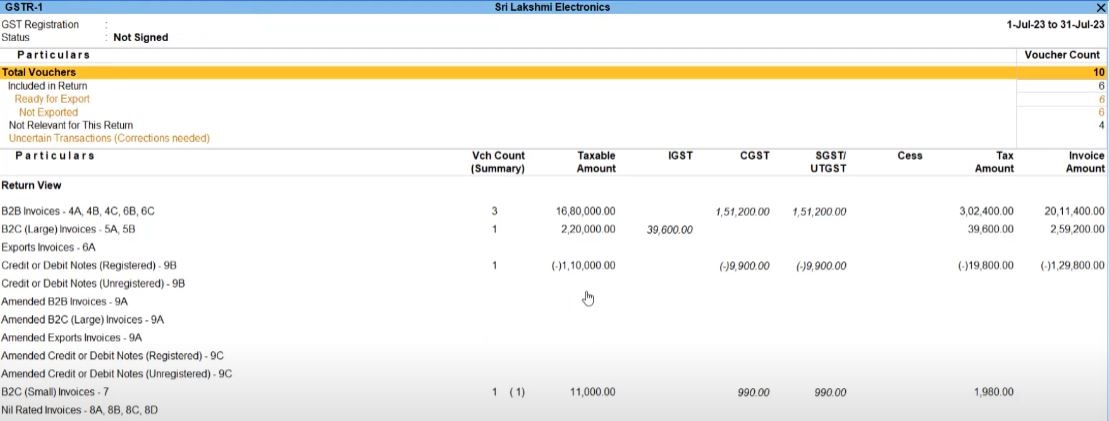

Simplified GST Return of Goods Process in Tally Prime

Purchase Return

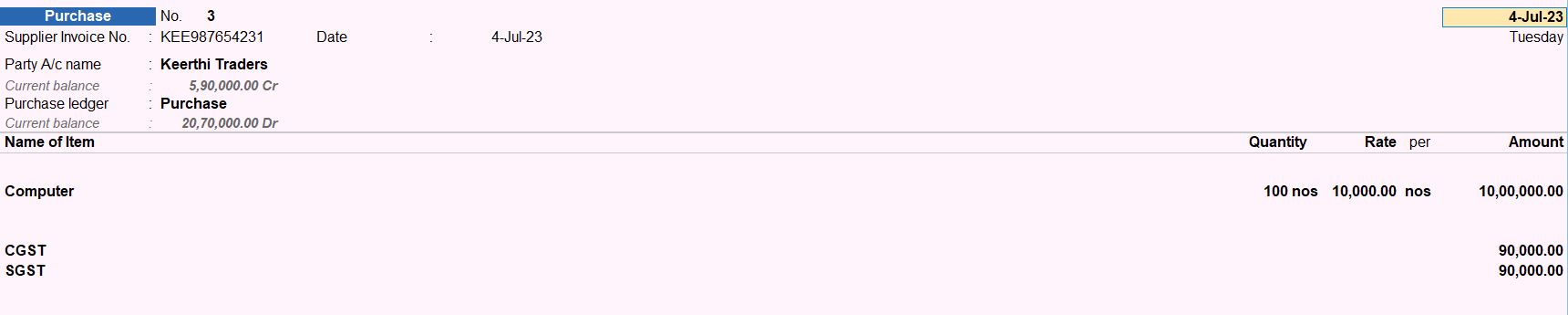

04-07-23 Purchase the following goods from Keerthi Traders Tamil Nadu with Supplier Invoice no: KEE987654231 with Tax 18%.

| Item |

Qty |

Rate |

| Computer |

100 |

10000 |

| PAN |

XXXXXXXXXX |

| GSTIN/UIN |

33XXXXXXXXXX1ZY |

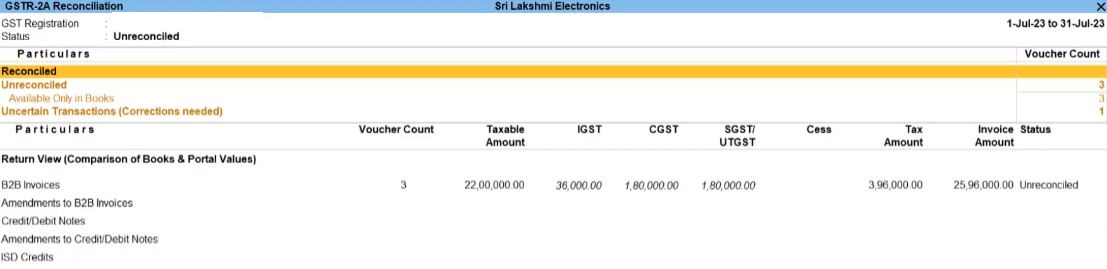

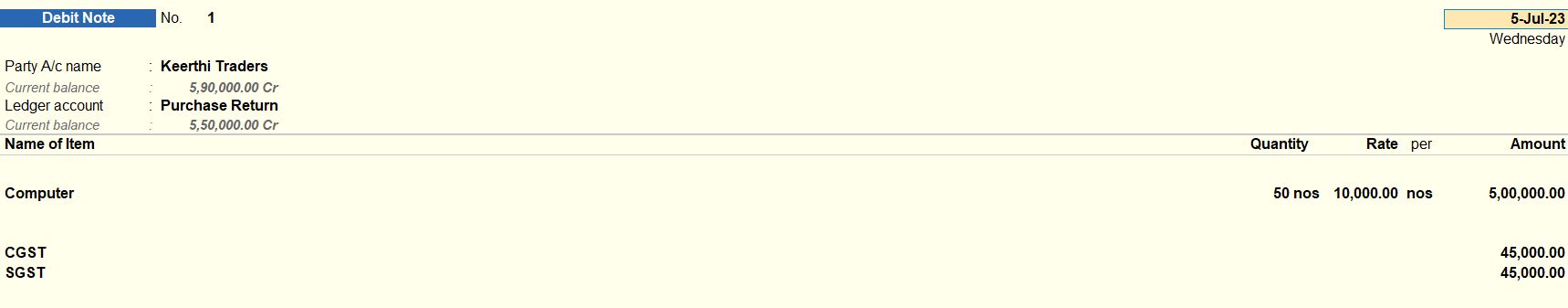

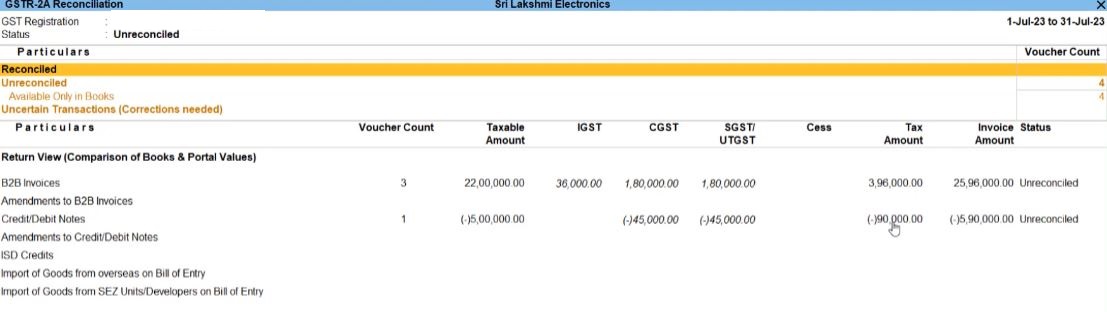

05-07-23 Returned the following damaged goods to Keerthi Traders against the supplier invoice no: KEE987654231 dated 04-07-23 with Tax 18%.

| Item |

Qty |

Rate |

| Computer |

50 |

10000 |

Sales Return

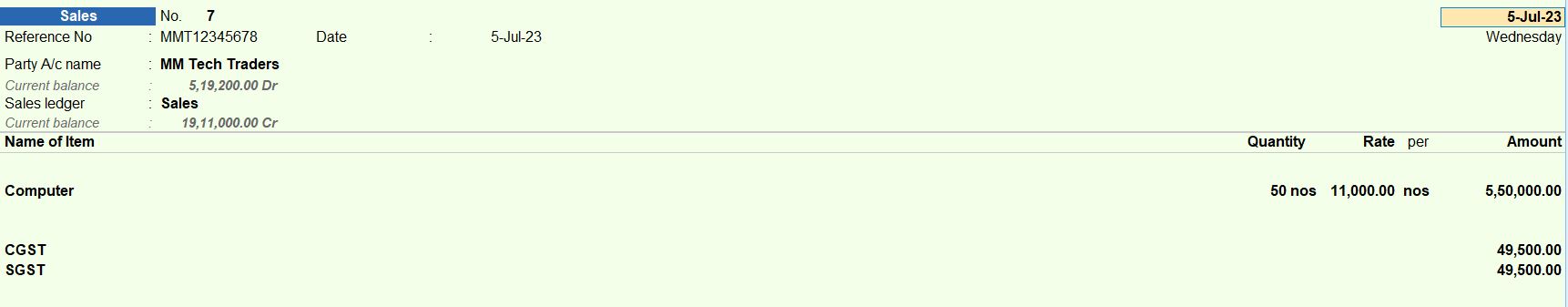

05-07-23 Sold the following goods to MM Tech Traders, Tamil Nadu with Reference no: MMTT12345678 with tax 18%.

| Item |

Qty |

Rate |

| Computer |

50 |

11000 |

| PAN |

XXXXXXXXXX |

| GSTIN/UIN |

33XXXXXXXXXX1Z5 |

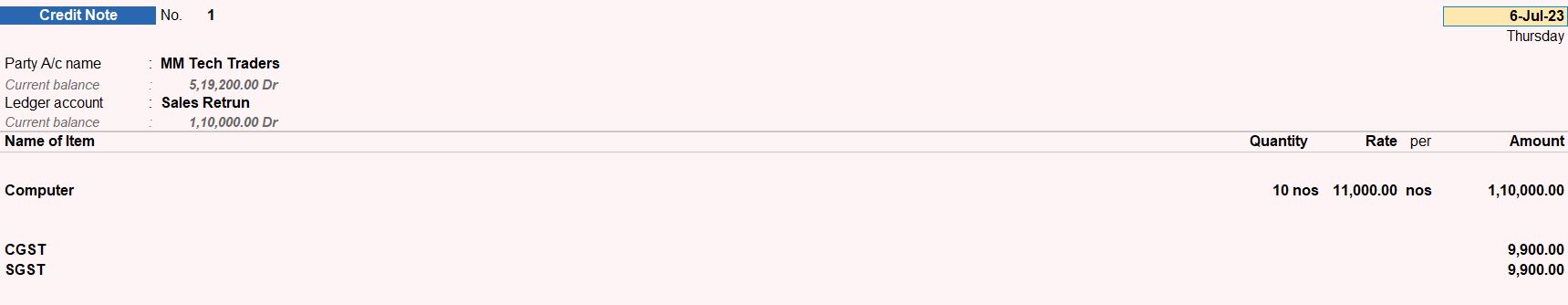

06-07-23 MM Tech Traders returned the following goods against the sales reference no: MT.

| Item |

Qty |

Rate |

| Computer |

10 |

11000 |

04-07-23 Purchase the following goods from Keerthi Traders Tamil Nadu with Supplier Invoice no: KEE987654231 with Tax 18%.

| Item |

Qty |

Rate |

| Computer |

100 |

10000 |

- Access Purchase Voucher Creation: From the Gateway of Tally screen, navigate to the "Accounting Vouchers" menu.

- Select Purchase Voucher: Choose the option to create a new Purchase Voucher.

- Enter Voucher Date: Set the voucher date as 04-07-23.

- Enter Supplier Details:

- Party A/c Name: Keerthi Traders

- PAN: XXXXXXXXXX (Enter the PAN number of the supplier if available)

- GSTIN/UIN: 33XXXXXXXXXX1ZY (Enter the GSTIN/UIN number of the supplier)

- Enter Supplier Invoice Details:

- Supplier Invoice No: KEE987654231

- Enter Items:

- Item: Computer

- Quantity: 100

- Rate: 10000

- Tax: 18%

- Enter CGST and SGST:

- Save and Confirm: After entering all the details accurately, save the purchase voucher.

05-07-23 Sold the following goods to MM Tech Traders, Tamil Nadu with Reference no: MMTT12345678 with tax 18%.

| Item |

Qty |

Rate |

| Computer |

50 |

11000 |

- Access Debit Note Voucher Creation: From the Gateway of Tally screen, navigate to the "Accounting Vouchers" menu.

- Select Debit Note Voucher: Choose the option to create a new Debit Note Voucher.

- Enter Voucher Date: Set the voucher date as 05-07-23.

- Enter Supplier Details:

- Party A/c Name: Keerthi Traders

- Enter Supplier Invoice Details:

- Supplier Invoice No: KEE987654231

- Invoice Date: 04-07-23

- Enter Items:

- Item: Computer

- Quantity: 50 (for returned damaged goods)

- Rate: 10000 (as per original purchase invoice)

- Tax: 18%

- Enter CGST and SGST:

- Save and Confirm: After entering all the details accurately, save the debit note voucher.

05-07-23 Sold the following goods to MM Tech Traders, Tamil Nadu with Reference no: MMTT12345678 with tax 18%.

| Item |

Qty |

Rate |

| Computer |

50 |

11000 |

| PAN |

XXXXXXXXXX |

| GSTIN/UIN |

33XXXXXXXXXX1Z5 |

- Access Sales Voucher Creation: From the Gateway of Tally screen, navigate to the "Accounting Vouchers" menu.

- Select Sales Voucher: Choose the option to create a new Sales Voucher.

- Enter Voucher Date: Set the voucher date as 05-07-23.

- Enter Customer Details:

- Party A/c Name: MM Tech Traders

- Enter Invoice Details:

- Reference No: MMTT12345678

- Enter Items:

- Item: Computer

- Quantity: 50

- Rate: 11000

- Tax: 18%

- Enter CGST and SGST:

- Save and Confirm: After entering all the details accurately, save the sales voucher.

06-07-23 MM Tech Traders returned the following goods against the sales reference no: MT.

| Item |

Qty |

Rate |

| Computer |

10 |

11000 |

- Access Credit Note Voucher Creation: From the Gateway of Tally screen, navigate to the "Accounting Vouchers" menu.

- Select Credit Note Voucher: Choose the option to create a new Credit Note Voucher.

- Enter Voucher Date: Set the voucher date as 06-07-23.

- Enter Customer Details:

- Party A/c Name: MM Tech Traders

- Enter Invoice Details:

- Enter Items:

- Item: Computer

- Quantity: 10

- Rate: 10000

- Tax: 18%

- Enter CGST and SGST:

- Save and Confirm: After entering all the details accurately, save the credit note voucher.