Handling Inclusive Tax in GST Supplies with Tally Prime

Supplies Inclusive of tax

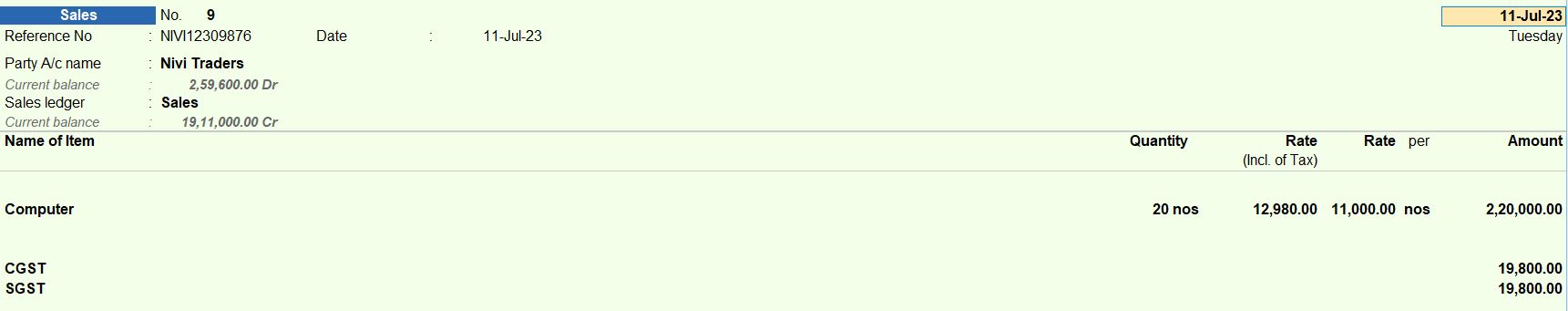

06-07-23 Sold the following to Nivi Traders, Tamil Nadu with Reference no: NIVI12309876.

| Item | Qty | Rate (inclu) |

|---|---|---|

| Computer | 20 | 12980 |

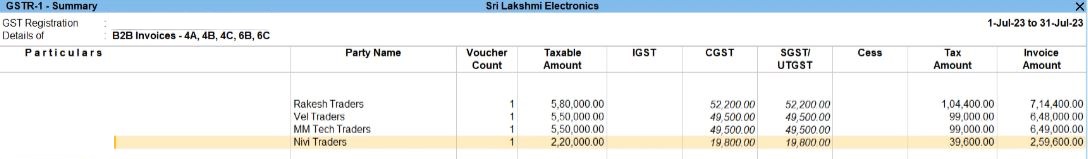

| Party Ledger | |

|---|---|

| Name | Nivi Traders |

| Under | Sundry Debtors |

| State | Tamil Nadu |

| Registration type | Regular |

| GSTIN/UIN | 33XXXXXXXXXX1Z1 |

- Access Sales Voucher: From the Gateway of Tally screen, navigate to the "Accounting Vouchers" menu.

- Select Sales Voucher: Choose the option to create a new Sales Voucher.

- Enter Voucher Date: Set the voucher date as 06-07-23.

- Enter Customer Details:

- Party A/c Name: Nivi Traders

- State: Tamil Nadu

- Registration Type: Regular

- GSTIN/UIN: 33XXXXXXXXXX1Z1

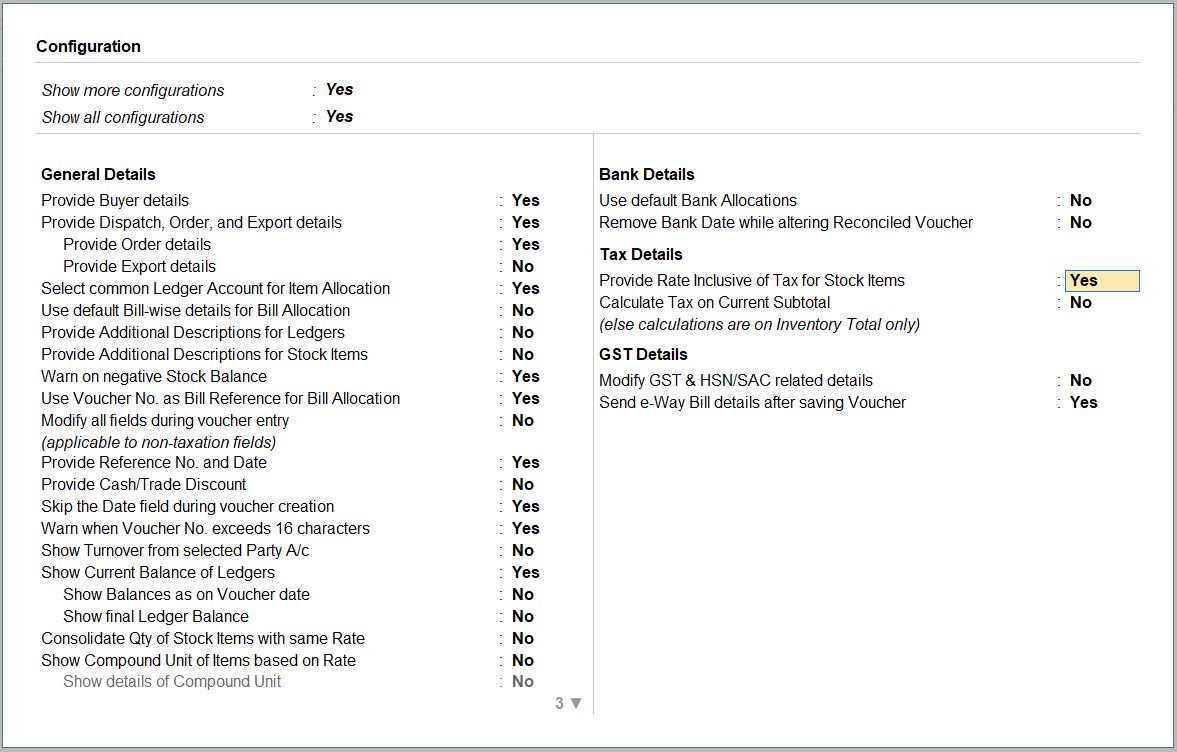

- Enable Rate Inclusive of Tax: Press F12 to enable the option "Provide Rate Inclusive of Tax for Stock item".

- Enter Items:

- Item: Computer

- Quantity: 20

- Rate (Incl. of tax): 12980

- Enter Tax Details:

- CGST: 19800

- SGST: 19800

- Review and Confirm: Ensure that the total rate amount matches the calculated value of 220000 (20 units * 11000 rate per unit). Then, save the sales voucher.

- Save and Confirm: After entering all the details accurately, save the sales voucher.

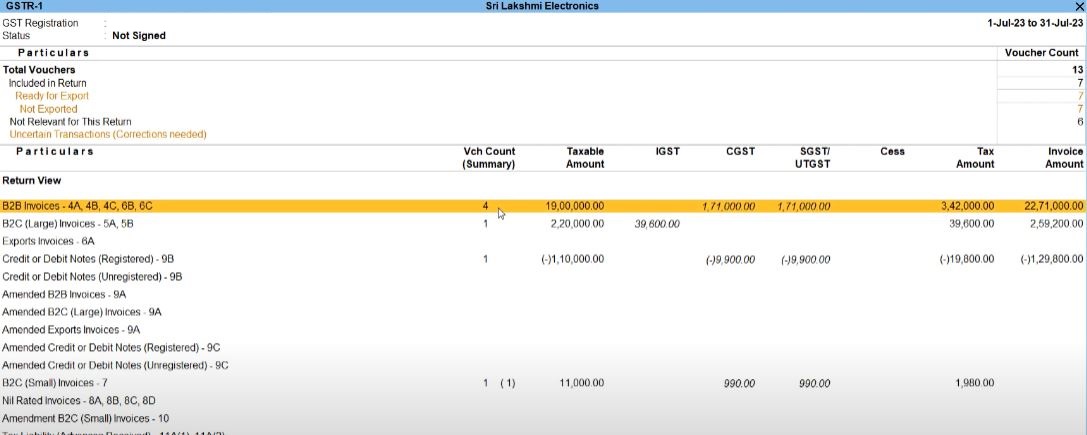

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions