GST Reports: Understanding Amended Transactions in Tally Prime

REPORTS

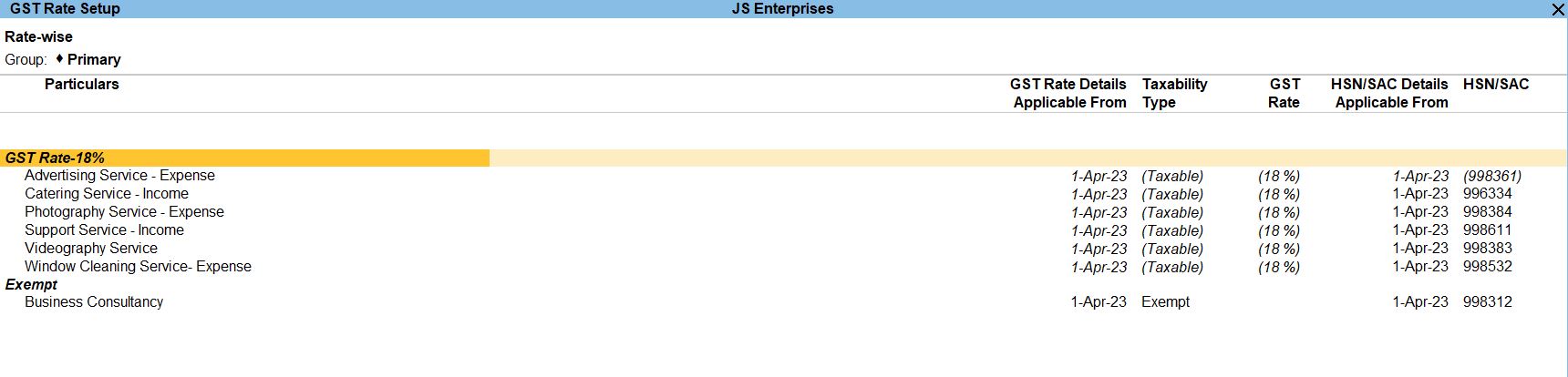

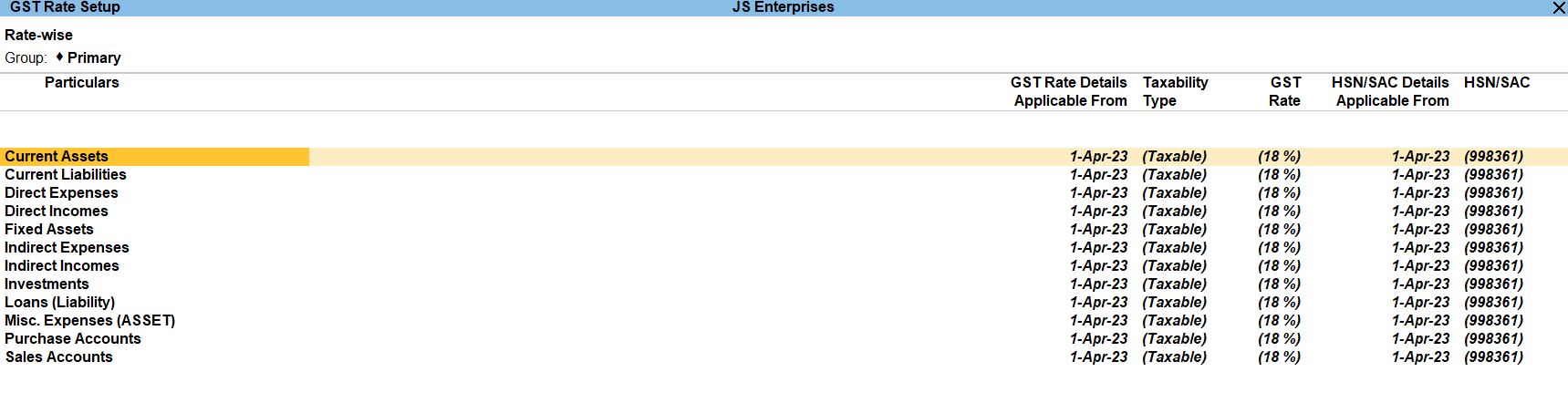

GST Rate Setup

- Go to "GST Reports" :

- Open Tally Prime software.

- Navigate to the main menu.

- Select "GST Reports" :

- Click on "Reports" from the main menu.

- Navigate to "GST Rate Setup" :

- Under the "GST Reports" section, find and select "GST Rate Setup".

- Understanding GST Rate Setup :

- The GST Rate Setup report in Tally Prime allows you to view and manage the GST rates applicable to various goods and services.

- It provides you with a list of HSN (Harmonized System of Nomenclature) or SAC (Service Accounting Code) codes along with their respective GST rates.

- You can use this report to verify the GST rates configured in your Tally Prime software and make any necessary adjustments if rates change or updates are required.

- Modifying GST Rates :

- From the GST Rate Setup report, you can modify GST rates if required. However, it's essential to ensure that any changes made are accurate and comply with the regulations set by the GST authorities.

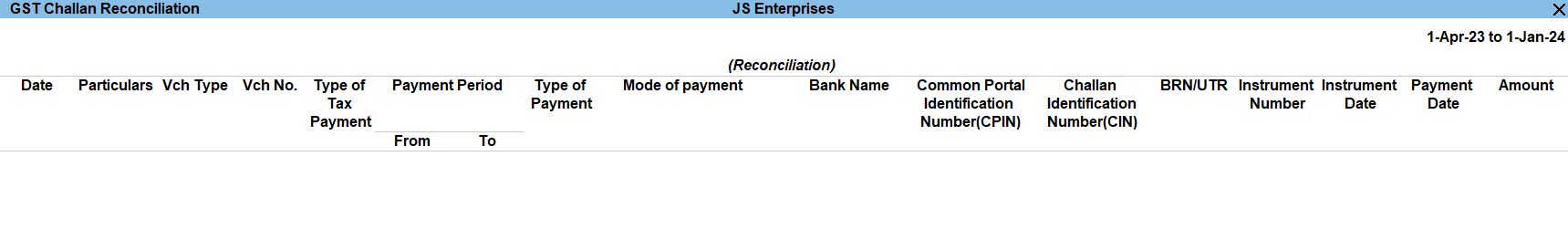

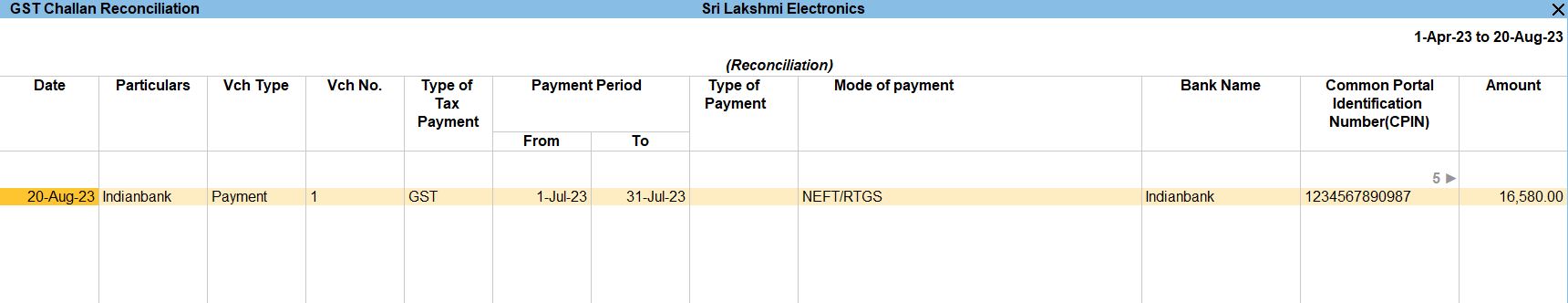

Challan Reconciliation

- Gateway of Tally :

- Open Tally Prime software.

- From the main screen, navigate to the Gateway of Tally.

- Display More Reports :

- Once in the Gateway of Tally, select "Display More Reports". This option allows you to access a wide range of reports available in Tally Prime.

- Statutory Reports :

- Under "Display More Reports", select "Statutory Reports". This section contains reports related to various statutory compliance requirements, including GST.

- GST Reports :

- In the Statutory Reports section, select "GST Reports". This will display all the GST-related reports available in Tally Prime.

- Challan Reconciliation :

- Under GST Reports, find and select "Challan Reconciliation". This report helps in reconciling the details of challans generated on the GST portal with the records maintained in Tally Prime.

- Understanding Challan Reconciliation Report :

- The Challan Reconciliation report in Tally Prime assists in verifying and reconciling the data related to GST payments made through challans.

- It compares the challan details captured in Tally Prime with those uploaded on the GST portal to identify any discrepancies or mismatches.

- This report is essential for ensuring the accuracy and completeness of GST payments made by your business.

- Reconciliation Process :

- Once you access the Challan Reconciliation report, you can review the details and reconcile any discrepancies identified.

- Investigate any variances between the challan details recorded in Tally Prime and those available on the GST portal.

- Take necessary actions to rectify the discrepancies and ensure that all GST payments are accurately reflected in your records.

- Generating and Analyzing the Report :

- After accessing the Challan Reconciliation report, you can generate it on the screen to review the details.

- Additionally, you can print or export the report in various formats like PDF or Excel for further analysis or sharing purposes.

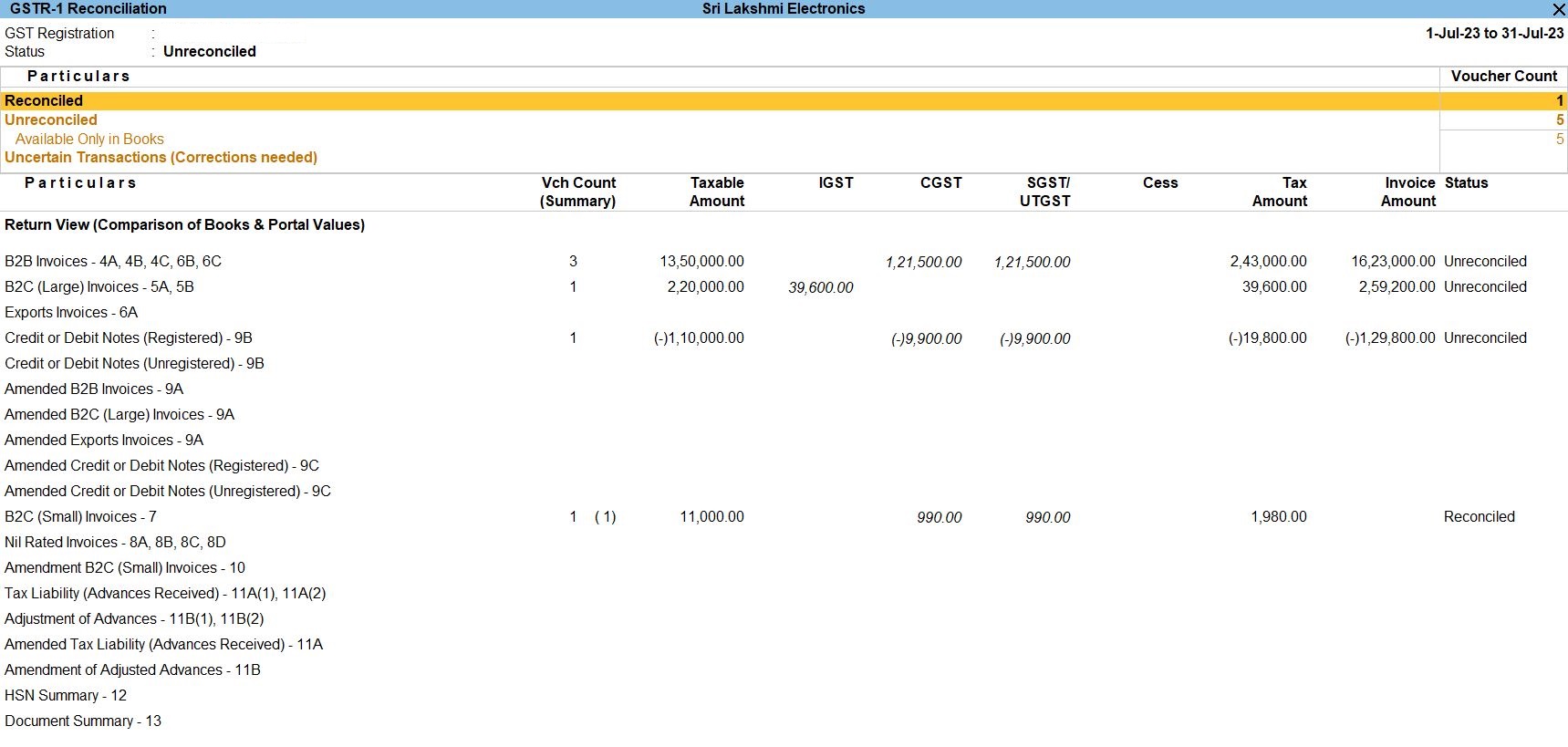

GSTR -1 Reconciliation

- Gateway of Tally :

- Open Tally Prime software.

- From the main screen, navigate to the Gateway of Tally.

- Display More Reports :

- Once in the Gateway of Tally, select "Display More Reports". This option allows you to access a wider range of reports available in Tally Prime.

- GST Reports :

- Under "Display More Reports", select "GST Reports". This section contains reports related to GST compliance and filings.

- GSTR-1 Reconciliation :

- In the GST Reports section, find and select "GSTR-1 Reconciliation". This report helps in reconciling the data entered in your Tally Prime software with the details to be filed in the GSTR-1 return.

- Understanding GSTR-1 Reconciliation Report :

- The GSTR-1 Reconciliation report in Tally Prime assists in comparing the sales data entered in Tally Prime with the data required for GSTR-1 filing.

- It helps identify any variances or discrepancies between the data captured in Tally Prime and the data to be reported in GSTR-1.

- Reconciliation Process :

- Once you access the GSTR-1 Reconciliation report, you can review the sales data recorded in Tally Prime and compare it with the data required for GSTR-1 filing.

- Identify any variances or discrepancies and take necessary actions to rectify them to ensure accurate GSTR-1 filing.

- Generating and Analyzing the Report :

- After accessing the GSTR-1 Reconciliation report, you can generate it on the screen to review the details.

- Analyze the variances or discrepancies identified and make corrections in Tally Prime as required.

- You can also print or export the report in various formats like PDF or Excel for further analysis or sharing purposes.

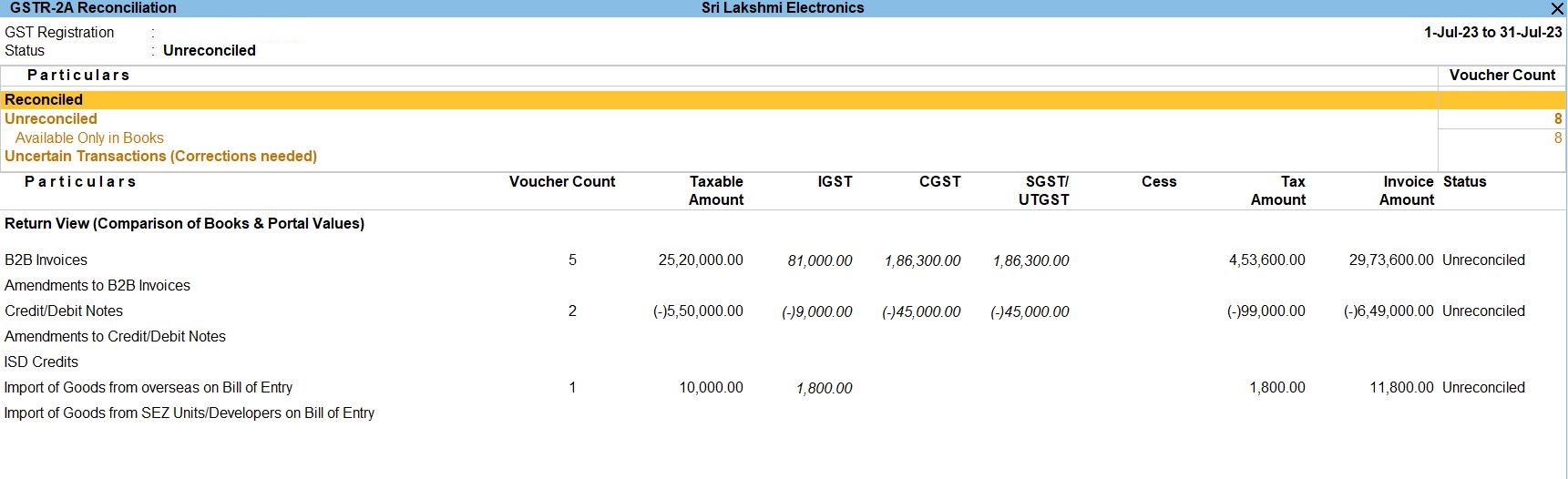

GSTR -2A Reconciliation

- Gateway of Tally :

- Open Tally Prime software.

- From the main screen, navigate to the Gateway of Tally.

- Display More Reports :

- Once in the Gateway of Tally, select "Display More Reports". This option allows you to access a wider range of reports available in Tally Prime.

- GST Reports :

- Under "Display More Reports", select "GST Reports". This section contains reports related to GST compliance and filings.

- GSTR-2A Reconciliation :

- In the GST Reports section, find and select "GSTR-2A Reconciliation". This report helps in reconciling the data available in GSTR-2A (Auto-populated return) with the purchase data entered in your Tally Prime software.

- Understanding GSTR-2A Reconciliation Report :

- The GSTR-2A Reconciliation report in Tally Prime assists in comparing the purchase data recorded in Tally Prime with the data available in GSTR-2A.

- It helps identify any variances or discrepancies between the purchase data captured in Tally Prime and the data available in GSTR-2A.

- Reconciliation Process :

- Once you access the GSTR-2A Reconciliation report, you can review the purchase data recorded in Tally Prime and compare it with the data available in GSTR-2A.

- Identify any variances or discrepancies and take necessary actions to rectify them to ensure accurate GST compliance.

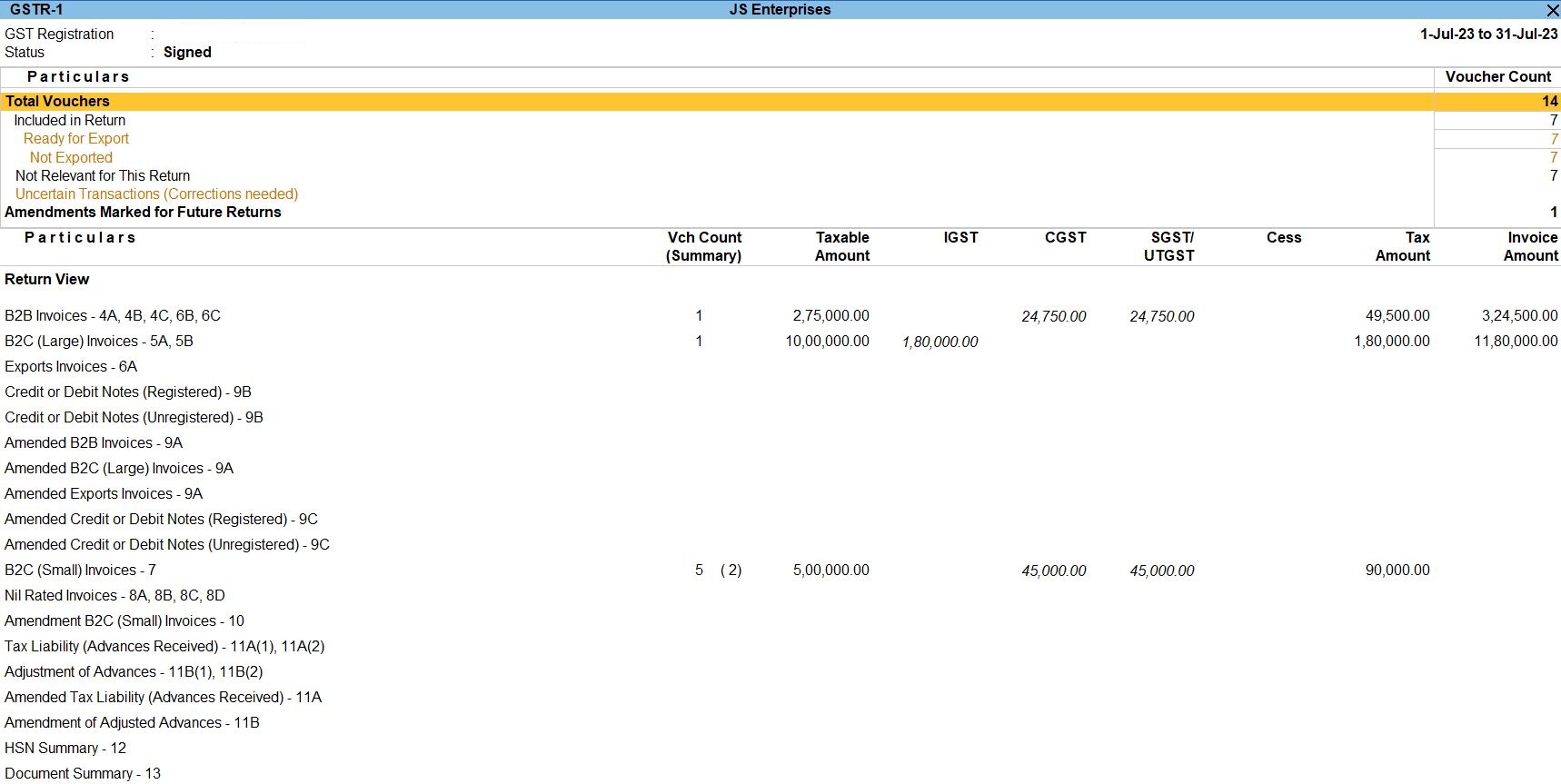

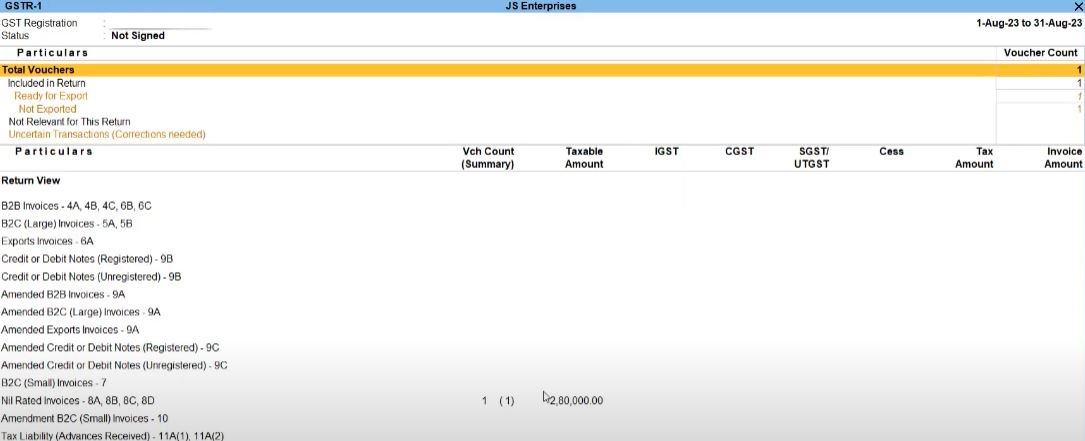

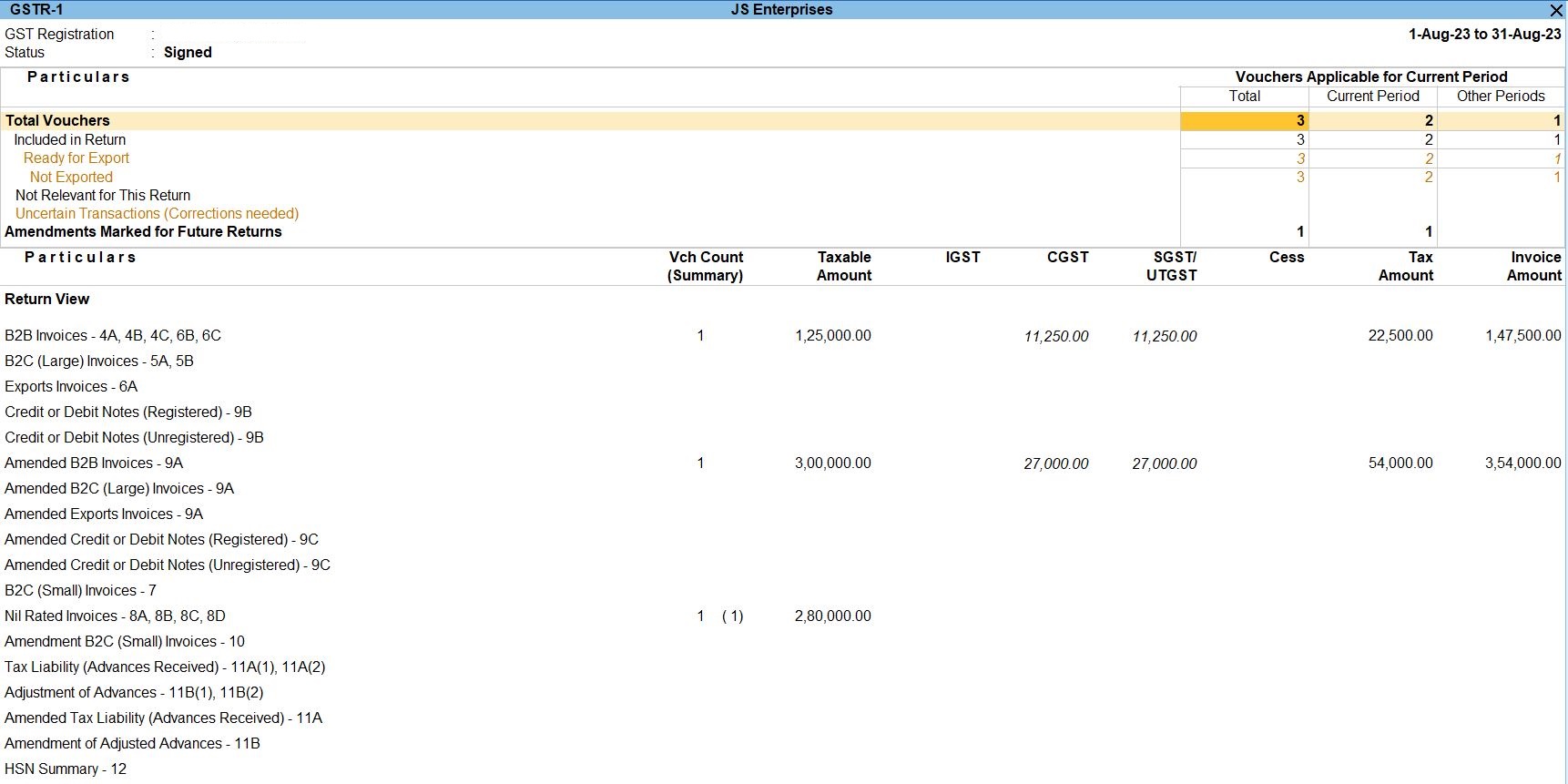

GSTR - 1

- Gateway of Tally :

- Open Tally Prime software.

- From the main screen, navigate to the Gateway of Tally.

- Display More Reports :

- Once in the Gateway of Tally, select "Display More Reports". This option allows you to access a wider range of reports available in Tally Prime.

- GST Reports :

- Under "Display More Reports", select "GST Reports". This section contains reports related to GST compliance and filings.

- GSTR-1 :

- In the GST Reports section, find and select "GSTR-1". This report displays the details of outward supplies made by your business, which need to be reported in the GSTR-1 return.

- Understanding GSTR-1 Report :

- The GSTR-1 report in Tally Prime provides a comprehensive view of all the outward supplies made by your business during a specific tax period.

- It includes details such as invoice-wise sales, taxable value, GST rates, and tax amounts for each transaction.

- The report helps in ensuring compliance with GST regulations by providing accurate information for filing the GSTR-1 return.

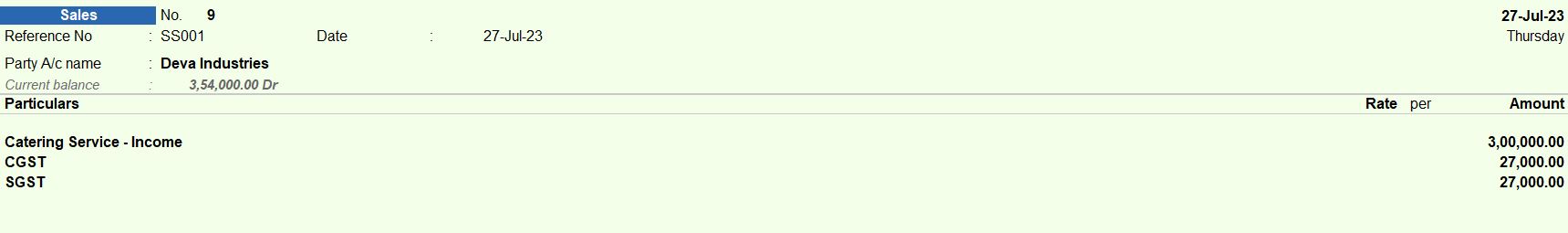

Sales Voucher

- Navigate to the voucher entry section. This is typically found in the "Accounting Vouchers" or "Gateway of Tally" section, depending on your Tally Prime configuration.

- Once in the voucher entry section, select the type of voucher you want to create. In this case, it would be a "Sales Voucher."

- In the sales voucher screen, you'll see fields to input various details. Here's how you would fill them based on the provided information:

- Party A/c Name : Deva Industries

- Particulars/Description : Catering Service – Income

- Amount : 275,000 (This is the amount of income from catering services)

- Tax details :

- CGST (Central Goods and Services Tax) : 24,750

- SGST (State Goods and Services Tax) : 24,750

- Ensure that the total amount reflects the sum of the income and the taxes (i.e., 275,000 + 24,750 + 24,750 = 324,500).

- Verify all the details entered in the voucher to ensure accuracy.

- Once you've reviewed everything, save the voucher.

GSTR -1 Reports

Amended Transaction in GST

- Accessing the Report :

- Go to the main menu.

- Navigate to the "Display" section.

- Select "GST Reports."

- Choose "Amended Transaction" from the list of available reports.

- Parameters :

- You can set parameters such as the period for which you want to view amended transactions. This allows you to focus on a specific time frame, such as a particular month or financial year.

- Additionally, you can specify other filters such as the type of transaction (e.g., sales, purchases) or the type of document (e.g., invoice, debit note, credit note).

- Information Provided :

- The report provides details of all transactions that have been amended during the specified period, including both sales and purchase transactions.

- Each entry in the report typically includes information such as the voucher number, date, party name, transaction type, original amount, amended amount, and remarks.

- Interpreting the Report :

- Use this report to review and reconcile any changes made to GST transactions. It helps in ensuring the accuracy of your GST filings and compliance with regulations.

- Identify any discrepancies or errors in the amended transactions and take necessary corrective actions.

- Monitor changes made by users to ensure accountability and transparency in financial transactions.

- Actions Based on the Report :

- If you identify any incorrect amendments, you can reverse or rectify them as needed.

- Use the information provided in the report for GST filing purposes, ensuring that amended transactions are accurately reflected in your GST returns.

- Analyze trends in amended transactions over time to identify areas for process improvement or training needs within your organization.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions