How to use the COUPDAYSNC function in Excel to calculate coupon periods with non-annual payments

The COUPDAYSNC function in Excel is used to calculate the number of days between the settlement date and the next coupon payment date for a security with non-annual coupon payments. This function is similar to the COUPDAYS function, but is specifically designed for securities with coupon payments that occur more than once per year

The COUPDAYSNC function takes the following arguments:

Syntax

=COUPDAYSNC(settlement, maturity, frequency, [basis])

Where:

- settlement: The settlement date of the security (the date the security is purchased or sold).

- maturity: The maturity date of the security (the date the security will be redeemed).

- frequency: The number of coupon payments per year.

- basis: The day count convention to use when calculating the number of days between settlement and the next coupon payment.

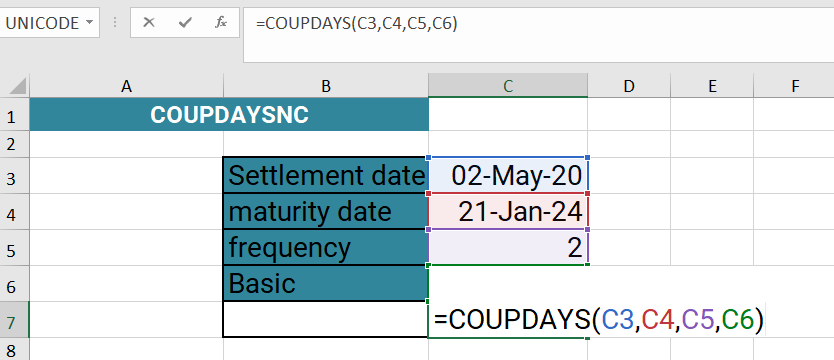

Example

=COUPDAYS(C3,C4,C5,C6)

The formula "=COUPDAYS(C3,C4,C5,C6)" is using the COUPDAYS function in Excel to calculate the number of days between the settlement date and the next coupon payment date for a security with periodic interest payments.

The arguments for the function are:

- C3: This is the settlement date of the security (the date the security is purchased or sold).

- C4: This is the maturity date of the security (the date the security will be redeemed).

- C5: This is the frequency of the coupon payments per year.

- C6: This is the day count convention to use when calculating the number of days between settlement and the next coupon payment.

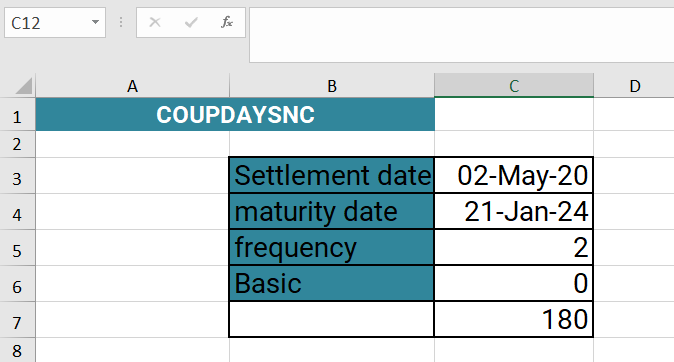

The COUPDAYS function will calculate the number of days between the settlement date and the next coupon payment date using the specified day count convention. The result is the actual number of days between the two dates, adjusted for any leap years or other calendar anomalies.

It's important to note that the COUPDAYS function assumes that the coupon payments are made annually. If the coupon payments are made more frequently than once per year, the COUPDAYSNC function should be used instead. Additionally, the day count convention specified in the function can impact the calculation of the number of days between the two dates. Therefore, it's important to choose the appropriate day count convention based on the specific security being analyzed.

The COUPDAYSNC function calculates the number of days between the settlement date and the next coupon payment date using the specified day count convention. The result is the actual number of days between the two dates, adjusted for any leap years or other calendar anomalies. This function is commonly used in financial analysis and is useful for calculating the time between coupon payments for securities such as bonds.

Output

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions