Bank Reconciliation Statement in Tally Prime

What is BRS?

- A bank reconciliation statement is a summary of all the transactions (deposits, withdrawals, extra charges, and interest) on a company's bank account and its equation with its financial records.

Bank Reconciliation Statement

- Compare the deposits.

- Adjust the bank statements.

- Adjust the cash account.

- Compare the balances.

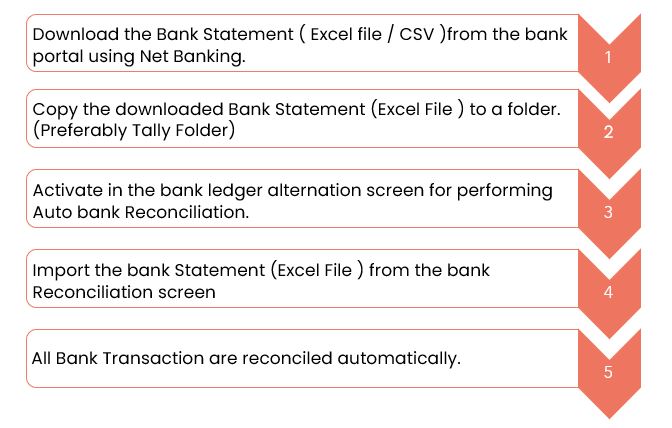

Auto Bank Reconciliation

How is Tally helpful in the Bank Reconciliation process

- Minimize the time spent and the risk of making errors.

- Enhanced the bank reconciliation capability.

- Provides facility to select the formats, configuration and input file type

- Supports Excel CSV, and MT940 formats.

Auto Bank Reconciliation

The following would be Recording in Journal Using Double Entry System. Do the Posting Process from Journal Entries And Prepare The Trial Balance, Trading A/C, Profit & Loss A/C, Balance Sheet, and bank reconciliation statement also in The Books of M/S. RAMAN PVT LTD for the following year 2022 to 2023.

| PARTICULAR | DR | CR |

|---|---|---|

| Capital | 380,000 | |

| Cash | 100,000 | |

| Federal Bank | 350,000 | |

| Bank O/D | 50,000 | |

| Furniture | 82,000 | |

| Land & Building | 50,000 | |

| Bills receivable | 150,000 | |

| Bills payable | 150,000 | |

| Good will | 50,000 | |

| Bank Loan | 152,000 | |

| Bonus payable | 50,000 | |

| SUNDRY CREDITORS.: Ms. Nathan & CO Rs.10000 Bill no: AC071 due days:28 Mr. Thanvi& CO Rs.5000 Bill no: AG085 due days:30 | ||

| SUNDRY DEBTORS.: Mr. Senthil Ltd Rs.8000 Bill No:AG035 due days:21 Mr. Selvi Ltd Rs.7000 Bill no:AC083 due days:10 | ||

TRANSACTION DURING THE PERIOD

- Apr 1 Paid Salary by cheque Rs.10000 Chno:73105

- Apr 2 Paid Commission by cheque Rs.750 Chno:83103

- Apr 3 Commission received Rs.10000 by cheque Chno:81883

- Apr 4 EB charges Rs.1500 by cheque chno:73113

- Apr 5 Amount paid to Ms. Nathan & co by cheque Rs.9500 Discount received Rs.500 chno:71383 against bill no: AC071.

- Apr 6 Amount received from Ms. Senthil Ltd by cheque & discount allowed Rs.700 chno:81735 against bill no:AG035.

- Apr 7 Amount received from Ms. Selvi Ltd by cheque chno:31780 against bill no:AC083.

- Apr 8 Interest received Rs.20000 by cheque chno:51333.

- Apr 9 House rent paid Rs.10000 by cheque chno:72450.

- Apr 10 Bank O/D settled Rs.30000 by cheque chno:63085

- Apr 11 Bank loan settled Rs.40000 by cheque chno:711103.

- Apr 12 Cash withdraw from bank Rs.7000 by cheque chno:37015.

- Apr 13 Cash deposit to bank Rs.70000 chno:63511

- Apr 14 Telephone charges Rs.1500 by cheque chno:13543

- Apr 15 Dividend received Rs.20000 by cheque chno:13515.

- Apr 16 Paid travelling expenses by cheque Rs.5000 chno:74332

- Apr 17 General expenses paid by cheque Rs.3000 chno:53533.

- Apr 18 Received interest from by cheque Rs.1000 chno:77777.

- Apr 19 Paid trade expenses Rs.2000 by cheque chno:25138

- Apr 20 Insurance paid Rs.5000 by cheque chno:53112

- Apr 21 Bank O/D settled Rs.10000 chno:73513

- Apr 22 Bank loan settled Rs.20000 chno:51031.

- Apr 23 Rent received by cheque Rs.10000 chno:73519.

BANK STATEMENT FOR THE MONTH OF APRIL:

| Federal Bank, 26, Fairland’s Road, Mittapudur, Salem-636016. | |||||

|---|---|---|---|---|---|

| Date | Particular | Reference | Dr | Cr | Balance |

| 1-4-2022 | Balance B/D | 350,000 | |||

| 2-4-2022 | Salary | 73105 | 10,000 | 340,000 | |

| 2-4-2022 | Commission | 83103 | 750 | 339,250 | |

| 4-4-2022 | Commission | 81883 | 10,000 | 349,250 | |

| 5-4-2022 | EB charges | 73113 | 1,500 | 347,750 | |

| 6-4-2022 | Dividend | 5,000 | 352,750 | ||

| 6-4-2022 | Nathan CO | 71383 | 9,500 | 343,250 | |

| 7-4-2022 | Senthil Ltd | 81735 | 7,300 | 350,550 | |

| 9-4-2022 | Selvi Ltd | 31780 | 7,000 | 357,550 | |

| 9-4-2022 | Interest | 51333 | 20,000 | 377,550 | |

| 10-4-2022 | House Rent | 72450 | 10,000 | 367,550 | |

| 12-4-2022 | Bank O/D settled | 63085 | 30,000 | 337,550 | |

| 14-4-2022 | Cash | 63511 | 70,000 | 407,550 | |

| 15-4-2022 | Cash | 70,000 | 337,550 | ||

| 15-4-2022 | Telephone charges | 13543 | 1,500 | 336,050 | |

| 15-4-2022 | Dividend | 13515 | 20,000 | 356,050 | |

| 16-4-2022 | Branch income | 43210 | 10,000 | 366,050 | |

| 16-4-2022 | ATM (02-10-35) | 10,000 | 356,050 | ||

| 19-4-2022 | Cash | 9,000 | 365,050 | ||

| 15-4-2022 | Cash | 37051 | 7,000 | 358,050 | |

| 22-4-2022 | Interest received | 77777 | 1,000 | 359,050 | |

| 22-4-2022 | Bank O/D settled | 73513 | 10,000 | 349,050 | |

| 24-4-2022 | Rent received | 73519 | 10,000 | 359,050 | |

| 30-4-2022 | Salary | 93158 | 100,000 | 459,050 | |

| Closing | 459050 | ||||

Balance as per company book : 384050

Balance as per passbook : 459050

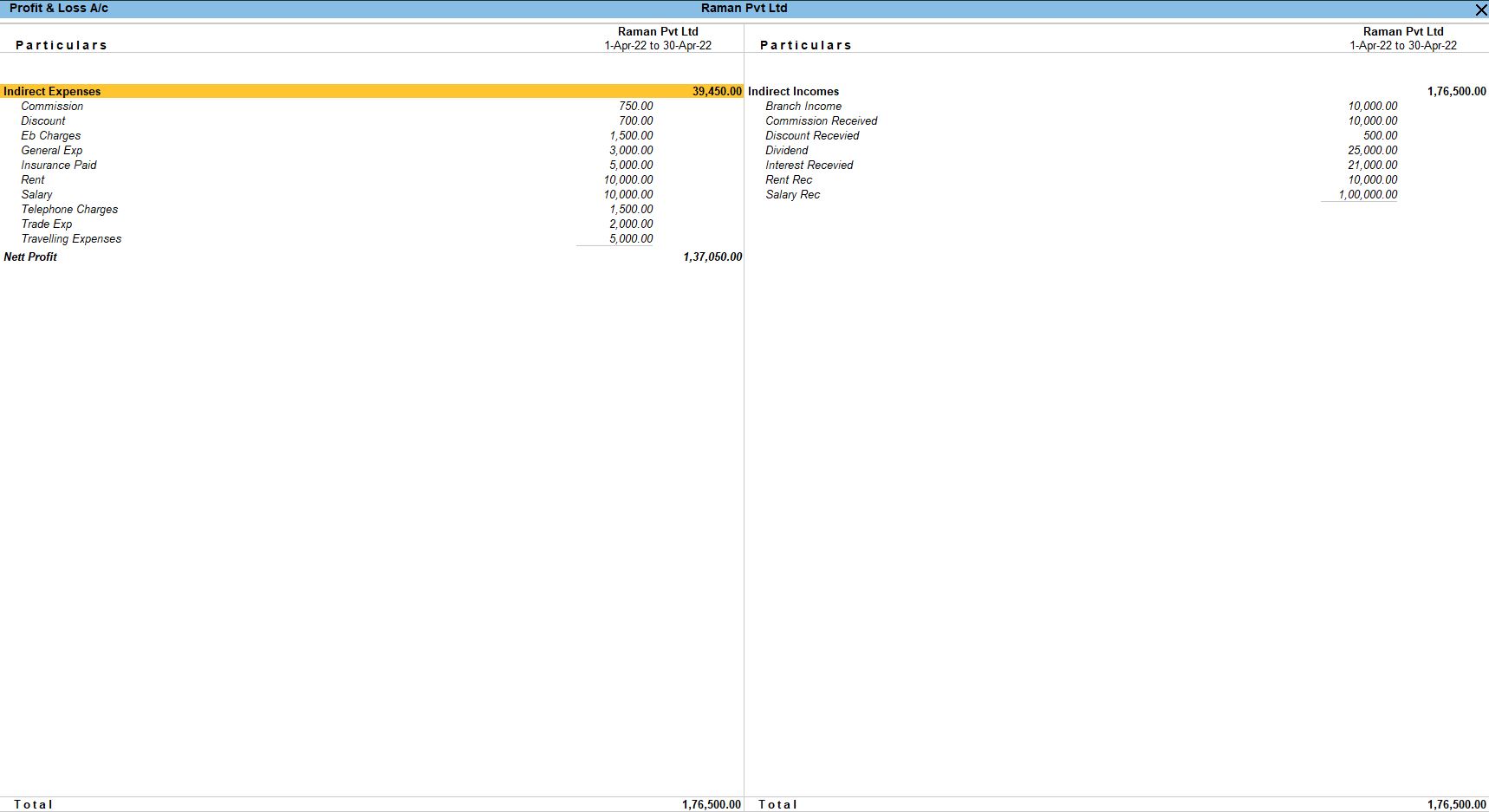

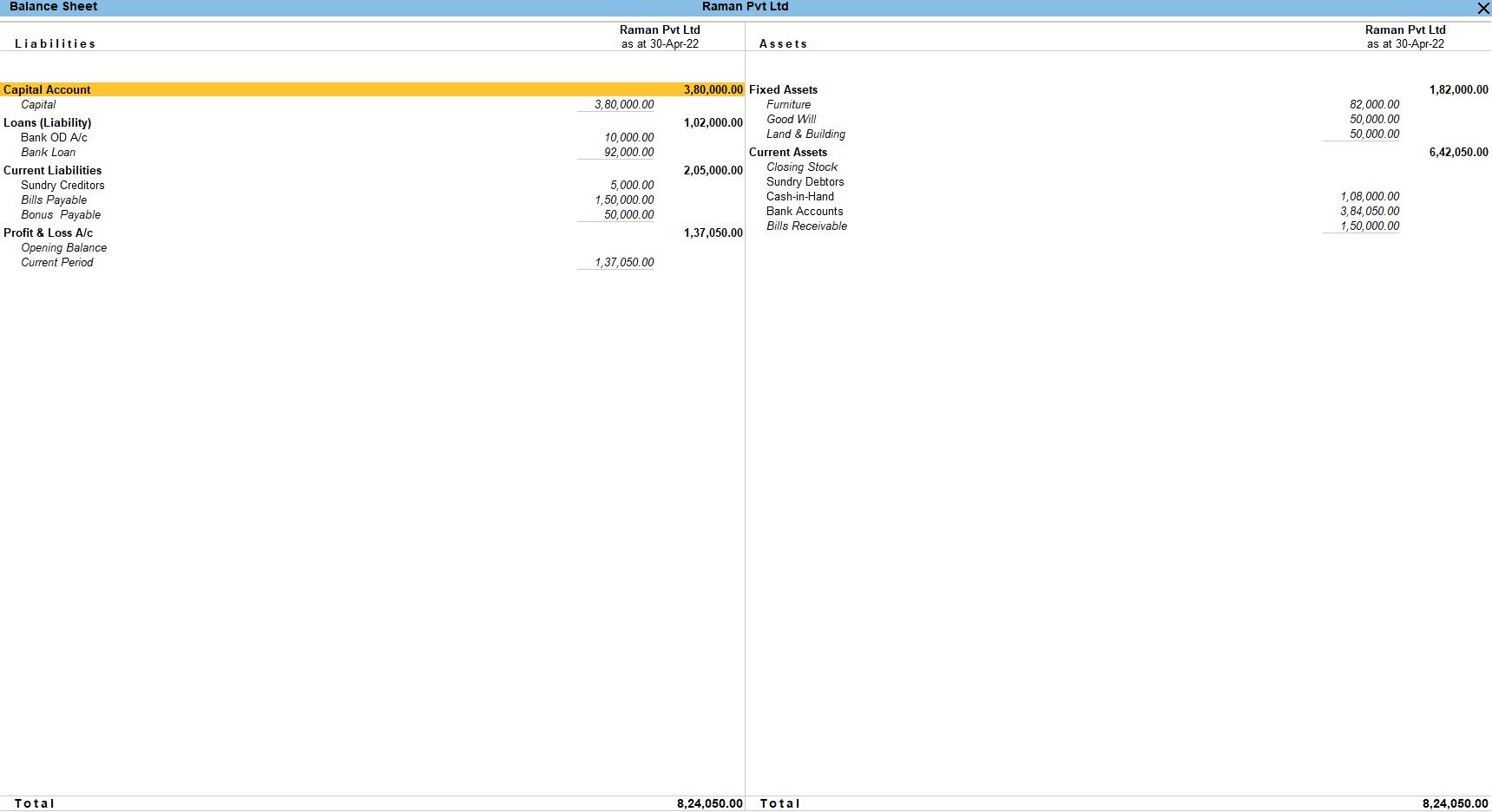

Answers

| Particular | Amount |

|---|---|

| Opening Balance | 797,000 |

| Gross Profit | ----- |

| Net Profit | 137,050 |

| Balance Sheet | 824,050 |

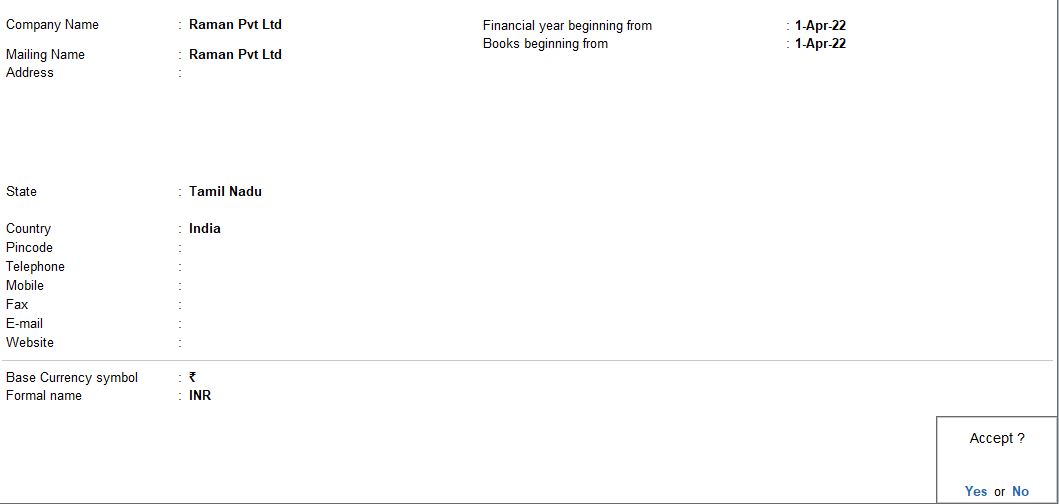

Create a New Company

- Go to the Gateway of Tally.

- Select "Create Company" or "Alt+ K" (exact wording may vary based on your version).

Fill in Company Creation Form:

- You will be prompted to fill in the Company Creation form. Enter the relevant details for M/S. RAMAN PVT LTD for the financial year 2022 to 2023.

- Here are some key details you may need to provide:

- Name: M/S. RAMAN PVT LTD

- Address: Enter the company's address.

- Statutory Compliance for: Choose your country.

- Security Control: Set a password for security purposes.

- Financial Year from: 01-04-2022 (Start of the financial year)

- Books Beginning from: Set the date from which you want to start maintaining accounts.

Save the Company:

- After entering all the required details, press Enter to save the company information.

Activate the Company:

- Once the company is created, you need to activate it. You can do this by selecting the company from the list and pressing Enter or by clicking on "Activate" at the bottom of the screen.

Confirmation:

- Confirm the activation by pressing Y for Yes.

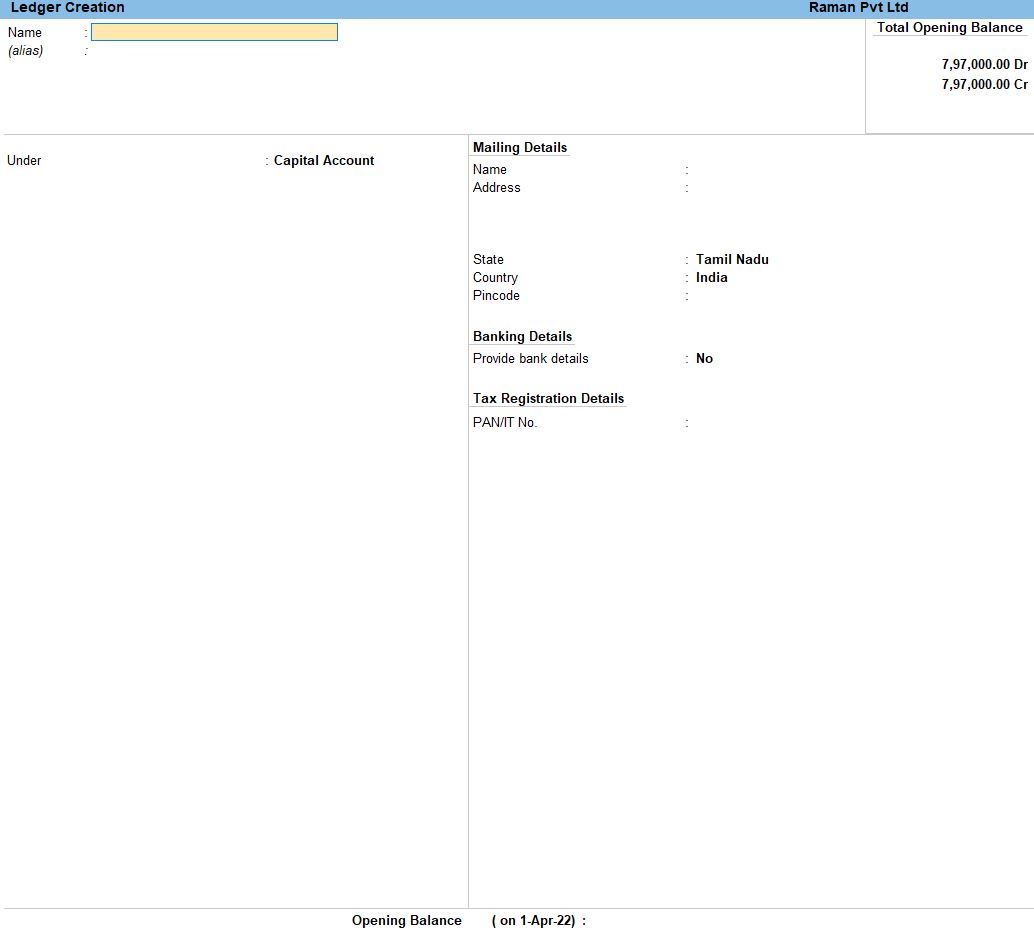

Create Ledger

| Ledger Name | Group | Opening Balance | Dr | Cr |

|---|---|---|---|---|

| Capital | Capital Accounts | 380,000 | Credit | |

| Cash | Cash in hand | 100,000 | Debit | |

| Federal Bank | Bank Accounts | 350,000 | Debit | |

| Bank O/D | Bank O/D | 50,000 | Credit | |

| Furniture | Fixed Assets | 82,000 | Debit | |

| Land & Building | Fixed Assets | 50,000 | Debit | |

| Bills receivable | Current Assets | 150,000 | Debit | |

| Bills payable | Current Liabilities | Credit | ||

| Good will | Fixed Assets | 50,000 | Debit | |

| Bank Loan | Loan Liabilities | 152,000 | Credit | |

| Bonus payable | Current Liabilities | Credit | ||

| MS. Nathan & CO | Sundry Creditors | 10,000 | Credit | |

| Mr. Thanvi & CO | Sundry Creditors | 5,000 | Credit | |

| Mr. Senthil Ltd | Sundry Debtors | 8,000 | Debit | |

| Mr. Selvi Ltd | Sundry Debtors | 7,000 | Debit |

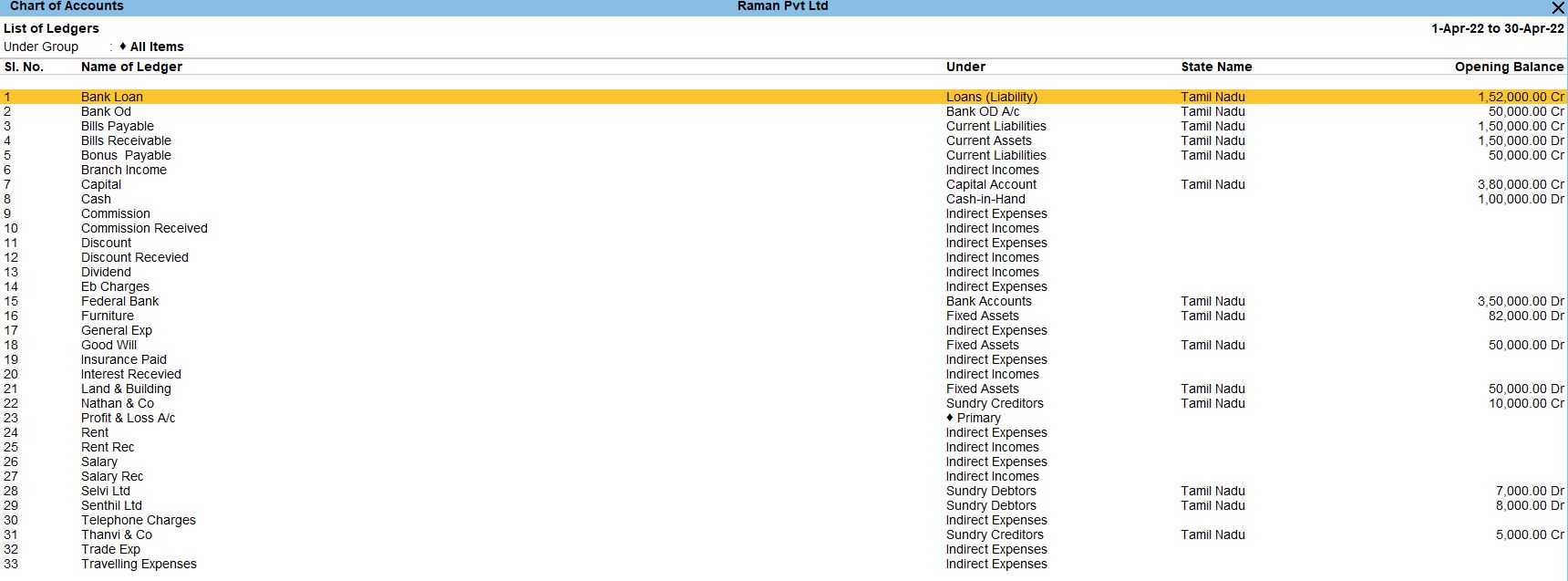

Select Chart of Accounts:

- Under the "Gateway of tally" menu, choose "Chart of Accounts" and then select "Groups" or "Ledgers.".

TRANSACTION DURING THE PERIOD

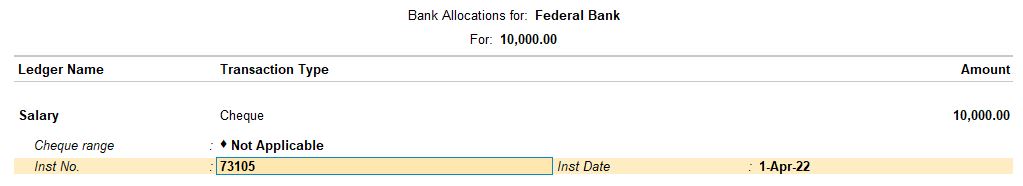

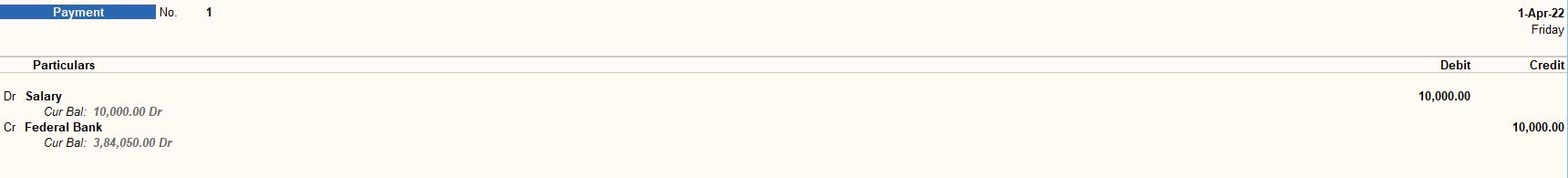

Apr 1Paid Salary by cheque Rs.10000 Chno:73105

Go to Gateway of Tally:

- Navigate to "Gateway of Tally."

Select Payment Voucher:

- Choose " Vouchers" from the main menu.

Choose Voucher Type:

- Select "F5: Payment" for creating a payment voucher.

Enter Voucher Date:

- Enter the voucher date as April 1, or the relevant date.

Enter Payment Details:

- In the payment voucher, enter the payment details:

- Particulars: Salary

- Account: Salary (or the relevant salary ledger)

- Debit: Rs. 10,000

- Particulars: Federal Bank

- Account: Federal Bank (or the relevant bank ledger)

- Credit: Rs. 10,000

Enter Cheque Details:

- Below the payment details, enter cheque details:

- Payment by: Cheque

- Cheque No.: 73105

Narration:

- Enter any relevant narration like "Salary payment for April 1."

Save the Voucher:

- Press Ctrl + A to save the voucher.

follow the above steps for the budget below.

- Apr 2 Paid Commission by cheque Rs.750 Chno:83103

- Apr 4 EB charges Rs.1500 by cheque chno:73113

- Apr 5 Amount paid to Ms. Nathan & co by cheque Rs.9500 Discount received Rs.500 chno:71383 against bill no: AC071.

- Apr 9 House rent paid Rs.10000 by cheque chno:72450.

- Apr 11 Bank loan settled Rs.40000 by cheque chno:711103.

- Apr 14 Telephone charges Rs.1500 by cheque chno:13543

- Apr 16 Paid travelling expenses by cheque Rs.5000 chno:74332

- Apr 17 General expenses paid by cheque Rs.3000 chno:53533.

- Apr 19 Paid trade expenses Rs.2000 by cheque chno:25138

- Apr 20 Insurance paid Rs.5000 by cheque chno:53112

- Apr 22 Bank loan settled Rs.20000 chno:51031

Apr 3 Commission received Rs.10000 by cheque Chno:81883

Go to Gateway of Tally:

- Navigate to "Gateway of Tally."

Select Payment Voucher:

- Choose " Vouchers" from the main menu.

Choose Voucher Type:

- Select "F6: Receipt" for creating a receipt voucher.

Enter Voucher Date:

- Enter the voucher date as April 3, or the relevant date.

Enter Receipt Details:

- In the receipt voucher, enter the receipt details:

- Particulars: Commission Received

- Account: Commission Received (or the relevant commission ledger)

- Debit: Rs. 10,000

- Particulars: Cash

- Account: Cash (or the relevant cash ledger)

- Credit: Rs. 10,000

Enter Cheque Details:

- Below the payment details, enter cheque details:

- Payment by: Cheque

- Cheque No.: 81883

Narration:

- Enter any relevant narration like "Commission received for April 3."

Save the Voucher:

- Press Ctrl + A to save the voucher.

follow the above steps for the budget below.

- Apr 6 Amount received from Ms. Senthil Ltd by cheque & discount allowed Rs.700 chno:81735 against bill no:AG035.

- Apr 7 Amount received from Ms. Selvi Ltd by cheque chno:31780 against bill no:AC083.

- Apr 8 Interest received Rs.20000 by cheque chno:51333.

- Apr 15 Dividend received Rs.20000 by cheque chno:13515.

- Apr 18 Received interest from by cheque Rs.1000 chno:77777.

- Apr 23 Rent received by cheque Rs.10000 chno:73519.

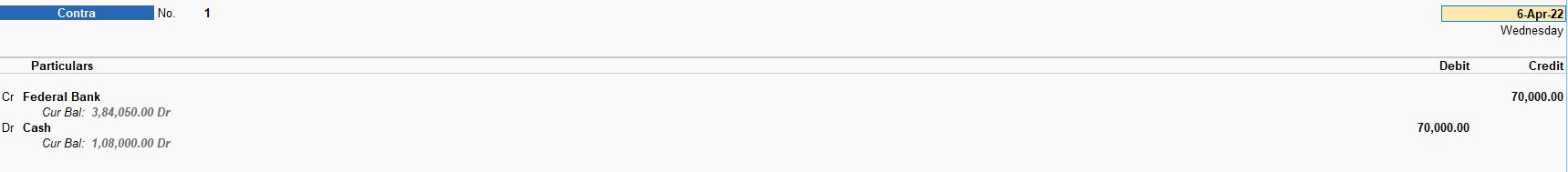

Apr 10 Bank O/D settled Rs.30000 by cheque chno:63085

Go to Gateway of Tally:

- Navigate to "Gateway of Tally."

Select Payment Voucher:

- Choose " Vouchers" from the main menu.

Choose Voucher Type:

- Select "F4: Contra" for creating a contra voucher.

Enter Voucher Date:

- Enter the voucher date as April 10, or the relevant date.

Enter Contra Details:

- In the Contra voucher, enter the Contra details:

- Particulars: Federal Bank

- Account: Federal Bank (or the relevant bank ledger)

- Credit: Rs. 30,000

- Particulars: Bank O/D

- Account: Bank O/D (or the relevant Bank O/D ledger)

- Debit: Rs. 30,000

Enter Cheque Details:

- Below the contra details, enter cheque details:

- Payment by: Cheque

- Cheque No.: 63085

Narration:

- Enter any relevant narration like "Bank O/D settlement for April 10."

Save the Voucher:

- Press Ctrl + A to save the voucher.

follow the above steps for the budget below.

- Apr 12 Cash withdraw from bank Rs.7000 by cheque chno:37015.

- Apr 13 Cash deposit to bank Rs.70000 chno:63511

- Apr 21 Bank O/D settled Rs.10000 chno:73513

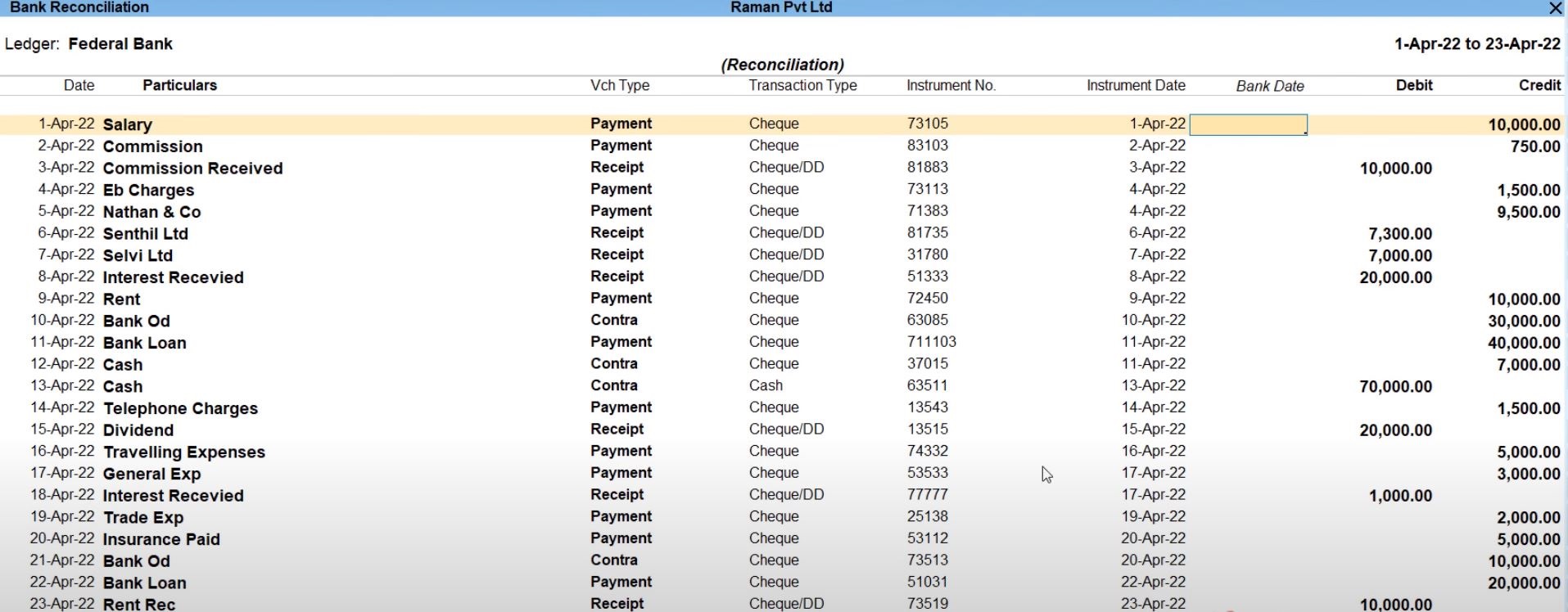

Banking Reconciliation

Go to Gateway of Tally:

- Navigate to "Gateway of Tally."

Navigate to "Bank Reconciliation"

- From the Gateway of Tally, go to "Banking."

- Under "Banking," you will find the option "Bank Reconciliation." Select it.

Select Bank Ledger

- In the Bank Reconciliation screen, you'll need to select the bank ledger for which you want to reconcile transactions. Use the arrow keys to choose the appropriate bank ledger.

| Company Transaction | |

|---|---|

| Apr 1 | Paid Salary by cheque Rs.10000 Chno:73105 |

| Apr 2 | Paid Commission by cheque Rs.750 Chno:83103 |

| Apr 3 | Commission received Rs.10000 by cheque Chno:81883 |

| Apr 4 | EB charges Rs.1500 by cheque chno:73113 |

| Apr 5 | Amount paid to Ms. Nathan & co by cheque Rs.9500 Discount received Rs.500 chno:71383 against bill no: AC071. |

| Apr 6 | Amount received from Ms. Senthil Ltd by cheque & discount allowed Rs.700 chno:81735 against bill no:AG035. |

| Apr 7 | Amount received from Ms. Selvi Ltd by cheque chno:31780 against bill no:AC083. |

| Apr 8 | Interest received Rs.20000 by cheque chno:51333. |

| Apr 9 | House rent paid Rs.10000 by cheque chno:72450. |

| Apr 10 | Bank O/D settled Rs.30000 by cheque chno:63085 |

| Apr 11 | Bank loan settled Rs.40000 by cheque chno:711103. |

| Apr 12 | Cash withdraw from bank Rs.7000 by cheque chno:37015. |

| Apr 13 | Cash deposit to bank Rs.70000 chno:63511 |

| Apr 14 | Telephone charges Rs.1500 by cheque chno:13543 |

| Apr 15 | Dividend received Rs.20000 by cheque chno:13515. |

| Apr 16 | Paid travelling expenses by cheque Rs.5000 chno:74332 |

| Apr 17 | General expenses paid by cheque Rs.3000 chno:53533. |

| Apr 18 | Received interest from by cheque Rs.1000 chno:77777. |

| Apr 19 | Paid trade expenses Rs.2000 by cheque chno:25138 |

| Apr 20 | Insurance paid Rs.5000 by cheque chno:53112 |

| Apr 21 | Bank O/D settled Rs.10000 chno:73513 |

| Apr 22 | Bank loan settled Rs.20000 chno:51031. |

| Apr 23 | Rent received by cheque Rs.10000 chno:73519. |

| Bank Statement | |||||

|---|---|---|---|---|---|

| Date | Particular | Reference | Dr | Cr | Balance |

| 1-4-2022 | Balance B/D | 350,000 | |||

| 2-4-2022 | Salary | 73105 | 10,000 | 340,000 | |

| 2-4-2022 | Commission | 83103 | 750 | 339,250 | |

| 4-4-2022 | Commission | 81883 | 10,000 | 349,250 | |

| 5-4-2022 | EB charges | 73113 | 1,500 | 347,750 | |

| 6-4-2022 | Dividend | 5,000 | 352,750 | ||

| 6-4-2022 | Nathan CO | 71383 | 9,500 | 343,250 | |

| 7-4-2022 | Senthil Ltd | 81735 | 7,300 | 350,550 | |

| 9-4-2022 | Selvi Ltd | 31780 | 7,000 | 357,550 | |

| 9-4-2022 | Interest | 51333 | 20,000 | 377,550 | |

| 10-4-2022 | House Rent | 72450 | 10,000 | 367,550 | |

| 12-4-2022 | Bank O/D settled | 63085 | 30,000 | 337,550 | |

| 14-4-2022 | Cash | 63511 | 70,000 | 407,550 | |

| 15-4-2022 | Cash | 70,000 | 337,550 | ||

| 15-4-2022 | Telephone charges | 13543 | 1,500 | 336,050 | |

| 15-4-2022 | Dividend | 13515 | 20,000 | 356,050 | |

| 16-4-2022 | Branch income | 43210 | 10,000 | 366,050 | |

| 16-4-2022 | ATM (02-10-35) | 10,000 | 356,050 | ||

| 19-4-2022 | Cash | 9,000 | 365,050 | ||

| 15-4-2022 | Cash | 37051 | 7,000 | 358,050 | |

| 22-4-2022 | Interest received | 77777 | 1,000 | 359,050 | |

| 22-4-2022 | Bank O/D settled | 73513 | 10,000 | 349,050 | |

| 24-4-2022 | Rent received | 73519 | 10,000 | 359,050 | |

| 30-4-2022 | Salary | 93158 | 100,000 | 459,050 | |

| Closing | 459050 | ||||

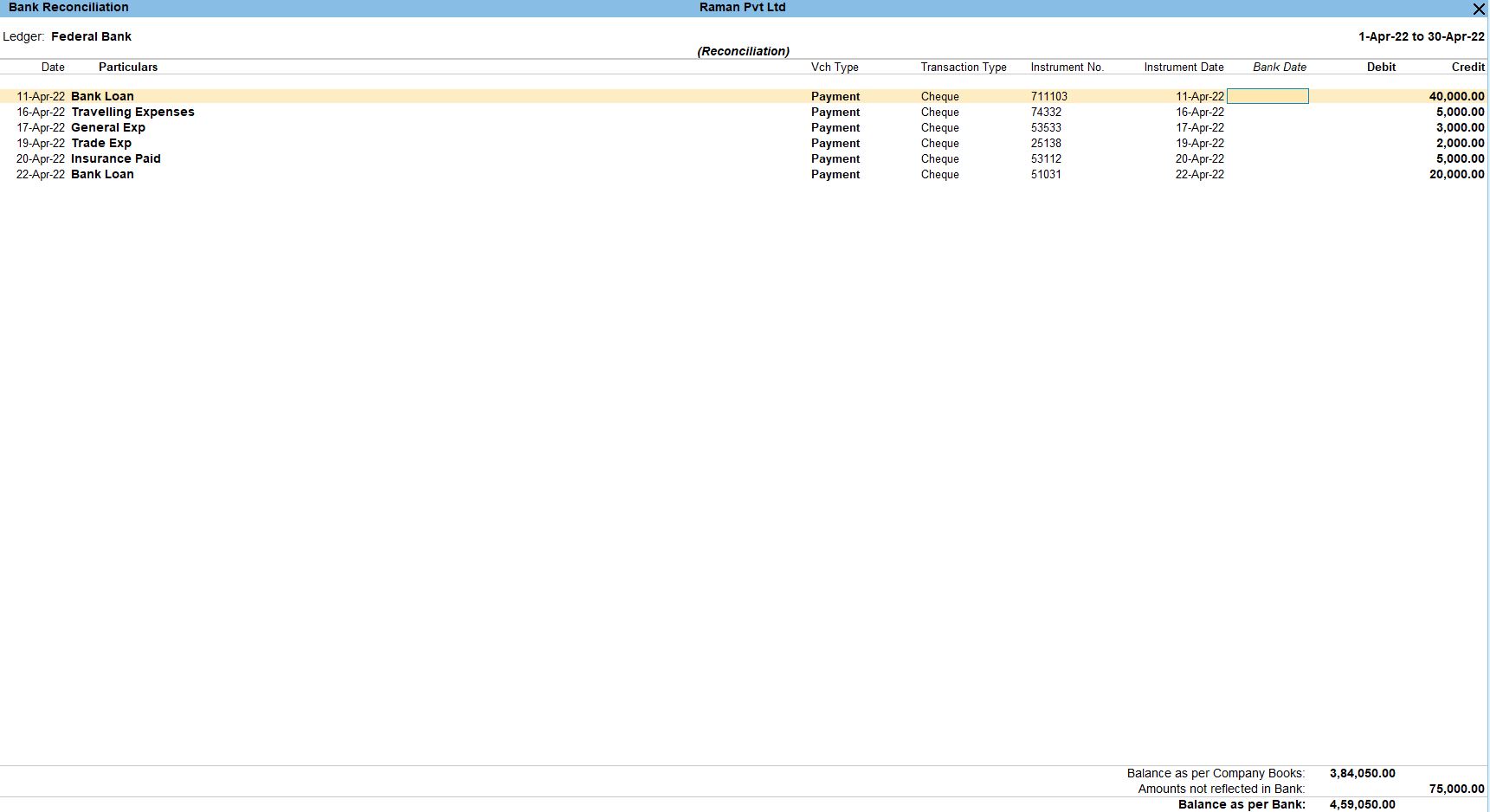

Missing Entry for Bank Statement

Follow the above steps for the following transaction.

- Apr 06 Dividend Received Rs. 5000

- Apr 15 Cash withdraw from bank Rs. 70000

- Apr 15 Cash withdraw from bank Rs Rs.7000

- Apr 16 Branch income Received Rs.10000

- Apr 16 Cash withdraw from bank Rs Rs.1000

- Apr 19 Cash deposit to bank Rs.9000

- Apr 30 Salary Received Rs. 100000

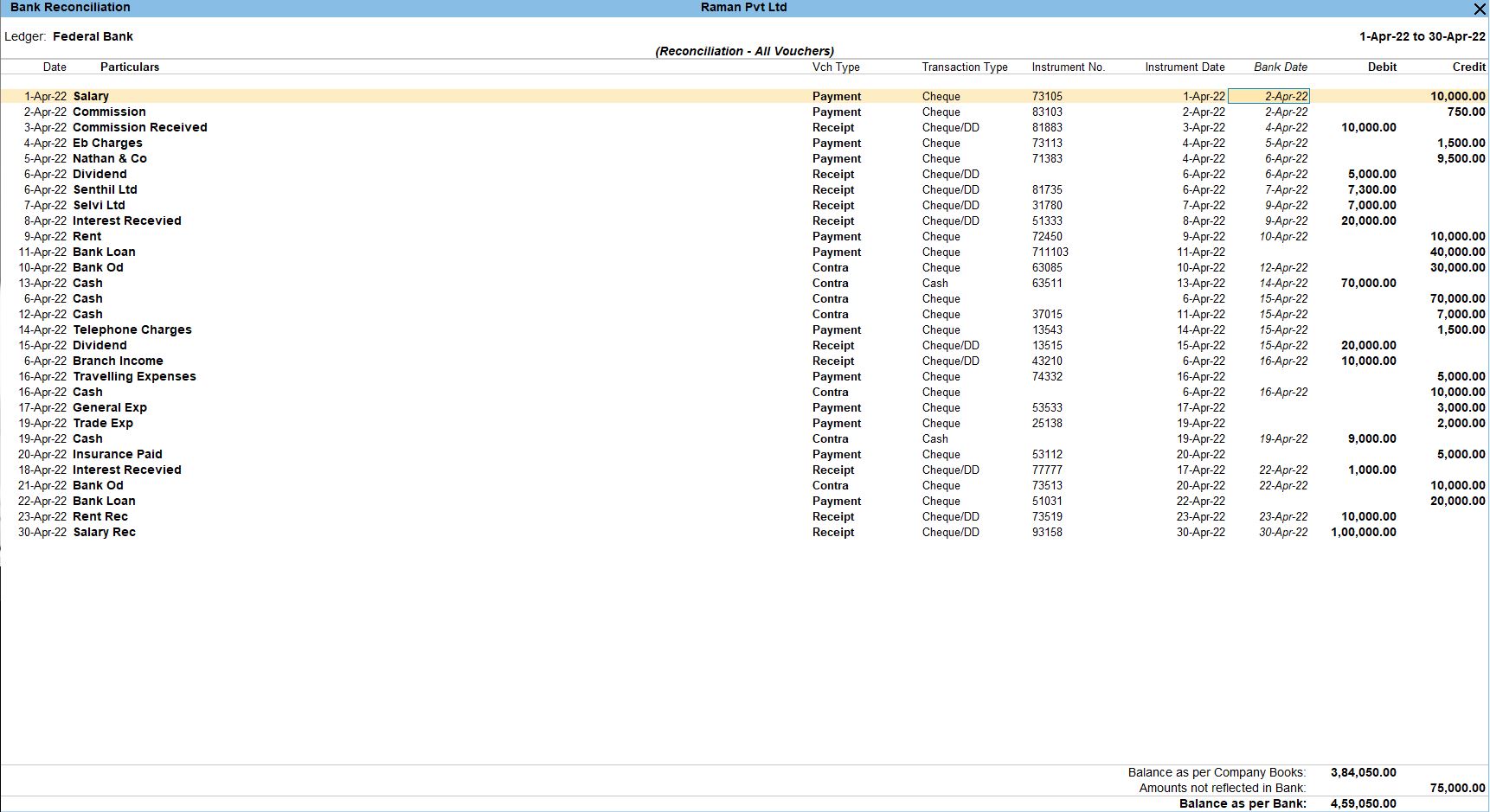

Banking Reconciliation Reports

Go to Gateway of Tally:

- Navigate to "Gateway of Tally."

Navigate to "Bank Reconciliation"

- From the Gateway of Tally, go to "Banking."

- Under "Banking," you will find the option "Bank Reconciliation." Select it.

Select Bank Ledger

- In the Bank Reconciliation screen, you'll need to select the bank ledger for which you want to reconcile transactions. Use the arrow keys to choose the appropriate bank ledger.

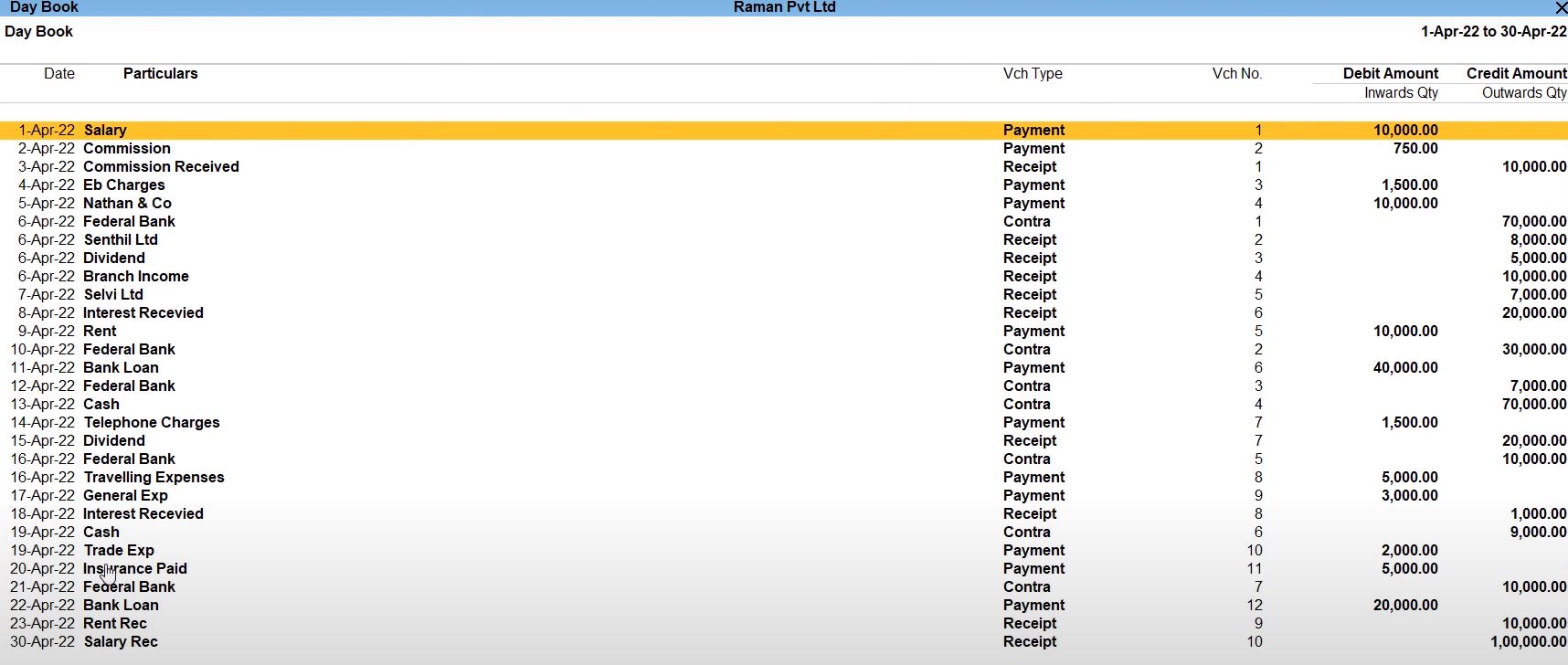

Day Book Reports

Go to Gateway of Tally:

- Navigate to "Gateway of Tally."

Navigate to "Daybook"

- From the Gateway of Tally, go to "Display."

- Under "Display," you will find the option "Daybook." Select it.

Profit and Loss

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Reports:

- From the Gateway of Tally, go to "Reports" by selecting it from the main menu.

Financial Reports:

- Under "Reports," navigate to "Profit & Loss" in the "Financial Reports" section.

Balance Sheets

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Reports:

- From the Gateway of Tally, go to "Reports" by selecting it from the main menu.

Financial Reports:

- Under "Reports," navigate to "Balance Sheet" in the "Financial Reports" section.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions