Simplified Interstate Inward and Outward Services in Tally Prime

Interstate Inward Supply

10-07-23 JS Enterprises received a service from Sandy Glass Industries, Bihar, for window cleaning service rendered for Rs. 800,000. Additionally, GST @18% is charged on the invoice with reference number JS002.

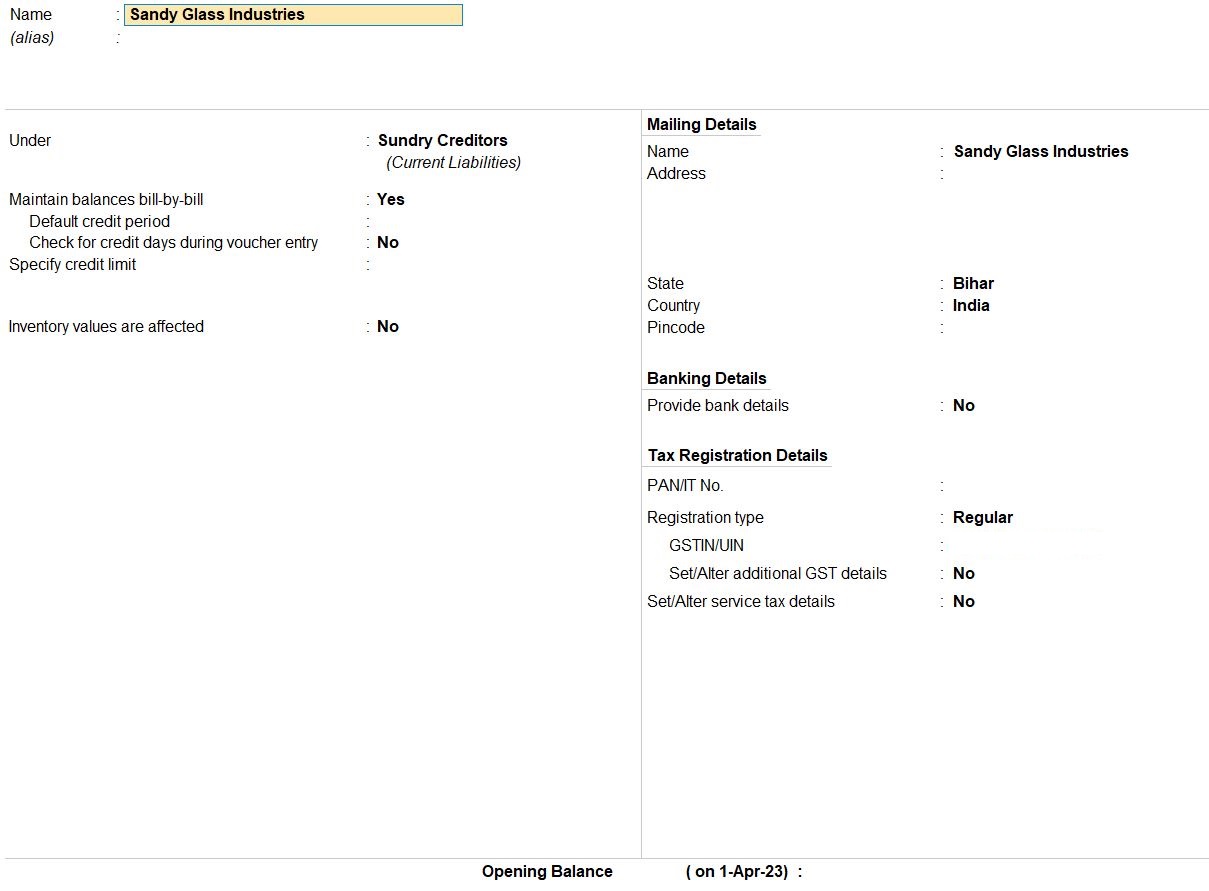

| Party Ledger | |

|---|---|

| Name | Sandy Glass Industries |

| Under | Sundry Creditors |

| Maintain balances bill-by-bill | Yes |

| State | Bihar |

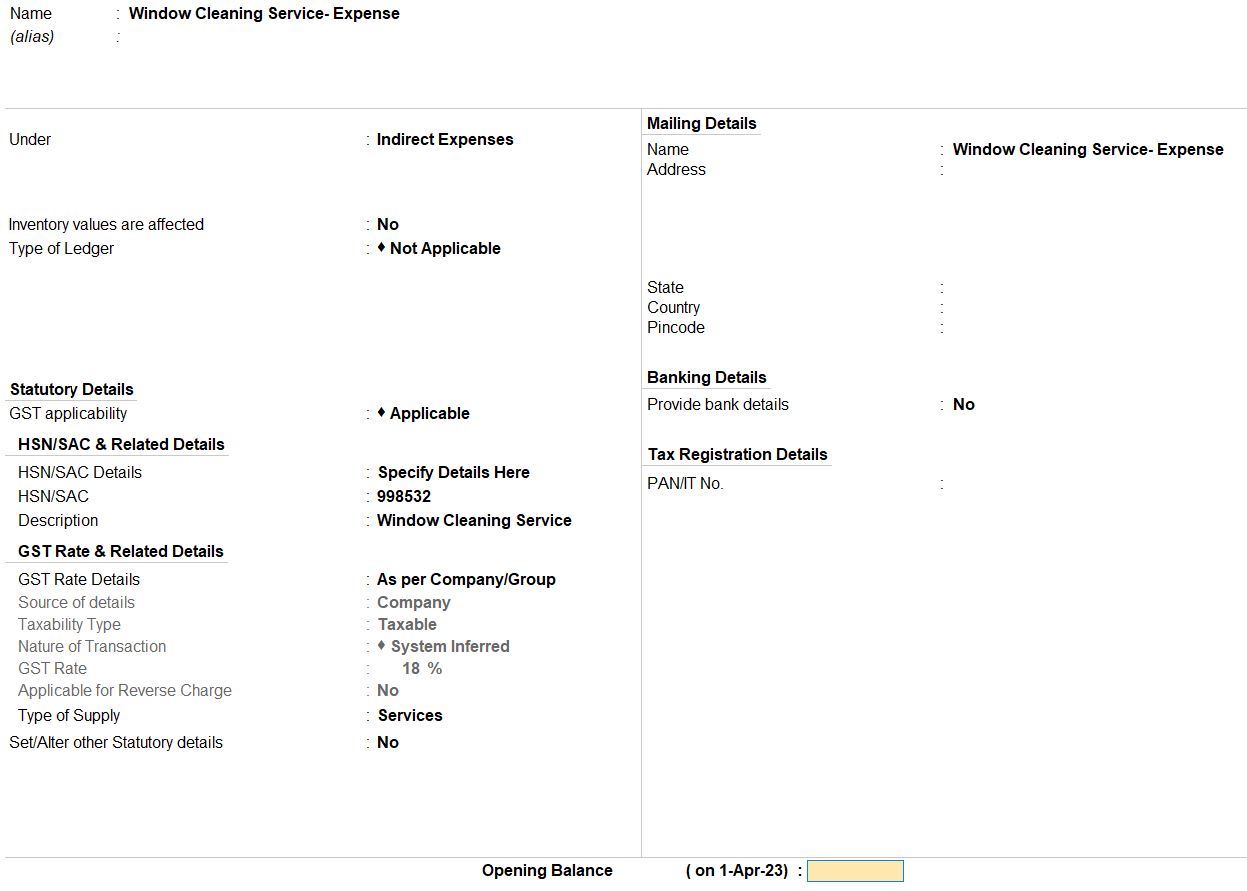

| Windows Cleaning Services | |

|---|---|

| Name | Windows Cleaning Services |

| Under | Indirect Expenses |

| Is GST Applicable | Applicable |

| Set/alter GST details | Yes |

| HSN/SAC Details | |

| Description | Windows Cleaning Services |

| HSN/SAC | 998532 |

| Nature of transaction | Not Applicable |

| Tax Details | |

| Taxability | Taxable |

| Integrated tax | 18% |

| Type of Supply | Services |

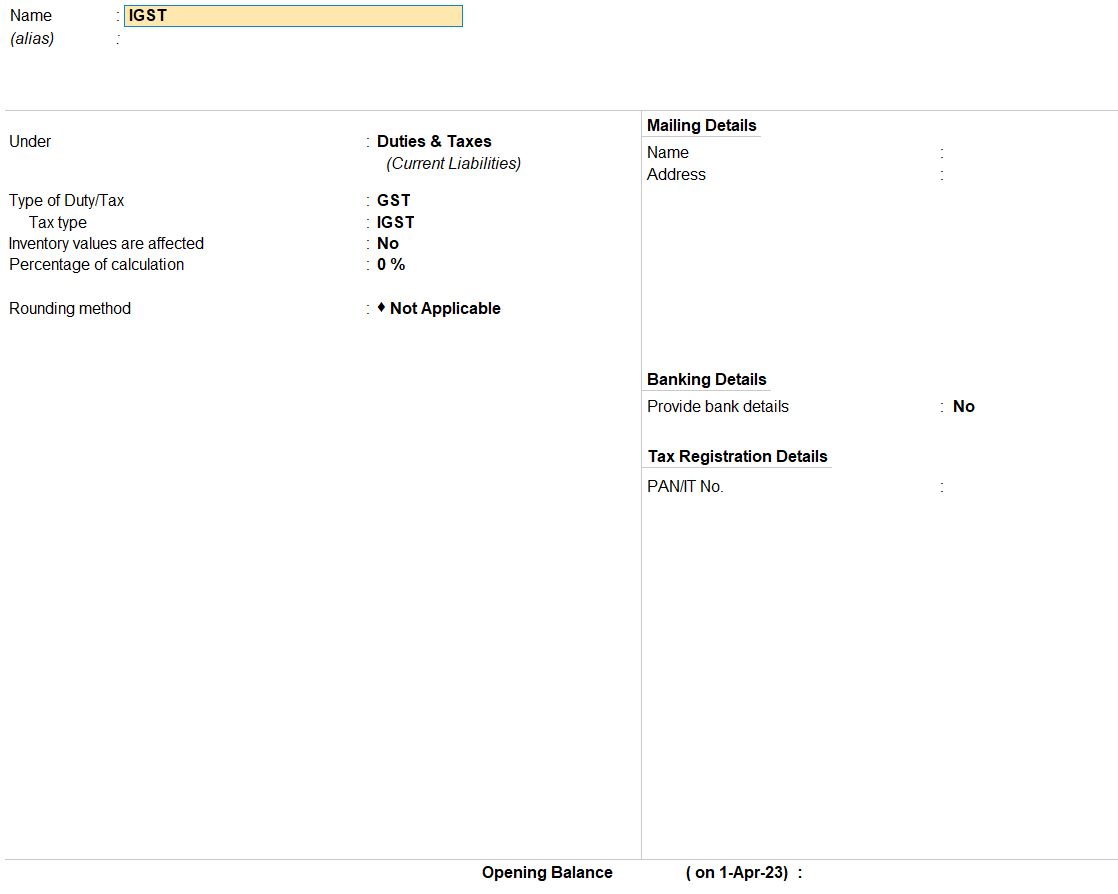

| Integrated Tax | |

|---|---|

| Name | Integrated Tax |

| Under | Duties & Taxes |

| Type of duty/tax | GST |

| Tax type | Integrated Tax |

Interstate Outward Supply of Services

12-07-23 JS Enterprises rendered support services to crop production on cultivation worth Rs. 1,000,000 to TJ Industries, Kerala. GST @18% is charged on the invoice with reference number SA002.

| Party Ledger | |

|---|---|

| Name | TJ Industries |

| Under | Sundry Debtors |

| Maintain balances bill-by-bill | Yes |

| Support Services | |

|---|---|

| Name | Support Services |

| Under | Indirect Income |

| Is GST Applicable | Applicable |

| Set/alter GST details | Yes |

| HSN/SAC Details | |

| Description | Support Services to Crop Production |

| HSN/SAC | 998611 |

| Nature of transaction | Not Applicable |

| Tax Details | |

| Taxability | Taxable |

| Integrated tax | 18% |

| Type of Supply | Services |

10-07-23 JS Enterprises received a service from Sandy Glass Industries, Bihar, for window cleaning service rendered for Rs. 800,000. Additionally, GST @18% is charged on the invoice with reference number JS002.

Party Ledger Details:

- Name: Sandy Glass Industries

- Under: Sundry Creditors

- Maintain balances bill-by-bill: Yes

- State: Bihar

Windows Cleaning Services Ledger Setup:

- Name: Windows Cleaning Services

- Under: Indirect Expenses

- Is GST Applicable: Yes

HSN/SAC Details:

- Description: Windows Cleaning Services

- HSN/SAC: 998532

Tax Details:

- Taxability: Taxable

- Integrated Tax: 18%

- Type of Supply: Services

IGST Ledger Setup:

- Name: IGST

- Under: Duties & Taxes

Tax Details:

- Type of Duty/Tax: GST

- Tax Type: IGST

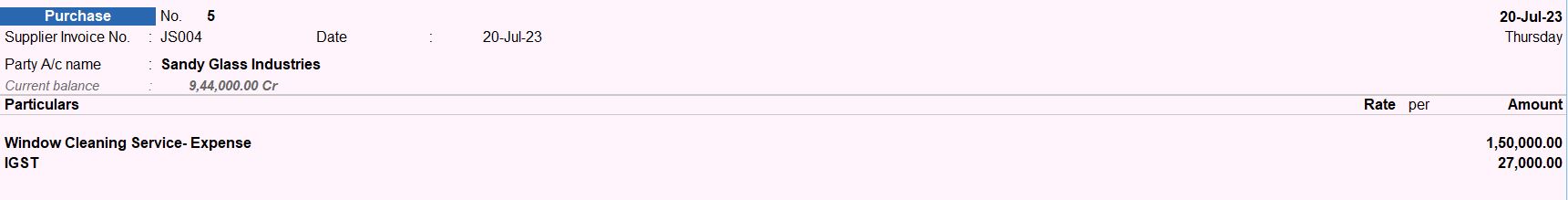

Purchase Voucher Entry:

- Go to Vouchers (Gateway of Tally > Vouchers or press FV).

- Select F9: Purchase.

- Fill in the voucher date: 10-Jul-23.

- Enter Supplier Invoice No: JS002.

- In the Particulars section, select the appropriate ledger:

- Account Name: Windows Cleaning Service - Expense Amount: 800,000

- Account Name: Integrated Tax Amount: 144,000

Explanation:

- JS Enterprises received window cleaning services from Sandy Glass Industries in Bihar.

- The total amount for the window cleaning services is Rs. 800,000.

- Additionally, GST @ 18% is charged on the invoice, resulting in an integrated tax of Rs. 144,000.

- The voucher reflects the purchase of these services along with the GST component.

Saving the Voucher:

- After entering all the necessary details, press Enter to save the voucher.

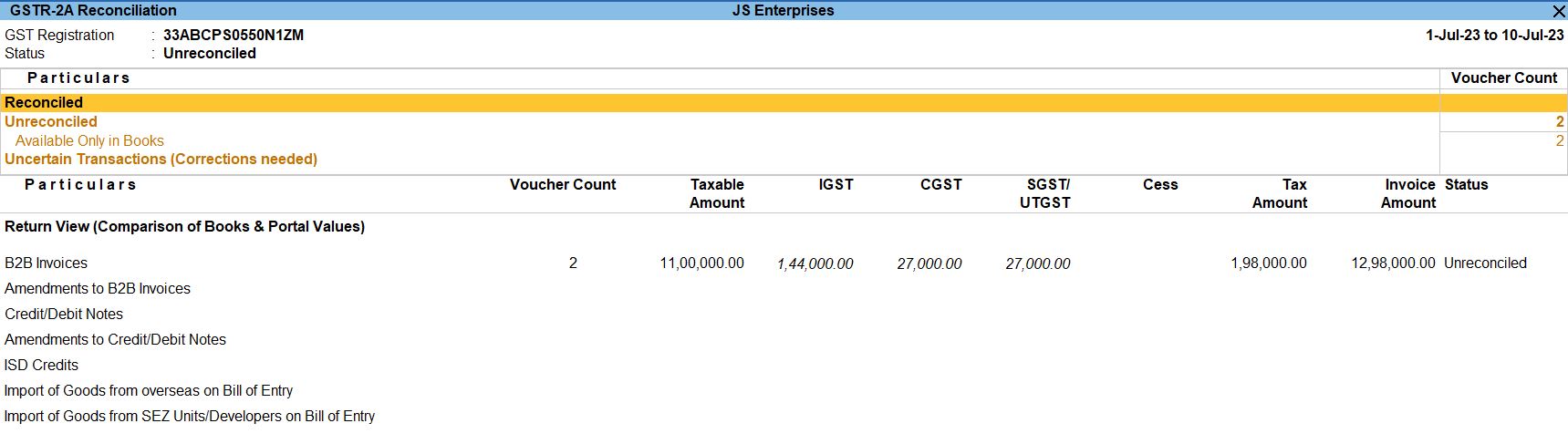

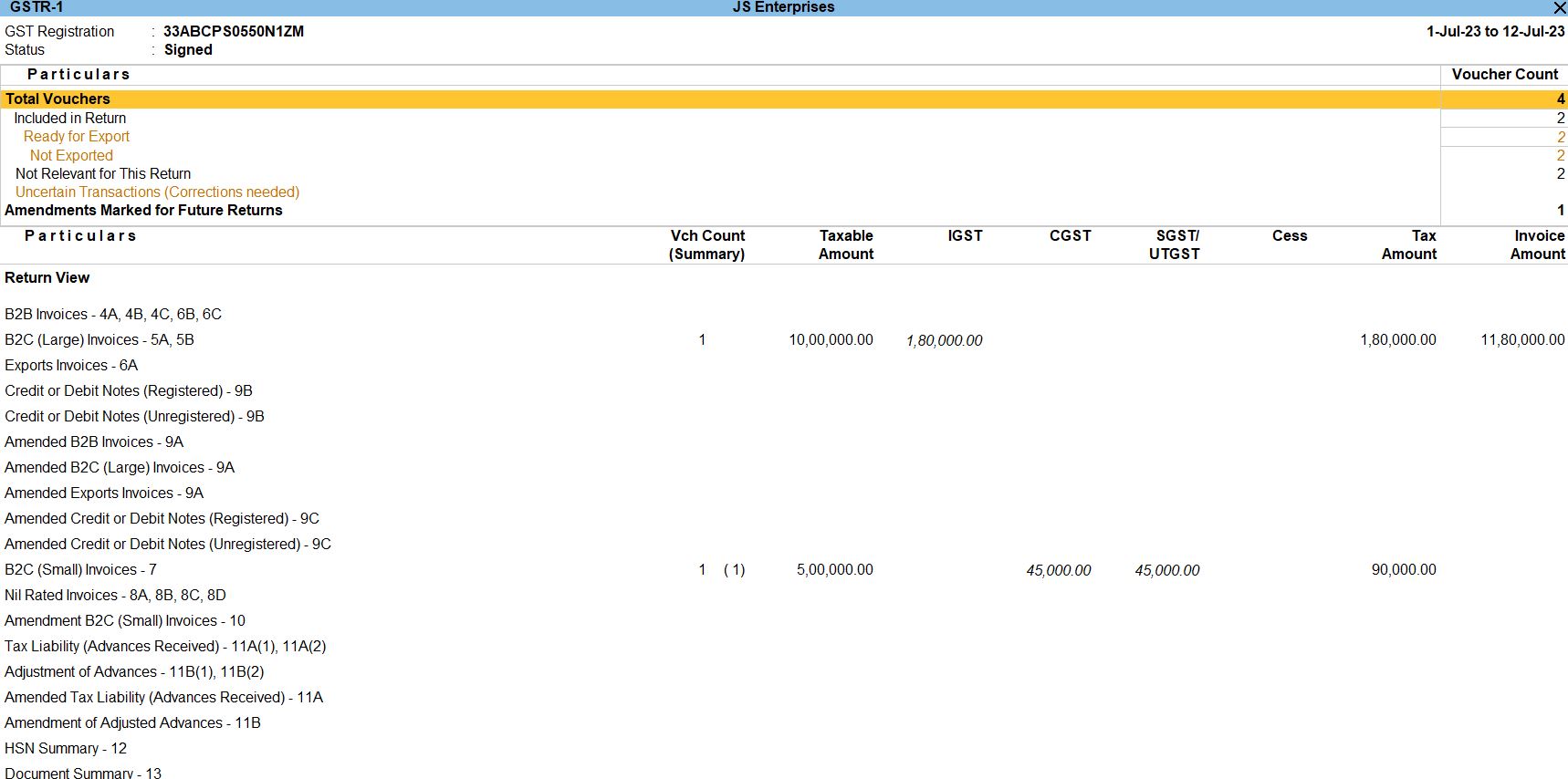

Reports

- Gateway of Tally -> Display More Reports -> Statutory Reports

12-07-23 JS Enterprises rendered support services to crop production on cultivation worth Rs. 1,000,000 to TJ Industries, Kerala. GST @18% is charged on the invoice with reference number SA002.

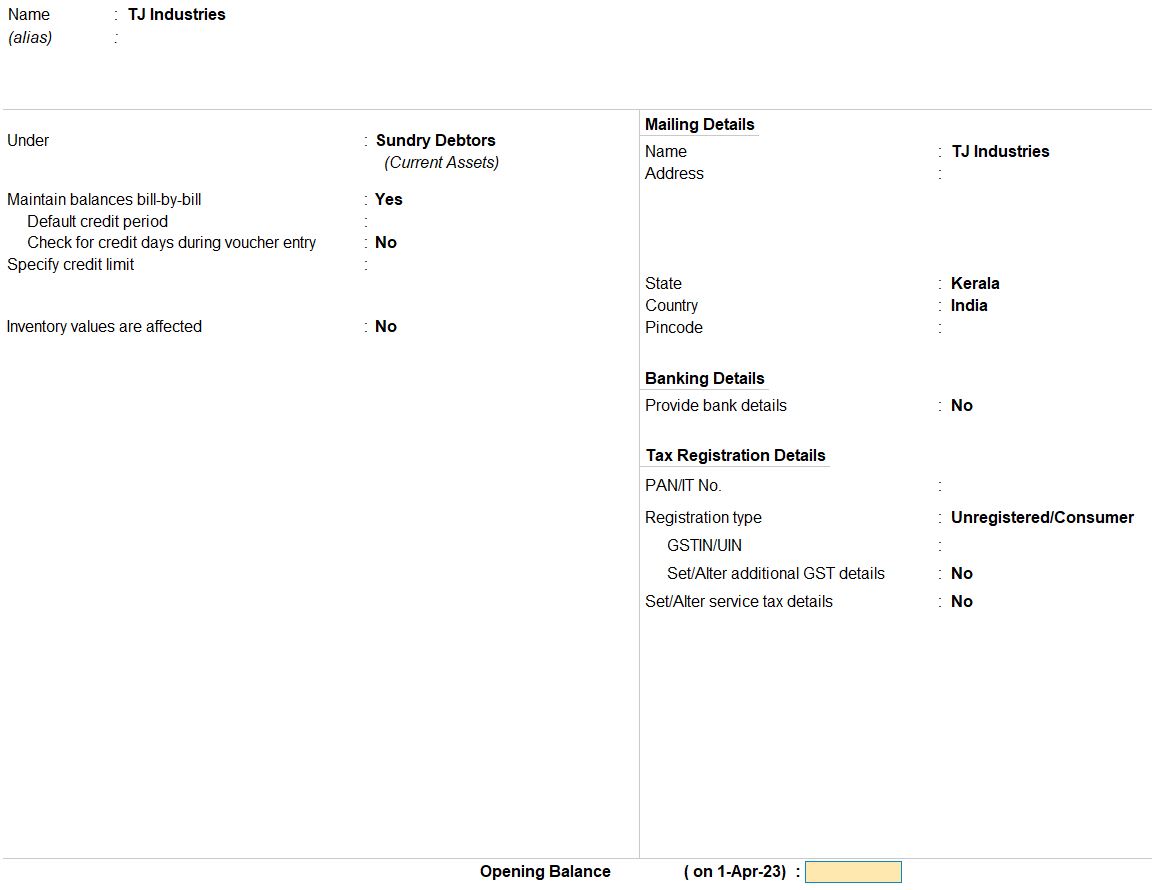

Party Ledger Details:

- Name: TJ Industries

- Under: Sundry Debtors

- Maintain balances bill-by-bill: Yes

- State: Kerala

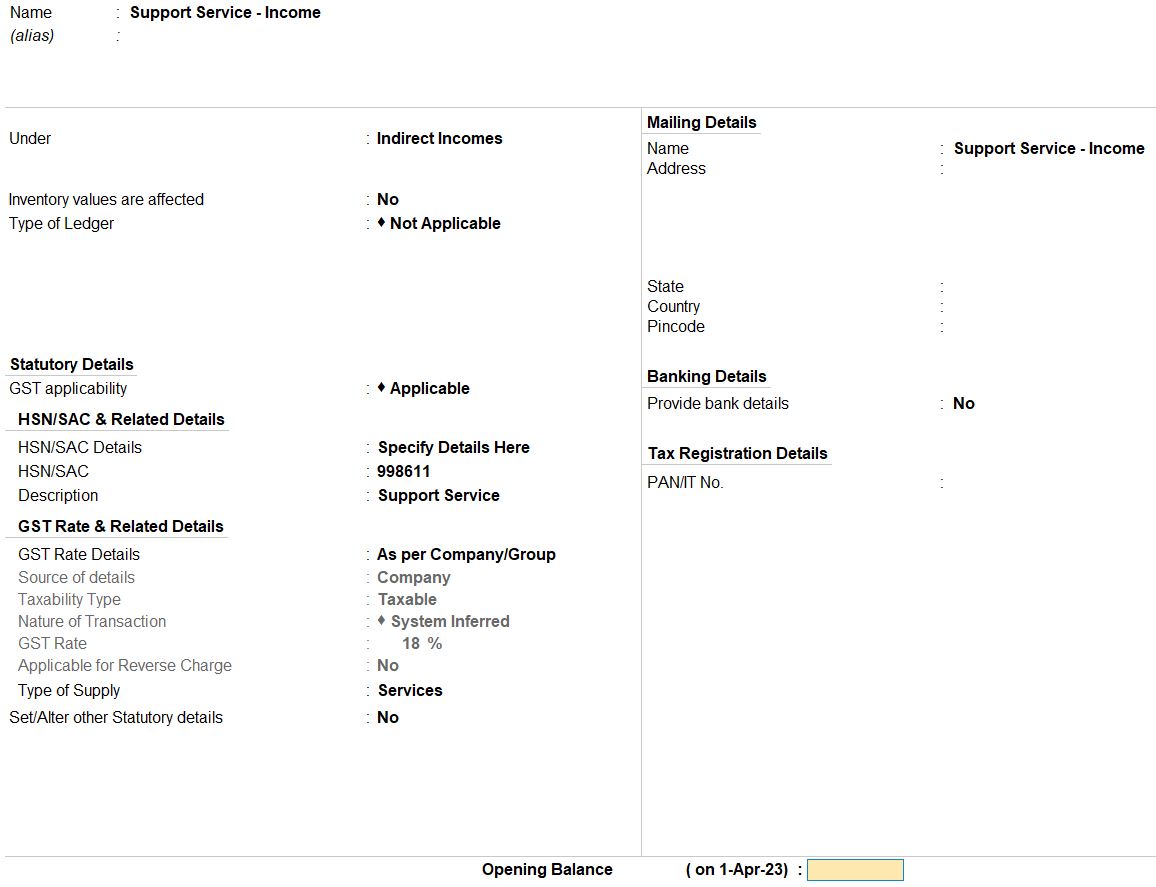

Support Services Ledger Setup:

- Name: Support Services

- Under: Indirect Income

- Is GST Applicable: Yes

HSN/SAC Details:

- Description: Support Services to Crop Production

- HSN/SAC: 998611

Tax Details:

- Taxability: Taxable

- Integrated Tax: 18%

- Type of Supply: Services

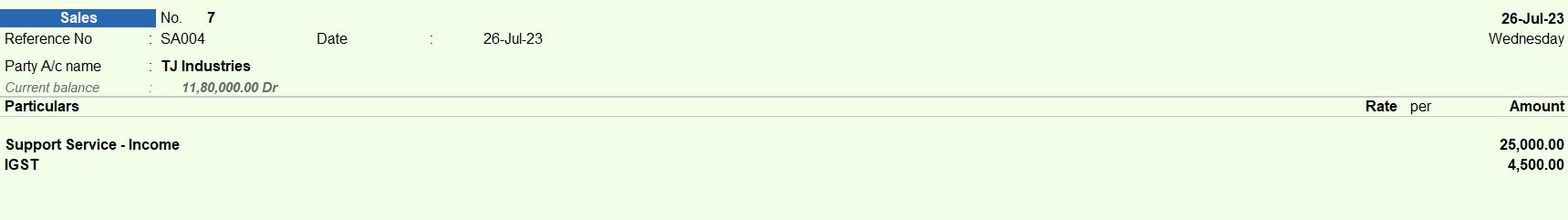

Sales Voucher Entry:

- Go to Accounting Vouchers (Gateway of Tally > Accounting Vouchers or press FV).

- Select F8: Sales.

- Fill in the voucher date: 12-Jul-23.

- Enter Invoice No: SA002.

- In the Party A/c Name field, select TJ Industries.

Enter the following details in the Particulars section:

- Account Name: Support Service - Income

- Amount: Rs. 1,000,000

- Account Name: IGST (Integrated Tax)

- Amount: Rs. 180,000

Explanation:

- JS Enterprises provided support services to crop production to TJ Industries in Kerala.

- The total amount for the support services rendered is Rs. 1,000,000.

- Additionally, GST @ 18% is charged on the invoice, resulting in an integrated tax of Rs. 180,000.

- The voucher reflects the sales of these services along with the GST component.

Save the Voucher:

- After entering all the necessary details, press Enter to save the voucher.

Reports

- Gateway of Tally -> Display More Reports -> Statutory Reports

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions