Mastering TDS Reports in Tally Prime for Comprehensive Tax Analysis

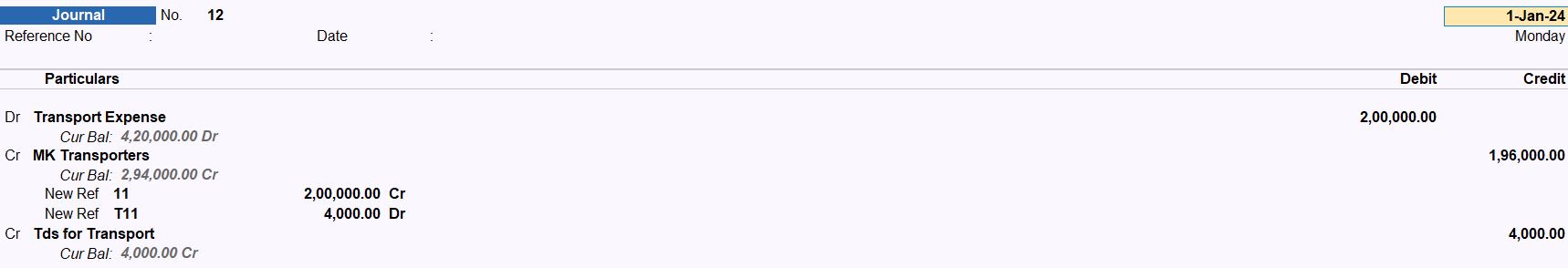

01-01-24 SS Motors received for Rs. 2,00,000 from MK Transporters towards Transport Expenses.

- Go to Gateway of Tally: From the Gateway of Tally screen, navigate to "Accounting Vouchers".

- Select Journal Voucher: Under Accounting Vouchers, select "F7: Journal".

- Enter Date: Input the date as "01-01-24".

- Enter Account Details:

- Debit: Select the account "Transport Expenses" and enter the amount as Rs. 200,000.

- Credit 1: Choose the account "Mk Transporters" and enter the amount as Rs. 196,000.

- Credit 2: Select the account "TDS for Transport" and enter the amount as Rs. 4,000.

- Save the Voucher: Once you've entered all the details, save the journal voucher.

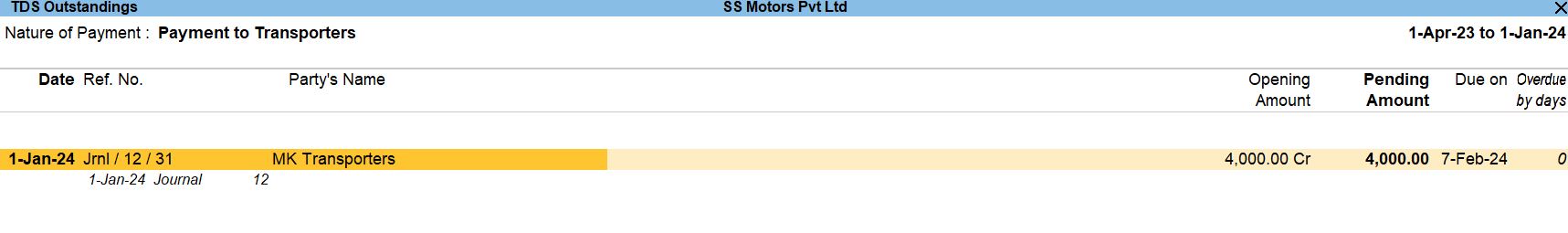

TDS Outstanding

- Accessing TDS Reports: Start by accessing the TDS reports section in Tally Prime and navigate to the Form 26Q report.

- Selecting "TDS Outstanding": Within the Form 26Q report, look for the option labeled "TDS Outstanding" or something similar. Selecting this option will display a list of transactions where TDS amounts are due but have not been remitted to the government.

- Viewing Outstanding Transactions: Tally Prime will present a list of transactions where TDS amounts are outstanding. These could include transactions where TDS has been deducted but not deposited with the tax authorities.

- Identifying Outstanding Amounts: Users can easily identify the outstanding TDS amounts by reviewing the list of transactions displayed in the TDS Outstanding report. The report typically includes details such as the deductee's name, PAN, transaction amount, TDS amount deducted, and the due date for remittance.

- Managing Outstanding TDS: Users can take appropriate actions to manage outstanding TDS amounts. This may involve reconciling TDS amounts deducted with those deposited to ensure compliance with tax regulations.

- Generating Reports: Users can generate detailed reports from the TDS Outstanding section to analyze outstanding TDS amounts, track payment due dates, and take necessary steps to remit the outstanding amounts to the tax authorities.

- Follow-up and Remittance: Based on the information provided in the TDS Outstanding report, users can follow up with relevant stakeholders, such as deductees and financial institutions, to ensure timely remittance of outstanding TDS amounts to the government.

- Maintaining Compliance: It's crucial to regularly review the TDS Outstanding report and take prompt action to remit any outstanding TDS amounts to maintain compliance with tax laws and regulations.

- Gateway of Tally → Display More Reports → Statutory Reports → TDS Outstandings

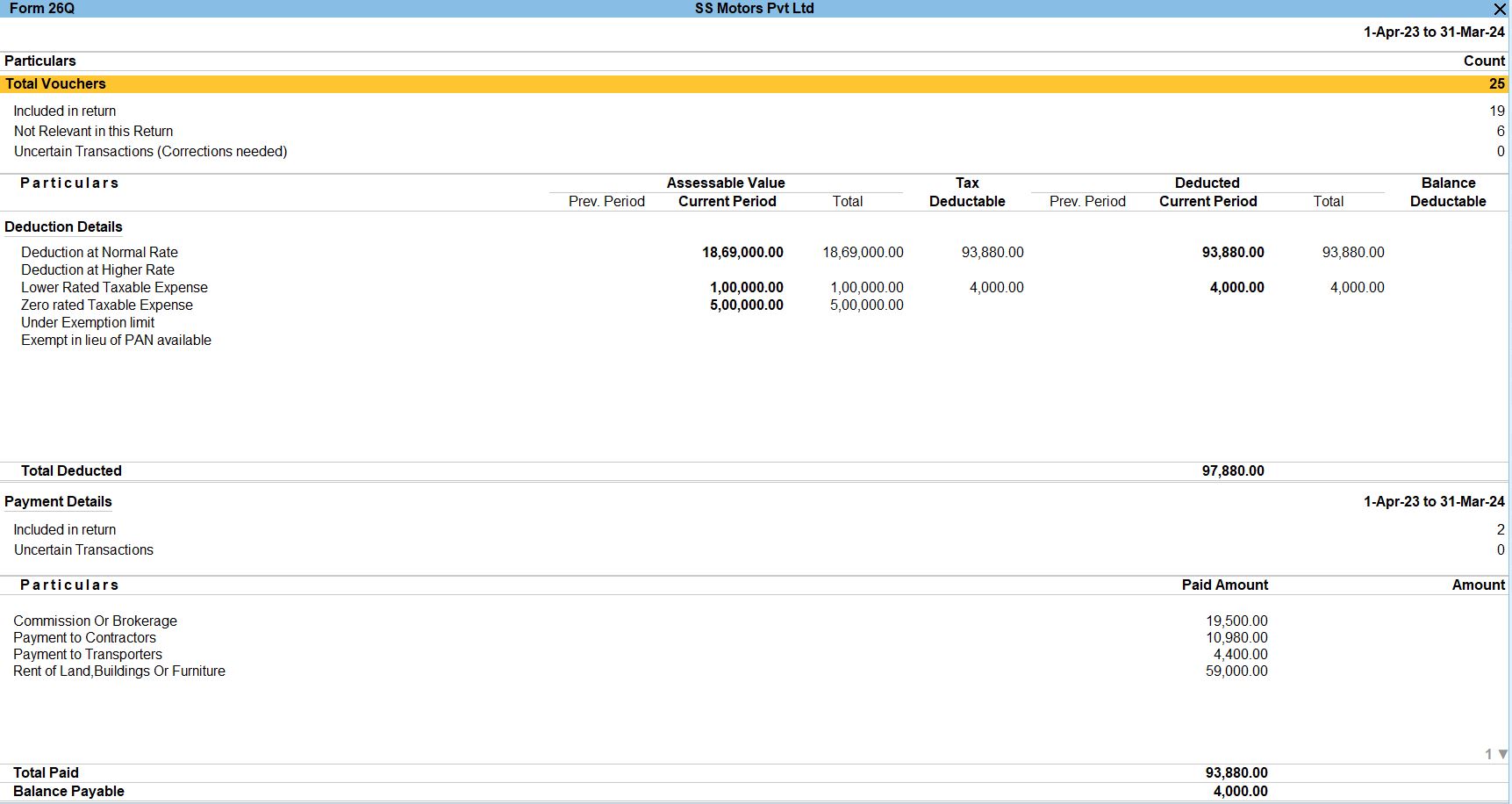

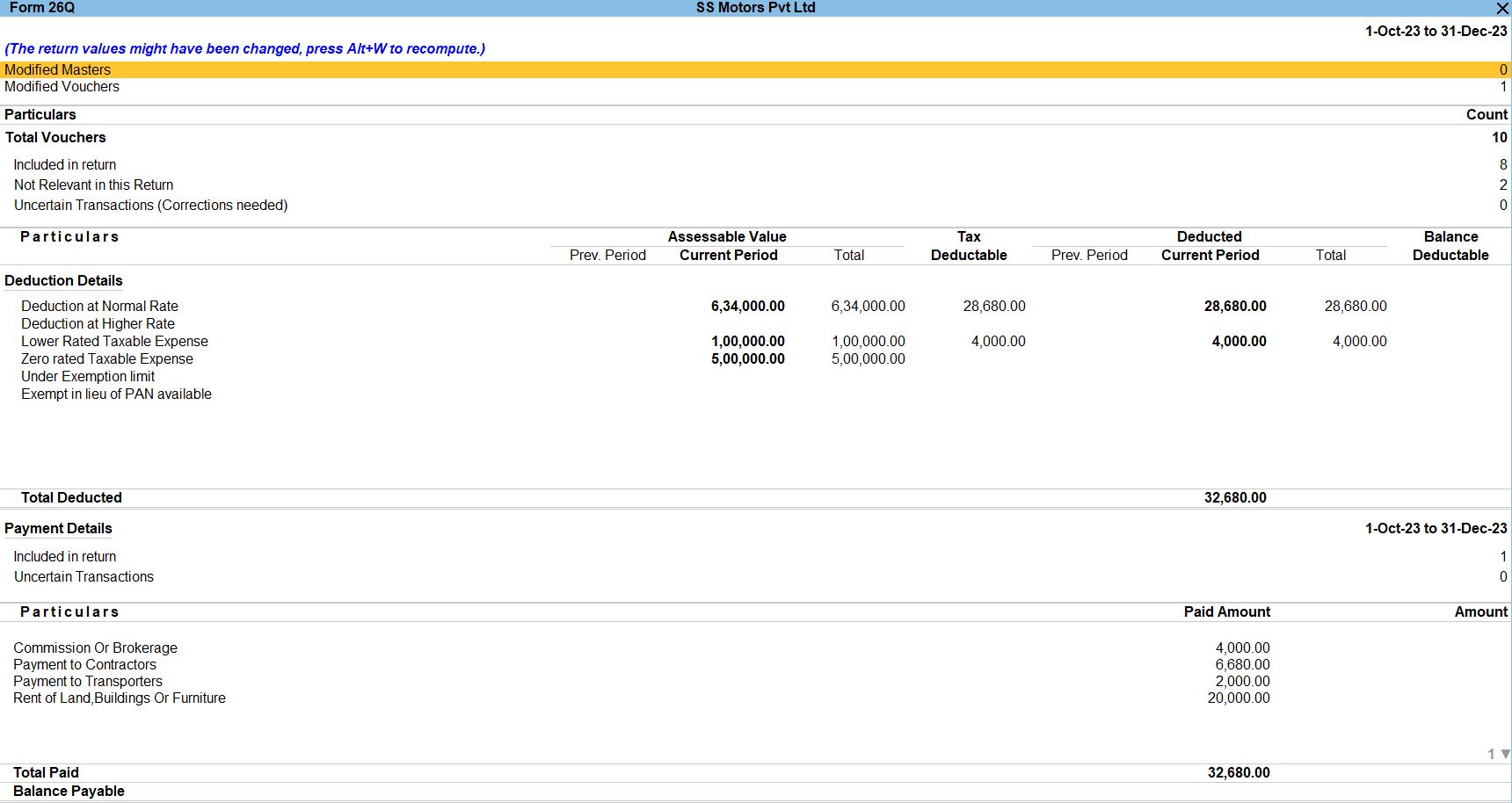

Form 26Q

- Go to Gateway of Tally: From the Gateway of Tally screen, navigate to "Reports".

- Select TDS Reports: Under Reports, select "TDS (Tax Deducted at Source)".

- Choose Form 26Q: In the TDS reports menu, select "Form 26Q".

- Set Appropriate Period: Specify the appropriate period for which you want to generate the Form 26Q report. This could be monthly, quarterly, or annually, depending on your requirements.

- Customize Report: You can customize the report further by selecting options such as Deductor Type, Deductee Type, etc., as per your requirements.

- View Report: After selecting the necessary options, view the Form 26Q report on the screen.

- Print or Export Report: You can print the report directly from Tally Prime or export it to different file formats such as PDF or Excel for further analysis or sharing.

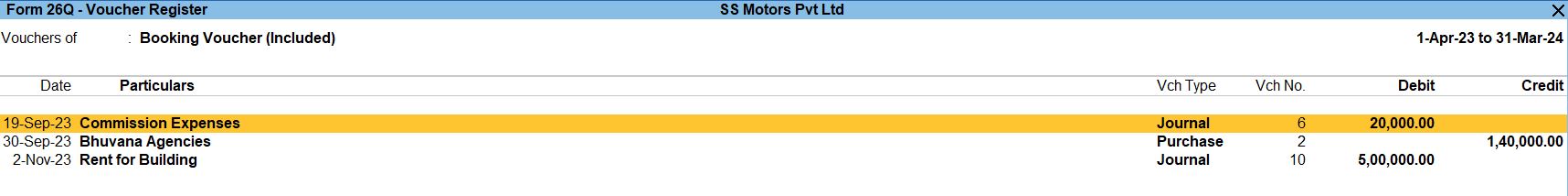

Booking Voucher

- Open the Voucher: Open the voucher for which you want to book TDS transactions. This could be a payment voucher, receipt voucher, journal voucher, or any other relevant voucher where TDS is applicable.

- Enter TDS Details: In the voucher entry screen, enter the details of TDS applicable to the transaction. This includes the TDS ledger account, TDS amount, and any other relevant information.

- Ensure Correct Deductee Details: Make sure that the deductee details, such as their PAN number and other particulars, are correctly entered in the voucher. This is essential for accurate reporting in Form 26Q.

- Save the Voucher: After entering all the necessary details, save the voucher.

- Include in Form 26Q: When you generate the Form 26Q report from Tally Prime, the software automatically includes the TDS transactions booked in vouchers. Ensure that you select the appropriate period and other parameters while generating the report.

- Verify the Report: Once the Form 26Q report is generated, review it to ensure that all TDS transactions are correctly included. Verify the deductee details, TDS amounts, and other information for accuracy.

- File TDS Returns: After verifying the Form 26Q report, you can use it to file TDS returns with the Income Tax Department as per the applicable guidelines and deadlines.

- Gateway of Tally → Display More Reports → Statutory Reports → Form 26Q → Included in return → Booking voucher

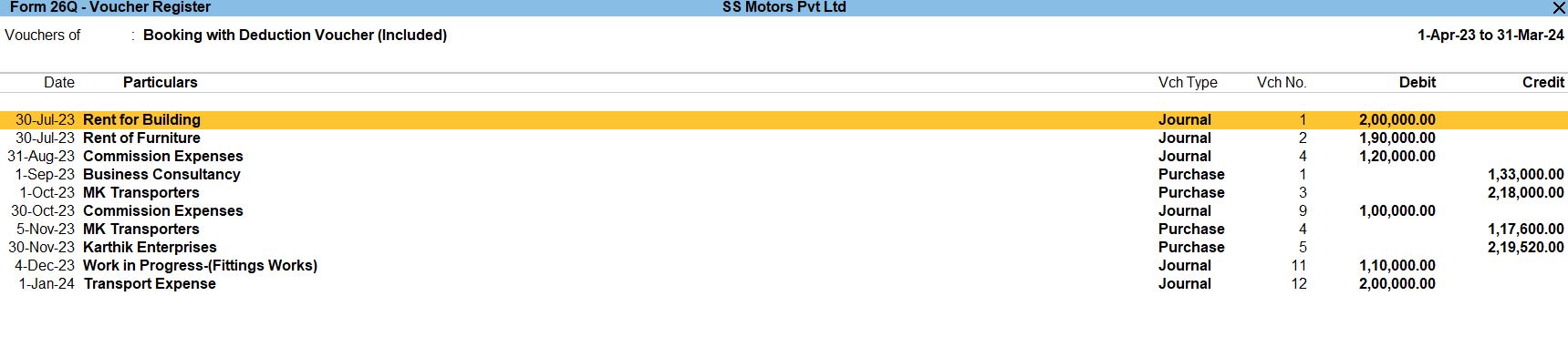

Booking with Deduction Voucher

- Open Deduction Voucher: Start by opening the deduction voucher where TDS needs to be recorded. This could be any voucher type such as a payment voucher, receipt voucher, or contra voucher, depending on the nature of the transaction.

- Enable TDS Feature: Ensure that the TDS feature is enabled in Tally Prime and that the necessary TDS masters and ledgers are configured correctly. This includes setting up TDS deduction rates, deductee details, and TDS ledger accounts.

- Enter Transaction Details: While entering the deduction voucher, you'll find an option to specify TDS details directly within the voucher entry screen. This includes selecting the appropriate TDS ledger account, entering the TDS amount, and providing other relevant information such as deductee details and TDS section.

- Save the Voucher: After entering all required details, save the deduction voucher. Tally Prime will automatically record the TDS transaction along with the deduction voucher entry.

- Generate Form 26Q Report: When you generate the Form 26Q report in Tally Prime, select the option "Booking with Deduction Voucher". This ensures that TDS transactions recorded through deduction vouchers are included in the report.

- Review and Verify: Once the Form 26Q report is generated, review it to ensure that all TDS transactions, including those recorded through deduction vouchers, are accurately reflected. Verify deductee details, TDS amounts, and other information for accuracy.

- File TDS Returns: Use the Form 26Q report to prepare and file TDS returns with the Income Tax Department as per the prescribed guidelines and deadlines. Ensure compliance with TDS regulations and maintain proper documentation for future reference.

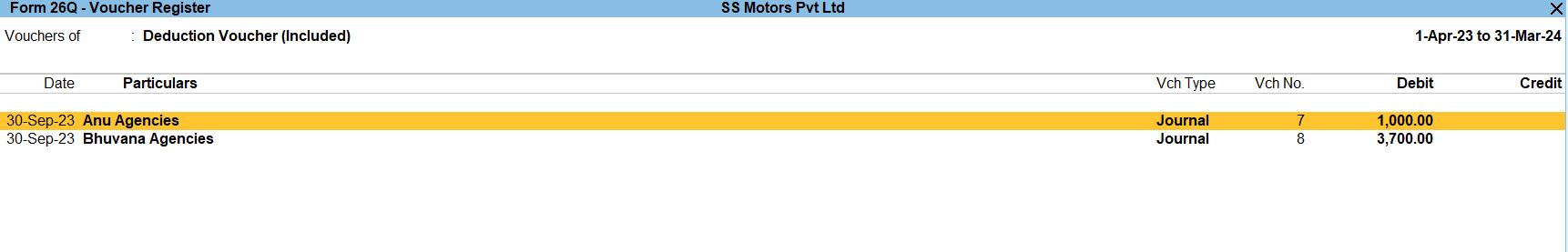

Deduction Voucher

- Access Deduction Voucher: Begin by accessing the deduction voucher where the TDS needs to be accounted for. This could be various types of vouchers such as payment, receipt, contra, or journal vouchers, depending on the transaction.

- Enable TDS Feature: Ensure that the TDS feature is activated in Tally Prime, and all necessary TDS masters and ledgers are set up correctly. This includes defining TDS deduction rates, configuring deductee details, and setting up TDS ledger accounts.

- Enter Transaction Details: While entering the deduction voucher, you'll have the option to input TDS details directly within the voucher entry screen. This includes selecting the appropriate TDS ledger account, inputting the TDS amount, and providing relevant information such as deductee details and TDS section.

- Save the Voucher: After entering all required details, save the deduction voucher. Tally Prime will automatically record the TDS transaction and associate it with the deduction voucher entry.

- Generate Form 26Q Report: When generating the Form 26Q report in Tally Prime, choose the option "Deduction Voucher". This ensures that TDS transactions recorded through deduction vouchers are included in the report.

- Review and Verify: Once the Form 26Q report is generated, review it to ensure that all TDS transactions, associated with deduction vouchers, are accurately reflected. Verify deductee details, TDS amounts, and other information for accuracy.

- File TDS Returns: Utilize the Form 26Q report to prepare and file TDS returns with the appropriate tax authorities in accordance with the prescribed guidelines and deadlines. Ensure compliance with TDS regulations and maintain proper documentation for audit purposes.

- Gateway of Tally → Display More Reports → Statutory Reports → Form 26Q → Included in return → Deduction Voucher

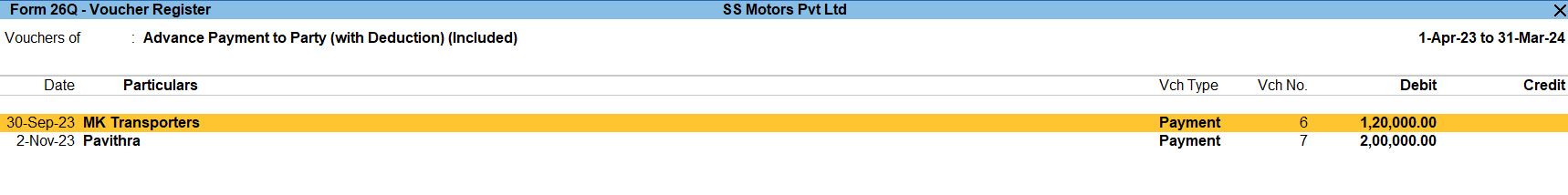

Advance Payment to Party (with Deduction)

- Access Advance Payment Voucher: Begin by accessing the advance payment voucher where the advance payment needs to be accounted for. This voucher is typically used when a business makes an advance payment to a party before the actual goods or services are received.

- Enable TDS Feature: Ensure that the TDS feature is activated in Tally Prime, and all necessary TDS masters and ledgers are set up correctly. This includes defining TDS deduction rates, configuring deductee details, and setting up TDS ledger accounts.

- Enter Transaction Details: While entering the advance payment voucher, you'll have the option to input TDS details directly within the voucher entry screen. This includes selecting the appropriate TDS ledger account, inputting the TDS amount, and providing relevant information such as deductee details and TDS section.

- Save the Voucher: After entering all required details, save the advance payment voucher. Tally Prime will automatically record the TDS transaction associated with the advance payment.

- Generate Form 26Q Report: When generating the Form 26Q report in Tally Prime, choose the option "Advance Payment to Party (with Deduction)". This ensures that advance payments made with TDS deduction are included in the report.

- Review and Verify: Once the Form 26Q report is generated, review it to ensure that all advance payment transactions, associated with TDS deduction, are accurately reflected. Verify deductee details, TDS amounts, and other information for accuracy.

- File TDS Returns: Utilize the Form 26Q report to prepare and file TDS returns with the appropriate tax authorities in accordance with the prescribed guidelines and deadlines. Ensure compliance with TDS regulations and maintain proper documentation for audit purposes.

- Gateway of Tally → Display More Reports → Statutory Reports → Form 26Q → Included in return → Advance Payment to Party (with Deduction)

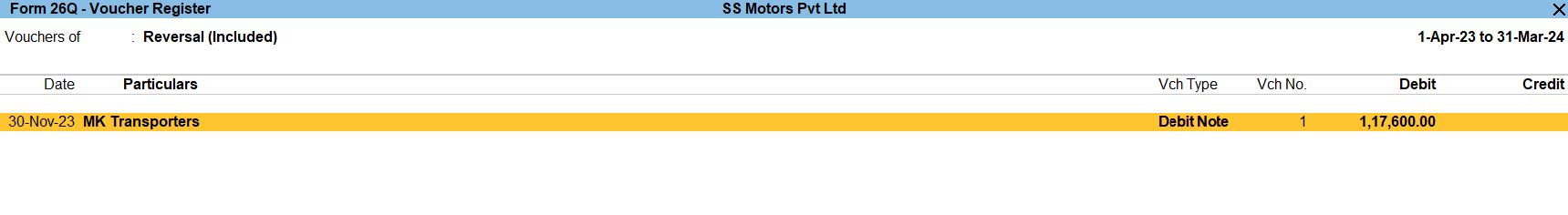

Reversal

- Access Reversal Voucher: Begin by accessing the voucher entry screen for the transaction where the TDS deduction needs to be reversed. This could be a payment voucher, journal voucher, or any other relevant voucher type where the original TDS deduction was recorded.

- Enable TDS Feature: Ensure that the TDS feature is activated in Tally Prime and all necessary TDS masters and ledgers are set up correctly. This includes defining TDS deduction rates, configuring deductee details, and setting up TDS ledger accounts.

- Enter Reversal Transaction Details: While entering the reversal voucher, specify the details related to the original transaction where TDS was deducted. This includes referencing the original voucher number, providing details about the TDS deduction amount, deductee information, and TDS section.

- Reverse TDS Deduction: Within the reversal voucher, use appropriate ledger accounts to reverse the TDS deduction amount. This typically involves debiting the TDS ledger account and crediting the relevant expense or income ledger account where the original TDS deduction was recorded.

- Save the Reversal Voucher: After entering all necessary details and reversing the TDS deduction, save the reversal voucher in Tally Prime.

- Generate Form 26Q Report: When generating the Form 26Q report in Tally Prime, ensure that the option for including reversals is selected. This will ensure that reversed TDS deductions are appropriately reflected in the report.

- Review and Verify: Once the Form 26Q report is generated, review it to ensure that all reversal transactions are accurately reflected. Verify deductee details, reversal amounts, and other information for accuracy.

- File TDS Returns: Utilize the Form 26Q report to prepare and file TDS returns with the appropriate tax authorities. Ensure compliance with TDS regulations and maintain proper documentation for audit purposes. Gateway of Tally → Display More Reports → Statutory Reports → Form 26Q → Included in return → Reversal.

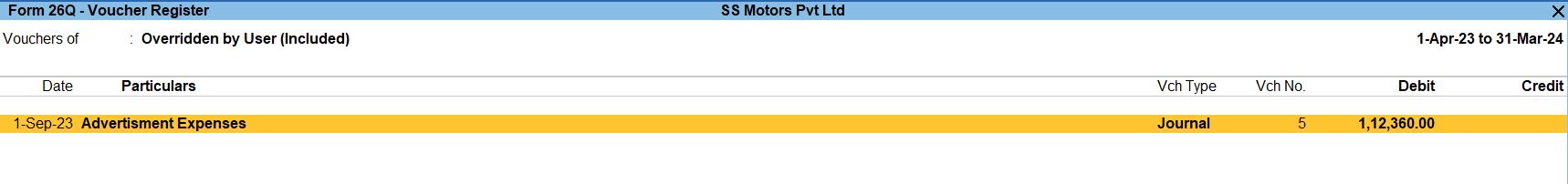

Overridden by User

- Accessing TDS Reports: Start by accessing the TDS reports section in Tally Prime, specifically the Form 26Q report.

- Selecting "Overridden by User": Within the Form 26Q report, look for the option labeled "Overridden by User" or something similar. Selecting this option will display a list of TDS transactions where users have manually overridden certain information.

- Viewing Overridden Transactions: Tally Prime will present a list of transactions where users have intervened to manually modify TDS-related details. This could include changes to the TDS amount, TDS rate, deductee PAN, section code, etc.

- Understanding Reasons for Overrides: Users may override TDS-related information for various reasons, such as correcting errors, adjusting TDS amounts based on specific circumstances, accommodating special cases, etc.

- Reviewing Overrides: Users should carefully review transactions where overrides have been applied to ensure that the modifications are accurate and justified. It's essential to maintain accuracy and compliance with tax regulations while making manual adjustments.

- Documenting Overrides: It's good practice to document the reasons for overrides and maintain a record of such modifications for audit and compliance purposes. This helps in providing a clear explanation of why changes were made to TDS-related information.

- Audit Trail: Tally Prime maintains an audit trail of all changes made to TDS transactions, including overrides. This allows administrators and auditors to track modifications and verify the integrity of the data.

- Ensuring Compliance: While users have the flexibility to override TDS-related information, it's crucial to ensure that such overrides are made in accordance with tax laws and regulations. Any deviations should be well-documented and supported by valid reasons.

- Generating Reports: Users can generate reports from the "Overridden by User" section to analyze overridden transactions, track the reasons for overrides, and ensure compliance with tax laws.

- Gateway of Tally → Display More Reports → Statutory Reports → Form 26Q → Included in return → Overridden by User

Return Transaction Book

- Accessing TDS Reports: Start by accessing the TDS reports section in Tally Prime, specifically the Form 26Q report.

- Selecting Return Transaction Book: Within the Form 26Q report, look for the option labeled "Return Transaction Book" or something similar. Select this option to access the detailed list of TDS transactions.

- Viewing Transaction Details: Tally Prime will display a list of all TDS transactions recorded in the software. This includes transactions where TDS has been deducted or collected, along with relevant details such as the deductee name, PAN number, transaction date, amount, TDS amount, etc.

- Filtering Transactions: Users can apply filters to narrow down the list of transactions based on criteria such as date range, deductee type, TDS section, etc. This helps in focusing on specific transactions or subsets of data as required.

- Sorting and Grouping: Tally Prime allows users to sort and group transactions based on different parameters such as transaction date, deductee name, TDS section, etc. This helps in organizing the data for better analysis and review.

- Exporting Data: Users can export the transaction data from Tally Prime to external formats such as Excel or PDF for further analysis, reporting, or sharing with stakeholders.

- Reviewing Compliance: The Return Transaction Book provides a comprehensive overview of TDS transactions, allowing users to review compliance with tax regulations and identify any discrepancies or errors that need to be addressed.

- Correcting Errors: If any errors or discrepancies are identified during the review, users can make corrections directly within Tally Prime by editing or deleting transactions as necessary.

- Maintaining Records: Ensure that accurate records of TDS transactions are maintained in Tally Prime for audit and compliance purposes. This includes documenting any corrections or adjustments made to the data.

- Generating Reports: Users can generate reports from the Return Transaction Book to analyze TDS data, track compliance status, and prepare for filing TDS returns with the tax authorities.

- Gateway of Tally → Display More Reports → Statutory Reports → Form 26Q → Return Transaction Book

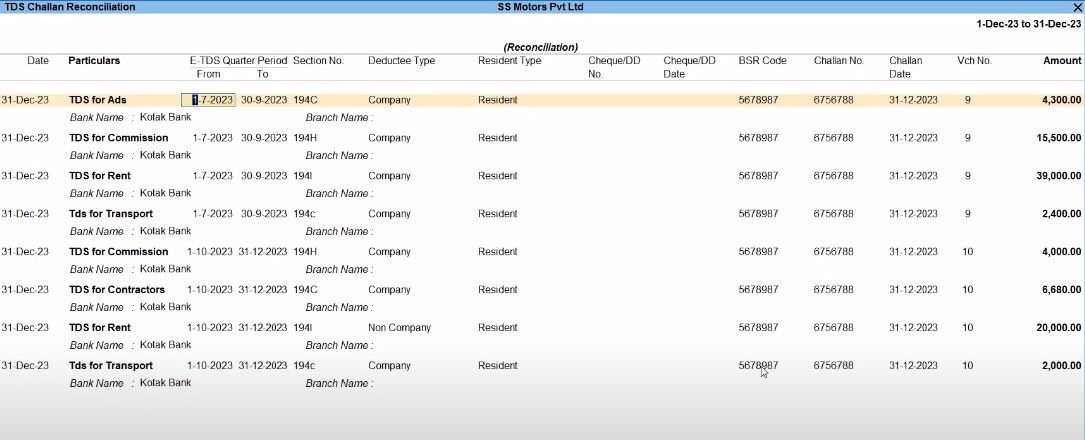

Challan Reconciliation

- Accessing TDS Reports: Start by accessing the TDS reports section in Tally Prime, specifically the Form 26Q report.

- Selecting Challan Reconciliation: Within the Form 26Q report, there should be an option labeled "Challan Reconciliation" or something similar. Select this option to initiate the reconciliation process.

- Viewing Challan Details: Tally Prime will display a list of challans that have been used to deposit TDS payments. These challans contain details such as the challan number, date, amount deposited, and the relevant deductee details.

- Matching Deductions: Users need to match the deductions made in transactions with the corresponding challans where TDS payments were made. This involves verifying that the amount deducted in transactions matches the TDS payments made through challans.

- Reconciliation Process: Tally Prime provides tools to reconcile deductions with challans. Users can mark deductions as reconciled when they match the payments made through challans. This helps ensure that all TDS payments are appropriately accounted for.

- Unreconciled Transactions: If there are any discrepancies or unreconciled transactions, users can investigate and resolve them as needed. This may involve verifying transaction details, checking for missed deductions or incorrect challan entries, and making necessary adjustments.

- Saving Reconciliation Data: Once the reconciliation process is complete, users can save the reconciliation data within Tally Prime. This helps maintain accurate records and ensures that TDS payments are properly accounted for.

- Generating Reports: After reconciliation, users can generate reports to view the status of TDS payments and deductions. These reports provide insights into the reconciliation process and help ensure compliance with tax regulations.

- Compliance and Documentation: Ensure that all TDS payments and deductions are reconciled accurately to comply with tax regulations. Maintain proper documentation and records of the reconciliation process for audit and compliance purposes.

- Gateway of Tally → Display More Reports → Statutory Reports → Form 26Q → Challan Reconciliation

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions