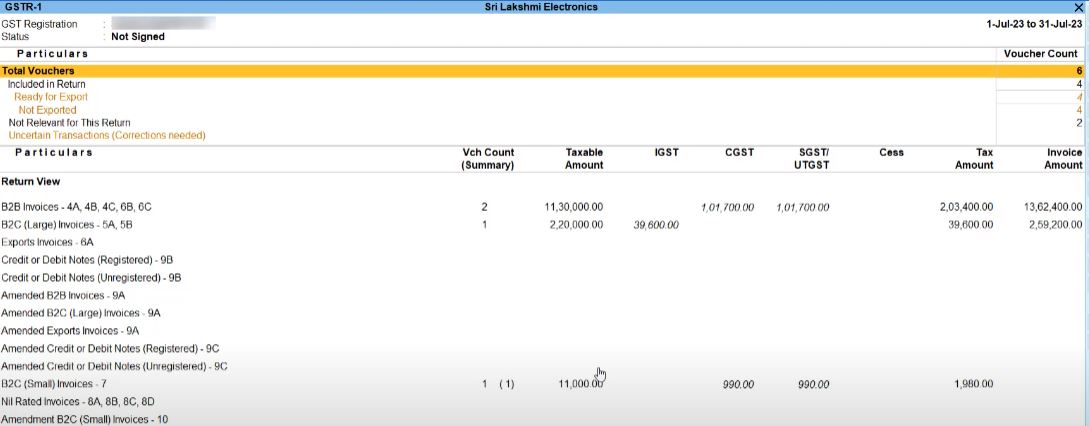

Seamless Interstate Supply with GST in Tally Prime: A Practical Tutorial

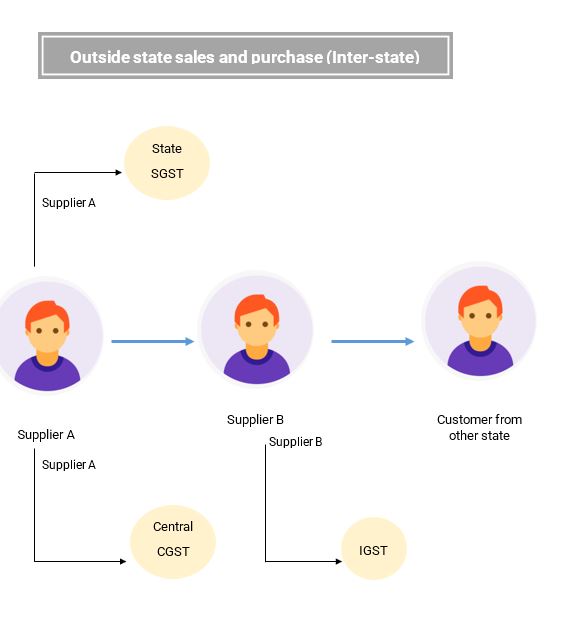

Goods and Services Tax

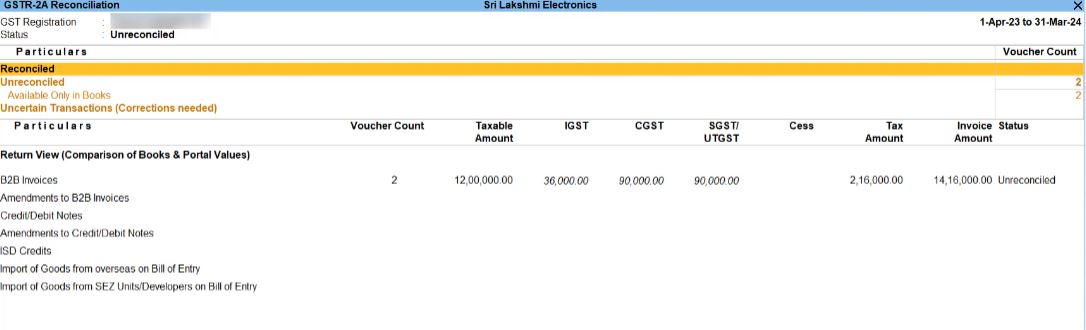

Interstate Inward Supply

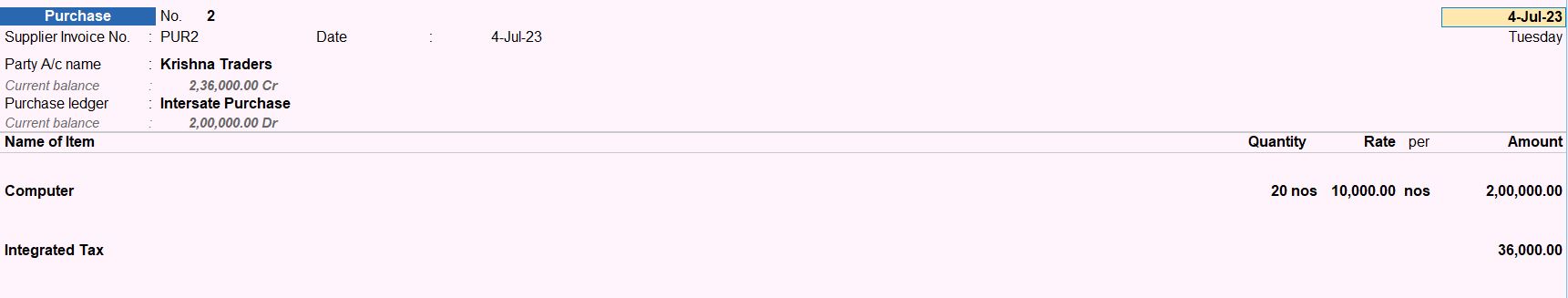

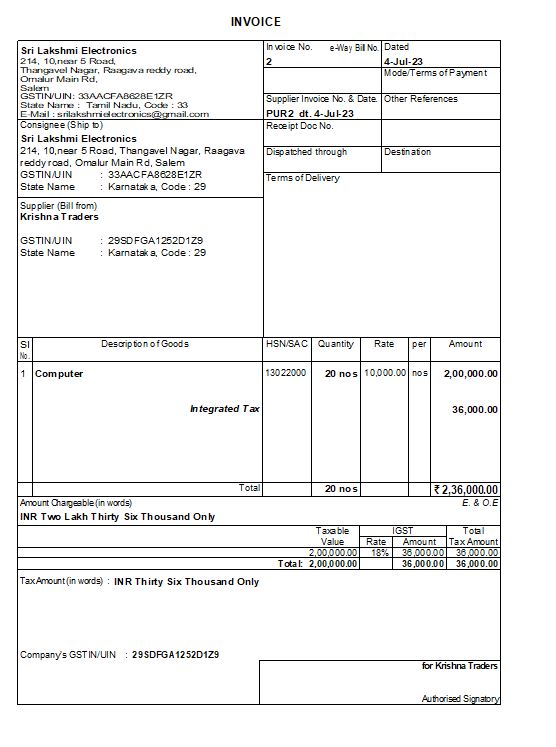

04-07-23 Purchased the following goods from Krishna Traders, Karnataka with Reference no: KTK181905603 integrated GST 18%.

| Item | Qty | Rate |

|---|---|---|

| Computer | 20 | 10000 |

| Krishna Traders | |

|---|---|

| Name | Krishna Traders |

| Under | Sundry Creditors |

| Maintain balances bill-by-bill | Yes |

| Country | India |

| State | Karnataka |

| Pin code | 560029 |

| Set/alter GST Details | Yes |

| Registration type | Regular |

| PAN | AIDPP9707C |

| GSTIN/UIN | 29AIDPP9707C2Z3 |

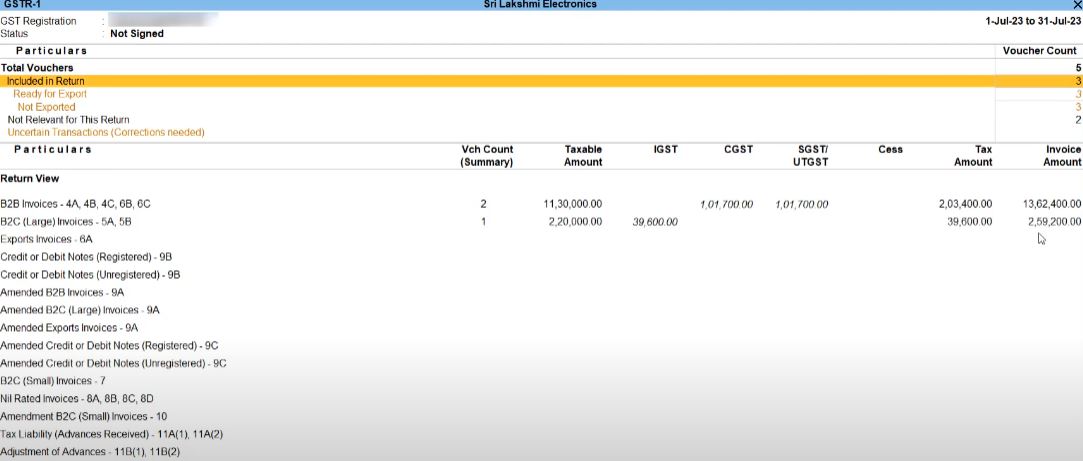

Interstate Outward Supply

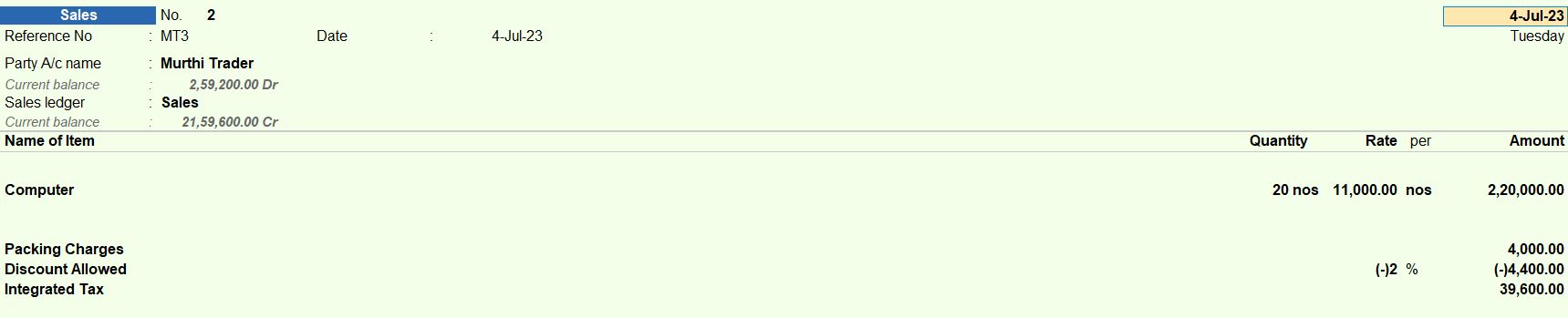

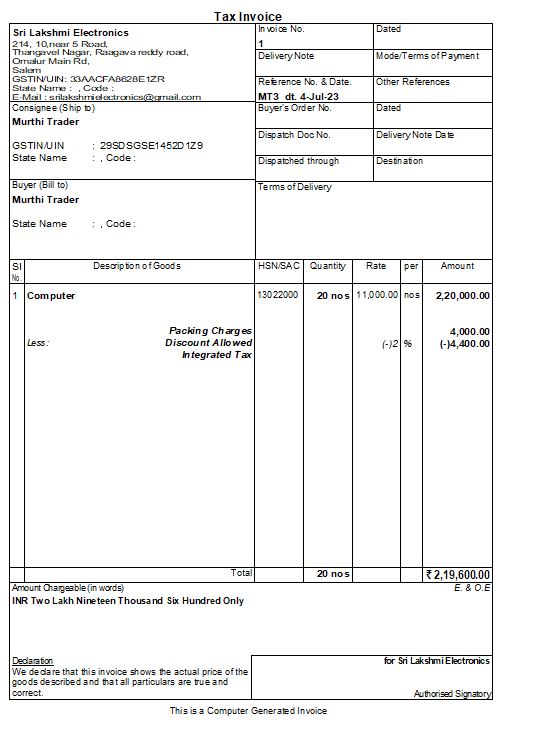

04-07-23 Sold the following goods to Murthi Trader Maharashtra with Reference no: MUR123458769 with Integrated GST 18%.

| Item | Qty | Rate |

|---|---|---|

| Computer | 20 | 11000 |

| Packing Charge 4000 Discount Allowed @2% |

||

| Murthi Traders | |

|---|---|

| Name | Murthi Trader |

| Under | Sundry Debtors |

| Maintain balances bill-by-bill | Yes |

| Country | India |

| State | Maharashtra |

| Pin code | 560028 |

| Set/alter GST Details | Yes |

| Registration type | Regular |

| PAN | AGGPP7947R |

| GSTIN/UIN | 27AGGPP7947R1Z9 |

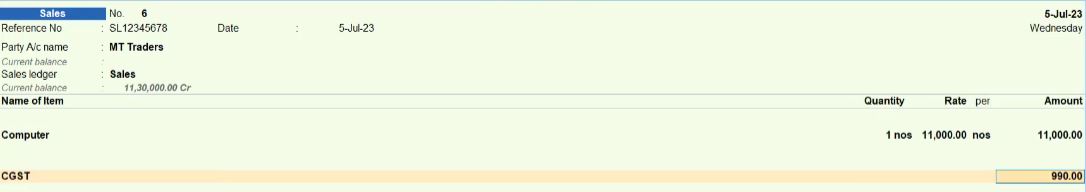

04-07-23 Sold the following goods to MT Trader Maharashtra with Reference no: MUR123458769 with Integrated GST 18%.

| Item | Qty | Rate |

|---|---|---|

| Computer | 1 | 11000 |

| Murthi Traders | |

|---|---|

| Name | MT Trader |

| Under | Sundry Debtors |

| Maintain balances bill-by-bill | Yes |

| Country | India |

| State | Tamil Nadu |

| Pin code | 560028 |

| Set/alter GST Details | Yes |

| Registration type | Unregistered/ Consumer |

04-07-23 Purchased the following goods from Krishna Traders, Karnataka with Reference no: KTK181905603 integrated GST 18%.

| Item | Qty | Rate |

|---|---|---|

| Computer | 20 | 10000 |

- Gateway of Tally: Navigate to the "Accounting Vouchers" section from the Gateway of Tally.

- Select Purchase Voucher: Choose to create a new purchase voucher by pressing F9 or selecting "Purchase Voucher" from the voucher types list.

- Enter Purchase Voucher Details:

- Date: Set the voucher date to 04-07-23.

- Supplier Invoice No: Enter the reference number provided by Krishna Traders.

- Party's Name: Select "Krishna Traders" from the list of parties.

- Purchase Ledger: Choose "Interstate Purchase" as the purchase ledger.

- Under Sundry Creditors: Ensure that it is selected.

- Maintain balances bill-by-bill: Set it to "Yes".

- Country, State, Pin code, PAN, and GSTIN/UIN: These details will be automatically populated based on the party's ledger information.

- Enter Item Details:

- Name of Item: Enter "Computer".

- Quantity: Input the quantity purchased, which is 20.

- Rate: Specify the rate per unit, which is Rs. 10,000.

- Enter Tax Details:

- IGST: Enter the integrated GST amount, which is Rs. 36,000.

- Save and Print: After entering all the necessary details, save the voucher. If you need to print the purchase invoice, you can do so by pressing Alt + P or by selecting the print option from the menu.

04-07-23 Sold the following goods to Murthi Trader Maharashtra with Reference no: MUR123458769 with Integrated GST 18%.

| Item | Qty | Rate |

|---|---|---|

| Computer | 20 | 11000 |

| Packing Charge 4000 Discount Allowed @2% |

||

- Gateway of Tally: Navigate to the "Accounting Vouchers" section from the Gateway of Tally.

- Select Sales Voucher: Choose to create a new sales voucher by pressing F8 or selecting "Sales Voucher" from the voucher types list.

- Enter Sales Voucher Details:

- Date: Set the voucher date to 04-07-23.

- Reference No: Enter the reference number provided by Murthi Trader.

- Party's Name: Select "Murthi Trader" from the list of parties.

- Sales Ledger: Choose "Interstate Sales" as the sales ledger.

- Under Sundry Debtors: Ensure that it is selected.

- Maintain balances bill-by-bill: Set it to "Yes".

- Country, State, Pin code, PAN, and GSTIN/UIN: These details will be automatically populated based on the party's ledger information.

- Enter Item Details:

- Name of Item: Enter "Computer".

- Quantity: Input the quantity sold, which is 20.

- Rate: Specify the rate per unit, which is Rs. 11,000.

- Additional Charges: Add "Packing Charge" with an amount of Rs. 4,000.

- Discount: Enter the discount allowed, which is 2%.

- Enter Tax Details:

- IGST: Enter the integrated GST amount, which is Rs. 39,600.

- Save and Print: After entering all the necessary details, save the voucher. If you need to print the sales invoice, you can do so by pressing Alt + P or by selecting the print option from the menu.

04-07-23 Sold the following goods to MT Trader Maharashtra with Reference no: MUR123458769 with Integrated GST 18%.

| Item | Qty | Rate |

|---|---|---|

| Computer | 1 | 11000 |

- Gateway of Tally: Navigate to the "Accounting Vouchers" section from the Gateway of Tally.

- Select Sales Voucher: Choose to create a new sales voucher by pressing F8 or selecting "Sales Voucher" from the voucher types list.

- Enter Sales Voucher Details:

- Date: Set the voucher date to 04-07-23.

- Reference No: Enter the reference number provided by MT Trader.

- Party's Name: Select "MT Trader" from the list of parties.

- Sales Ledger: Choose "Sales" as the sales ledger.

- Under Sundry Debtors: Ensure that it is selected.

- Maintain balances bill-by-bill: Set it to "Yes".

- Country, State, Pin code: These details will be automatically populated based on the party's ledger information.

- Registration type: Select "Unregistered/Consumer".

- Enter Item Details:

- Name of Item: Enter "Computer".

- Quantity: Input the quantity sold, which is 1.

- Rate: Specify the rate per unit, which is Rs. 11,000.

- Enter Tax Details:

- CGST: Enter the CGST amount, which is Rs. 990.

- Save and Print: After entering all the necessary details, save the voucher. If you need to print the sales invoice, you can do so by pressing Alt + P or by selecting the print option from the menu.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions