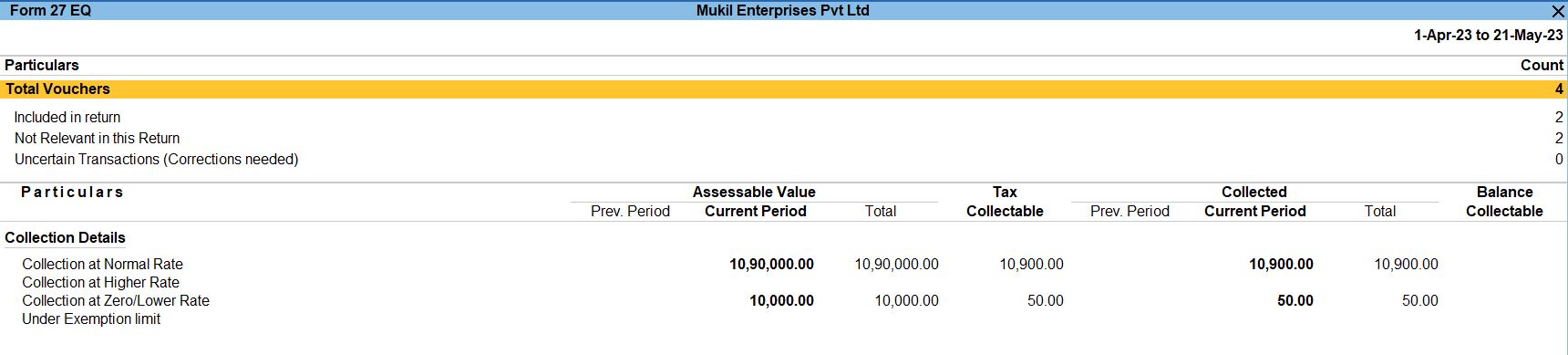

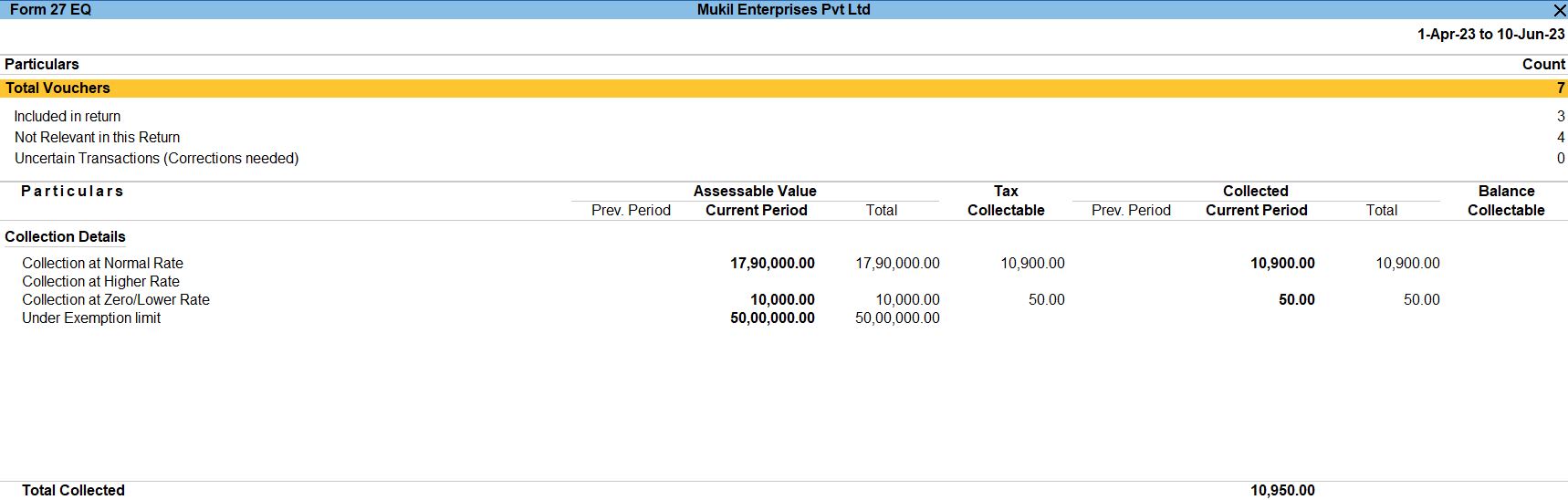

TCS: Managing Lower Rate and Higher Rated Transactions in Tally Prime

Sale of TCS Goods at Lower Rate/Nil Rate

21st May 2023 Mukil Enterprises Pvt. Ltd. sold the following goods to MIG Industries Pvt. Ltd. (Company - Resident) vide Sale Bill No.20.The company is liable to collect TCS at 0.5% from MIG Industries Pvt. Ltd. who owns a lower collection certificate (206C-17(1)/23-24) on Scrap.

| Item | Qty | Rate |

|---|---|---|

| Scrap | 1 | ₹ 10,000 |

25th May 2023 Mukil Enterprises Pvt. Ltd. Received an amount from MIG Industries Pvt. Ltd against the Sales made on 21st May 2023. The payment was received vide Bank A/c cheque 800801.

Sale of TCS Goods at Higher Tax Rate (Under Section 206CCA)

2nd June 2023 Mukil Enterprises Pvt. Ltd. purchased the following goods from Lenovo Computer Zone on credit with Supplier Invoice No. LEN/PUR/25.

| Item | Qty | Rate |

|---|---|---|

| Lenovo Fliptop 17 Laptop | 100 | ₹ 51,000 |

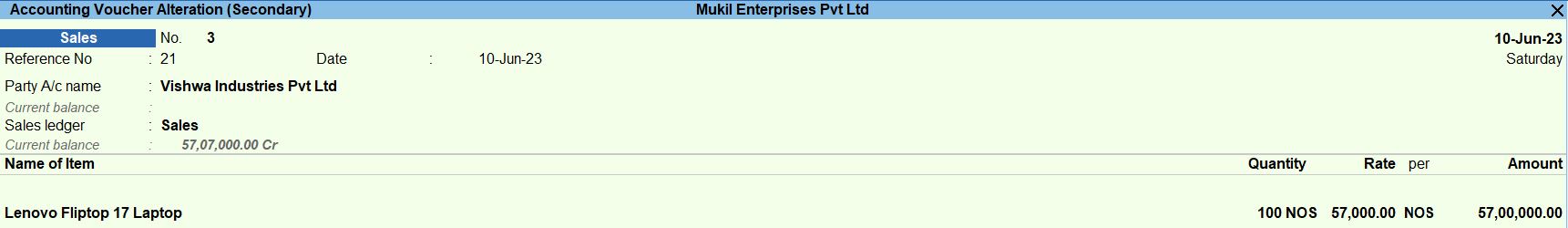

10th June 2023 Mukil Enterprises Pvt. Ltd. sold the following goods to vishwa Industries Pvt. Ltd. on credit with Sale Bill No. 21.

| Item | Qty | Rate |

|---|---|---|

| Lenovo Fliptop 17 Laptop | 100 | ₹ 57,000 |

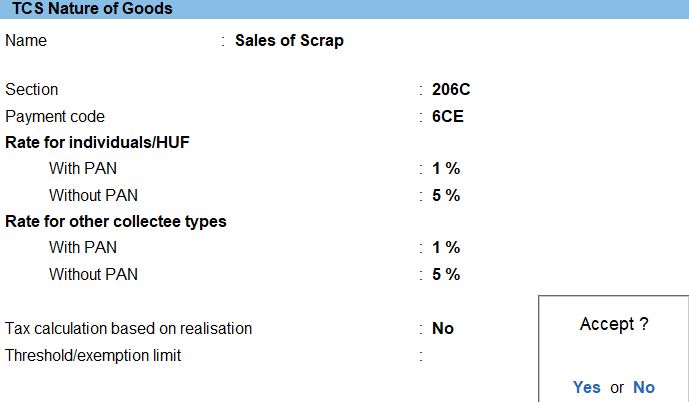

TCS Nature of Goods

- Navigate to Statutory Masters Creation:

- Open Tally Prime software.

- Go to the "Statutory" section.

- Create New TCS Nature of Goods:

- From the menu, select "TCS Nature of Goods" or "TCS Masters."

- Choose "Create" to add a new TCS Nature of Goods entry.

- Enter Details:

- Name: Enter "Sales of Scrap" as the name of the TCS Nature of Goods entry.

- Section: Specify "206C" as the section for this TCS entry.

- Payment Code: Input "6CE" as the payment code for this entry.

- Set Rates:

- Rate for Individual/HUF:

- With PAN: Enter the rate as "1%".

- Without PAN: Enter the rate as "5%".

- Rate for other collectee types:

- With PAN: Enter the rate as "1%".

- Without PAN: Enter the rate as "5%".

- Save Changes:

- After entering all the necessary details, save the TCS Nature of Goods entry.

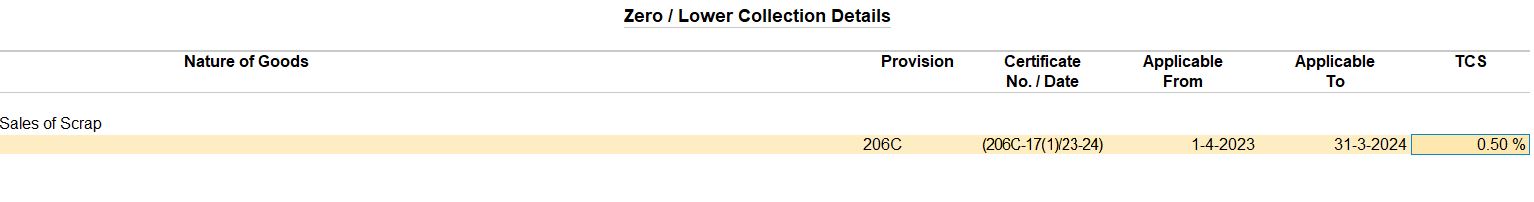

Party Ledger

- Navigate to Ledger Creation:

- Open Tally Prime software.

- Go to the "Accounts Info" section.

- Create New Ledger:

- From the menu, select "Ledgers."

- Choose "Create" to add a new ledger.

- Enter Ledger Details:

- Name: Enter "MIG Industries Pvt Ltd" as the name of the ledger.

- Under: Select "Sundry Debtors" to categorize it correctly.

- Maintain balance bill-by-bill: Set this option to "Yes."

- Statutory Details:

- Is TCS Applicable: Set this option to "Yes."

- Buyer/Lessee Type: Specify "Company – Resident."

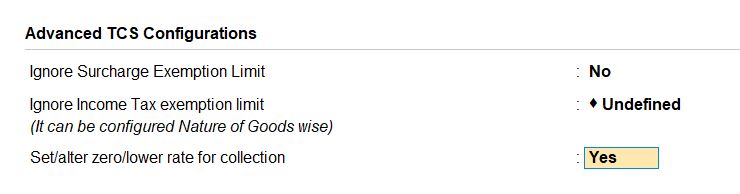

- Advanced TCS Configurations:

- Use advanced configuration for TCS: Set this option to "Yes."

- Set/alter zero lower rate for collection: Set this option to "Yes."

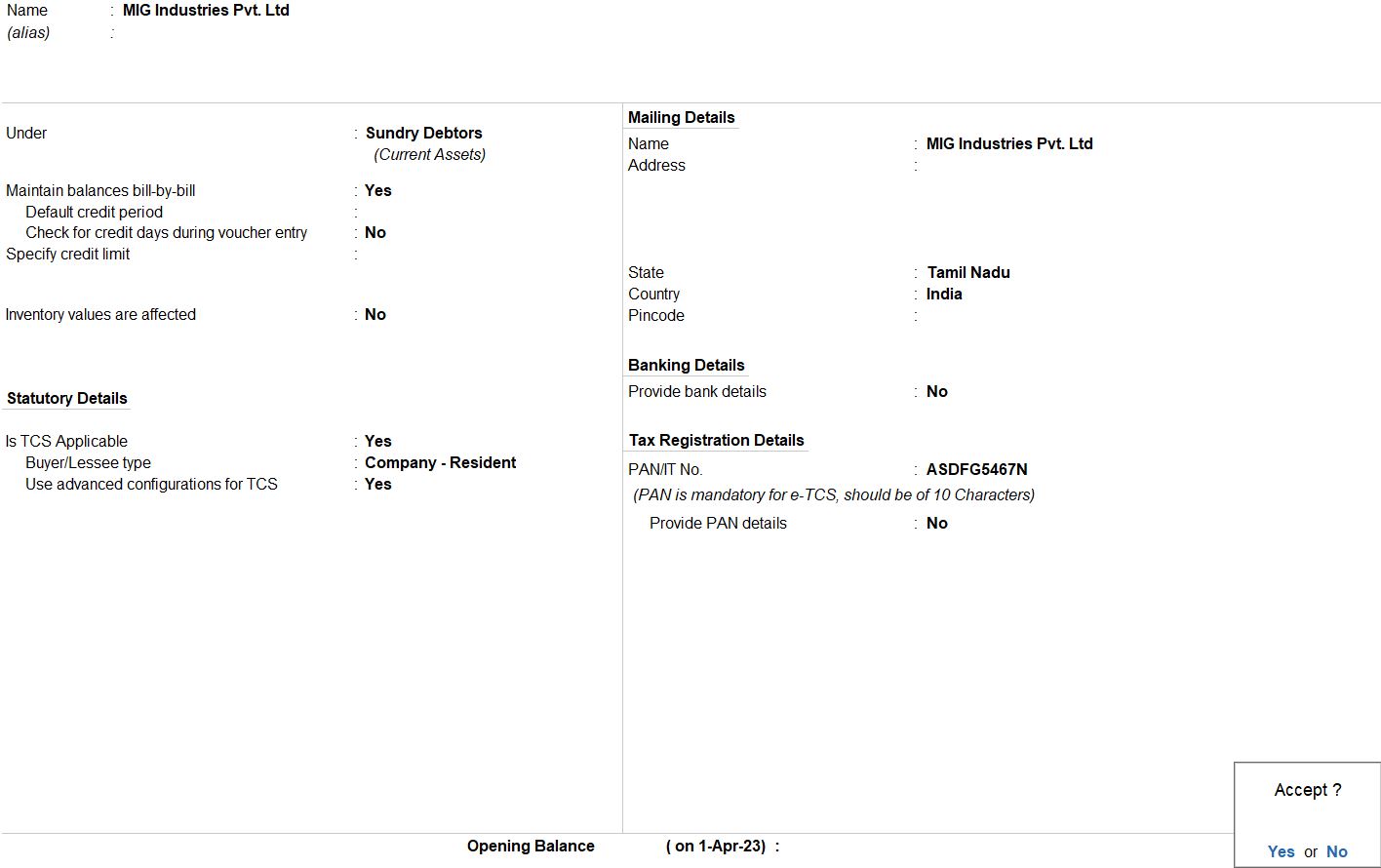

- Zero/Lower Collection Details:

- Nature of Goods: Enter "Sales of Scrap."

- Provision: Specify "206C" for the provision.

- Certificate No./Date: Enter "(206C-17(1)23-24)" as the certificate number and date.

- Applicable from: Set the date as 1st April 2023.

- Applicable to: Set the date as 31st March 2024.

- TCS Rate: Enter "0.05%" for the TCS rate.

- Save Changes:

- After entering all the necessary details, save the ledger.

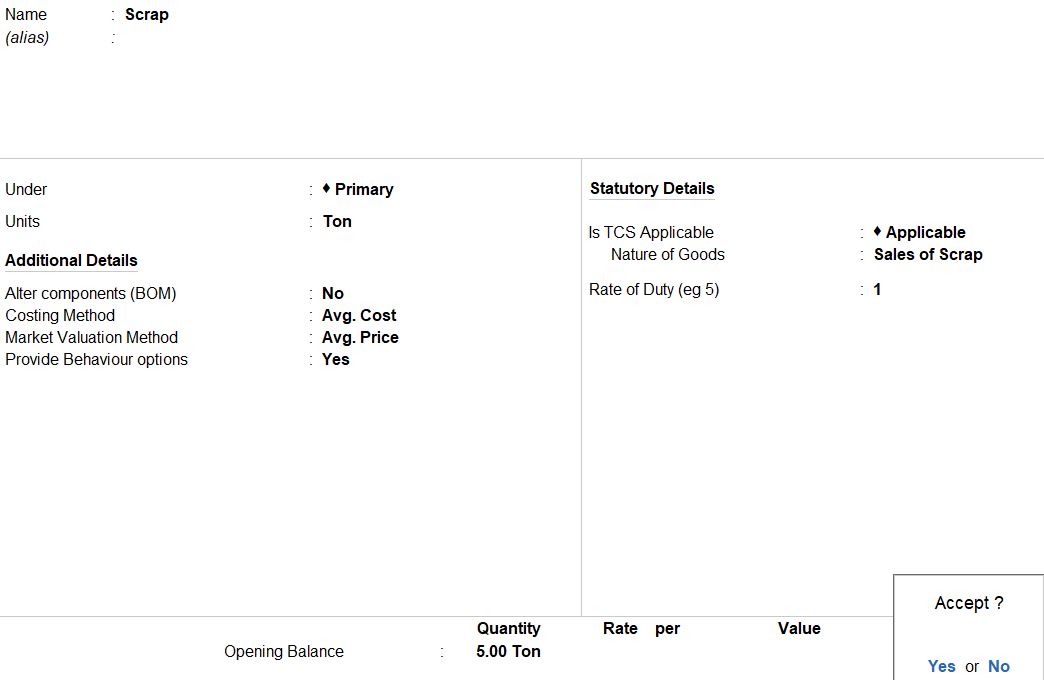

Stock Item

- Navigate to Stock Item Creation:

- Open Tally Prime software.

- Go to the "Inventory" section.

- Create New Stock Item:

- From the menu, select "Stock Items."

- Choose "Create" to add a new stock item.

- Enter Stock Item Details:

- Name: Enter "Scrap" as the name of the stock item.

- Under: Select "Primary" to categorize it correctly.

- Unit: Specify "Ton" as the unit of measurement for the stock item.

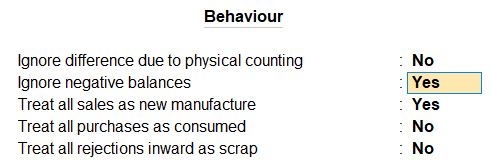

- Additional Details:

- Costing Method: Choose "Avg.Cost" for the costing method. This indicates that the average cost will be used for valuation.

- Market Valuation Method: Select "Avg. Price" for the market valuation method. This means that the average price will be used for valuation.

- Provide Behavior Options: Set this to "Yes" to access behavior options.

- Ignore Negative Balances: Set this to "Yes" to ignore negative balances.

- Treat All Sales as New Manufacture: Set this to "Yes" to treat all sales as new manufacture.

- Statutory Details:

- Is TCS Applicable: Set this to "Applicable" to enable TCS for this stock item.

- Nature of Goods: Enter "Sales of Scrap" as the nature of goods for TCS purposes.

- Rate of Duty: Input "1" as the rate of duty for TCS.

- Save Changes:

- After entering all the necessary details, save the stock item.

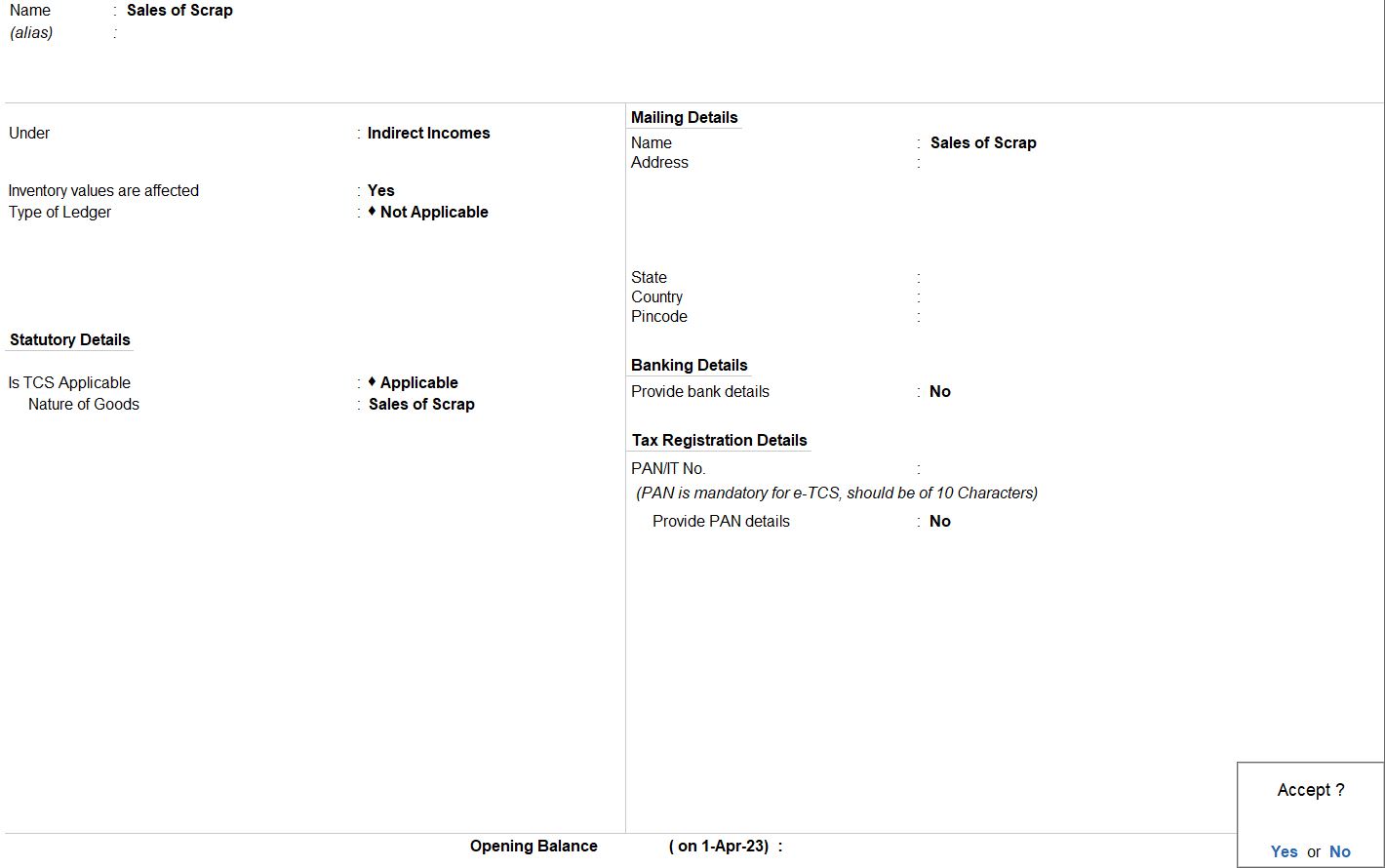

Sales of Scrap ledger

- Navigate to Ledger Creation:

- Open Tally Prime software.

- Go to the "Accounts Info" section.

- Create New Ledger:

- From the menu, select "Ledgers."

- Choose "Create" to add a new ledger.

- Enter Ledger Details:

- Name: Enter "Sales of Scrap" as the name of the ledger.

- Under: Select "Indirect Income" to categorize it correctly.

- Inventory values are affected: Set this to "Yes" to indicate that this ledger will affect inventory values.

- Statutory Details:

- Is TCS Applicable: Set this to "Applicable" to enable TCS for this ledger.

- Nature of Goods: Enter "Sales of Scrap" as the nature of goods for TCS purposes.

- Save Changes:

- After entering all the necessary details, save the ledger.

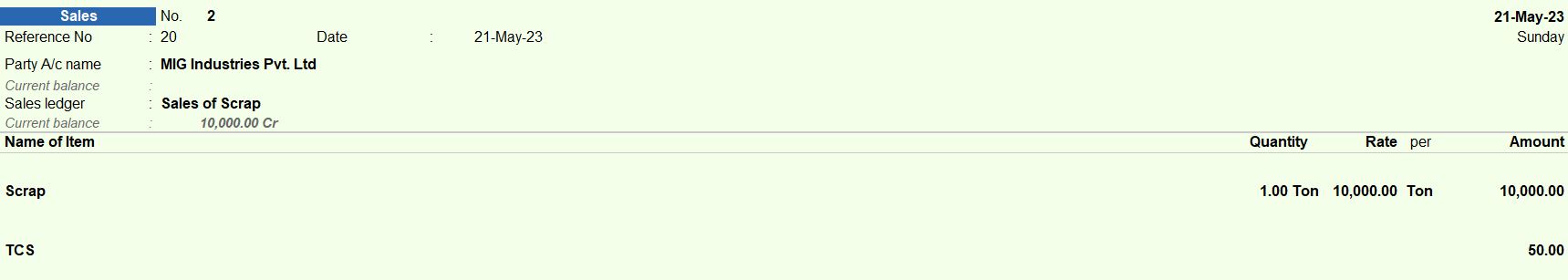

21st May 2023 Mukil Enterprises Pvt. Ltd. sold the following goods to MIG Industries Pvt. Ltd. (Company - Resident) vide Sale Bill No.20.The company is liable to collect TCS at 0.5% from MIG Industries Pvt. Ltd. who owns a lower collection certificate (206C-17(1)/23-24) on Scrap.

| Item | Qty | Rate |

|---|---|---|

| Scrap | 1 | ₹ 10,000 |

- Navigate to Sales Voucher Entry:

- Open Tally Prime software.Go to the "Accounting Vouchers" section.

- Enter Date and Voucher Details:

- Set the voucher date as the transaction date.

- Choose "Sales" as the voucher type.

- Enter Party and Sales Ledger Details:

- Party A/c Name : MIG Industries Pvt Ltd.

- Sales Ledger: Sales of Scrap under Sales A/c.

- Enter Item Details:

- Name of Item: Scrap

- Quantity: 1 Ton

- Rate: ₹10,000 (per Ton)

- Total: ₹10,000

- Enter TCS Details:

- Debit: TCS

- Credit: Sales of Scrap

- Amount: ₹50 (assuming TCS is 0.5% of the sales amount)

- Save and Verify:

- Save the sales voucher after verifying all the entries.

25th May 2023 Mukil Enterprises Pvt. Ltd. Received an amount from MIG Industries Pvt. Ltd against the Sales made on 21st May 2023. The payment was received vide Bank A/c cheque 800801.

- Navigate to Receipt Voucher Entry:

- Open Tally Prime software.

- Go to the "Accounting Vouchers" section.

- Enter Date and Voucher Details:

- Set the voucher date as 25th May 2023.

- Choose "Receipt" as the voucher type.

- Ensure that the voucher mode is set to "Single Entry Mode."

- Enter Transaction Details:

- Account : Indian Bank under Account.

- Particular: MIG Industries Pvt Ltd under Particulars.

- Amount: Enter the amount received from MIG Industries Pvt Ltd, which is ₹10,050.

- Save and Verify:

- Save the receipt voucher after verifying all the entries.

- Double-check all the details entered to ensure accuracy.

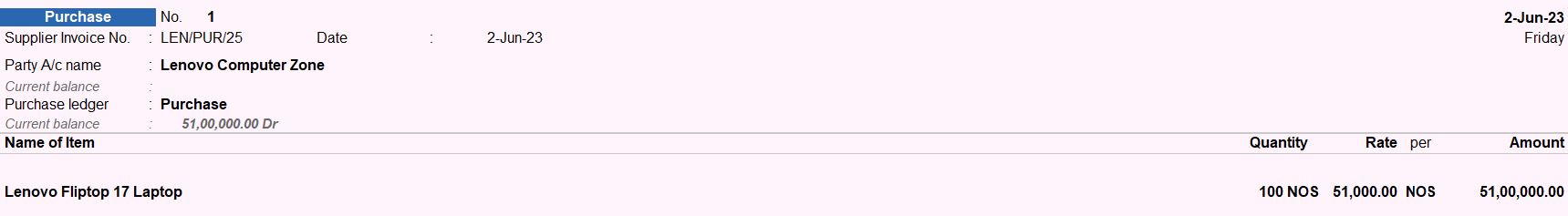

2nd June 2023 Mukil Enterprises Pvt. Ltd. purchased the following goods from Lenovo Computer Zone on credit with Supplier Invoice No. LEN/PUR/25.

| Item | Qty | Rate |

|---|---|---|

| Lenovo Fliptop 17 Laptop | 100 | ₹ 51,000 |

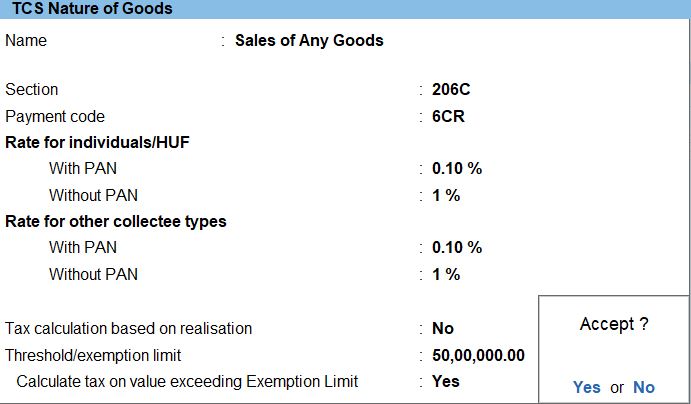

Sales of any Goods

- Navigate to Statutory Masters Creation:

- Open Tally Prime software.

- Go to the "Statutory" section.

- Create New TCS Nature of Goods:

- From the menu, select "TCS Nature of Goods" or "TCS Masters."

- Choose "Create" to add a new TCS Nature of Goods entry.

- Enter Details:

- Name: Enter "Sales of any Goods" as the name of the TCS Nature of Goods entry.

- Section: Specify "206C" as the section for this TCS entry.

- Payment Code: Input "6CE" as the payment code for this entry.

- Set Rates:

- Rate for Individual/HUF:

- With PAN: Enter the rate as "0.10%".

- Without PAN: Enter the rate as "1%".

- Rate for other collectee types:

- With PAN: Enter the rate as "0.10%".

- Without PAN: Enter the rate as "1%".

- Rate for Individual/HUF:

- Threshold/Exemption Limit:

- Enter the threshold/exemption limit as "5000000".

- Save Changes:

- After entering all the necessary details, save the TCS Nature of Goods entry.

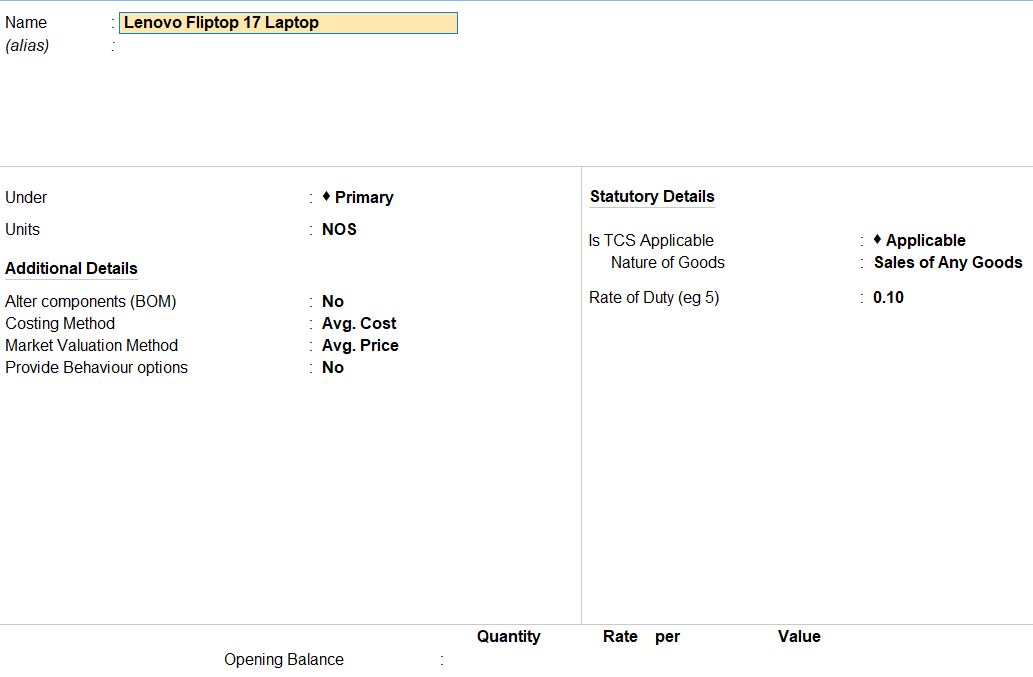

Lenovo Fliptop 17 Laptop

- Navigate to Stock Item Creation:

- Open Tally Prime software.

- Go to the "Inventory" section.

- Create New Stock Item:

- From the menu, select "Stock Items."

- Choose "Create" to add a new stock item.

- Enter Stock Item Details:

- Name: Enter "Lenovo Fliptop 17 Laptop" as the name of the stock item.

- Under: Select "Primary" to categorize it correctly.

- Unit: Specify "Nos" as the unit of measurement for the stock item.

- Additional Details:

- Costing Method: Choose "Avg.Cost" for the costing method. This indicates that the average cost will be used for valuation.

- Market Valuation Method: Select "Avg. Price" for the market valuation method. This means that the average price will be used for valuation.

- Provide Behavior Options: Set this to "No" as per your requirement.

- Statutory Details:

- Is TCS Applicable: Set this to "Applicable" to enable TCS for this stock item.

- Nature of Goods: Enter "Sales of any goods" as the nature of goods for TCS purposes.

- Rate of Duty: Input "1" as the rate of duty for TCS.

- Save Changes: After entering all the necessary details, save the stock item.

- Navigate to Purchase Voucher Entry:

- Open Tally Prime software.

- Go to the "Accounting Vouchers" section.

- Enter Date and Voucher Details:

- Set the voucher date as the transaction date.

- Choose "Purchase" as the voucher type.

- Enter Party and Purchase Ledger Details:

- Party A/c Name: Lenovo Computer Zone under.

- Purchase Ledger: Purchase under Purchase A/c.

- Enter Item Details:

- Name of Item: Lenovo Fliptop 17 Laptop

- Quantity: 100 Nos

- Rate: ₹51,000 per Nos

- Total: ₹5,100,000

- Save and Verify:

- Save the purchase voucher after verifying all the entries.

10th June 2023 Mukil Enterprises Pvt. Ltd. sold the following goods to vishwa Industries Pvt. Ltd. on credit with Sale Bill No. 21.

| Item | Qty | Rate |

|---|---|---|

| Lenovo Fliptop 17 Laptop | 100 | ₹ 57,000 |

- Navigate to Sales Voucher Entry:

- Open Tally Prime software.

- Go to the "Accounting Vouchers" section.

- Enter Date and Voucher Details:

- Set the voucher date as 10th June 2023.

- Choose "Sales" as the voucher type.

- Enter Party and Sales Ledger Details:

- Party A/c Name: Vishwa Industries Pvt Ltd.

- Sales Ledger: Sales under Sales Ledger.

- Enter Item Details:

- Name of Item: Lenovo Fliptop 17 Laptop

- Quantity: 100 Nos

- Rate: ₹57,000 per Nos

- Total: ₹5,700,000

- Save and Verify:

- Save the sales voucher after verifying all the entries.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions