Accounting Voucher Entry in Tally Prime

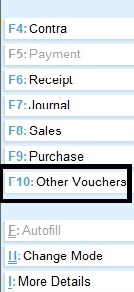

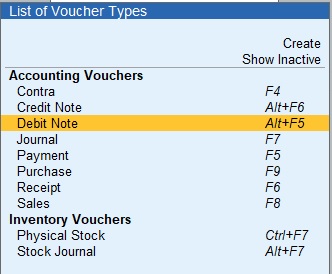

Shortcut Keys in Accounting Voucher Entry

- Payment Voucher-F5

- Receipt Voucher-F6

- Contra Voucher-F4

- Journal Voucher-F7

- Sales Voucher-F8

- Purchase Voucher-F9

- Credit Note Voucher-Alt+F6

- Debit Note Voucher-Alt+F5

- Stock journal–Alt+F7

- Physical stock–Alt+F10

Click Other Voucher->Credit Note Voucher (or) Debit Note Voucher (or) Stock journal (or) Physical stock

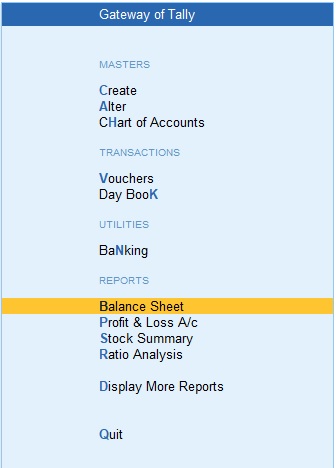

TO Check the Profit and Loss (or) Balance Sheet

Profit and Loss

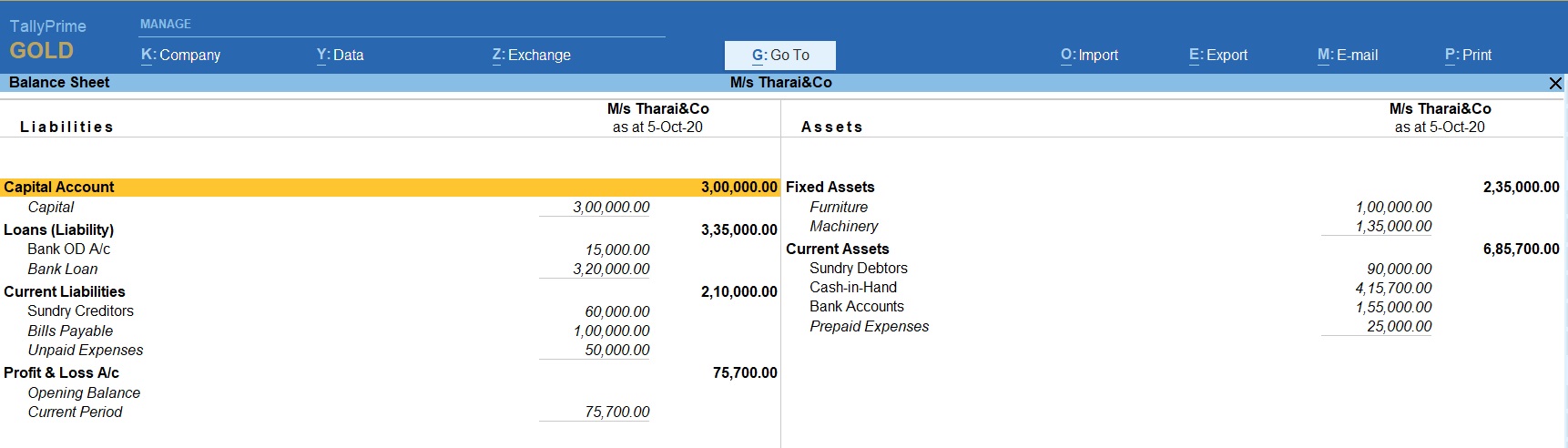

Balance Sheet

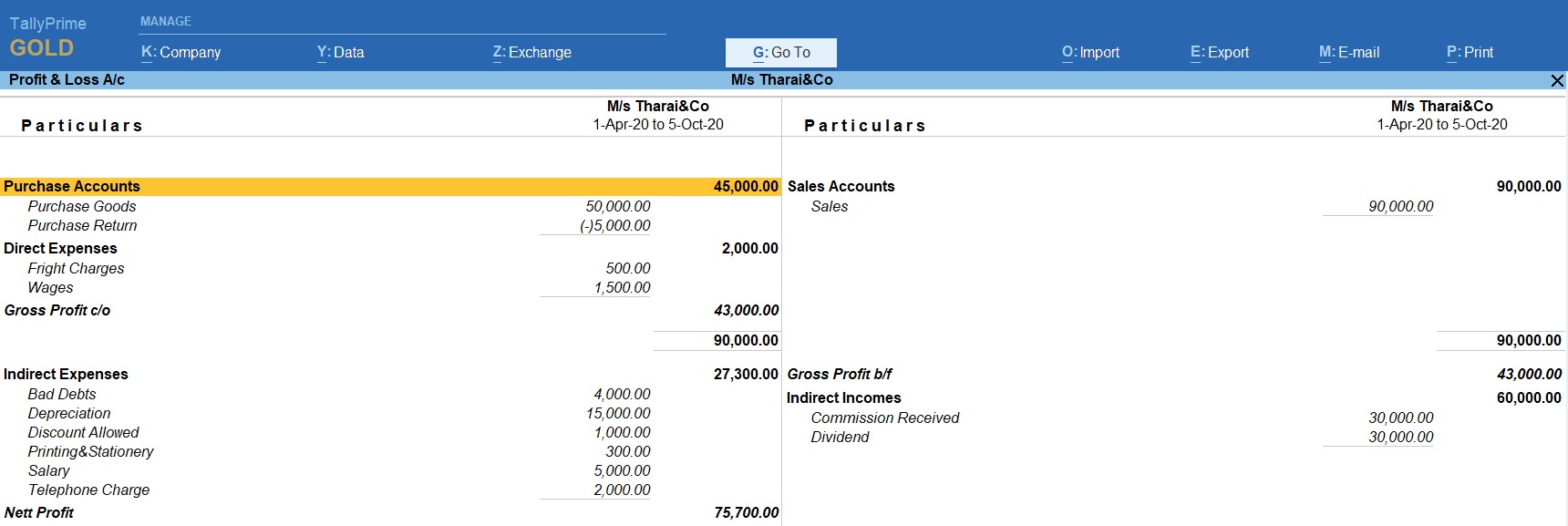

Sample Sum

| Capital | 300000 |

| Cash | 150000 |

| Furniture’s | 100000 |

| KVB Bank | 150000 |

| Bills payable | 100000 |

| Prepaid expenses | 25000 |

| Unpaid expenses | 50000 |

| Machinery | 150000 |

| Bank loan | 120000 |

| Sundry Creditors M/s. ANU ENTERPRISES was Rs.30000 Date: 28.03.2011 bill no: 21 (40days) |

Sundry Debtors M/s.RIYAS & CO was Rs. 25000 Date: 18.03.2011 bill no: 010 (35days) |

Transaction During The Period

Apr 05 Paid Telephone Charges Rs.2000

Apr 10 Received Commission Rs.30000

Apr 23 An account paid to M/s.ANU ENTERPRISES was Rs.15000 part settlement against bill no:21

May 01 Purchase goods from M/s.A.P COMPUTERS was Rs.50000 bill no:30 25days

May 13 Depreciation of Machinery @ 10%

May 19 Cash withdraw from bank Rs.10000

May 27 Bank O/D Received Rs.200000

June 08 Bank Loan Received Rs.200000

June 29 Paid Wages Rs.1500

July 06 Good sold on credit to M/s.SARASWATHI PRINTERS was Rs.90000 bill no:01

July 25 Paid Fright Charges Rs.500

Aug 01 We return to M/s.A.P COMPUTERS was Rs.5000 against bill no:30

Aug 24 Dividend received Rs.30000

Sep 08 Paid salary Rs.5000

Sep 12 Paid Printing & Stationery Rs.300

Oct 05 Amount received from M/s.RIYAS & CO was Rs.20000 against bill:010 and discount allowed to Rs.1000 balance amount Bad debit written off

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions