Service Tax in Tally ERP 9

Introduction of service tax:

Service tax is an indirect tax levied by the government of India on certain categories of services provided by a person, firm, agency, etc…, the responsibility of collecting and paying the service tax rests with service provider the seller. Service tax returns are to be filed with the commiserate of service tax at the end of every six month.

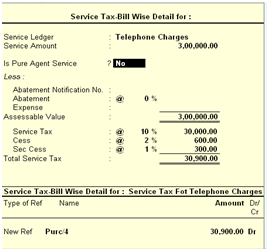

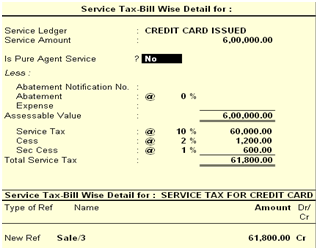

In the year 2009, the service tax was 10% and an additional education cess 3% ( 2% higher education cess, 1% secondary education cess ) service tax is charged. The service tax applicable on 110 categories of services.

Maintain -> Accounts only

Financial year - 1.4.2010 to 31.3.2011

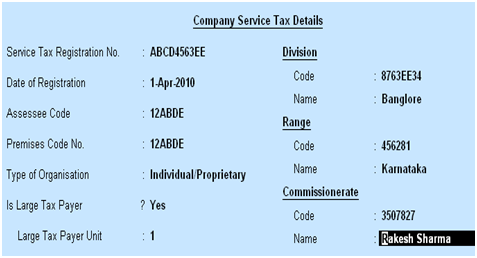

Activate service tax

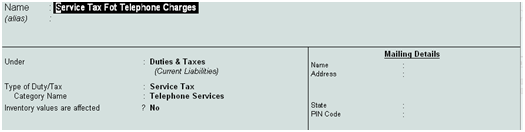

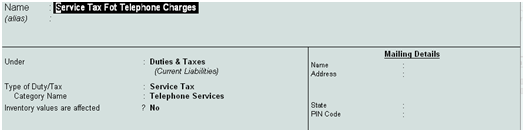

Type of service tax

- Service Purchase ( Amount paid )

- Service sales ( Amount received )

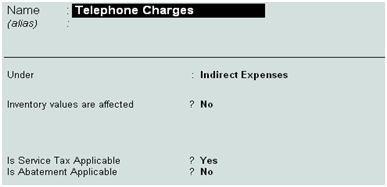

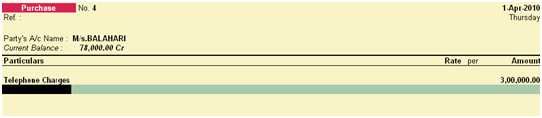

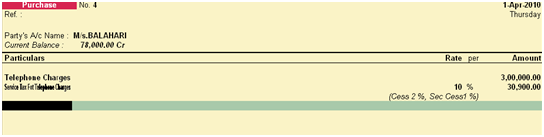

Service purchase:

Purchase (F9)

Change Double Entry mode ( Ctrl + V )

F12 -> Use common ledger a/c for item allocation -> no

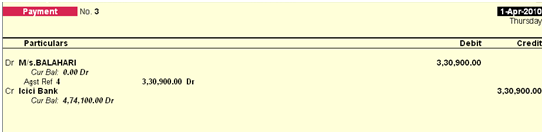

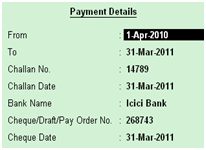

Payment (F5):

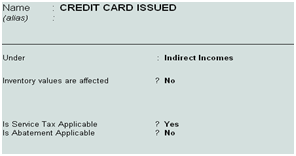

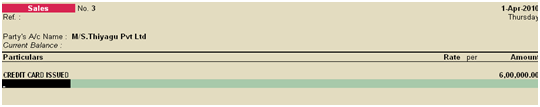

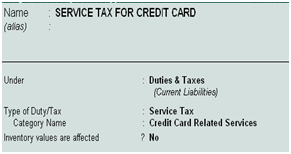

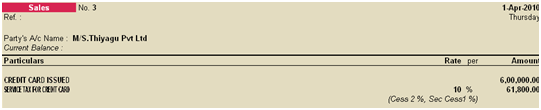

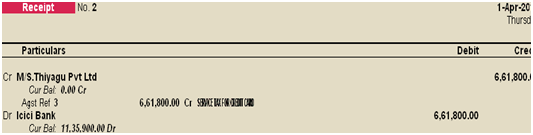

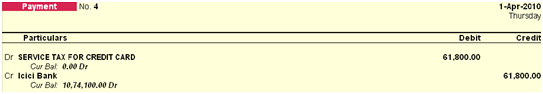

Service sales :

Sales (F8)

Receipt (F6)

Payment (F5):

Display service tax report

Display -> Statutory report -> Service tax report -> Service tax payables

Tally ERP 9

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions