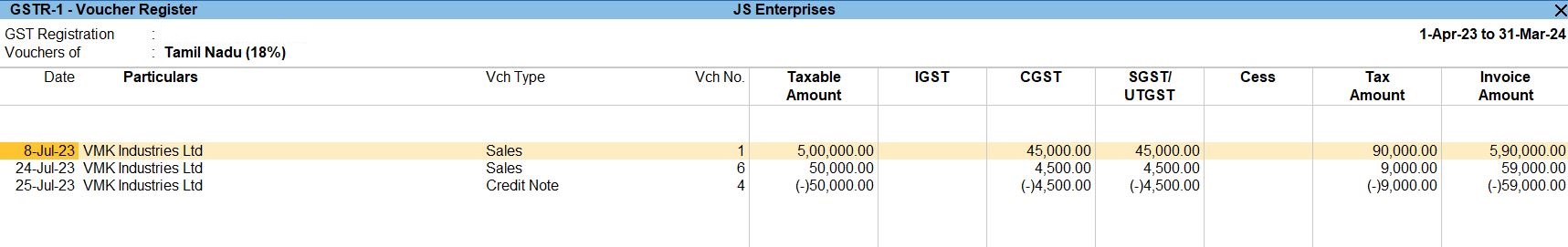

GST Sales Cancellation of Services

Cancellation of Outward Supply of Services

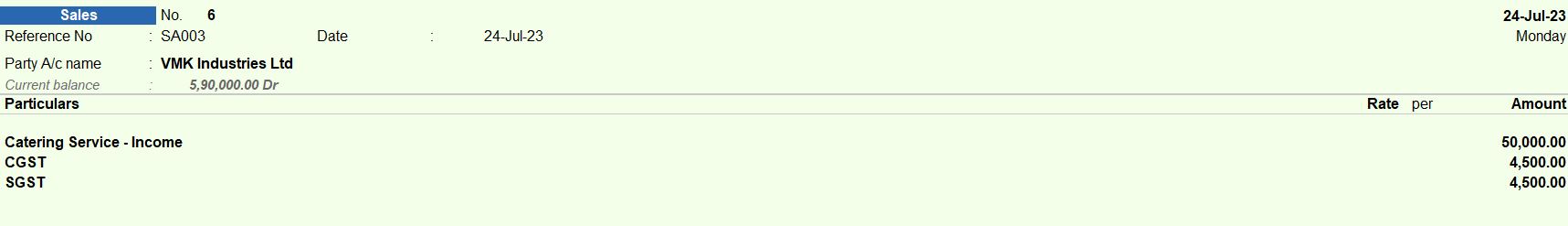

24-07-23 JS Enterprises rendered Catering Services worth Rs. 50,000 to VMK Industries Pvt Ltd. Additionally, GST @18% with Central Tax and State Tax components is charged on the invoice with reference number SA003.

25-07-23 VMK Industries Pvt Ltd. cancelled Catering Services as JS Enterprises failed to provide the quality services as per the terms & conditions of the contract. The invoice amounting to Rs. 50,000 received on 24-07-23 against the bill number SA003 with GST @18% with Central Tax and State Tax components was cancelled.

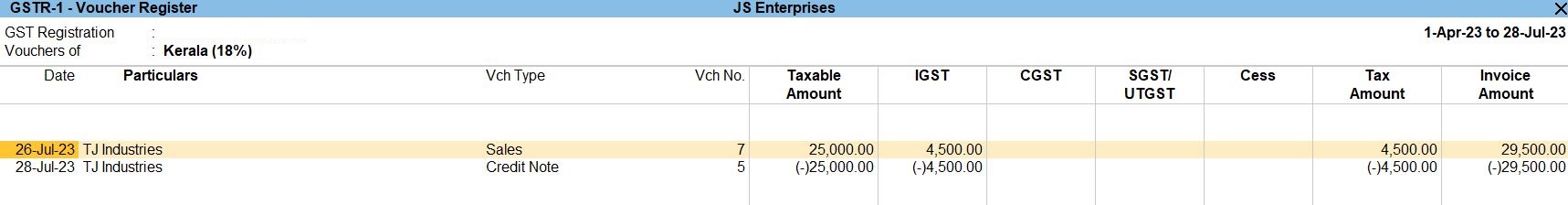

26-07-23 JS Enterprises rendered support services worth Rs. 25,000 to TJ Industries. Additionally, GST @18% with Integrated Tax components is charged on the invoice with reference number SA004.

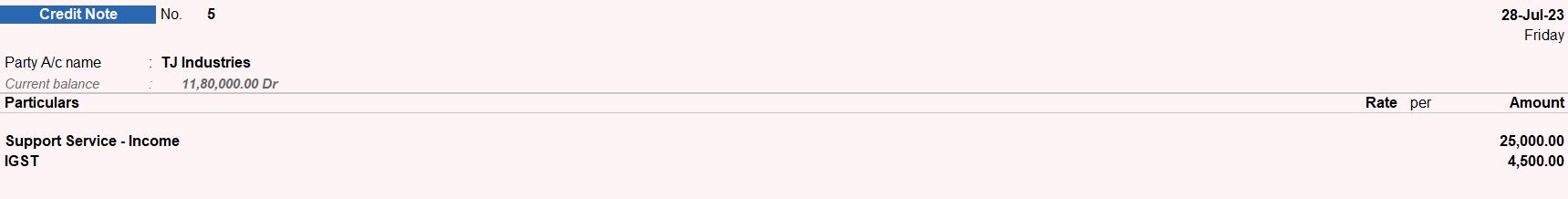

28-07-23 TJ Industries cancelled support services as JS Enterprises failed to provide the services as per the terms & conditions of the contract. The invoice amounting to Rs. 25,000 received on 24-07-23 against bill number SA004 with GST @18% with Integrated Tax component was cancelled.

24-07-23 JS Enterprises rendered Catering Services worth Rs. 50,000 to VMK Industries Pvt Ltd. Additionally, GST @18% with Central Tax and State Tax components is charged on the invoice with reference number SA003.

- Go to Accounting Vouchers by pressing FV or navigating through Gateway of Tally > Accounting Vouchers.

- Select F8: Sales from the right side of the screen or press F8.

- Fill in the following details:

- Voucher Date: 24-Jul-23

- Invoice No: SA003

- Party A/c Name: VMK Industries Ltd

- Enter the following particulars:

- Account Name: Catering Service - Income Amount: Rs. 50,000

- Account Name: CGST Amount: Rs. 4,500

- Account Name: SGST Amount: Rs. 4,500

- Press Enter to save the voucher.

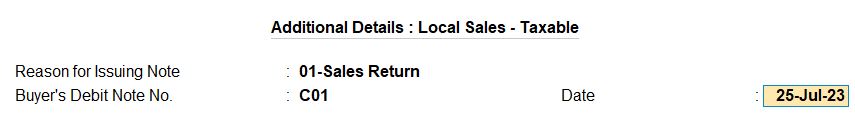

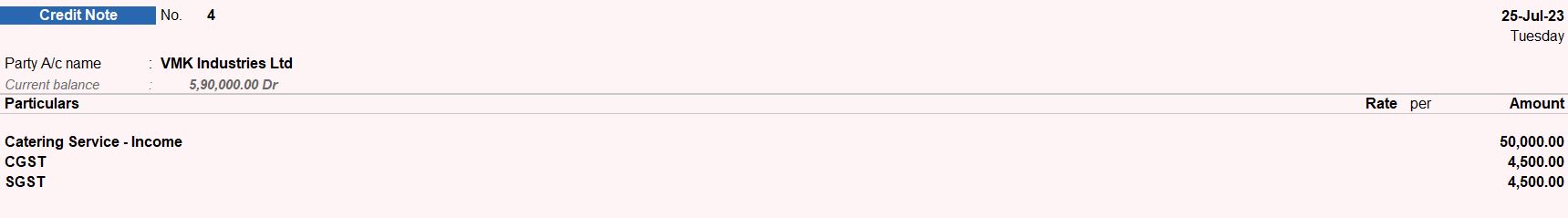

25-07-23 VMK Industries Pvt Ltd. cancelled Catering Services as JS Enterprises failed to provide the quality services as per the terms & conditions of the contract. The invoice amounting to Rs. 50,000 received on 24-07-23 against the bill number SA003 with GST @18% with Central Tax and State Tax components was cancelled.

- Go to Vouchers by pressing FV or navigating through Gateway of Tally > Vouchers.

- Select Alt + F6 : Credit Note from the right side of the screen or press F10 other voucher.

- Fill in the following details:

- Voucher Date: 25-Jul-23

- Buyer’s Debit Note No: C01

- Buyer’s Debit Note Date: 25-Jul-23

- Party A/c Name: VMK Industries Ltd

- Enter the following particulars:

- Account Name: Catering Service - Income Amount: Rs. 50,000

- Account Name: CGST Amount: Rs. 4,500

- Account Name: SGST Amount: Rs. 4,500

- Enter additional details:

- Local Sales - Taxable

- Reason for Issuing Note: 01 - Sales Return

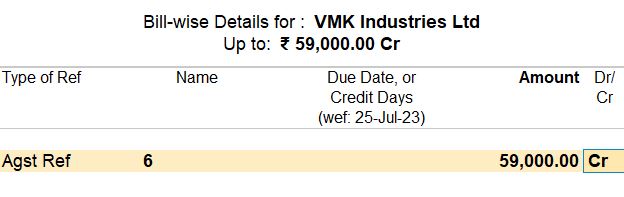

- Now, enter the Bill-wise details:

- Type of Ref: Agst Ref

- Name: 6

- Due Date: Leave it blank if not applicable

- Amount: Rs. 59,000

- Press Enter to save the voucher.

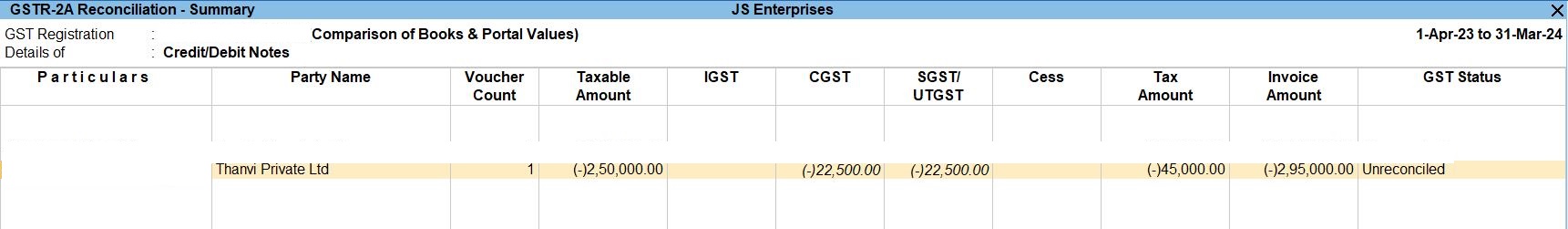

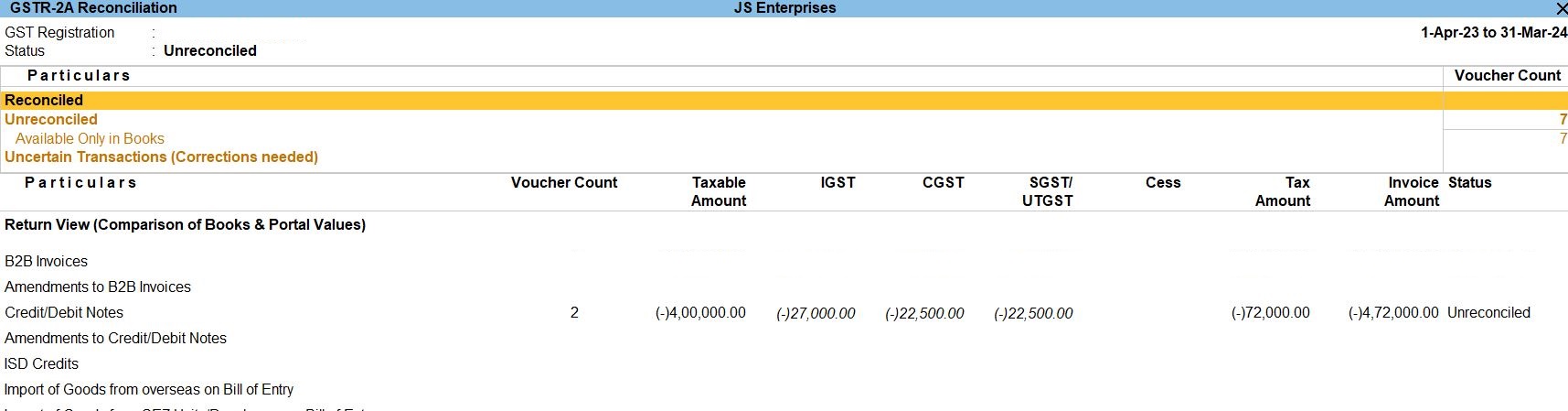

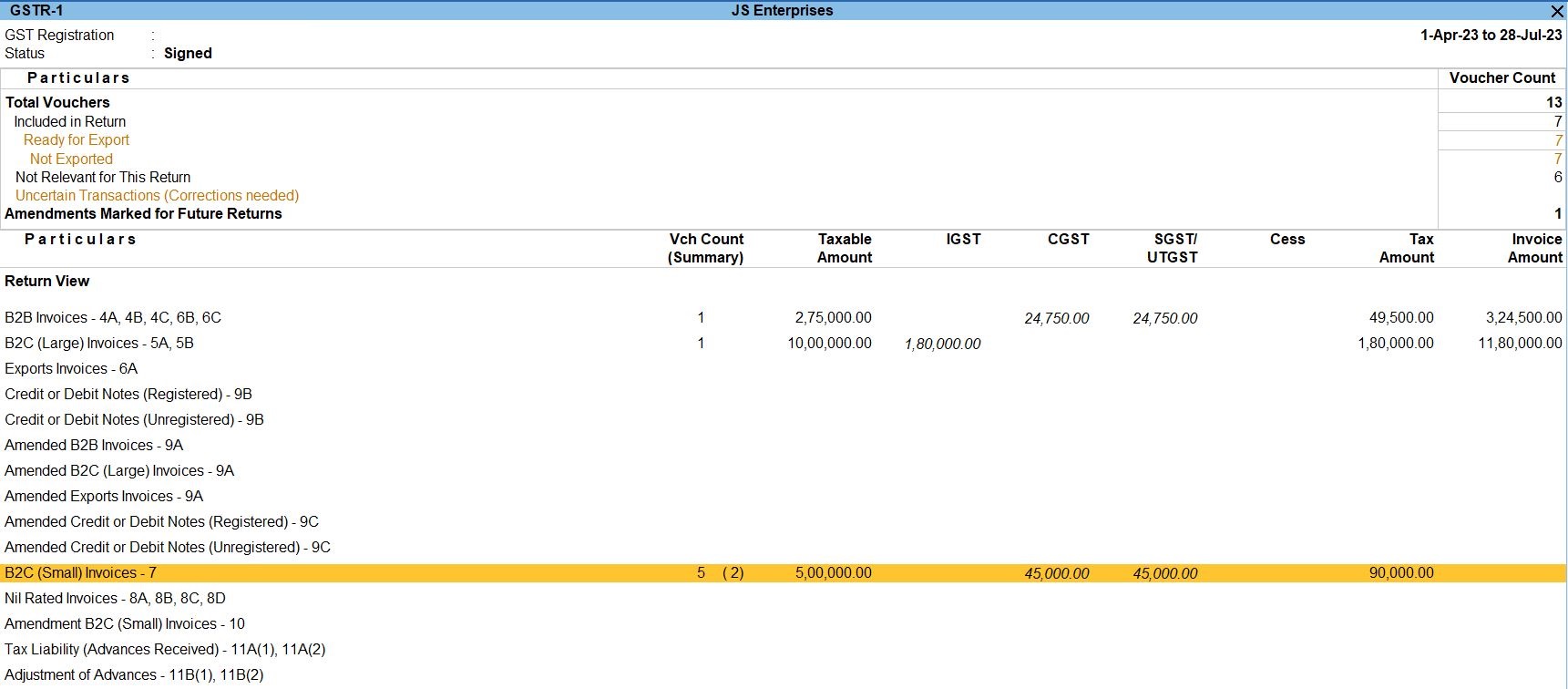

Reports

- Gateway of Tally -> Display More Reports -> Statutory Reports -> GSTR -1 -> Voucher Register

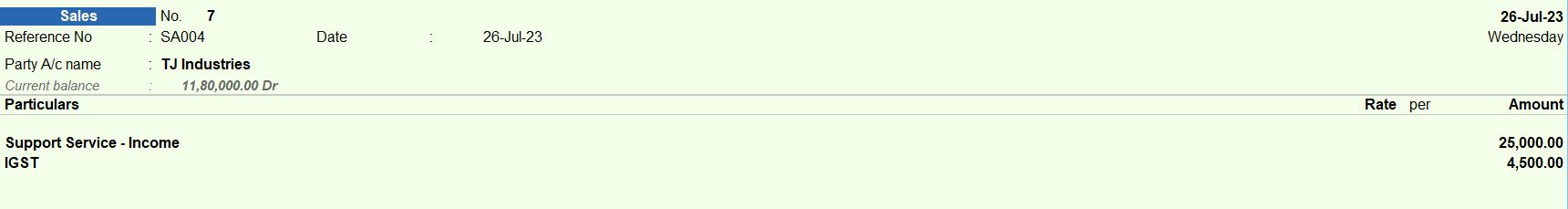

26-07-23 JS Enterprises rendered support services worth Rs. 25,000 to TJ Industries. Additionally, GST @18% with Integrated Tax components is charged on the invoice with reference number SA004.

- Go to Accounting Vouchers by pressing FV or navigating through Gateway of Tally > Accounting Vouchers.

- Select F8: Sales from the right side of the screen or press F8.

- Fill in the following details:

- Voucher Date: 26-Jul-23

- Invoice No: SA004

- Party A/c Name: TJ Industries

- Enter the following particulars:

- Account Name: Support Service - Income Amount: Rs. 25,000

- Account Name: IGST Amount: Rs. 4,500

- Press Enter to save the voucher.

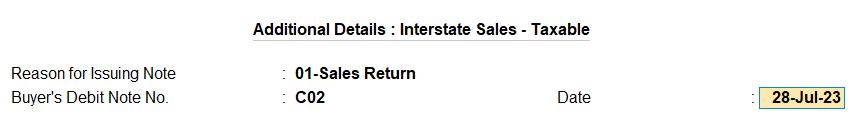

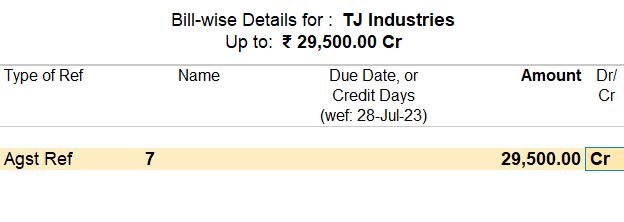

28-07-23 TJ Industries cancelled support services as JS Enterprises failed to provide the services as per the terms & conditions of the contract. The invoice amounting to Rs. 25,000 received on 24-07-23 against bill number SA004 with GST @18% with Integrated Tax component was cancelled.

- Go to Vouchers by pressing FV or navigating through Gateway of Tally > Vouchers.

- Select Alt + F6: Credit Note from the right side of the screen or press F10 Other voucher.

- Fill in the following details:

- Voucher Date: 28-Jul-23

- Buyer’s Debit Note No: C02

- Buyer’s Debit Note Date: 28-Jul-23

- Party A/c Name: TJ Industries

- Enter the following particulars:

- Account Name: Support Service - Income

- Amount: Rs. 25,000

- Account Name: IGST

- Amount: Rs. 4,500

- Enter additional details:

- Type of Ref: Agst Ref

- Name: 7

- Due Date: Leave it blank if not applicable

- Amount: Rs. 29,500

- Press Enter to save the voucher.

Reports

- Gateway of Tally -> Display More Reports -> Statutory Reports -> GSTR -1 -> Voucher Register

- Gateway of Tally -> Display More Reports -> Statutory Reports -> GSTR -1

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions