Tax Deducted at Source in Tally Prime

Introduction

TDS stands for tax deducted at source. As per the Income Tax Act, any company or person making a payment is required to deduct tax at source if the payment exceeds certain threshold limits. TDS has to be deducted at the rates prescribed by the tax department.

- Go to Gateway of Tally prime -> masters-> TDS Nature of Payment-> Create .

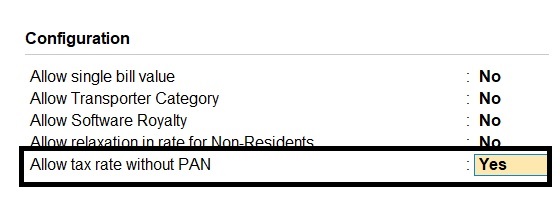

- Press F12 .

- Set Allow transporter category to Yes , to capture the value of transaction recorded with party having PAN, under Exempt in lieu of PAN available in Form 26Q .

- Set Allow no PAN tax rate to Yes , to enter the tax rates for Individuals/HUF for each nature of payment

- Press Enter to save.

1. Go to Gateway of tally prime > masters > create > Ledger > TDS Nature of Payment > Create .

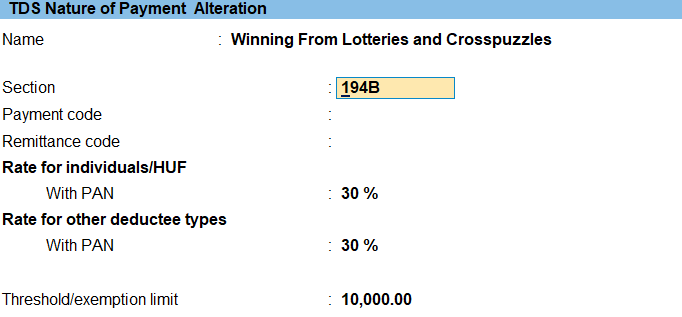

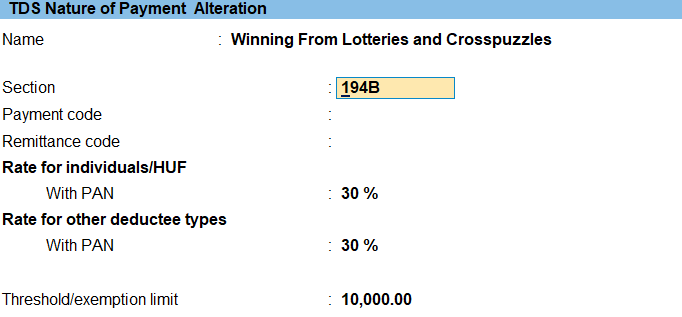

2. Enter the name of the sub-section as Leaf co. You can give your own name but ensure that the section code and payment code are selected correctly.

3.Select Section as 194B and Payment code as 94B .

4. Press Ctrl+A to accept.

5. Enter the Threshold / exemption limit as applicable .

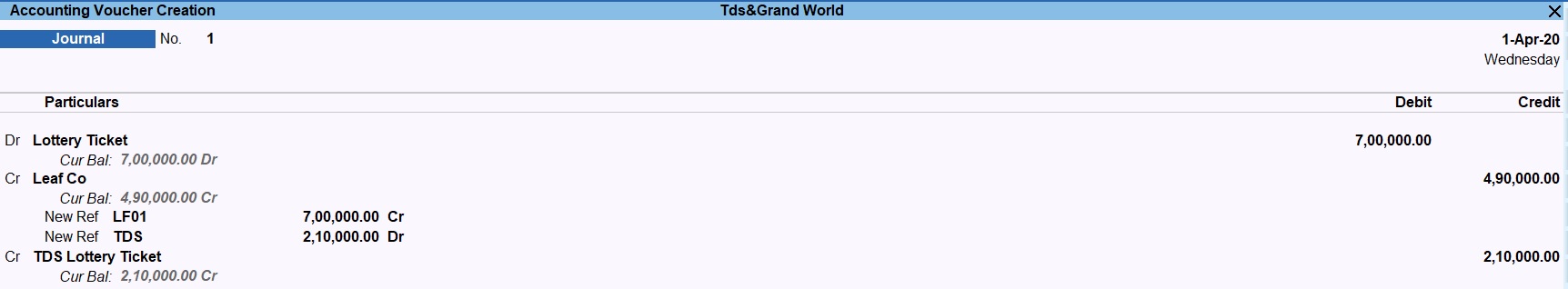

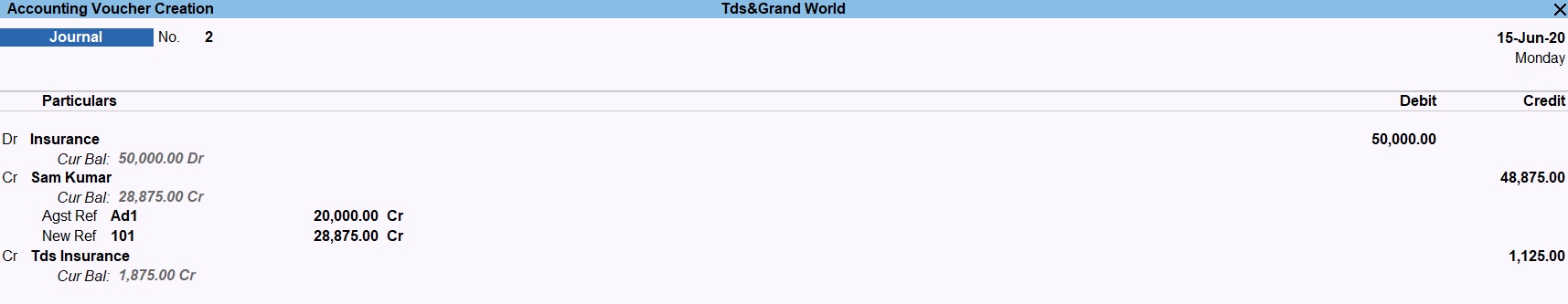

1. Enter the deductee tax details in journal voucher.

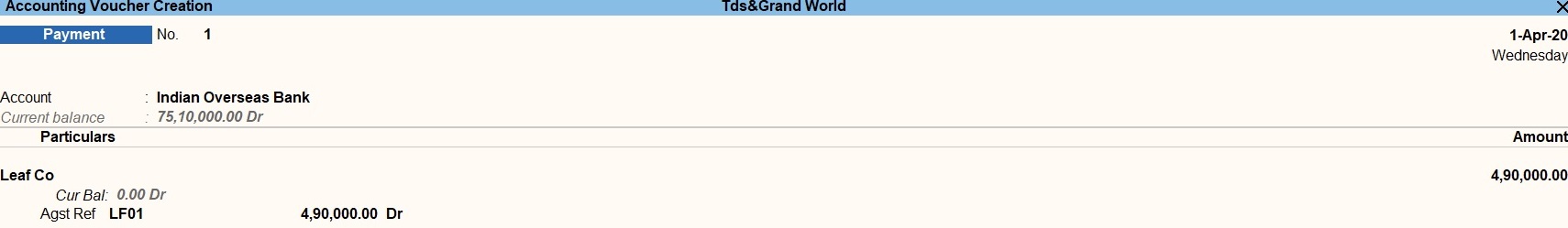

2. Enter the deductee tax details in payment voucher.

3. Enter the tax payment details.

1.Enter the deductee tax details in journal voucher or purchase voucher.

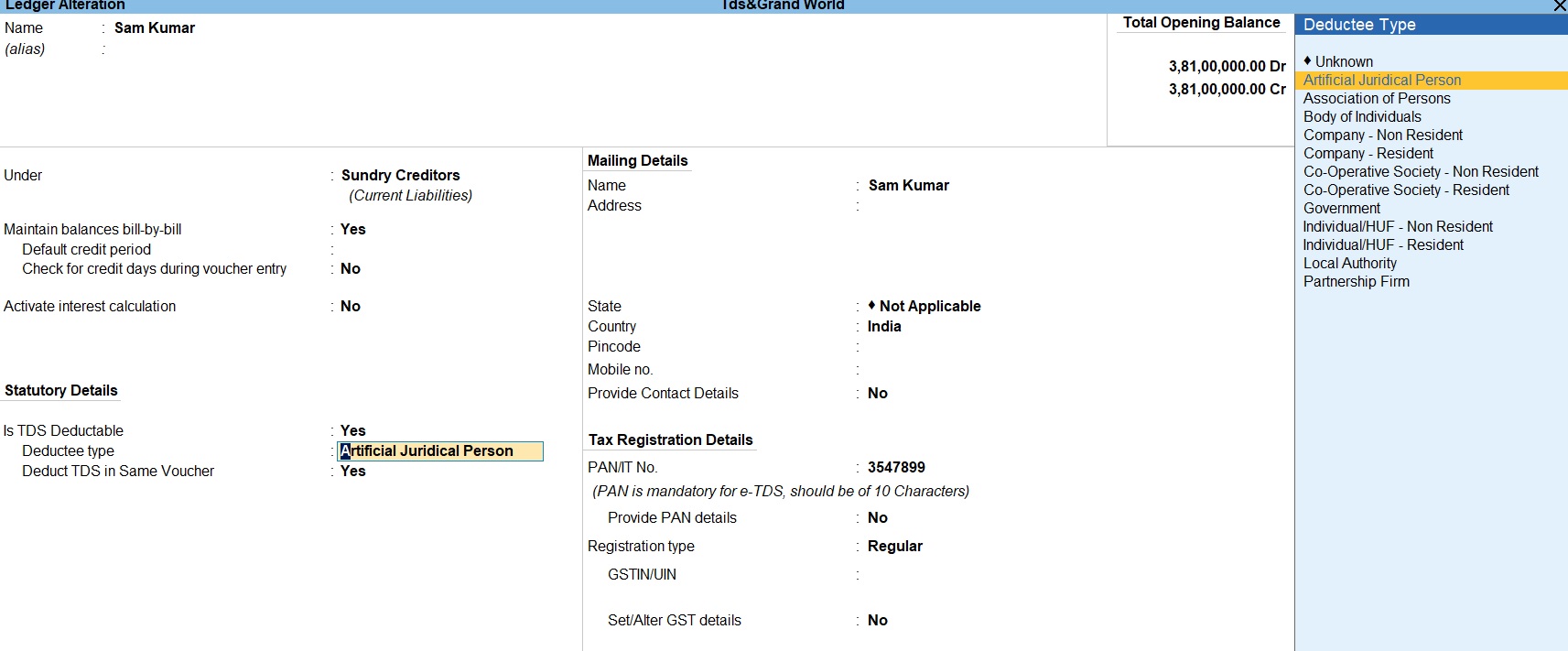

- Enter the Name and select Sundry Creditor in the Under field.

- Enter the Name and select Sundry Creditor in the Under field

- Enable the option Is TDS Deductible,to allow TDS deduction for the ledger.

- . Select a Deductee Type from the list.

- Enable Deduct TDS in Same Voucher , if required, and select the TDS Nature of Payment. You can also select to All Items ..

- Set Use Advanced TDS Entries .

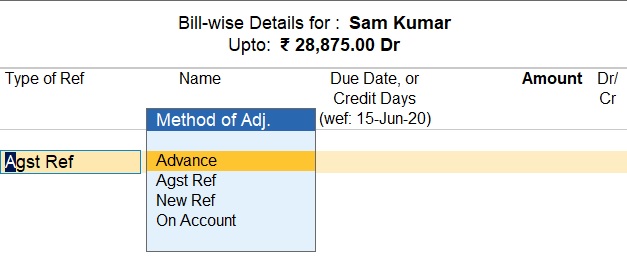

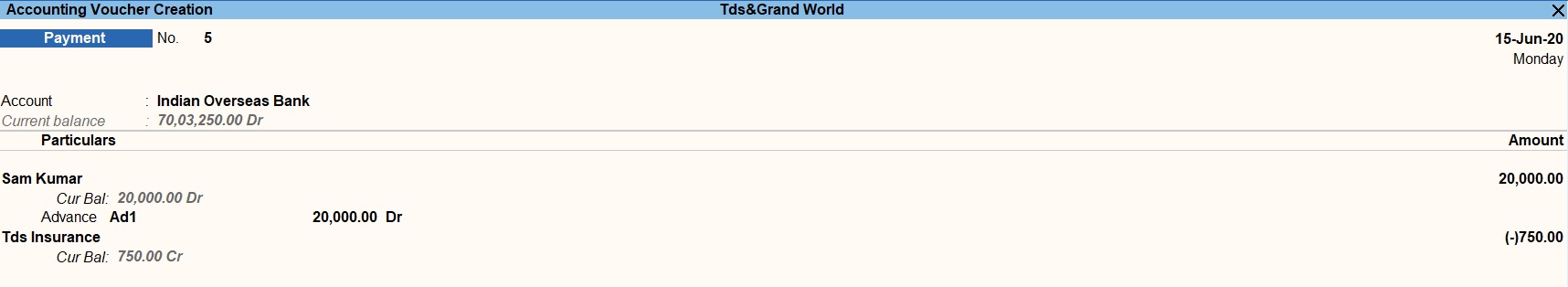

2. Enter the advance details in payment voucher.

3. Enter the advance details in journal voucher

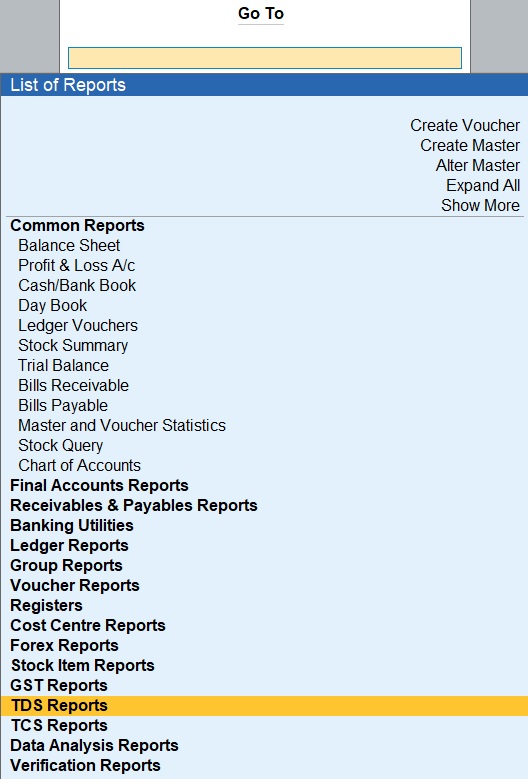

Reports

1. Go to Gateway of Tally prime -> Go to ->(alt + G)

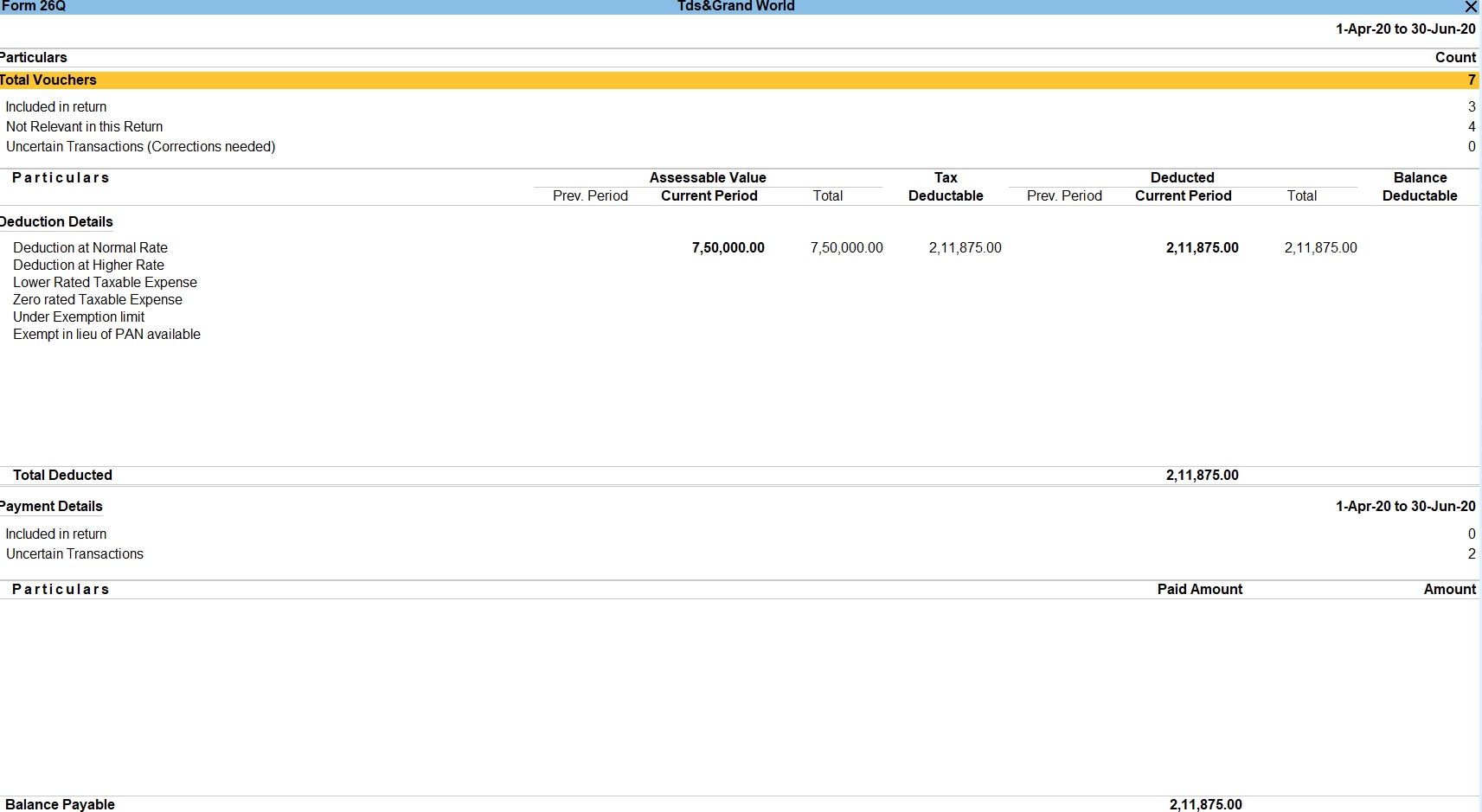

- This payment is other than payment of salary, and the payer has to file TDS return in Form 26Q. 26Q is to be submitted on a quarterly basis.

- Total amount paid during the quarter and TDS amount deducted on such payments have to be reported in 26Q.

Tax Deducted at Source

| Section | Nature of Payment | Threshold Rs | Indv / HUF TDS | Others TDS | |

| Existing Rate (%) | New rate (%) wef 14.05.2020 | Rate (%) | |||

| 192 | Salaries | - | Basis on Slab | ||

| 192A | Premature withdrawal from EPF | 50,000 | 10 | - | |

| 193 | Interest on Securities/Debenture’s | 10,000 | 10 | 7.5 | 10 |

| 194 | Dividends (other than listed Companies) | - | - | 7.5 | 10 |

| 194A | Interest (Banks)/ For Senior Rs 50000 | 40,000 | 10 | 7.5 | 10 |

| 194A | Interest (Others) | 5,000 | 10 | 7.5 | 10 |

| 194B | Winning from Lotteries | 10,000 | 30 | 30 | 30 |

| 194BB | Winning from Horse Race | 10,000 | 30 | 30 | 30 |

| 194A | Contractor – Single Transaction | 30,000 | 1 | 0.75 | 1.5 |

| 194C | Contractor – During the F.Y. | 1,00,000 | 1 | 0.75 | 1.5 |

| 194C | Contractor – During the F.Y. | 1,00,000 | 1 | 0.75 | 1.5 |

| 194C | Transporter (44AE) declaration with PAN | ||||

| 194D | Insurance Commission (15G – 15H allowed) | 15,000 | 5 | 3.75 | 3.75 |

| 194DA | Life insurance Policy | 1,00,000 | 5 | 3.75 | 3.75 |

| 194E | Non-Resident Sportsmen or Sports Association | 1,00,000 | 20 | 20 | |

| 194EE | NSS | 2,500 | 10 | 7.5 | 7.5 |

| 194F | Repurchase Units by MFs | 20 | 15 | 15 | |

| 194G | Commission – Lottery | 15,000 | 5 | 3.75 | 5 |

| 194H | Commission / Brokerage | 15,000 | 5 | 3.75 | 5 |

| 194I | Rent of Land and Building – F&F | 2,40,000 | 10 | 7.5 | 7.5 |

| 194I | Rent of Plant / Machinery / Equipment | 2,40,000 | 2 | 1.5 | 1.5 |

| 194IB | Rent by Individual / HUF | 50000/PM | 5 | 3.75 | 3.75 |

| 194IA | Transfer of certain immovable property other than agriculture land | 50,00,000 | 1 | 0.75 | 0.75 |

| 194J | Professional Fees / Technical Fees etc. | 30,000 | 10 | 7.5 | 7.5 |

| 194J | Payment to FTS, Certain Royalties and Call Centre Oparator | 30,000 | 2 | 1.5 | 1.5 |

| 194IA | Compensation on transfer of certain immovable property other than agricultural land | 2,50,000 | 10 | 7.5 | 7.5 |

| 194LB | Income by way of interest from infrastructure debt fund | 5 | 5 | 5 | |

| 194LD | Interest on Certain bonds. Securities | 5 | 5 | 5 | |

Tax Deducted at source Sum

| particular | DR | CR |

| capital | 3,10,00,000 | |

| Reserves & surplus | 2,75,000 | |

| Bills for collection | 40,000 | |

| Debenture’s | 13,00,000 | |

| Leas hold property | 50,000 | |

| Indian Overseas Bank | 80,00,000 | |

| Bank O/d | 5,25,000 | |

| Cash | 10,000 | |

| Royalties | 50,00,000 |

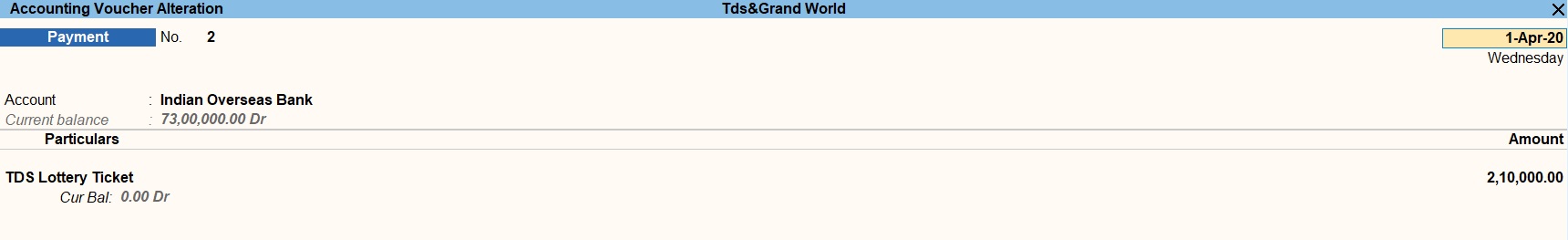

1. Jun 10 M/s. Leaf co (Local Authority) wins the lottery ticket. So the company decided to pay a winning amount for Rs.7, 00,000. The deducted taxable amount pays to Indian Overseas bank. And remaining amount paid to party by cheque. (Nature of payment: winning from lotteries and crossword puzzles)

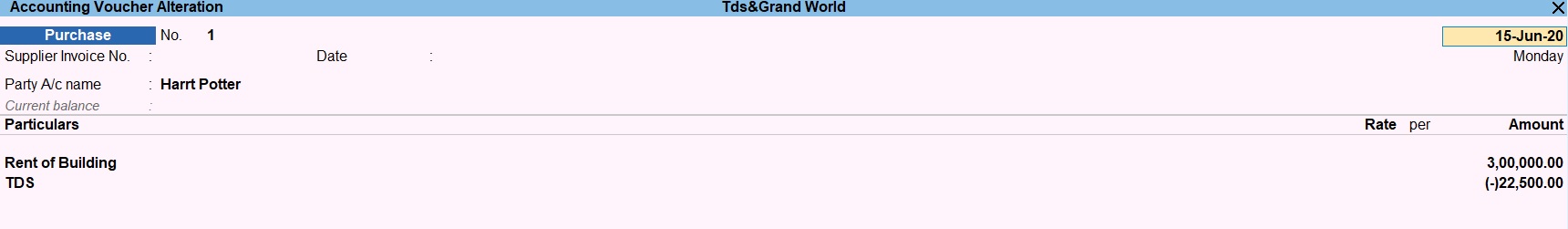

2. Jun15 M/s. Grand world (P) ltd has decided to pay a Rent of Building Rs.3, 00,000 to pay a party M/s. Harry potter (Company resident). The deducted taxable amount pays to Indian Overseas Bank. (Nature of Payment: Rent of land, building and furniture’s)

3.July 07 M/s Ramadevi & Co pay advance Rs. 20000 for insurance commission to pay a party M/s Taehyung ltd (Partnership firms). The deducted taxable for the advance payment. on July 10 Ramadevi paid actual payment of insurance commission is Rs. 50000 to pay Taehyung ltd. The overall deducted taxable amount pays to Indian Overseas Bank. (Nature of Payment: Insurance Commission)

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions