Example Bank Reconciliation Statement Tally Prime in Tamil

Bank Reconciliation Statement in TallyPrime

Bank reconciliation statement (BRS) involves the process of identifying the transactions individually and match it with the bank statement such that the closing balance of bank in books matches with the bank statement. The bank reconciliation statement helps to check the correctness of the entries recorded in the books of accounts and thereby, ensures the accuracy of bank balances.

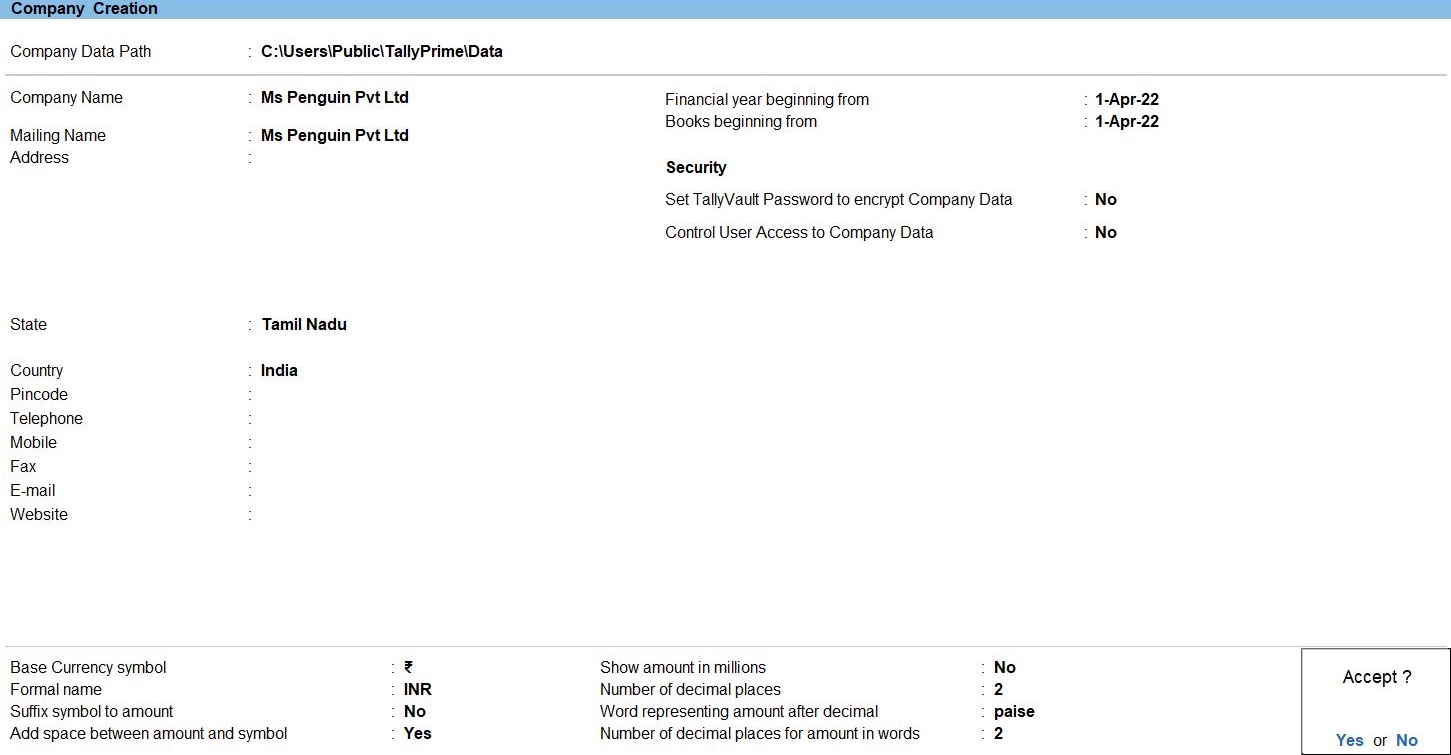

Create Company

To get started with Tally Prime, you need to first create your company to keep a record of all your day-to-day business transactions. To create the company, you need the company name and financial year information. You can enter all other details such as contact information, security, while creating the company or any time later.

How to create a company in Tally Prime

- In tally, after login double click on the create company option under company information.

- Go to Top Menu -> Company -> Create -> Enter

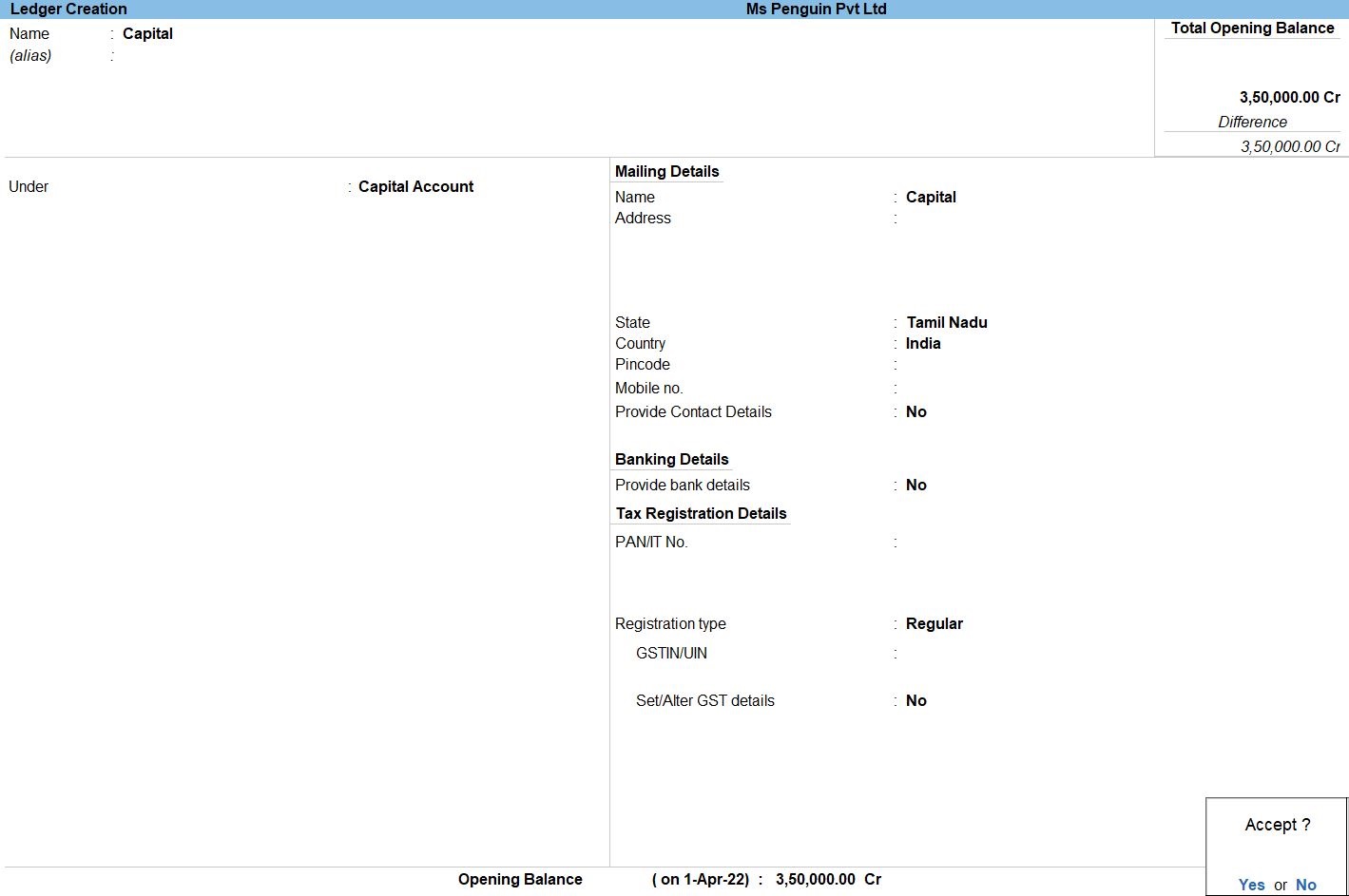

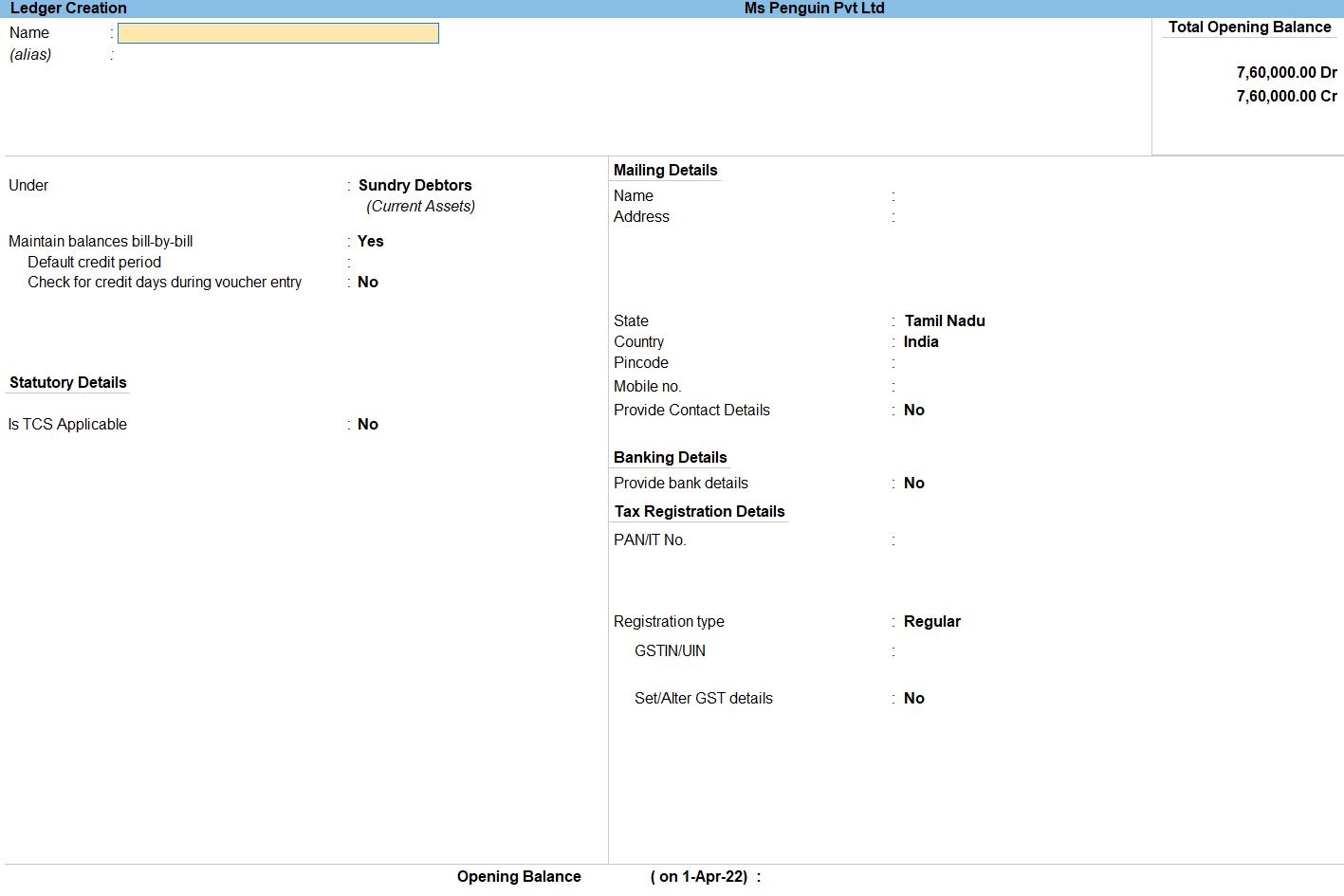

Ledger in Tally Prime

Ledgers in Tally Prime The ledgers in Tally Prime or in the Books of Accounts affect assets, liabilities, income or expenses. Tally Prime can generate a Profit & Loss A/c and Balance Sheet immediately after a transaction has been entered. It can also generate a range of comprehensive financial statements and reports.

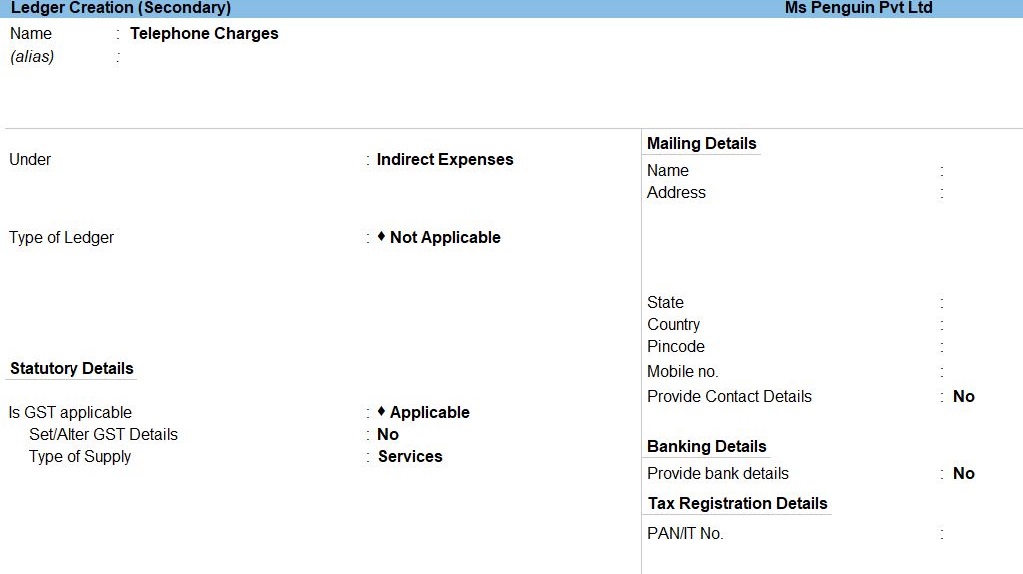

Create a single ledger

- Press Alt+G (Go To) -> Create Master -> type or select Ledger and press Enter.

Alternatively, Gateway of Tally -> Create -> type or select Ledger and press Enter.

- Enter the Name of the ledger account.

Duplicate names are not allowed.

- Enter the alias of the ledger account, if required.

You can access the ledgers using the original name or the alias name

- Select a group category from the List of Groups.

- Enter the Opening Balance.

The opening balance is applicable when the ledger is an asset or a liability, and also if it has a balance in the account as on the books beginning date.

- Press Ctrl + A to save, as always

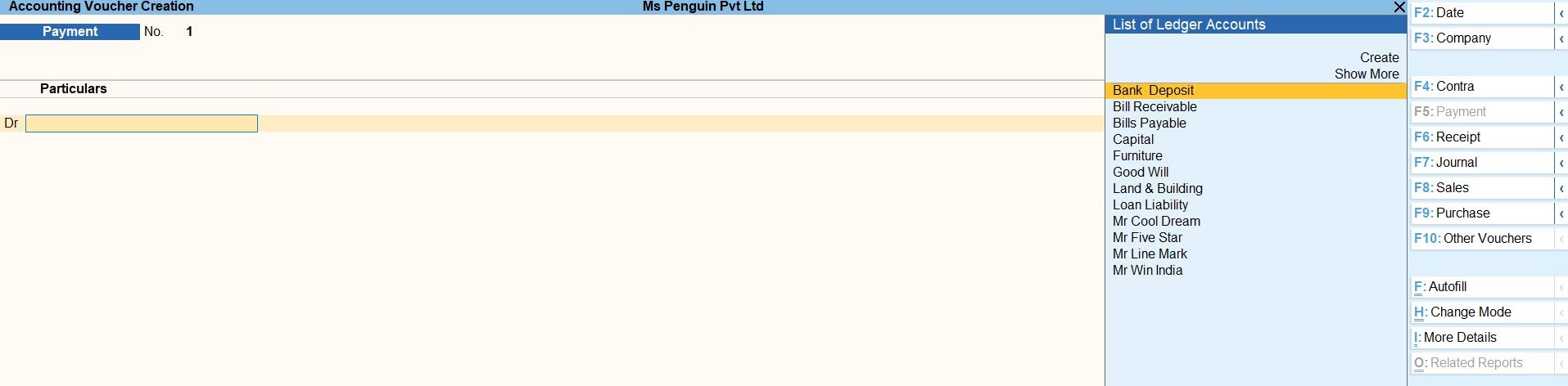

Voucher in Tally Prime

There are 24 pre-defined voucher types in Tally Prime for accounting, inventory, payroll and orders. You can create more voucher types under these pre-defined voucher types as per your business needs.

For example, for cash payments and bank payments, the predefined voucher type is Payment Voucher. You can also have two or more sales voucher types in Tally Prime for different kinds of sales transactions. For example, credit sales, cash sales, and so on.

Payment Voucher in Tally Prime

A payment voucher is a way to record payments made to suppliers and maintain a history of payments that your business has made. Companies use vouchers to gather and file supporting documents that are required to approve and track payments of liabilities.A payment voucher is a way to record payments made to suppliers and maintain a history of payments that your business has made. Companies use vouchers to gather and file supporting documents that are required to approve and track payments of liabilities.

Payment voucher- It is also called a debit voucher. A payment voucher is used to keep a record of payments made in cash or through the bank.

Some of the instances when a payment voucher is prepared are:

- Payment of expenses such as rent, security, operating expenses, printing and stationery, etc.

- Payment for purchase of raw material

- Payment of expenses such as rent, security, operating expenses, printing and stationery, etc.

- Payment for purchase of raw material

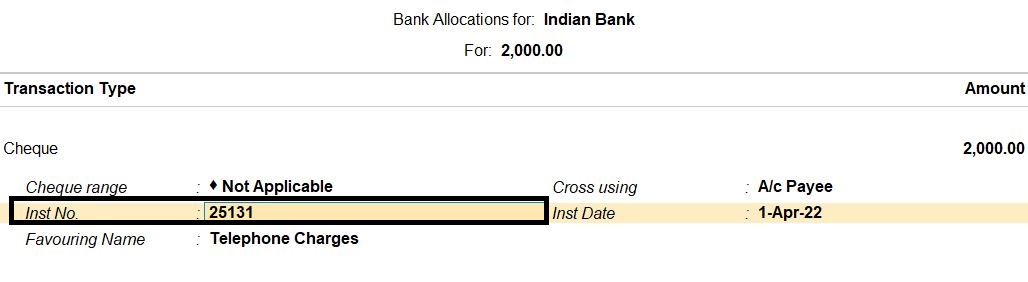

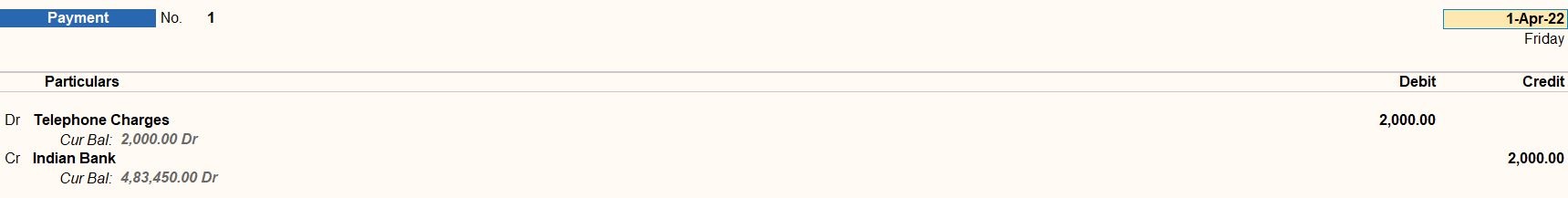

How to Use Payment Voucher in Tally Prime

- Gateway of Tally -> Voucher -> Payment Voucher(F5) or F10: Other Voucher -> Payment voucher

- Create ->Secondary ledger press Alt +C

- Select Dr Telephone Leder and Cr Indian bank ledger enter the Amount Enter Bank Allocation screen appears then Inst No Enter

- Accept the screen. As always, press Ctrl+A to Save.

follow the above steps for following transaction.

Apr 2 Amount Paid To Mr. Win India Was Rs.5000 Against Bill. No. AC075. Ch.No. 25132

Apr 4 Month Salary Rs.10000 By Cheque Paid Ch.No.25133

Apr 10 Paid Rent By ChequeRs.4500 .Ch.No.25134

Apr 11 Amount Paid To Mr. Cool Dream Rs.7000 By Cheque Discount Received Rs.700 Ch.No.25135

Apr 15 Electric Charge Paid Cheque .Rs.1500 Ch.No.25136

Apr 20 Paid Trade Expenses By Cheque Rs.2500 Ch.No.25137

Apr 25 Paid To General Expenses Rs.6000 Ch.No.25138

Receipt Voucher in Tally Prime

The receipt is the act of receiving, or the fact of having been received while voucher is a piece of paper that entitles the holder to a discount, or that can be exchanged for goods and services.

Receipt voucher- It is also called a credit voucher. A receipt voucher is used to keep a record of cash or bank receipt.

Some of the instances when a receipt voucher is prepared are:

- Cash sales, Customer advances received, Receipt of interest, rent, etc.Refund of tax

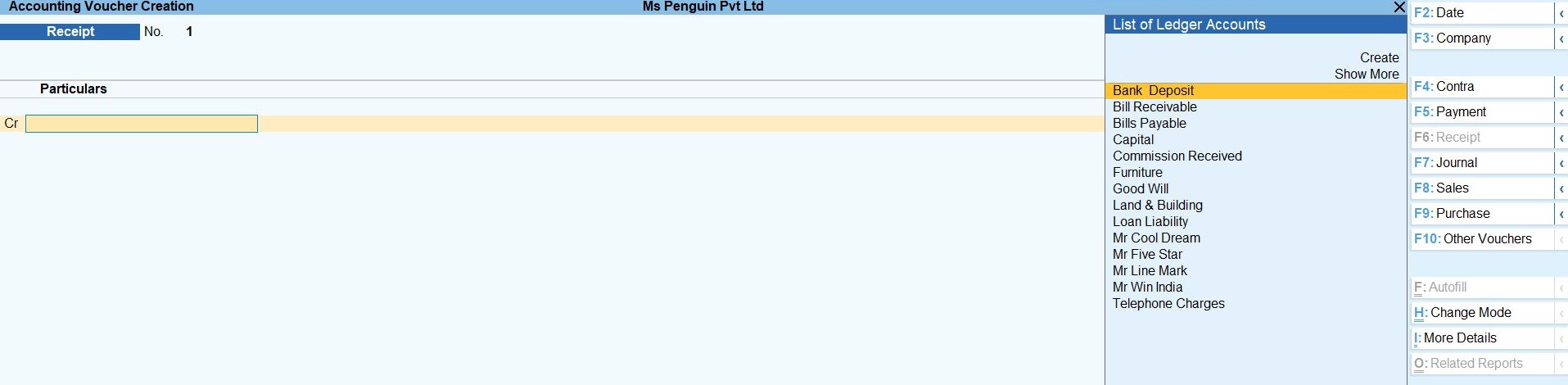

How to Use Receipt Voucher in Tally Prime

- Gateway of Tally -> Voucher -> Receipt Voucher(F6) or F10: Other Voucher -> Receipt Voucher

- Create ->Secondary ledger press Alt +C

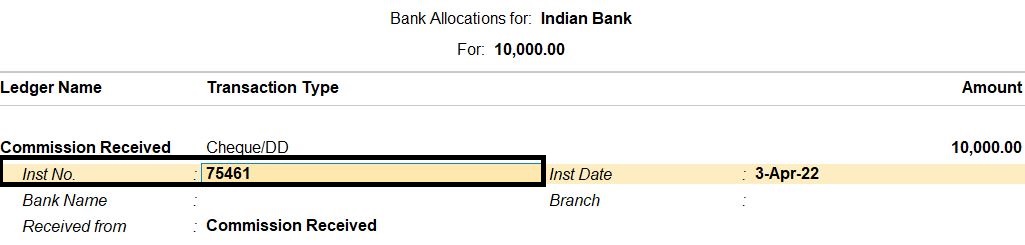

- Select cr Commission Received Leder and Dr Indian bank ledger enter the Amount Enter Bank Allocation screen appears then Inst No Enter

follow the above steps for following transaction.

Apr 5 Amount Received M/r.Five Star Rs.15000 By Cheque Discount allowed Rs.750.Ch.No.42678

Apr 6 Dividend Received Rs.29000 By Cheque .Ch.No.13555

Apr 16 Interest Received By Cheque Rs.2000 Ch.No.41596

Apr 17 Amount Received Mr. Lion Mark Was Rs.19000 Discount Allowed Rs.1000 By Cheque Ch.No.89576

Apr 19 Received Branch Income Rs. 25000 By Cheque .Ch.No. 89156

Apr 26 Received House Rent Rs.3000 Ch.No.695472

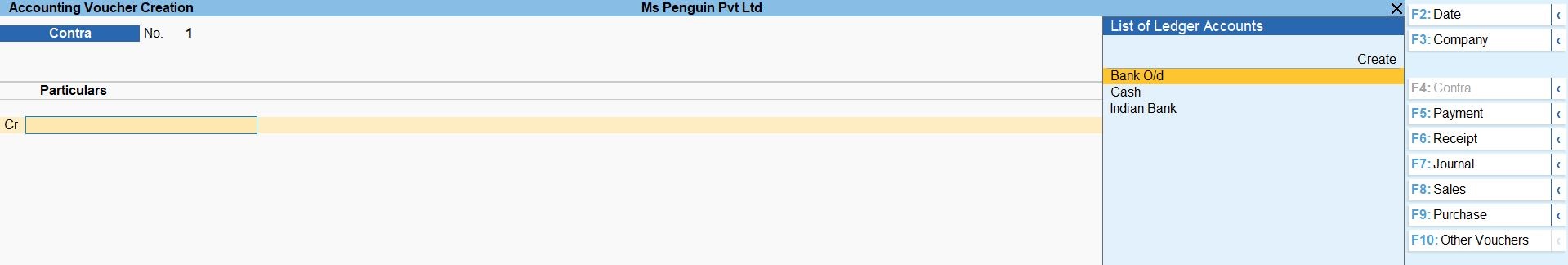

Contra Voucher in Tally Prime

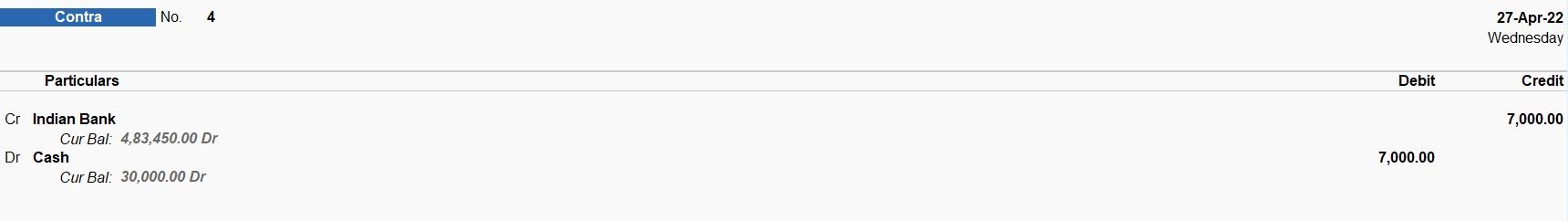

Contra entry in tally is done when the transactions involve cash and a bank account. In other words, any entry that includes both cash and bank accounts of an entity is called a contra entry.

How to Use Contra Voucher in Tally Prime

- Gateway of Tally -> Voucher -> Contra Voucher(F7) or F10: Other Voucher -> Contra Voucher

- Create ->Secondary ledger press Alt +C

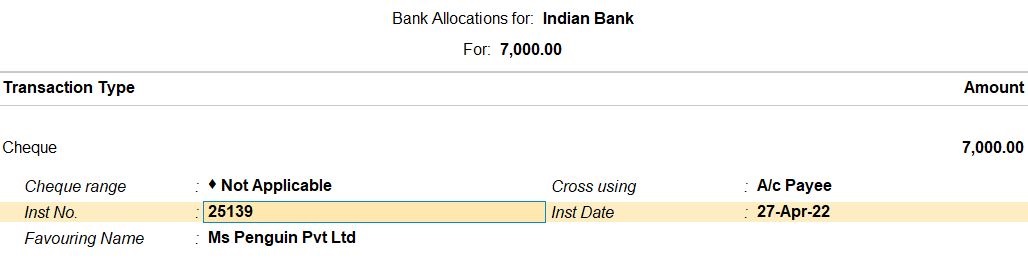

- Select cr Commission Received Leder and Dr Indian bank ledger enter the Amount Enter Bank Allocation screen appears then Inst No Enter

- Accept the screen. As always, press Ctrl+A to Save.

follow the above steps for following transaction.

Apr 30 Deposit To Bank Rs.9000

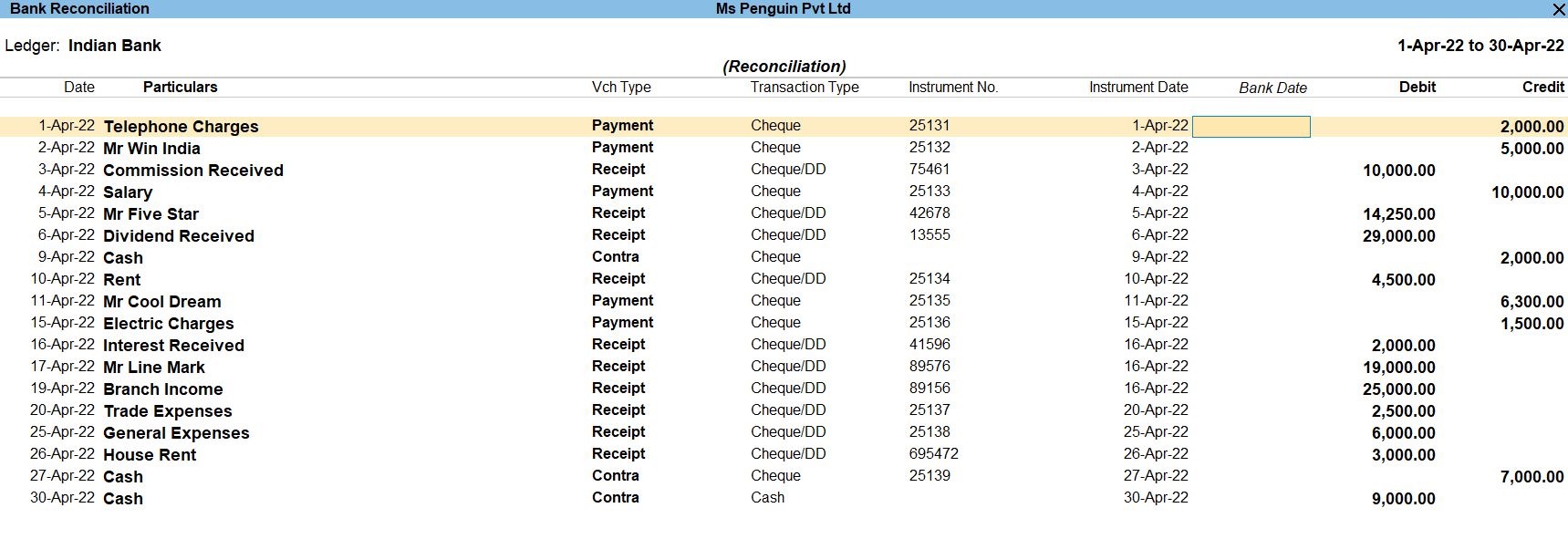

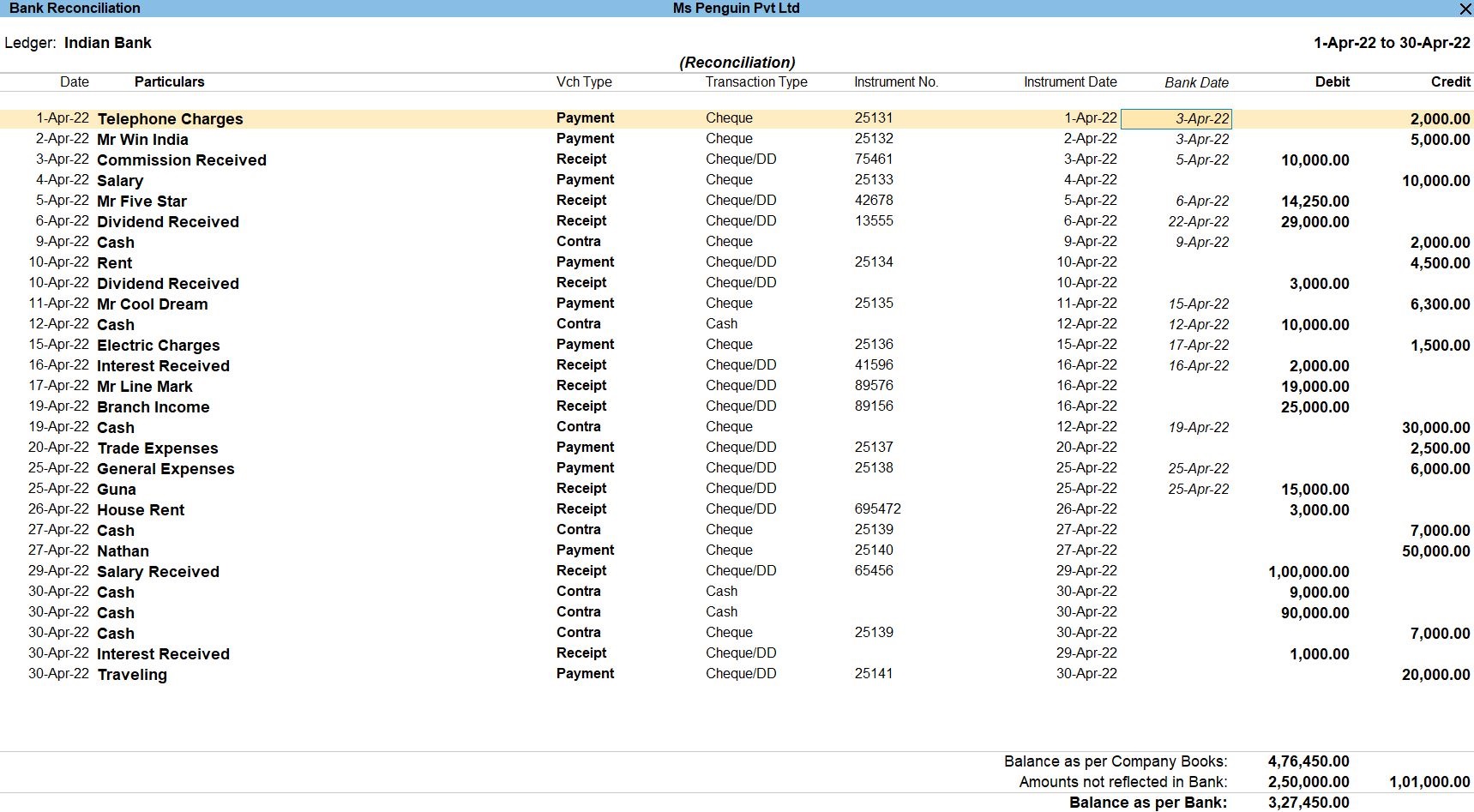

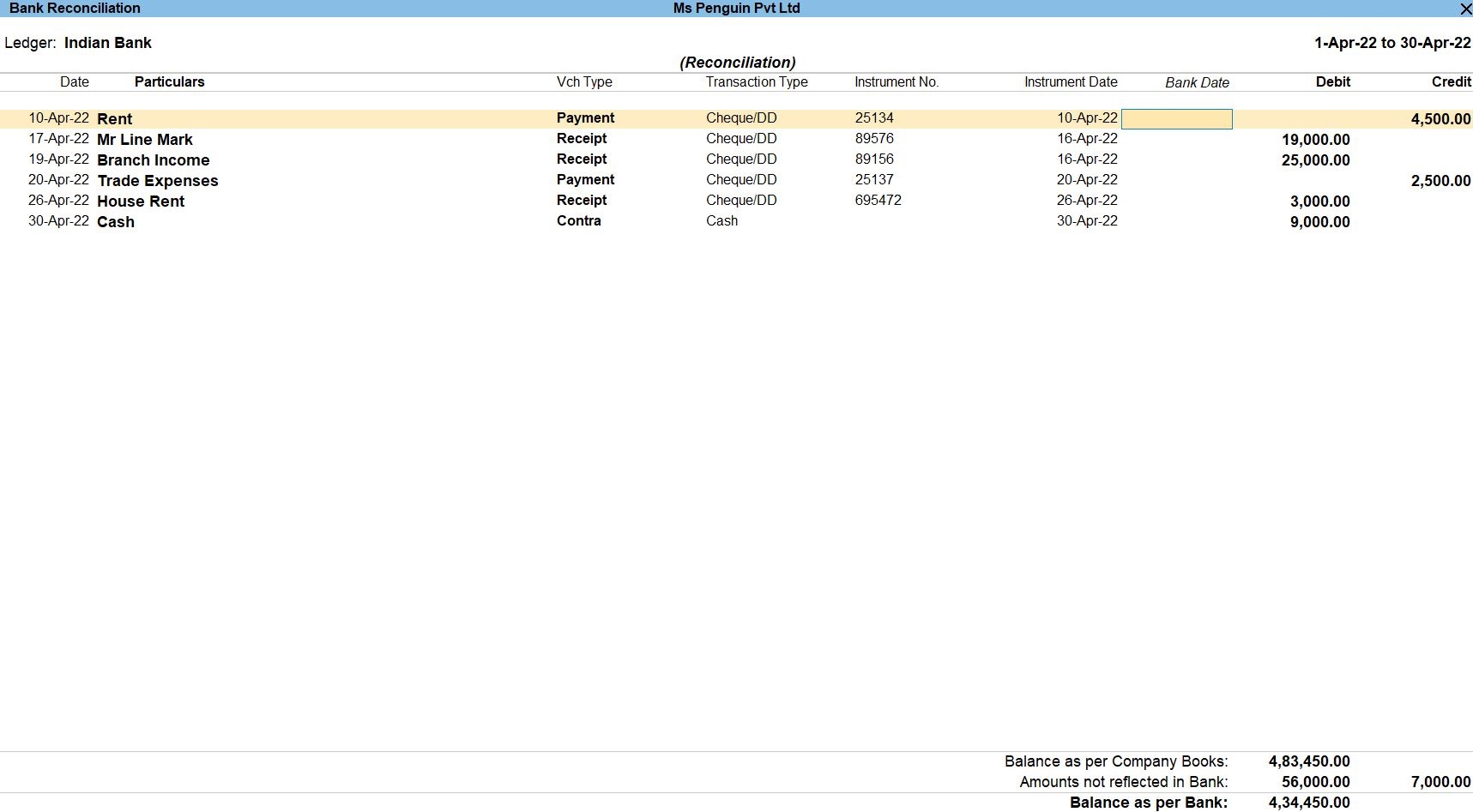

How to Use Bank Reconciliation in Tally Prime

- Gateway of Tally -> Banking -> Bank Reconciliation -> Indian Bank Enter

Alternatively,Go To -> Banking Utilities -> Bank Reconciliation -> Indian Bank Enter - Create ->Bank Date for Bank Reconciliation press Enter

- Accept the screen. As always, press Ctrl+A to Save.

| Company Transaction | |

| 1-4-2022 | Paid Telephone Charge Rs.2000 By Cheque [Vodafone] Ch.No.25131 |

| 2-4-2022 | Amount Paid To Mr. Win India Was Rs.5000 Against Bill. No. AC075. Ch.No. 25132 |

| 3-4-2022 | Commission Received By Cheque Rs.10000 Ch.No.75461 |

| 4-4-2022 | Month Salary Rs.10000 By Cheque Paid Ch.No.25133 |

| 5-4-2022 | Amount Received M/r.Five Star Rs.15000 By Cheque Discount allowed Rs.750.Ch.No.42678 |

| 6-4-2022 | Dividend Received Rs.29000 By Cheque .Ch.No.13555 |

| 10-4-2022 | Paid Rent By ChequeRs.4500 .Ch.No.25134 |

| 11-4-2022 | Amount Paid To Mr. Cool Dream Rs.7000 By Cheque Discount Received Rs.700 Ch.No.25135 |

| 15-4-2022 | Electric Charge Paid Cheque .Rs.1500 Ch.No.25136 |

| 16-4-2022 | Interest Received By Cheque Rs.2000 Ch.No.41596 |

| 17-4-2022 | Amount Received Mr. Lion Mark Was Rs.19000 Discount Allowed Rs.1000 By Cheque Ch.No.89576 |

| 19-4-2022 | Received Branch Income Rs. 25000 By Cheque .Ch.No. 89156 |

| 20-4-2022 | Paid Trade Expenses By Cheque Rs.2500 Ch.No.25137 |

| 25-4-2022 | Paid To General Expenses Rs.6000 Ch.No.25138 |

| 26-4-2022 | Received House Rent Rs.3000 Ch.No.695472 |

| 27-4-2022 | With Draw From Bank Rs.7000 Ch.No.25139 |

| 30-4-2022 | Deposit To Bank Rs.9000 |

| Bank Statement | |||||

| Date | Particular | Reference | Dr | Cr | Balance |

| 1-4-2022 | Balance B/d | 300000 | |||

| 3-4- 2022 | Win India | 25132 | 5000 | 295000 | |

| 3-4- 2022 | Vodafone | 25131 | 2000 | 293000 | |

| 5-4- 2022 | Commission | 75461 | 10000 | 303000 | |

| 6-4- 2022 | Five star | 42678 | 14250 | 317250 | |

| 7-4- 2022 | Salary | 25133 | 10000 | 307250 | |

| 9-4-2022 | ATM 15:15:49 | 2000 | 305250 | ||

| 10-4- 2022 | Dividend | 3000 | 308250 | ||

| 12-4- 2022 | Cash | 10000 | 318250 | ||

| 15-4- 2022 | Cool dream | 25135 | 6300 | 311950 | |

| 16-4- 2022 | Interest | 41596 | 2000 | 313950 | |

| 17-4- 2022 | EB charges | 25136 | 1500 | 312450 | |

| 19-4-2022 | ATM 15:45:06 | 30000 | 282450 | ||

| 22-4-2022 | Dividend | 13555 | 29000 | 311450 | |

| 25-4-2022 | General exp | 25138 | 6000 | 305450 | |

| 25-4-2022 | Guna | 35486 | 15000 | 320450 | |

| 27-4-2022 | Nathan | 25140 | 50000 | 270450 | |

| 29-4-2022 | Salary | 65456 | 100000 | 370450 | |

| 30-4-2022 | Cash | 90000 | 460450 | ||

| 30-4- 2022 | Cash | 25139 | 7000 | 453450 | |

| 30-4-2022 | Interest | 1000 | 454450 | ||

| 30-4-2022 | Travelling | 25141 | 20000 | 434450 | |

| Closing | 434450 | ||||

Missing Entry For Bank Statement

Follow the above steps for following transaction.

9-4-22 Cash withdraw from Bank Rs 2000

10-4-22 Dividend Received Rs 3000

12-4-22 Cash Deposit in Bank Rs 10000

12-4-22 Cash Deposit in Bank Rs 10000

19-4-22 Cash Withdraw from Bank Rs

25-4-22 Amount Received from Mr. Guna Rs. 15000

27-4-22 Amount Paid Nathan Rs 50000

29-4-22 Salary received from Rs 100000

30-4-22 Cash deposit in bank Rs 90000

30-4-22 Interest Received Rs 1000

30-4-22 Paid Travelling Expenses Rs 20000

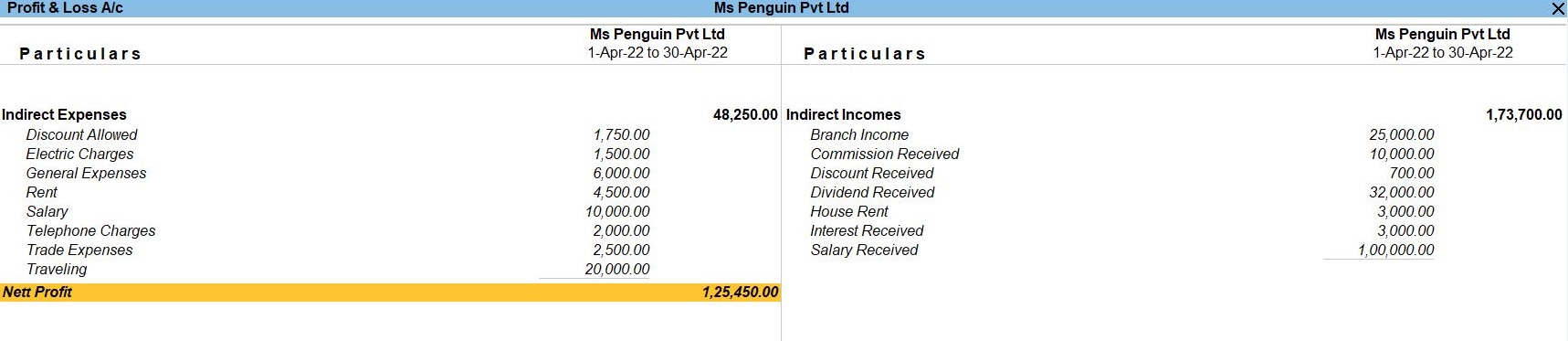

Profit and Loss In TallyPrime

Profit and Loss A/c is one of the primary financial statements that you can use to monitor the health of your business. It summarizes the revenues, costs, and expenses for a specific period, such as a quarter or a year. Thus, you can easily gather the net result of the business operations.

Using the Profit and Loss A/c in Tally Prime, you can measure the ability of your business to generate profit. Accordingly, you can take various measures to increase revenue, reduce costs, and so on. What’s more, you can view the Profit and Loss A/c in the browser.

How to Use Profit and Loss in Tally Prime

- Gateway of Tally -> Report -> Profit & Loss A/C (F1)

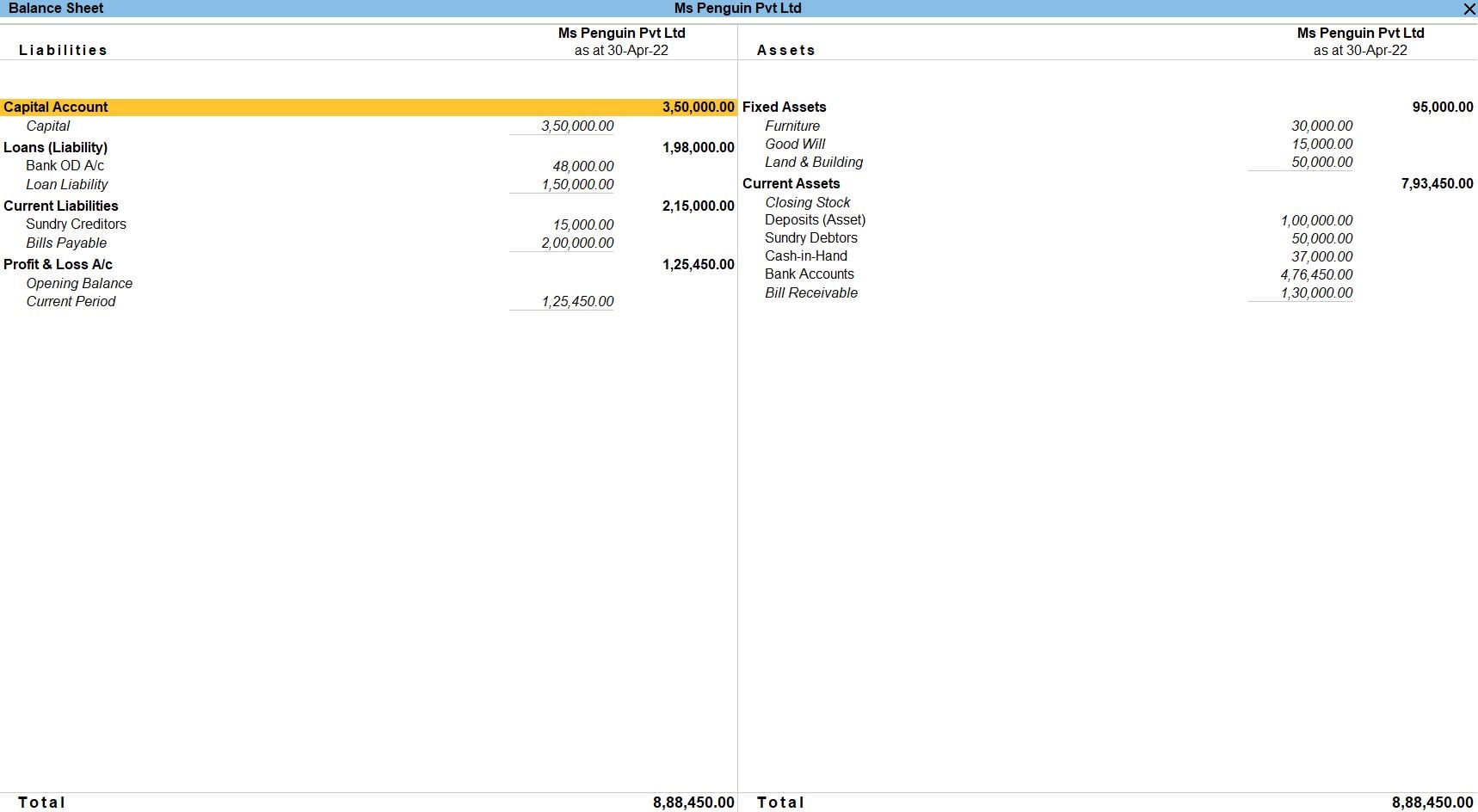

Balance Sheet In TallyPrime

Balance Sheet is one of topmost financial statement prepared by the businesses. The financial details of the balance sheet help you and the external stakeholders to evaluate the financial performance of the business on a given date. Before knowing the steps to prepare a balance sheet and reading the balance sheet, it is important to be familiar with the components and format of the balance sheet.

- Gateway of Tally -> Report -> Balance Sheet (F1)

Report Bank Reconciliation in Tally Prime

- Gateway of Tally -> Banking -> Bank Reconciliation -> Indian Bank Enter

Alternatively,Go To -> Banking Utilities -> Bank Reconciliation -> Indian Bank Enter - Accept the screen. As always, press Ctrl+A to Save.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions