Cash and Bank Book Reports in Tally Prime

In Tally Prime, the Cash and Bank Book Reports offer a detailed view of cash and bank transactions, helping you analyze your financial position with respect to cash and bank balances. Below is a step-by-step breakdown of the process and the configuration options you've mentioned.

Navigating to Cash and Bank Book Reports:

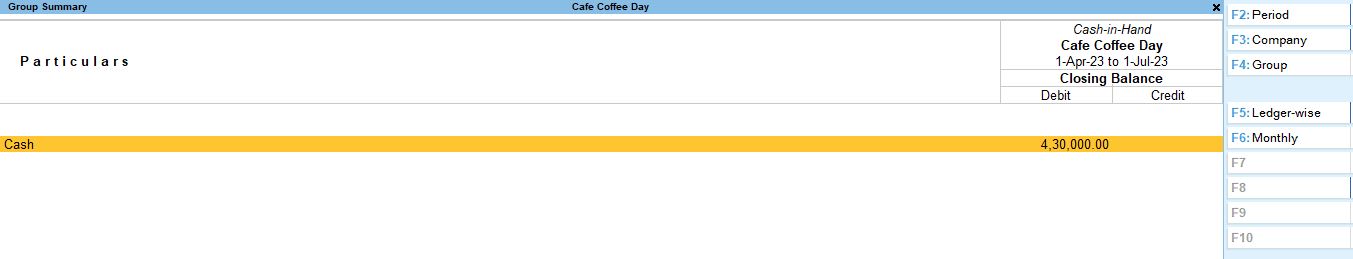

In Tally Prime, accessing Cash and Bank Book Reports is crucial for tracking and managing your cash and bank transactions effectively. The path you mentioned:

Alt + G (Go To) → Group Reports → Cash/Bank Book → Cash in Hand / Bank Account, allows you to view all financial transactions related to cash or bank accounts. Here’s a detailed explanation of this process:

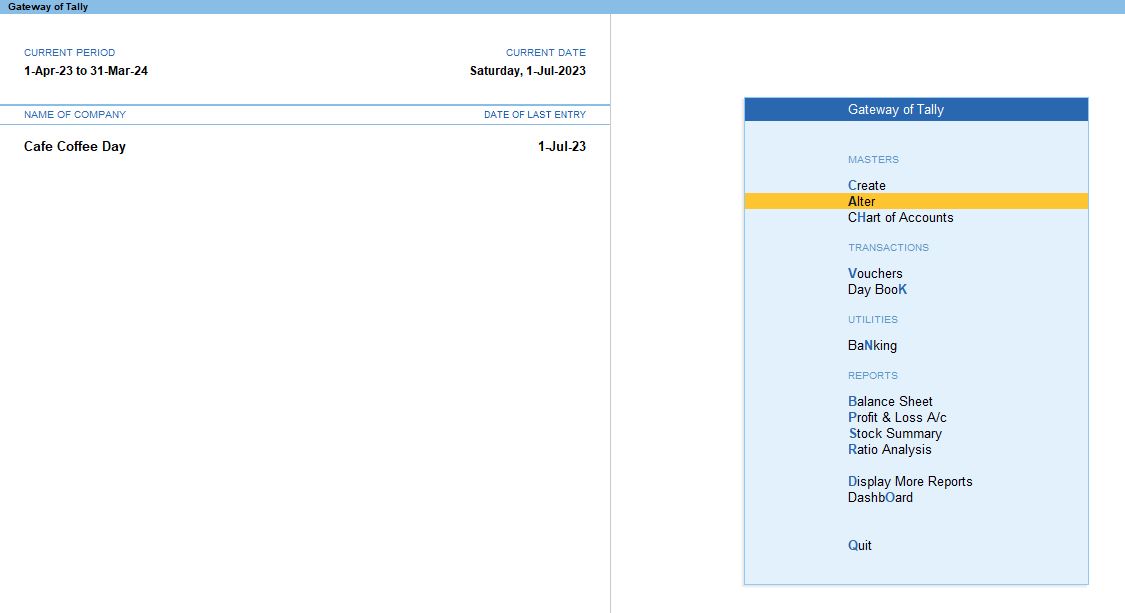

Gateway of Tally

This is the main screen of Tally, providing access to all modules such as Accounting, Inventory, Payroll, etc.

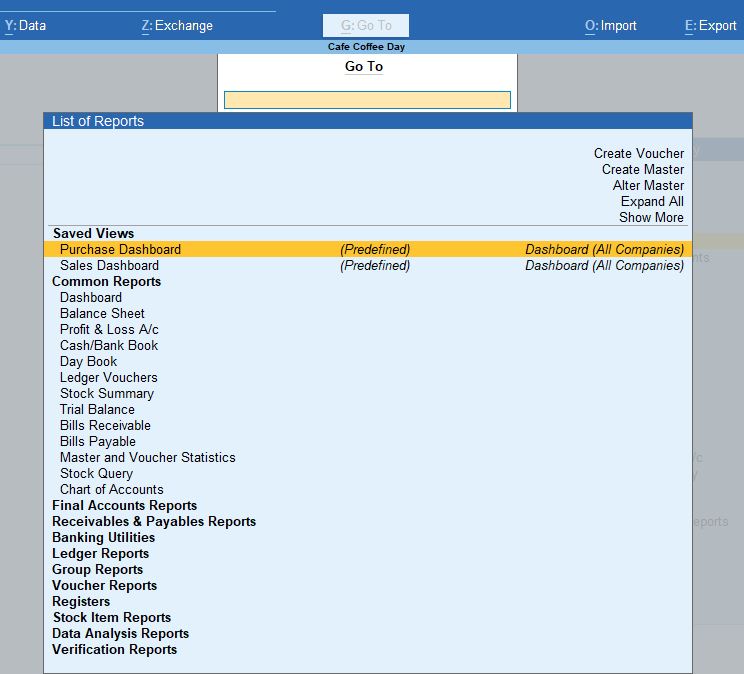

1. Alt + G (Go To) → Group Reports

- Alt + G is a shortcut that opens the Go To menu in Tally Prime, which provides quick access to various reports and ledgers.

- From this menu, you can select Group Reports, which allows you to access reports related to various ledger groups like Cash, Bank Accounts, Sundry Debtors, Sundry Creditors, and other ledger categories.

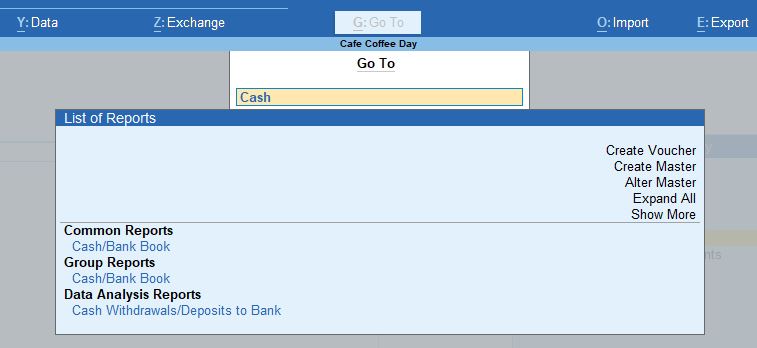

2. Group Reports → Cash/Bank Book

- In Group Reports, choose Cash/Bank Book. This option enables you to view the financial transactions of your cash and bank accounts, separately or together. These books help you track inflows and outflows of money from your business.

- This report gives you a ledger-wise view of all cash and bank accounts, summarizing their opening balances, transactions (receipts and payments), and closing balances.

3. Cash in Hand / Bank Account

Once inside the Cash/Bank Book, you will be prompted to select either:

a. Cash in Hand (Cash Book)

- Selecting Cash in Hand will take you to the Cash Book.

- Cash Book is a ledger that shows all the transactions involving cash. This includes cash receipts (money coming into the business) and cash payments (money going out).

- The Cash Book report helps you monitor:

- Opening Balance: The cash balance at the beginning of the period.

- Receipts: All cash inflows, such as from sales, payments received from debtors, or other receipts.

- Payments: All cash outflows, such as payments made to suppliers, expenses, or salaries.

- Closing Balance: The final cash balance at the end of the period.

b. Bank Account (Bank Book)

- Selecting Bank Account will take you to the Bank Book.

- Bank Book is a ledger that records all transactions involving your bank accounts. It tracks payments made by cheque, bank transfers, or other bank transactions.

- The Bank Book helps you manage and reconcile bank transactions, showing:

- Opening Balance: The amount in the bank at the start of the period.

- Receipts: Money deposited into the bank account, such as payments from customers or any bank deposits.

- Payments: Money withdrawn from the bank account, such as vendor payments, salary transfers, or any bank charges.

- Closing Balance: The ending balance in your bank account after all transactions.

4. Features of Cash and Bank Books:

- Date Range Customization: You can set a specific date range to view transactions for a particular period (e.g., monthly, quarterly, or yearly).

- Transaction Details: The report shows every transaction, including the date, voucher type (payment, receipt, or contra), ledger name, and amount involved.

- Drill-down Capability: By pressing Enter on any transaction, you can drill down into the individual voucher entry, which gives you a more detailed view of the transaction.

5. Additional Analysis Available:

- Monthly, Quarterly, or Yearly Summaries: You can press F6 to view the cash or bank transactions summarized on a monthly, quarterly, or yearly basis. This feature helps in analyzing the cash and bank account flows over time.

- F12 (Configuration): You can configure the report to show narrations, bill-wise details, inventory details, and other custom settings to match your reporting needs.

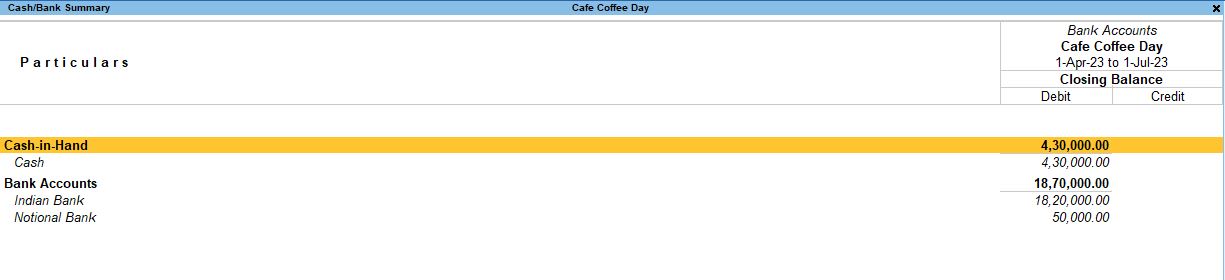

- This path will take you to either the Cash in Hand report (for cash accounts) or the Bank Account report (for bank transactions).

- You can analyze the transactions related to cash or bank accounts, including payments, receipts, and transfers, along with opening and closing balances.

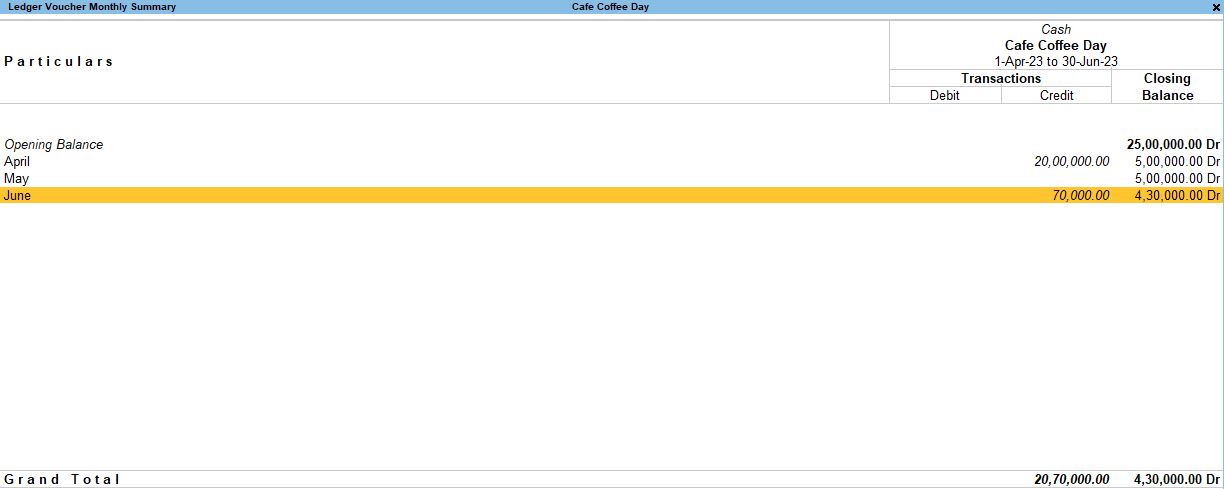

6. F6 (Monthly View) → Enter → Cash

- Pressing F6 gives you a Monthly Summary of the cash book or bank book. It shows the cash or bank transactions month by month, allowing you to see the financial activity over a selected period.

- Pressing Enter after selecting Cash drills down further into detailed transactions for a specific month.

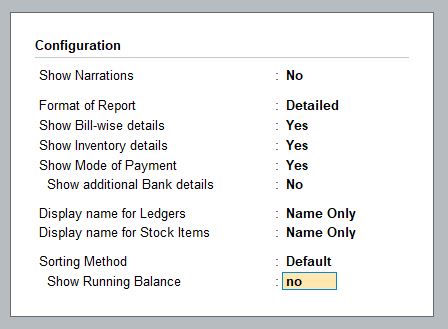

F12 Configuration (For Cash/Bank Book Reports):

By pressing F12, you can configure how you want the report to be displayed. Here's what each option does:

1. Show Narrations: No

- Narrations are the additional details or descriptions you add to each transaction. Setting this to No means the report will not display these narrations.

2. Format of Reports: Detailed

- The Detailed format shows each transaction in full, with the date, amount, and other details. This option gives you a comprehensive view of your transactions.

3. Show Bill-wise Details: Yes

- Enabling this will show bill-wise details for each transaction. This is useful if you are tracking payments and receipts against specific invoices or bills.

4. Show Inventory Details: Yes

- This shows whether there are any inventory movements (stock in or out) associated with the cash or bank transactions. It helps in tracking how inventory transactions affect your cash flow.

5. Show Mode of Payment: Yes

- This shows the mode of payment (cash, cheque, bank transfer, etc.) for each transaction, giving you insight into how payments were made.

6. Display Name for Ledger: Name Only

- This will display only the Name of the ledger involved in the transaction, instead of a full description.

7. Sorting Method: Default

- The transactions are sorted in the default order, which is typically by date or voucher number.

8. Show Running Balance: No

- If set to No, the report will not show the running balance after each transaction. Running balance is useful to track the balance of cash or bank after each entry, but it is excluded in this case.

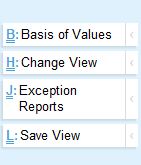

Ledger Monthly Summary → Ctrl + H (Change Periodicity) → Quarterly

- In the Ledger Monthly Summary, you can press Ctrl + H to change the report periodicity from monthly to quarterly, allowing you to see cash or bank transactions summarized by quarters (every three months).

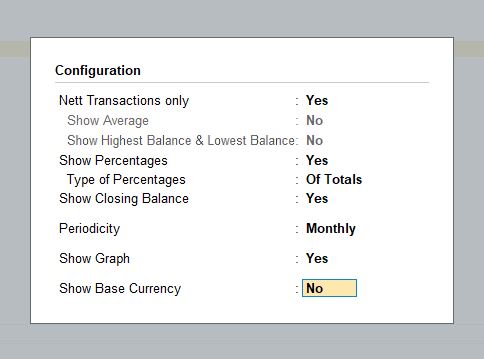

F12 Configuration (For Ledger Monthly Summary - Quarterly View):

When viewing the Quarterly Summary, you have different configuration options in F12:

1. Nett Transactions Only: Yes

- If this option is set to Yes, the report will show only net transactions (i.e., only the total inflow and outflow of funds) for each period, excluding zero-value or balanced entries.

2. Show Percentages: Yes

- This will display the percentage each transaction or entry represents in relation to the total value.

3. Type of Percentages: Of Totals

- This configuration shows percentages as a proportion of the overall totals for the period or ledger.

4. Show Closing Balance: Yes

- The report will show the Closing Balance for each quarter. This helps track the balance at the end of every quarter.

5. Periodicity: Yes

- The report can be shown in different periodicities like monthly, quarterly, or yearly, depending on your preference.

6. Show Base Currency: Yes

- If you are dealing with multiple currencies, this option will display the base currency value for the transactions. This is essential for businesses handling foreign exchange.

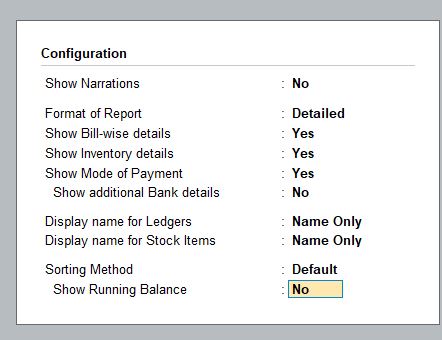

F12 Configuration (Further Details in Quarterly View):

When you access the Quarterly View, additional configurations under F12 allow more granular control of how the report looks

1. Show Narrations: No

- This configuration hides narrations (descriptions) for transactions in the report.

2. Format of Reports: Detailed

- Displays a detailed format of the transactions, giving comprehensive information on each.

3. Show Bill-wise Details: No

- If set to No, the report will not show bill-wise details for each transaction, keeping the focus on the overall ledger.

4. Show Inventory Details: No

- This excludes any inventory details from the report, which can be useful if you want to focus purely on cash or bank transactions.

5. Show Mode of Payment: Yes

- Displays the mode of payment (like cash, cheque, bank transfer, etc.) for each transaction.

6. Show Additional Bank Details: No

- This hides additional bank details such as cheque numbers or bank references.

7. Sorting Method: Default

- The transactions are displayed in the default sort order, typically by date or voucher number.

8. Show Running Balance: No

- This hides the running balance in the report, meaning you won’t see how the balance changes after each transaction.

Summary of Configurations in Tally Prime Cash and Bank Book Reports:

- Cash/Bank Book reports provide detailed or summarized views of cash and bank transactions.

- F12 Configuration allows customization of the report format, including what details to show (like narrations, bill-wise details, inventory details, mode of payment, and running balances).

- Ctrl + H allows changing the report periodicity to monthly or quarterly, giving flexibility in viewing data over different periods.

- Additional F12 settings for the Quarterly View provide control over what information to include, such as percentages, nett transactions, and closing balances, making the report highly customizable.

These features allow you to tailor reports according to your business needs, focusing on specific transaction details or giving a high-level summary for quick analysis.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions