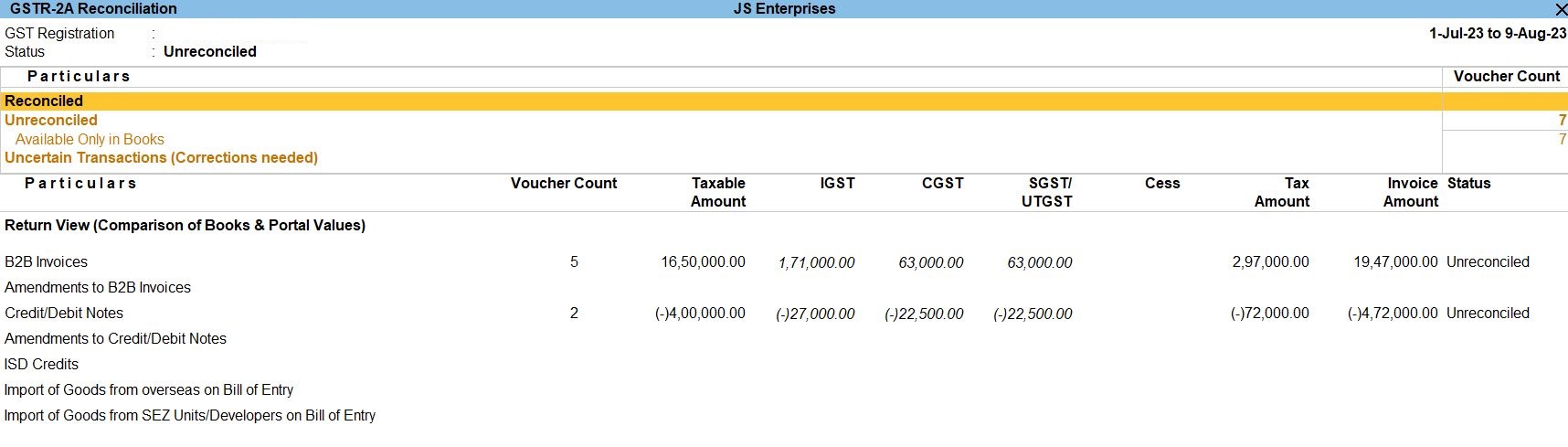

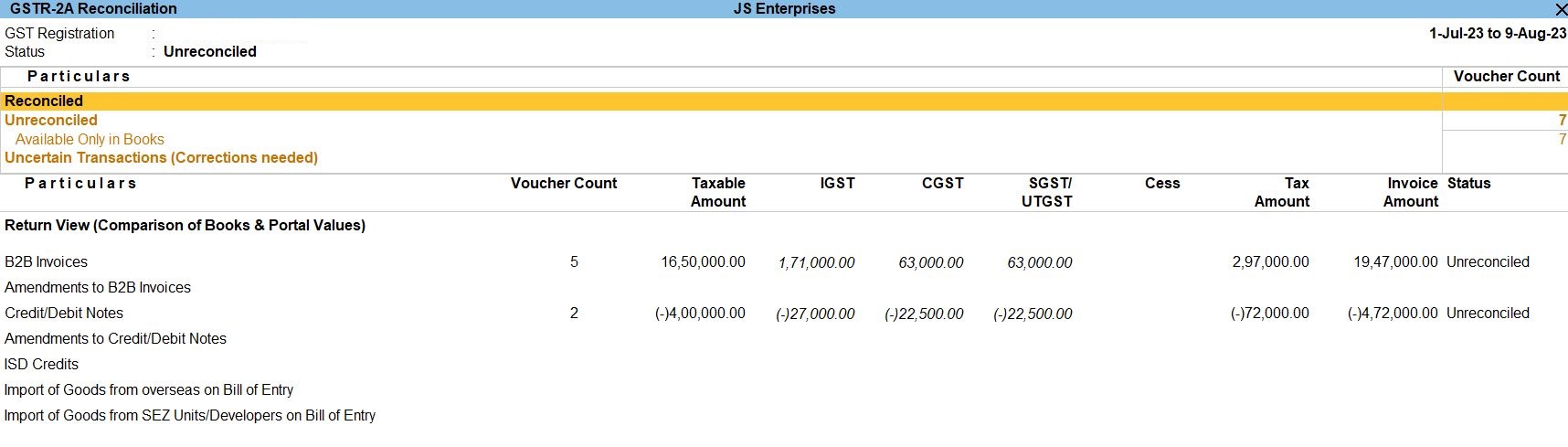

Handling Multi-Service Transactions and Exempted Services in Tally Prime: A Comprehensive Tutorial

Tax Rates at Master and Transaction levels

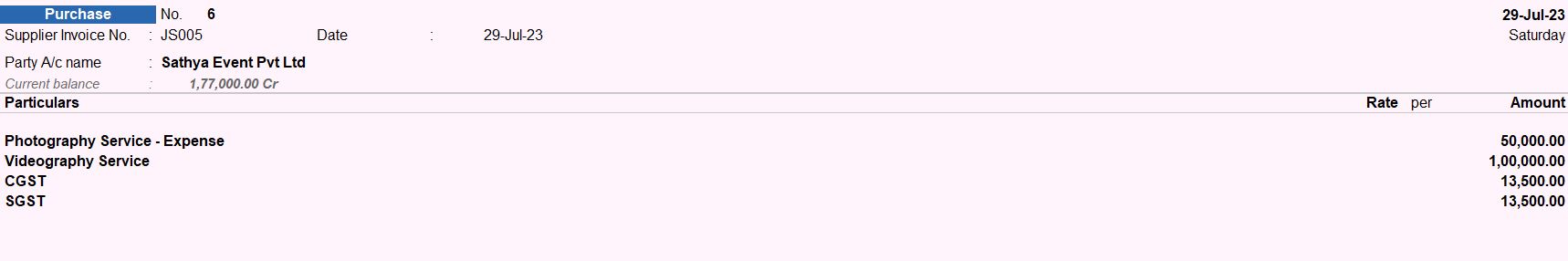

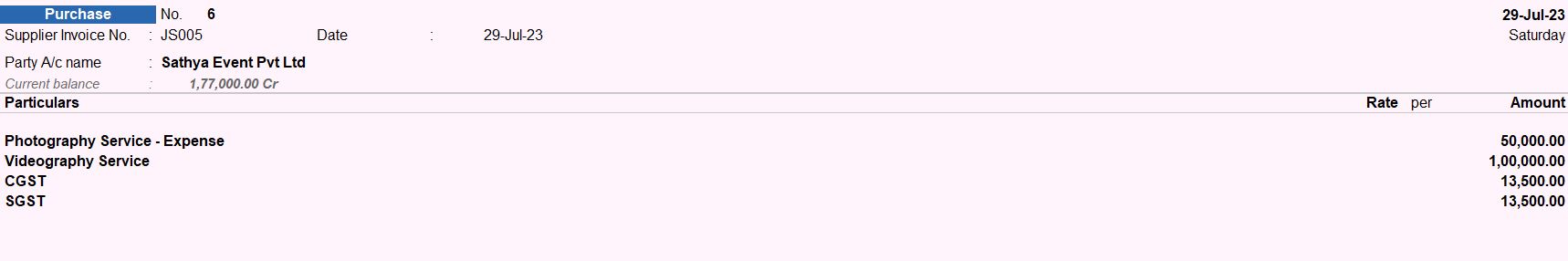

29-07-23 We were charged Rs. 100,000 for videography services, and Rs. 50,000 for photography services by Sathya Events Pvt Ltd., Tamil Nadu. GST @18% is charged on the invoice with reference number JS005.

| Party Ledger |

| Name |

Sathya Events Pvt Ltd |

| Under |

Sundry Creditors |

| Maintain balances bill-by-bill |

Yes |

| Tax Registration Details |

| PAN/IT No |

XXXXXXXXXX |

| Set/alter GST details |

Yes |

| GST Details |

| Registration Type |

Regular |

| GSTIN/UIN |

33XXXXXXXXX1Z5 |

| Event Services |

| Name |

Event Services |

| Under |

Indirect Expenses |

| Set/alter GST Details |

Yes |

| HSN/SAC |

| Description |

Event photography and Event Videography Services |

| HSN/SAC |

998383 |

| Nature of transaction |

Not Applicable |

| Taxability |

Taxable |

| Integrated Tax |

18% |

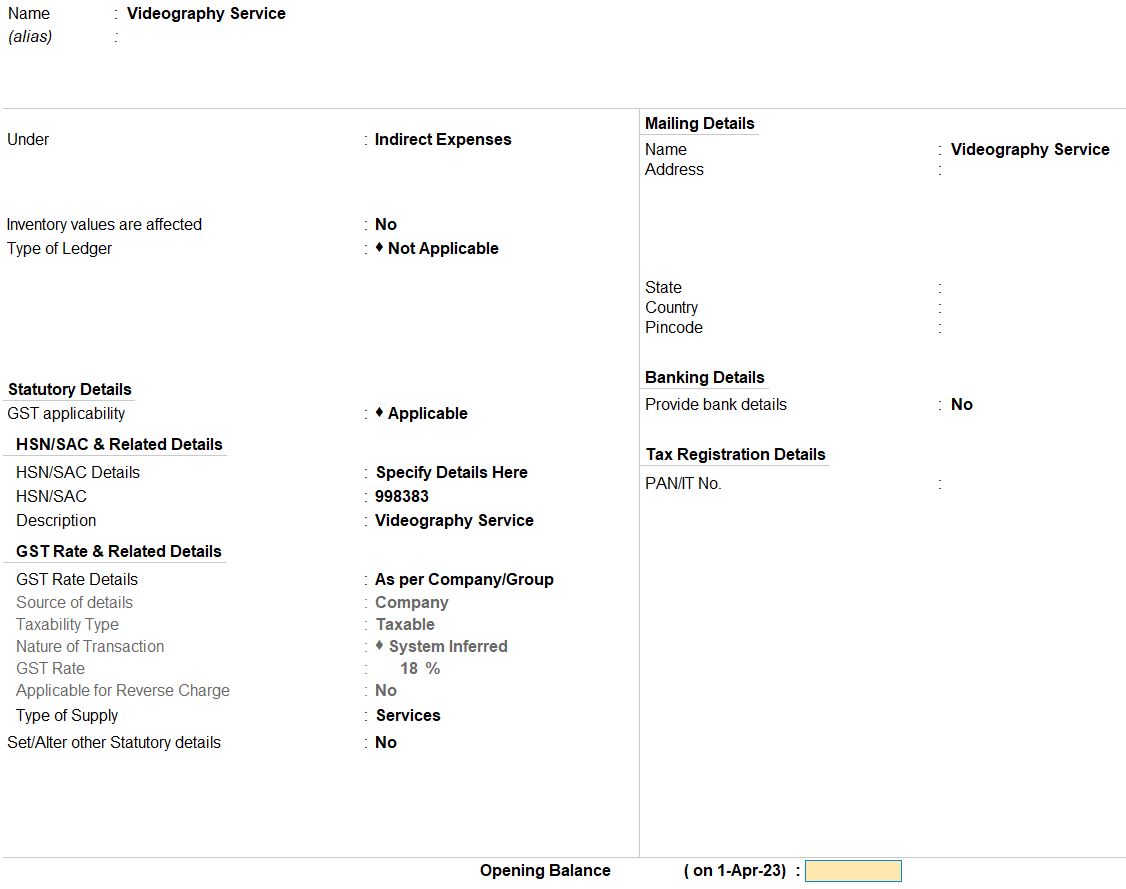

| Videography Services |

| Name |

Videography Services |

| Under |

Event Services |

| Is GST Applicable |

Applicable |

| Set/alter GST details |

No |

| Type of Supply |

Services |

| Photography Services |

| Name |

Photography Services |

| Under |

Event Services |

| Is GST Applicable |

Applicable |

| Set/alter GST details |

No |

| Type of Supply |

Services |

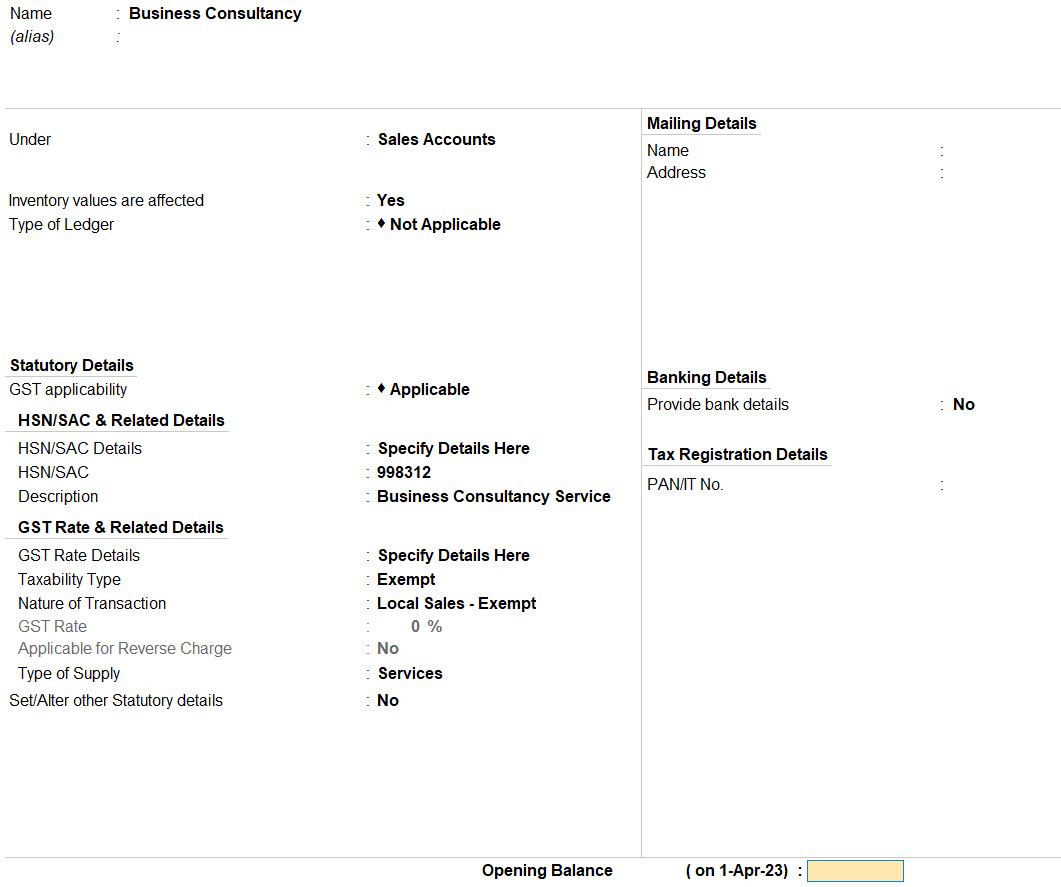

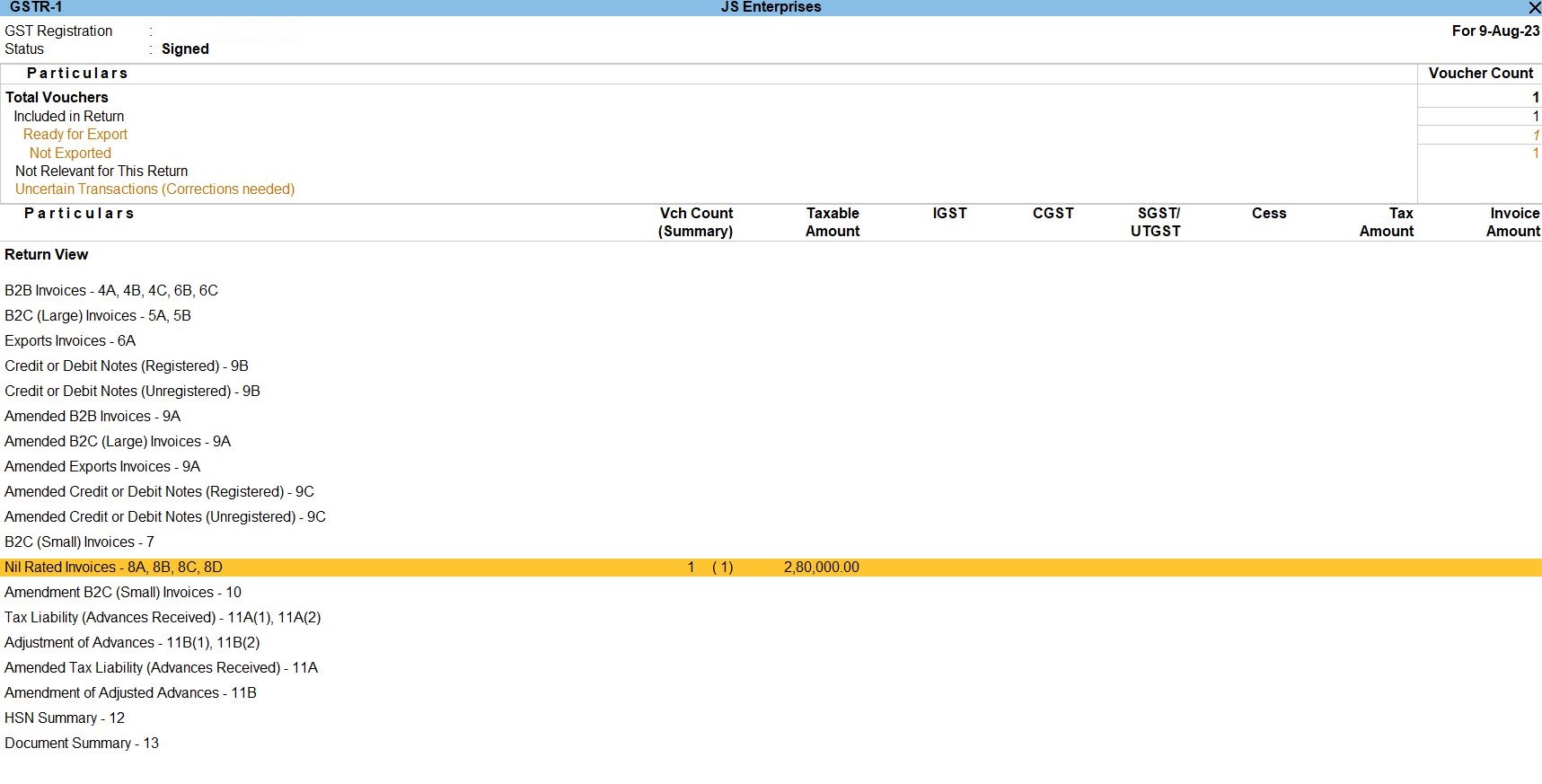

Accounting Exempted Service

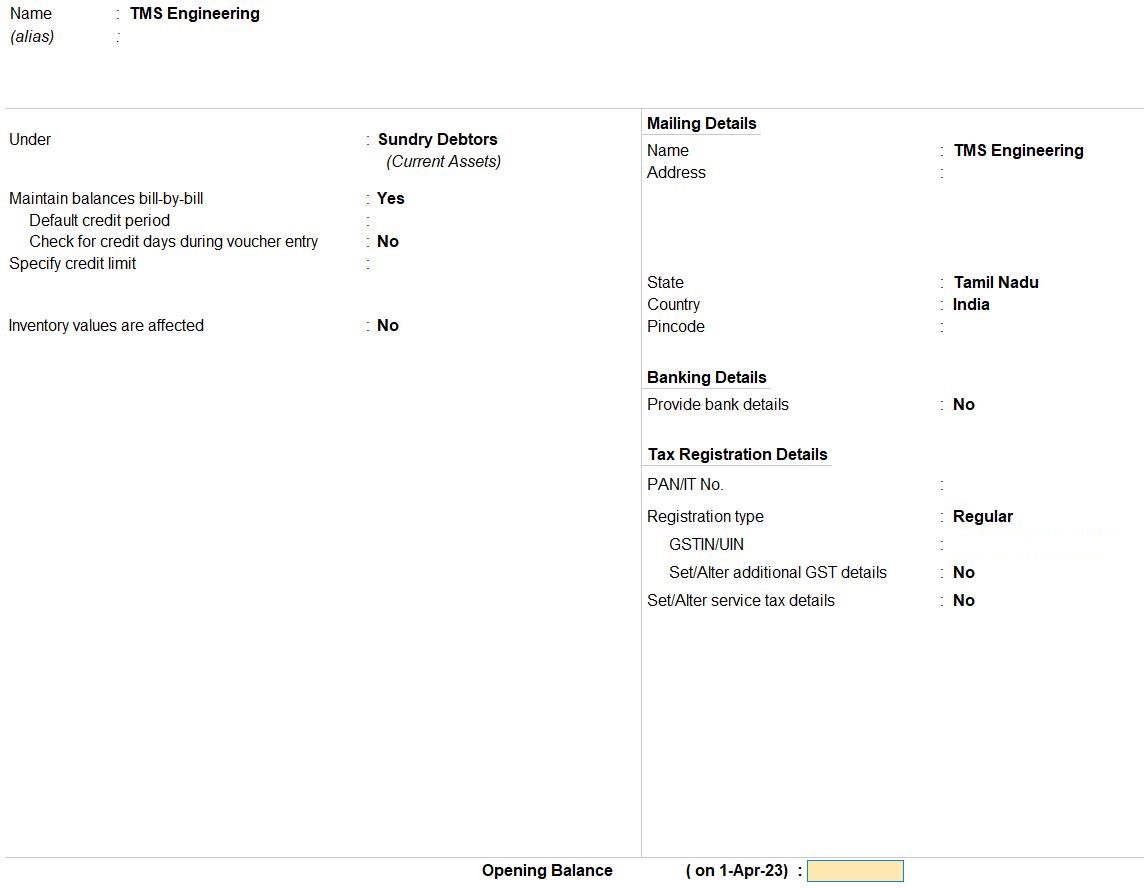

09-08-23 We supply business consultancy services for Rs. 280,000 to TMS Engineering based in Tamil Nadu.

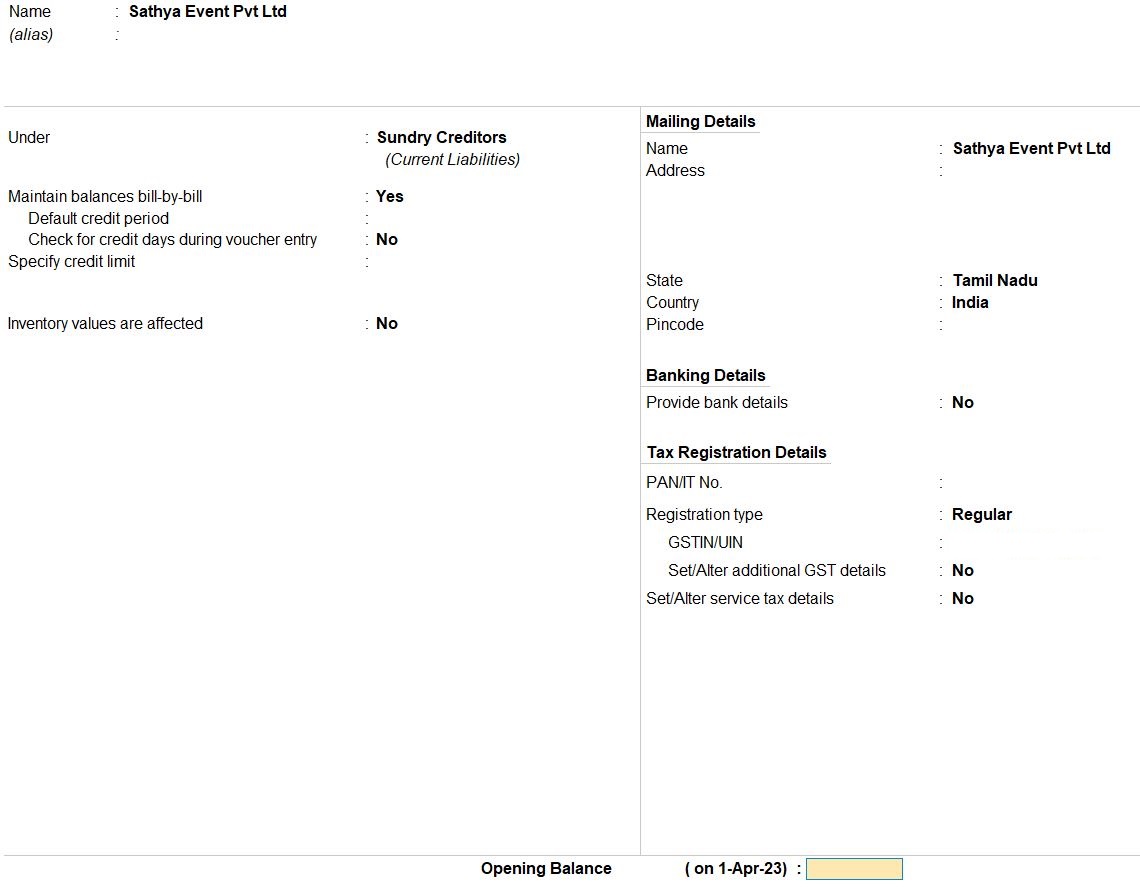

| Party Ledger |

| Name |

TMS engineering |

| Under |

Sundry Debtors |

| Set/alter GST details |

Regular |

| business consultancy services |

| Name |

business Consultancy Services |

| Under |

Sales Accounts |

| Is GST Applicable |

Applicable |

| Set/alter GST details |

Yes |

| Description |

business Consultancy Services |

| HSN/SAC |

12786567 |

| Nature of transaction |

Sales Exempt |

| Taxability |

Exempt |

| Type of Supply |

Services |

- Party Ledger Details:

- Name: Sathya Events Pvt Ltd

- Under: Sundry Creditors

- Maintain balances bill-by-bill: Yes

- Tax Registration Details:

- PAN/IT No: XXXXXXXXXX

- Registration Type: Regular

- GSTIN/UIN: 33XXXXXXXXX1Z5

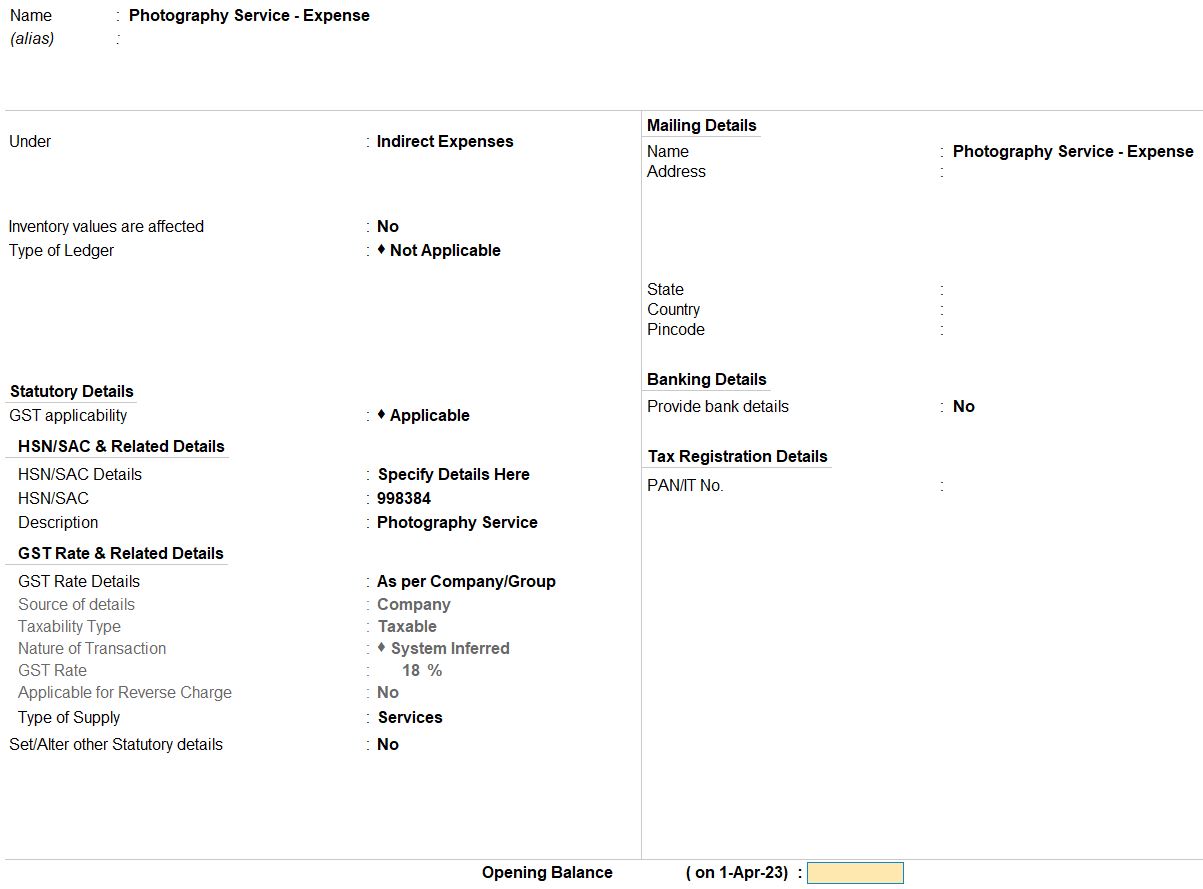

- Photography Services Ledger Setup:

- Name: Photography Services

- Under: Event Services

- Is GST Applicable: Yes

- Type of Supply: Services

- Videography Services Ledger Setup:

- Name: Videography Services

- Under: Event Services

- Is GST Applicable: Yes

- Type of Supply: Services

- Event Services Ledger Setup:

- Name: Event Services

- Under: Indirect Expenses

- Set/alter GST Details: Yes

- HSN/SAC:

- Description: Event photography and Event Videography Services

- HSN/SAC: 998383

- Tax Details:

- Taxability: Taxable

- Integrated Tax: 18%

- Purchase Voucher Entry:

- Go to Accounting Vouchers (Gateway of Tally > Accounting Vouchers or press FV).

- Select F9: Purchase.

- Fill in the voucher date: 29-Jul-23.

- Enter Supplier Invoice No: JS005.

- In the Party A/c Name field, select Sathya Events Pvt Ltd.

- Enter the following details in the Particulars section:

- Account Name: Videography Service - Expense Amount: 100,000

- Account Name: Photography Service - Expense Amount: 50,000

- Account Name: CGST Amount: 13,500

- Account Name: SGST Amount: 13,500

- Explanation:

- JS Enterprises received videography and photography services from Sathya Events Pvt Ltd, Tamil Nadu.

- The total amount for videography services is Rs. 100,000 and for photography services is Rs. 50,000.

- Additionally, CGST and SGST @ 9% each are charged on the invoice, resulting in Rs. 13,500 each.

- The voucher reflects the purchase of these services along with the GST components.

- Save the Voucher:

- After entering all the necessary details, press Enter to save the voucher.

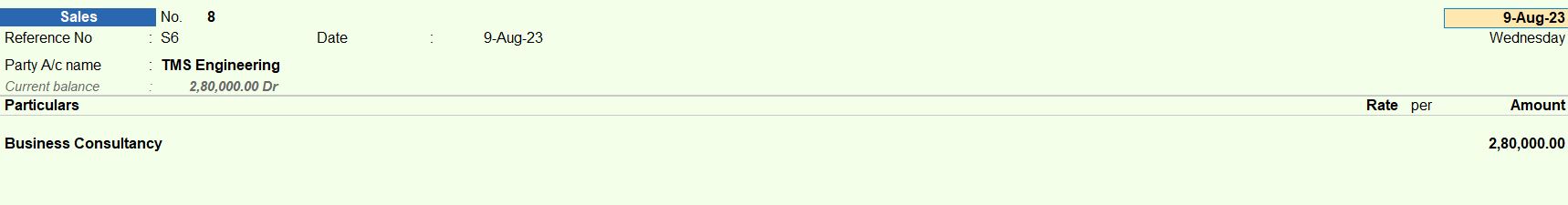

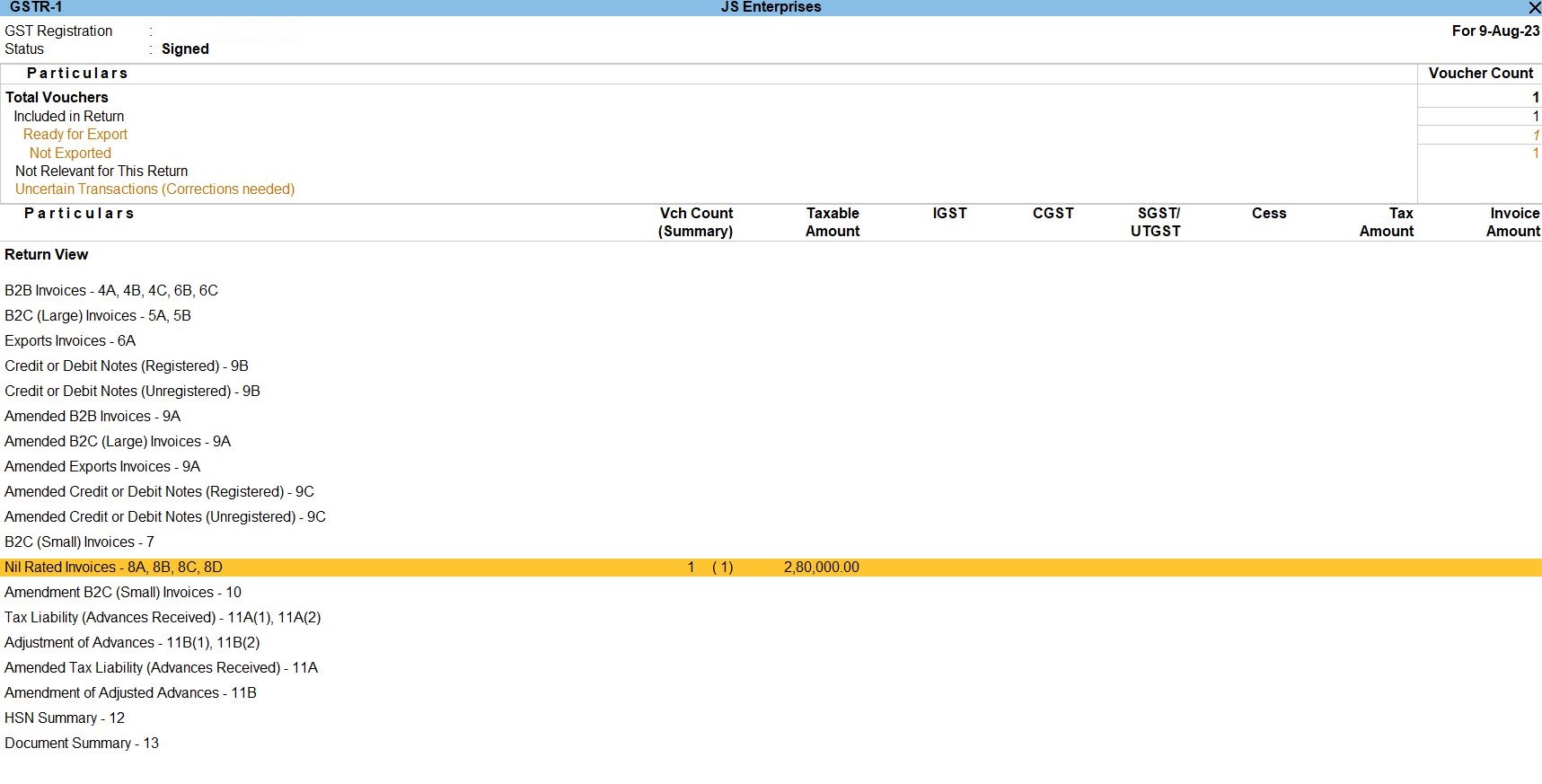

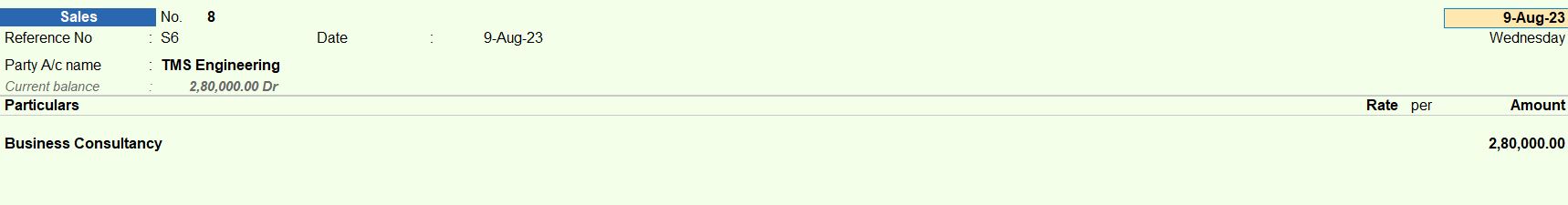

09-08-23 We supply business consultancy services for 280000 to TMS engineering Based in Tamil Nadu.

- Party Ledger Details:

- Name: TMS Engineering

- Under: Sundry Debtors

- Set/alter GST details: Regular

- Business Consultancy Services Ledger Setup:

- Name: Business Consultancy Services

- Under: Sales Accounts

- Is GST Applicable: Applicable

- Set/alter GST Details: Yes

- Description: Business Consultancy Services

- HSN/SAC: 12786567

- Nature of transaction: Sales Exempt

- Taxability: Exempt

- Type of Supply: Services

- Sales Voucher Entry:

- Go to Vouchers (Gateway of Tally > Vouchers or press FV).

- Select F8: Sales.

- Fill in the voucher date: 09-Aug-23.

- Enter Invoice No: [Your Invoice Number].

- In the Party A/c Name field, select TMS Engineering.

- Enter the following details in the Particulars section:

- Account Name: Business Consultancy Services

- Amount: 280,000

- Explanation:

- Your company supplied business consultancy services to TMS Engineering, Tamil Nadu.

- The total amount for the business consultancy services is Rs. 280,000.

- The services provided are exempt from GST, hence they are marked as exempt.

- Save the Voucher:

- After entering all the necessary details, press Enter to save the voucher.