Calculating Depreciation Using the DB Function in Excel

The DB function in Excel is used to calculate the depreciation of an asset for a specified period using the declining balance method. The function takes the following arguments:

Syntax

=DB(cost, salvage, life, period, [month])

Where:

- cost: The initial cost of the asset.

- salvage: The value of the asset at the end of its useful life.

- life: The number of periods (usually years) over which the asset is depreciated.

- period: The period for which you want to calculate the depreciation.

- month (optional): The number of months in the first year of the asset's life.

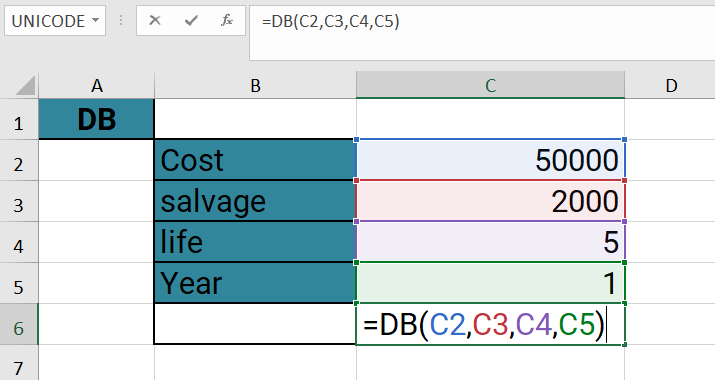

Example

=DB(C2,C3,C4,C5)

The formula "=DB(C2,C3,C4,C5)" is using the DB function in Excel to calculate the depreciation of an asset for a specific period, based on the declining balance method

The arguments for the function are:

- C2: This is the cost of the asset, or the initial amount paid for it.

- C3: This is the salvage value, or the estimated value of the asset at the end of its useful life.

- C4: This is the life of the asset, or the number of periods over which it is depreciated.

- C5: This is the period for which you want to calculate the depreciation.

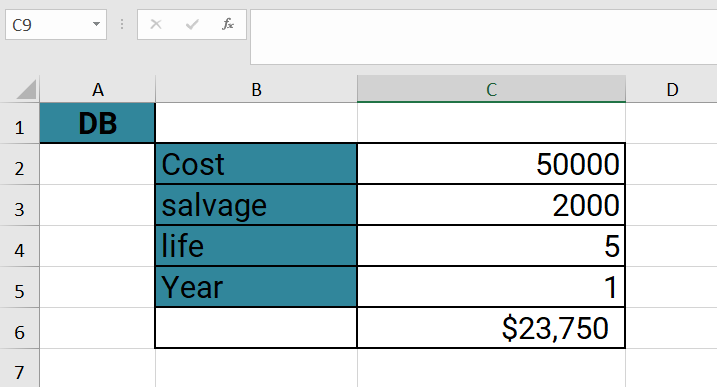

The function will calculate the depreciation of the asset using the declining balance method, which means that a higher percentage of the asset's value is depreciated in the earlier years of its useful life. The DB function uses a specified depreciation rate, which is a multiple of the straight-line depreciation rate. The formula does not specify a value for the optional "month" argument, so it will default to 12, meaning that each period is assumed to be one year. The result of the formula will be the amount of depreciation for the specified period.

The DB function calculates depreciation using the declining balance method, which means that the depreciation rate is applied to the asset's book value at the beginning of each period. The depreciation rate is calculated as a multiple of the straight-line depreciation rate and is specified as an argument in the DB function. The book value of the asset is reduced by the amount of depreciation each period until it reaches the salvage value at the end of its useful life.

Output

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions