Tax Deducted at Source in Tally ERP 9

Income tax is collected / recovered at two stages, namely pre-assessment stage and post assessment stage. Nearly 85% of the tax is collected at the pre-assessment stage. The methods by which pre-assessment tax collected are deduction tax at source, collection of tax at source, advance payment of tax.

According to CBDT (Central Board of Direct Taxes), nearly 40% of the total direct taxes collection accrues through tax deducted at source (TDS) of which salaries contribute almost 50%. Of the total, direct taxes realization expected in a financial year, officials estimate that the TDS collections will be on top.

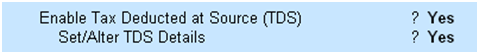

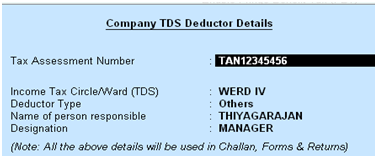

Activate TDS

F11 -> Statutory & Taxation

Step 1:

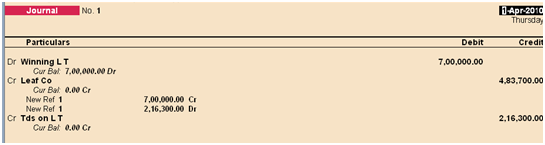

Journal (Tax calculation purpose)

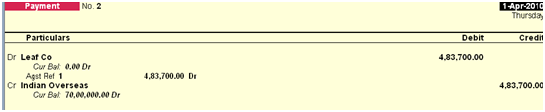

Payment:

Amount paid to party's by cheque

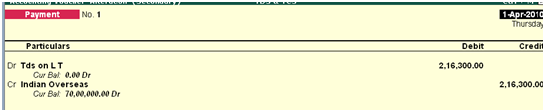

Payment:

Amount paid to Income tax department

Tally ERP 9

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions