COUPDAYS Function in Excel: How to Calculate the Number of Days Between Settlement and Coupon Payment Dates

The COUPDAYS function is a built-in function in Microsoft Excel that calculates the number of days from the beginning of a coupon period to the settlement date. It is commonly used in financial calculations and is often used in conjunction with other functions, such as COUPNCD and COUPPCD.

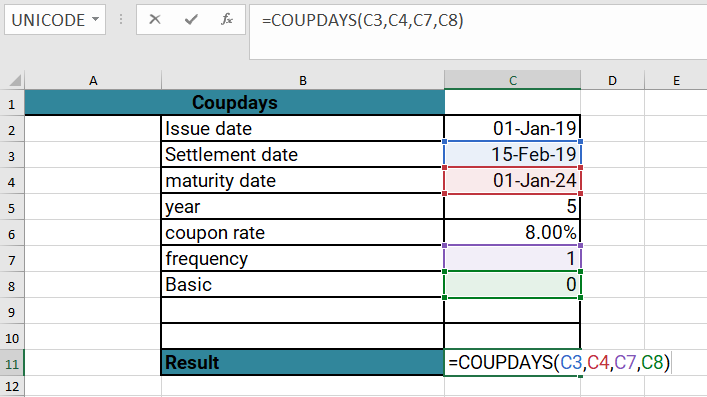

Syntax

=COUPDAYS(settlement, maturity, frequency, [basis])

Where:

- Settlement: the settlement date of the security, represented as a serial number or a valid Excel date.

- Maturity: the maturity date of the security, represented as a serial number or a valid Excel date.

- Frequency: the number of coupon payments per year, also known as the coupon frequency.

- Basis: [optional] the day count basis to use when calculating the number of days. This argument is typically omitted, in which case Excel uses the US (NASD) 30/360 day count basis by default.

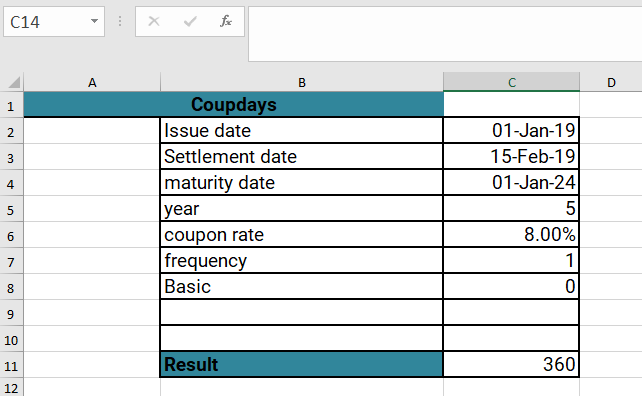

Example

=COUPDAYS(C3,C4,C7,C8)

This formula calculates the number of days between the settlement date (C3), the maturity date (C4), and the coupon frequency (C7), using the day count basis (C8) if provided. The result will be the number of days from the beginning of the coupon period to the settlement date.

Conclusion

The COUPDAYS function in Excel is a useful tool for calculating the number of days between two coupon dates on a bond. By understanding how to use the function and its various parameters, you can make accurate calculations and better analyze the performance of your bond investments.

Output

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions