Payroll in Tally ERP 9

Company -> Accounts only

Financial year -> 1.4.2024 to 31.3.2025

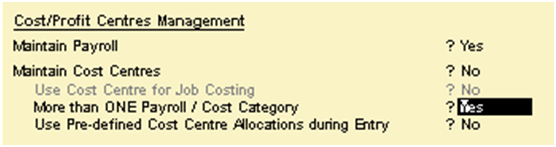

F11-> Accounting futures

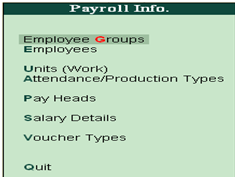

Payroll Info:

Step 1

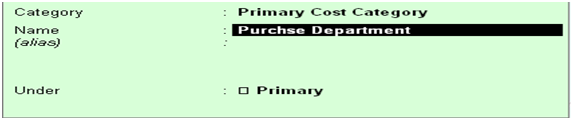

Employee Group -> Single Group -> Create

(To be create the Department Name of the company)

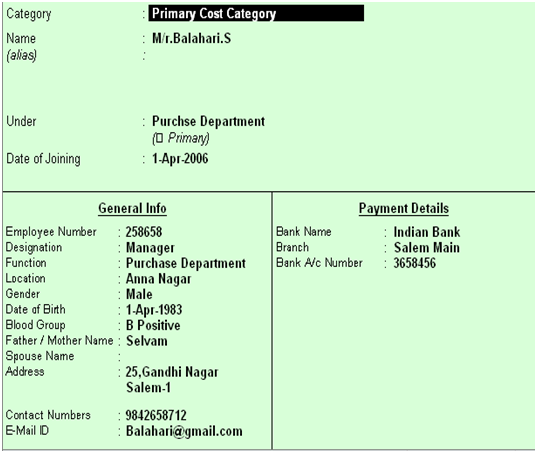

Step 2Employees -> Single Employee -> Create

Step 3

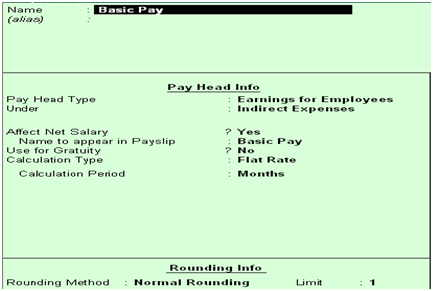

Pay head -> create

(To be allocating the total allowances and deduction of company)

Pay head -> create

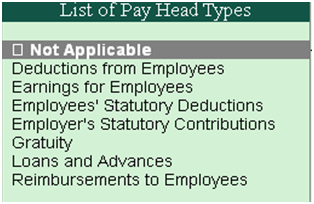

Deductions from Employees

- Name : PF,PPF,GPF

- Under: Current Liabilities

Earnings From Employees

- Name : Basic pay, DA HRA, TA, MA, FA any Allowances name

- Under: Indirect Expenses

Employees Statutory Deductions

- Name : Income Tax

- Under: Duties & Taxes

Employees Statutory Contributions

- Name : Tsunami contribution

- Under: Indirect Expenses

Gratutity

- Name : Gratutity

- Under: Current Liability

Loans and Advances

- Name : Advance, Car,loan,House loan and any Loan name

- Under: Loans and Advances (ASSETS)

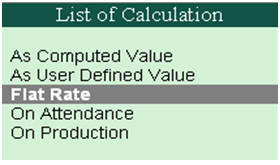

Calculation Type:

Net Amount(Rs)-> Flat Rate

Percentage(%)-> As Computed Value

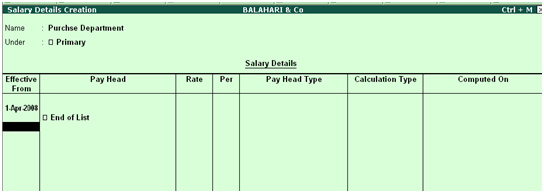

Step 4

Payroll info-> Salary detail -> Create

(To be allocating the allowances and deductions of every department)

Step 5

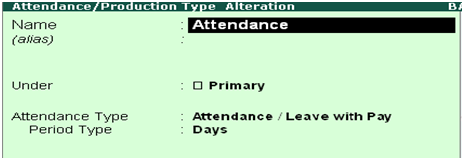

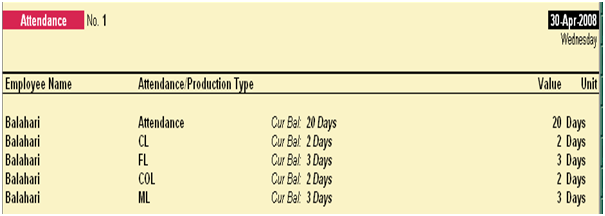

Payroll info->Attendance/Production type -> Create

Step 6

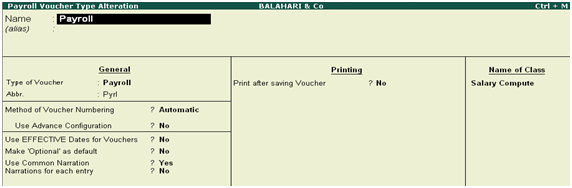

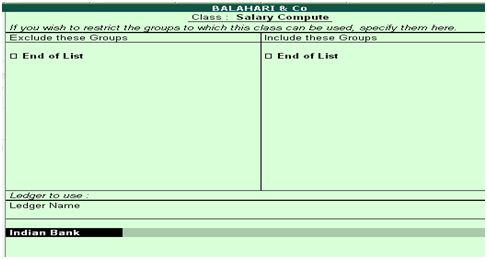

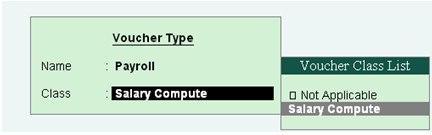

Voucher type->Alter->Payroll voucher-> Name of Class-> Salary compute -> Ledger Name-> Bank Name

Step 7

Payroll voucher->Ctrl +F4(Salary compute Voucher)-> Alt+ A(Employee filter)

Step 8

Payroll voucher->Ctrl +F5(Attendance Voucher)

Step 9

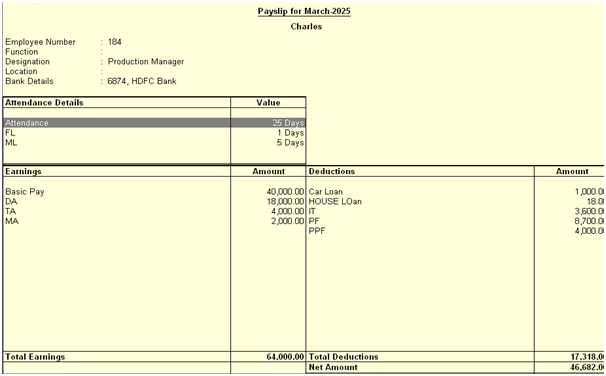

Display->Payroll Reports -> Statement of Payroll -> Pay Slip

Tally ERP 9

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions