Mastering GST Tax Rates: Master Levels and Transaction Levels

GST Rates Stock Group Level

For Example : We deal with Hardware like USB, Keyboards, Mouse etc. which attracts GST 18% and Software like Tally, Os-windows, MS-office Package etc. which attracts GST 18%. We can create the stock group Hardware and Software and configure GST rates for each stock group.

| Group Name | Stock Item Name | HSN Code |

|---|---|---|

| Hardware | USB | 85444292 |

| Keyboards | 84716040 | |

| Mouse | 84716060 | |

| Furniture’s | Table light lamp | 94055031 |

| Desktop Table | 94036000 | |

| Steel Chairs | 94017900 |

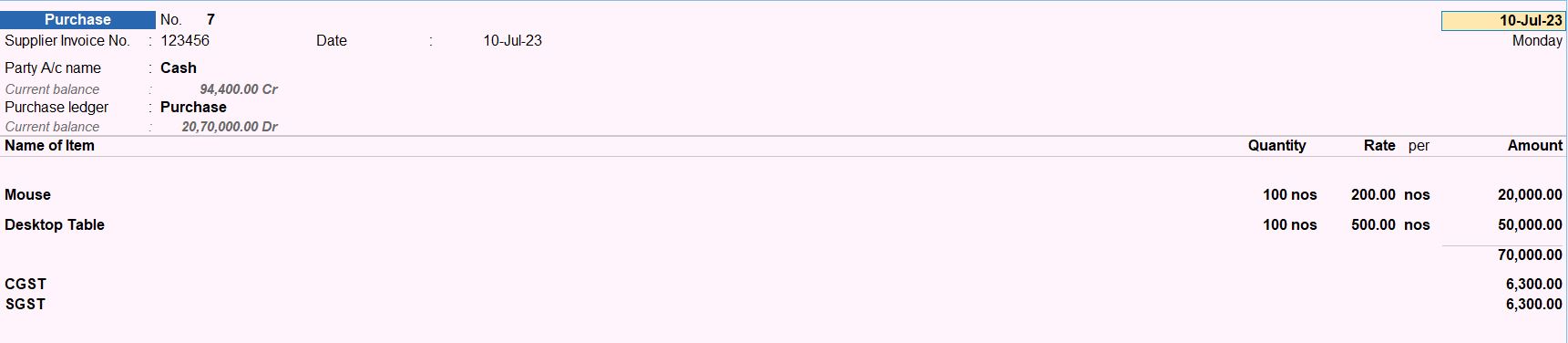

10-07-23 Lakshmi Electronics purchased the following stock item on cash from a registered dealer in Tamil Nadu.

| Item | Qty | Rate |

|---|---|---|

| Mouse | 100 Nos | 200 |

| Desktop Table | 100 Nos | 500 |

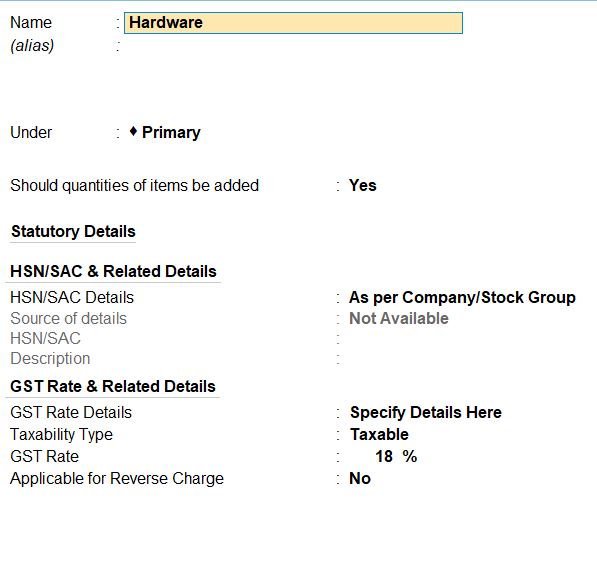

Stock Group Creation

- Access Stock Group Creation:

- Go to Gateway of Tally.

- Select "Create" from the main menu.

- Choose " Inventory Master " under " Stock Groups ".

- Create Stock Group for Hardware:

- Press Alt+C to create a new stock group.

- Enter "Hardware" as the Group Name.

- Specify the Taxability Type as 18%.

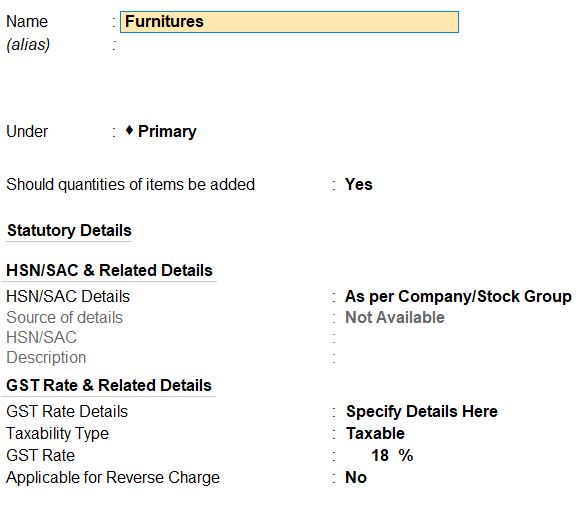

- Create Stock Group for Furniture:

- Press Alt+C to create another new stock group.

- Enter "Furniture" as the Group Name.

- Specify the Taxability Type as 18%.

- Save Changes: After entering the details for both stock groups, press Enter to save the changes.

Stock Item Creation

- Access Stock Item Creation:

- Go to Gateway of Tally.

- Select "Create" from the main menu.

- Choose " Inventory Master " under " Stock Items ".

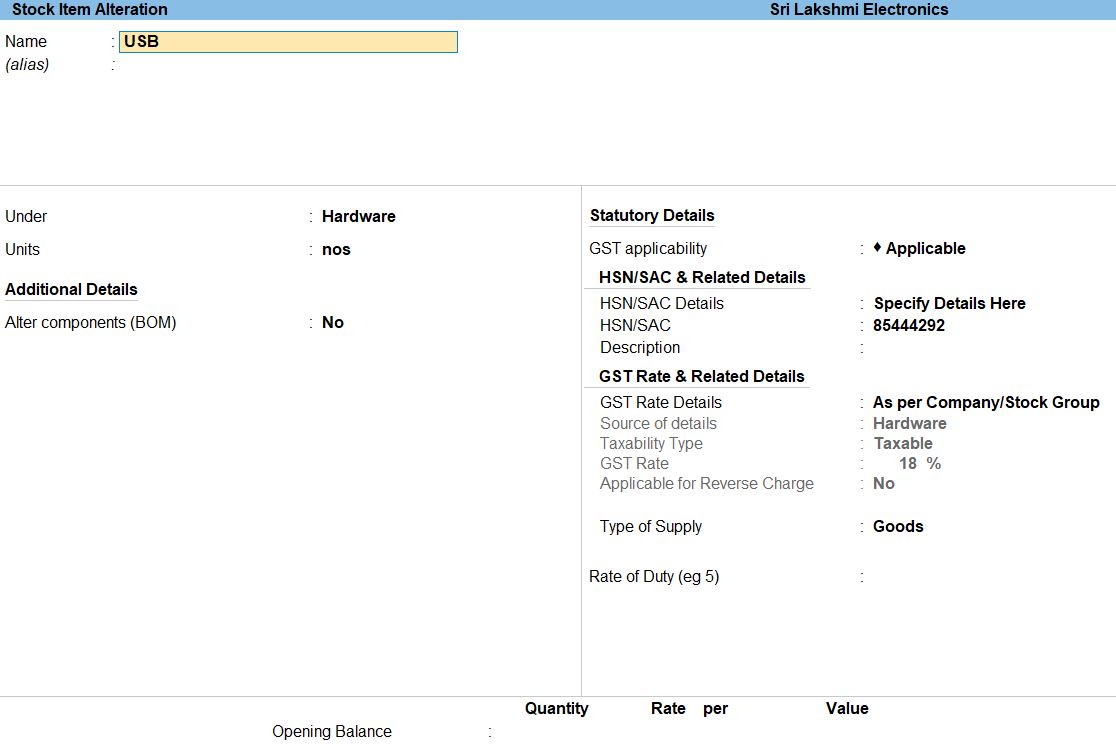

- Create Stock Items for Hardware:

- Press Alt+C to create a new stock item.

- Enter the details for the first item, "USB":

- Stock Item Name: USB

- Under Group: Select "Hardware" from the list.

- HSN Code: 85444292

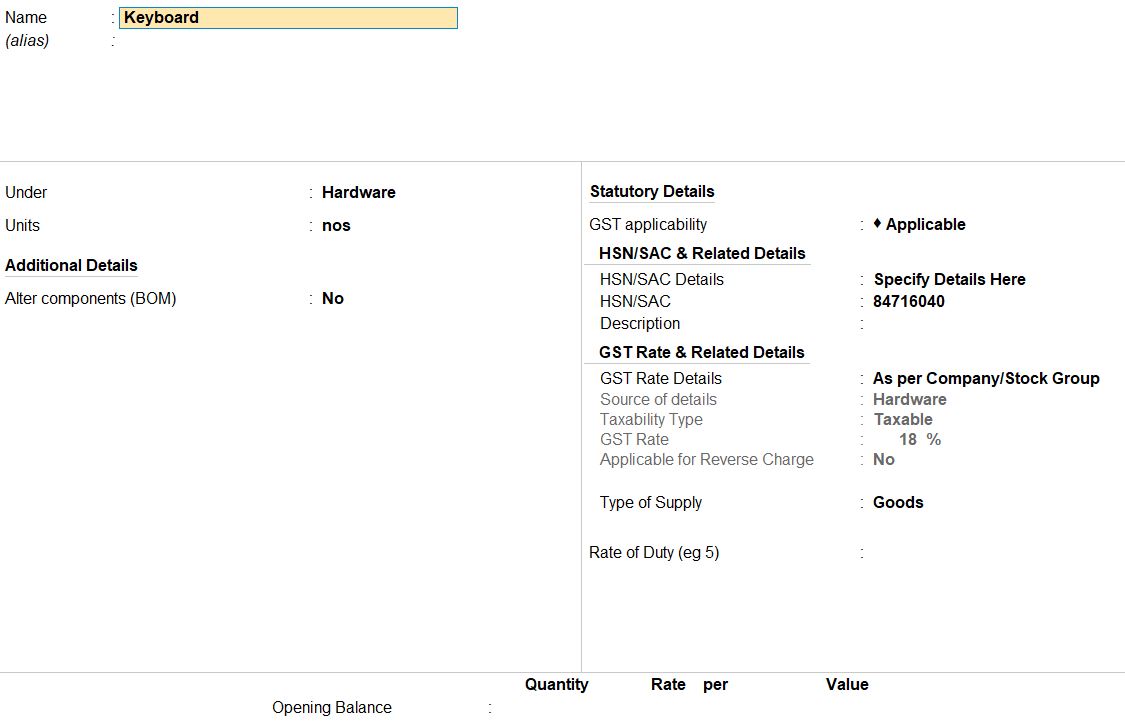

- Enter the details for the second item, "Keyboards":

- Stock Item Name: Keyboards

- Under Group: Select "Hardware" from the list.

- HSN Code: 84716040

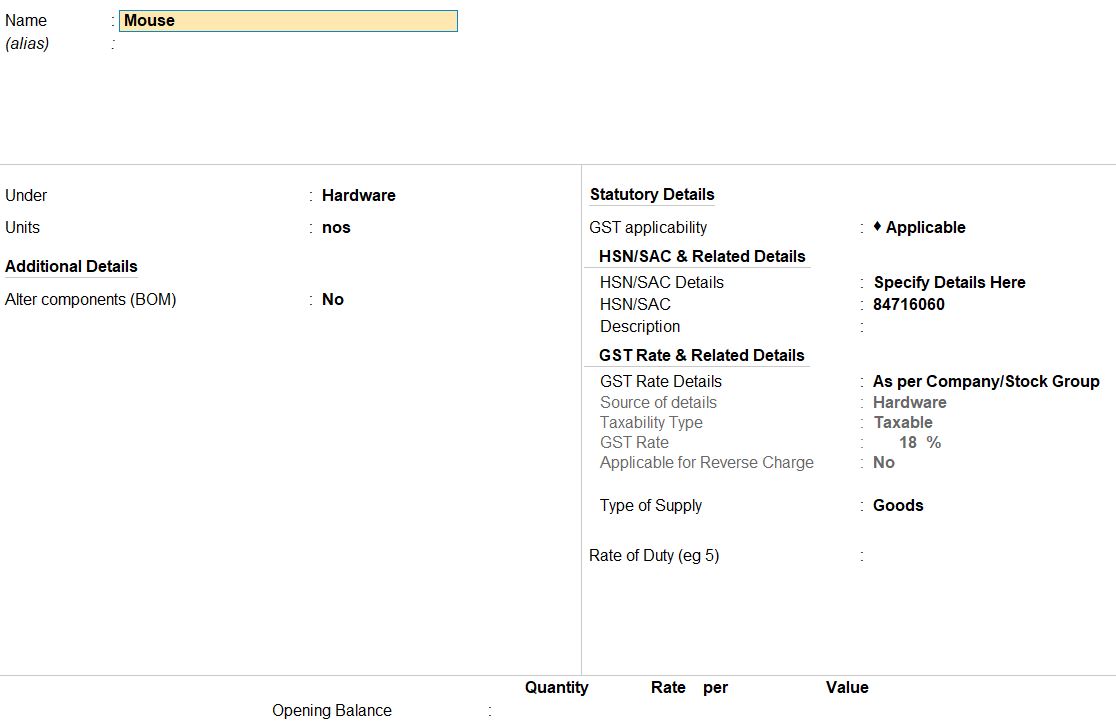

- Enter the details for the third item, "Mouse":

- Stock Item Name: Mouse

- Under Group: Select "Hardware" from the list.

- HSN Code: 84716060

- Create Stock Items for Furniture:

- Press Alt+C to create another new stock item.

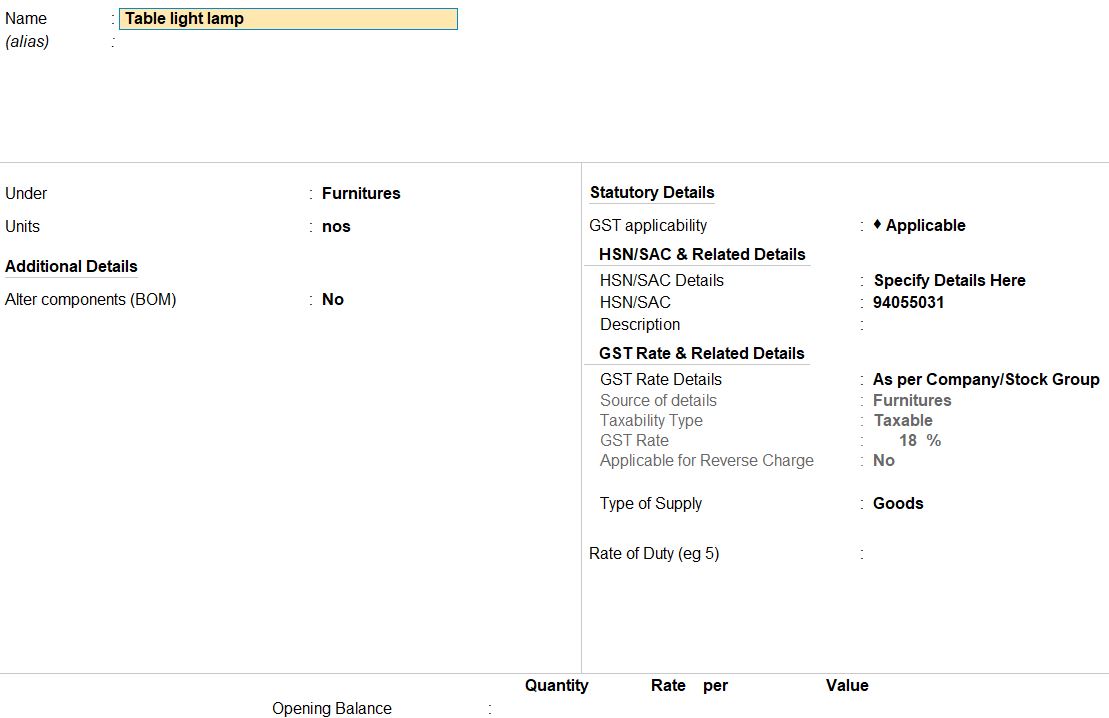

- Enter the details for the first furniture item, "Table light lamp":

- Stock Item Name: Table light lamp

- Under Group: Select "Furniture" from the list.

- HSN Code: 94055031

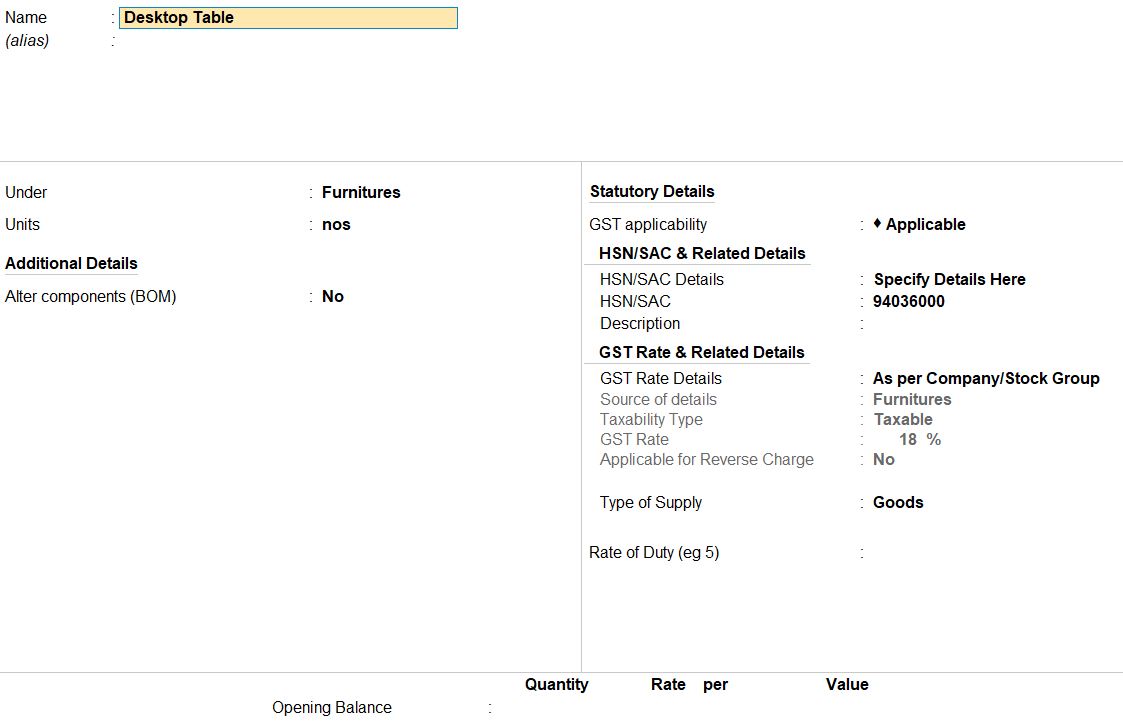

- Enter the details for the second furniture item, "Desktop Table":

- Stock Item Name: Desktop Table

- Under Group: Select "Furniture" from the list.

- HSN Code: 94036000

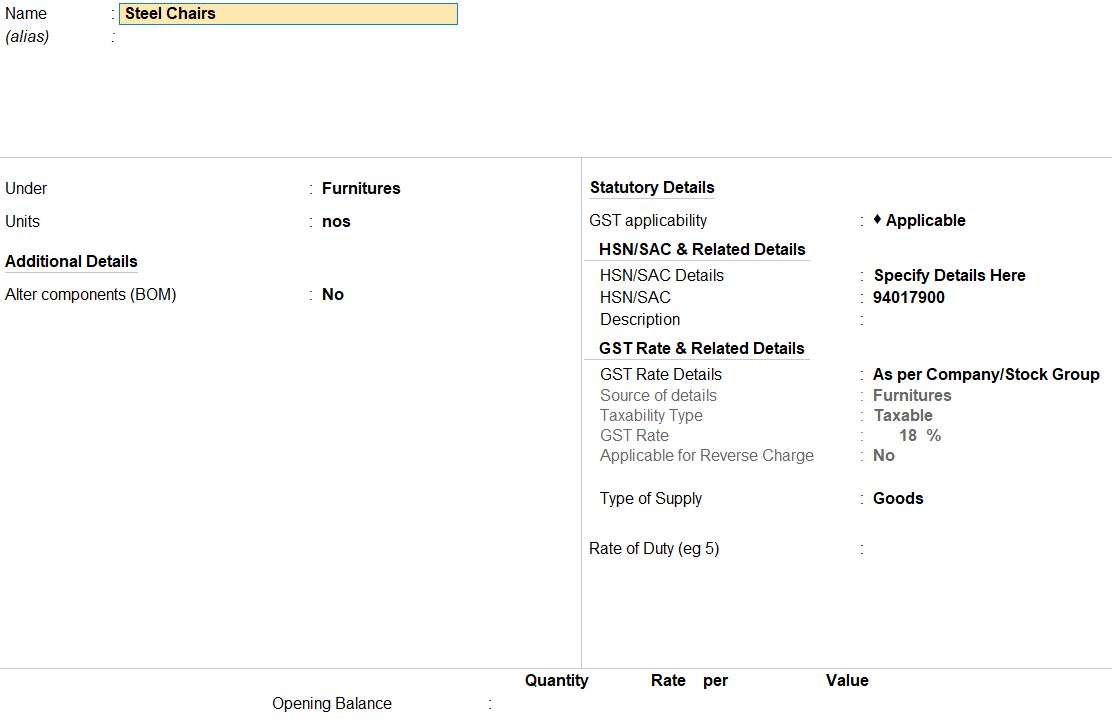

- Enter the details for the third furniture item, "Steel Chairs":

- Stock Item Name: Steel Chairs

- Under Group: Select "Furniture" from the list.

- HSN Code: 94017900

- Save Changes: After entering the details for all stock items, press Enter to save the changes.

- Access Purchase Voucher:

- Go to Gateway of Tally.

- Select "Accounting Vouchers" from the main menu.

- Choose "F9: Purchase" to create a new purchase voucher.

- Enter Purchase Details:

- Date: 10-07-23

- Supplier Invoice No: [Enter the supplier invoice number, if available]

- Party A/c Name: Select "Cash" from the list of ledgers.

- Add Stock Items:

- Under Particulars, select the first item, "Mouse":

- Qty: 100 Nos

- Rate: Rs. 200

- Similarly, add the second item, "Desktop Table":

- Qty: 100 Nos

- Rate: Rs. 500

- Specify GST Details:

- CGST: Rs. 6300

- SGST: Rs. 6300

- Ensure that the tax amounts are correctly calculated based on the GST rates and quantities entered for each item.

- Under Particulars, select the first item, "Mouse":

- Save the Voucher:

- Verify all details entered in the purchase voucher.

- Press Ctrl+A to save the voucher.

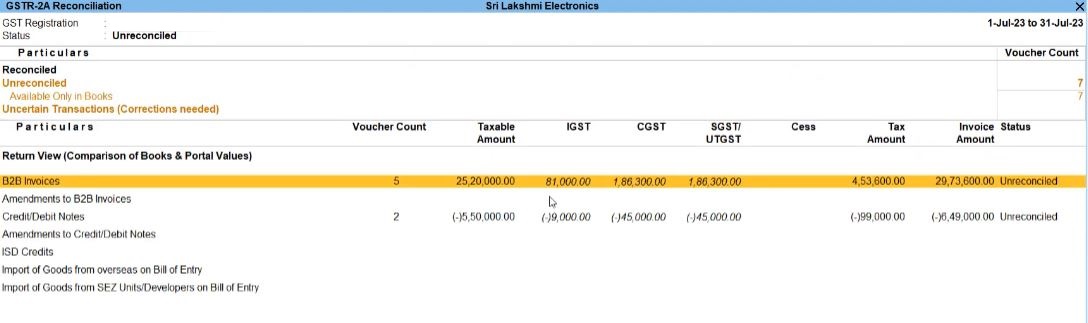

Reports

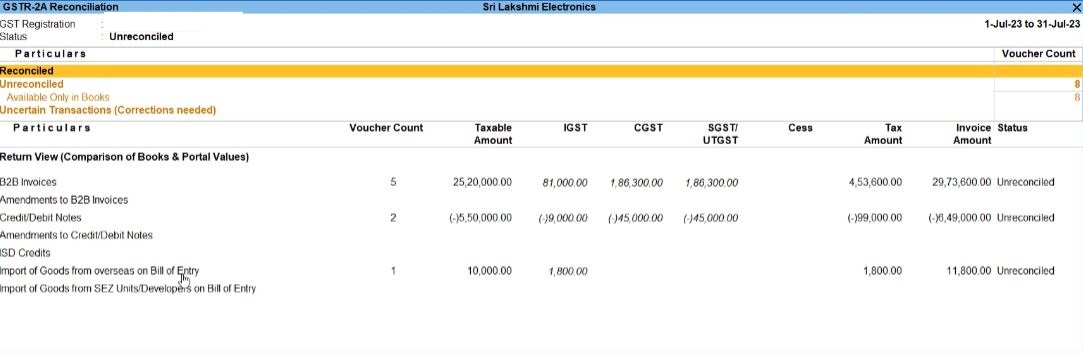

- Gateway of Taly -> Display More Reports -> GST Reports -> GSTR-2A Reconciliation

Transaction Levels

GST Rate at Transaction Level

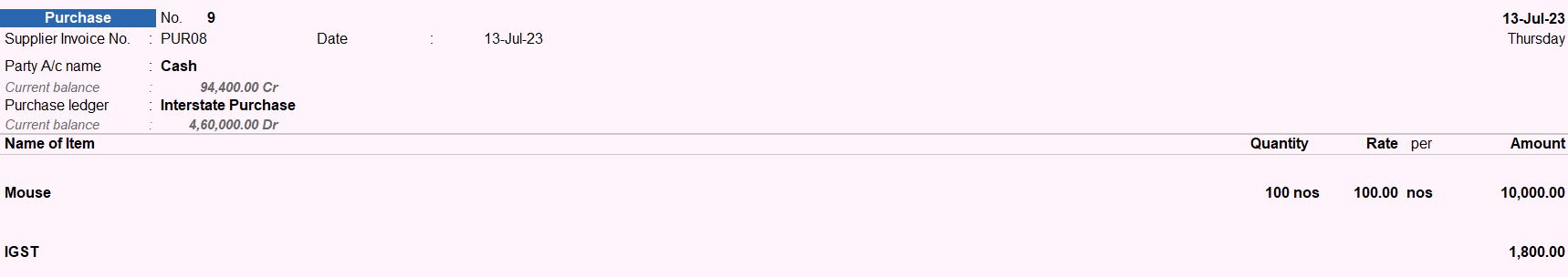

For Example : Sri Lakshmi Electronics imported 100 Nos of Mouse from Bangladesh.

- Access Purchase Voucher:

- Go to Gateway of Tally.

- Select "Vouchers" from the main menu.

- Choose "F9: Purchase" to create a new purchase voucher.

- Enter Purchase Details:

- Date: [Enter the purchase date]

- Supplier Invoice No: [Enter the supplier invoice number, if available]

- Party A/c Name: Select "Cash" from the list of ledgers.

- Purchase Ledger: Select "Interstate Purchase" from the list of ledgers.

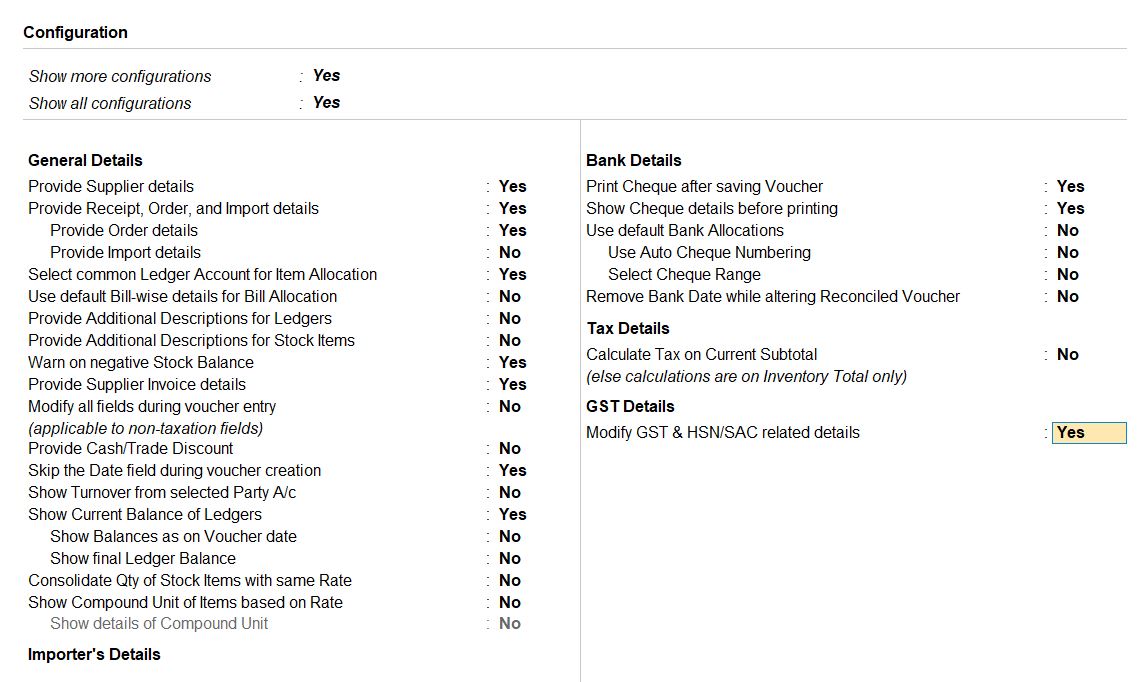

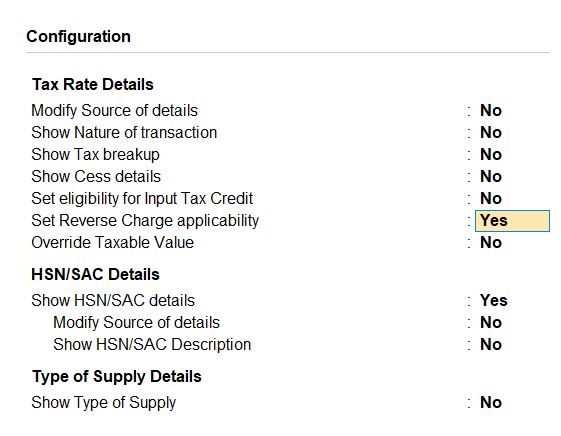

- Modify GST & HSN/SAC Details:

- Set "Modify GST & HSN/SAC related details" to "Yes".

- Specify the HSN/SAC code for the Mouse item if required.

- Add Stock Item:

- Under Particulars, select the item "Mouse":

- Qty: 100 Nos

- Rate: Rs. 100 (per unit)

- Under Particulars, select the item "Mouse":

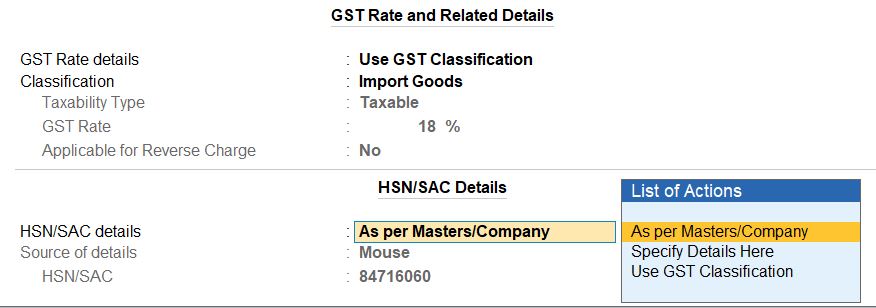

- Specify GST Rate Details:

- Press F12 to configure GST rate details.

- Set Reverse Charges Applicability: Set "Set Reverse Charges Applicability" to "Yes" if applicable.

- Enable "Use GST Classification".

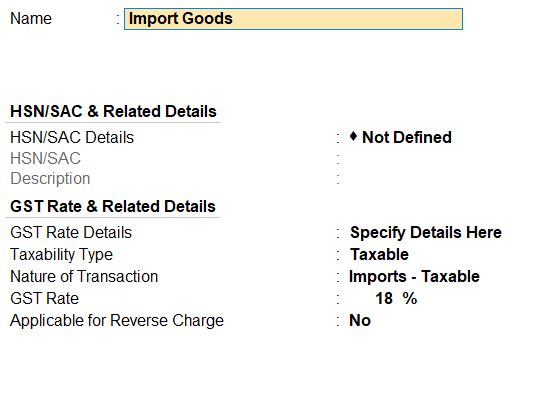

- Create a new classification named "Import Goods" with the following details:

- Taxability Type: Taxable

- Nature of Transaction: Imports – Taxable

- GST Rate: 18%

- Select "Import Goods" under GST Classification.

- Enter the IGST amount as Rs. 1800.

- Save the Voucher:

- Verify all details entered in the purchase voucher.

- Press Ctrl+A to save the voucher.

Reports

- Gateway of Taly -> Display More Reports -> GST Reports -> GSTR-2A Reconciliation

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions