Payroll in Tally Prime

Employee Groups

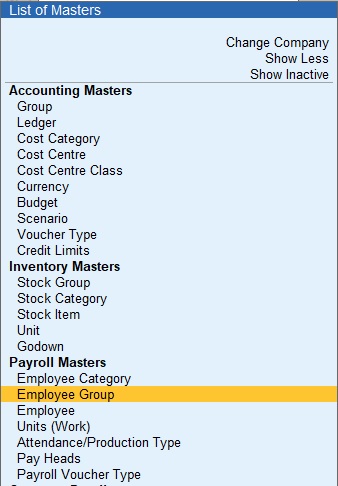

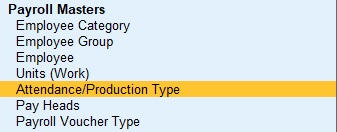

1. Go to Gateway of Tally -> Masters -> Create -> Payroll Masters -> Employee Groups

Employees

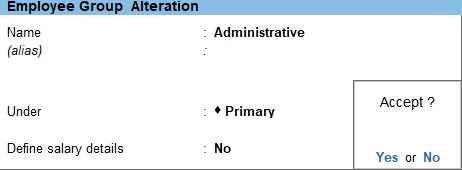

1. Go to Gateway of Tally -> Masters -> Create -> Payroll Masters -> Employee

2. Enter the Name of the employee.

3. Select the Employee Group in the field Under.

4. Enter the Date of joining.

5. Set the Define salary details option to No , and press Enter

Attendance

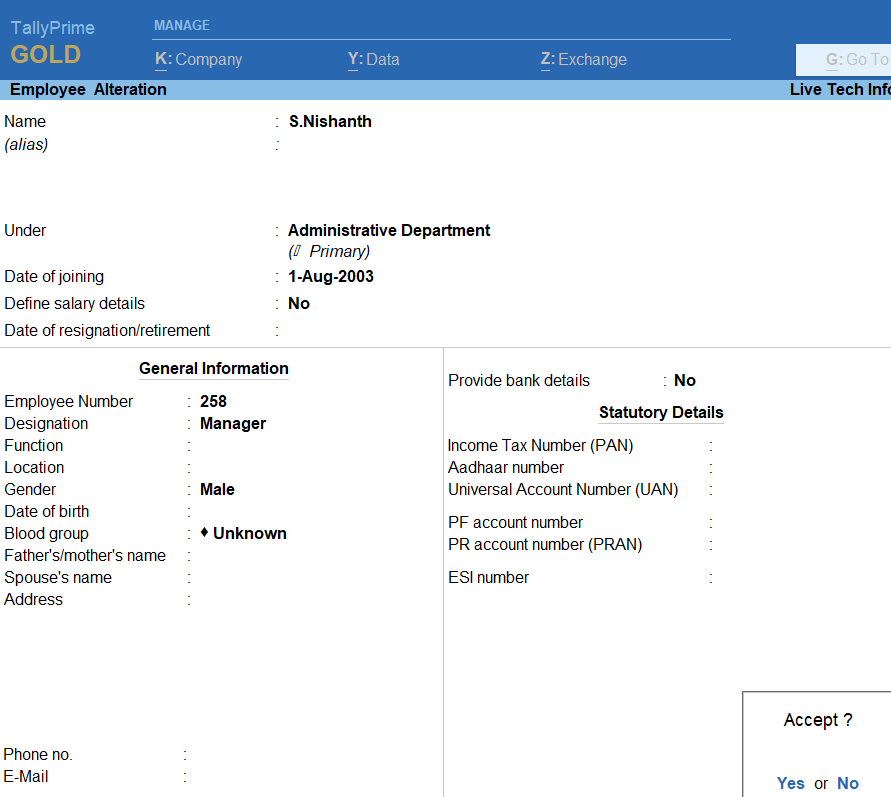

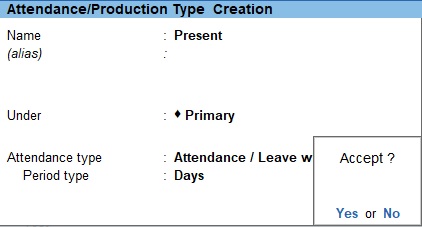

Go to Gateway of Tally -> Masters -> Create -> Payroll Masters -> Attendance/Production Type

1. Enter the Name of the attendance

2. Select the Primary from the list for Under.

3. Select the Attendance type as Attendance/Leave with Pay.

4. Press Enter.

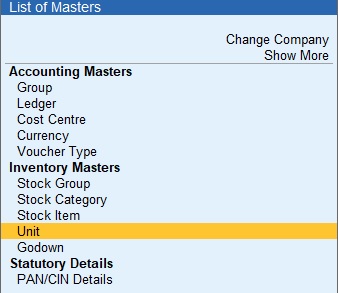

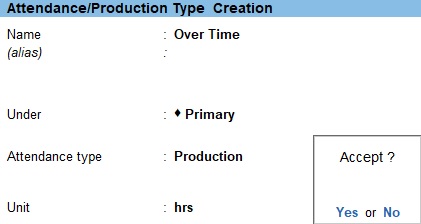

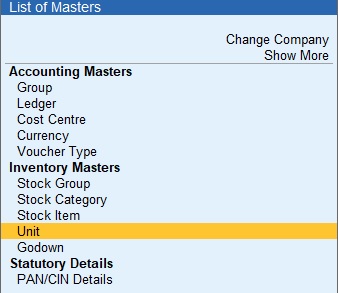

Units

Go to Gateway of Tally -> Masters -> Create -> Payroll Masters -> Units

1. Enter the Type of Simple

2. Enter the symbol of hrs

3. Enter the Formal name of Hours.

4. Enter the Unit Quantity code of Hrs-Hours.

5. Press Enter

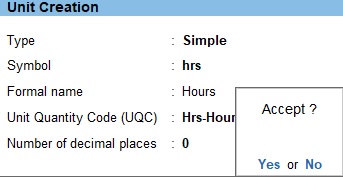

1. Go to Gateway of Tally -> Masters -> Create -> Payroll Masters -> Attendance/Production Type

2. Enter the Name of the Over Time.

3. Select Primary from the list, for the field Under.

4. Select Production as the Attendance Type.

5. Select the Unit of hrs

6. Press Enter

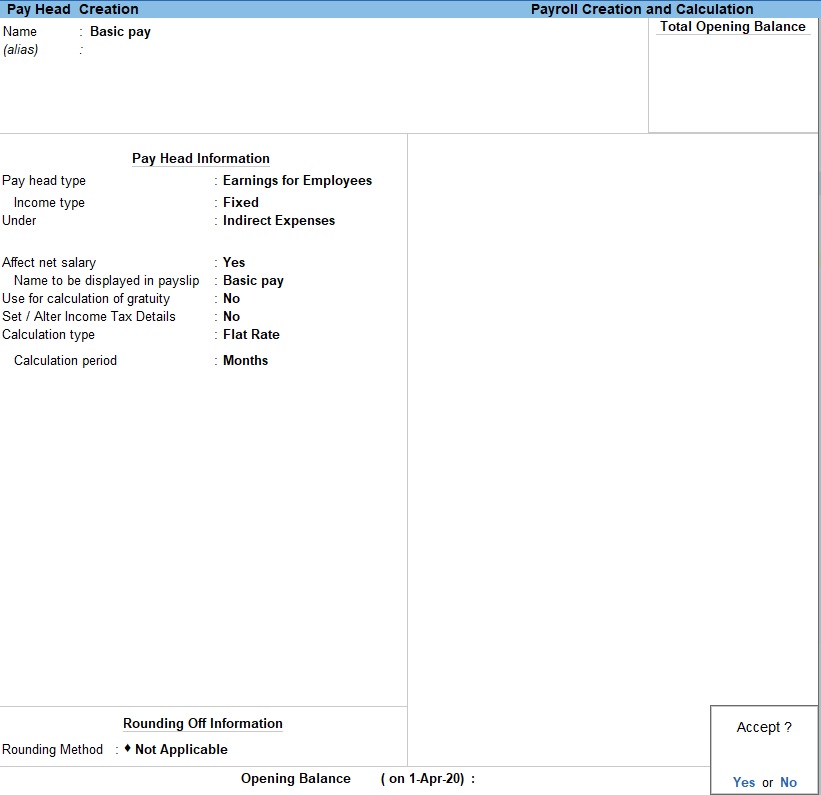

Pay Head

1. Go to Gateway of Tally -> Masters -> Create -> Payroll Masters -> Pay Head

2. Enter the pay head name in the Name

3. Select Earnings for Employees from the List of Pay Head Types

4. Select Income type for the pay head as fixed

5. Select the Under field as Indirect Expenses from the List of Groups

6. Select Affect Net Salary to Yes

7. Select On Calculation type

8. Select the required Calculation period from the List of Calculation Periods.

9. Select the Rounding Method as Not applicable.

10.Press Enter

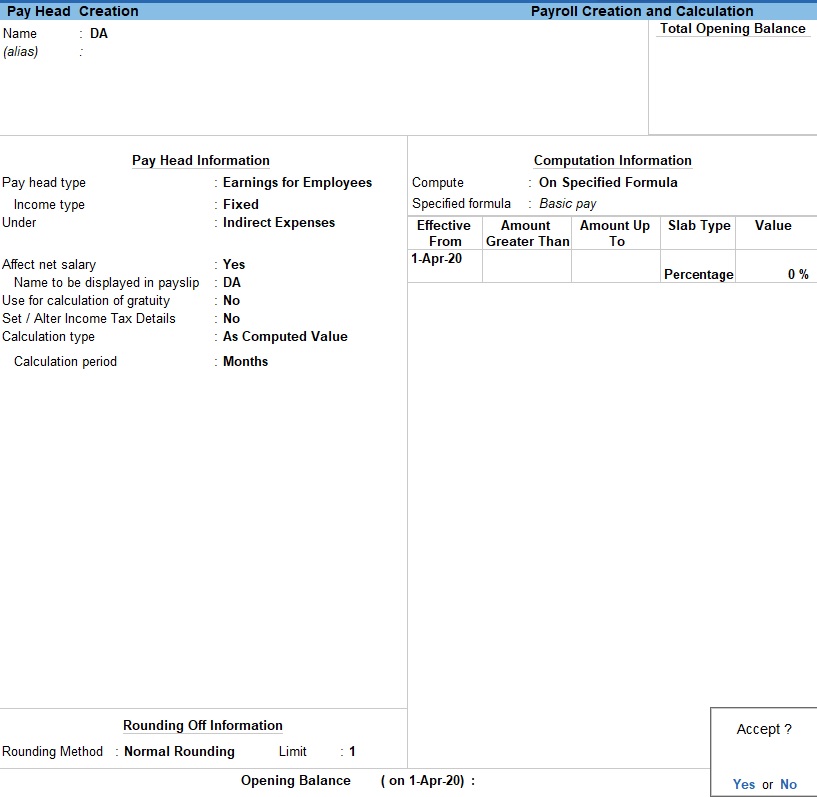

1. Select On Calculation type as Computed Value.

2. Select the Calculation period from the List of Calculation Periods

3. Select the Rounding Method as Normal Rounding.

4. Enter the desired rounding limit.

5. Select On Specified Formula from Compute field

6. Select Basic Pay from the List of Pay Heads column.

7. Select End of List to return to Pay Head Creation screen.

8. Enter the desired date in the Effective Date field.

9. Select Percentage.

10.Press Enter to accept and save.

11. You can Create other details

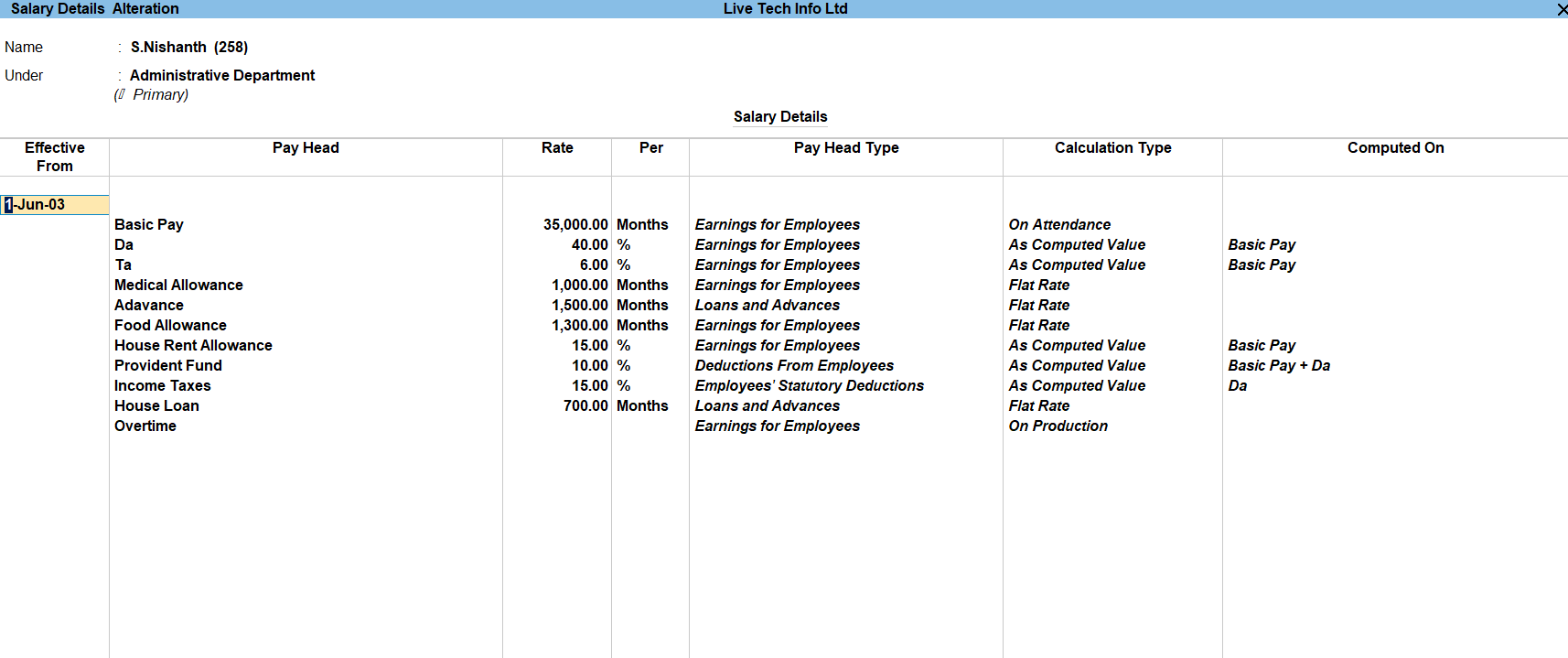

Define Salary

1. Go to Gateway of Tally -> Master -> Alter -> Payroll Masters -> Define Salary -> select field

2. Select the list enter the amount (or) percentage

3. Press Enter

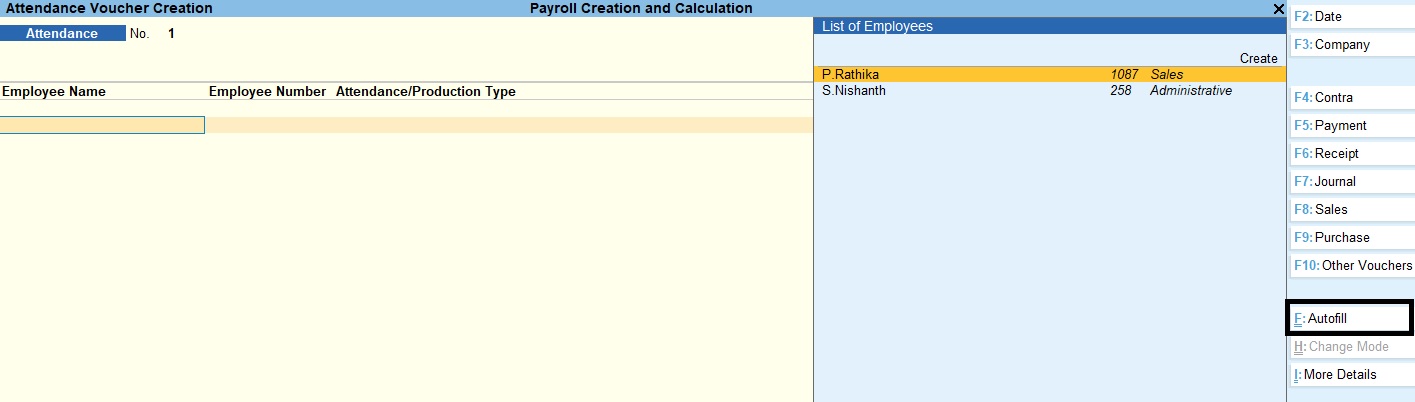

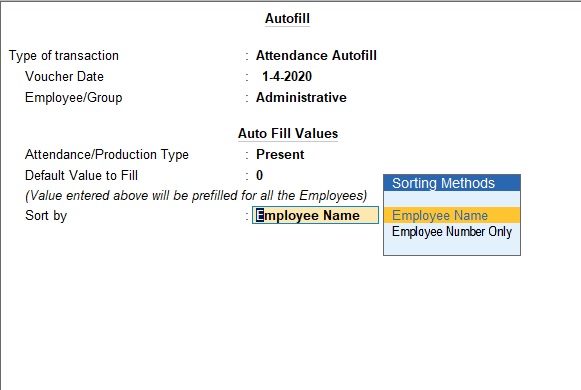

Go to Gateway of Tally -> Transaction -> Voucher -> Autofill Click

1. Click Payroll Auto Fill

2. Select the Salary in Process for field.

3. Enter the date.

4. Select the employee, from the List of Employees/Group

5. Select the attendance/production type

6. Select the sorting option in the Sort by field.

7. Select the appropriate Payroll Ledger from the List of Ledger Accounts.

Payroll

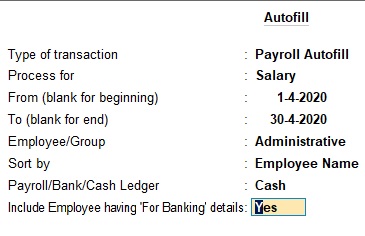

Go to Gateway of Tally -> Transaction -> Voucher -> Other Voucher -> Payroll

1. Select the Payroll AutoFill.

2. Select the process

3. Enter the From and To date.

4. Select the employee, from the List of Employees/Group

5. Select the sorting option in the Sort by field.

6. Select the Payroll/Bank/Cash Ledger from the field

7. Include employee have for banking details as click yes

8. Press Enter

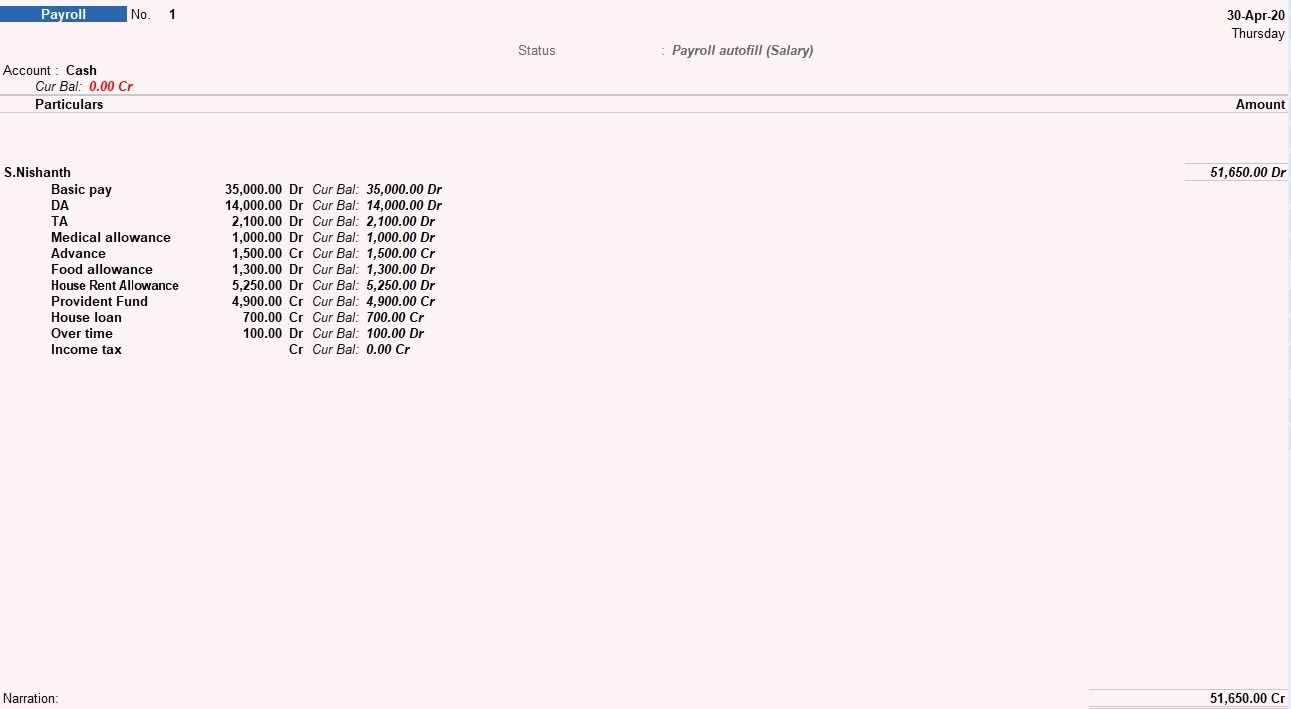

Payroll Creation and Calculation Sum

| Employee Details | |||

|---|---|---|---|

| Name | S.Nishanth | P.Rathika | |

| Department | Administrative | Sales | |

| Designation | Manager | Sales Manager | |

| Date of Join | 1.8.1995 | 1.6.2000 | |

| Employee ID | 258 | 1087 | |

| Bank name | HDFC Bank Ltd | HDFC Bank Ltd | |

| Account number | 1234567890 | 9876543210 | |

| Employee Salary Details | ||||

|---|---|---|---|---|

| S.Nishanth | P.Rathika | |||

| Basic pay | Rs.35000 | Basic pay | Rs.20000 | |

| DA | 40% for Basic pay | DA | 20% for Basic pay | |

| TA | 6% for Basic pay | TA | 5% for Basic pay | |

| Medical allowance | Rs.1000 per Month | Medical allowance | Rs.600 per Month | |

| Advance | Rs.1500 per Month | Public provident fund | 6.5% for Basic pay | |

| Food allowance | Rs.1300 per Month | Food allowance | Rs.500 per Month | |

| House Rent Allowance | 15% for Basic pay | House Rent Allowance | 8.5% for Basic pay | |

| Provident Fund | 10% for Basic pay + DA | Provident Fund | 7% for Basic pay + DA | |

| Income tax | 15% for DA | Income tax | 10% for DA | |

| House loan | Rs.700 per Month | City compensatory allowance | 15% for Basic pay | |

| Over time | 10hrs | Over time | 8hrs | |

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions