Service Example Sum - 3 in Tally Prime Tamil

Service tax is a tax levied by the government on service providers on certain service transactions, but is actually borne by the customers. It is categorized under Indirect Tax and came into existence under the Finance Act, 1994. ... This tax is not applicable in the state of Jammu & Kashmir.

- GSTR 1 is a monthly return of outward supplies. Essentially, it is a return showing all the sales transactions of a business.

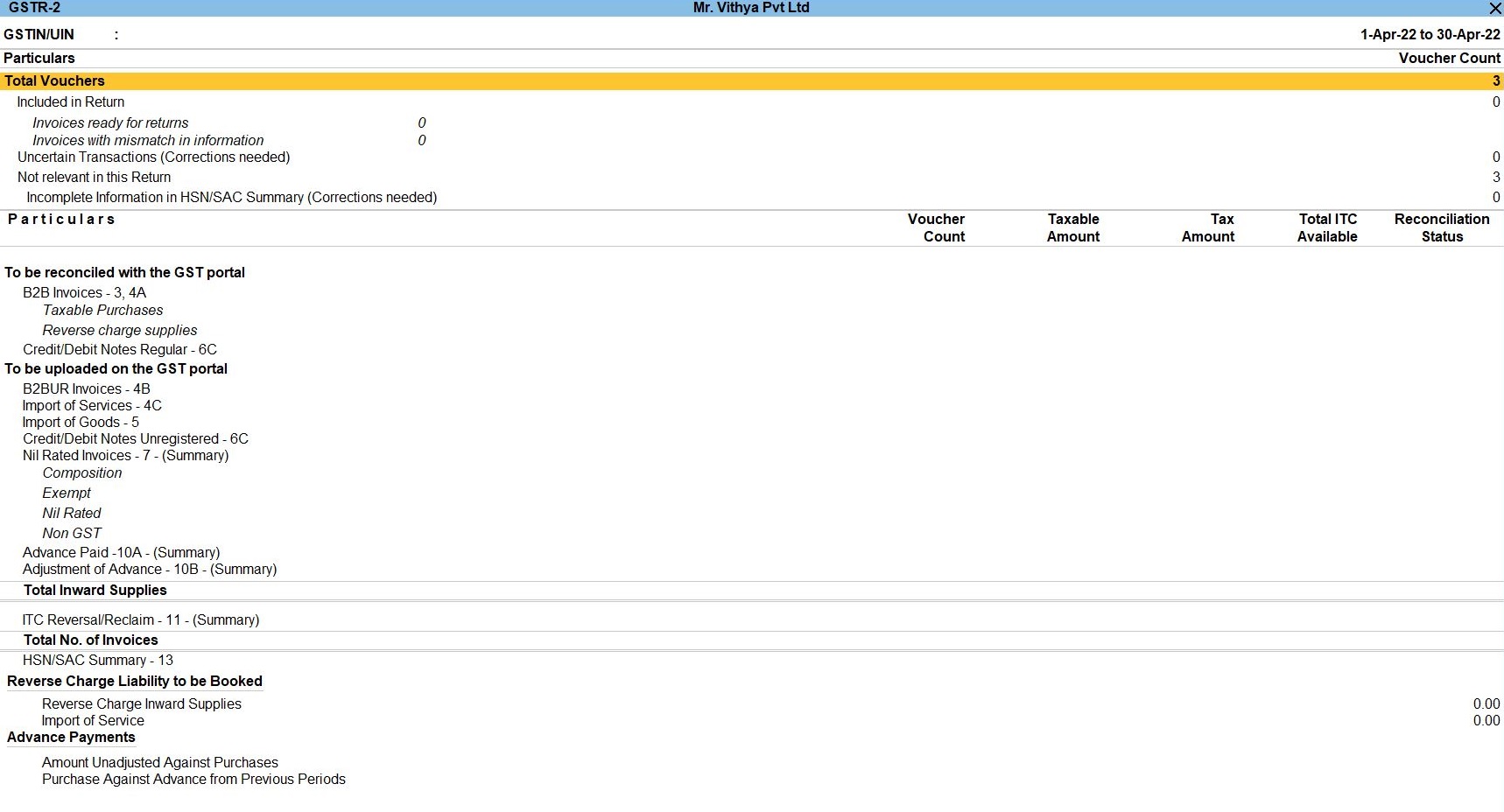

- GGSTR-2 contains details of all the purchases transactions of a registered dealer for a month. It will also include purchases on which reverse charge applies.

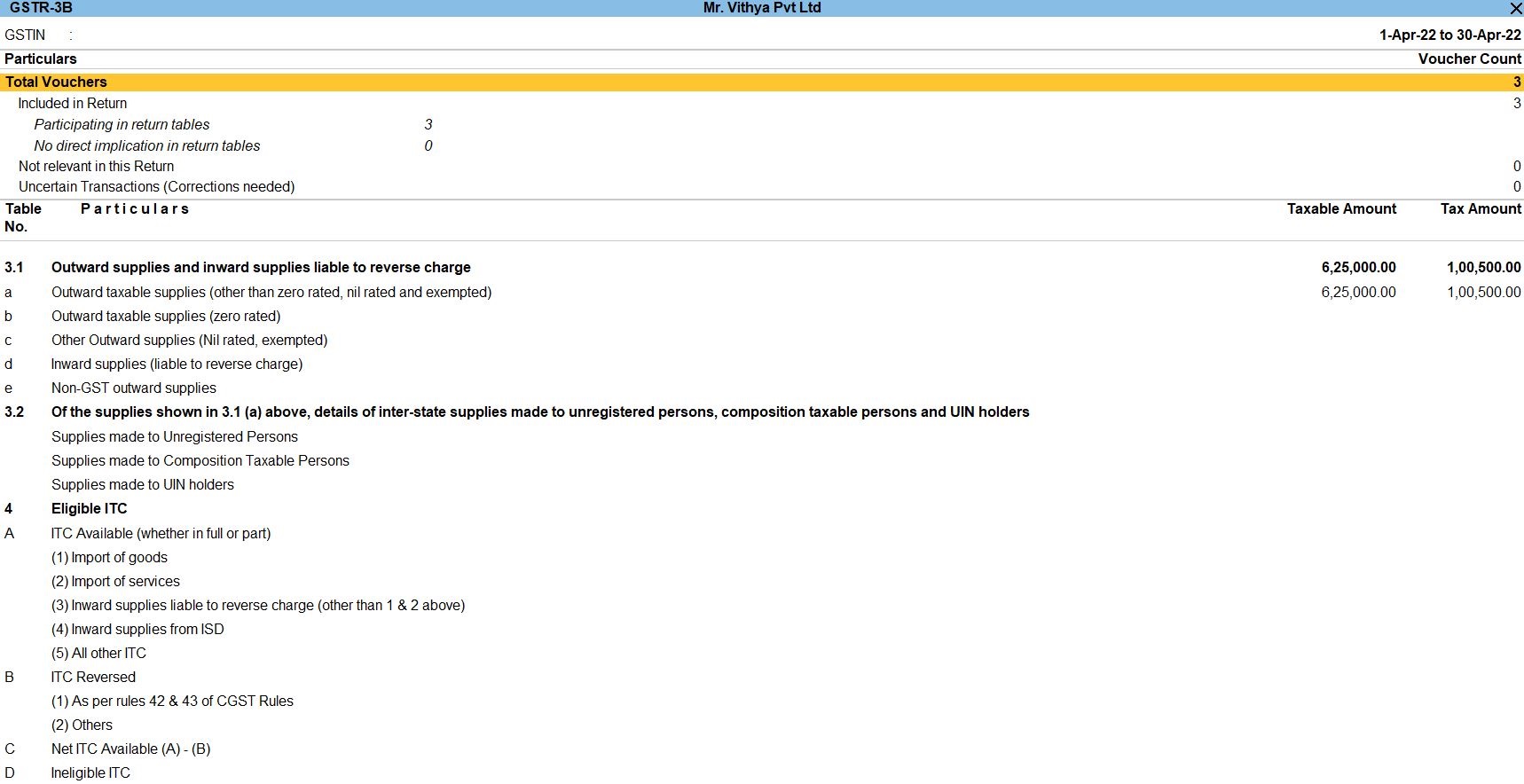

- GST-3b is a monthly self-declaration to be filed by a registered GST dealer along with GSTR1 and GSTR2 return. it is a simplified return to declare summary liabilities for a tax period.

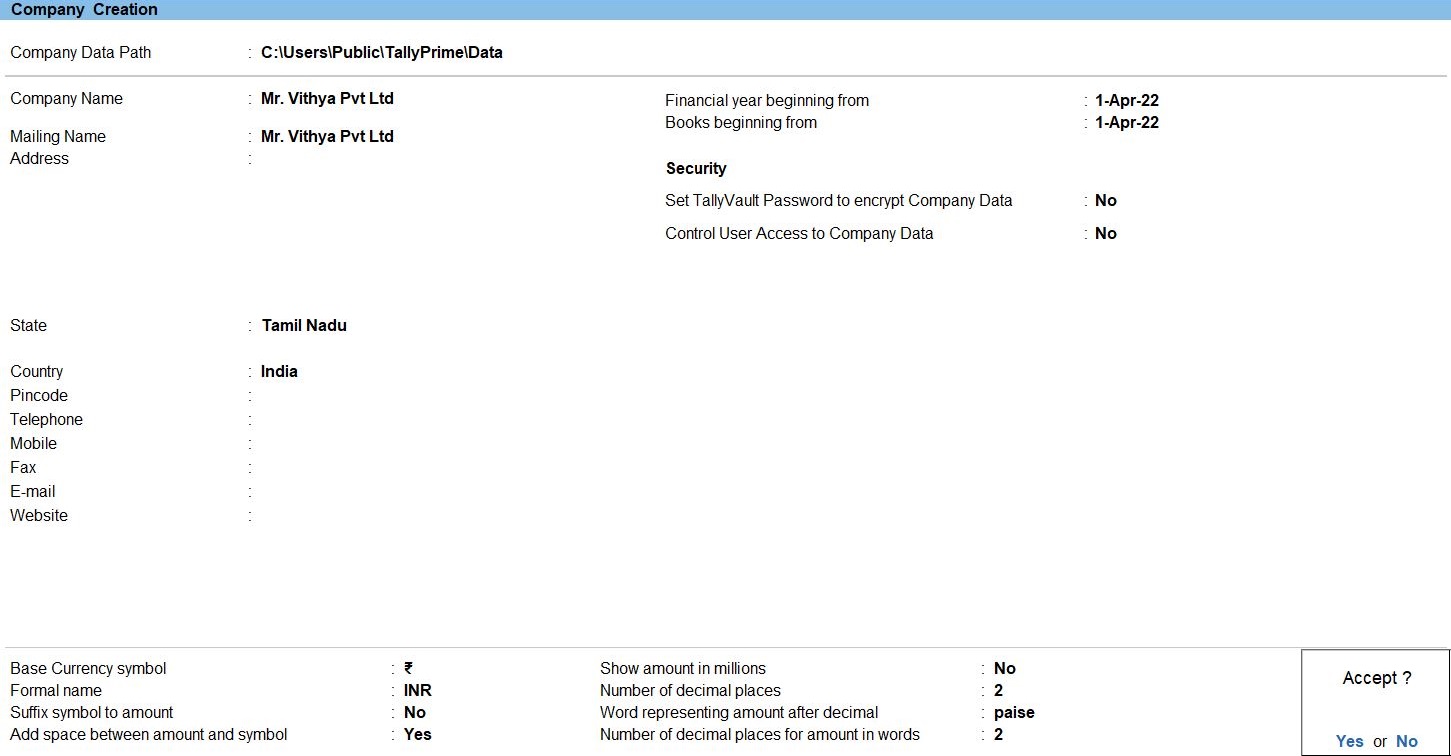

Create Company

To get started with Tally Prime, you need to first create your company to keep a record of all your day-to-day business transactions. To create the company, you need the company name and financial year information. You can enter all other details such as contact information, security, while creating the company or any time later.

How to create a company in Tally Prime

- In tally, after login double click on the create company option under company information.

- Go to Top Menu -> Company -> Create -> Enter

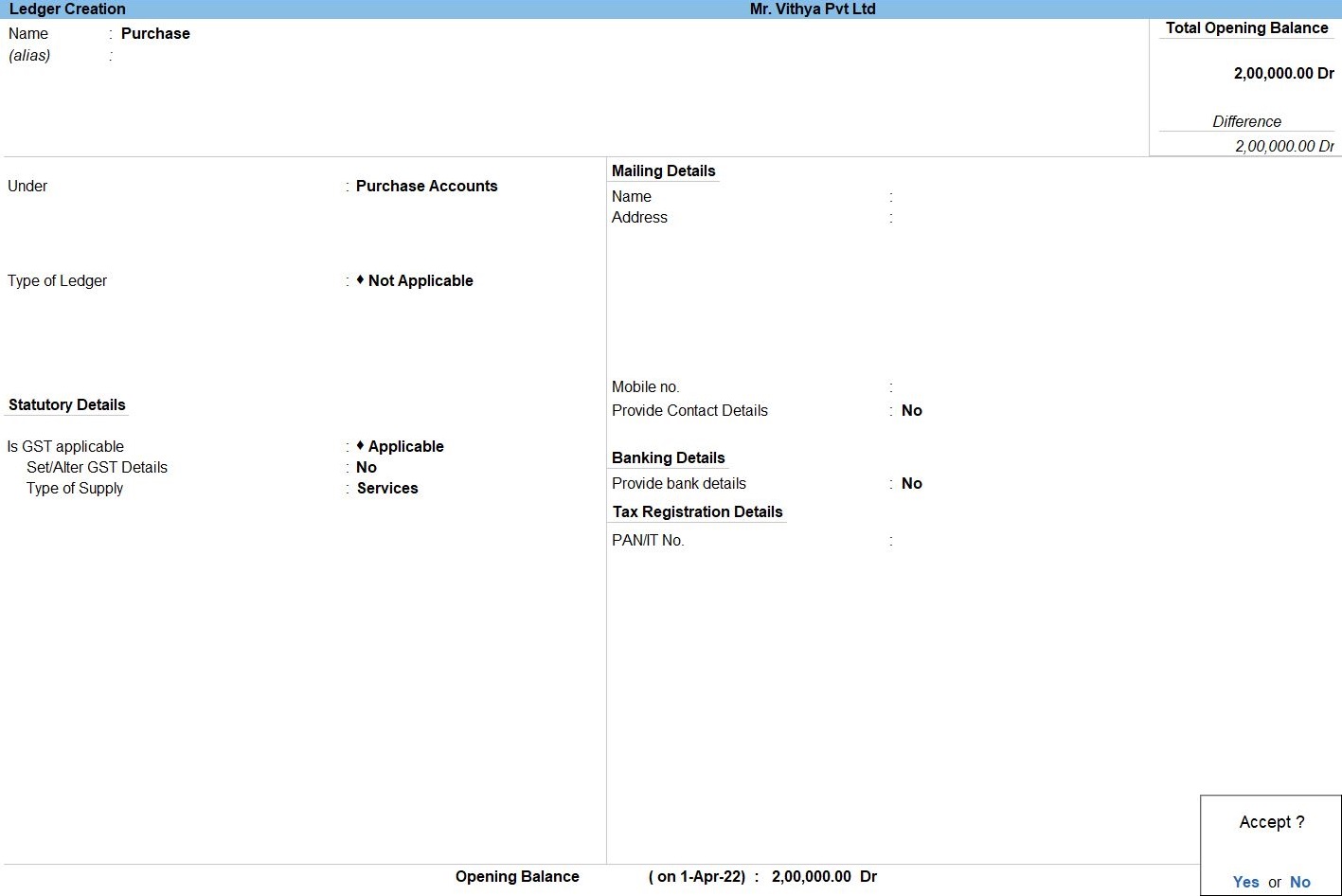

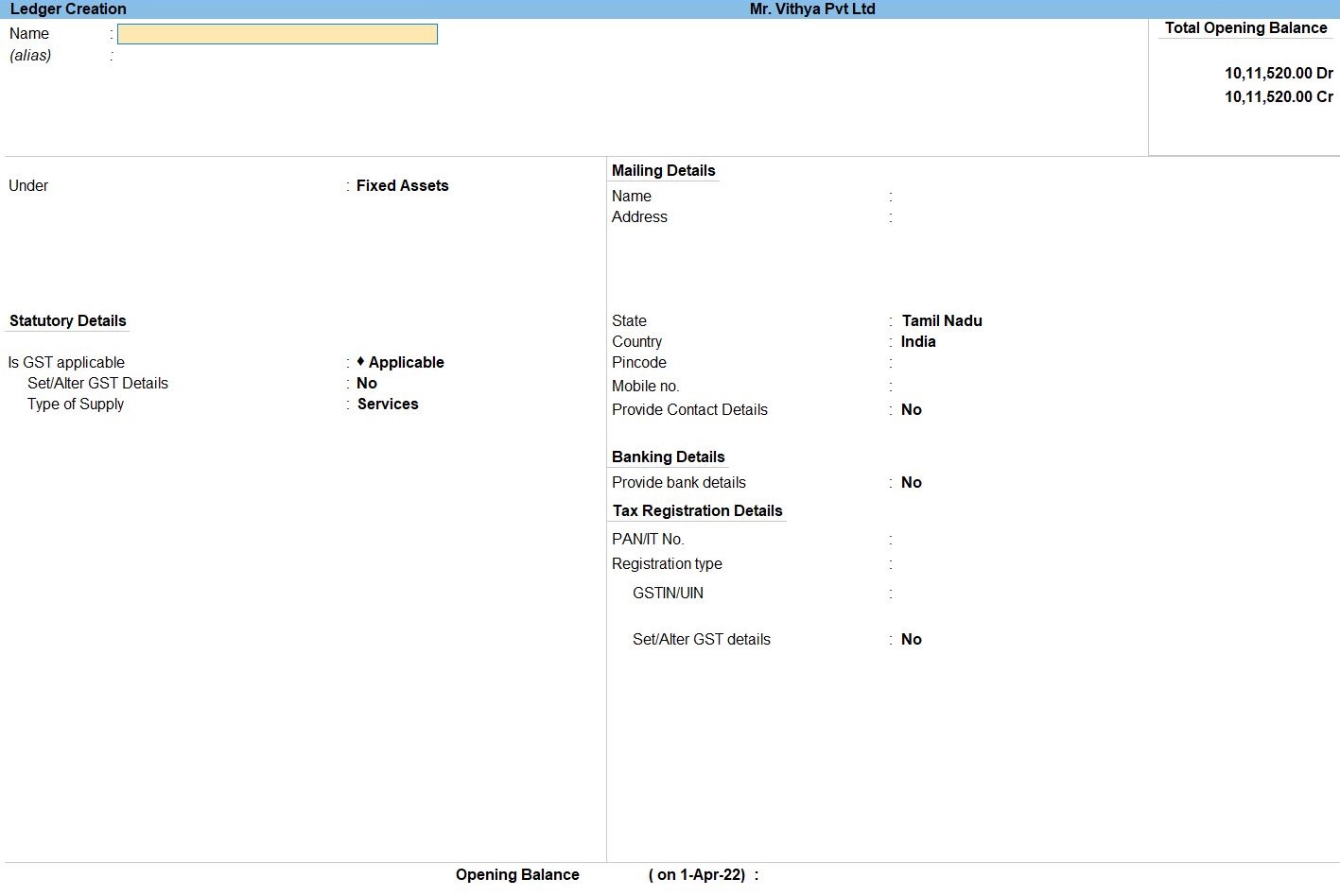

Ledger in Tally Prime

Ledgers in Tally Prime The ledgers in Tally Prime or in the Books of Accounts affect assets, liabilities, income or expenses. Tally Prime can generate a Profit & Loss A/c and Balance Sheet immediately after a transaction has been entered. It can also generate a range of comprehensive financial statements and reports.

Create a single ledger

- Press Alt+G (Go To) -> Create Master -> type or select Ledger and press Enter.

Alternatively, Gateway of Tally -> Create -> type or select Ledger and press Enter.

- Enter the Name of the ledger account.

Duplicate names are not allowed.

- Enter the alias of the ledger account, if required.

You can access the ledgers using the original name or the alias name

- Select a group category from the List of Groups.

- Enter the Opening Balance.

The opening balance is applicable when the ledger is an asset or a liability, and also if it has a balance in the account as on the books beginning date.

- Press Ctrl + A to save, as always

Voucher in Tally Prime

There are 24 pre-defined voucher types in Tally Prime for accounting, inventory, payroll and orders. You can create more voucher types under these pre-defined voucher types as per your business needs.

For example, for cash payments and bank payments, the predefined voucher type is Payment Voucher. You can also have two or more sales voucher types in Tally Prime for different kinds of sales transactions. For example, credit sales, cash sales, and so on.

INTRA STATE (Within The State)

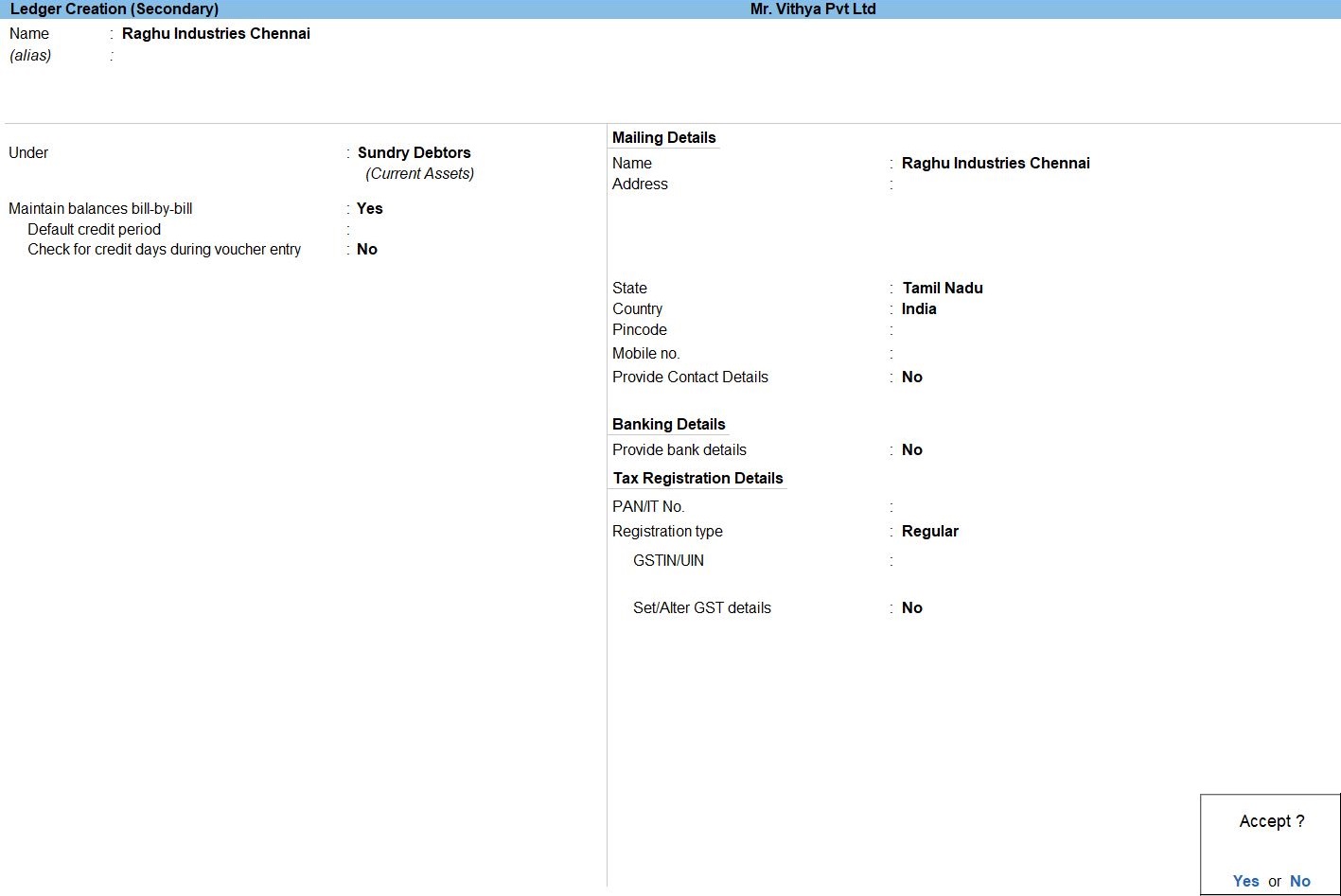

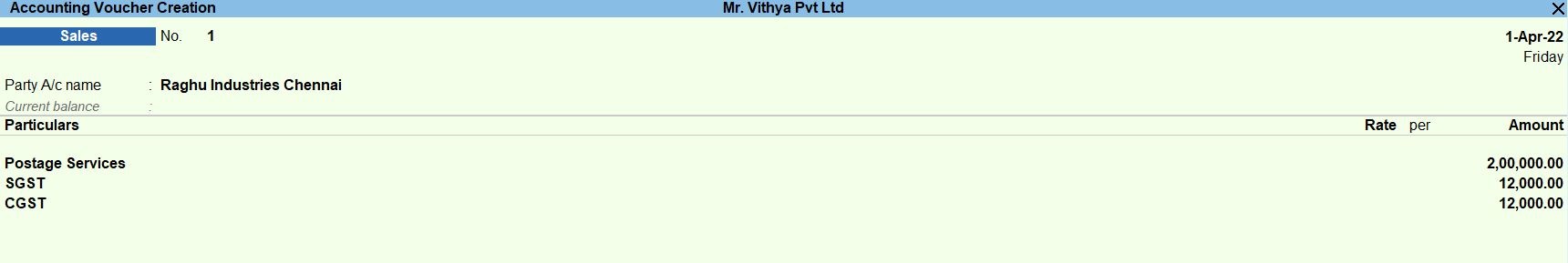

Apr 01 Providing Postage Services to Raghu Industries Chennai, Tamil Nadu worth Rs.200000. Additionally GST 12% is charged on the invoice with reference number GS 005.

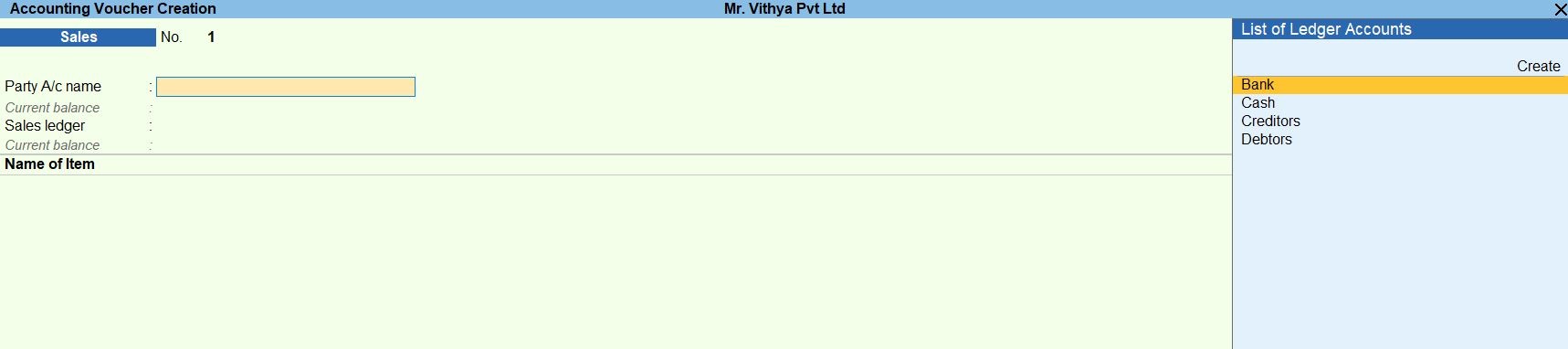

Sales Voucher in Tally Prime

Whenever you sell a product or service, you record sales entries. In tally, the sales are recorded through the sales voucher. It is one of the most widely used accounting vouchers in tally. There are two modes for accounting in sales vouchers- Invoice mode and Voucher mode.

How to Use Sales Voucher in Tally Prime

- Gateway of Tally -> Voucher -> Sales Voucher(F8) or F10: Other Voucher ->Sales Voucher

- Enter the Customer Invoice No. and Date.

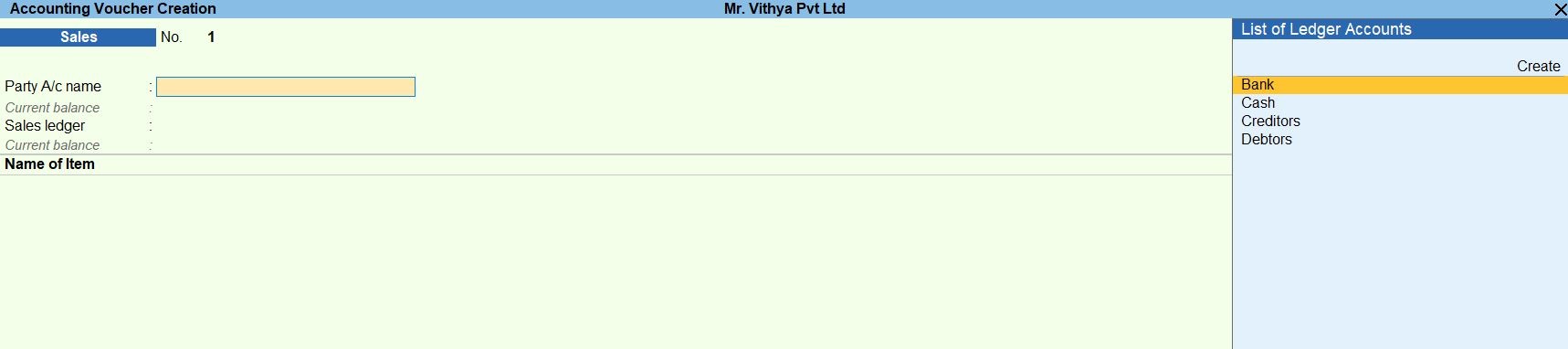

- Create ->Secondary ledger press Alt +C

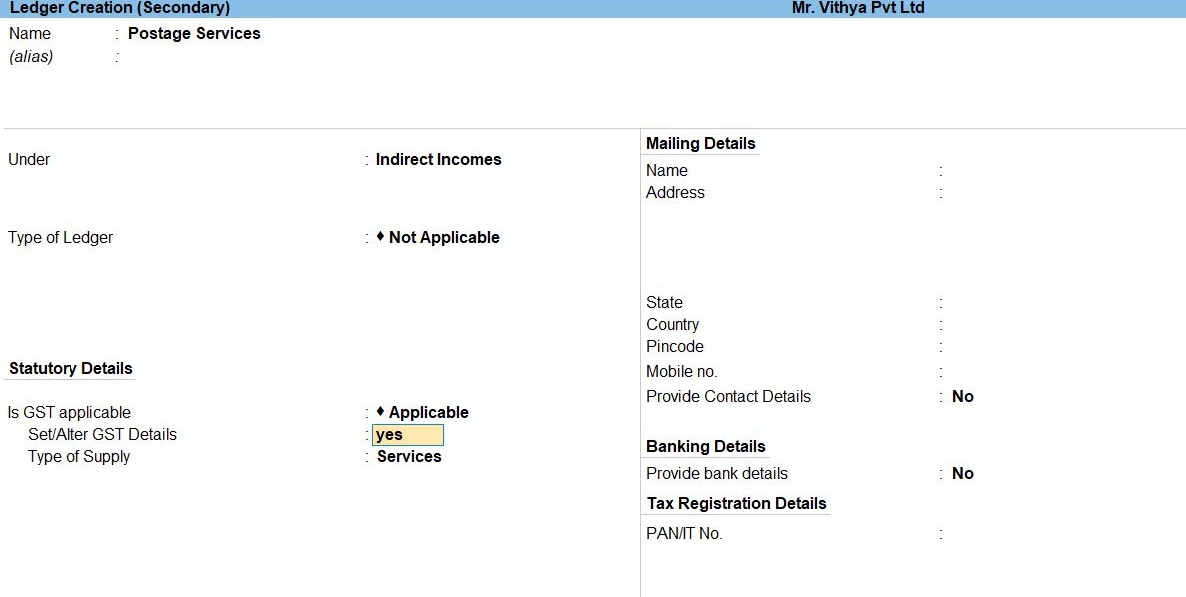

- Create ->Secondary ledger service press Alt +C

- Enter ->Ledger create Name

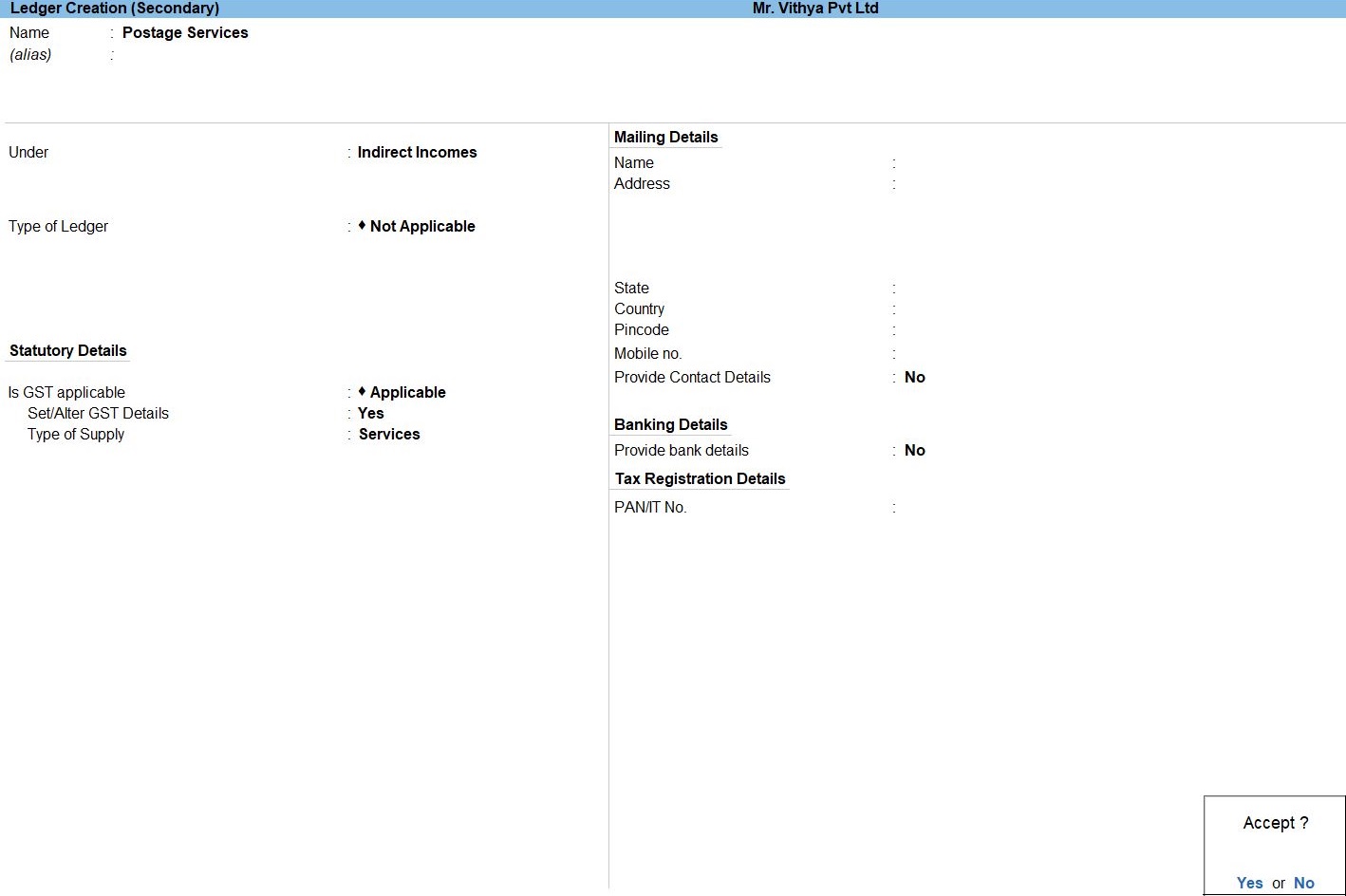

- Enter -> create Under Indirect Income

- GST Applicable: Applicable

- Set Alter GST DetailsYes

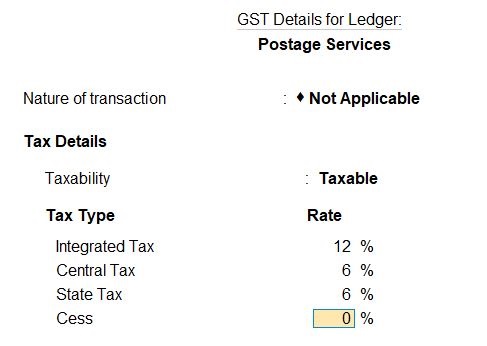

- The GST Details for Service window opens.

- This Under Taxability, select Taxable.

- This Under Integrated Tax, enter the GST Rate of the Stock Items.

- Enter Cess, if applicable.

After providing all the details, The GST Details of Stock Item screen appears as shown below. - As always, press Ctrl+A to save.

- Type of Supply:Service.

- Accept the screen. As always, press Ctrl+A to Save.

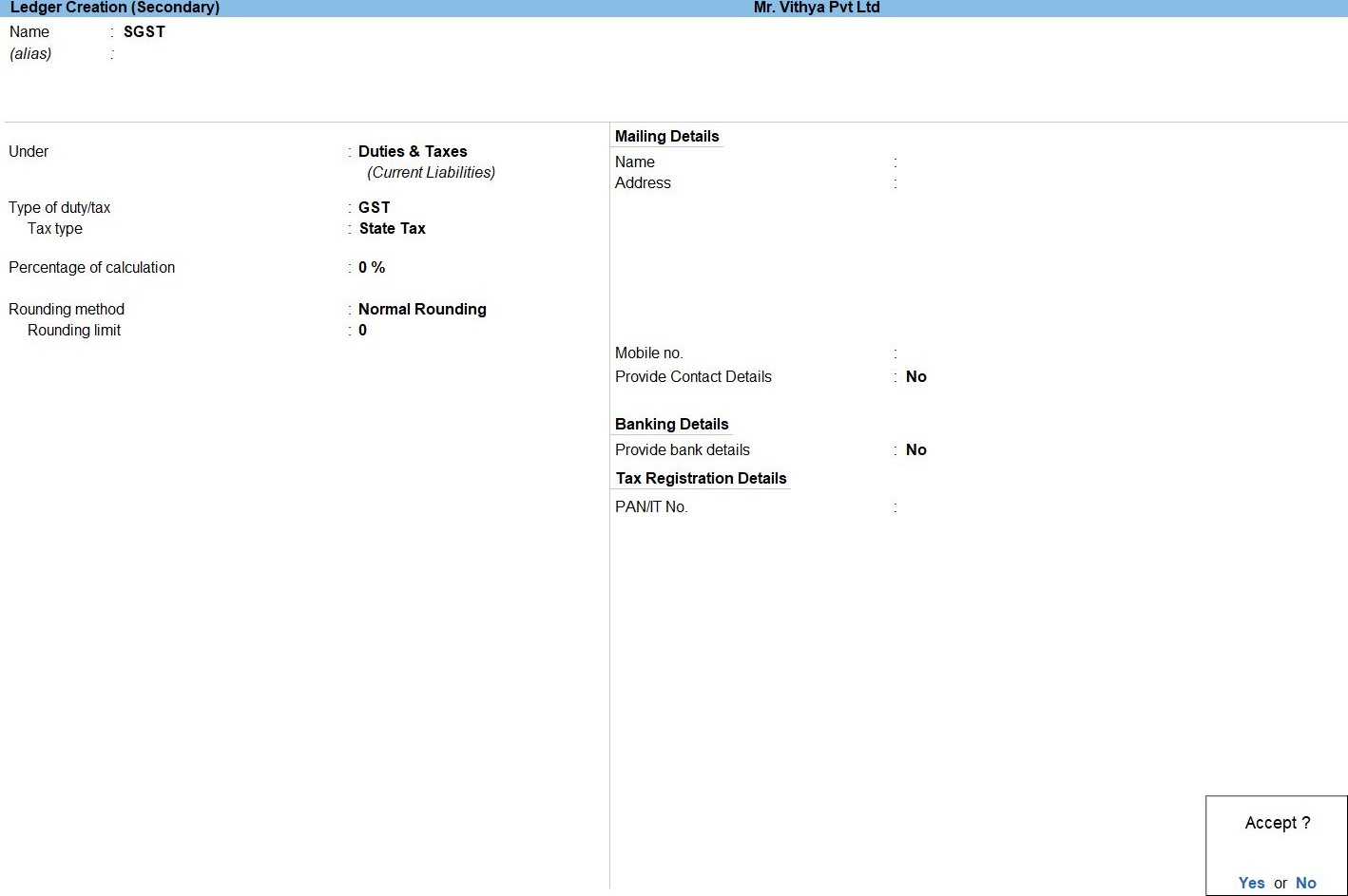

State Tax

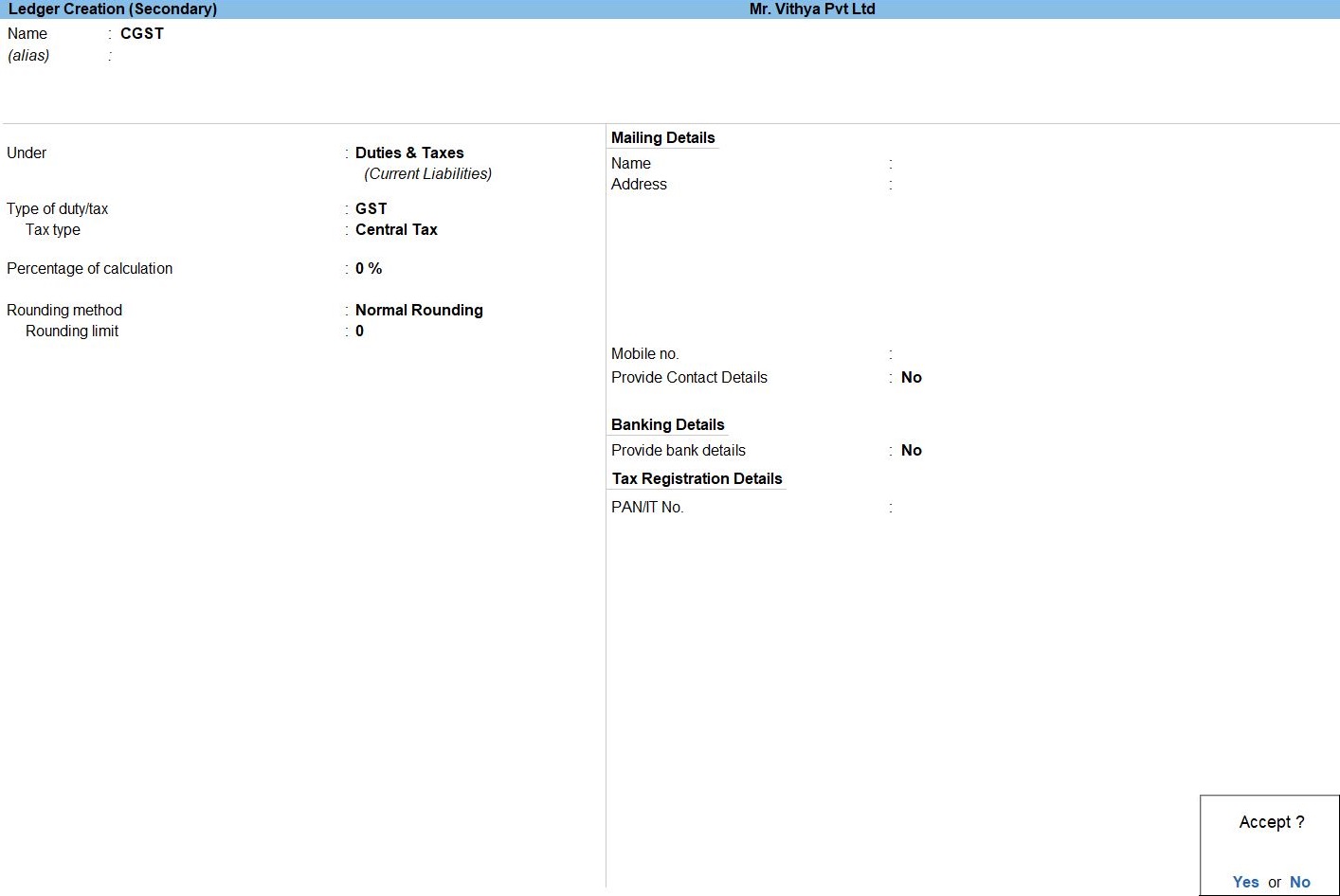

Central Tax

INTER STATE (Outside The State)

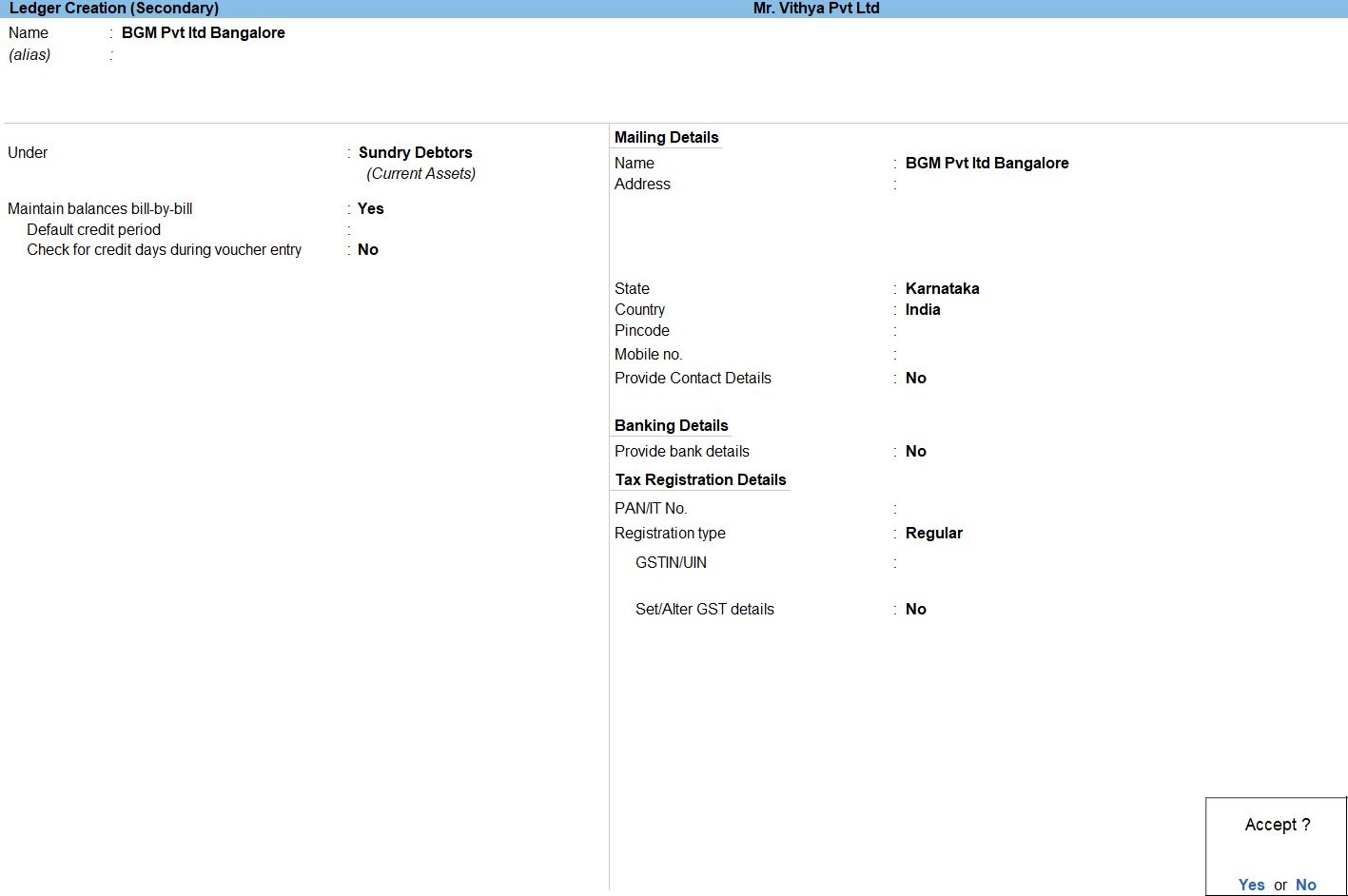

Apr 10 Providing Electricity Service to BGM Pvt ltd Bangalore, Karnataka worth Rs.250000. Additionally GST 18% is Charged on the Invoice with reference number BH836.

Apr 29 Providing Consultancy Services to RBS Pvt Ltd Cochin, Kerala worth Rs.175000. Additionally GST 18% charged on the invoice with reference number AS987.

How to Use Sales Voucher in Tally Prime

- Gateway of Tally -> Voucher -> Sales Voucher(F8) or F10: Other Voucher ->Sales Voucher

- Enter the Customer Invoice No. and Date.

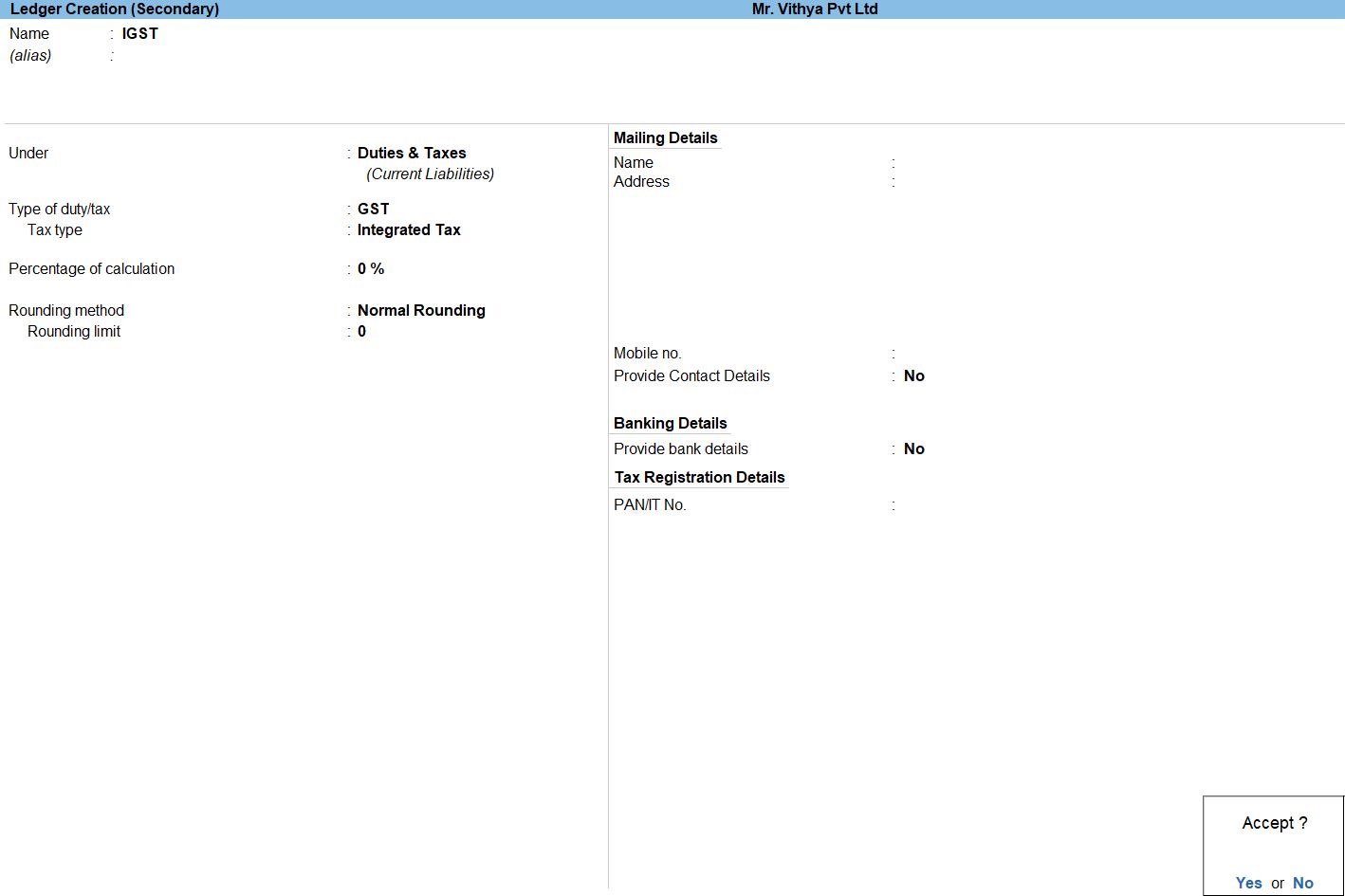

- Create ->Secondary ledger press Alt +C

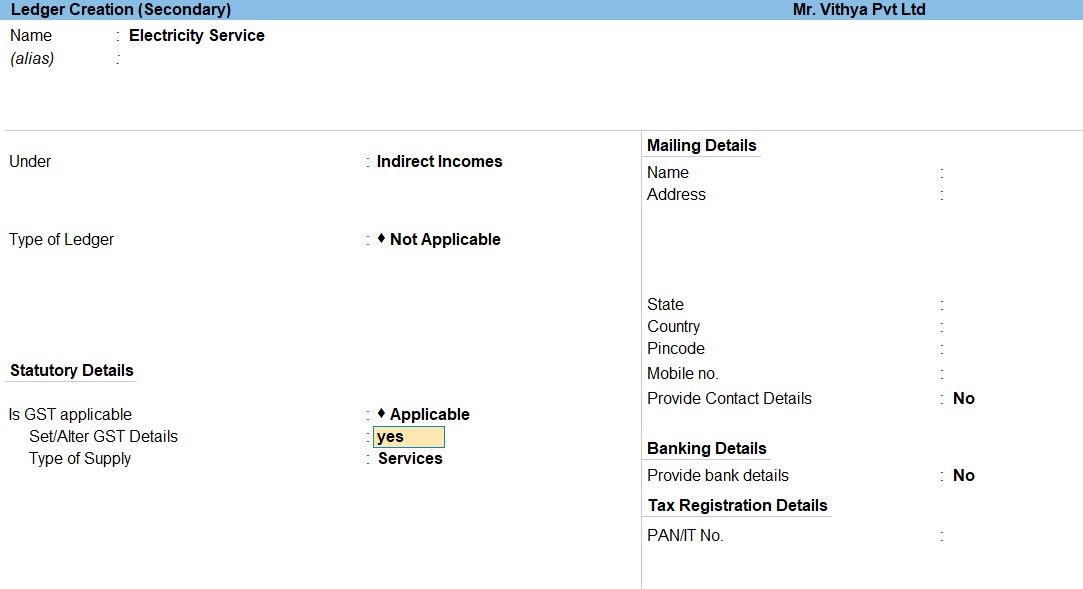

- Create ->Secondary ledger service press Alt +C

- Enter ->Ledger create Name

- Enter -> create Under Indirect Income

- GST Applicable: Applicable

- Set Alter GST DetailsYes

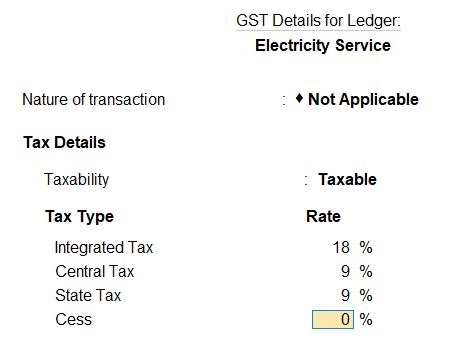

- The GST Details for Service window opens.

- This Under Taxability, select Taxable.

- This Under Integrated Tax, enter the GST Rate of the Stock Items.

- Enter Cess, if applicable.

After providing all the details, The GST Details of Stock Item screen appears as shown below. - As always, press Ctrl+A to save.

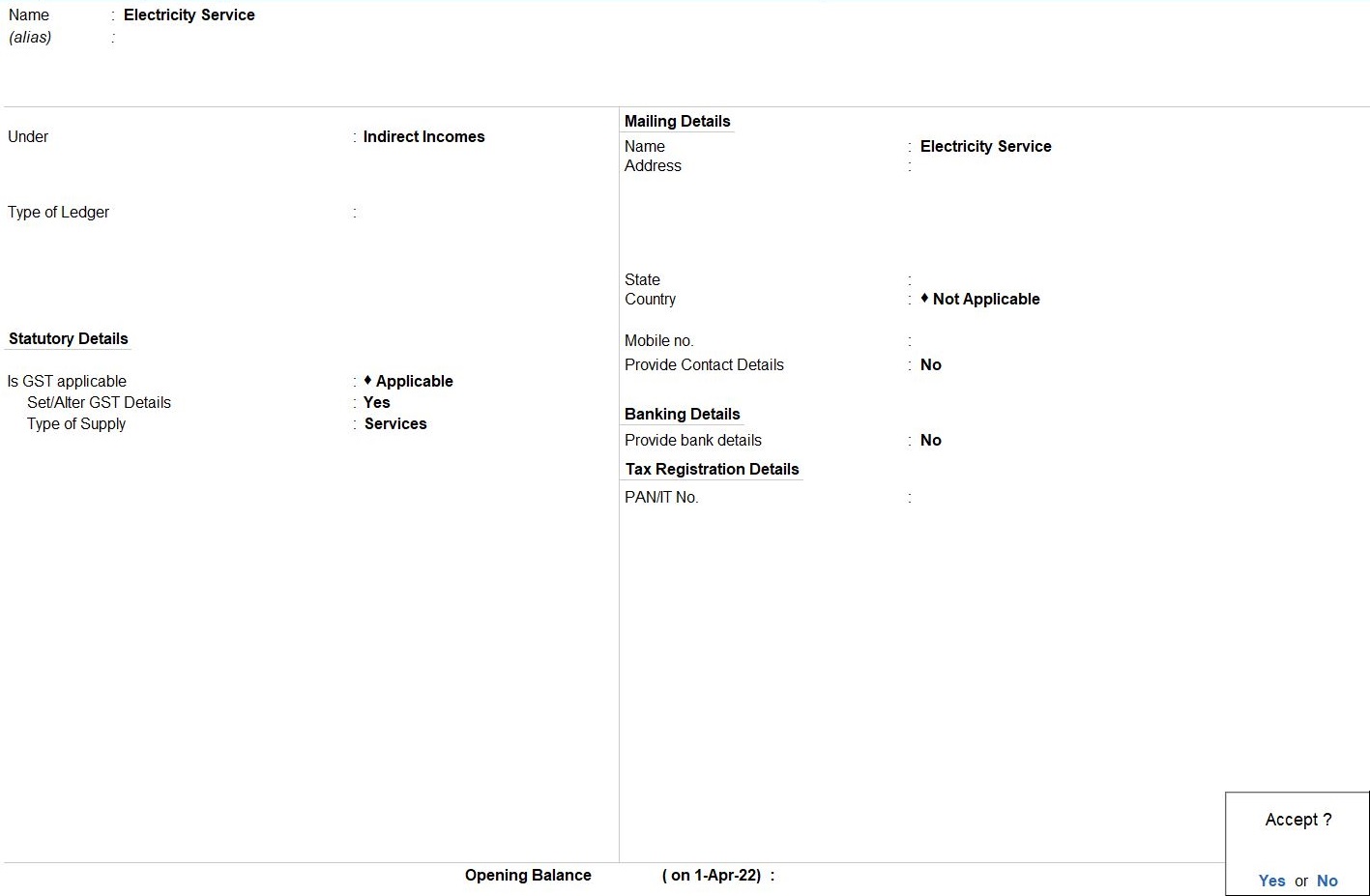

- Type of Supply:Service.

- Accept the screen. As always, press Ctrl+A to Save.

Integrated Tax

INTRA STATE (Within The State)

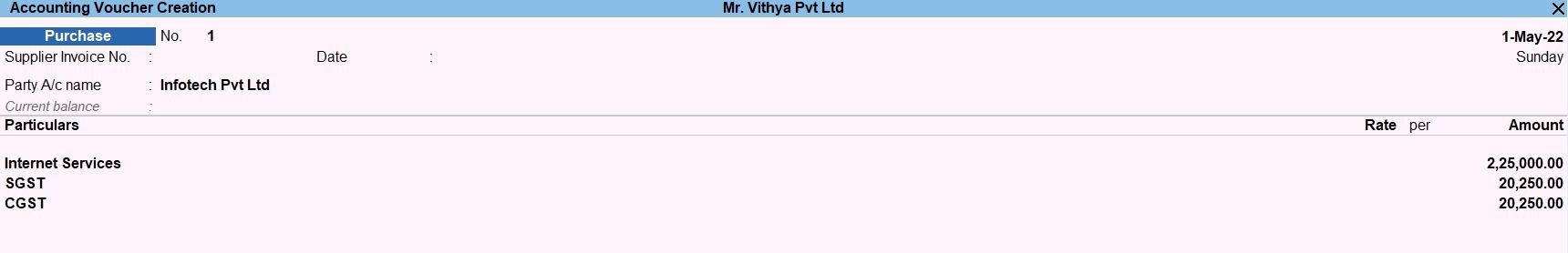

May 01 Receiving Internet Services from Infotech Pvt Ltd Chennai, Tamil Nadu worth Rs.225000. Additionally GST 18% is charged on the Invoice with reference number RA98.

Whenever you purchase a product or service, you record the purchase entry. In tally, this is recorded through the purchase voucher. It is also one of the most widely used vouchers in tally. There are two modes for accounting in purchase vouchers- Invoice mode and Voucher mode, as mentioned in the sales voucher

You may do a simple cash purchase or purchase on credit. For each purchase transaction, you will need to keep a record of the items you bought, payments made, goods returned, and so on.

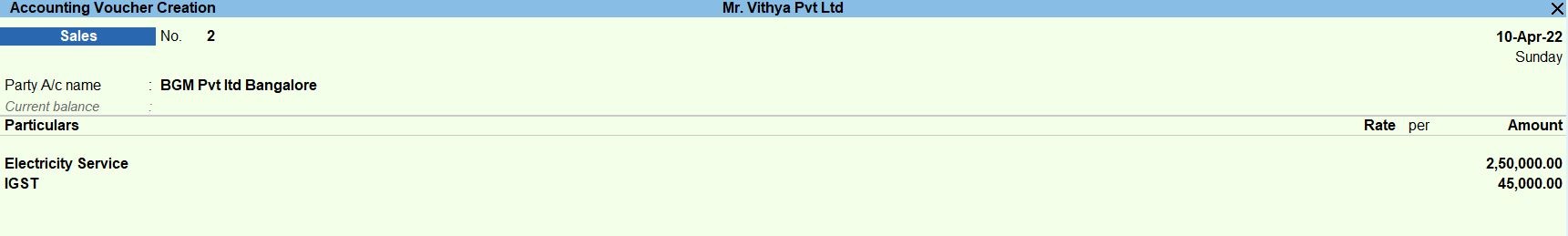

- Gateway of Tally -> Voucher -> Purchase Voucher(F9) or F10: Other Voucher ->Purchase Voucher

- Enter the Customer Invoice No. and Date.

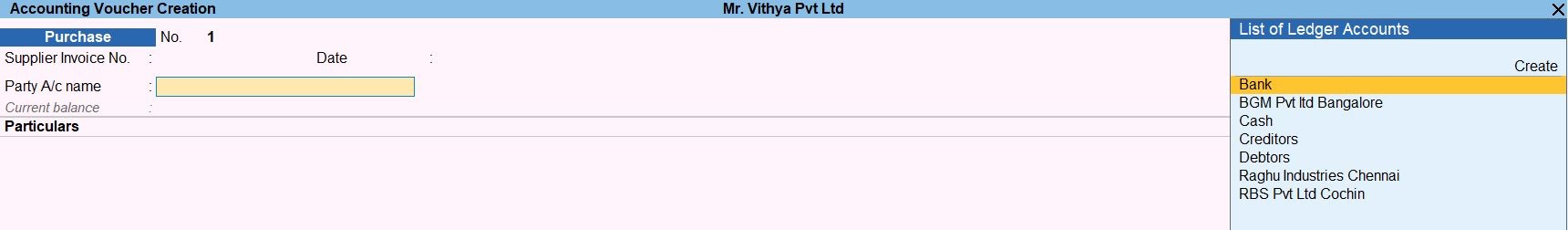

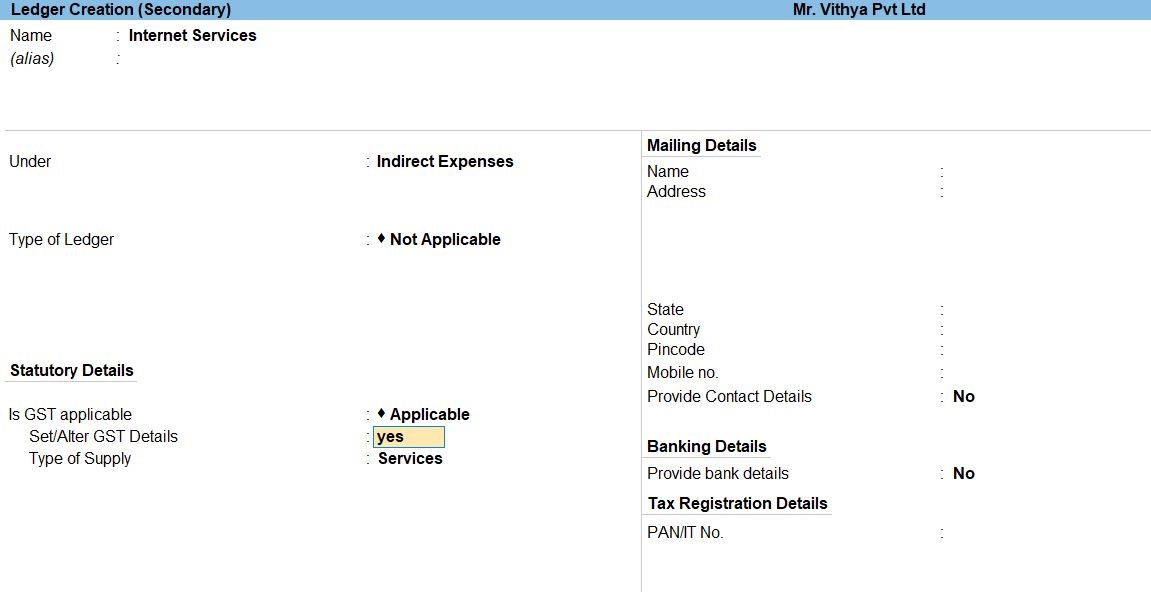

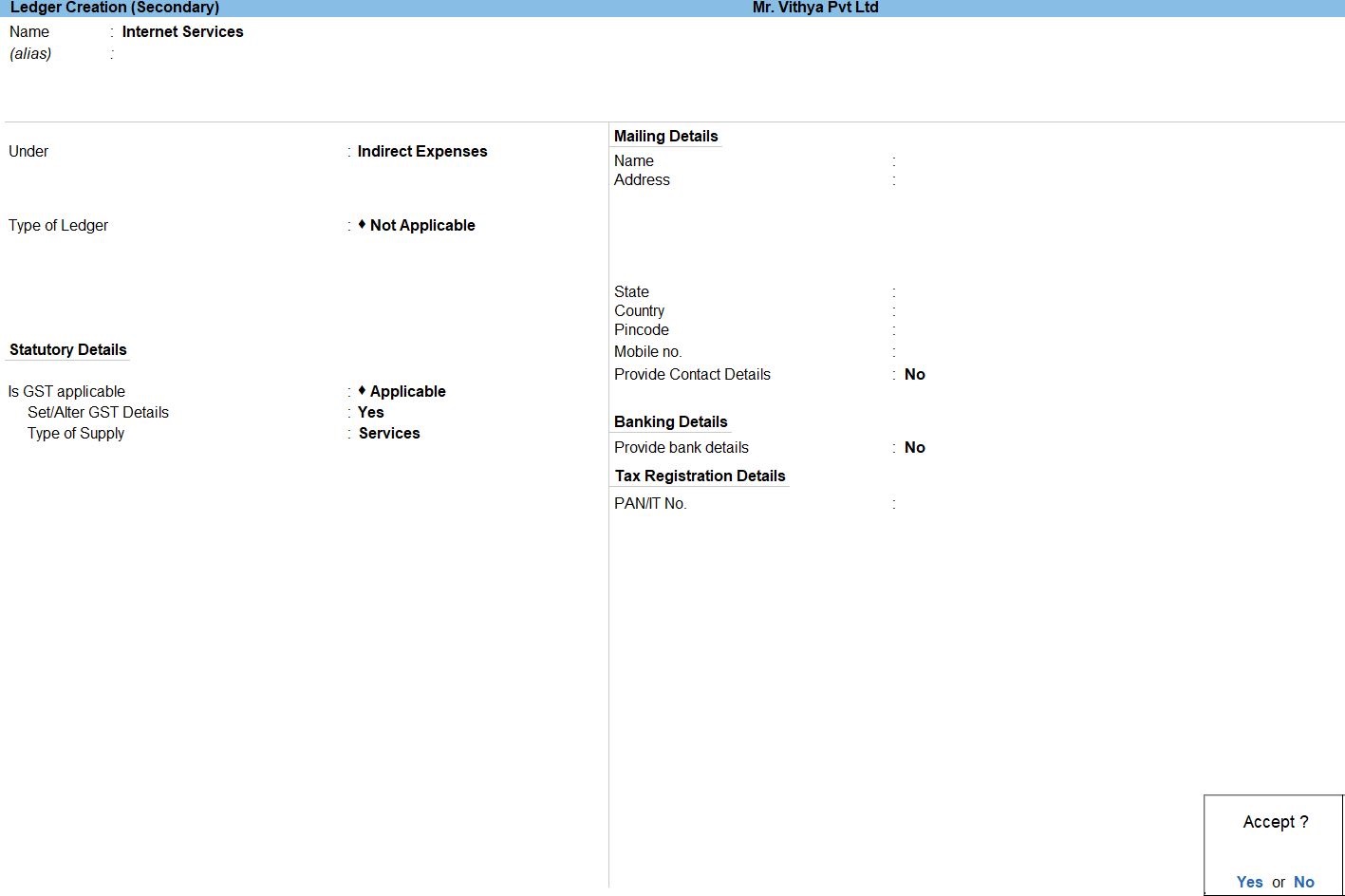

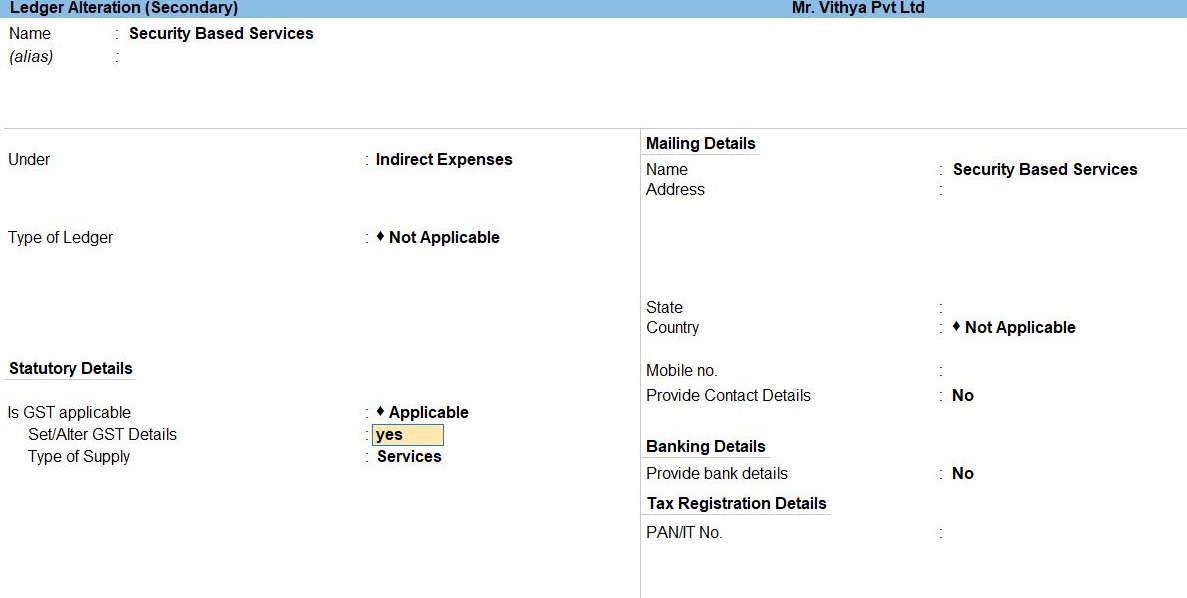

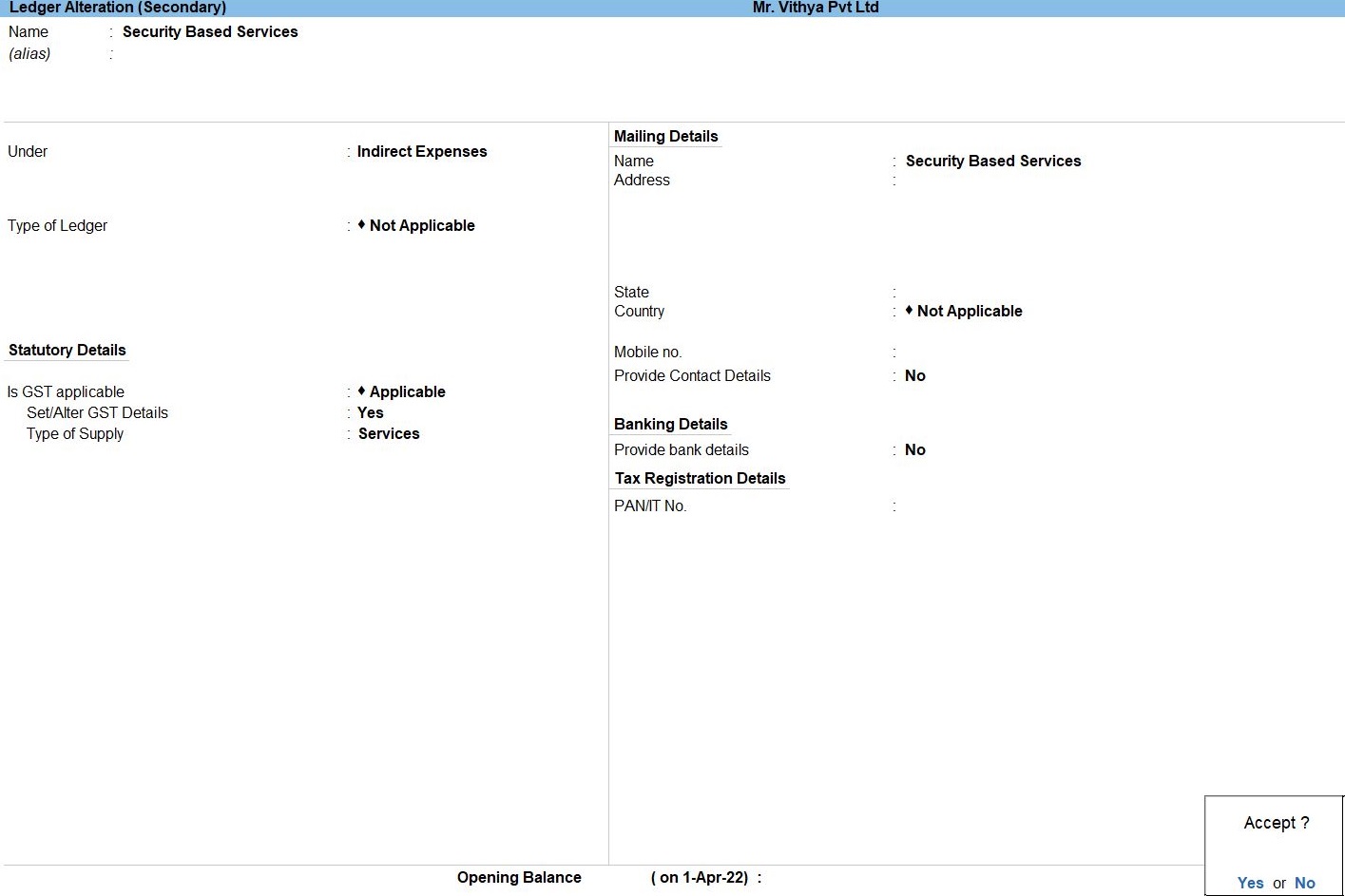

- Create ->Secondary ledger press Alt +C

- Create ->Secondary ledger service press Alt +C

- Enter ->Ledger create Name

- Enter -> create Under Indirect Income

- GST Applicable: Applicable

- Set Alter GST DetailsYes

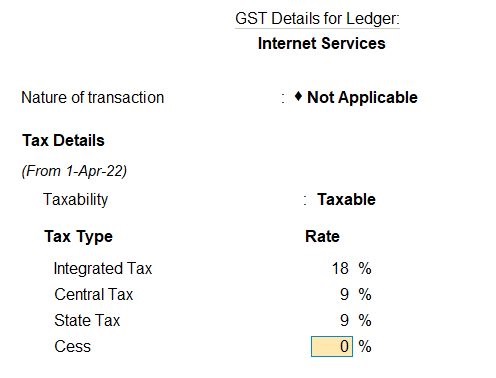

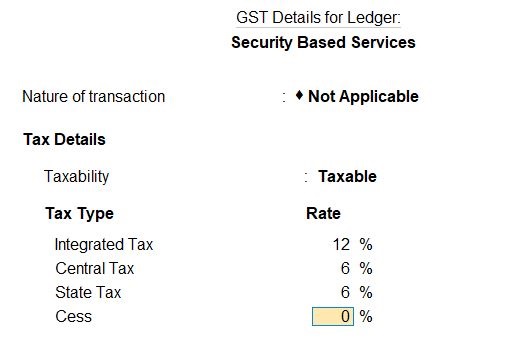

- The GST Details for Service window opens.

- This Under Taxability, select Taxable.

- This Under Integrated Tax, enter the GST Rate of the Stock Items.

- Enter Cess, if applicable.

After providing all the details, The GST Details of Stock Item screen appears as shown below. - As always, press Ctrl+A to save.

- Type of Supply:Service.

- Accept the screen. As always, press Ctrl+A to Save.

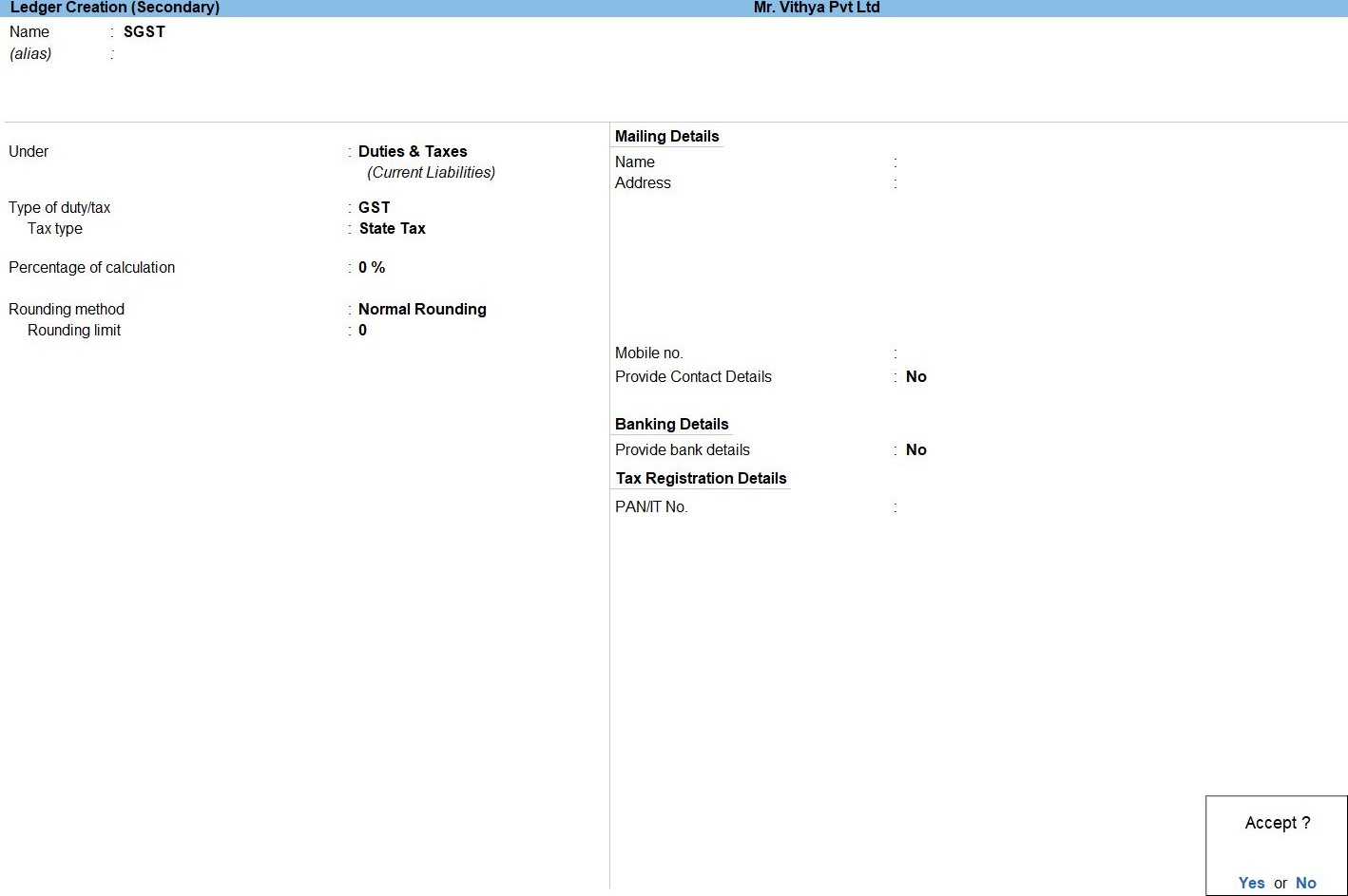

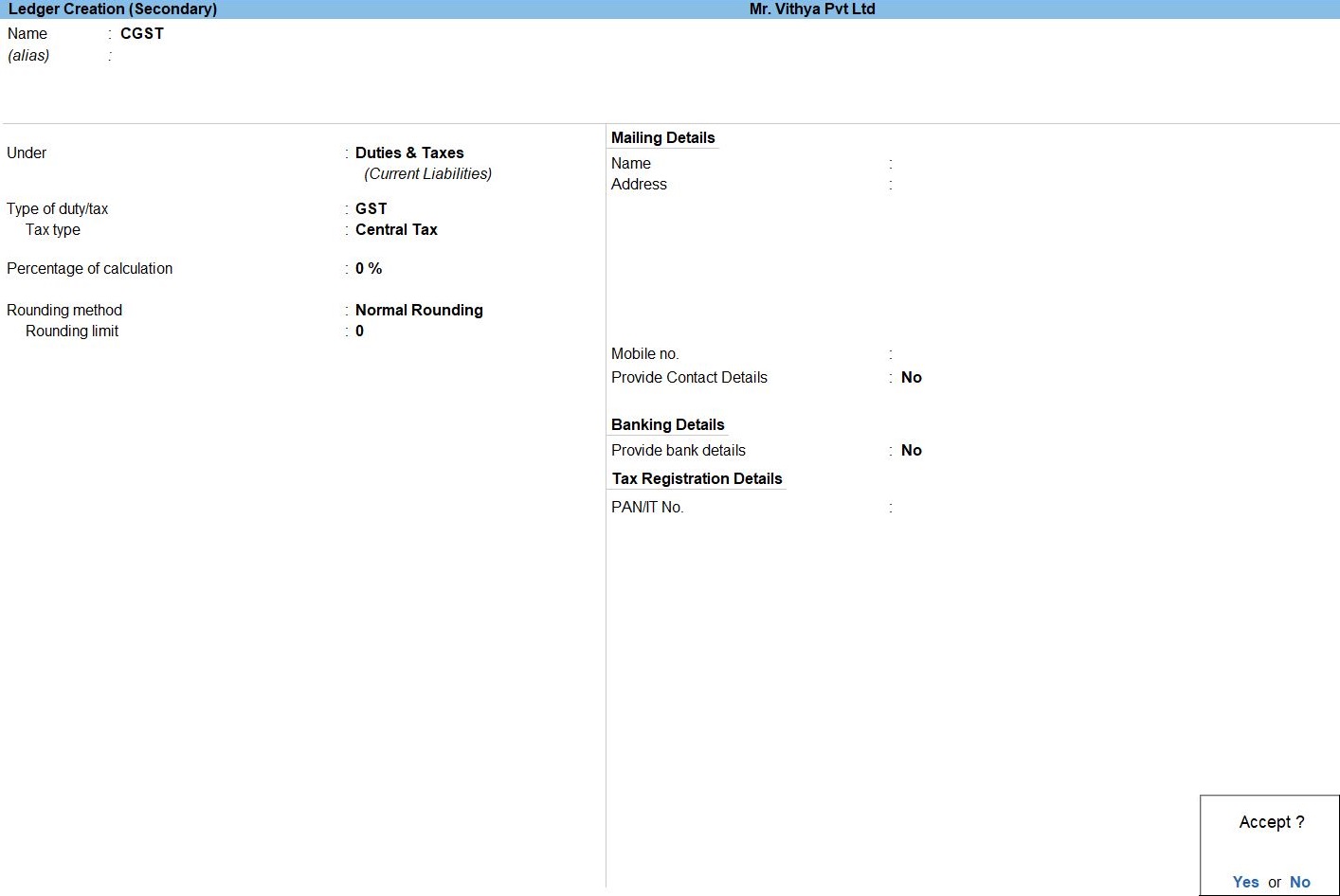

State Tax

Central Tax

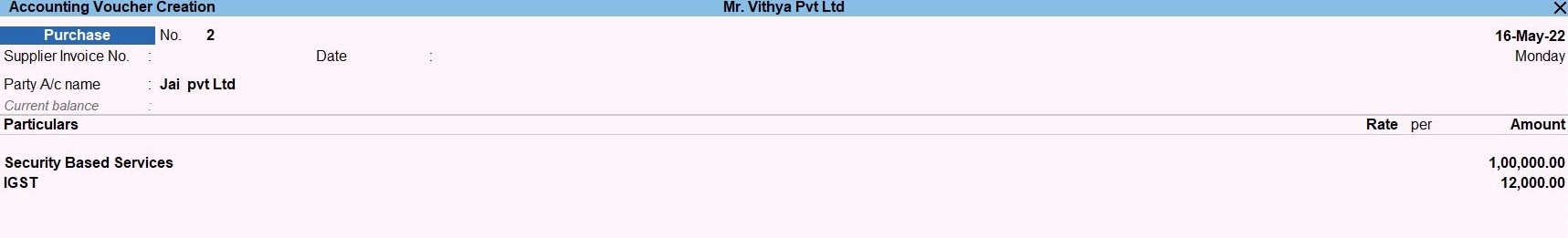

INTER STATE (Outside The State)

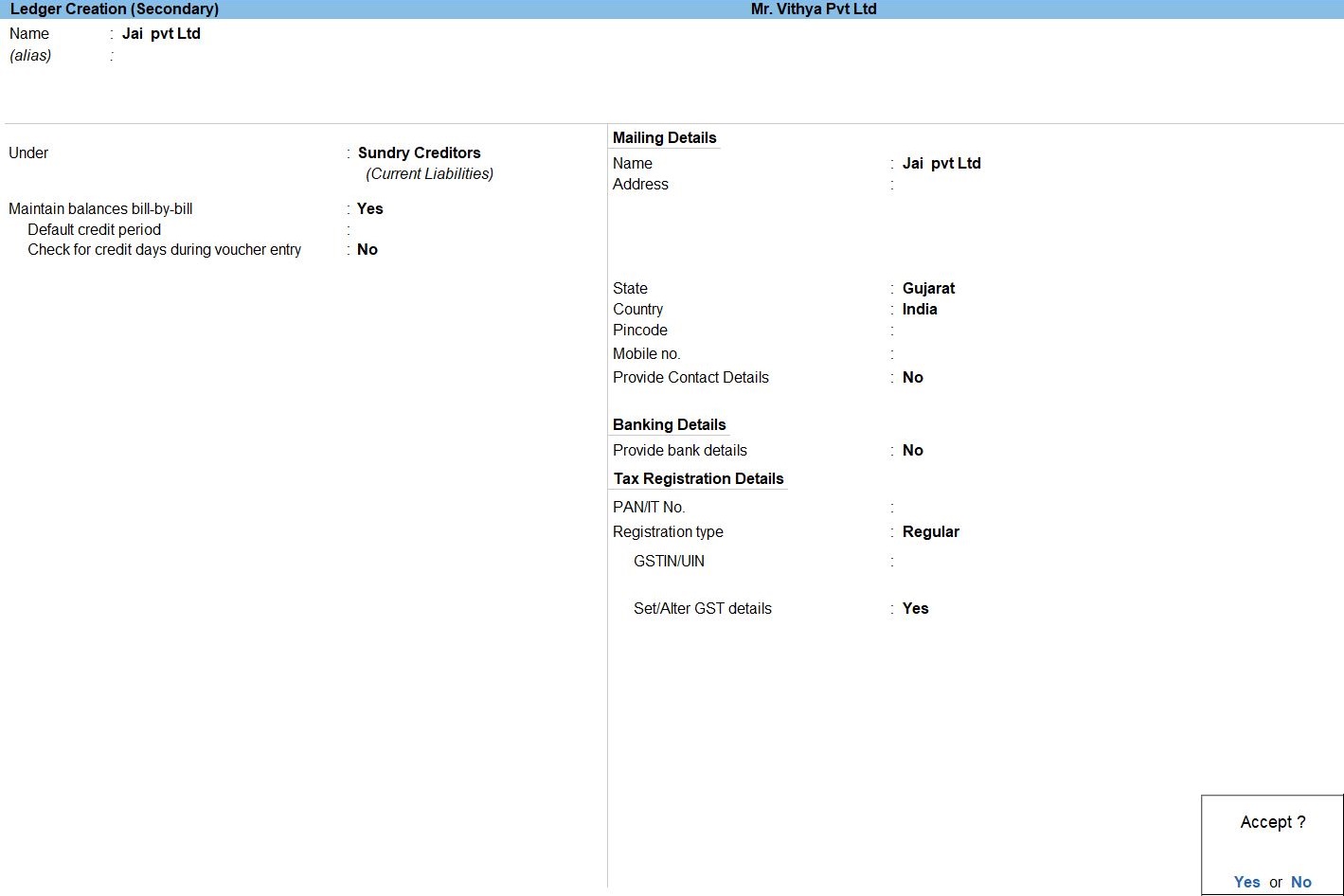

May 16 Receiving Security Based Services from Jai pvt Ltd, Gujarat worth Rs.100000. Additionally GST 12% is charged on the invoice with reference number GM236.

May 22 Receiving legal Services from Aadhira Pvt Ltd, Telangana worth Rs.150000. Additionally GST 12% is charged on the invoice with reference number AP095.

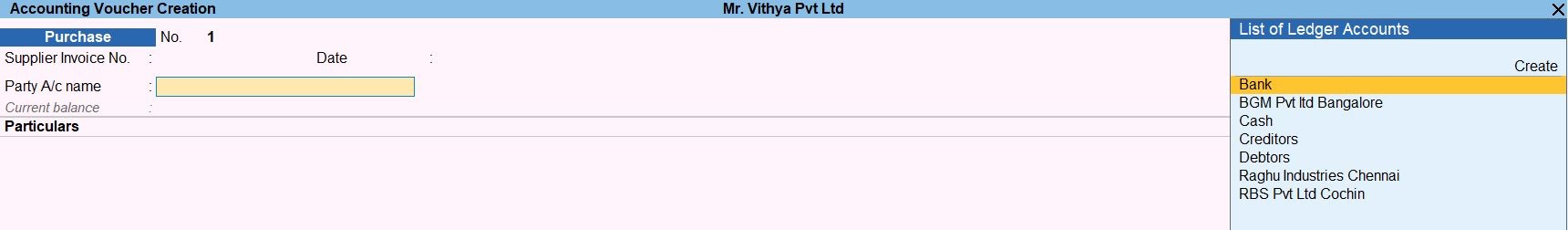

- Gateway of Tally -> Voucher -> Purchase Voucher(F9) or F10: Other Voucher ->Purchase Voucher

- Enter the Customer Invoice No. and Date.

- Create ->Secondary ledger press Alt +C

- Create ->Secondary ledger service press Alt +C

- Enter ->Ledger create Name

- Enter -> create Under Indirect Income

- GST Applicable: Applicable

- Set Alter GST DetailsYes

- The GST Details for Service window opens.

- This Under Taxability, select Taxable.

- This Under Integrated Tax, enter the GST Rate of the Stock Items.

- Enter Cess, if applicable.

After providing all the details, The GST Details of Stock Item screen appears as shown below. - As always, press Ctrl+A to save.

- Type of Supply:Service.

- Accept the screen. As always, press Ctrl+A to Save.

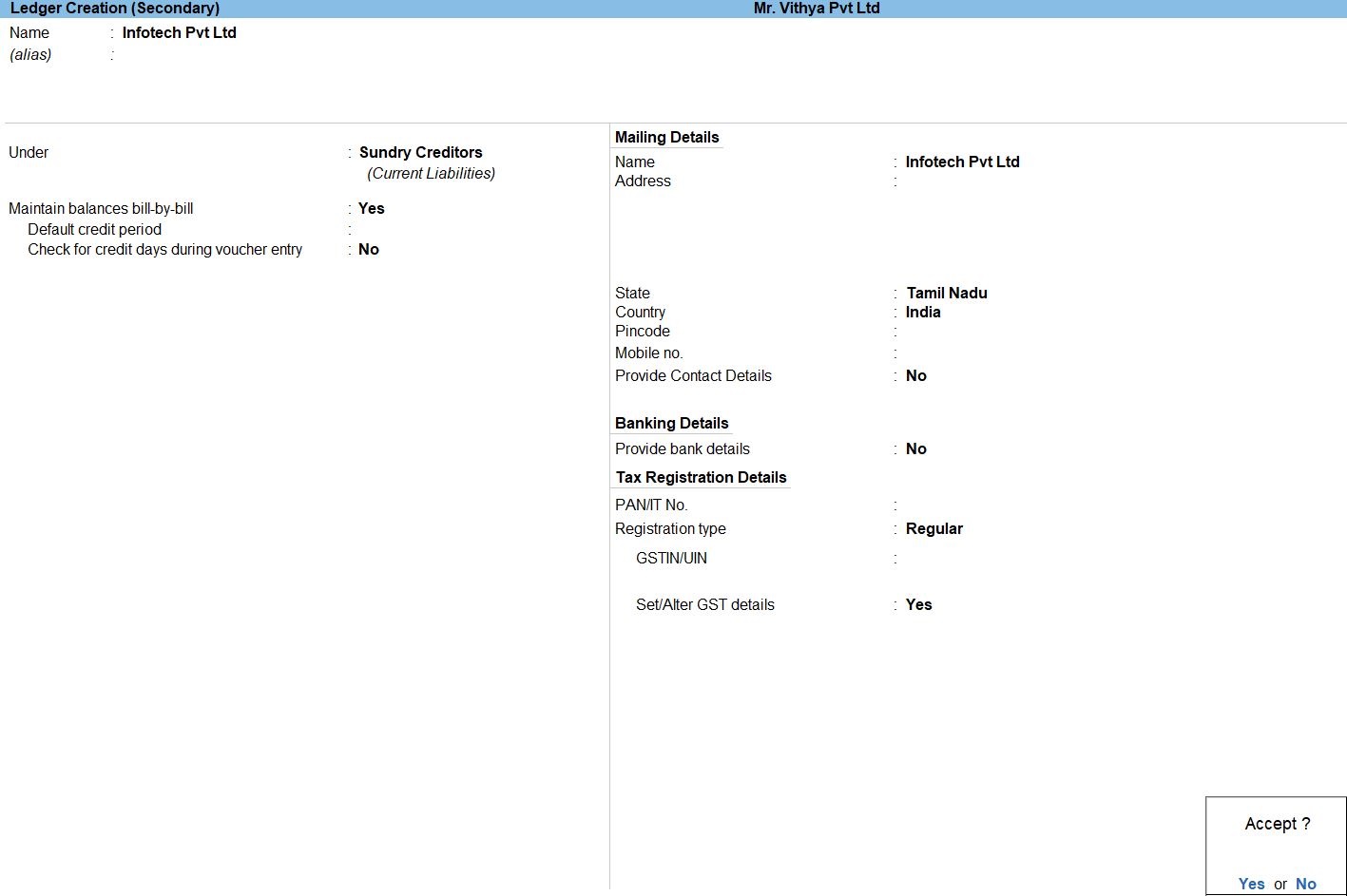

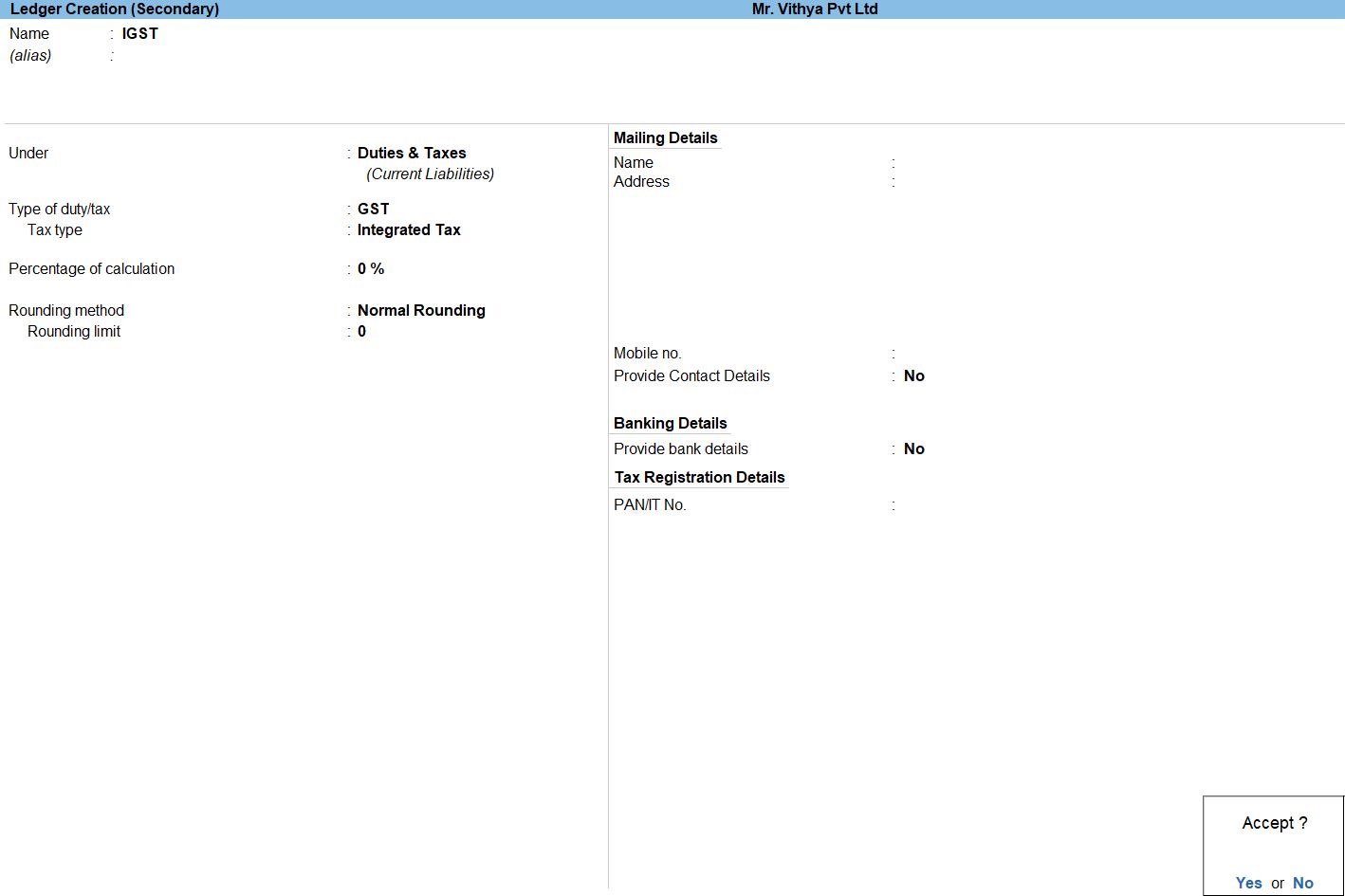

- Create ->Secondary Ledger for TAX press Alt +C

- Accept the screen. As always, press Ctrl+A to Save.

Integrated Tax

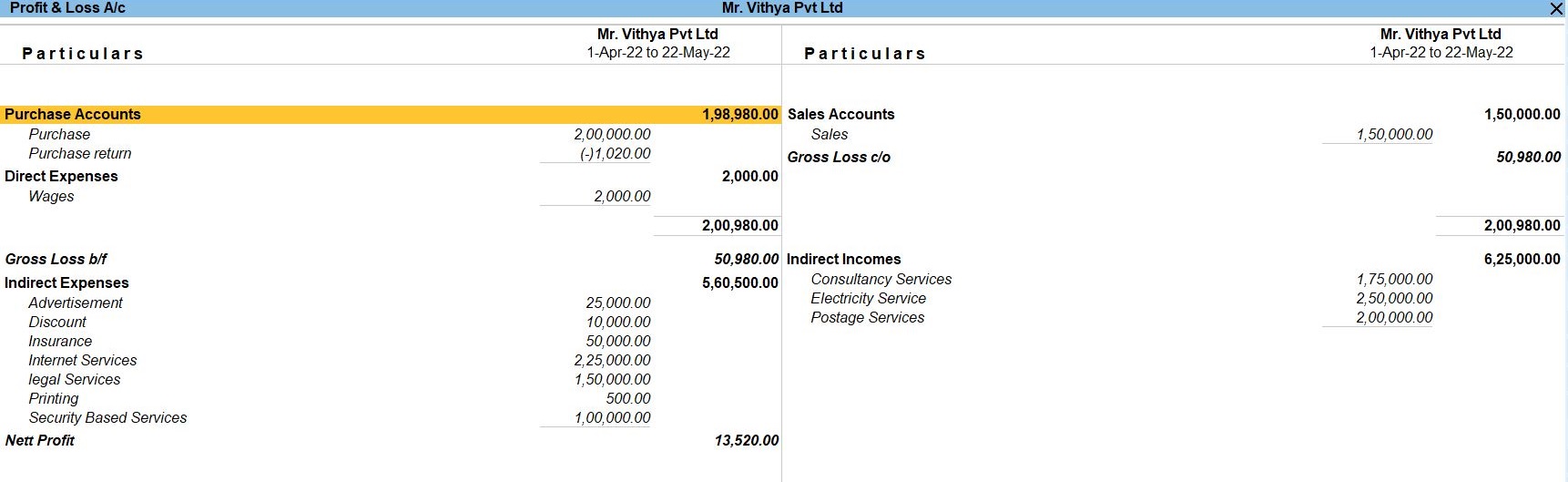

Profit and Loss In TallyPrime

Profit and Loss A/c is one of the primary financial statements that you can use to monitor the health of your business. It summarizes the revenues, costs, and expenses for a specific period, such as a quarter or a year. Thus, you can easily gather the net result of the business operations.

Using the Profit and Loss A/c in Tally Prime, you can measure the ability of your business to generate profit. Accordingly, you can take various measures to increase revenue, reduce costs, and so on. What more, you can view the Profit and Loss A/c in the browser.

How to Use Profit and Loss in Tally Prime

- Gateway of Tally -> Report -> Profit & Loss A/C (F1)

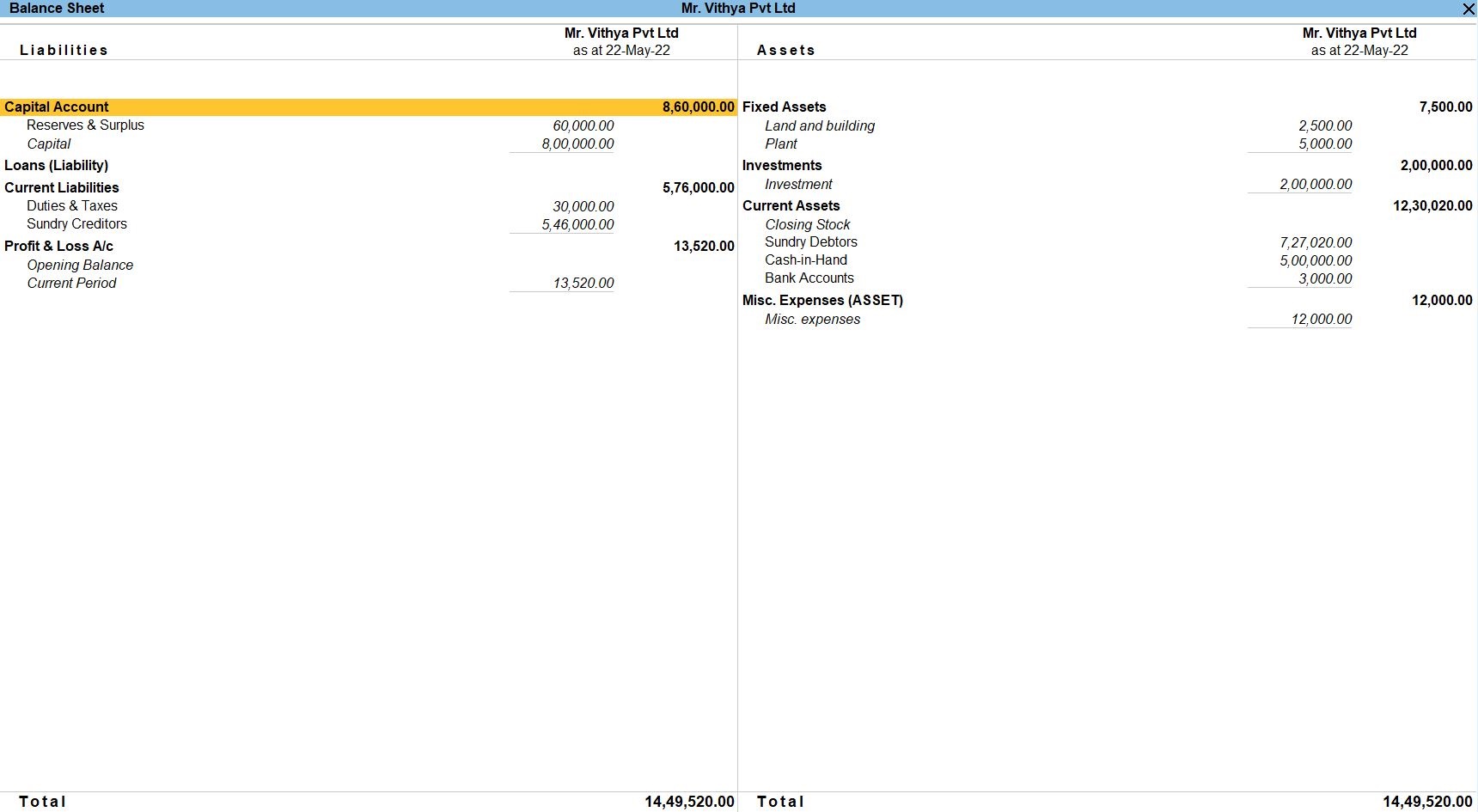

Balance Sheet In TallyPrime

Balance Sheet is one of topmost financial statement prepared by the businesses. The financial details of the balance sheet help you and the external stakeholders to evaluate the financial performance of the business on a given date. Before knowing the steps to prepare a balance sheet and reading the balance sheet, it is important to be familiar with the components and format of the balance sheet.

- Gateway of Tally -> Report -> Balance Sheet (F1)

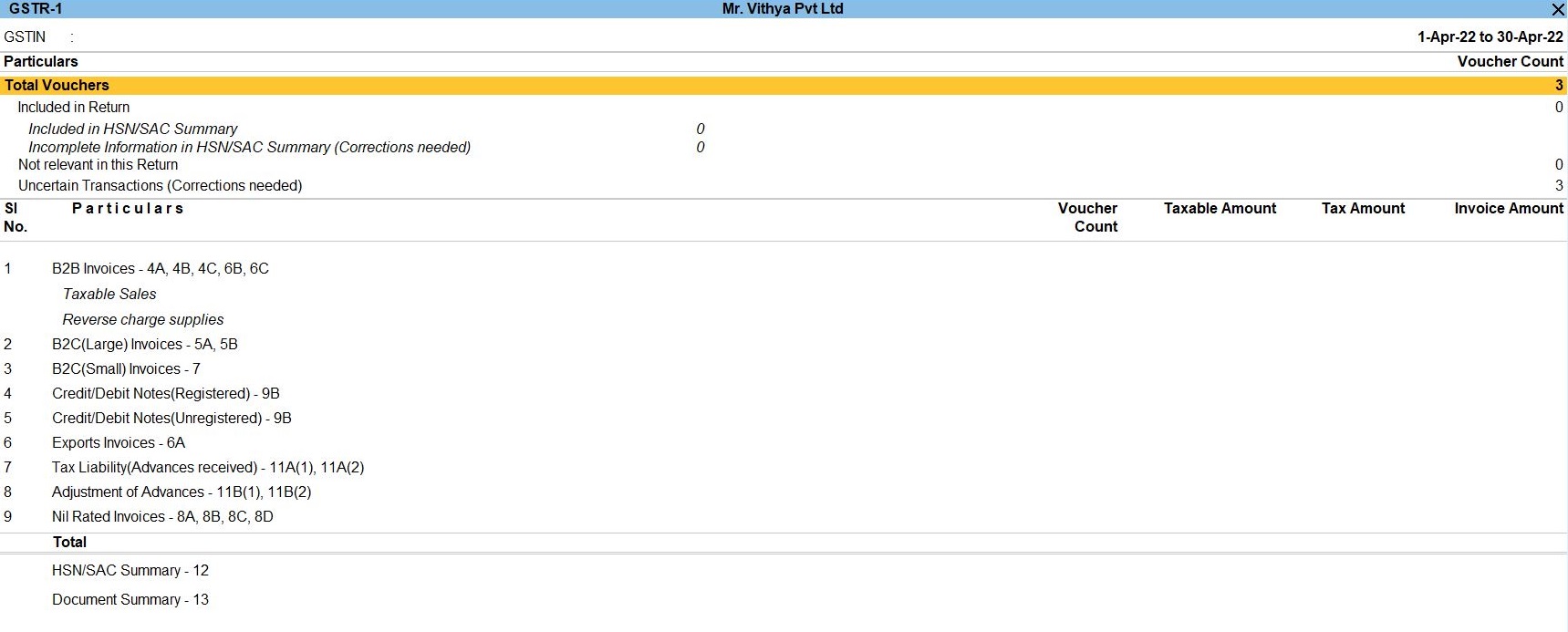

GST Reports In TallyPrime

- Go to Gateway of Tally prime -> Go To -> GST ReportsEnter

- Go to Gateway of Tally prime -> Go To -> GST Reports->GSTR-1 Enter

- Go to Gateway of Tally prime -> Go To -> GST Reports->GSTR-2 Enter

- Go to Gateway of Tally prime -> Go To -> GST Reports->GSTR-3B Enter

GSTR-1 in Tally Prime

Form GSTR-1 is a monthly/quarterly Statement of Outward Supplies to be furnished by all normal and casual registered taxpayers making outward supplies of goods and services or both and contains details of outward supplies of goods and services.

GSTR-2 in Tally Prime

The GSTR-2 is a monthly tax return showing the purchases you've made for that month. When you make purchases from registered vendors, the information from their sales returns (GSTR-1) will be available in the GSTN portal as GSTR-2A for you to use in your GSTR-2.

GSTR-3B in Tally Prime

Form GSTR-3B is a simplified summary return and the purpose of the return is for taxpayers to declare their summary GST liabilities for a particular tax period and discharge these liabilities. A normal taxpayer is required to file Form GSTR-3B returns for every tax period.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions