Journal Voucher in Tally ERP 9

In Tally ERP 9, a journal voucher is a type of accounting voucher used to record financial transactions that do not involve cash or bank accounts. Journal vouchers are used to make general journal entries that involve adjustments to accounts, such as the adjustment of depreciation, prepaid expenses, or the recording of opening balances.

When you create a journal voucher in Tally ERP 9, you will need to provide the following information:

- Voucher Type: Select "Journal" from the list of voucher types.

- Date: Enter the date of the transaction.

- Account: Select the account to which the journal entry is being made.

- Debit/Credit: Select whether the entry is a debit or credit entry.

- Amount: Enter the amount of the entry.

- Narration: Optionally, you can provide a brief description of the entry.

- Additional Details: Optionally, you can provide additional details, such as cost centers or project details.

Once you have entered all the required information, you can save the journal voucher. Tally ERP 9 will automatically update the relevant ledger accounts, and the journal voucher will be reflected in the books of accounts. Additionally, you can generate reports to analyze the entries recorded in the journal voucher.

Journal vouchers are an essential tool for maintaining accurate financial records and ensuring that all financial transactions are properly recorded and accounted for. They can also be used to generate reports for analysis and to facilitate the preparation of financial statements.

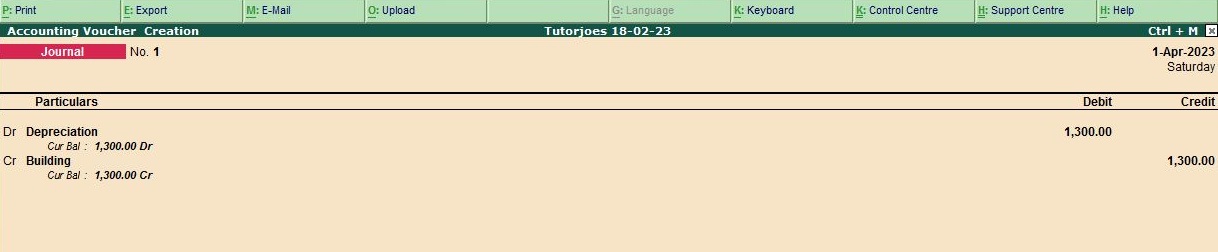

Example

Deprecition of Building Rs.1300

To create an entry for Depreciation of Building of Rs. 1300 in Tally ERP 9, follow these steps:

- Go to Gateway of Tally and click on the "Accounting Vouchers" option.

- Select the "Journal Voucher" option.

- In the "Journal Voucher" screen, in the first "Account" field, select the ledger for "Depreciation" under the "Indirect Expenses" group.

- In the second "Account" field, select the ledger for "Depreciation" under the "Indirect Expenses" group.

- In the "Debit" field, enter the amount of Rs. 1300.

- Press Enter to move to the "Credit" field.

- In the "Credit" field, select the ledger for "Building" under the "Fixed Assets" group.

- Press Enter to move to the "Amount" field.

- In the "Amount" field, enter the amount of Rs. 1300.

- Press Enter to save the entry.

- You can also add additional details such as narration and reference number if needed.

- Once you have entered all the details, press Ctrl+A to save the entry.

Your entry for Depreciation of Building of Rs. 1300 should now be saved in Tally ERP 9.

Tally ERP 9

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions