Service Tax in Tally Prime

What is Services Tax

Service tax is a tax levied by the government on service providers on certain service transactions, but is actually borne by the customers. It is categorized under Indirect Tax and came into existence under the Finance Act, 1994. ... This tax is not applicable in the state of Jammu & Kashmir.

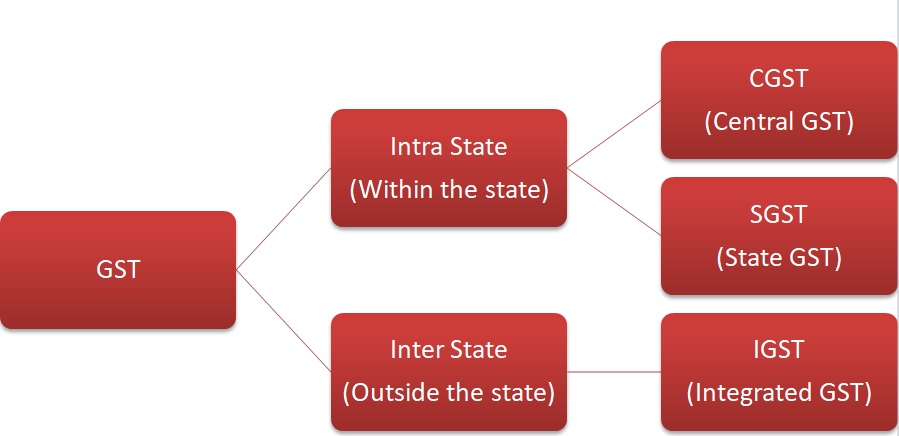

GST

- Intra-State supply of goods or services is when the location of the supplier and the place of supply i.e., location of the buyer are in the same state. In Intra-State transactions, a seller has to collect both CGST and SGST from the buyer. The CGST gets deposited with Central Government and SGST gets deposited with State Government.

- Inter-State supply of goods or services is when the location of the supplier and the place of supply are in different states. Also, in cases of export or import of goods or services or when the supply of goods or services is made to or by a SEZ unit, the transaction is assumed to be Inter-State. In an Inter-State transaction, a seller has to collect IGST from the buyer.

Sales voucher

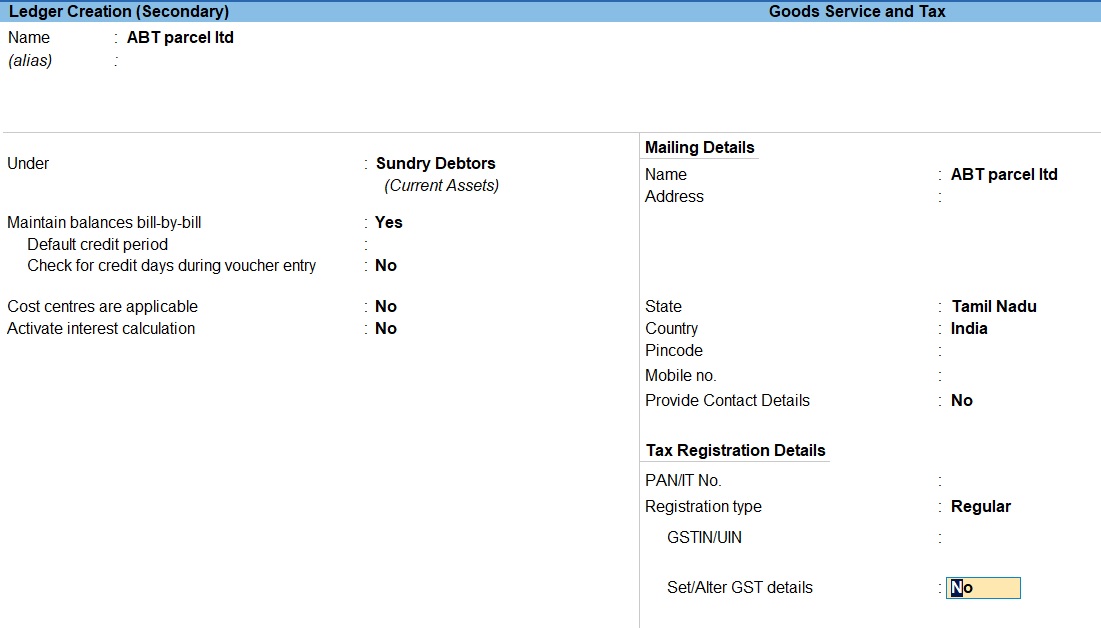

1. Go to Gateway of Tally prime > masters > Ledgers > Create .

2. Enter the ledger Name .

3.Select sundry debtors as the group name in the field Under .

4.Select Service Tax as the Type of duty/tax .

5.The Ledger Creation screen appears as shown below:

6. press Enter to save.

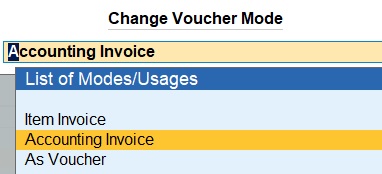

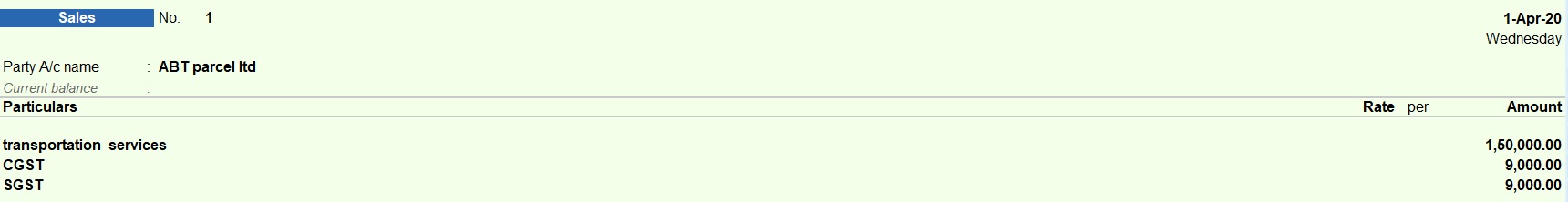

1. Select Change mode > Accounting Invoice > Enter

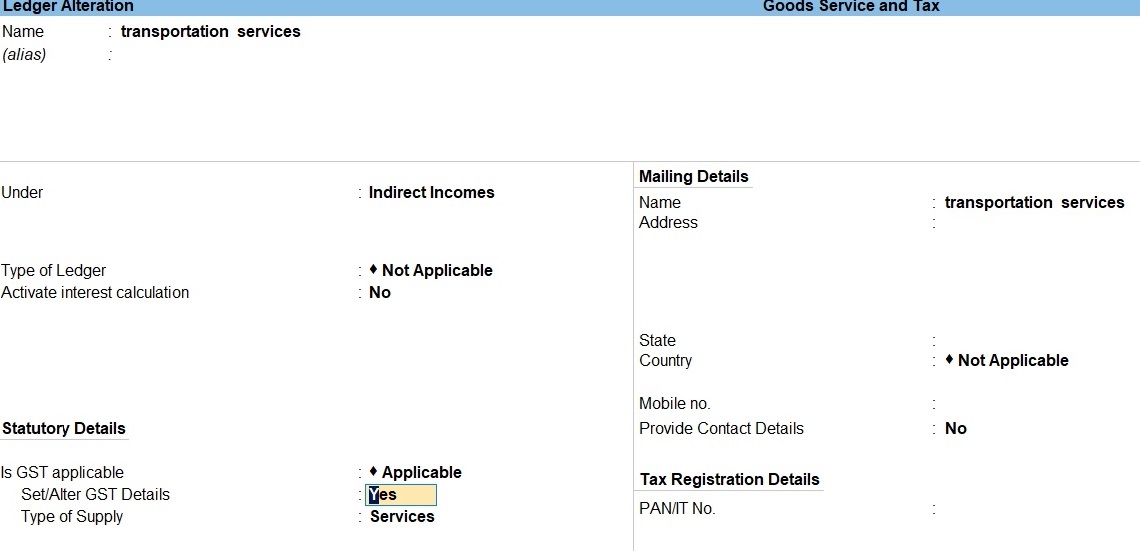

2. Go to Gateway of Tally prime > voucher sales >Alt+ C > Create .

3. Enter the ledger Name .

4. Select indirect incomes as the group name in the field Under .

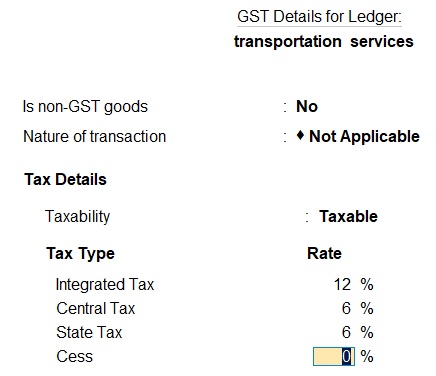

5. Select Set/alter GST details Enter YES.

6. Select Service Tax as the Type of duty/tax

7. The Ledger Creation screen appears as shown below:

8. press Enter to save.

Common tax ledger creation

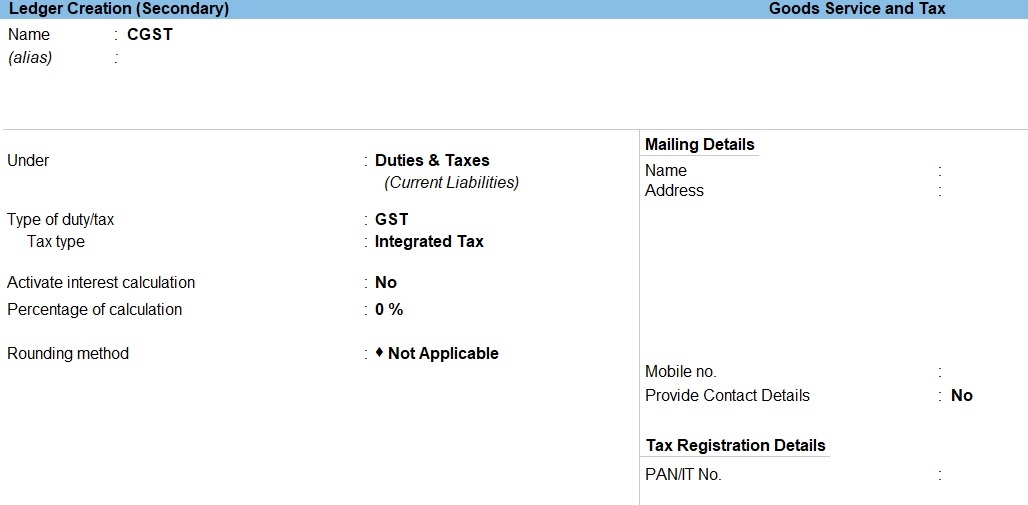

1. Go to Gateway of Tally > voucher sales >Alt+ C > Create .

2. Enter the ledger Name .

3. Select Duties & Taxes as the group name in the field Under .

4. Select Integrated tax as the Type of duty/tax .

5. The Ledger Creation screen appears as shown below:

6. Press Enter to save.

voucher purchase

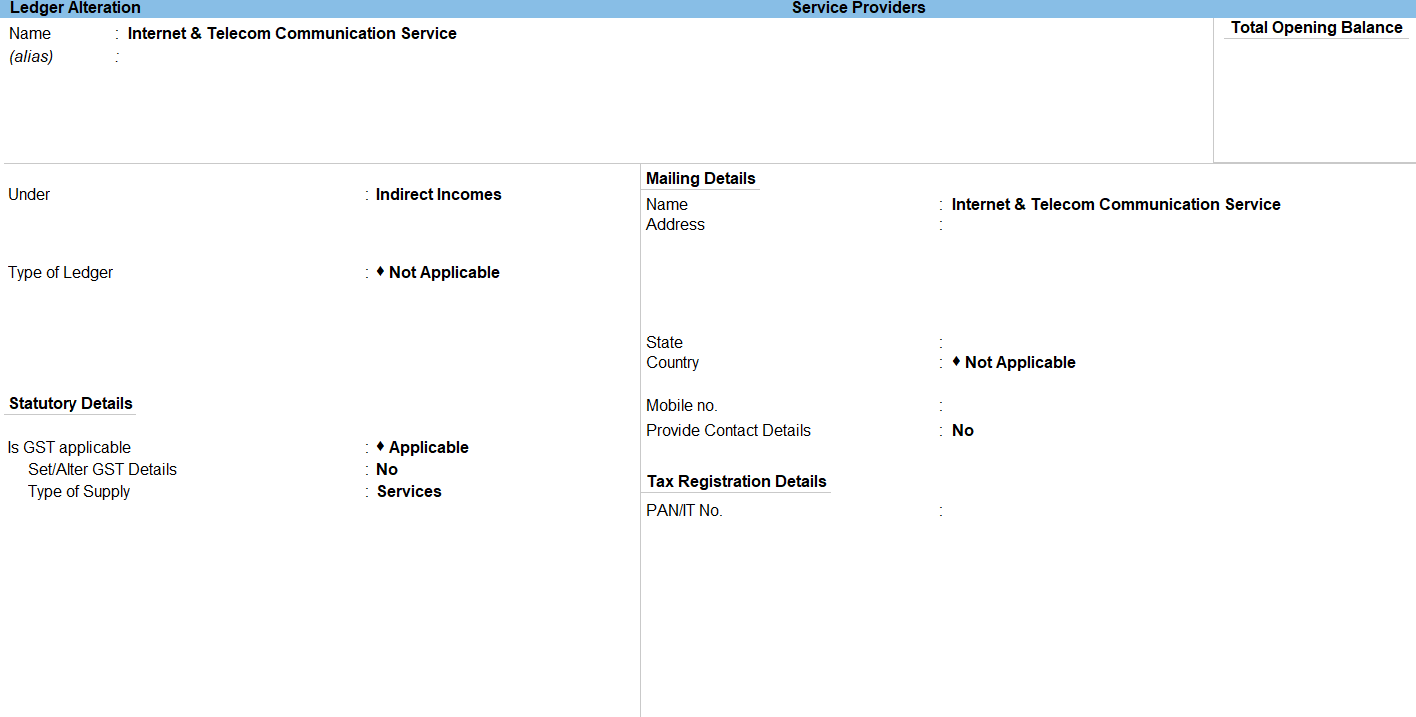

1. Go to Gateway of Tally prime > voucher purchase >Alt+ C > Create .

2. Enter the ledger Name .

3. Select Indirect Income as the group name in the field Under .

4. Select Set/alter GST details Enter YES.

6. Select Service Tax as the Type of duty/tax

7. The Ledger Creation screen appears as shown below:

8. press Enter to save.

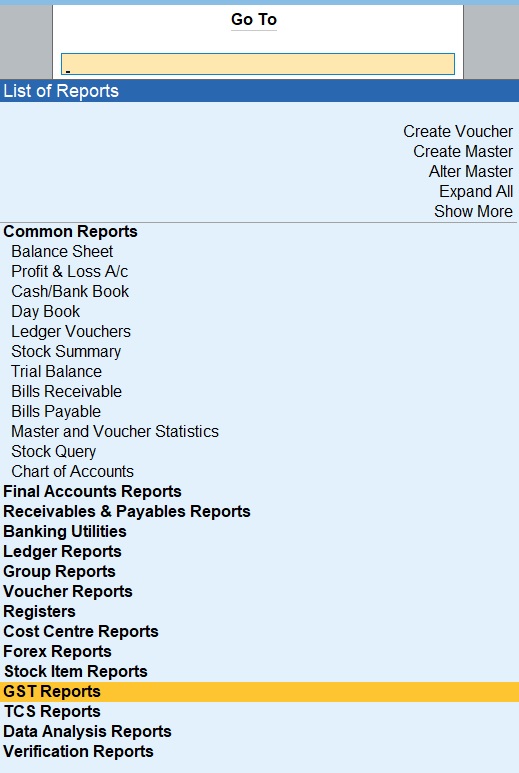

Reports

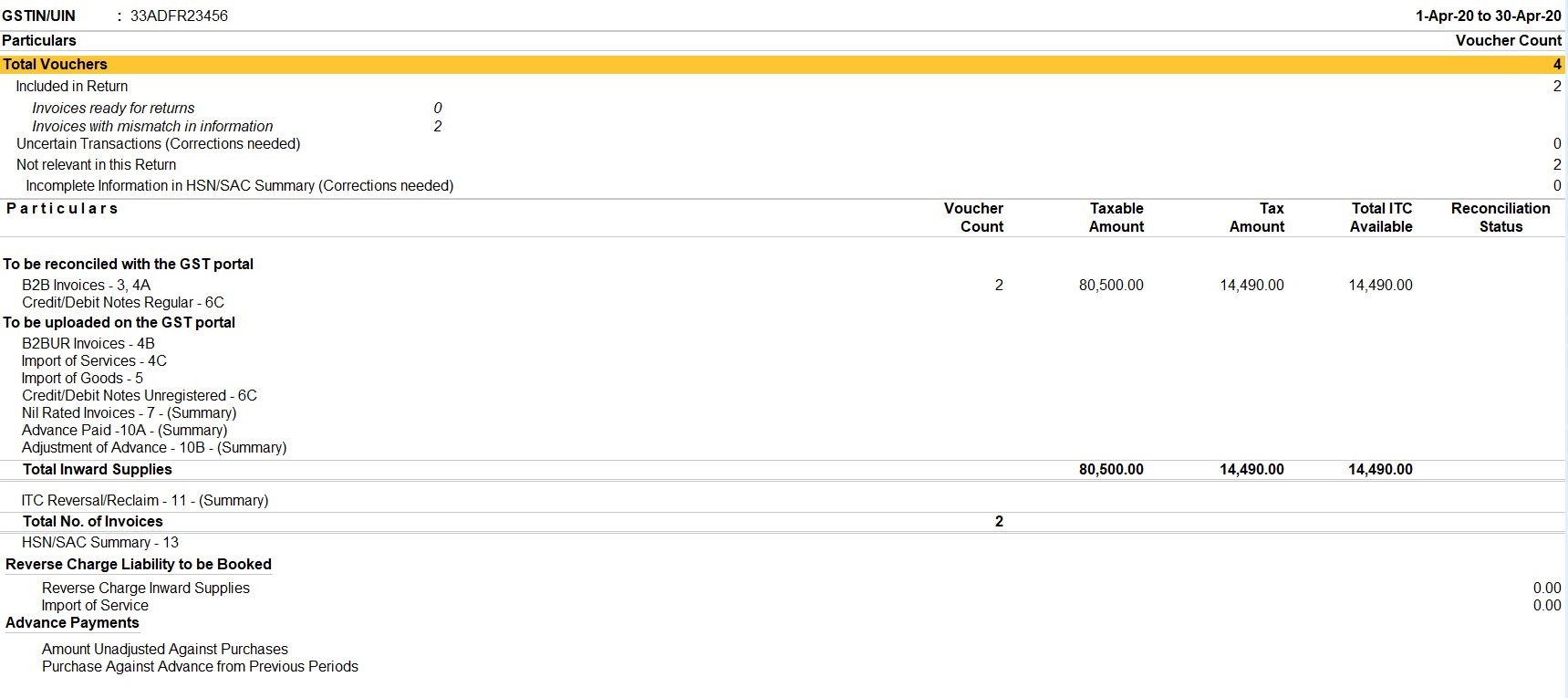

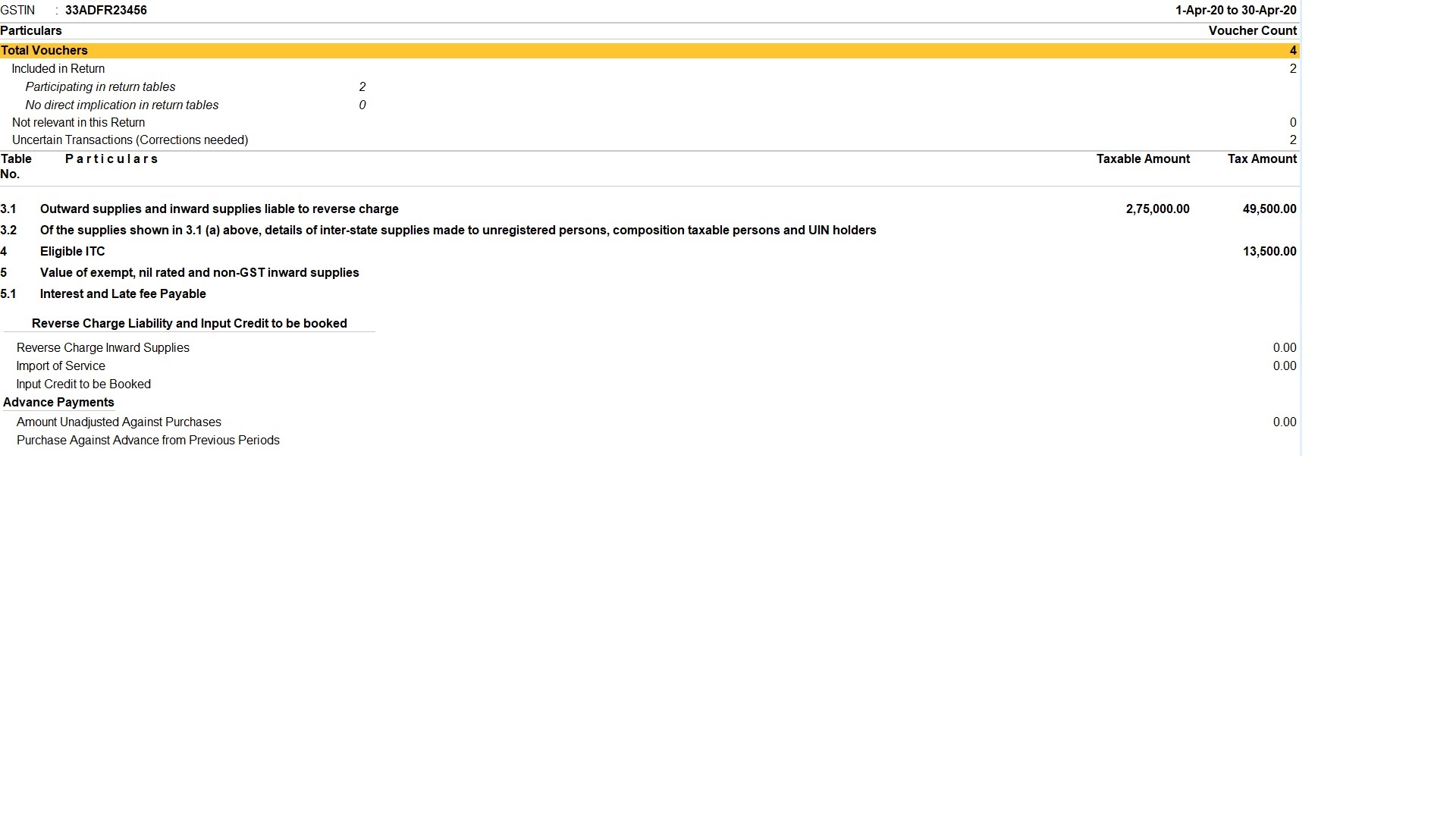

1. Go to Gateway of Tally prime > GO To > GST Reports>Enter.

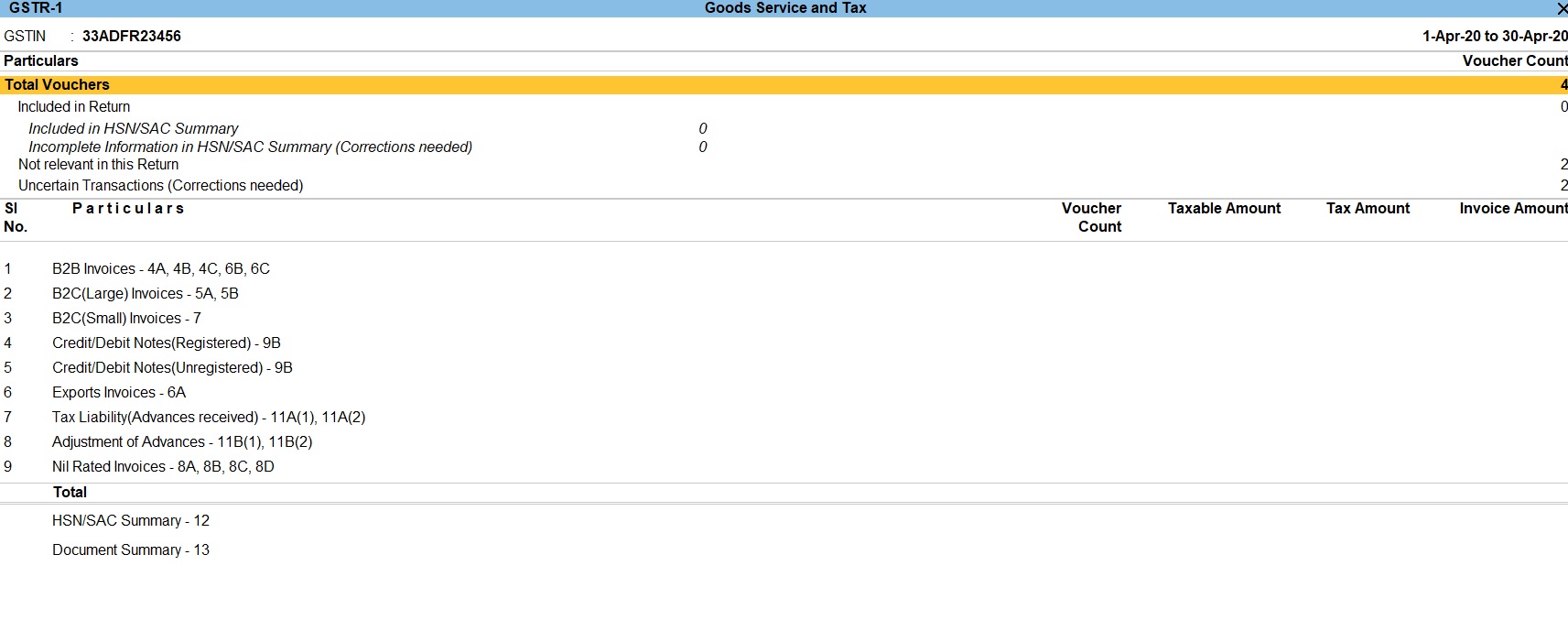

2.Go to Gateway of Tally prime > GO To > GST Reports > GSTR-1> Enter.

3.Go to Gateway of Tally prime >Display more Reports> Statutory Reports> GST Reports> GSTR-2> Enter.

4.Go to Gateway of Tally prime > Display more Reports > Statutory Reports > GST Reports > GSTR -3B > Enter.

Service Tax Sum

1. Providing transportation based services to ABT parcel ltd Chennai,tamilnadu worth rs.150000. Additionally GST 12% is charged on the invoice with reference number SR101.

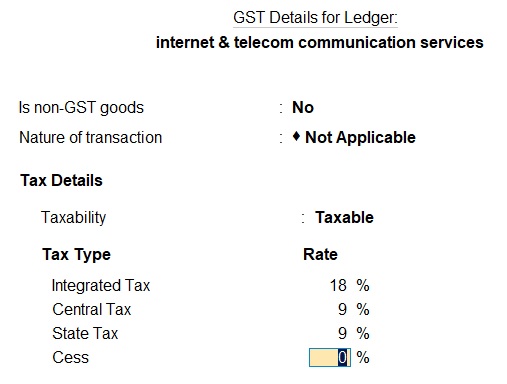

2. Providing internet & telecom communication based services to info tech ltd Bangalore, Karnataka worth rs.275000. Additionally GST 18% is charged on the invoice with reference number SR105.

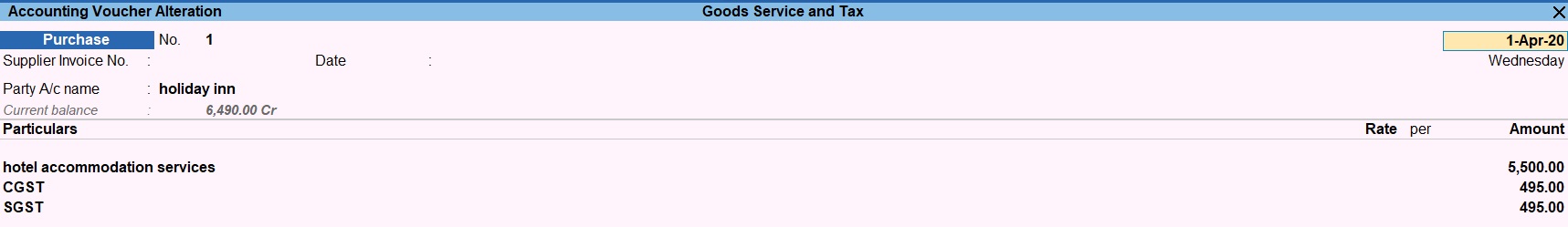

3. Receiving a hotel accommodation services from holiday inn hotel Salem, tamilnadu worth rs.5500. Additionally 18% GST charged on the invoice with reference number HI123.

4. Receiving professional services from terabyte ltd Gujarat worth rs.75000. Additionally 18% GST charged on the invoice with reference number HI124.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions