Value Added Tax in Tally ERP 9

VAT introduced in MOROCCO in the year 1962. Presently in more than 123 countries used in VAT tax. VAT is the abbreviated form for Value Added Tax. For this purpose value added is to understood as "The value that a producer adds to his raw materials or purchase before selling the new improved product or service".

Value added tax is a multi-stage tax. Levied on value added at different stages of production and distribution of a commodity or the supply of a service.

Value added tax is an indirect tax on goods. Introduced in lieu of sales tax, to ensure transparency and greater compliance. The basic premise of VAT is to tax the "True Value" added to the goods, at each stages in the transaction chain. The ultimately reduces:

- Tax paid to the government.

- Cost / tax passed on to the consumer.

VAT SCHEDULE:

- Schedule I -> 0% for Exempted goods.

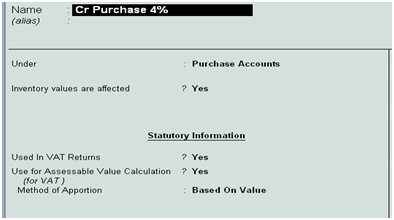

- Schedule II -> 4% for manufacturing inputs

- Schedule III -> 1% for gold and precious stone

- Schedule IV -> 20% to 32.5% for petrol, diesel, oil

- Schedule V -> 12.5% for the goods not specified under any schedule

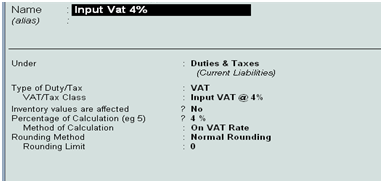

- Vat Class -> Purchase -16, Sales -18, VAT - 14

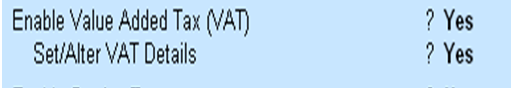

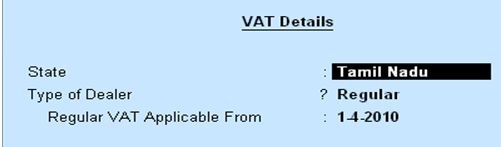

How to activate VAT?

F11-> Statutory & Taxation

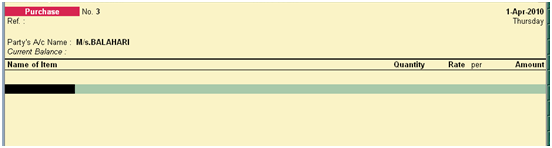

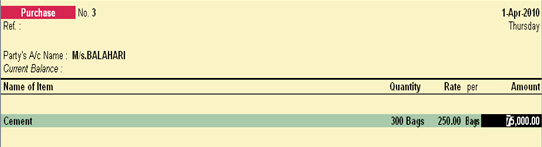

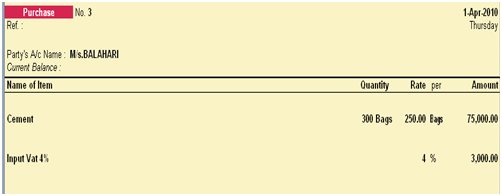

Accounting Voucher:

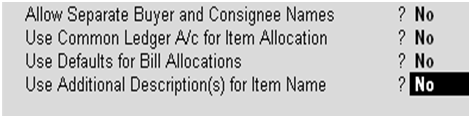

F12-> Purchase invoice Configurations

Go to Party's Name -> Alt + C -> create the name of the suppliers

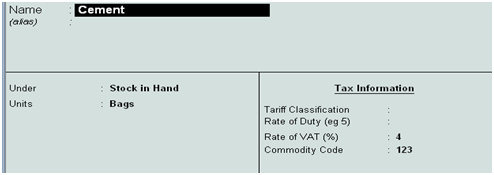

Name of the items -> Alt +C -> create the name of the items

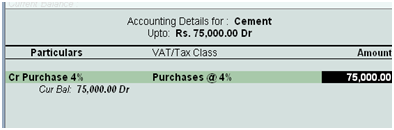

Display -> Statutory report -> VAT report -> VAT Computation

Tally ERP 9

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions