TCS in Tally Prime: A Comprehensive Introduction for Tally

TAX COLLECTED AT SOURCE

Introduction of TCS

- TDS stands for Tax Collected at Source.

- The concept of TDS was introduced in the Income Tax Act, 206C 1961.

- Collection of tax at source by the seller (Collector) from the buyer(Collectee/payee) on trading of the goods specified Act.

TCS Nature of Goods

| Sno | Nature of Goods | Rate(%) |

|---|---|---|

| 1 | Alcoholic for human consumption | 1% |

| 2 | Tendu leaves | 5% |

| 3 | Timber Obtained under a forest lease | 2.5% |

| 4 | Timber Obtained by any mode other than under a forest lease | 2.5% |

| 5 | Any other forest produce not being timber or Tendu leaves | 2.5% |

| 6 | Scrap | 1% |

Seller

- Central Government:

- Refers to the central governing authority of a country, responsible for administering and managing national-level affairs, including taxation and regulation.

- State Government:

- Refers to the governing authority of a specific state or province within a country, responsible for managing state-level affairs, including taxation and regulation.

- Any Local Authority:

- Includes entities such as municipal corporations, city councils, townships, or village councils that have administrative jurisdiction over a specific locality or area.

- Corporation or Authority Established by or Under a Central, State, or Provincial Act:

- Encompasses entities established by specific legislative acts at the central, state, or provincial level. These can include statutory bodies, regulatory authorities, or public-sector enterprises.

- Any Company:

- Refers to legally registered business entities formed under the Companies Act or similar legislation. Companies can be public or private and operate for-profit or non-profit.

- Firm

- Refers to a partnership or association of individuals carrying on a business together with a view to making a profit. A firm can be registered or unregistered.

- Co-operative Society:

- Refers to an autonomous association of individuals united voluntarily to meet their common economic, social, and cultural needs and aspirations through a jointly-owned and democratically-controlled enterprise.

Buyer

- Public Sector Company:

- Refers to a company where the majority of shares are owned by the government or its agencies. These companies operate in various sectors, including infrastructure, utilities, transportation, and finance.

- Central Government:

- Refers to the central governing authority of a country. The central government may engage in purchasing goods or services for various national-level projects, programs, or administrative needs.

- State Government:

- Refers to the governing authority of a specific state or province within a country. State governments may procure goods or services for state-level projects, programs, or administrative purposes.

- High Commission:

- A diplomatic mission of one Commonwealth country to another Commonwealth country, primarily representing the interests and citizens of the sending country. High commissions may engage in purchasing goods or services related to diplomatic functions, consular services, or administrative needs.

- Legation:

- Historically, a diplomatic mission located in a foreign country. While the term "legation" is less commonly used today, it may refer to diplomatic missions of certain countries. Similar to high commissions, legations may procure goods or services related to diplomatic functions or administrative requirements.

Returns & Timelines

| Financial Year | Form No | Particulars | Periodicity |

|---|---|---|---|

| 2008-09 | Form 27E | Annual return of collection of tax under section 206C of Income Tax Act 1961 | Annual |

| Form 27B | Physical control charts containing control totals mentioned in TCS returns furnished electronically. Form 27 E | With each e-TCS return Form 27 E | |

| 2008-09 | Form 27EQ | Quarterly return of collection of tax | Quarterly |

| Form 27B | Physical Control Charts Containing control totals mentioned in TCS returns finished electronically. Form 27B in physical form to be submitted along with e-TCS quarterly return Form 27EQ | With each e-TCS returns Form 27EQ |

TCS under GST

- Any dealer or traders selling goods online would get the payment from the online platform after deducting an amount tax @ 1 % under IGST Act. (0.5% in CGST & 0.5% in SGST)

- The tax would have to be deposited to the government by 10th of the next month.

- All the dealers/traders are required to get registered under GST compulsorily.

- These provisions are effective from 1st Oct 2018.

Applicability

- If you are a seller of goods such as timber wood, tendu leaves, scrap, and so on, then you must collect TCS at the time of sale.

- TCS will be charged for other goods as well when the value of sales or receipt crosses ₹50 lakhs for a particular party.

- This is applicable only for sellers whose annual income has exceeded ₹10 crore in the previous financial year.

Requirement of TCS

| Against the field | Action to be performed |

|---|---|

| TAN registration number | TAN registration number is given when TAN is applied |

| Tax deduction and collection account number(TAN) | TAN number |

| Collector type | Your Company type |

| Collector Branch/division | Enter city details |

| Set/alter details of person | Collector details |

Payment of Tax to the Income Tax Department

| Particulars | TCS Amount Deducted in (Months) | Due Date |

|---|---|---|

| In all Cases | March | 30 April of Next Year |

| All other months | 7th of succeeding month. (if the TCS is collected in May, then TCS tax needs to be deposited on or before 7th of June) | |

| Government | Payment made with challan | 7th of succeeding month |

| Payment made without challan | Same date of payments |

TCS in Tally

| Mukil Enterprises Pvt Ltd | |

|---|---|

| ADDRESS | 1505, H Block, 15th Main Rd, opposite to Parthasarathi Puram, T. Nagar, Chennai, Tamil Nadu 600017 |

| MOBILE NO | 020 1351 5375 |

| mukil2005@gmail.com | |

| WEBSITE | mukil2005.in |

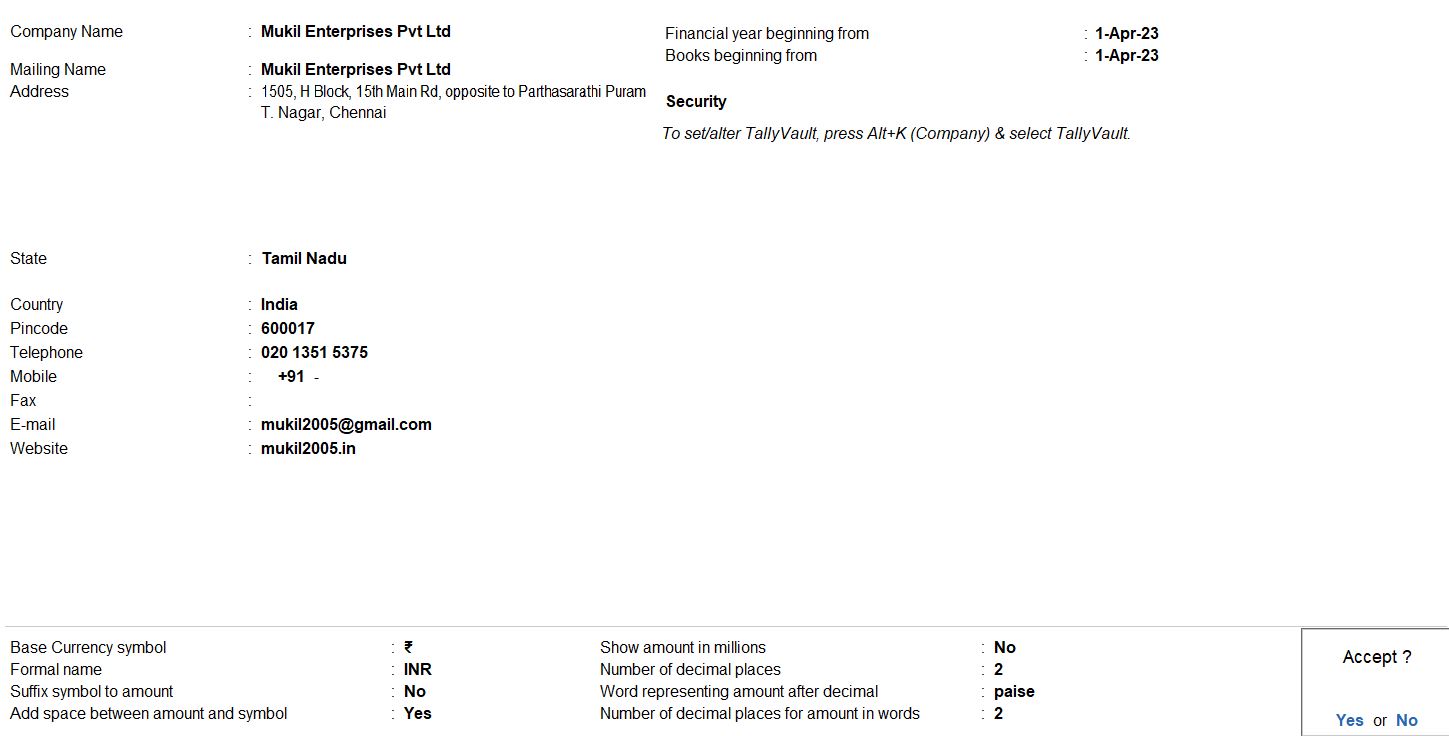

- Company Creation: Start by creating a new company profile for Mukil Enterprises Pvt Ltd in Tally Prime.

- Company Details: Input the company details such as company name, address, contact information, and other relevant details. Here are the details provided:

- Company Name: Mukil Enterprises Pvt Ltd

- Address: 1505, H Block, 15th Main Rd, opposite to Parthasarathi Puram, T. Nagar, Chennai, Tamil Nadu 600017

- Mobile No: 020 1351 5375

- Email: mukil2005@gmail.com

- Website: mukil2005.in

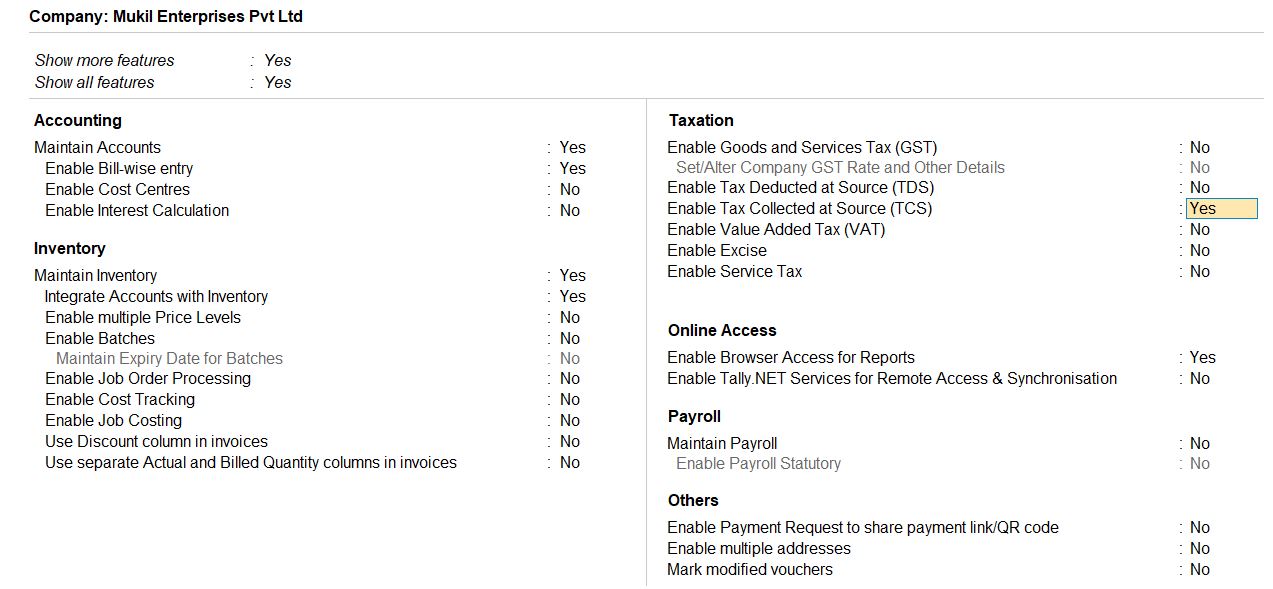

- Enable TCS in Tally Prime:

- Navigate to the Configuration screen.

- Choose "Features" or "Statutory and Taxation" depending on Tally Prime version.

- Look for "TCS" or "Tax Collected at Source" option.

- Enable TCS by selecting "Yes" for the option "Enable Tax Collected at Source (TCS)".

- Save Changes: Once you've enabled TCS, make sure to save the changes to ensure they are applied to the company profile.

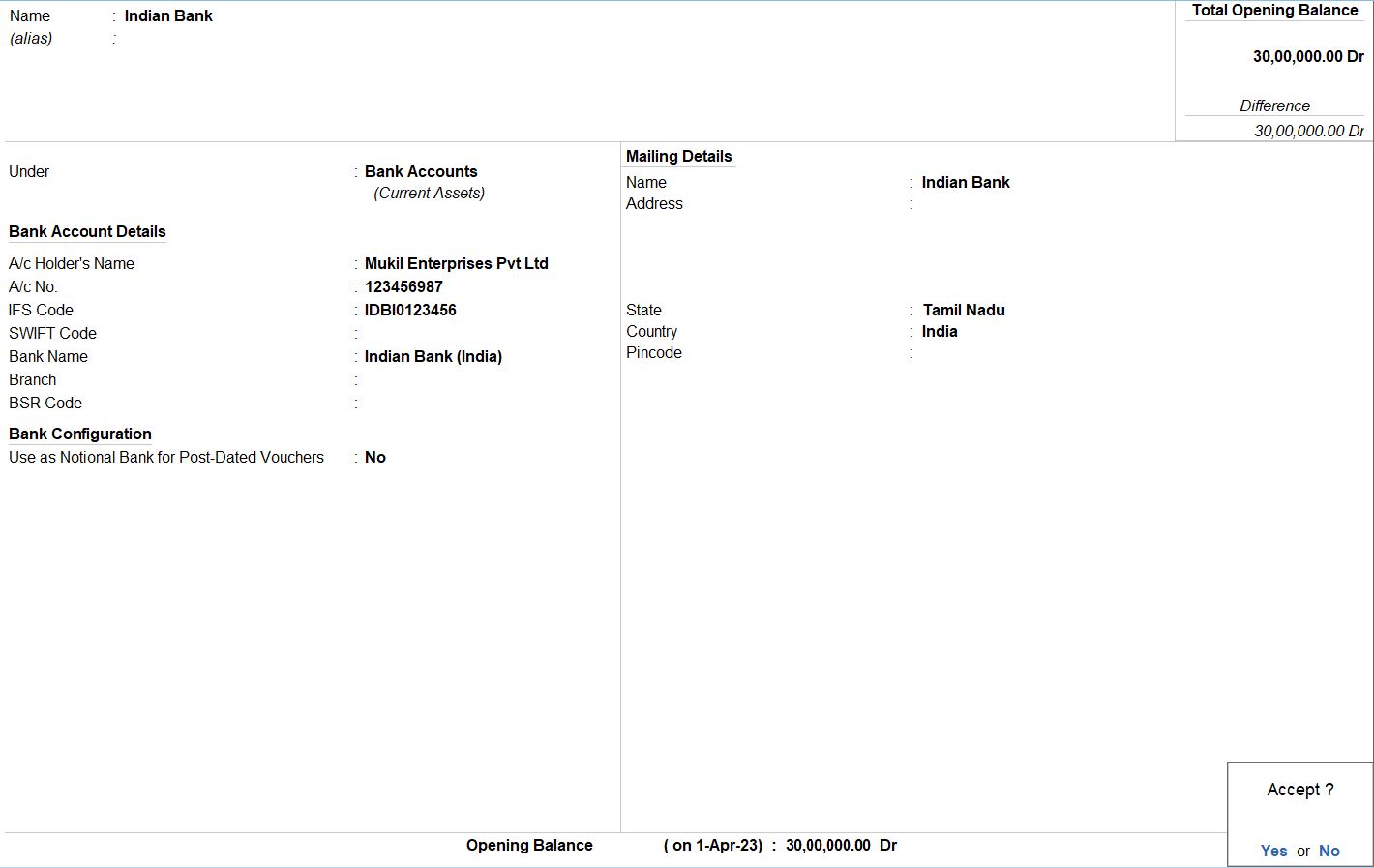

Create Bank Ledger

- Navigate to Ledger Creation:

- Open Tally Prime software.

- Go to the "Accounting Vouchers" section.

- Create New Ledger:

- From the menu, select "Accounts Info" and then "Ledgers."

- Choose "Create" to add a new ledger.

- Enter Ledger Details:

- Name: Enter "Indian Bank" as the name of the ledger.

- Under: Select "Bank Accounts" to categorize it properly.

- Bank Account Details:

- A/c Holder’s Name: Enter "Mukil Enterprises Pvt Ltd" as the account holder's name.

- A/c No: Input the account number, which is "123456987".

- IFSC Code: Enter the IFSC Code, which is "IDBI 0123456".

- Bank Name: Specify the bank name as "Indian Bank (India)".

- Opening Balance:

- Input the opening balance as Rs. 3,000,000.00.

- Save Changes:

- After entering all the necessary details, save the ledger.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions