Tax Collected At Sources Example Sum - 2 in Tally Prime Tamil

Tax collected at source mean tax being collected from the source by the seller (collector) from buyer for goods traded u/s 206c (1) of the income tax act 1961.it is collected when accrued or when paid whichever occurs earlier. it is prescribed for any business or trade dealing with alcoholic liquor ,forest product, scrap etc..,

TCS Changes in Budget 2020

Finance bill 2020 has amended tax collection at source (TCS) provisions in order to widen and deepen its tax base by including remittance under liberalized remittance scheme, sale of overseas tour packages and sales of goods this change shall come in force from 1st October 2020.

Sale of any Goods

Every seller whose total sales ,gross receipts or turnover from the business carried on by him exceed Rs. 10 corers during the FY 2019-20& onwards ,and if sales to buyer is exceeding Rs 50 lakes during the FY 2020-21 & onwards than seller has a to collect TCS tax for such buyer on the value exceeding the threshold limit.

Information related to TCS on sales of any Goods

| Name | Sale of Any Goods |

| Section code | 206C |

| Payment code | Yet to provided by the department Note: As the payment code is not yet notified by the department this field will be left blak and the same will not be printed on ITNS challan 281. |

| Rate of tax With PAN/Aadhaar 0.075% | No PAN /Aadhaar 1% Note: as per finance bill 2020, the TCS rate for this category with PAN is 0.1% and No PAN will be 1%.Due to COVID19 outbreak, department has reduced to 0.075% and No PAN remains as 1%. |

| Threshold limit | Rs.50,00,000 |

| Effective From | 01-10-2020 |

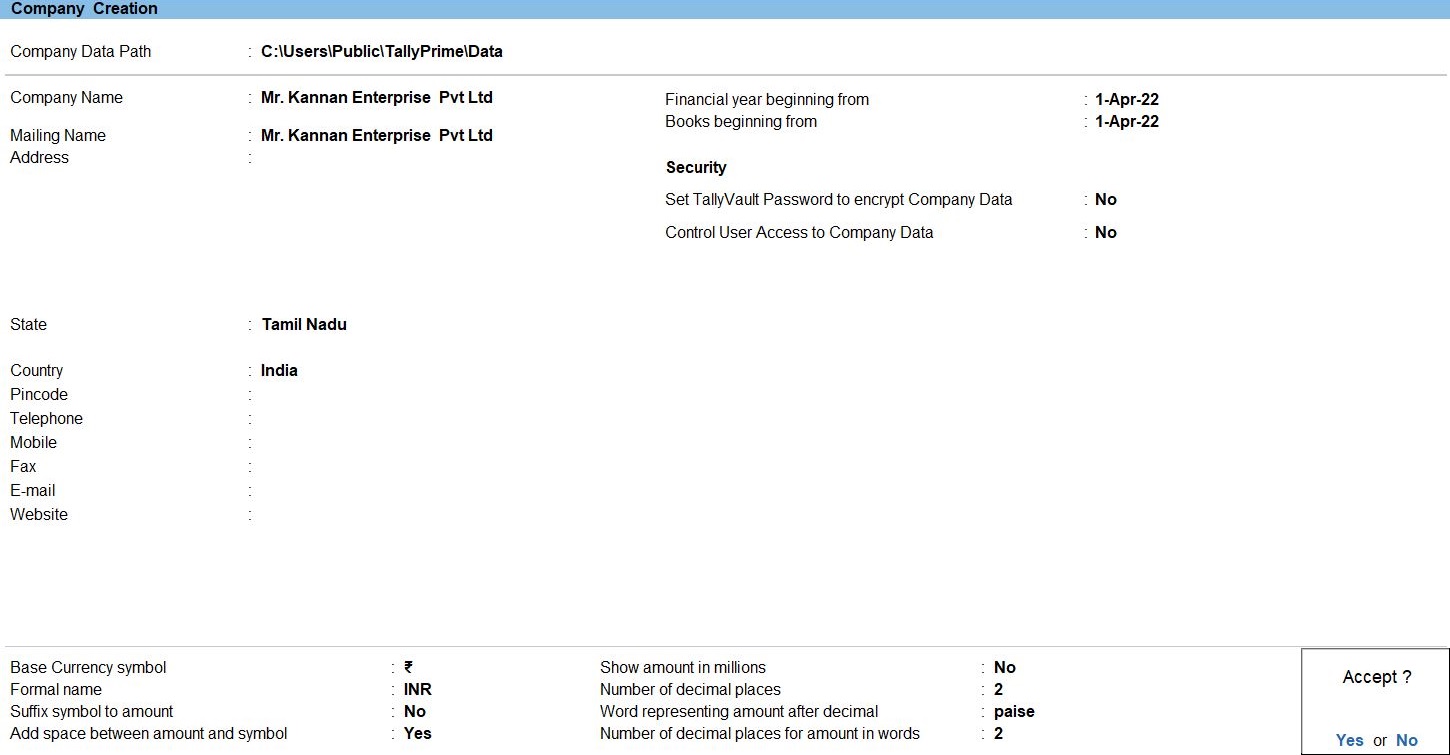

Create Company

To get started with Tally Prime, you need to first create your company to keep a record of all your day-to-day business transactions. To create the company, you need the company name and financial year information. You can enter all other details such as contact information, security, while creating the company or any time later.

How to create a company in Tally Prime

- In tally, after login double click on the create company option under company information.

- Go to Top Menu -> Company -> Create -> Enter

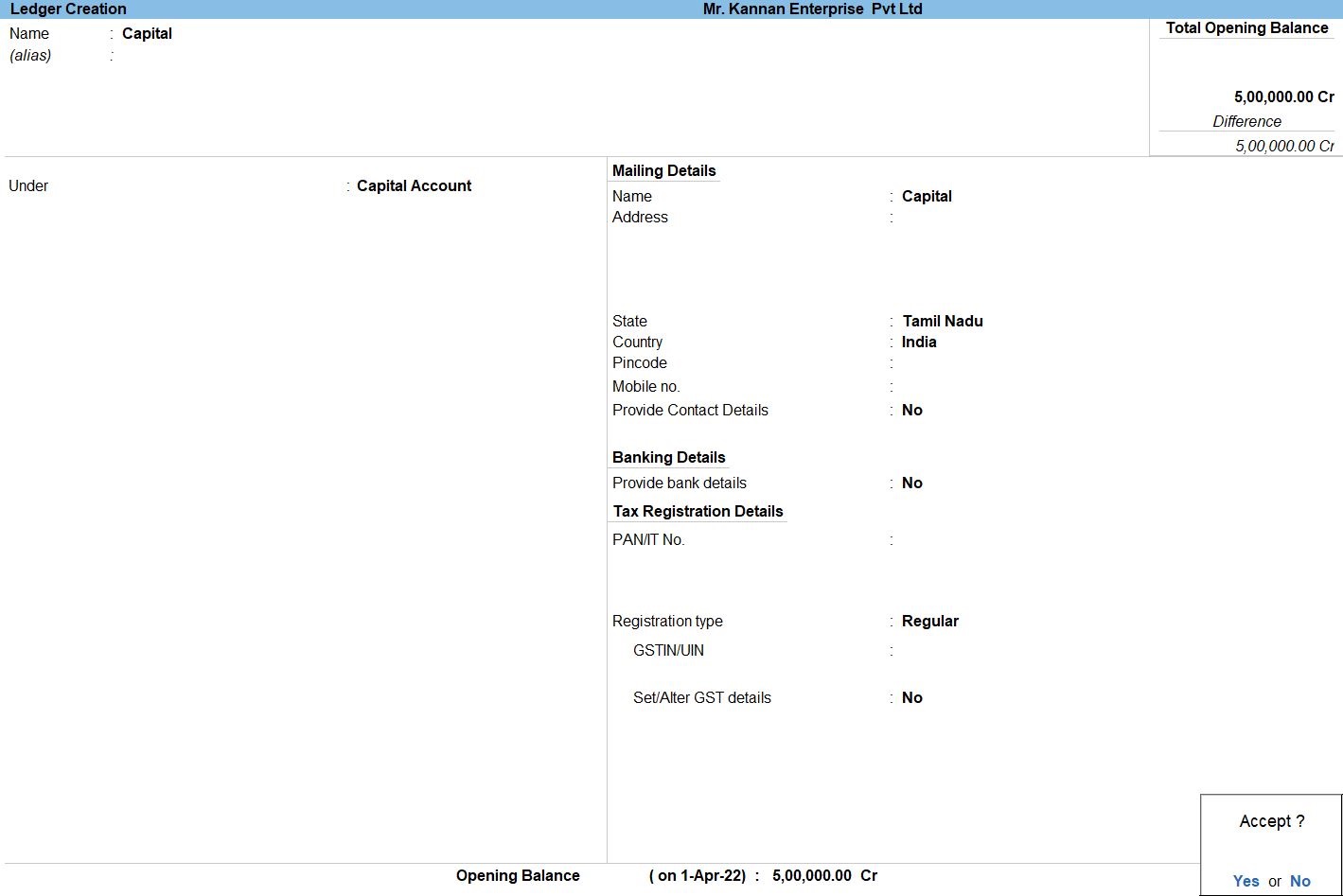

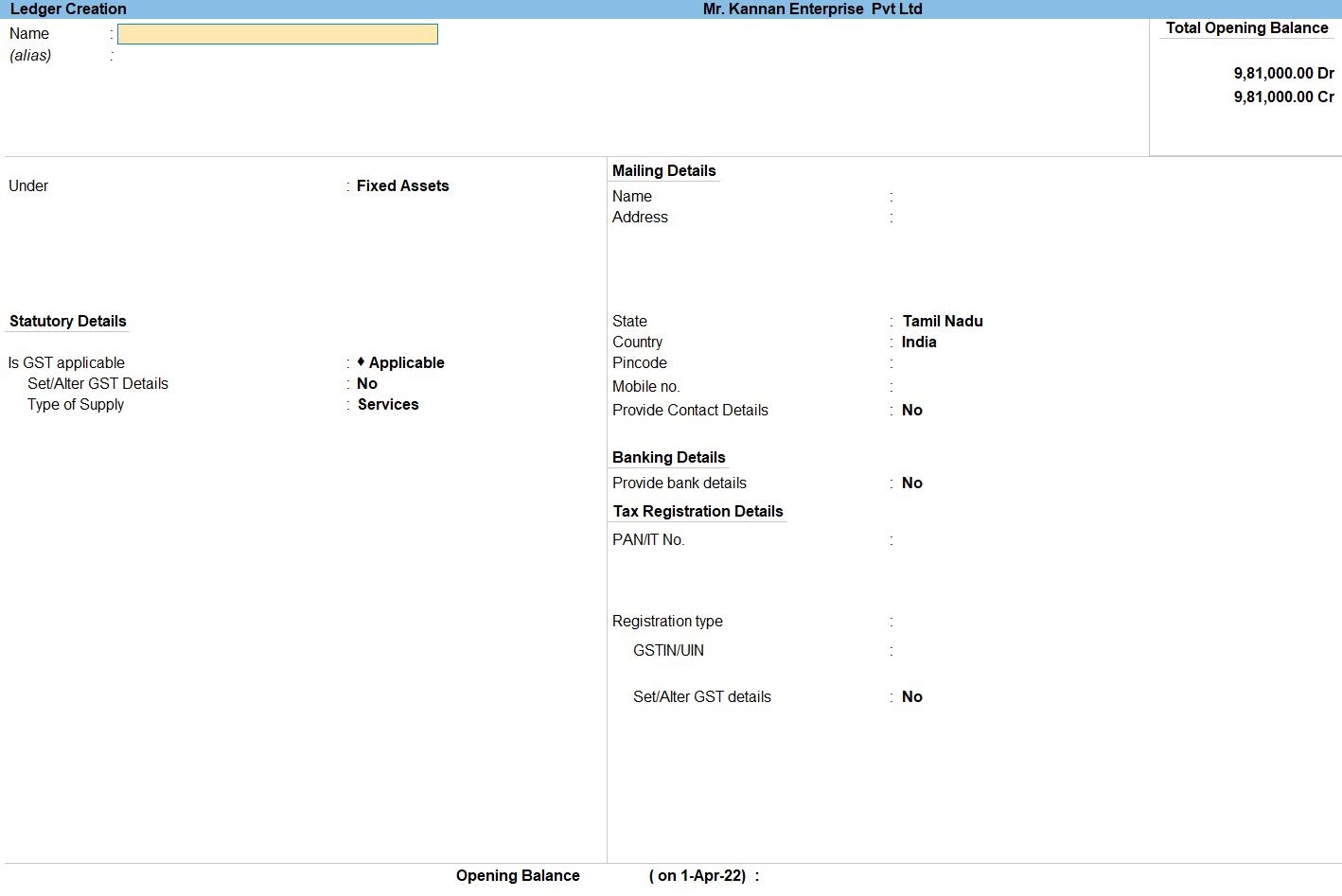

Ledger in Tally Prime

Ledgers in Tally Prime The ledgers in Tally Prime or in the Books of Accounts affect assets, liabilities, income or expenses. Tally Prime can generate a Profit & Loss A/c and Balance Sheet immediately after a transaction has been entered. It can also generate a range of comprehensive financial statements and reports.

Create a single ledger

- Press Alt+G (Go To) -> Create Master -> type or select Ledger and press Enter.

Alternatively, Gateway of Tally -> Create -> type or select Ledger and press Enter.

- Enter the Name of the ledger account.

Duplicate names are not allowed.

- Enter the alias of the ledger account, if required.

You can access the ledgers using the original name or the alias name

- Select a group category from the List of Groups.

- Enter the Opening Balance.

The opening balance is applicable when the ledger is an asset or a liability, and also if it has a balance in the account as on the books beginning date.

- Press Ctrl + A to save, as always

Voucher in Tally Prime

There are 24 pre-defined voucher types in Tally Prime for accounting, inventory, payroll and orders. You can create more voucher types under these pre-defined voucher types as per your business needs.

For example, for cash payments and bank payments, the predefined voucher type is Payment Voucher. You can also have two or more sales voucher types in Tally Prime for different kinds of sales transactions. For example, credit sales, cash sales, and so on.

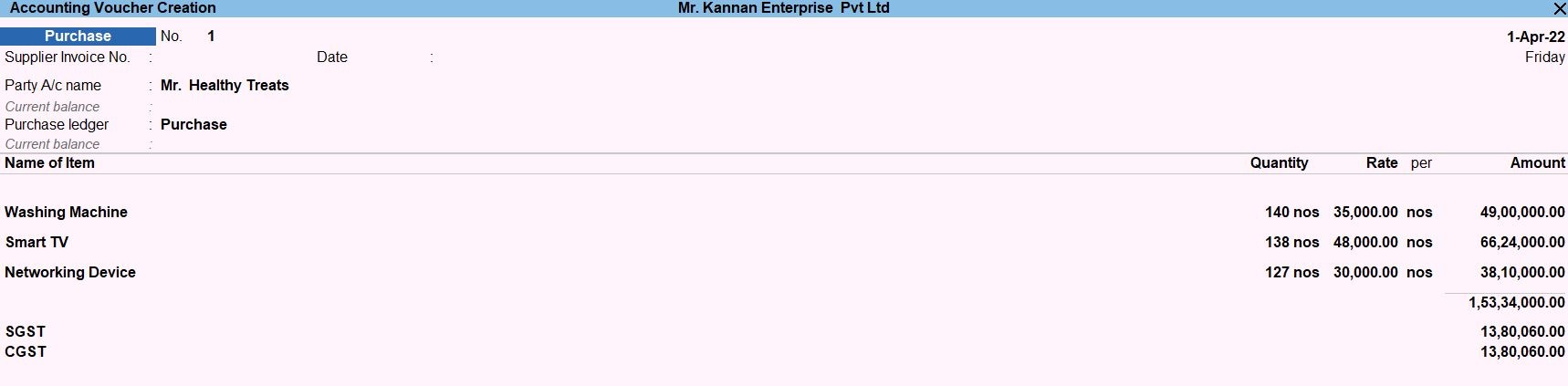

Apr 01 Purchasing the following goods from Mr. Healthy Treats, Tamil Nadu with supplier invoice SM301

| S.NO | Product | Qty | Rate | TAX | HSN Code |

| 1 | Washing Machine | 140 nos | Rs. 35000 | 18% | 8450 |

| 2 | Smart TV | 138 nos | Rs.48000 | 18% | 85287100 |

| 3 | Networking Device | 127 nos | Rs. 30000 | 18% | 851762 |

Apr 08 Purchasing the following goods from Mr. Better Land Grocery, New Delhi with supplier invoice SJ302

| S.NO | Product | Qty | Rate | TAX | HSN Code |

| 1 | Microwave Oven | 130 nos | Rs. 25000 | 18% | 85165000 |

| 2 | Smart Refrigerator | 125 nos | Rs.18000 | 18% | 84182100 |

| 3 | Water Purifier/Dispenser | 155 nos | Rs.15000 | 18% | 84186920 |

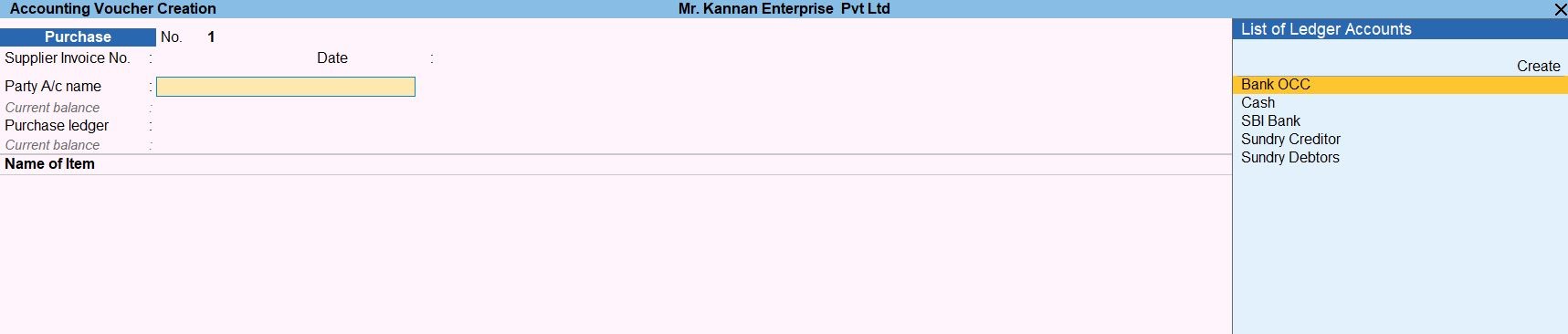

Purchase Voucher in Tally Prime

Whenever you purchase a product or service, you record the purchase entry. In tally, this is recorded through the purchase voucher. It is also one of the most widely used vouchers in tally. There are two modes for accounting in purchase vouchers- Invoice mode and Voucher mode, as mentioned in the sales voucher

You may do a simple cash purchase or purchase on credit. For each purchase transaction, you will need to keep a record of the items you bought, payments made, goods returned, and so on.

How to Use Purchase Voucher in Tally Prime

- Gateway of Tally -> Voucher -> Purchase Voucher(F9) or F10: Other Voucher ->Purchase Voucher

- Enter the Supplier Invoice No. and Date.

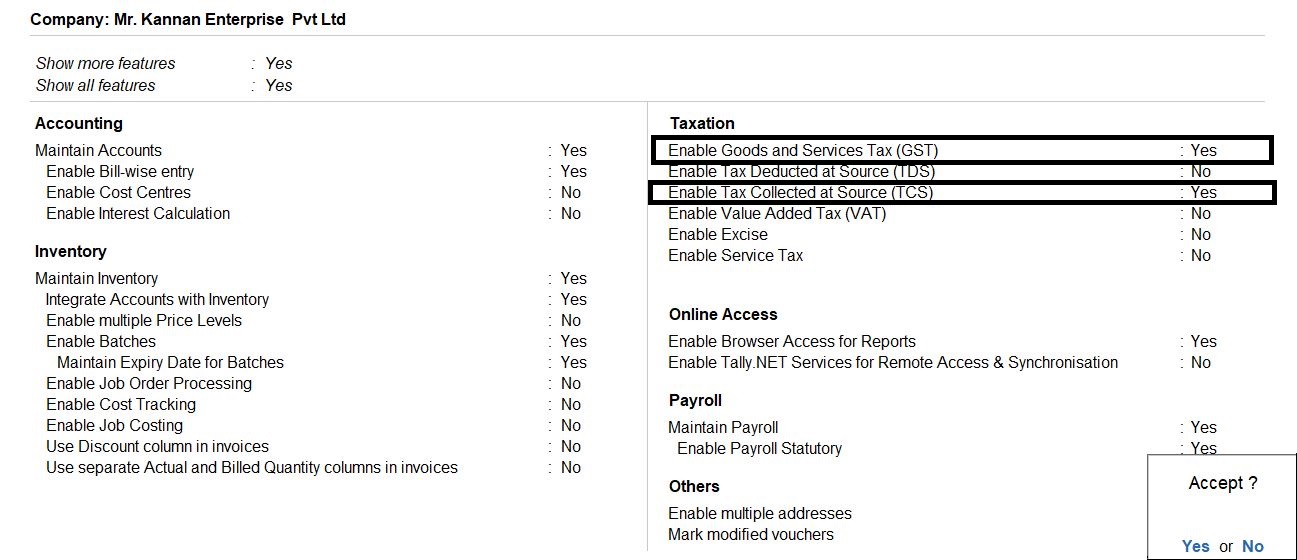

- Enter the F11 press Enable Goods and service Tax(GTS) -> Enable Tax collected at Source (TCS). Yes

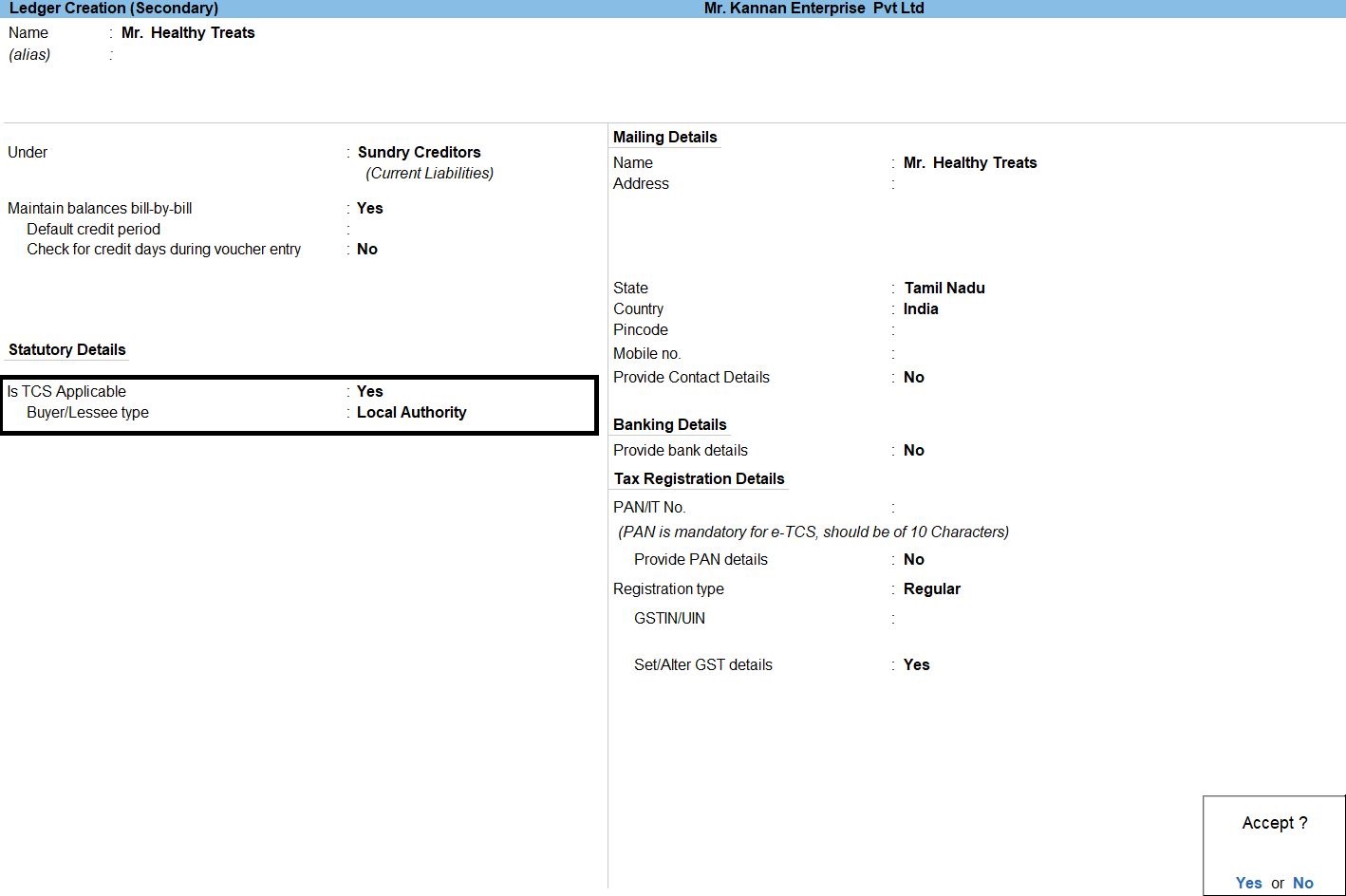

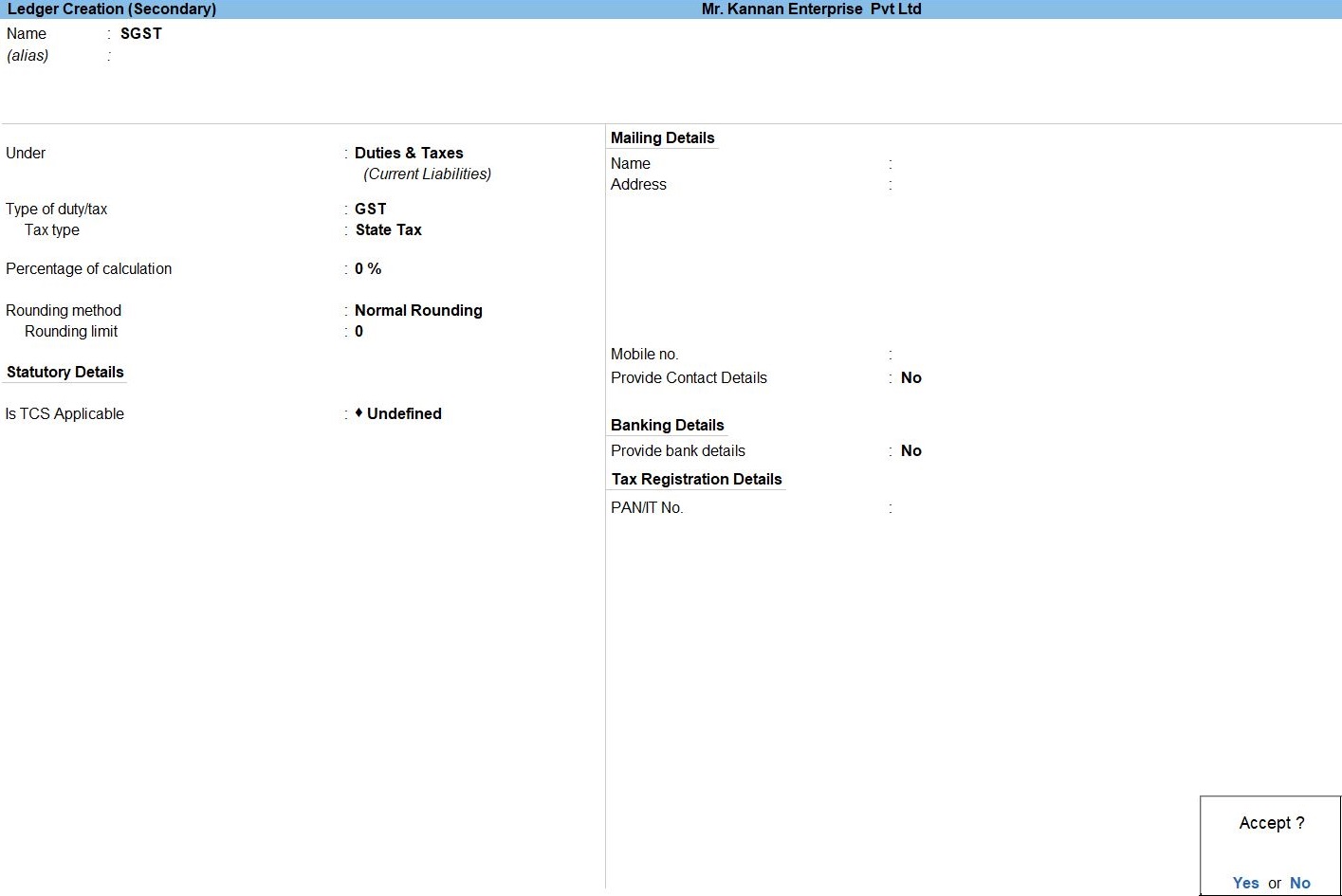

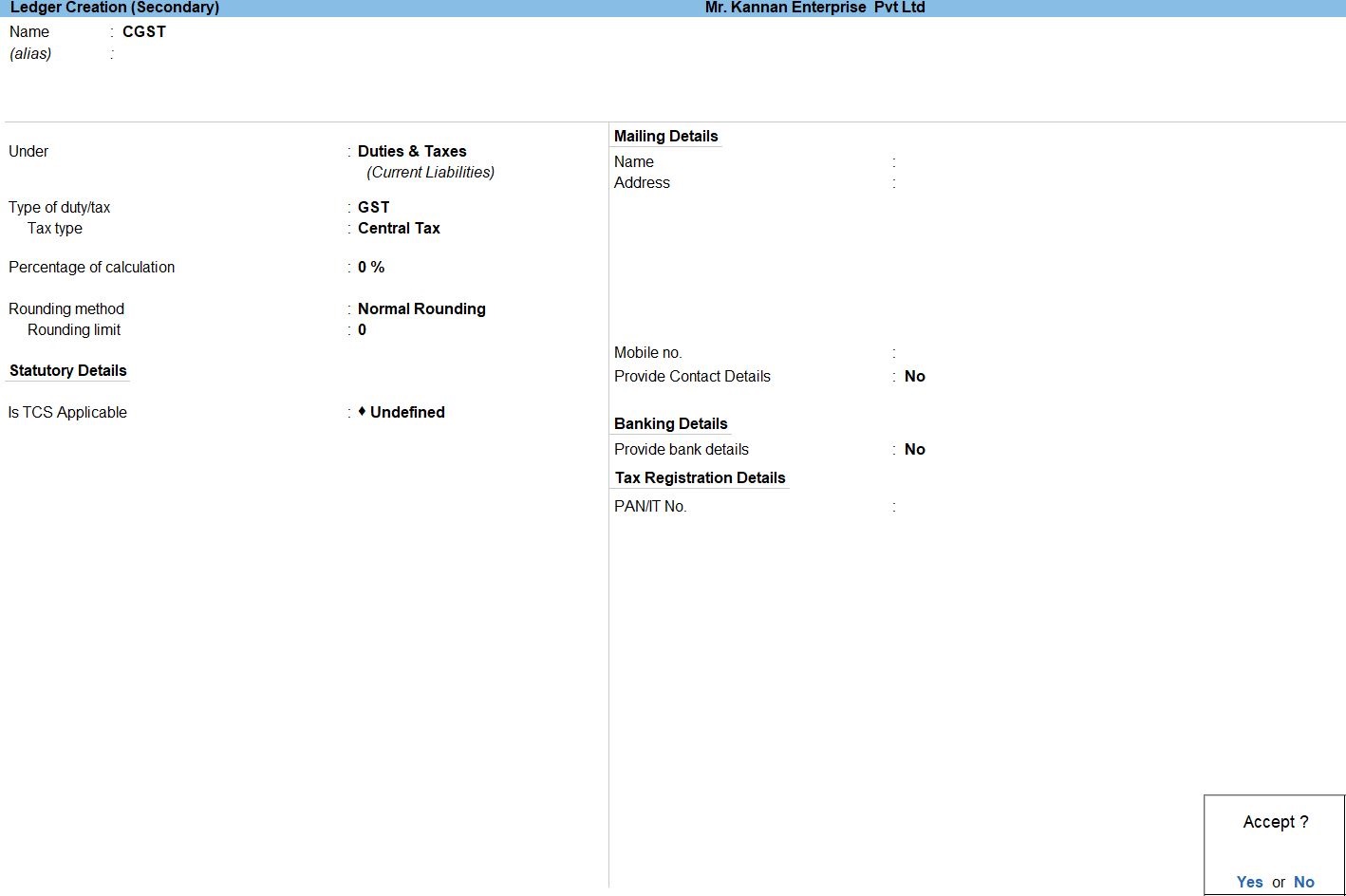

- Create ->Secondary ledger press Alt +C

- Create ->Secondary Stock Item press Alt +C

- Create ->Secondary Stock Item press Alt +C

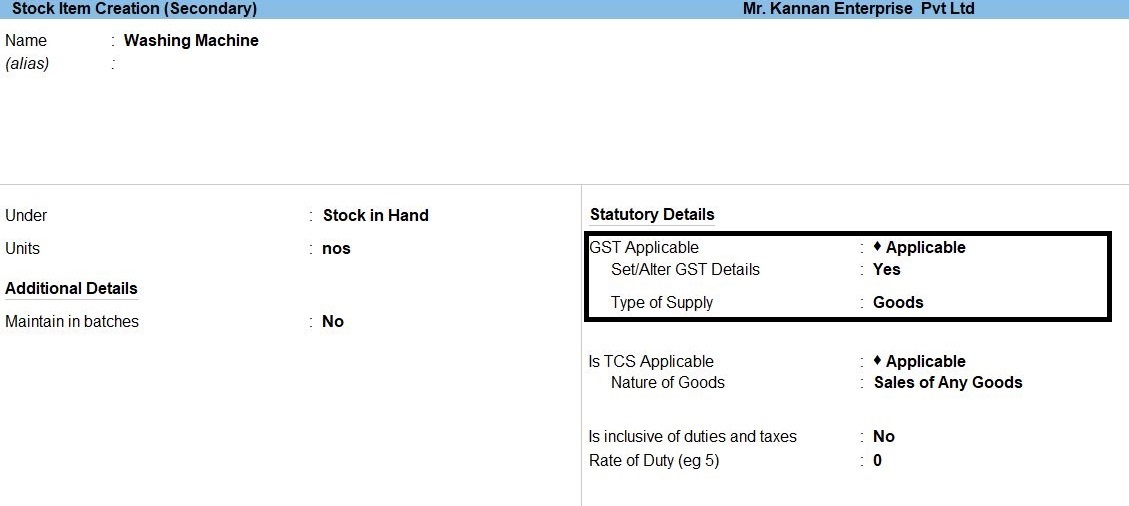

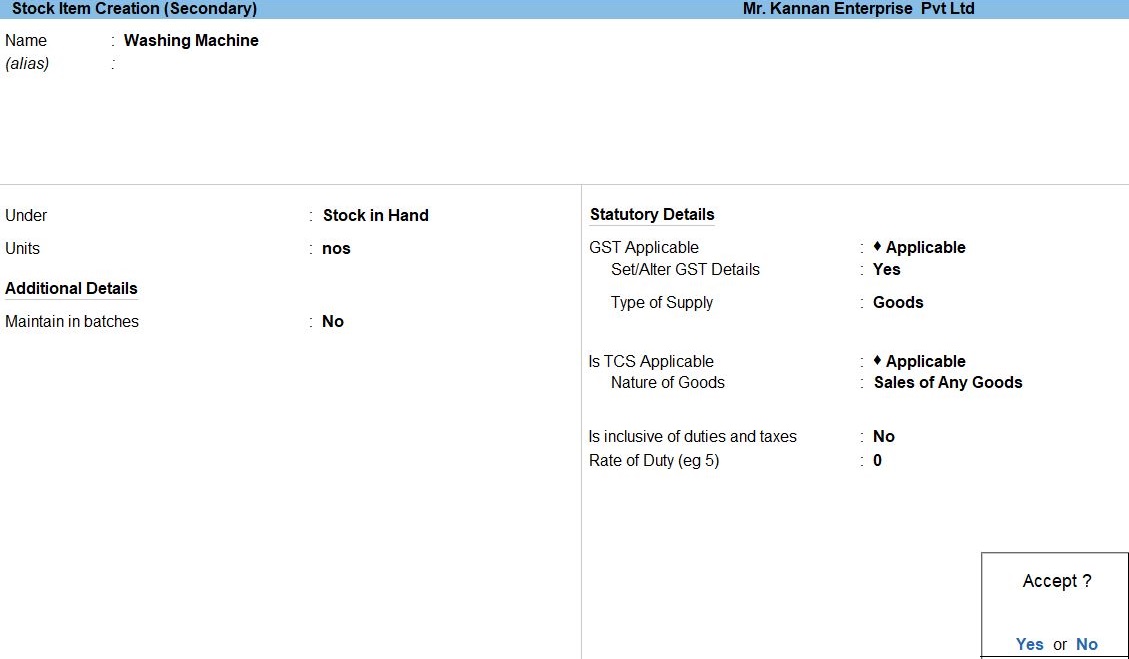

- Enter ->Stock Item create Name

- Enter ->Stock Item create Under in Stock in Hand

- Enter ->Stock Item create Unit in Nos

- GST Applicable: Applicable

- Set Alter GST DetailsYes

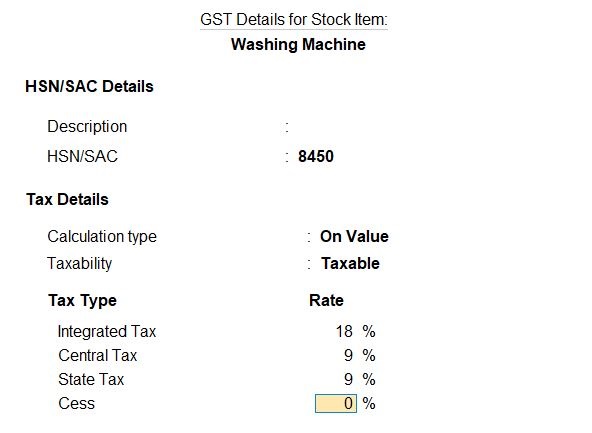

- The GST Details for Stock Item window opens.

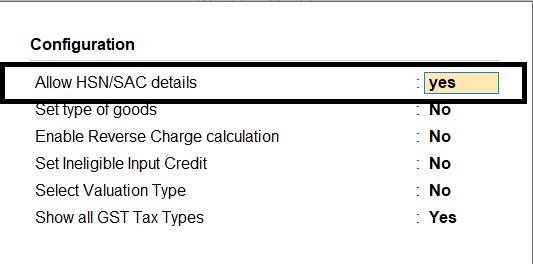

- Press F12 Configure -> set Allow HSN/SAC details to Yes.

As always, press Ctrl+A to save. - As always, press Ctrl+A to save.

- Enter the Description.

- The under HSN/SAC, enter the HSN Code .of the Stock Items.

This can be a 4-digit, 6-digit, or 8-digit HSN Code, depending on the type of item. - The Under Calculation Type, select

On Value.On the basis of this selection,the tax amount will be calculated based on the value of the Stock Items.

If you select Item Rate then the tax amount will be calculated based on the rate corresponding to the Item. - This Under Taxability, select Taxable.

- This Under Integrated Tax, enter the GST Rate of the Stock Items.

- Enter Cess, if applicable.

After providing all the details, The GST Details of Stock Item screen appears as shown below. - As always, press Ctrl+A to save.

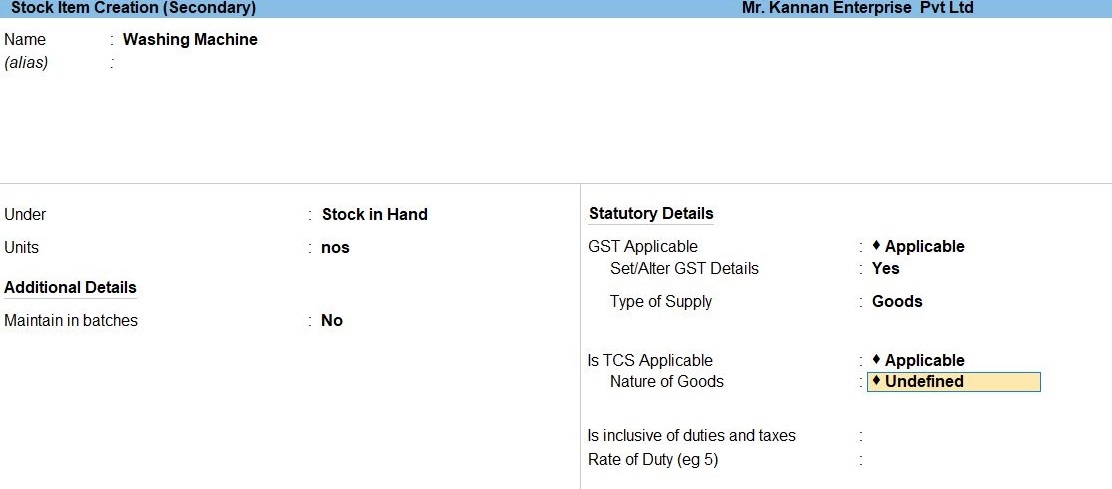

- TCS Applicable: Applicable

- Nature of Goods ->Create

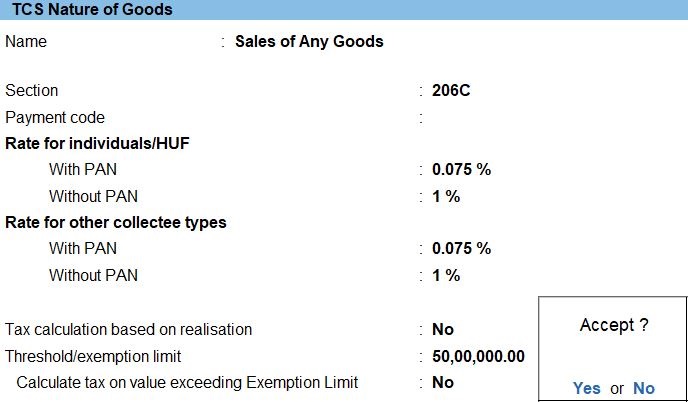

- The TCS Nature of Goods for window opens.

- Enter the Name.

- Enter the name of the Nature of Goods

- Enter the Section

- Enter the Payment code

- Enter the applicable TCS rates

- Enter the Calculate tax on value exceeding Exemption Limit – Set this option to Yes to calculate TCS on the amount exceeding the threshold limit, as recommended by the latest department rules. If you set this option to No

- Enter the Threshold/exemption limit

- Accept the screen. As always, press Ctrl+A to Save.

- Type of Supply:Goods.

- Accept the screen. As always, press Ctrl+A to Save.

- Accept the screen. As always, press Ctrl+A to Save.

State Tax

Central Tax

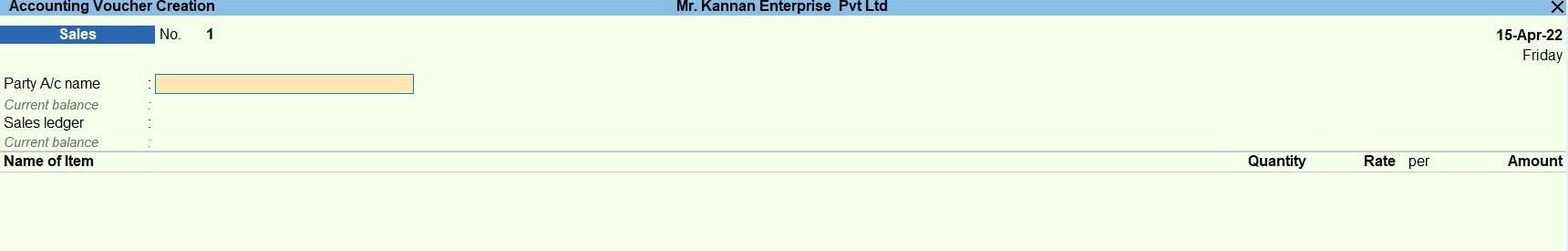

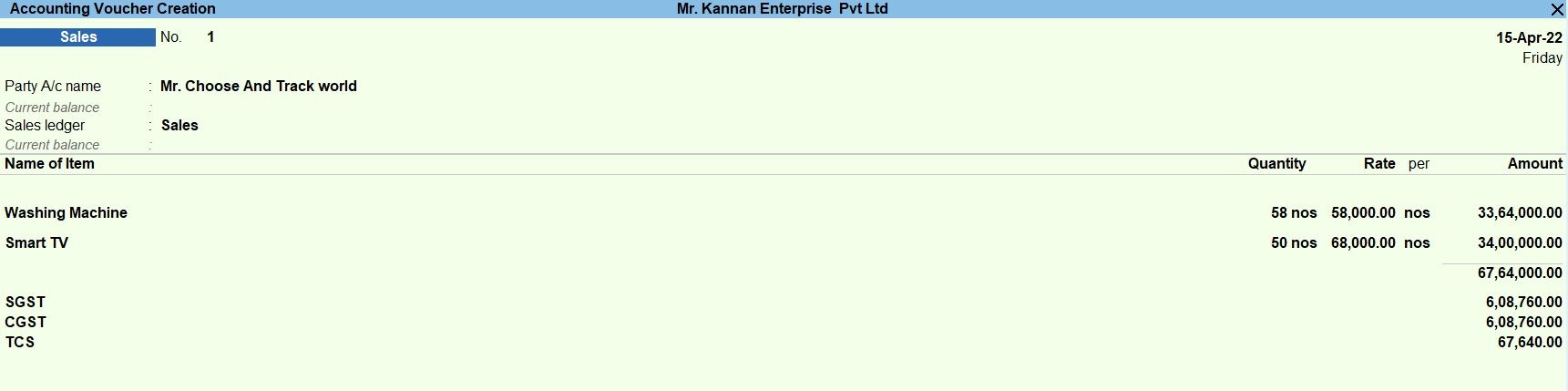

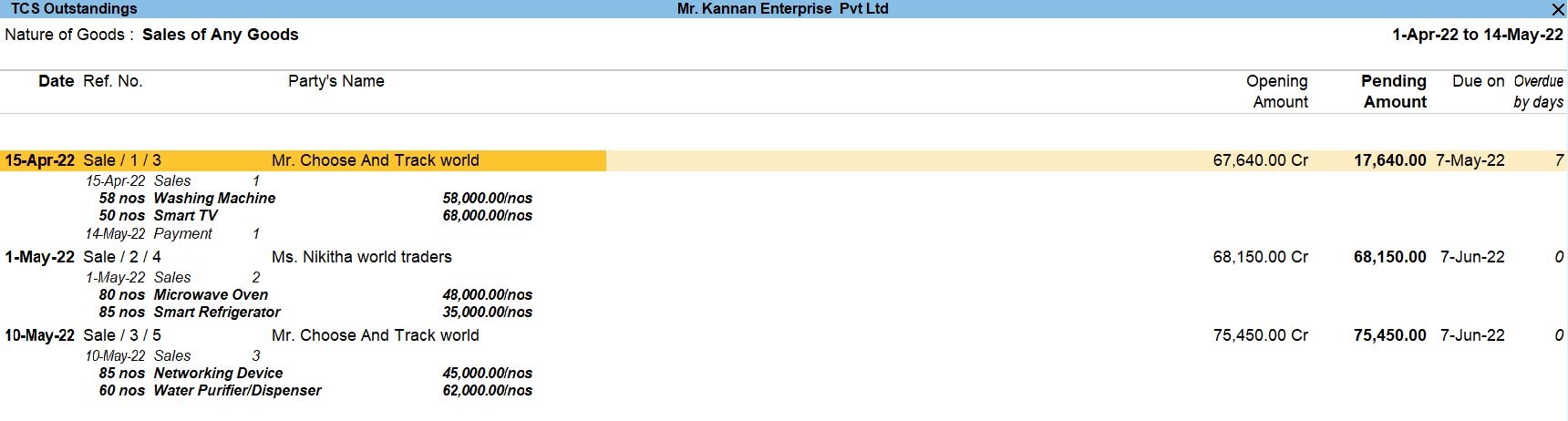

Apr 15 Sold the following goods to Mr. Choose And Track world, Tamil Nadu with customer invoice NNA303

| S.NO | Product | Qty | Rate |

| 1 | Washing Machine | 58 nos | Rs.58000 |

| 2 | Smart TV | 50 nos | Rs.68000 |

May 01 Sold the following goods to Ms. Nikitha world traders, Gujarat with customer invoice MSJ304

| S.NO | Product | Qty | Rate |

| 1 | Microwave Oven | 80 nos | Rs.48000 |

| 2 | Smart Refrigerator | 85 nos | Rs.35000 |

May 10 Sold the following goods to Mr. Choose And Track world, Tamil Nadu with customer invoice NN305

| S.NO | Product | Qty | Rate |

| 1 | Networking Device | 85 nos | Rs.45000 |

| 2 | Water Purifier/Dispenser | 60 nos | Rs.62000 |

Sales Voucher in Tally Prime

Whenever you sell a product or service, you record sales entries. In tally, the sales are recorded through the sales voucher. It is one of the most widely used accounting vouchers in tally. There are two modes for accounting in sales vouchers- Invoice mode and Voucher mode.

How to Use Sales Voucher in Tally Prime

- Gateway of Tally -> Voucher -> Sales Voucher(F8) or F10: Other Voucher ->Sales Voucher

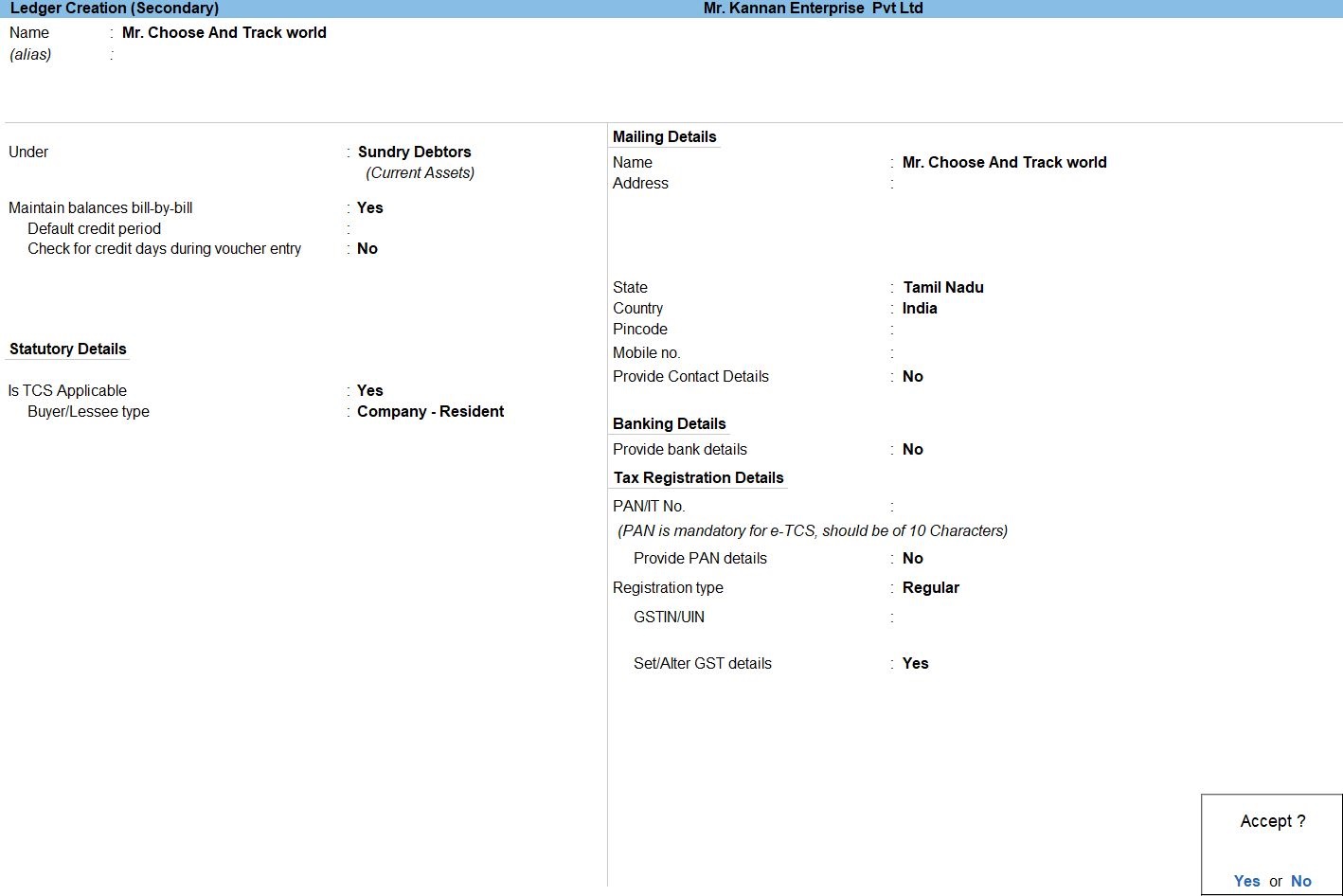

- Create ->Secondary ledger press Alt +C

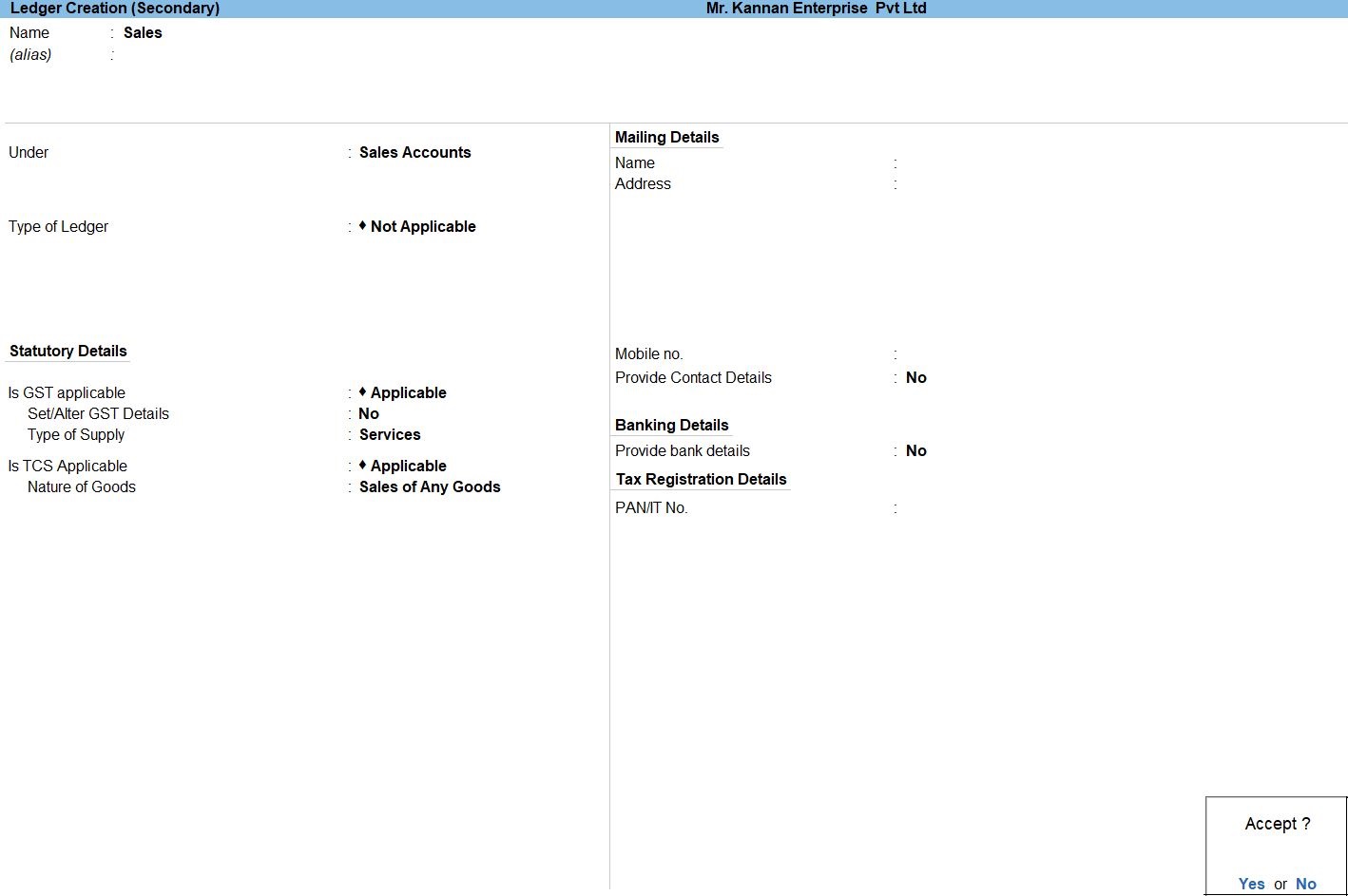

- Create ->Sales ledger press Alt +C

- Select ->Stock Item for press Enter

- Create ->Secondary ledger press Alt +C

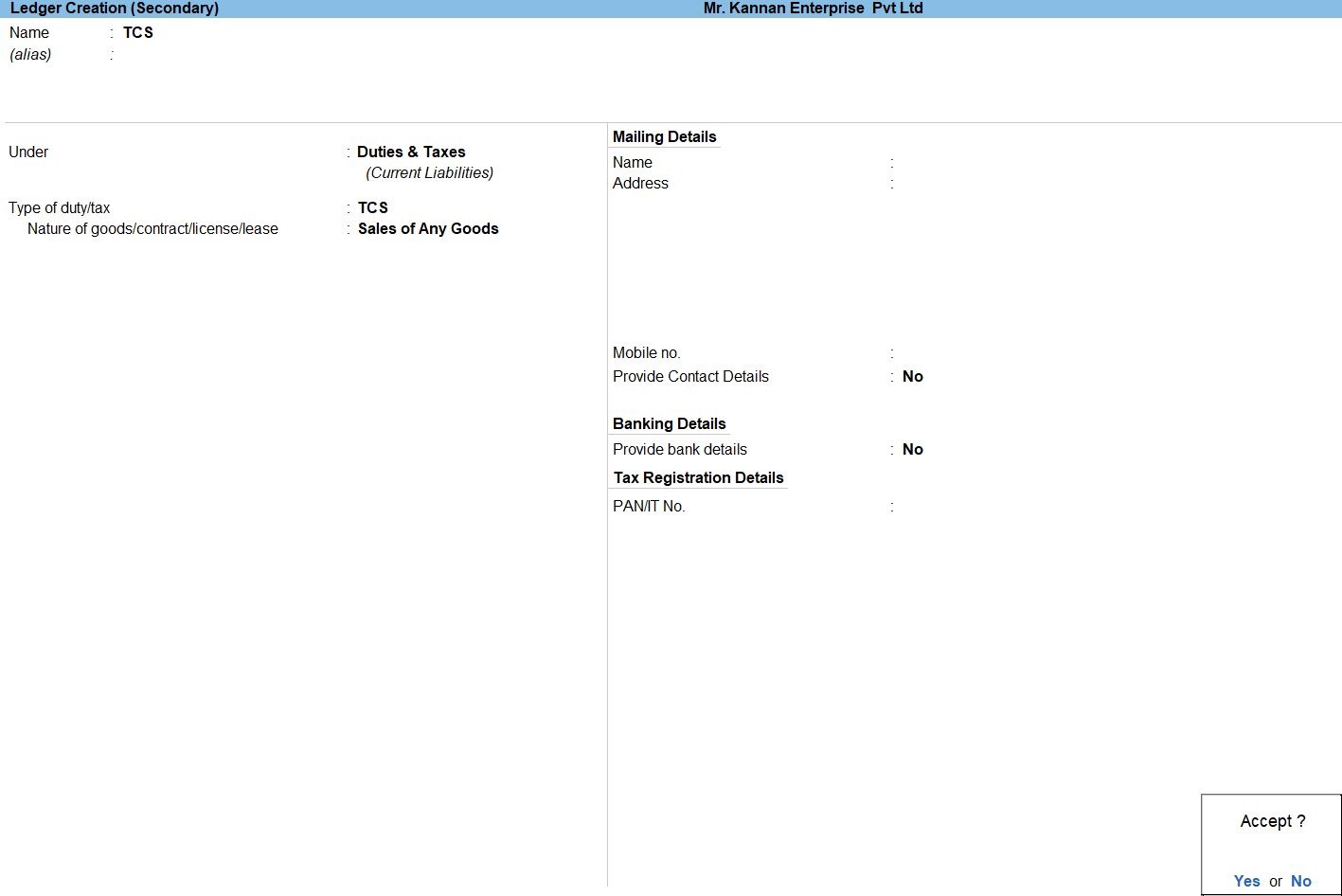

- Enter ->Name -> TCS

- Select the ->Under -> Duties & Tax

- select the ->Type of duty/tax -> TCS

- Select this ->Nature of goods/contract/license/lease -> Sales of any goods

- Accept the screen. As always, press Ctrl+A to Save.

TCS TAX

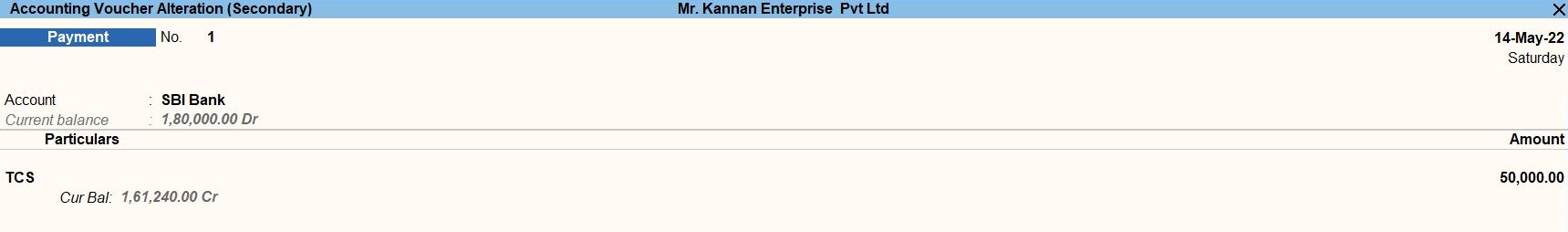

TCS Tax Payment Voucher in Tally Prime

A payment voucher is a way to record payments made to suppliers and maintain a history of payments that your business has made. Companies use vouchers to gather and file supporting documents that are required to approve and track payments of liabilities.A payment voucher is a way to record payments made to suppliers and maintain a history of payments that your business has made. Companies use vouchers to gather and file supporting documents that are required to approve and track payments of liabilities.

Payment voucher- It is also called a debit voucher. A payment voucher is used to keep a record of payments made in cash or through the bank.

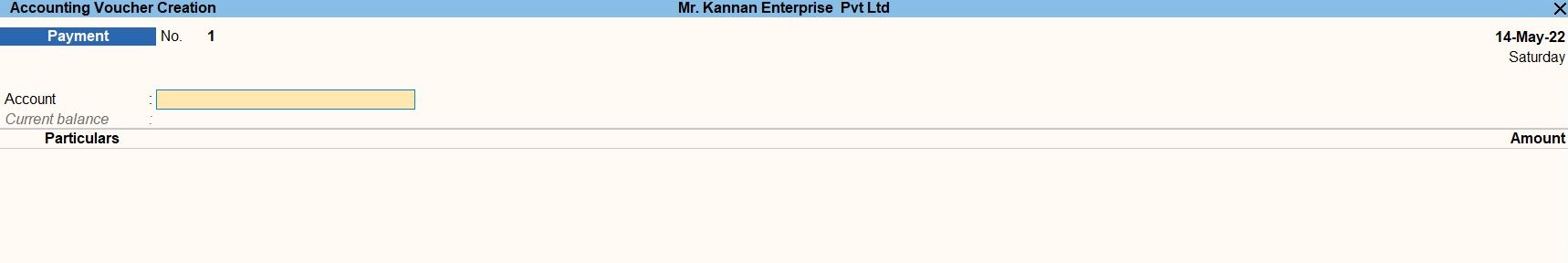

How to Use Payment Voucher in Tally Prime

- Gateway of Tally -> Voucher -> Payment Voucher(F5) or F10: Other Voucher -> Payment voucher

- Select ->Secondary ledger for Party Name

- Select ->Tax ledger for TCS

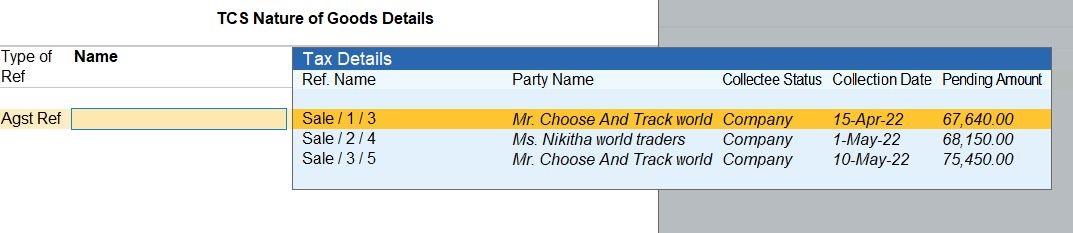

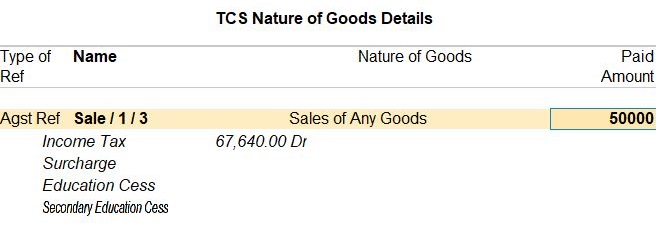

- The Select ->Bill NO Agents Ref TCS

- Accept the screen. As always, press Ctrl+A to Save.

If you want make a part payment settlement select the bill no and enter the amount value.

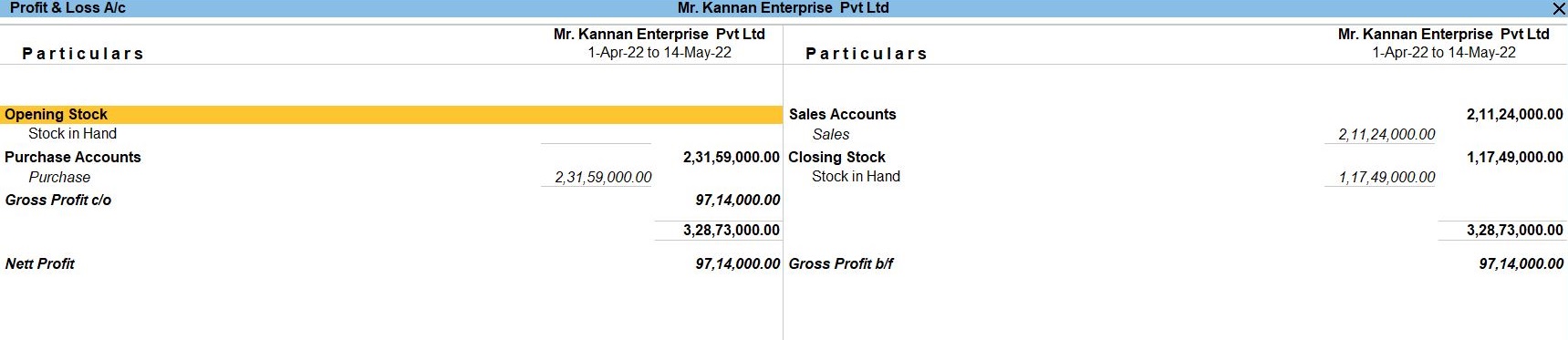

Profit and Loss In TallyPrime

Profit and Loss A/c is one of the primary financial statements that you can use to monitor the health of your business. It summarizes the revenues, costs, and expenses for a specific period, such as a quarter or a year. Thus, you can easily gather the net result of the business operations.

Using the Profit and Loss A/c in Tally Prime, you can measure the ability of your business to generate profit. Accordingly, you can take various measures to increase revenue, reduce costs, and so on. What’s more, you can view the Profit and Loss A/c in the browser.

How to Use Profit and Loss in Tally Prime

- Gateway of Tally -> Report -> Profit & Loss A/C (F1)

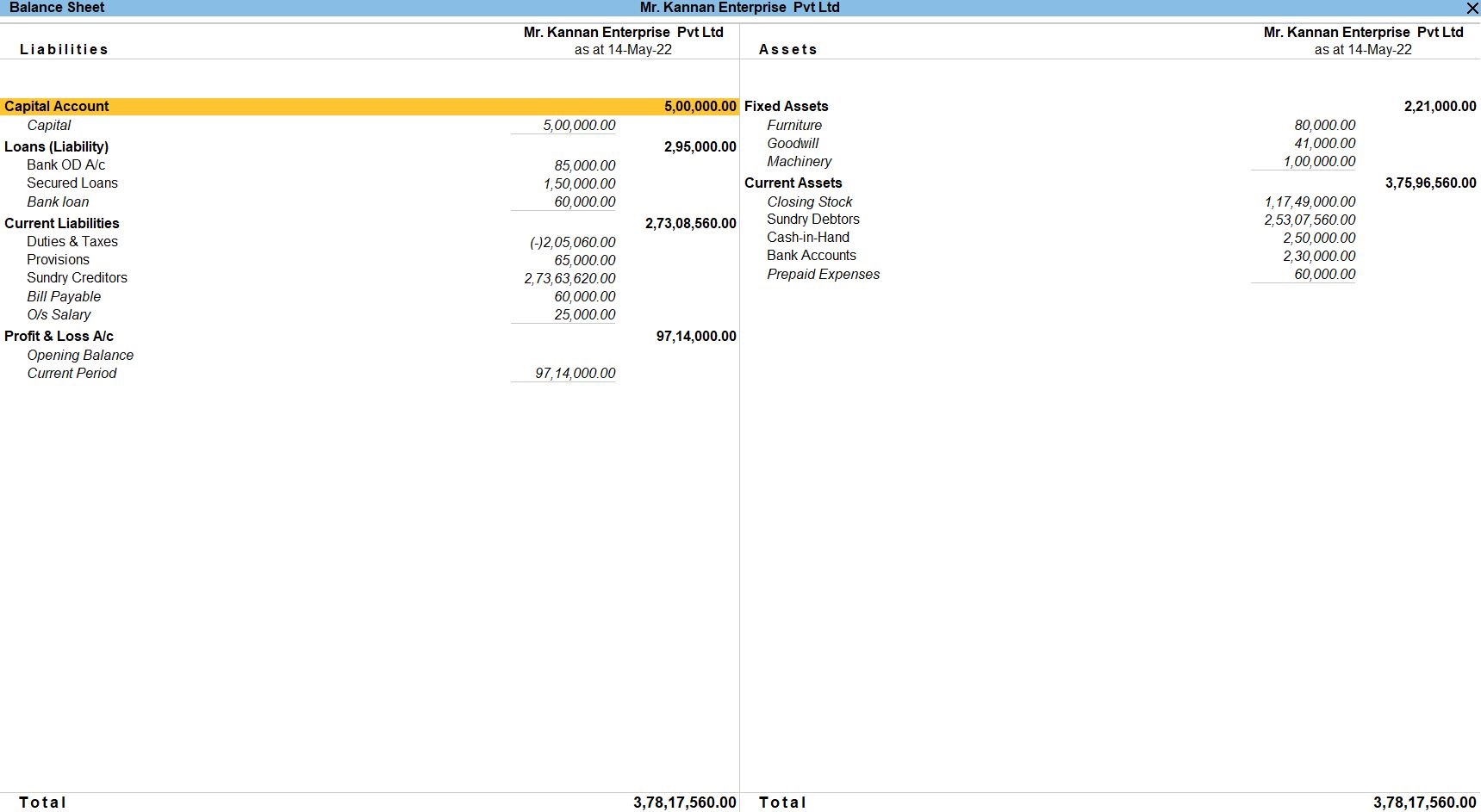

Balance Sheet In TallyPrime

Balance Sheet is one of topmost financial statement prepared by the businesses. The financial details of the balance sheet help you and the external stakeholders to evaluate the financial performance of the business on a given date. Before knowing the steps to prepare a balance sheet and reading the balance sheet, it is important to be familiar with the components and format of the balance sheet.

- Gateway of Tally -> Report -> Balance Sheet (F1)

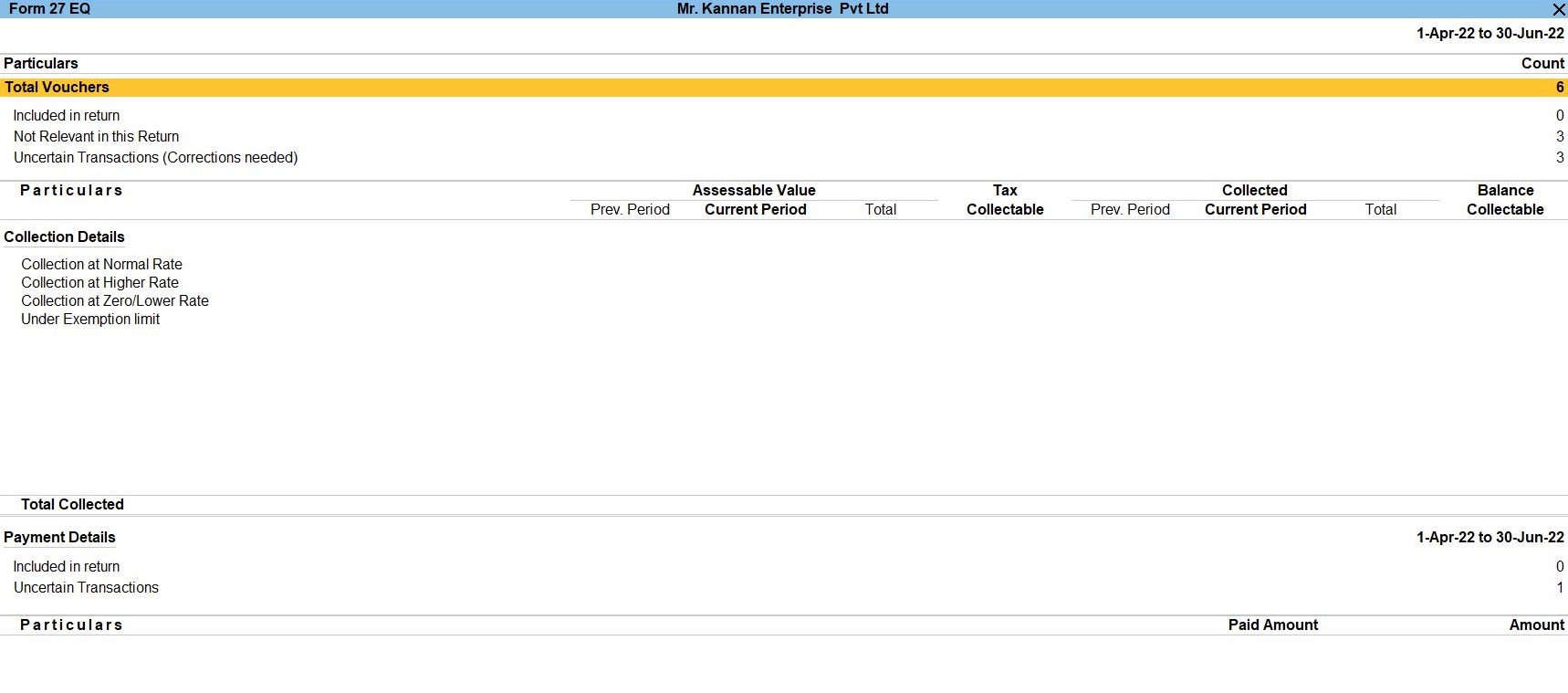

TCS Reports In TallyPrime

- Go to Gateway of Tally prime -> Go To -> TCS ReportsEnter

- Go to Gateway of Tally prime -> Go To -> TCS Reports->Form 27EQ Enter

- Go to Gateway of Tally prime -> Go To -> TCS Reports-> TCS Outstandings Enter

Form 27EQ in Tally Prime

Form 27EQ contains all details pertaining to tax that is collected at source. According to Section 206C of the Income Tax Act 1961, this form must be filed every quarter. The form has to be submitted by both the corporate and government collectors and deductors.

TCS Outstandings in Tally Prime

Displays the total amount of tax collected from parties of Individual/HUF - Resident and Individual/HUF - Non Resident buyer or lessee type for whom sale transactions were recorded. Total Pending. Displays the total outstanding amount of all TCS pending payment to be made.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions