Navigating Intrastate Supply under GST in Tally Prime

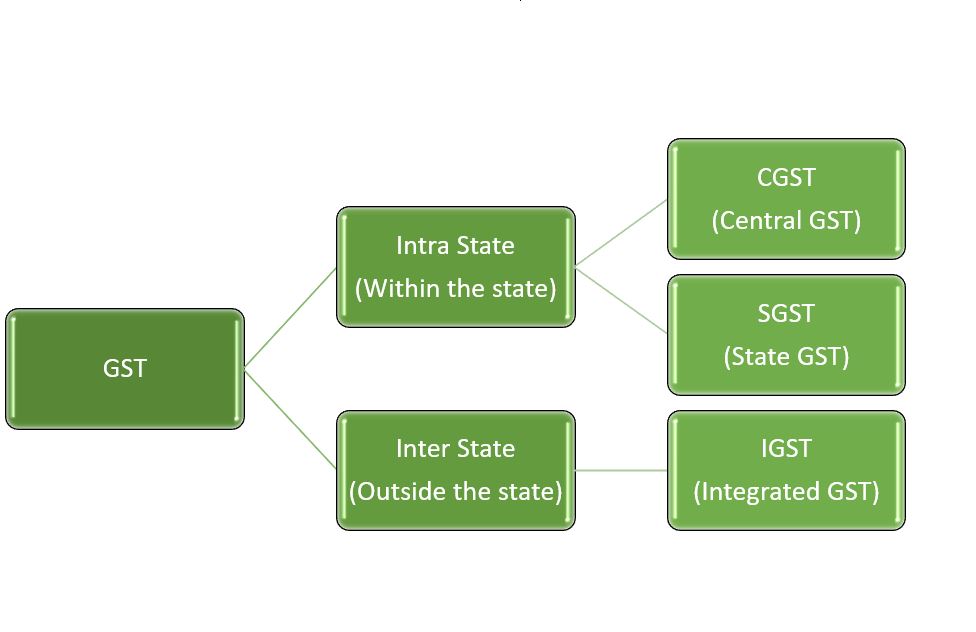

Goods and Services Tax

GST GOODS TAX

| Sri Lakshmi Electronics |

|---|

| ADDRESS |

214, 10, near 5 Road, Thangavel Nagar, Raagava reddy road, Omalur Main Rd, Salem -636455 |

| MOBILE NO |

7896320145 |

| EMAIL |

srilakshmielectronics@gmail.com |

| WEBSITE |

Srilakshmielectronics.in |

| GSTIN NO |

33XXXXXXXXXX1ZR |

| PANCARD NO |

XXXXXXXXXX |

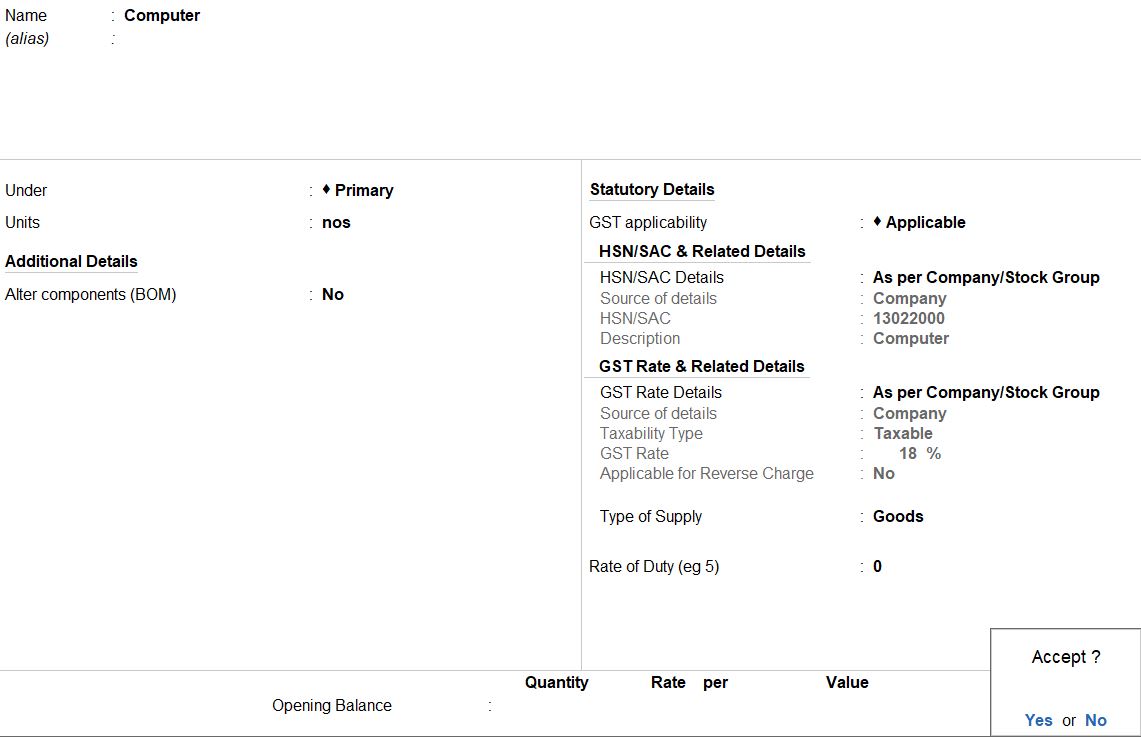

| Against the Field |

Action to be performed |

| Description |

Computer |

| HSN/SAC |

13022000 |

| Taxability |

Taxable |

| Integrated Tax |

18% |

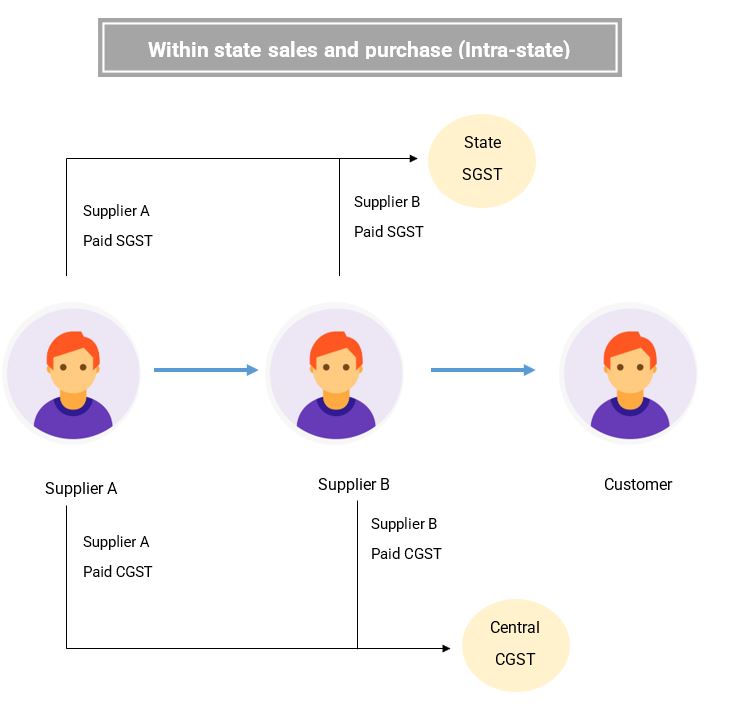

Intrastate Supply of Goods

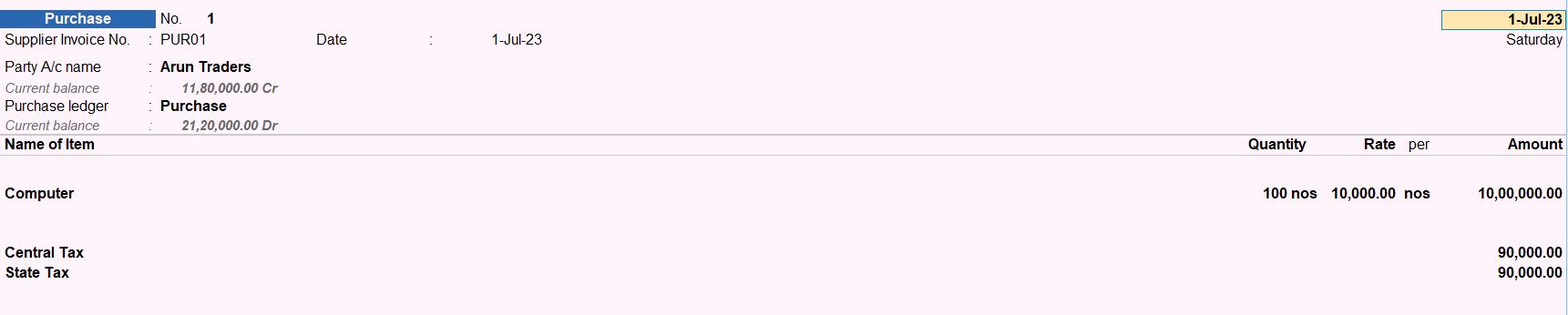

01-07-23 Purchase the following goods from Arun Traders, Tamil Nadu with Supplier Invoice No: MIT181905602 with GST tax 18%.

| Item |

Qty |

Rate |

| Computer |

100 |

10000 |

| Party Ledger |

| Under |

Sundry Creditors |

| Name |

Arun Traders |

| Tax Registration Details |

| Set/alter GST Details |

yes |

| GST Details |

| Registration Type |

Regular |

| PAN |

XXXXXXXXXX |

| GSTIN/UIN |

33XXXXXXXXXX1Z9 |

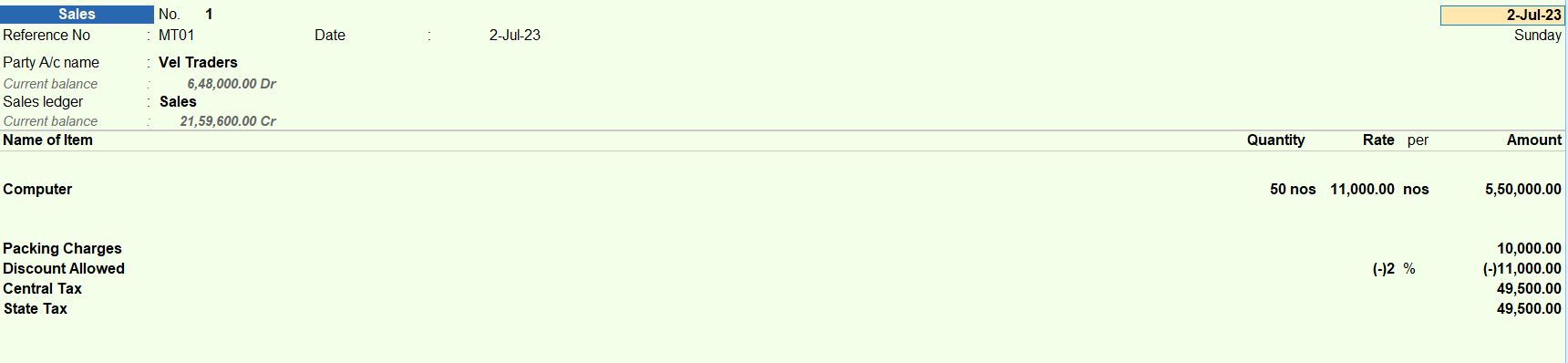

Intrastate Outward Supply

| Item |

Qty |

Rate |

| Computer |

50 |

11000 |

Packing Charge Rs.10000

Discount Allowed @2% |

| Vel Traders |

| Name |

Vel Traders |

| Under |

Sundry Debtors |

| Set/alter GST Details |

Yes |

| Registration |

Regular |

| PAN |

XXXXXXXXXX |

| GSTIN/UIN |

33XXXXXXXXXX1Z6 |

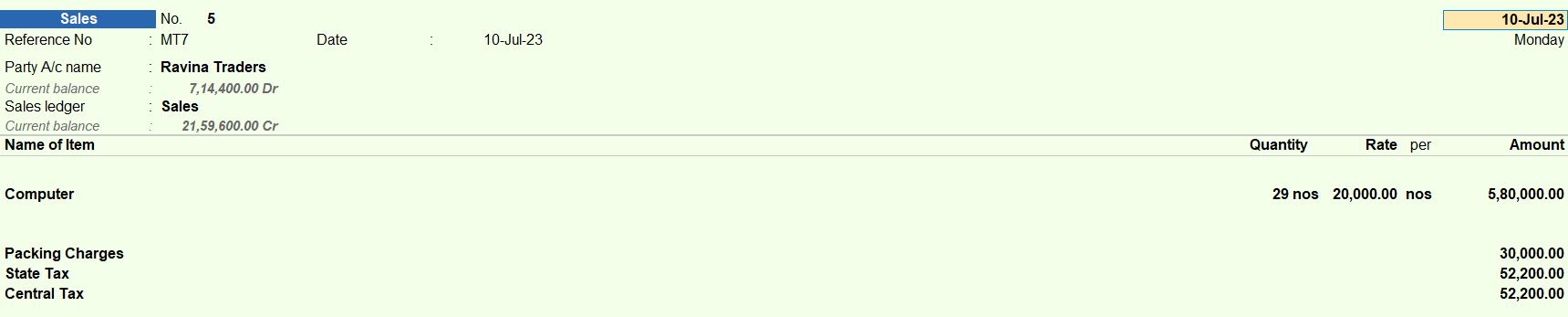

10-07-23 Sold the following goods to Rakesh Traders, Tamil Nadu with Reference no: SHD123405961 with Central tax 9% and State Tax 9%.

| Item |

Qty |

Rate |

| Computer |

29 |

20000 |

| Packing Charge Rs.30000 |

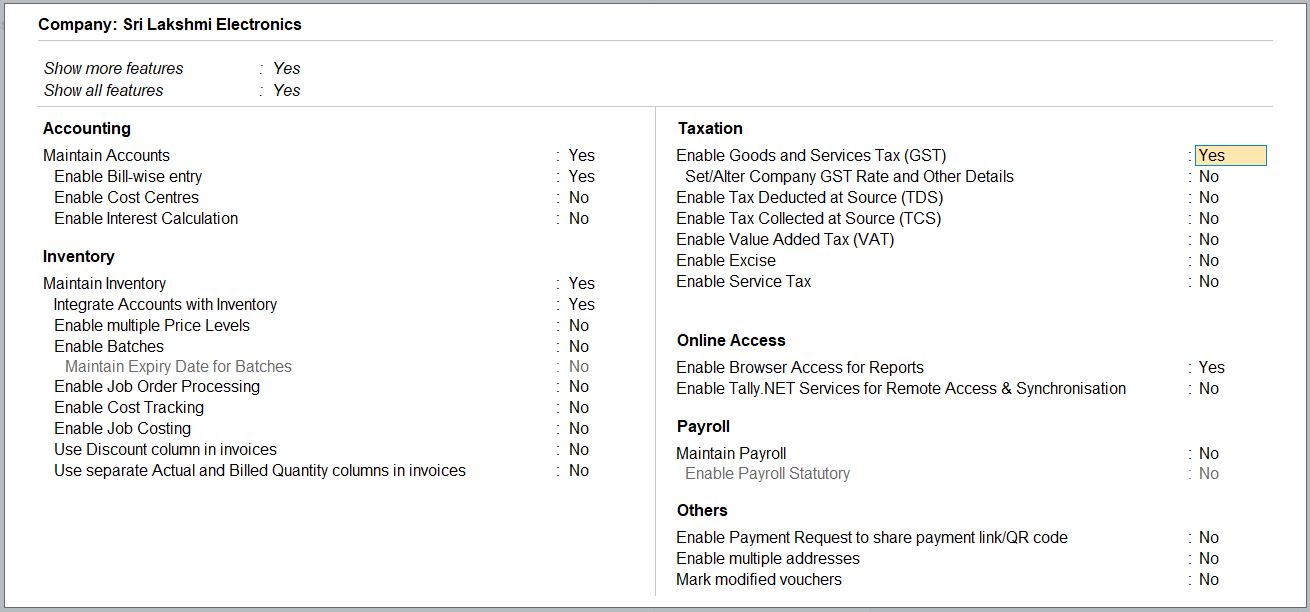

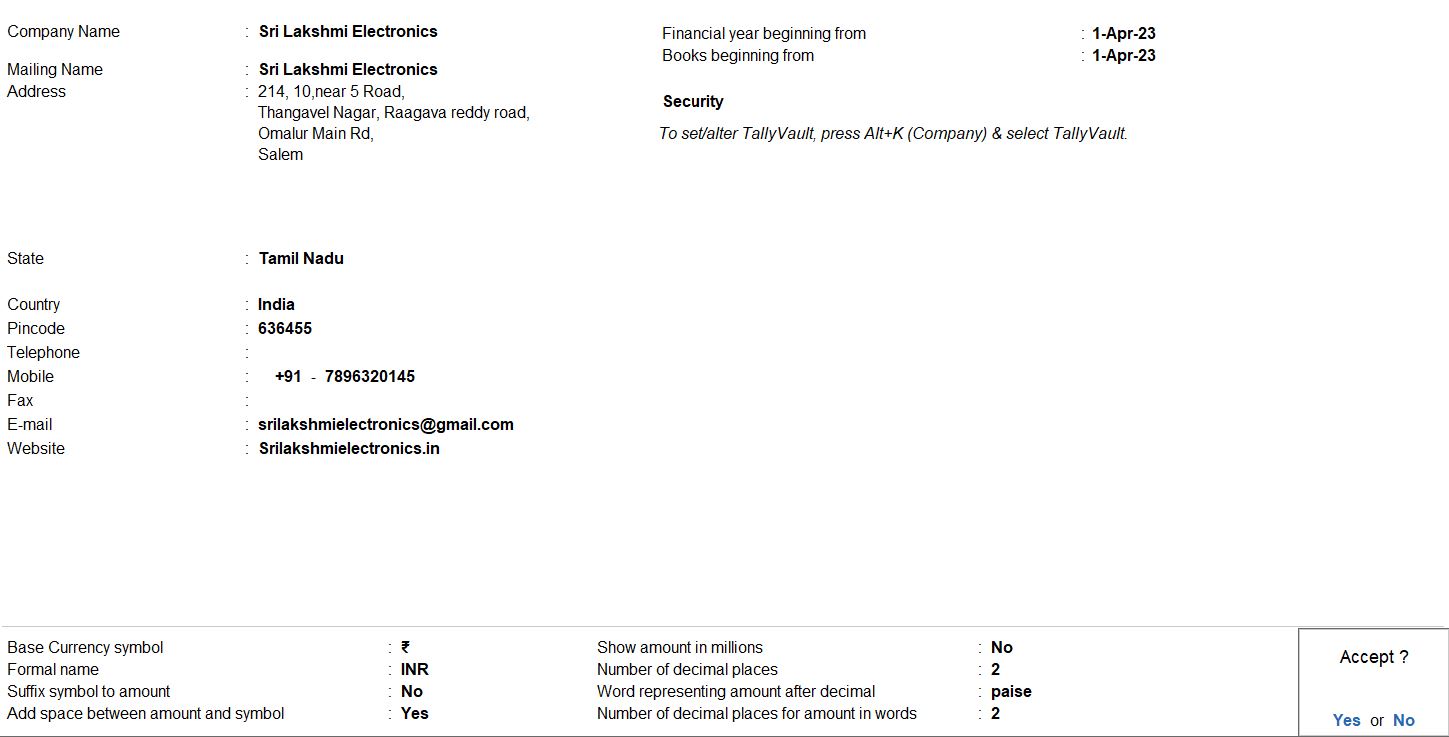

Company Creation

- Go to Gateway of Tally: Navigate to the Gateway of Tally from the main menu.

- Select "Create Company": Choose the "Create Company" option.

- Enter Company Details: Fill in the company details:

- Name: Sri Lakshmi Electronics

- Address: 214, 10, near 5 Road, Thangavel Nagar, Raagava reddy road, Omalur Main Rd, Salem - 636455

- Mobile No: 7896320145

- Email: srilakshmielectronics@gmail.com

- Website: Srilakshmielectronics.in

- Activate GST Option: Enable the Goods and Services Tax (GST) option by selecting "Yes" when prompted during the company creation process.

- GSTIN No: 33XXXXXXXXXXXR

- PAN Card No: XXXXXXXXXX

- Review and Confirm: Review the details entered for accuracy. Once you are satisfied, confirm the creation of the company.

- Save and Exit: After confirming, save the company details, and exit the company creation screen.

| Against the Field |

Action to be performed |

| Description |

Computer |

| HSN/SAC |

13022000 |

| Taxability |

Taxable |

| Integrated Tax |

18% |

- Go to Gateway of Tally: Access the Gateway of Tally from the main menu.

- Select "Inventory Masters": From the Gateway of Tally, choose "Inventory Info."

- Choose "Stock Items": Under "Inventory Masters," select "Stock Items" to create a new stock item.

- Create Stock Item: Press Alt + C to create a new stock item.

- Enter Details: Fill in the following details:

- Name: Computer

- Under: Select an appropriate group (e.g., "IT Equipment" or "Electronics").

- Alias: Enter an alias for the stock item if needed.

- Units: Specify the unit of measurement (e.g., "Nos" for numbers).

- Taxability: Set to "Taxable" since the item is taxable.

- Integrated Tax: Enter the tax rate for Integrated Tax (e.g., 18%).

- HSN/SAC: Enter the HSN or SAC for the item (e.g., 13022000).

- Save the Details: After entering all necessary details, press Ctrl + A to save the stock item.

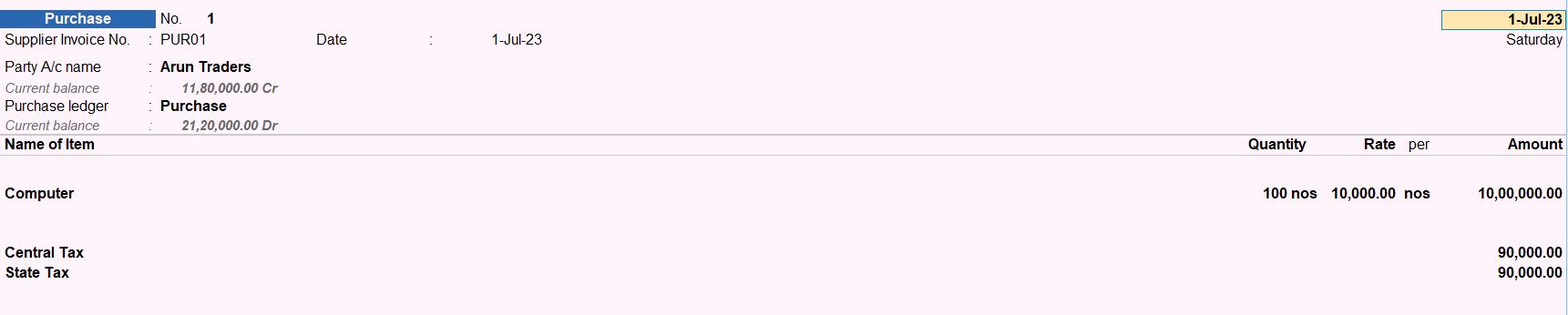

01-07-23 Purchase the following goods from Arun Traders, Tamil Nadu with Supplier Invoice No: MIT181905602 with GST tax 18%.

| Item |

Qty |

Rate |

| Computer |

100 |

10000 |

- Gateway of Tally: Access the Gateway of Tally.

- Select "Accounting Vouchers": Choose "Accounting Vouchers" from the available options.

- Create Purchase Voucher: Press F9 or click on "F9: Purchase" to create a new purchase voucher.

- Enter Supplier Invoice Details:

- Supplier Invoice No: MIT181905602

- Supplier's Name: Arun Traders

- Under: Select "Sundry Creditors" as the group under which the supplier falls.

- Tax Details:

- GST Tax Rate: 18%

- Integrated Tax (IGST): Since the supplier is from Tamil Nadu and the purchase is for inter-state transactions, select IGST.

- Taxable Value: Tally Prime will automatically calculate based on the entered quantity and rate.

- Enter GSTIN/UIN and PAN:

- Set/Alter GST Details: Yes

- Registration Type: Regular

- PAN: XXXXXXXXXX

- GSTIN/UIN: 33XXXXXXXXXX1Z9

- Enter Purchase Details:

- Item: Computer

- Quantity: 100 Nos

- Rate: Rs. 10,000 per unit

- Tax Details:

- GST Tax Rate: 18%

- CGST: Rs. 9,000

- SGST: Rs. 9,000

- Tally Prime will automatically calculate the tax amounts based on the taxable value and GST tax rate.

- Save the Voucher: Press Ctrl + A to save the purchase voucher.

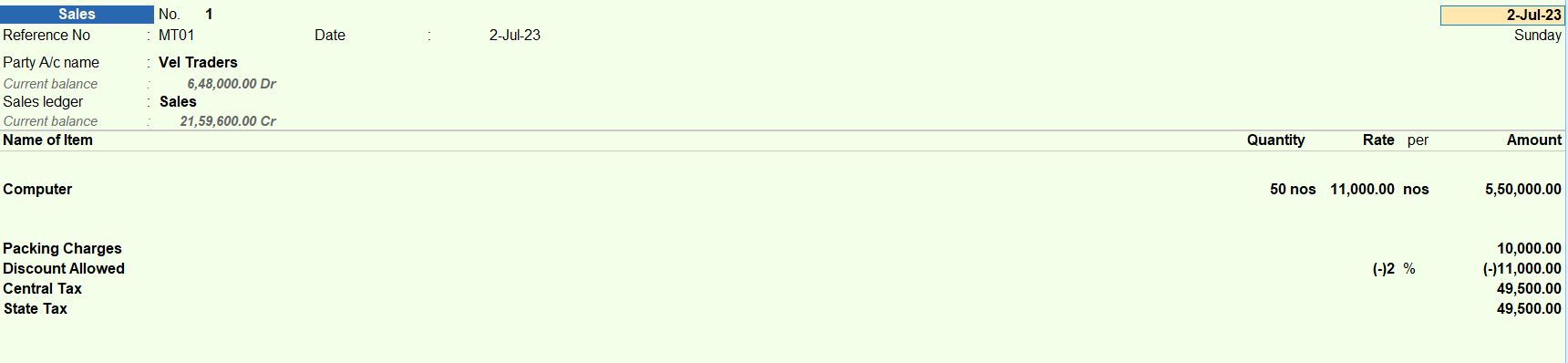

02-07-23 Sold the following goods to Vel Traders, Tamil Nadu with Reference no: VT/E/14419/23 with GST tax 18%.

| Item |

Qty |

Rate |

| Computer |

50 |

11000 |

Packing Charge Rs.10000

Discount Allowed @2% |

- Gateway of Tally: Navigate to the Gateway of Tally.

- Select "Accounting Vouchers": Choose "Accounting Vouchers" from the available options.

- Create Sales Voucher: Press F8 or click on "F8: Sales" to create a new sales voucher.

- Enter Reference Details:

- Reference No: VT/E/14419/23

- Enter Customer Details:

- Customer Name: Vel Traders

- Under: Select "Sundry Debtors" as the group under which the customer falls.

- Enter GSTIN/UIN and PAN:

- Set/Alter GST Details: Yes

- Registration Type: Regular

- PAN: XXXXXXXXXX

- GSTIN/UIN: 33XXXXXXXXXX1Z6

- Enter Sales Details:

- Item: Computer

- Quantity: 50 Nos

- Rate: Rs. 11,000 per unit

- Packing Charges: Rs. 10,000 (As an additional ledger)

- Tax Details:

- GST Tax Rate: 18%

- CGST: Rs. 9,000

- SGST: Rs. 9,000

- Tally Prime will automatically calculate the tax amounts based on the taxable value and the GST tax rate.

- Enter Discount:

- Discount Allowed: 2% (Enter as a negative value)

- Save the Voucher: Press Ctrl + A to save the sales voucher.

10-07-23 Sold the following goods to Rakesh Traders, Tamil Nadu with Reference no: SHD123405961 with Central tax 9% and State Tax 9%.

| Item |

Qty |

Rate |

| Computer |

29 |

20000 |

| Packing Charge Rs.30000 |

- Gateway of Tally: Navigate to the Gateway of Tally.

- Select "Accounting Vouchers": Choose "Accounting Vouchers" from the available options.

- Create Sales Voucher: Press F8 or click on "F8: Sales" to create a new sales voucher.

- Enter Reference Details:

- Reference No: SHD123405961

- Enter Customer Details:

- Customer Name: Rakesh Traders

- Under: Select "Sundry Debtors" as the group under which the customer falls.

- Enter Sales Details:

- Item: Computer

- Quantity: 29 Nos

- Rate: Rs. 20,000 per unit

- Packing Charges: Rs. 30,000 (As an additional ledger)

- Tax Details:

- Central Tax Rate: 9%

- State Tax Rate: 9%

- CGST: Rs. 25,200

- SGST: Rs. 25,200

- Tally Prime will automatically calculate the tax amounts based on the taxable value and the tax rates.

- Save the Voucher: Press Ctrl + A to save the sales voucher.

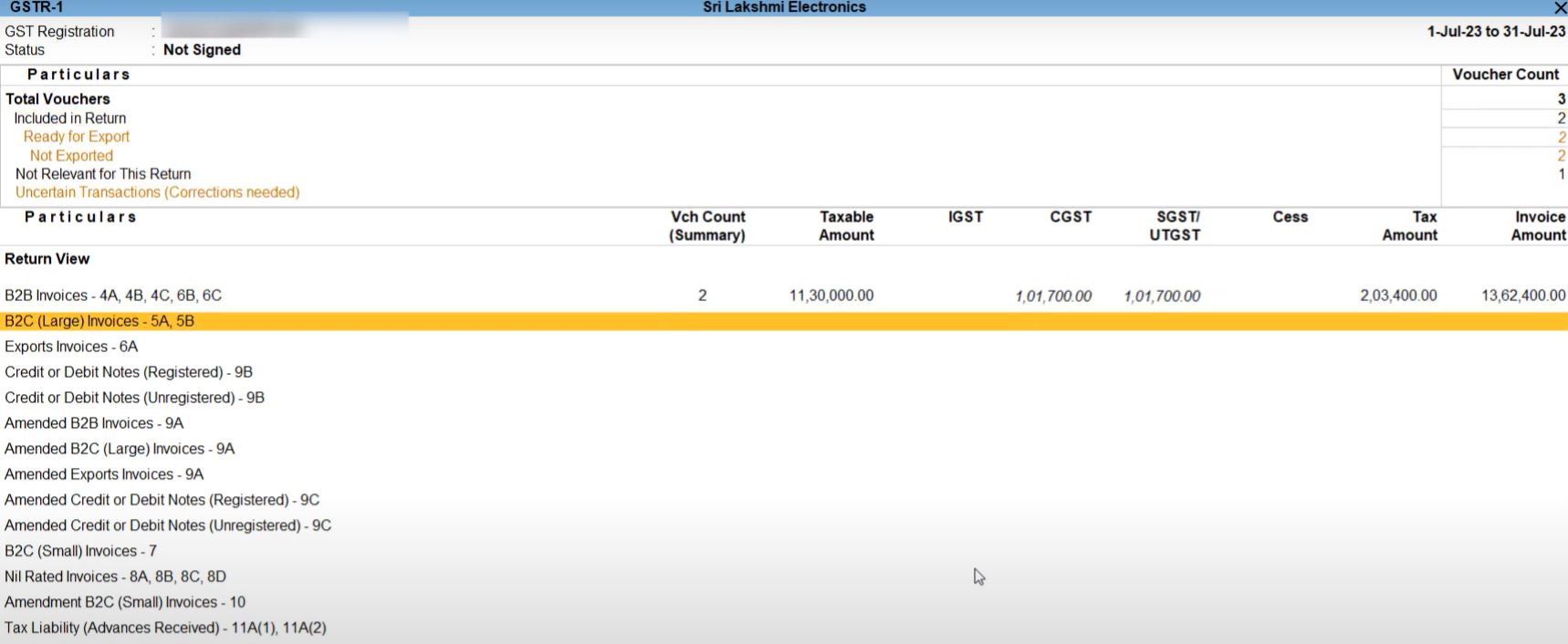

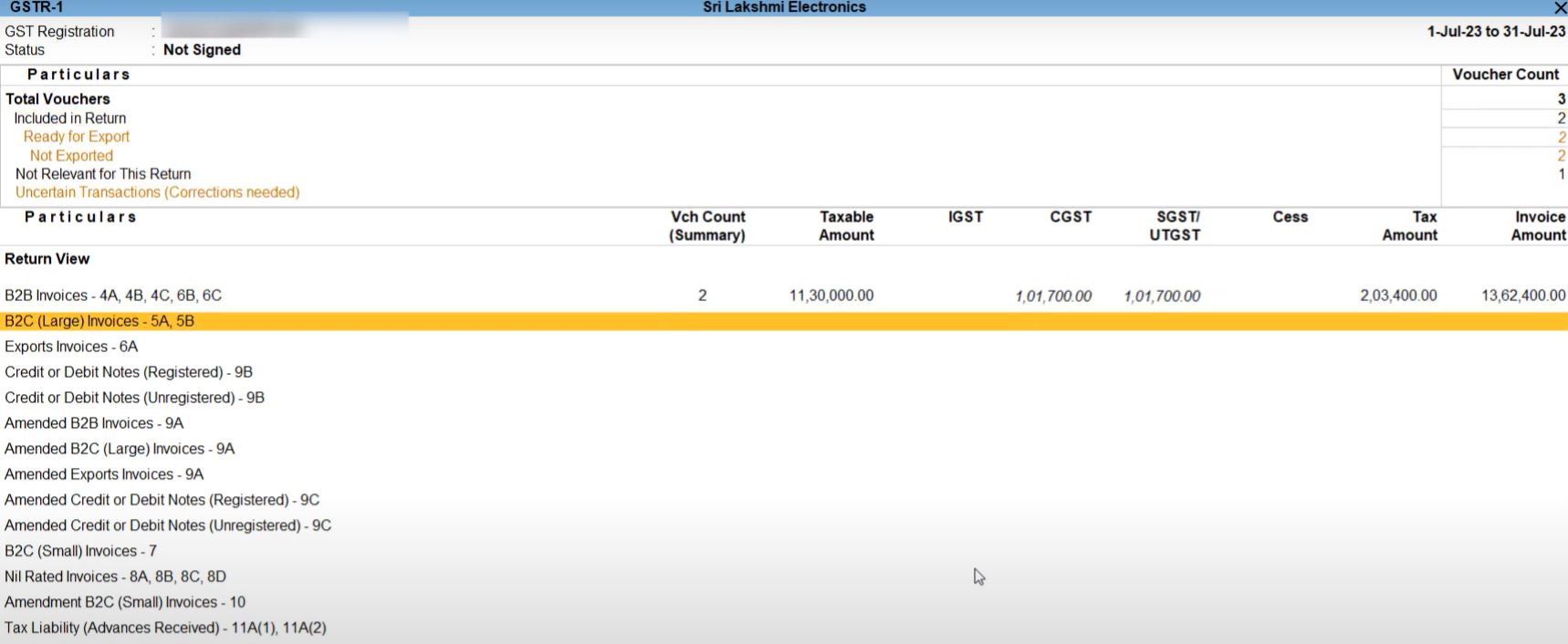

Reports

- Gateway of Tally: Navigate to the Gateway of Tally.

- Access Reports: From the Gateway of Tally, go to "Reports" and then "Display More Reports" to access the reports section.

- GSTR-1 Reconciliation Report: Under the GST Reports section, locate and select "GSTR-1 Reconciliation" from the list of available reports.

- Specify Reconciliation Period: You will be prompted to specify the reconciliation period for which you want to generate the report. Enter the desired period.

- View Report: Once the period is specified, Tally Prime will generate the GSTR-1 Reconciliation report. This report compares the data entered in Tally with the data expected to be uploaded to the GST portal for GSTR-1 filing.

- Review Details: Review the details provided in the report. It will typically include sections for outward supplies, inward supplies liable for reverse charge, amendments to taxable outward supplies, and other relevant information.

- Resolve Discrepancies: If there are any discrepancies between the data in Tally and what is expected for GSTR-1 filing, you can use this report to identify and resolve them. This might involve correcting entries, adding missing transactions, or making adjustments as necessary.

- Export or Print: You may choose to export the report to Excel or PDF format for further analysis or printing purposes.

- Close: After reviewing and taking necessary actions, close the report window.

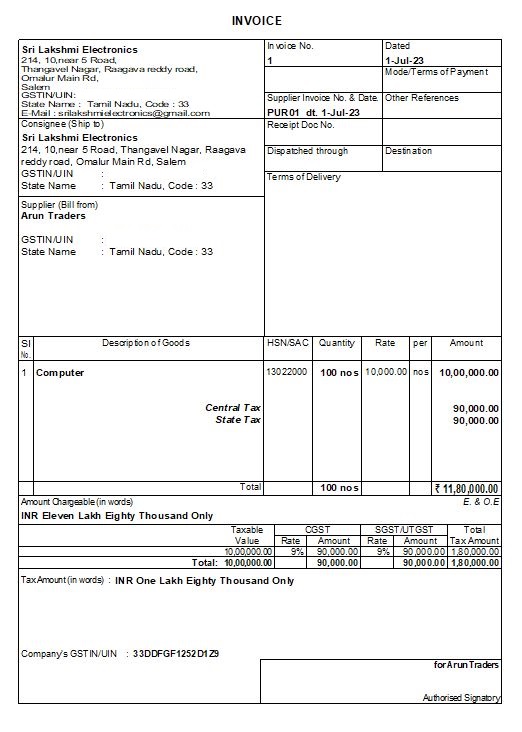

Purchase Invoice printing

- Gateway of Tally: Navigate to the "Accounting Vouchers" section from the Gateway of Tally.

- Select Purchase Voucher: Locate and select the purchase voucher you want to print the invoice for by pressing F9 or using the mouse.

- View Voucher: View the details of the selected purchase voucher on the screen.

- Print Invoice: Press Alt + P or click on the "Print" button from the button bar at the top of the screen.

- Select Printer: Choose the printer from the printer selection dialog box if you have multiple printers installed.

- Configure Print Settings: Optionally, configure print settings such as page layout, paper size, and orientation.

- Confirm Printing: Click on the "Print" button to confirm and start printing the purchase invoice.

- Review Printed Invoice: After printing, review the invoice to ensure all details are correct.

- Close: Close the print preview window after reviewing the printed invoice.